Sanofi to Buy Assets From Inhibrx in Deal Valued at Up to $2.2 Billion -- Update

23 January 2024 - 10:05PM

Dow Jones News

By Dominic Chopping and Fabiana Negrin Ochoa

Sanofi plans to buy assets from biopharmaceutical company

Inhibrx in a deal worth up to $2.2 billion as it looks to diversify

its product base and boost its pipeline of rare disease

treatments.

The French pharmaceutical giant said Tuesday that it will

acquire Inhibrx's INBRX-101 therapy, a potential treatment for a

genetic disorder that raises a patient's risk of developing lung

diseases and other illnesses.

The deal comes after Chief Executive Paul Hudson last year

outlined plans to transition the company into a pure-play

biopharmaceutical company by spinning off its consumer-healthcare

business and ramping up spending on research and development.

The company currently derives most of its sales from blockbuster

anti-inflammatory drug Dupixent, which makes up roughly a quarter

of group sales, as well as its flu vaccines that make up around 15%

of sales. Although these will remain a focus for the company, it

has committed to strengthening growth through existing or new

clinical development.

"The addition of INBRX-101 as a high potential asset to our rare

disease portfolio reinforces our strategy to commit to

differentiated and potential best-in-class products," said Houman

Ashrafian, Sanofi's head of research and development. "With our

expertise in rare diseases and growing presence in immune-mediated

respiratory conditions, INBRX-101 will complement our approach to

deploy R&D efforts in key areas of focus."

Before the deal is closed, the rest of California-based

Inhibrx's assets and liabilities not associated with INBRX-101 will

be spun off into a new publicly traded company.

Sanofi will pay Inhibrx stockholders $30 in cash for each share,

plus a deferred payment of $5 a share contingent on regulatory

milestones. They will also receive one share of the new company for

every four Inhibrx common shares held.

The acquisition is slated to be completed in the second

quarter.

The deal comes after a flurry of recent acquisitions in the

pharmaceutical industry as companies seek to re-stock their

pipelines at attractive valuations.

Already this year, Johnson & Johnson agreed to buy

cancer-focused biotech Ambrx Biopharma for about $2 billion while

Merck said it is buying another cancer-focused biotech, Harpoon

Therapeutics, for $680 million.

Write to Dominic Chopping at dominic.chopping@wsj.com and

Fabiana Negrin Ochoa at fabiana.negrinochoa@wsj.com

(END) Dow Jones Newswires

January 23, 2024 05:50 ET (10:50 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

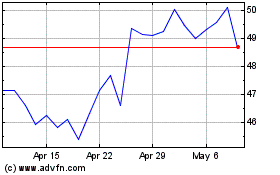

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Oct 2024 to Nov 2024

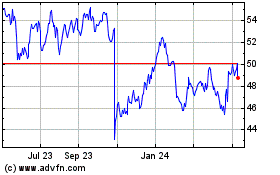

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Nov 2023 to Nov 2024