- Combined annual revenue expected to be approximately $620

million

- Highly synergistic transaction expected to result in

run-rate cost synergies/savings of approximately $10

million

- Atlantic CEO Jeffrey Jagid to remain Chief Executive Officer

of combined company; Staffing 360 Solutions CEO Brendan Flood to

serve as President of Staffing 360 Solutions

- Atlantic will acquire all outstanding shares of Staffing 360

Solutions in a transaction valued at approximately $25

million

Atlantic International Corp. (“Atlantic”) (OTC: ATLN), and

Staffing 360 Solutions, Inc. (“Staffing 360”) (Nasdaq: STAF), both

leading providers of strategic outsourced services and workforce

solutions, today announced that their boards of directors

unanimously approved a definitive agreement under which Atlantic

will acquire all outstanding shares of Staffing 360’s common stock.

The Staffing 360 shareholders will receive 1.202 Atlantic shares

for each Staffing 360 share. Atlantic and Staffing 360 shareholders

will own approximately 90% and 10%, respectively, of the combined

company on a fully diluted basis.

The transaction is expected to close within the next 90 days and

is subject to the approval of Staffing 360’s shareholders and other

customary closing conditions, including regulatory approval. Those

matters, including the record date and meeting date, will be

communicated subsequent to the receipt of SEC approval of related

proxy materials. When complete, Staffing 360 will continue to

operate under its current leadership team and brand as a wholly

owned subsidiary of Atlantic. The record date and the date for the

special meeting of shareholders to vote on the transaction will be

communicated to shareholders in the coming days.

“We have great respect for Staffing 360 and its talented team,

and are enthusiastic about the mutual benefits this transaction

brings to the clients of both entities,” said Atlantic’s CEO

Jeffrey Jagid. “The merger provides a unique opportunity to

increase our business by approximately 50 percent to an annualized

revenue run rate of approximately $620 million and allows us to

become an even bigger force in the broad staffing sector. Our

objective is to build a multibillion-dollar diversified services

company through both organic growth and M&A, and this

transaction is consistent with the achievement of our goals.

“Joining forces provides an expanded suite of services, broader

geographic reach and enhanced professional opportunities for our

combined organization. Together, we are even stronger, and I look

forward to a bright future ahead,” Jagid added.

Brendan Flood, Staffing 360’s CEO, said, “We are excited to join

forces with Atlantic International and its wholly owned operating

subsidiary, Lyneer Staffing Solutions, to become part of a

distinguished, national leader in the sector. Building on

complementary footprints and shared values, our combined company

will be even better positioned to deliver enhanced levels of

service to a growing number of companies throughout the United

States whose management teams recognize the value of outsourcing

and the trends toward engaging flexible workforces. This merger is

a testament to the strengths of our respective brands and the

accomplishments of our dedicated team members.”

Anticipated Benefits to Shareholders from the Merger

- Enhanced scale and liquidity with potential for premium

valuation: With a pro-forma revenue base of approximately $620

million, Atlantic and Staffing 360 shareholders are expected to

benefit from the scale, liquidity and capital alternatives of a

larger combined company. Additionally, larger capitalized human

capital management and workforce solutions companies have

historically carried premium valuations.

- Improved cost structure: The combination of Atlantic and

Staffing 360 is expected to create cost efficiencies and decrease

Atlantic’s operating expense ratio, leading to improved

profitability. Atlantic has identified opportunities to further

enhance operating cost efficiencies in the year following the close

of the transaction.

- Benefit from a more diversified customer base:

Atlantic’s broad customer base has grown organically and through

M&A and is positioned to withstand periods of market

volatility. Together with Staffing 360, the combined company will

serve more than 1,500 customers, with no customer generating more

than 5% of total revenue.

Cautionary Notes on Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the federal securities laws, including Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. In this context,

forward-looking statements often address expected future business

and financial performance and financial condition, and often

contain words such as “expect,” “anticipate,” “intend,” “plan,”

“believe,” “seek,” “see,” “will,” “would,” “target,” similar

expressions, and variations or negatives of these words.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, such as statements about the

consummation of the proposed transaction and the anticipated

benefits thereof. These and other forward-looking statements,

including, but not limited to, the failure to consummate the

proposed transaction or to make or take any filing or other action

required to consummate such transaction on a timely matter or at

all, are not guarantees of future results and are subject to risks,

uncertainties and assumptions that could cause actual results to

differ materially from those expressed in any forward-looking

statements. Important risk factors that may cause such a difference

include, but are not limited to, (i) the completion of the proposed

transaction on anticipated terms and timing, including obtaining

shareholder and regulatory approvals, anticipated tax treatment,

unforeseen liabilities, future capital expenditures, revenues,

expenses, earnings, synergies, economic performance, indebtedness,

financial condition, losses, future prospects, business and

management strategies for the management, expansion and growth of

the new combined company’s operations and other conditions to the

completion of the merger, (ii) the ability of Atlantic and Staffing

360 to integrate the business successfully and to achieve

anticipated synergies, risks and costs and (iii) potential

litigation relating to the proposed transaction that could be

instituted against Atlantic, Staffing 360 or their respective

directors, (iv) the risk that disruptions from the proposed

transaction will harm Atlantic’s or Staffing 360’s business,

including current and proposed plans and operations, (v) the

ability of Atlantic or Staffing 360 to retain and hire key

personnel, (vi) potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the

merger, (vii) uncertainty as to the long-term value of Atlantic

common stock, (viii) continued availability of capital and

financing and rating agency actions, (ix) legislative, regulatory

and economic developments and (x) unpredictability and severity of

catastrophic events, including, but not limited to, acts of

terrorism or outbreak of war or hostilities, as well as

management’s response to any of the aforementioned factors. These

risks, as well as other risks associated with the proposed merger,

will be more fully discussed in the joint proxy

statement/prospectus that will be included in the registration

statement on Form S-4 that will be filed with the SEC in connection

with the proposed merger. While the list of factors presented here

is, and the list of factors to be presented in the registration

statement on Form S-4 are, considered representative, no such list

should be considered to be a complete statement of all potential

risks and uncertainties. Unlisted factors may present significant

additional obstacles to the realization of forward-looking

statements. Consequences of material differences in results as

compared with those anticipated in the forward-looking statements

could include, among other things, business disruption, operational

problems, financial loss, legal liability to third parties and

similar risks, any of which could have a material adverse effect on

Atlantic’s or Staffing 360’s consolidated financial condition,

results of operations, credit rating or liquidity. Neither Atlantic

nor Staffing 360 assumes any obligation to publicly provide

revisions or updates to any forward-looking statements, whether as

a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by

securities and other applicable laws.

About Atlantic International Corp.

Atlantic International Corp. (“Atlantic”) is a leading strategic

staffing, outsourced services, and workforce solutions company

executing a high-growth strategy. Through its principal operating

subsidiary, Lyneer Investments LLC (“Lyneer”), Atlantic’s

approximately 300 employees generated over $400 million in revenue

(for the twelve months ended June 30, 2024). According to Staffing

Industry Analysts, Atlantic is among the top 20 largest national

staffing companies servicing the light industrial, commercial,

professional, finance, direct placement, and managed service

provider verticals. Atlantic provides its customers with complete

HR solutions, operating 40 independent on-site and

vendor-on-premises facilities and paying over 12,000 employees

weekly. For more information about Lyneer Staffing Solutions please

visit www.lyneer.com. For more information about Atlantic

International Corp., please visit

www.atlantic-international.com.

About Staffing 360 Solutions, Inc.

Staffing 360 Solutions, Inc. provides a complete suite of

professional and commercial staffing and employer-of- record HR

services to the accounting, finance, IT, engineering and

administration sectors on a temporary, contract or permanent basis.

For more information, visit www.staffing360solutions.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104899753/en/

Staffing 360 Roger Pondel or

Natalie Mu PondelWilkinson Inc. (310) 279-5980 rpondel@pondel.com

nmu@pondel.com Atlantic

International Kale Fein (213) 915-6414

kfein@atlantic-international.com

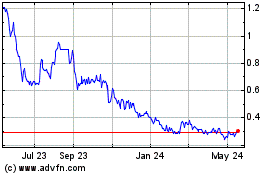

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Feb 2025 to Mar 2025

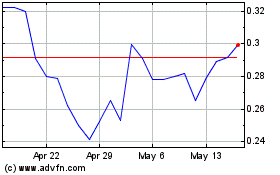

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Mar 2025