Form SC 13G - Statement of Beneficial Ownership by Certain Investors

13 November 2024 - 8:30AM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 13G |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. )* |

| |

|

SenesTech, Inc. |

| (Name of Issuer) |

| |

Common stock, par value $0.001 per share

|

| (Title of Class of Securities) |

| |

|

81720R604 |

| (CUSIP Number) |

| |

|

November 27, 2023

and December 31, 2023 |

| (Date of Event Which Requires Filing of This Statement) |

| |

| |

| Check the appropriate box to designate the rule pursuant to which this Schedule is filed: |

| |

| ¨ |

Rule 13d-1(b) |

| x |

Rule 13d-1(c) |

| ¨ |

Rule 13d-1(d) |

| |

| (Page

1 of 7 Pages) |

______________________________

*The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 81720R604 | 13G | Page 2 of 7 Pages |

| 1 |

NAME OF REPORTING PERSON

PFS Cap Mgt Co |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Nevada |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

-0- |

| 6 |

SHARED VOTING POWER

95,000 shares of Common Stock (including 30,000 shares of

Common Stock issuable upon the exercise of warrants) (see Item 4)* |

| 7 |

SOLE DISPOSITIVE POWER

-0- |

| 8 |

SHARED DISPOSITIVE POWER

95,000 shares of Common Stock (including 30,000 shares of

Common Stock issuable upon the exercise of warrants) (see Item 4)* |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

95,000 shares of Common Stock (including 30,000 shares of

Common Stock issuable upon the exercise of warrants) (see Item 4)* |

| 10 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES |

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99% (see Item 4)* |

| 12 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

|

* The information set forth above reflects the information

as the date hereof. As of the date of event requiring the filing of this statement (the “Event Date”), the Reporting

Persons may have been deemed to beneficially own 26,442 shares of Common Stock (including 15,000 shares of Common Stock issuable upon

the exercise of warrants held by the Trust (as defined in Item 2(a)) (the “Reported Warrants”)) and representing approximately

9.99% of the outstanding shares of Common Stock as of such time. As of December 31, 2023, the Reporting Persons may have been deemed

to beneficially own 27,400 shares of Common Stock (including 15,000 shares of Common Stock issuable upon the exercise of the Reported

Warrants) and representing approximately 9.99% of the outstanding shares of Common Stock as of such time.

The positions reported as of the date of event requiring the filing of

this statement and as of December 31, 2023 have been adjusted to reflect the 1-for-10 reverse stock split effected by the Issuer on July

24, 2024. As more fully described in Item 4, the Reported Warrants are subject to the 9.99% Blocker (as defined in Item 4) and the

percentages set forth above give effect to the 9.99% Blocker. However, each position reported above is the number of shares of Common

Stock that would be issuable upon the full exercise of the Reported Warrants at such time and do not give effect to the 9.99% Blocker.

Therefore, the actual number of shares of Common Stock beneficially owned by such Reporting Person at such time, after giving effect to

the 9.99% Blocker, is less than the positions reported above.

| CUSIP No. 81720R604 | 13G | Page 3 of 7 Pages |

| 1 |

NAME OF REPORTING PERSON

PFS Trust |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Nevada |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

-0- |

| 6 |

SHARED VOTING POWER

95,000 shares of Common Stock (including 30,000 shares of

Common Stock issuable upon the exercise of warrants) (see Item 4)* |

| 7 |

SOLE DISPOSITIVE POWER

-0- |

| 8 |

SHARED DISPOSITIVE POWER

95,000 shares of Common Stock (including 30,000 shares of

Common Stock issuable upon the exercise of warrants) (see Item 4)* |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

95,000 shares of Common Stock (including 30,000 shares of

Common Stock issuable upon the exercise of warrants) (see Item 4)* |

| 10 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES |

¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99% (see Item 4)* |

| 12 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

* The information set forth above reflects the information as the date hereof.

As of the Event Date, the Reporting Persons may have been deemed to beneficially own 26,442 shares of Common Stock (including 15,000 shares

of Common Stock issuable upon the exercise of the Reported Warrants) and representing approximately 9.99% of the outstanding shares of

Common Stock as of such time. As of December 31, 2023, the Reporting Persons may have been deemed to beneficially own 27,400 shares of

Common Stock (including 15,000 shares of Common Stock issuable upon the exercise of the Reported Warrants) and representing approximately

9.99% of the outstanding shares of Common Stock as of such time.

The positions reported as of the date of event requiring the filing of

this statement and as of December 31, 2023 have been adjusted to reflect the 1-for-10 reverse stock split effected by the Issuer on July

24, 2024. As more fully described in Item 4, the Reported Warrants are subject to the 9.99% Blocker and the percentages set forth

above give effect to the 9.99% Blocker. However, each position reported above is the number of shares of Common Stock that would be issuable

upon the full exercise of the Reported Warrants at such time and do not give effect to the 9.99% Blocker. Therefore, the actual number

of shares of Common Stock beneficially owned by such Reporting Person at such time, after giving effect to the 9.99% Blocker, is less

than the positions reported above.

| CUSIP No. 81720R604 | 13G | Page 4 of 7 Pages |

| Item 1(a). |

NAME OF ISSUER |

| |

SenesTech, Inc. (the “Issuer”) |

| Item 1(b). |

ADDRESS OF ISSUER’S PRINCIPAL EXECUTIVE OFFICES |

| |

23460 N 19th Ave, Suite 110, Phoenix, AZ 85027 |

| Item 2(a). |

NAME OF PERSON FILING |

| |

This report on Schedule 13G is being filed by: (i)

PFS Cap Mgt Co, a Nevada corporation (“Mgt Co”) and (ii) PFS Trust, a Nevada trust (the “Trust”).

Mgt Co indirectly controls the Trust, with respect to the Common Stock (as defined in Item 2(d) below) and the Common Stock underlying

warrants directly held by the Trust.

The foregoing persons are hereinafter sometimes collectively

referred to as the “Reporting Persons.” Any disclosures herein with respect to persons other than the Reporting Persons

are made on information and belief after making inquiry to the appropriate party.

The filing of this statement should not be construed

as an admission that any of the foregoing persons or any Reporting Person is, for the purposes of Section 13 of the Act, the beneficial

owner of the securities reported herein. |

| Item 2(b). |

ADDRESS OF PRINCIPAL BUSINESS OFFICE OR, IF NONE, RESIDENCE |

| |

The address for each of the Reporting Persons is 2207, Suite B, Bellanca St., Minden, Nevada 89423. |

| Item 2(c). |

CITIZENSHIP |

| |

Mgt Co is a Nevada corporation. The Trust is a Nevada trust. |

| Item 2(d). |

TITLE OF CLASS OF SECURITIES |

| |

Common stock, par value $0.001 per share (the “Common Stock”) |

| Item 2(e). |

CUSIP NUMBER |

| |

81720R604 |

| Item 3. |

IF THIS STATEMENT IS FILED PURSUANT TO Rules 13d-1(b), OR 13d-2(b) OR (c), CHECK WHETHER THE PERSON FILING IS A: |

| |

(a) |

¨ |

Broker or dealer registered under Section 15 of the Act; |

| |

(b) |

¨ |

Bank as defined in Section 3(a)(6) of the Act; |

| |

(c) |

¨ |

Insurance company as defined in Section 3(a)(19) of the Act; |

| |

(d) |

¨ |

Investment company registered under Section 8 of the Investment Company Act of 1940; |

| |

(e) |

¨ |

An investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E); |

| |

(f) |

¨ |

An employee benefit plan or endowment

fund in accordance with Rule 13d-1(b)(1)(ii)(F);

|

| CUSIP No. 81720R604 | 13G | Page 5 of 7 Pages |

| |

(g) |

¨ |

A parent holding company or control

person in accordance with Rule 13d-1(b)(1)(ii)(G);

|

| |

(h) |

¨ |

A savings association as defined in Section 3(b) of

the Federal Deposit Insurance Act;

|

| |

(i) |

¨ |

A church plan that is excluded from the definition

of an investment company under Section 3(c)(14) of the Investment Company Act;

|

| |

(j) |

¨ |

A non-U.S. institution in accordance with Rule 13d-1(b)(1)(ii)(J); |

| |

(k) |

¨ |

Group, in accordance with Rule 13d-1(b)(1)(ii)(K). |

| |

If filing as a non-U.S. institution in accordance

with Rule 13d-1(b)(1)(ii)(J), please

specify the type of institution: ___________________________________________ |

| Item 4. |

OWNERSHIP |

| |

The information

required by Items 4(a) – (c) is set forth in Rows (5) – (11) of the cover page hereto and is incorporated herein by reference

for the Reporting Person.

The percentages set forth as of the date hereof are

calculated based upon 515,340 shares of Common Stock outstanding as of August 6, 2024, as reported in the Issuer's Quarterly Report on

Form 10-Q for the quarterly period ended June 30, 2024, filed with the Securities and Exchange Commission (the “SEC”)

on August 8, 2024, and assumes the exercise of the Reported Warrants held by the Trust, subject to the 9.99% Blocker (as defined below).

The percentages set forth as of the Event Date and

December 31, 2023 are calculated based upon approximately 94,260 shares of Common Stock outstanding, which is based on assuming the completion

of the Common Stock offering described in the Issuer’s Prospectus filed pursuant to Rule 424(b)(4) with the SEC on November 29,

2023, as confirmed in the Issuer’s Current Report on Form 8-K filed with the SEC on November 29, 2023, and gives effect to the 1-for-10

reverse stock split effected by the Issuer on July 24, 2024, as reported in the Issuer’s Current Report on Form 8-K filed with the

SEC on July 23, 2024, and assumes the exercise of the Reported Warrants held by the Trust, subject to the 9.99% Blocker.

Pursuant to the terms of the Reported Warrants, the

Reporting Persons cannot exercise any of the Reported Warrants to the extent the Reporting Persons would beneficially own, after any such

exercise, more than 9.99% of the outstanding Common Stock (the “9.99% Blocker”) and the percentage set forth on the

cover page for each Reporting Person gives effect to the 9.99% Blocker. Consequently, at this time, the Reporting Persons are not able

to exercise all of such Reported Warrants due to the 9.99% Blocker. In addition, as of the date of event requiring the filing of this

statement and as of December 31, 2023, the Reporting Persons were not able to exercise all of such Reported Warrants due to the 9.99%

Blocker. |

| Item 5. |

OWNERSHIP OF FIVE PERCENT OR LESS OF A CLASS |

| |

If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following: ¨ |

| CUSIP No. 81720R604 | 13G | Page 6 of 7 Pages |

| Item 6. |

OWNERSHIP OF MORE THAN FIVE PERCENT ON BEHALF OF ANOTHER PERSON |

| |

Not applicable. |

| Item 7. |

IDENTIFICATION AND CLASSIFICATION OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT HOLDING COMPANY OR CONTROL PERSON |

| |

Not applicable. |

| Item 8. |

IDENTIFICATION AND CLASSIFICATION OF MEMBERS OF THE GROUP |

| |

Not applicable. |

| Item 9. |

NOTICE OF DISSOLUTION OF GROUP |

| |

Not applicable. |

| Item 10. |

CERTIFICATION |

|

| |

Each of the Reporting Persons hereby makes the following certification: |

| |

|

| |

By signing below, each Reporting Person certifies that, to the best of his or its knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect. |

| CUSIP No. 81720R604 | 13G | Page 7 of 7 Pages |

SIGNATURES

After reasonable inquiry

and to the best of our knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

DATE: November 12, 2024

| |

PFS CAP MGT CO |

| |

|

| |

|

| |

/s/ John David Kessler |

| |

Name: John David Kessler |

| |

Title: Director |

| |

PFS TRUST |

| |

|

| |

|

| |

/s/ John David Kessler |

| |

Name: John David Kessler |

| |

Title: Authorized Signatory |

Exhibit 1

JOINT FILING AGREEMENT

The undersigned acknowledge and

agree that the foregoing statement on Schedule 13G is filed on behalf of each of the undersigned and that all subsequent amendments to

this statement on Schedule 13G shall be filed on behalf of each of the undersigned without the necessity of filing additional joint filing

agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness

and accuracy of the information concerning him or it contained herein and therein, but shall not be responsible for the completeness and

accuracy of the information concerning the others, except to the extent that he or it knows or has reason to believe that such information

is inaccurate.

DATE: November 12, 2024

| |

PFS CAP MGT CO |

| |

|

| |

|

| |

/s/ John David Kessler |

| |

Name: John David Kessler |

| |

Title: Director |

| |

PFS TRUST |

| |

|

| |

|

| |

/s/ John David Kessler |

| |

Name: John David Kessler |

| |

Title: Authorized Signatory |

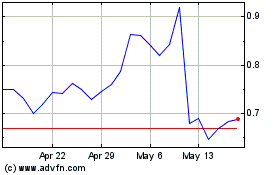

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Nov 2024 to Dec 2024

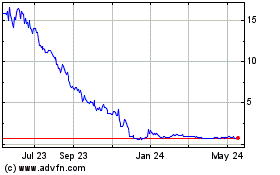

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Dec 2023 to Dec 2024