false

Q3

--12-31

0001178697

P3Y

0001178697

2024-01-01

2024-09-30

0001178697

2024-11-08

0001178697

2024-09-30

0001178697

2023-12-31

0001178697

2024-07-17

2024-07-17

0001178697

2024-07-01

2024-09-30

0001178697

2023-07-01

2023-09-30

0001178697

2023-01-01

2023-09-30

0001178697

us-gaap:CommonStockMember

2023-06-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001178697

us-gaap:RetainedEarningsMember

2023-06-30

0001178697

2023-06-30

0001178697

us-gaap:CommonStockMember

2024-06-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001178697

us-gaap:RetainedEarningsMember

2024-06-30

0001178697

2024-06-30

0001178697

us-gaap:CommonStockMember

2022-12-31

0001178697

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001178697

us-gaap:RetainedEarningsMember

2022-12-31

0001178697

2022-12-31

0001178697

us-gaap:CommonStockMember

2023-12-31

0001178697

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001178697

us-gaap:RetainedEarningsMember

2023-12-31

0001178697

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001178697

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001178697

us-gaap:CommonStockMember

2024-07-01

2024-09-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2024-07-01

2024-09-30

0001178697

us-gaap:RetainedEarningsMember

2024-07-01

2024-09-30

0001178697

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0001178697

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0001178697

us-gaap:CommonStockMember

2024-01-01

2024-09-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-09-30

0001178697

us-gaap:RetainedEarningsMember

2024-01-01

2024-09-30

0001178697

us-gaap:CommonStockMember

2023-09-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001178697

us-gaap:RetainedEarningsMember

2023-09-30

0001178697

2023-09-30

0001178697

us-gaap:CommonStockMember

2024-09-30

0001178697

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0001178697

us-gaap:RetainedEarningsMember

2024-09-30

0001178697

SONM:ReceivablesFinancingAgreementMember

2024-09-23

2024-09-23

0001178697

SONM:ReceivablesFinancingAgreementMember

2024-09-23

0001178697

SONM:JeffreyWangMember

2023-12-15

0001178697

srt:ScenarioPreviouslyReportedMember

2024-01-01

2024-03-31

0001178697

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2024-01-01

2024-03-31

0001178697

2024-01-01

2024-03-31

0001178697

srt:ScenarioPreviouslyReportedMember

2024-01-01

2024-06-30

0001178697

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2024-01-01

2024-06-30

0001178697

2024-01-01

2024-06-30

0001178697

srt:ScenarioPreviouslyReportedMember

2024-03-31

0001178697

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2024-03-31

0001178697

2024-03-31

0001178697

srt:ScenarioPreviouslyReportedMember

us-gaap:RelatedPartyMember

2024-03-31

0001178697

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

us-gaap:RelatedPartyMember

2024-03-31

0001178697

us-gaap:RelatedPartyMember

2024-03-31

0001178697

srt:ScenarioPreviouslyReportedMember

2024-06-30

0001178697

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2024-06-30

0001178697

srt:ScenarioPreviouslyReportedMember

us-gaap:RelatedPartyMember

2024-06-30

0001178697

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

us-gaap:RelatedPartyMember

2024-06-30

0001178697

us-gaap:RelatedPartyMember

2024-06-30

0001178697

SONM:SmartPhonesMember

2024-07-01

2024-09-30

0001178697

SONM:SmartPhonesMember

2023-07-01

2023-09-30

0001178697

SONM:SmartPhonesMember

2024-01-01

2024-09-30

0001178697

SONM:SmartPhonesMember

2023-01-01

2023-09-30

0001178697

SONM:FeaturePhonesMember

2024-07-01

2024-09-30

0001178697

SONM:FeaturePhonesMember

2023-07-01

2023-09-30

0001178697

SONM:FeaturePhonesMember

2024-01-01

2024-09-30

0001178697

SONM:FeaturePhonesMember

2023-01-01

2023-09-30

0001178697

SONM:WhiteLabelPhonesMember

us-gaap:RelatedPartyMember

2024-07-01

2024-09-30

0001178697

SONM:WhiteLabelPhonesMember

us-gaap:RelatedPartyMember

2023-07-01

2023-09-30

0001178697

SONM:WhiteLabelPhonesMember

us-gaap:RelatedPartyMember

2024-01-01

2024-09-30

0001178697

SONM:WhiteLabelPhonesMember

us-gaap:RelatedPartyMember

2023-01-01

2023-09-30

0001178697

SONM:WhiteLabelTabletsMember

2024-07-01

2024-09-30

0001178697

SONM:WhiteLabelTabletsMember

2023-07-01

2023-09-30

0001178697

SONM:WhiteLabelTabletsMember

2024-01-01

2024-09-30

0001178697

SONM:WhiteLabelTabletsMember

2023-01-01

2023-09-30

0001178697

SONM:AccessoriesAndOtherMember

2024-07-01

2024-09-30

0001178697

SONM:AccessoriesAndOtherMember

2023-07-01

2023-09-30

0001178697

SONM:AccessoriesAndOtherMember

2024-01-01

2024-09-30

0001178697

SONM:AccessoriesAndOtherMember

2023-01-01

2023-09-30

0001178697

srt:MinimumMember

2024-01-01

2024-09-30

0001178697

srt:MaximumMember

2024-01-01

2024-09-30

0001178697

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

2024-09-30

0001178697

us-gaap:FairValueInputsLevel2Member

us-gaap:MoneyMarketFundsMember

2024-09-30

0001178697

us-gaap:FairValueInputsLevel3Member

us-gaap:MoneyMarketFundsMember

2024-09-30

0001178697

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

2023-12-31

0001178697

us-gaap:FairValueInputsLevel2Member

us-gaap:MoneyMarketFundsMember

2023-12-31

0001178697

us-gaap:FairValueInputsLevel3Member

us-gaap:MoneyMarketFundsMember

2023-12-31

0001178697

SONM:CustomerMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

2024-01-01

2024-09-30

0001178697

SONM:CustomerMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

2023-01-01

2023-12-31

0001178697

SONM:CustomerOneMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

2024-01-01

2024-09-30

0001178697

SONM:CustomerTwoMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

2023-01-01

2023-12-31

0001178697

SONM:CustomerMember

2023-12-31

0001178697

SONM:CustomerMember

2024-02-06

0001178697

2024-04-29

2024-04-29

0001178697

2024-04-29

0001178697

2024-08-06

2024-08-06

0001178697

us-gaap:CommonStockMember

SONM:SalesAgreementMember

2024-07-01

2024-09-30

0001178697

SONM:SalesAgreementMember

2024-07-01

2024-09-30

0001178697

us-gaap:CostOfSalesMember

2024-07-01

2024-09-30

0001178697

us-gaap:CostOfSalesMember

2023-07-01

2023-09-30

0001178697

us-gaap:CostOfSalesMember

2024-01-01

2024-09-30

0001178697

us-gaap:CostOfSalesMember

2023-01-01

2023-09-30

0001178697

us-gaap:ResearchAndDevelopmentExpenseMember

2024-07-01

2024-09-30

0001178697

us-gaap:ResearchAndDevelopmentExpenseMember

2023-07-01

2023-09-30

0001178697

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-09-30

0001178697

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-09-30

0001178697

us-gaap:SellingAndMarketingExpenseMember

2024-07-01

2024-09-30

0001178697

us-gaap:SellingAndMarketingExpenseMember

2023-07-01

2023-09-30

0001178697

us-gaap:SellingAndMarketingExpenseMember

2024-01-01

2024-09-30

0001178697

us-gaap:SellingAndMarketingExpenseMember

2023-01-01

2023-09-30

0001178697

us-gaap:GeneralAndAdministrativeExpenseMember

2024-07-01

2024-09-30

0001178697

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2023-09-30

0001178697

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-09-30

0001178697

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-09-30

0001178697

us-gaap:RestrictedStockUnitsRSUMember

2024-09-30

0001178697

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-09-30

0001178697

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

0001178697

us-gaap:EmployeeStockOptionMember

2024-07-01

2024-09-30

0001178697

us-gaap:EmployeeStockOptionMember

2023-07-01

2023-09-30

0001178697

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-09-30

0001178697

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-09-30

0001178697

SONM:UnvestedRestrictedStockUnitsMember

2024-07-01

2024-09-30

0001178697

SONM:UnvestedRestrictedStockUnitsMember

2023-07-01

2023-09-30

0001178697

SONM:UnvestedRestrictedStockUnitsMember

2024-01-01

2024-09-30

0001178697

SONM:UnvestedRestrictedStockUnitsMember

2023-01-01

2023-09-30

0001178697

SONM:SharesSubjectToWarrantsToPurchaseCommonStockMember

2024-07-01

2024-09-30

0001178697

SONM:SharesSubjectToWarrantsToPurchaseCommonStockMember

2023-07-01

2023-09-30

0001178697

SONM:SharesSubjectToWarrantsToPurchaseCommonStockMember

2024-01-01

2024-09-30

0001178697

SONM:SharesSubjectToWarrantsToPurchaseCommonStockMember

2023-01-01

2023-09-30

0001178697

country:US

2024-07-01

2024-09-30

0001178697

country:US

2023-07-01

2023-09-30

0001178697

country:US

2024-01-01

2024-09-30

0001178697

country:US

2023-01-01

2023-09-30

0001178697

srt:AsiaPacificMember

2024-07-01

2024-09-30

0001178697

srt:AsiaPacificMember

2023-07-01

2023-09-30

0001178697

srt:AsiaPacificMember

2024-01-01

2024-09-30

0001178697

srt:AsiaPacificMember

2023-01-01

2023-09-30

0001178697

country:CA

2024-07-01

2024-09-30

0001178697

country:CA

2023-07-01

2023-09-30

0001178697

country:CA

2024-01-01

2024-09-30

0001178697

country:CA

2023-01-01

2023-09-30

0001178697

SONM:EuropeAndMiddleEastMember

2024-07-01

2024-09-30

0001178697

SONM:EuropeAndMiddleEastMember

2023-07-01

2023-09-30

0001178697

SONM:EuropeAndMiddleEastMember

2024-01-01

2024-09-30

0001178697

SONM:EuropeAndMiddleEastMember

2023-01-01

2023-09-30

0001178697

us-gaap:ProductMember

2024-07-01

2024-09-30

0001178697

us-gaap:ProductMember

2023-07-01

2023-09-30

0001178697

us-gaap:ProductMember

2024-01-01

2024-09-30

0001178697

us-gaap:ProductMember

2023-01-01

2023-09-30

0001178697

us-gaap:ServiceMember

2024-07-01

2024-09-30

0001178697

us-gaap:ServiceMember

2023-07-01

2023-09-30

0001178697

us-gaap:ServiceMember

2024-01-01

2024-09-30

0001178697

us-gaap:ServiceMember

2023-01-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerAMember

2024-07-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerAMember

2023-07-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerAMember

2024-01-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerAMember

2023-01-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerBRelatedPartyMember

2024-07-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerBRelatedPartyMember

2023-07-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerBRelatedPartyMember

2024-01-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerBRelatedPartyMember

2023-01-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerCMember

2024-07-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerCMember

2023-07-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerCMember

2024-01-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerCMember

2023-01-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerDMember

2024-07-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerDMember

2023-07-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerDMember

2024-01-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerDMember

2023-01-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerEMember

2024-07-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerEMember

2023-07-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerEMember

2024-01-01

2024-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomerEMember

2023-01-01

2023-09-30

0001178697

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SONM:CustomersMember

srt:MaximumMember

2024-01-01

2024-09-30

0001178697

SONM:JeffreyWangMember

us-gaap:SubsequentEventMember

2024-10-01

0001178697

us-gaap:SubsequentEventMember

2024-10-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

SONM:Segment

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C.

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended September 30, 2024

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from __________ to ____________

Commission

File Number: 001-38907

Sonim

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

94-3336783 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

4445

Eastgate Mall, Suite 200

San

Diego, CA 92121

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code: (650) 378-8100

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock par value $0.001 per share |

|

SONM |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

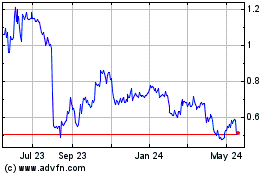

On

November 8, 2024, there were 4,871,639 shares of the registrant’s common stock, par value $0.001, outstanding. The foregoing

reflects the reverse stock split of the registrant’s common stock that became effective on July 17, 2024, and began trading on

a post-split adjusted basis on July 18, 2024.

Table

of Contents

Cautionary

Note about Forward-Looking Statements

This

Quarterly Report contains statements that we believe are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Those forward-looking statements are intended to enjoy the protection of the safe harbor for forward-looking

statements provided by that act as well as protections afforded by other federal securities laws. Generally, words such as “achieve,”

“aim,” “ambitions,” “anticipate,” “believe,” “committed,” “continue,”

“could,” “designed,” “estimate,” “expect,” “forecast,” “future,”

“goals,” “grow,” “guidance,” “intend,” “likely,” “may,” “milestone,”

“objective,” “on track,” “opportunity,” “outlook,” “pending,” “plan,”

“position,” “possible,” “potential,” “predict,” “progress,” “roadmap,”

“seek,” “should,” “strive,” “targets,” “to be,” “upcoming,” “will,”

“would,” and variations of such words and similar expressions identify forward-looking statements, which are not historical

in nature. Forward-looking statements may appear throughout this Quarterly Report and other documents we file with the Securities and

Exchange Commission (the “SEC”), including without limitation, the following sections:

| |

(i) |

Note

8 “Commitments and Contingencies” to our Condensed Consolidated Financial Statements regarding the possible outcome of,

and future effect on our financial condition and results of operations of, certain litigations and other proceedings to which we

are a party; |

| |

|

|

| |

(ii) |

Part

I, Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” including the

statements with regard to the future changes to our business and our expectations regarding our strategy and new lines of products,

future cash requirements, assessment of our liquidity, the availability, uses, sufficiency, and cost of capital resources, and sources

of funding, and future products, services, and technologies; and |

| |

|

|

| |

(iii) |

Part

I, Item 4. “Controls and Procedures,” including the description of limitations on effectiveness of controls and procedures. |

Forward-looking

statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking

statements. These risks and uncertainties include, but are not limited to, the following:

| |

● |

the

availability of cash on hand and other sources of liquidity to fund our operations and grow our business; |

| |

|

|

| |

● |

our

ability to compete effectively depends on multiple factors and we may not be able to continue to develop solutions to address user

needs effectively; |

| |

|

|

| |

● |

we

may not be able to continue to develop solutions to address user needs effectively, including our next-generation products, which

could materially adversely affect our liquidity and our ability to continue operations; |

| |

|

|

| |

● |

a

small number of customers account for a significant portion of our revenue; |

| |

|

|

| |

● |

our

entry into the data device sector could divert our management team’s attention from existing products, cause delays in launching

our new products, or otherwise have a significant adverse impact on our business, operating results, and financial condition; |

| |

|

|

| |

● |

failure

to meet the Nasdaq’s continued listing requirements and other Nasdaq rules could adversely affect the price of our common stock

and make it more difficult for us to sell securities in a future financing or for you to sell our common stock; |

| |

|

|

| |

● |

the

financial and operational projections that we may provide from time to time are subject to inherent risks; |

| |

|

|

| |

● |

our

ability to incorporate emerging technologies into our new consumer products given the lengthy development cycle; |

| |

|

|

| |

● |

our

ability to adapt to shortened customer lead times and tightened inventory controls from our key customers; |

| |

|

|

| |

● |

we

are materially dependent on some customer relationships that are characterized by product award letters and the loss of such relationships

could harm our business and operating results; |

| |

|

|

| |

● |

our

quarterly results may vary significantly from period to period; |

| |

|

|

| |

● |

we

rely primarily on third-party contract manufacturers and partners; |

| |

|

|

| |

● |

if

our products contain defects or errors, we could incur significant unexpected expenses, experience product returns and lost sales,

experience product recalls, suffer damage to our brand and reputation, and be subject to product liability or other claims; |

| |

|

|

| |

● |

we

are required to undergo a lengthy customization and certification process for each wireless carrier customer; |

| |

|

|

| |

● |

we

are dependent on the continued services and performance of a concentrated and limited group of senior management and other key personnel; |

| |

|

|

| |

● |

we

face risks related to the impact of various economic, political, environmental, social, and market events beyond our control that

can impact our business and results of operations; and |

| |

|

|

| |

● |

other

risks and uncertainties described in this Quarterly Report, our most recent Annual Report on Form 10-K, and our other filings with

the SEC. |

We

urge investors to consider all of the risks, uncertainties, and other factors disclosed in these filings carefully in evaluating the

forward-looking statements contained in this Quarterly Report. We cannot assure you that the results or developments anticipated by us

and reflected or implied by any forward-looking statement contained in this Quarterly Report will be realized or, even if substantially

realized, that those results or developments will result in the forecasted or expected consequences for us or affect us, our operations

or financial performance as we forecasted or expected. As a result of the matters discussed above and other matters, including changes

in facts, assumptions not being realized, or other factors, the actual results relating to the subject matter of any forward-looking

statement in this Quarterly Report may differ materially from the anticipated results expressed or implied in that forward-looking statement.

The forward-looking statements included in this Quarterly Report are made only as of the date of this Quarterly Report, and we undertake

no obligation to update any such statements to reflect subsequent events or circumstances.

As

used herein, “Sonim,” the “Company,” “we,” “us,” “our,” and similar terms

include Sonim Technologies, Inc. and its subsidiaries, unless the context indicates otherwise.

SONIM

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(IN

THOUSANDS EXCEPT SHARE AND

PER

SHARE AMOUNTS)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 9,060 | | |

$ | 9,397 | |

| Accounts receivable, net | |

| 5,240 | | |

| 25,304 | |

| Non-trade receivable | |

| 4,322 | | |

| 961 | |

| Related party receivable | |

| 644 | | |

| — | |

| Inventory | |

| 12,374 | | |

| 6,517 | |

| Prepaid expenses and other current assets | |

| 2,224 | | |

| 1,608 | |

| Total current assets | |

| 33,864 | | |

| 43,787 | |

| Property and equipment, net | |

| 239 | | |

| 71 | |

| Contract fulfillment assets | |

| 12,063 | | |

| 9,232 | |

| Other assets | |

| 2,981 | | |

| 2,953 | |

| Total assets | |

$ | 49,147 | | |

$ | 56,043 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Accounts payable | |

$ | 9,056 | | |

$ | 19,847 | |

| Accrued liabilities | |

| 23,128 | | |

| 12,300 | |

| Total current liabilities | |

| 32,184 | | |

| 32,147 | |

| Income tax payable | |

| 1,614 | | |

| 1,528 | |

| Total liabilities | |

| 33,798 | | |

| 33,675 | |

| Commitments and contingencies (Note 8) | |

| - | | |

| - | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock, $0.001 par value per share; 100,000,000 shares authorized: and 4,871,639 and 4,426,867 shares issued and outstanding at September 30, 2024, and December 31, 2023, respectively (*) | |

| 5 | | |

| 4 | |

| Preferred stock, $0.001 par value per share, 5,000,000 shares authorized, and no shares issued and outstanding at September 30, 2024, and December 31, 2023, respectively | |

| — | | |

| — | |

| Additional paid-in capital (*) | |

| 277,338 | | |

| 272,324 | |

| Accumulated deficit | |

| (261,994 | ) | |

| (249,960 | ) |

| Total stockholders’ equity | |

| 15,349 | | |

| 22,368 | |

| Total liabilities and stockholders’ equity | |

$ | 49,147 | | |

$ | 56,043 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SONIM

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN

THOUSANDS EXCEPT SHARE AND PER SHARE AMOUNTS)

(UNAUDITED)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net revenues | |

$ | 15,022 | | |

$ | 27,566 | | |

$ | 35,656 | | |

$ | 80,202 | |

| Related party net revenues | |

| — | | |

| — | | |

| 7,658 | | |

| — | |

| Total net revenues | |

| 15,022 | | |

| 27,566 | | |

| 43,314 | | |

| 80,202 | |

| Cost of revenues | |

| 10,790 | | |

| 21,963 | | |

| 33,211 | | |

| 65,998 | |

| Gross profit | |

| 4,232 | | |

| 5,603 | | |

| 10,103 | | |

| 14,204 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 715 | | |

| 741 | | |

| 1,728 | | |

| 846 | |

| Sales and marketing | |

| 3,045 | | |

| 2,133 | | |

| 8,756 | | |

| 5,717 | |

| General and administrative | |

| 2,848 | | |

| 2,041 | | |

| 7,937 | | |

| 5,873 | |

| Impairment of contract fulfillment assets | |

| — | | |

| — | | |

| 3,217 | | |

| — | |

| Total operating expenses | |

| 6,608 | | |

| 4,915 | | |

| 21,638 | | |

| 12,436 | |

| Income (loss) from operations | |

| (2,376 | ) | |

| 688 | | |

| (11,535 | ) | |

| 1,768 | |

| Interest expense, net | |

| — | | |

| (6 | ) | |

| (17 | ) | |

| (11 | ) |

| Other expense, net | |

| (19 | ) | |

| (59 | ) | |

| (203 | ) | |

| (213 | ) |

| Income tax expense | |

| (117 | ) | |

| (96 | ) | |

| (279 | ) | |

| (281 | ) |

| Net income (loss) | |

$ | (2,512 | ) | |

$ | 527 | | |

$ | (12,034 | ) | |

$ | 1,263 | |

| Net income (loss) per share: | |

| | | |

| | | |

| | | |

| | |

| Basic(*) | |

$ | (0.52 | ) | |

$ | 0.12 | | |

$ | (2.58 | ) | |

$ | 0.30 | |

| Diluted(*) | |

$ | (0.52 | ) | |

$ | 0.12 | | |

$ | (2.58 | ) | |

$ | 0.29 | |

| Weighted-average shares used in computing net income (loss) per share: | |

| | | |

| | | |

| | | |

| | |

| Basic(*) | |

| 4,848,999 | | |

| 4,303,931 | | |

| 4,658,193 | | |

| 4,245,717 | |

| Diluted(*) | |

| 4,848,999 | | |

| 4,418,026 | | |

| 4,658,193 | | |

| 4,372,328 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SONIM

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(IN

THOUSANDS EXCEPT SHARE AMOUNTS)

(UNAUDITED)

| For the Three

Months Ended September 30, 2023 | |

Shares

(*) | | |

Amount | | |

Paid-in

Capital | | |

Accumulated

Deficit | | |

Stockholders’

Equity | |

| | |

Common

stock | | |

Additional | | |

| | |

| |

| For the Three

Months Ended September 30, 2023 | |

Shares

(*) | | |

Amount | | |

Paid-in

Capital | | |

Accumulated

Deficit | | |

Stockholders’

Equity | |

| Balance at July 1, 2023 | |

| 4,229,786 | | |

$ | 4 | | |

$ | 270,779 | | |

$ | (249,134 | ) | |

$ | 21,649 | |

| Issuance of common stock to settle restricted

stock units | |

| 29,915 | | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of common stock for payment of services | |

| 14,161 | | |

| 1 | | |

| 143 | | |

| — | | |

| 144 | |

| Issuance of common stock upon exercise of stock

options | |

| 100,000 | | |

| 1 | | |

| 418 | | |

| — | | |

| 419 | |

| Issuance of common stock upon exercise of stock

options and settlement of restricted stock units, net of taxes withheld | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock upon exercise of stock

options and settlement of restricted stock units, net of taxes withheld, shares | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxes withheld on net settled restricted stock

units | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock, net of issuance costs | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock, net of issuance

costs, shares | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| — | | |

| — | | |

| 371 | | |

| — | | |

| 371 | |

| Impact of retroactively adjusted reverse stock

split | |

| — | | |

| (2 | ) | |

| 2 | | |

| — | | |

| — | |

| Net income | |

| — | | |

| — | | |

| — | | |

| 527 | | |

| 527 | |

| Balance at September 30, 2023 | |

| 4,373,862 | | |

$ | 4 | | |

$ | 271,713 | | |

$ | (248,607 | ) | |

$ | 23,110 | |

| | |

Common

stock | | |

Additional | | |

| | |

| |

| For the Three

Months Ended September 30, 2024 | |

Shares

(*) | | |

Amount | | |

Paid-in

Capital | | |

Accumulated

Deficit | | |

Stockholders’

Equity | |

| Balance at July 1, 2024 | |

| 4,827,092 | | |

$ | 5 | | |

$ | 276,951 | | |

$ | (259,482 | ) | |

$ | 17,474 | |

| Issuance of common stock upon exercise of stock

options and settlement of restricted stock units, net of taxes withheld | |

| 9,384 | | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of common stock, net of issuance costs | |

| 35,163 | | |

| — | | |

| 14 | | |

| — | | |

| 14 | |

| Stock-based compensation | |

| — | | |

| — | | |

| 373 | | |

| — | | |

| 373 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (2,512 | ) | |

| (2,512 | ) |

| Balance at September 30, 2024 | |

| 4,871,639 | | |

$ | 5 | | |

$ | 277,338 | | |

$ | (261,994 | ) | |

$ | 15,349 | |

| | |

Common

stock | | |

Additional | | |

| | |

| |

| For the Nine

Months Ended September 30, 2023 | |

Shares

(*) | | |

Amount | | |

Paid-in

Capital | | |

Accumulated

Deficit | | |

Stockholders’

Equity | |

| Balance at January 1, 2023 | |

| 4,077,469 | | |

$ | 41 | | |

$ | 269,874 | | |

$ | (249,870 | ) | |

$ | 20,045 | |

| Issuance of common stock to settle restricted

stock units | |

| 31,900 | | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of common stock for payment of services | |

| 45,735 | | |

| 1 | | |

| 344 | | |

| — | | |

| 345 | |

| Issuance of common stock upon exercise of stock

options | |

| 100,000 | | |

| 1 | | |

| 418 | | |

| | | |

| 419 | |

| Stock-based compensation | |

| — | | |

| — | | |

| 1,038 | | |

| — | | |

| 1,038 | |

| Impact of retroactively adjusted reverse stock

split | |

| 118,758 | | |

| (39 | ) | |

| 39 | | |

| — | | |

| — | |

| Net income | |

| — | | |

| — | | |

| — | | |

| 1,263 | | |

| 1,263 | |

| Balance at September 30, 2023 | |

| 4,373,862 | | |

$ | 4 | | |

$ | 271,713 | | |

$ | (248,607 | ) | |

$ | 23,110 | |

| For the Nine

Months Ended September 30, 2024 | |

Shares

(*) | | |

Common stock | | |

Additional

Paid-in Capital | | |

Accumulated

Deficit | | |

Equity | |

| | |

Common

stock | | |

Additional | | |

| | |

| |

| For the Nine

Months Ended September 30, 2024 | |

Shares

(*) | | |

Amount | | |

Paid-in

Capital | | |

Accumulated

Deficit | | |

Stockholders’

Equity | |

| Balance at January 1, 2024 | |

| 4,426,867 | | |

$ | 4 | | |

$ | 272,324 | | |

$ | (249,960 | ) | |

$ | 22,368 | |

| Balance | |

| 4,426,867 | | |

$ | 4 | | |

$ | 272,324 | | |

$ | (249,960 | ) | |

$ | 22,368 | |

| Issuance of common stock upon exercise of stock

options and settlement of restricted stock units, net of taxes withheld | |

| 59,609 | | |

| 1 | | |

| 52 | | |

| — | | |

| 53 | |

| Taxes withheld on net settled restricted stock

units | |

| — | | |

| — | | |

| (5 | ) | |

| — | | |

| (5 | ) |

| Issuance of common stock, net of issuance costs | |

| 385,163 | | |

| 4 | | |

| 3,794 | | |

| — | | |

| 3,798 | |

| Stock-based compensation | |

| — | | |

| — | | |

| 1,169 | | |

| — | | |

| 1,169 | |

| Impact of retroactively adjusted reverse stock

split | |

| — | | |

| (4 | ) | |

| 4 | | |

| — | | |

| — | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (12,034 | ) | |

| (12,034 | ) |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| (12,034 | ) | |

| (12,034 | ) |

| Balance at September 30, 2024 | |

| 4,871,639 | | |

$ | 5 | | |

$ | 277,338 | | |

$ | (261,994 | ) | |

$ | 15,349 | |

| Balance | |

| 4,871,639 | | |

$ | 5 | | |

$ | 277,338 | | |

$ | (261,994 | ) | |

$ | 15,349 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SONIM

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS

(IN

THOUSANDS)

(UNAUDITED)

| | |

2024 | | |

2023 | |

| | |

Nine Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income (loss) | |

$ | (12,034 | ) | |

$ | 1,263 | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,643 | | |

| 1,250 | |

| Stock-based compensation | |

| 1,169 | | |

| 1,038 | |

| Stock issued for services | |

| — | | |

| 345 | |

| Inventory write-downs | |

| 1,013 | | |

| — | |

| Impairment of contract fulfillment assets | |

| 3,217 | | |

| — | |

| Other | |

| 287 | | |

| (201 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 8,579 | | |

| (7,915 | ) |

| Non-trade receivable | |

| (3,361 | ) | |

| 639 | |

| Related party receivable | |

| (644 | ) | |

| — | |

| Inventory | |

| (6,870 | ) | |

| (309 | ) |

| Prepaid expenses and other current assets | |

| (639 | ) | |

| 352 | |

| Contract fulfillment assets | |

| (8,643 | ) | |

| (1,973 | ) |

| Other assets | |

| (125 | ) | |

| (105 | ) |

| Accounts payable | |

| 517 | | |

| 2,130 | |

| Accrued liabilities | |

| 10,828 | | |

| (248 | ) |

| Income tax payable | |

| 86 | | |

| 33 | |

| Net cash used in operating activities | |

| (3,977 | ) | |

| (3,701 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (206 | ) | |

| (24 | ) |

| Net cash used in investing activities | |

| (206 | ) | |

| (24 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock, net of issuance costs | |

| 3,798 | | |

| — | |

| Repayment of debt | |

| — | | |

| (110 | ) |

| Proceeds from stock option exercises, net of taxes paid on vested restricted stock units | |

| 48 | | |

| 419 | |

| Net cash provided by financing activities | |

| 3,846 | | |

| 309 | |

| Net decrease in cash and cash equivalents | |

| (337 | ) | |

| (3,416 | ) |

| Cash and cash equivalents at beginning of period | |

| 9,397 | | |

| 13,213 | |

| Cash and cash equivalents at end of period | |

$ | 9,060 | | |

$ | 9,797 | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 17 | | |

$ | 11 | |

| Cash paid for income taxes | |

$ | 12 | | |

$ | 69 | |

| Non-cash activities: | |

| | | |

| | |

| Receivables transferred to satisfy payables (Note 4) | |

$ | 11,308 | | |

$ | — | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SONIM

TECHNOLOGIES, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(In

Thousands, except Share and Per Share Amounts)

NOTE

1 — The Company and Its Significant Accounting Policies

Description

of Business

Sonim

Technologies, Inc. was incorporated in the state of Delaware on August 5, 1999, and is headquartered in San Diego, California. The Company

specializes in rugged and durable mobile devices, catering to users who require extra resilience in their professional and personal lives.

Initially focusing on handsets and accessories for the enterprise, first responder, and government sectors, Sonim has broadened its offerings

to include connected devices for wireless internet access such as mobile hotspots.

In

2023, the Company announced an expanded portfolio which includes next-generation ultra-rugged 5G feature phones, a next-generation rugged

smartphone, and a connected solutions portfolio of wireless internet solutions, including wireless modems, mobile hotspots and fixed

wireless access routers. Sonim launched a mobile hotspot at the end of the second quarter of 2024 in the United States and Canada, and

as of the date of this report, has launched other versions of the mobile hotspots, one with Verizon in the U.S. and one with Telstra

in Australia, and two new models of rugged phones in Europe.

A

significant revenue driver in 2023 was a tablet developed under Sonim’s original design manufacturer (“ODM”) model,

emphasizing high-volume and low-margin production tailored to a specific customer’s needs. Tablet sales concluded in the fourth

quarter of 2023 due to its life cycle end, the ODM model was also applied late in the fourth quarter of 2023 for a range of low-priced

smartphones with sales ending in the first quarter of 2024. The ODM model does not represent the Company’s core business strategy.

Reverse

Stock Split

On

July 17, 2024, the Company effected a 1-for-10 reverse stock split of its issued and outstanding common stock (the “Reverse Stock

Split”). The Company’s common stock began trading on the Nasdaq Capital Market on a post-split basis on July 18, 2024. As

a result of the Reverse Stock Split, each share of common stock issued and outstanding immediately prior to July 17, 2024, was automatically

converted into one-tenth (1/10) of a share of common stock. The Reverse Stock Split affected all common stockholders uniformly and did

not alter any stockholder’s percentage interest in the Company’s equity, except to the extent that the Reverse Stock Split

would result in a stockholder owning a fractional share. No fractional shares were issued in connection with the Reverse Stock Split.

Stockholders who otherwise would be entitled to receive a fractional share instead were entitled to receive one whole share in lieu of

such fractional share.

The

Reverse Stock Split did not change the par value of the common stock or the authorized number of shares of common stock. All outstanding

stock options, restricted stock units, and warrants entitling their holders to purchase or obtain or convert into shares of our common

stock were adjusted, as required by the terms of these securities.

The

Company’s stockholders’ equity, in the aggregate, remained unchanged following the Reverse Stock Split. Net income (loss)

per share increased because there were fewer shares of common stock outstanding. There were no other accounting consequences, including

changes to the amount of stock-based compensation expense to be recognized in any period, that arose as a result of the Reverse Stock

Split.

All

common share and per-share amounts in this Form 10-Q have been retroactively restated to reflect the effect of the Reverse Stock Split.

Receivables

Financing Agreement

On

September 23, 2024, the Company entered into an invoice purchase agreement (the “Receivables Financing Agreement”) with LS

DE LLC (“LS”), pursuant to which LS will provide receivables factoring to the Company. Pursuant to the terms of the Receivables

Financing Agreement, LS will advance 80% of the face value of the receivables being sold by the Company, up to a maximum of $2,500 of

eligible customer invoices from the Company. In consideration of the advances, LS is entitled to receive (i) an invoice purchase fee

equal to 0.20% of the face amount of each purchased invoice payable at the time of the purchase and (ii) a daily funds usage fee equal

to 0.0388%, payable monthly in arrears on the last day of each month.

The

Receivables Financing Agreement has an initial term of twelve (12) months, subject to automatic annual extension unless terminated.

Additionally, under certain circumstances and unless waived by LS, the Company will be obligated to pay a missing notation fee of 15%

in the event of its failure to affix a certain legend regarding assignment or a misdirected payment fee in the amount of 15%.

In the event of the Company’s default, the Company’s payment obligations will be accelerated, and, in addition to the

aforementioned fees payable to LS, the Company will be required to pay the default interest rate of the lesser of 24%

per annum or the maximum rate permitted by law until the default is cured or until all Company’s obligations are paid in

full.

The

Company’s obligations under the Receivables Financing Agreement are secured by a lien on all of the Company’s accounts receivable,

inventory, and related property, excluding accounts receivable from certain specified counterparties.

The

Receivables Financing Agreement contains representations and warranties by the Company and LS, certain indemnification provisions in

favor of LS and customary covenants (including limitations on other debt, liens, acquisitions, investments and dividends), and events

of default (including payment defaults, breaches of covenants, a material impairment in LS’s security interest or in the collateral,

and events relating to bankruptcy or insolvency). The Receivables Financing Agreement can be terminated by either party upon written

notice or by LS upon the occurrence of certain events including the Company’s default. As of September 30, 2024, there were no

borrowings outstanding under the Receivables Financing Agreement.

Liquidity

and Ability to Continue as a Going Concern

The

Company’s condensed consolidated financial statements account for the continuation of its business as a going concern. The

Company is subject to the risks and uncertainties associated with the development and release of new products. The Company’s principal

sources of liquidity as of September 30, 2024, consist of existing cash and cash equivalents totaling $9,060. The Company believes that

it can meet its obligations with this cash over the next twelve months following the filing date of this report.

Basis

of presentation and preparation

The

condensed consolidated financial statements include the accounts of Sonim Technologies, Inc. and its wholly owned subsidiaries (collectively

“Sonim” or the “Company”). Intercompany accounts and transactions have been eliminated. In the opinion of the

Company’s management, the condensed consolidated financial statements reflect all adjustments, which are normal and recurring in

nature, necessary for fair financial statement presentation. The preparation of these condensed consolidated financial statements and

accompanying notes in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make

estimates and assumptions that affect the amounts reported. Actual results could differ materially from those estimates. Certain prior

period amounts in the condensed consolidated financial statements and accompanying notes have been reclassified to conform to the current

period’s presentation. These condensed consolidated financial statements and accompanying notes should be read in conjunction with

the Company’s annual consolidated financial statements and accompanying notes included in its Annual Report on Form 10-K for the

year ended December 31, 2023.

As

discussed above, all per share amounts and common shares amounts have been adjusted on a retroactive basis to reflect the effect of the

Reverse Stock Split. Proportionate adjustments were made to the per share exercise price and number of shares of common stock issuable

under all outstanding stock options, restricted stock units, and warrants. In addition, proportionate adjustments have been made to the

number of shares of common stock reserved for the Company’s equity incentive awards.

Prior

period reclassifications

Certain

amounts in prior periods have been reclassified to conform with current period presentation. These reclassifications had no effect on

the reported results of operations.

Related

Party Transactions

Effective

December 15, 2023, in the ordinary course of business, the Company entered into an agreement pursuant to which the Company would execute

various statements of work and sell white label phones under the ODM model arrangement with a related party, in which a family member

of our director, Jeffrey Wang, holds indirect interest of approximately 40% (the “ODM Arrangement”). Pursuant to the ODM

Arrangement, the Company consummated various transactions during the first quarter of 2024. The Company did not have any sales under

the ODM Arrangement during the three months ended June 30, 2024, or September 30, 2024.

Revision

of Previously Reported Condensed Consolidated Financial Statements

In

connection with the preparation of the condensed consolidated financial statements as of September 30, 2024 and for the three-months

and nine-months ended September 30, 2024 and 2023, the Company determined that it did not separately disclose related party revenue under

the ODM Arrangement for the three months ended March 31, 2024 and the six-months ended June 30, 2024, or the related party receivable

as of March 31, 2024 and June 30, 2024. The Company evaluated the impact of these disclosure errors, considering both qualitative and

quantitative factors, and concluded that these errors did not have a material impact on any of the prior periods stated above. However,

the Company has elected to revise the prior periods for the separate disclosure of the related party transactions as follows:

Condensed

Consolidated Statements of Operations

Schedule of Condensed Consolidated Statements of Operations

| | |

As Previously Reported | | |

Adjustment | | |

As Revised | |

| | |

For the Three Months Ended March 31, 2024 | |

| | |

As Previously Reported | | |

Adjustment | | |

As Revised | |

| Net revenues | |

$ | 16,776 | | |

$ | (7,658 | ) | |

$ | 9,118 | |

| Related party net revenues | |

| — | | |

| 7,658 | | |

| 7,658 | |

| Total net revenues | |

$ | 16,776 | | |

$ | — | | |

$ | 16,776 | |

Condensed

Consolidated Balance Sheet

Schedule of Condensed Consolidated Balance Sheet

| | |

As Previously Reported | | |

Adjustment | | |

As Revised | |

| | |

As of March 31, 2024 | |

| | |

As Previously Reported | | |

Adjustment | | |

As Revised | |

| Accounts receivable, net | |

$ | 13,337 | | |

$ | (5,817 | ) | |

$ | 7,520 | |

| Related party receivable | |

| — | | |

| 5,817 | | |

| 5,817 | |

Condensed

Consolidated Statements of Operations

| | |

Previously Reported | | |

Adjustment | | |

As Revised | |

| | |

For the Six Months Ended June 30, 2024 | |

| | |

As Previously Reported | | |

Adjustment | | |

As Revised | |

| Net revenues | |

$ | 28,292 | | |

$ | (7,658 | ) | |

$ | 20,634 | |

| Related party net revenues | |

| — | | |

| 7,658 | | |

| 7,658 | |

| Total net revenues | |

$ | 28,292 | | |

$ | — | | |

$ | 28,292 | |

Condensed

Consolidated Balance Sheet

| | |

Previously Reported | | |

Adjustment | | |

As Revised | |

| | |

As of June 30, 2024 | |

| | |

As Previously Reported | | |

Adjustment | | |

As Revised | |

| Accounts receivable, net | |

$ | 10,781 | | |

$ | (2,647 | ) | |

$ | 8,134 | |

| Related party receivable | |

| — | | |

| 2,647 | | |

| 2,647 | |

New

accounting pronouncements

The

Company is an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our

Business Startups Act of 2012 (the “JOBS Act”), and it may take advantage of certain exemptions from various reporting requirements

that are applicable to other public companies that are not emerging growth companies. Section 102(b)(1) of the JOBS Act exempts emerging

growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those

that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the

Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that an emerging growth

company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies

but any such election to opt out is irrevocable. The Company has elected not to opt out of such extended transition period which means

that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an

emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This

may make comparison of the Company’s consolidated financial statements with another public company, which is neither an emerging

growth company nor an emerging growth company that has opted out of using the extended transition period, difficult or impossible because

of the potential differences in accounting standards used.

Pronouncements

adopted in 2024

None.

Pronouncements

not yet adopted

In

November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures.

This ASU was issued to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment

expenses. This guidance applies to all public entities that are required to report segment information in accordance with Topic 280,

Segment Reporting. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years

beginning after December 15, 2024. Early adoption is permitted and the guidance should be applied retrospectively. ASU 2023-07 will be

effective for the Company for the annual period of its fiscal year ending December 31, 2024. The Company does not anticipate the adoption

of this guidance will have a material impact on its condensed consolidated financial statements.

In

December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This ASU

was issued to address investor requests for more transparency about income tax information through improvements to income tax disclosure

primarily related to the rate reconciliation and income taxes paid information, and to improve the effectiveness of income tax disclosures.

This guidance is effective for public entities for annual periods beginning after December 15, 2024. Early adoption is permitted. ASU

2023-09 will be effective for the Company in the first quarter of its fiscal year ending December 31, 2025. The Company is currently

evaluating the impact the adoption of this guidance will have on its condensed consolidated financial statements.

In November 2024, the FASB issued ASU 2024-03, Income Statement –

Reporting Comprehensive Income – Expense Disaggregation Disclosures (Topic 220): Disaggregation of Income Statement Expenses.

This guidance requires additional disclosure of certain amounts included in the expense captions presented on the Statement of Operations

as well as disclosures about selling expenses. The ASU is effective on a prospective basis, with the option for retrospective application,

for annual periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption

is permitted. The Company is currently evaluating the impact the adoption of this guidance will have on its condensed consolidated financial

statements and related disclosures.

NOTE

2 — Revenue Recognition

The

Company recognizes revenue primarily from the sale of products, which are primarily mobile phones, mobile hotspots, and related accessories,

and the majority of the Company’s contracts include only one performance obligation, namely the delivery of product. A performance

obligation is a promise in a contract to transfer a distinct good or service to the customer and is defined as the unit of account for

revenue recognition under Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers. The Company

also recognizes revenue from other contracts that may include a combination of products and non-recurring engineering (“NRE”)

services or from the provision of solely NRE services. Where there is a combination of products and NRE services, the Company accounts

for the promises as individual performance obligations if they are concluded as distinct. Performance obligations are considered distinct

if they are both capable of being identified and distinct within the context of the contract. In determining whether performance obligations

meet the criteria for being distinct, the Company considers a number of factors, such as the degree of interrelation and interdependence

between obligations, and whether or not the good or service significantly modifies or transforms another good or service in the contract.

During the three and nine months ended September 30, 2024, and 2023, the Company did not have any contracts in which the products and

NRE services were concluded to be a single performance obligation. In certain cases, the Company may offer tiered pricing based on volumes

purchased for specific products. To date, all tiered pricing provisions have fallen into observable ranges of pricing to existing customers,

thus, not resulting in any material right which could be concluded as its own performance obligation. In addition, the Company does not

offer material post-contract support services to its customers.

Net

revenue for an individual contract is recognized at the related transaction price, which is the amount the Company expects to be entitled

to in exchange for transferring the goods and/or services. The transaction price for product sales is calculated as the product selling

price, net of variable consideration, which may include estimates for marketing development funds, sales incentives, and price protection

and stock rotation rights. The Company records reductions to net revenues related to future product returns based on the Company’s

expectations and historical experience. Typically, variable consideration does not need to be constrained as estimates are based on specific

contract terms. However, the Company continues to assess variable consideration estimates such that it is probable that a significant

reversal of revenue will not occur. The transaction price for a contract with multiple performance obligations is allocated to the separate

performance obligations on a relative standalone selling price basis. Standalone selling prices for products are determined based on

the prices charged to customers, which are directly observable. Standalone selling price of the professional services are mostly based

on time and materials. The Company determines its estimates of variable consideration based on historical collection experience with

similar payor classes, aged accounts receivable by payor class, terms of payment agreements, correspondence from payors related to revenue

audits or reviews, the Company’s historical settlement activity of audited and reviewed claims and current economic conditions

using the portfolio approach. Revenue is recognized only to the extent that it is probable that a significant reversal of the cumulative

amount recognized will not occur in future periods.

Revenue

is then recognized for each distinct performance obligation as control is transferred to the customer. Revenue attributable to hardware

is recognized at the time control of the product transfers to the customer. Control is generally transferred when the Company has a present

right to payment and title and the significant risks and rewards of ownership of products or services are transferred to its customers.

For most of the Company’s revenue attributable to hardware, control transfers when products are shipped. Revenue attributable to

professional services is recognized as the Company performs the professional services for the customer.

Disaggregation

of revenue

The

following table presents the Company’s total net revenues disaggregated by product category:

Schedule of Net Revenue Disaggregate by Product Category

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Smartphones | |

$ | 7,957 | | |

$ | 8,364 | | |

$ | 19,910 | | |

$ | 23,683 | |

| Feature Phones | |

| 6,780 | | |

| 4,907 | | |

| 14,839 | | |

| 11,737 | |

| White Label Phones (ODM Model) (Related Party) | |

| — | | |

| — | | |

| 7,658 | | |

| — | |

| White Label Tablets (ODM Model) | |

| — | | |

| 13,870 | | |

| — | | |

| 43,864 | |

| Accessories and Other | |

| 285 | | |

| 425 | | |

| 907 | | |

| 918 | |

| Total net revenues | |

$ | 15,022 | | |

$ | 27,566 | | |

$ | 43,314 | | |

$ | 80,202 | |

Shipping

and handling costs

The

Company has elected to account for shipping and handling activities related to contracts with customers as costs to fulfill the promise

to transfer the associated products.

Contract

costs

Applying

the practical expedient, the Company recognizes the incremental costs of obtaining contracts as an expense when incurred when the amortization

period of the assets that otherwise would have been recognized is one year or less. These costs are included in sales and marketing expenses.

The

non-recurring costs associated with design and development of new products for technical approval represent costs to fulfill a contract

pursuant to ASC 340-40, Other Assets and Deferred Costs. Accordingly, the Company capitalizes these contract fulfillment costs

and amortizes such costs over the estimated period of time they are expected to be recovered, which is typically three to four years,

the estimated life of a particular product model. As of September 30, 2024, and December 31, 2023, the net contract fulfillment assets

were $12,063 and $9,232, respectively.

If

the Company determines that such contract fulfillment costs are not expected to be recovered, it records an impairment in the period

such determination is made. During the nine months ended September 30, 2024, the Company recorded an impairment of contract fulfillment

assets of $3,217 due to a decrease in projected profit of one of its hotspots and the cancellation of a consumer durable product.

NOTE

3 — Fair Value Measurement

The

fair value measurements standard establishes a framework for measuring fair value. That framework provides a fair value hierarchy that

prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted

prices in active markets for identical assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level

3 measurements). The three levels of the fair value hierarchy under the standard are described below:

Level

1—Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the

Company has the ability to access.

Level

2—Inputs to the valuation methodology include:

| |

● |

Quoted

market prices for similar assets or liabilities in active markets; |

| |

|

|

| |

● |

Quoted

prices for identical or similar assets or liabilities in inactive markets; |

| |

|

|

| |

● |

Inputs

other than quoted prices that are observable for the asset or liability; |

| |

|

|

| |

● |

Inputs

that are derived principally from or corroborated by observable market data by correlation or other means. |

If

the asset or liability has a specified (contractual) term, the level 2 input must be observable for substantially the full term of the

asset or liability.

Level

3—Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The

assets or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that

is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the

use of unobservable inputs.

The

following is a description of the valuation methodologies used for assets and liabilities measured at fair value. There have been no

changes in the methodologies used at September 30, 2024, and December 31, 2023.

Money

market funds are classified within level 1 of the fair value hierarchy because they are valued using quoted market prices.

The

methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future

fair values. Furthermore, while the Company believes its valuation methods are appropriate and consistent with other market participants,

the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different

fair value measurement at the reporting date.

The

following tables set forth by level, within the fair value hierarchy, the Company’s assets at fair value:

Schedule of Fair Value Assets

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

September 30, 2024 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Assets: | |

| | | |

| | | |

| | | |

| | |

| Money market funds * | |

$ | 103 | | |

$ | — | | |

$ | — | | |

$ | 103 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

December 31, 2023 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Assets: | |

| | | |

| | | |

| | | |

| | |

| Money market funds * | |

$ | 102 | | |

$ | — | | |

$ | — | | |

$ | 102 | |

NOTE

4 — Significant Balance Sheet Components

The

following table presents the components of the Company’s accounts receivable, net:

Schedule of Accounts Receivable

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Trade receivables | |

$ | 5,689 | | |

$ | 25,576 | |

| Allowance for credit losses | |

| (449 | ) | |

| (272 | ) |

| Total accounts receivable | |

$ | 5,240 | | |

$ | 25,304 | |

The

Company determines the probability of default for each pool of receivables with similar risk characteristics. The probability of loss

is applied to the value of the receivables and an allowance for potential credit losses is recorded with the offset to credit loss expense.

Trade

receivables from the customer that purchased white label tablets from the Company accounts for 52% and 69%, respectively, of accounts

receivable, net, at September 30, 2024, and December 31, 2023. One additional customer accounts for 28% of accounts receivable, net,

at September 30, 2024. A separate customer accounts for 15% of accounts receivable, net, at December 31, 2023. In October 2023, the Company

stopped sales of the white label tablets to its tablet customer as the product reached the end of its life cycle. The tablet

customer had a receivable due to the Company of $17,443 at December 31, 2023. In February 2024, an agreement was executed that transferred

$11,308 of the receivables to the manufacturer of the tablets in exchange for relieving the Company of a $11,308 accounts payable liability.

The

Company has non-trade receivables from manufacturing vendors resulting from the sale of components to vendors who manufacture and assemble

final products for the Company.

Customer

Concentration Risk

Accounts Receivable

The

following table presents the components of the Company’s inventory:

Schedule of Inventory

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Devices – for resale | |

$ | 5,408 | | |

$ | 5,324 | |

| Raw materials | |

| 6,542 | | |

| 751 | |

| Accessories | |

| 424 | | |

| 442 | |

| Inventory, net | |

$ | 12,374 | | |

$ | 6,517 | |

For

certain new products, the Company began purchasing raw materials in 2024 that will be used by the third-party manufacturers to build

the products. These purchased parts represent most of the raw materials in inventory at September 30, 2024.

The

following table presents the components of the Company’s accrued liabilities:

Schedule of Accrued Expenses

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Customer allowances | |

$ | 11,454 | | |

$ | 8,148 | |

| Contract fulfillment liabilities | |

| 4,074 | | |

| 568 | |

| Inventory received, not billed | |

| 4,324 | | |

| 325 | |

| Employee-related liabilities | |

| 1,309 | | |

| 1,755 | |

| Warranties | |

| 519 | | |

| 518 | |

| Other | |

| 1,448 | | |

| 919 | |

| Accrued liabilities | |

$ | 23,128 | | |

$ | 12,233 | |

NOTE

5 — Stockholders’ Equity

Equity

Financing

On

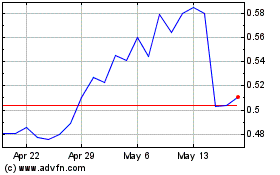

April 29, 2024, the Company closed on a capital investment of 350,000

shares of common stock and warrants, as adjusted for the Reverse Stock Split, with a single investor for an aggregate purchase

price of $3,850.

In connection with the closing, the Company incurred approximately $66

in issuance costs, which was offset against the proceeds.

Each

warrant has an exercise price of $11.00 per share, as adjusted for the Reverse Stock Split, is immediately exercisable, will expire in

five years from the date of issuance, and is subject to customary adjustments for certain transactions affecting the Company’s

capitalization. The warrants may not be exercised if the aggregate number of shares of common stock beneficially owned by the investor

subsequent to the exercise exceeds the specified beneficial ownership limitation provided therein (which is currently 9.99% and may be

adjusted upon advance notice).

ATM

Offering

On

August 6, 2024, the Company entered into a sales agreement (the “Sales Agreement”) with Roth Capital Partners, LLC (“Roth”).

Pursuant to the Sales Agreement, the Company may sell, at its option, shares of common stock through Roth, as sales agent. Sales of shares

of the Company’s common stock made pursuant to the Sales Agreement are being made under the Registration Statement on Form S-3