UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-38714

STONECO LTD.

(Exact name of registrant as specified in its charter)

4th Floor, Harbour Place

103 South Church Street, P.O. Box 10240

Grand Cayman, KY1-1002, Cayman Islands

+55 (11) 3004-9680

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INCORPORATION BY REFERENCE

This report on

Form 6-K shall be deemed to be incorporated by reference into the registration statement on Form S-8 (Registration Number: 333-265382)

of StoneCo Ltd. and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports

subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

StoneCo Ltd. |

| |

|

| |

By: |

/s/ Mateus Scherer Schwening |

| |

|

Name: |

Mateus Scherer Schwening |

| |

|

Title: |

Chief Financial Officer and Investor Relations Officer |

Date: November 12, 2024

EXHIBIT INDEX

Exhibit 99.1

Unaudited Interim Condensed

Consolidated Financial Statements

StoneCo Ltd.

September 30, 2024

with

report on review of interim condensed consolidated financial information

Index

to Consolidated Financial Statements

| Interim Condensed Consolidated Financial Statements |

Page |

| Report on review of interim condensed consolidated financial information |

F-3 |

| Unaudited interim consolidated statement of financial position |

F-4 |

| Unaudited interim consolidated statement of profit or loss |

F-6 |

| Unaudited interim consolidated statement of other comprehensive income (loss) |

F-7 |

| Unaudited interim consolidated statement of changes in equity |

F-8 |

| Unaudited interim consolidated statement of cash flows |

F-9 |

| Notes to unaudited interim condensed consolidated financial statements as of September 30, 2024 |

F-11 |

REPORT ON REVIEW OF INTERIM CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

To the Shareholders and Management of

StoneCo Ltd.

Introduction

We have reviewed the accompanying interim

consolidated statement of financial position of StoneCo Ltd. (the “Company”) as of September 30, 2024 and the related

interim consolidated statements of profit or loss and of other comprehensive income (loss) for the three and nine-months periods

then ended, and of changes in equity and cash flows for the nine-months period then ended and explanatory notes.

Management is responsible for

the preparation and fair presentation of this interim condensed consolidated financial information in accordance with IAS 34 – Interim

Financial Reporting, issued by the International Accounting Standards Board (IASB). Our responsibility is to express a conclusion on this

interim consolidated financial information based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity.

A review of interim financial information consists of making

inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures.

A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing and consequently

does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly,

we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention

that causes us to believe that the accompanying interim condensed consolidated financial statement does not give a true and fair

view of the financial position of the entity as at September 30, 2024, and of its financial performance and its cash flows for the

three and nine-months periods then ended in accordance with IAS 34 – Interim Financial Reporting, issued by the International

Accounting Standards Board (IASB).

São Paulo, November 11, 2024

ERNST & YOUNG

Auditores Independentes S/S Ltda.

| |

|

|

| |

|

| |

Unaudited interim consolidated statement of financial position |

| |

As of September 30, 2024 and December 31, 2023 |

| |

(In thousands of Brazilian Reais) |

| |

Notes |

|

September 30,

2024 |

|

December 31,

2023 |

| |

|

|

|

|

|

| Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

| Cash and cash equivalents |

4 |

|

4,013,279 |

|

2,176,416 |

| Short-term investments |

5.1 |

|

373,652 |

|

3,481,496 |

| Financial assets from banking solutions |

5.5 |

|

7,558,492 |

|

6,397,898 |

| Accounts receivable from card issuers |

5.2.1 |

|

26,207,888 |

|

23,895,512 |

| Trade accounts receivable |

5.3.1 |

|

381,379 |

|

459,947 |

| Loans operations portfolio |

5.4 |

|

653,745 |

|

209,957 |

| Recoverable taxes |

7 |

|

376,004 |

|

146,339 |

| Derivative financial instruments |

5.7 |

|

51,838 |

|

4,182 |

| Other assets |

6 |

|

373,871 |

|

380,854 |

| |

|

|

39,990,148 |

|

37,152,601 |

| Non-current assets |

|

|

|

|

|

| Long-term investments |

5.1 |

|

32,629 |

|

45,702 |

| Accounts receivable from card issuers |

5.2.1 |

|

102,331 |

|

81,597 |

| Trade accounts receivable |

5.3.1 |

|

26,038 |

|

28,533 |

| Loans operations portfolio |

5.4 |

|

144,059 |

|

40,790 |

| Derivative financial instruments |

5.7 |

|

344 |

|

— |

| Receivables from related parties |

11.1 |

|

628 |

|

2,512 |

| Deferred tax assets |

8.2 |

|

692,799 |

|

664,492 |

| Other assets |

6 |

|

145,044 |

|

137,508 |

| Investment in associates |

|

|

79,139 |

|

83,010 |

| Property and equipment |

9.1 |

|

1,760,401 |

|

1,661,897 |

| Intangible assets |

10.1 |

|

8,952,124 |

|

8,794,919 |

| |

|

|

11,935,536 |

|

11,540,960 |

| |

|

|

|

|

|

| Total assets |

|

|

51,925,684 |

|

48,693,561 |

| |

|

|

|

|

(continued) |

| |

|

|

|

|

|

The accompanying notes

are an integral part of these unaudited interim condensed consolidated financial statements.

| |

|

|

| |

|

| |

Unaudited interim consolidated statement of financial position |

| |

As of September 30, 2024 and December 31, 2023 |

| |

(In thousands of Brazilian Reais) |

| |

Notes |

|

September 30,

2024 |

|

December 31,

2023 |

| |

|

|

|

|

|

| Liabilities and equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

| Retail deposits |

5.6.1 |

|

6,816,752 |

|

6,119,455 |

| Accounts payable to clients |

5.2.2 |

|

16,550,066 |

|

19,163,672 |

| Trade accounts payable |

|

|

564,346 |

|

513,877 |

| Institutional deposits and marketable debt securities |

5.6.2 |

|

1,763,481 |

|

475,319 |

| Other debt instruments |

5.6.2 |

|

1,053,492 |

|

1,404,678 |

| Labor and social security liabilities |

|

|

603,162 |

|

515,749 |

| Taxes payable |

|

|

431,518 |

|

514,299 |

| Derivative financial instruments |

5.7 |

|

1,480 |

|

4,558 |

| Other liabilities |

|

|

288,432 |

|

119,526 |

| |

|

|

28,072,729 |

|

28,831,133 |

| Non-current liabilities |

|

|

|

|

|

| Accounts payable to clients |

5.2.2 |

|

53,347 |

|

35,455 |

| Institutional deposits and marketable debt securities |

5.6.2 |

|

4,940,927 |

|

3,495,759 |

| Other debt instruments |

5.6.2 |

|

2,277,700 |

|

143,456 |

| Derivative financial instruments |

5.7 |

|

83,781 |

|

311,613 |

| Deferred tax liabilities |

8.2 |

|

600,411 |

|

546,514 |

| Provision for contingencies |

12.1 |

|

247,583 |

|

208,866 |

| Labor and social security liabilities |

|

|

33,261 |

|

34,301 |

| Other liabilities |

|

|

286,968 |

|

410,504 |

| |

|

|

8,523,978 |

|

5,186,468 |

| |

|

|

|

|

|

| Total liabilities |

|

|

36,596,707 |

|

34,017,601 |

| |

|

|

|

|

|

| Equity |

13 |

|

|

|

|

| Issued capital |

13.1 |

|

76 |

|

76 |

| Capital reserve |

13.2 |

|

14,107,223 |

|

14,056,484 |

| Treasury shares |

13.3 |

|

(1,205,664) |

|

(282,709) |

| Other comprehensive income (loss) |

13.4 |

|

(204,197) |

|

(320,449) |

| Retained earnings |

|

|

2,577,649 |

|

1,168,862 |

| Equity attributable to controlling shareholders |

|

|

15,275,087 |

|

14,622,264 |

| Non-controlling interests |

|

|

53,890 |

|

53,696 |

| Total equity |

|

|

15,328,977 |

|

14,675,960 |

| |

|

|

|

|

|

| Total liabilities and equity |

|

|

51,925,684 |

|

48,693,561 |

| |

|

|

|

|

(concluded) |

| |

|

|

|

|

|

The accompanying notes

are an integral part of these unaudited interim condensed consolidated financial statements.

| |

|

|

| |

|

| |

Unaudited interim consolidated statement of profit or loss |

| |

For the nine and three months ended September 30, 2024 and 2023 |

| |

(In thousands of Brazilian Reais, unless otherwise stated) |

| |

|

|

Nine months ended September 30, |

|

Three months ended September 30, |

| |

Notes |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Net revenue from transaction activities and

other services |

15.1 |

|

2,386,195 |

|

2,441,652 |

|

828,854 |

|

868,527 |

Net revenue from subscription services and

equipment rental |

15.1 |

|

1,375,600 |

|

1,365,878 |

|

465,624 |

|

463,419 |

| Financial income |

15.1 |

|

5,486,596 |

|

4,458,553 |

|

1,918,820 |

|

1,620,914 |

| Other financial income |

15.1 |

|

399,626 |

|

540,238 |

|

143,935 |

|

187,022 |

| Total revenue and income |

|

|

9,648,017 |

|

8,806,321 |

|

3,357,233 |

|

3,139,882 |

| |

|

|

|

|

|

|

|

|

|

| Cost of services |

16 |

|

(2,510,344) |

|

(2,180,064) |

|

(859,044) |

|

(773,485) |

| Administrative expenses |

16 |

|

(827,215) |

|

(880,286) |

|

(314,728) |

|

(278,338) |

| Selling expenses |

16 |

|

(1,556,363) |

|

(1,244,252) |

|

(501,758) |

|

(442,433) |

| Financial expenses, net |

17 |

|

(2,658,133) |

|

(3,056,365) |

|

(910,534) |

|

(1,058,882) |

Mark-to-market on equity securities

designated at FVPL |

16 |

|

— |

|

30,574 |

|

— |

|

— |

| Other income (expenses), net |

16 |

|

(290,600) |

|

(240,867) |

|

(101,624) |

|

(82,616) |

| |

|

|

(7,842,655) |

|

(7,571,260) |

|

(2,687,688) |

|

(2,635,754) |

| |

|

|

|

|

|

|

|

|

|

| Gain (loss) on investment in associates |

|

|

266 |

|

(2,443) |

|

379 |

|

(595) |

| Profit before income taxes |

|

|

1,805,628 |

|

1,232,618 |

|

669,924 |

|

503,533 |

| |

|

|

|

|

|

|

|

|

|

| Current income tax and social contribution |

8.1 |

|

(369,903) |

|

(252,935) |

|

(112,674) |

|

(135,182) |

| Deferred income tax and social contribution |

8.1 |

|

(20,952) |

|

(35,446) |

|

(14,373) |

|

42,985 |

| Net income for the period |

|

|

1,414,773 |

|

944,237 |

|

542,877 |

|

411,336 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net income attributable to: |

|

|

|

|

|

|

|

|

|

| Controlling shareholders |

|

|

1,408,787 |

|

940,762 |

|

539,692 |

|

408,754 |

| Non-controlling interests |

|

|

5,986 |

|

3,475 |

|

3,185 |

|

2,582 |

| |

|

|

1,414,773 |

|

944,237 |

|

542,877 |

|

411,336 |

| |

|

|

|

|

|

|

|

|

|

| Earnings per share |

|

|

|

|

|

|

|

|

|

| Basic earnings per share for the period attributable to controlling shareholders (in Brazilian reais) |

14 |

|

4.62 |

|

3.00 |

|

1.82 |

|

1.30 |

| Diluted earnings per share for the period attributable to controlling shareholders (in Brazilian reais) |

14 |

|

4.53 |

|

2.89 |

|

1.78 |

|

1.25 |

The accompanying notes

are an integral part of these unaudited interim condensed consolidated financial statements.

| |

|

|

| |

|

| |

Unaudited interim consolidated statement of other comprehensive income (loss) |

| |

For the nine and three months ended September 30, 2024 and 2023 |

| |

(In thousands of Brazilian Reais) |

| |

|

|

Nine months ended September 30, |

|

Three months ended September 30, |

| |

Notes |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

| Net income for the period |

|

|

1,414,773 |

|

944,237 |

|

542,877 |

|

411,336 |

| Other comprehensive income ("OCI") |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Other comprehensive income that may be reclassified to profit or loss in subsequent periods: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Changes in the fair value of accounts receivable from card issuers |

19.1 |

|

(3,242) |

|

122,093 |

|

85,884 |

|

(17,741) |

| Tax on changes in the fair value of accounts receivable from card issuers |

|

|

1,162 |

|

(41,504) |

|

(29,202) |

|

6,032 |

| Exchange differences on translation of foreign operations |

|

|

629 |

|

(13,603) |

|

(876) |

|

(4,835) |

| Changes in the fair value of cash flow hedge |

|

|

76,618 |

|

40,642 |

|

207,401 |

|

(24,815) |

| |

|

|

|

|

|

|

|

|

|

| Other comprehensive income that will not be reclassified to profit or loss in subsequent periods: |

|

|

|

|

|

|

|

|

|

| Net monetary position in hyperinflationary economies |

|

|

3,422 |

|

2,494 |

|

1,046 |

|

1,574 |

| Gain on sale of equity instruments designated at fair value through other comprehensive income |

5.1 |

|

35,647 |

|

— |

|

— |

|

— |

| Changes in the fair value of equity instruments designated at fair value |

5.1/19.1 |

|

1,623 |

|

2,857 |

|

— |

|

3,998 |

| Other comprehensive income (loss) for the period |

|

|

115,859 |

|

112,979 |

|

264,253 |

|

(35,787) |

| |

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period |

|

|

1,530,632 |

|

1,057,216 |

|

807,130 |

|

375,549 |

| |

|

|

|

|

|

|

|

|

|

| Total comprehensive income attributable to: |

|

|

|

|

|

|

|

|

|

| Controlling shareholders |

|

|

1,525,039 |

|

1,053,741 |

|

803,509 |

|

372,967 |

| Non-controlling interests |

|

|

5,593 |

|

3,475 |

|

3,621 |

|

2,582 |

| Total comprehensive income for the period |

|

|

1,530,632 |

|

1,057,216 |

|

807,130 |

|

375,549 |

The accompanying notes

are an integral part of these unaudited interim condensed consolidated financial statements.

| |

|

|

| |

|

| |

Unaudited interim consolidated statement of changes in equity |

| |

For the nine months ended September 30, 2024 and 2023 |

| |

(In thousands of Brazilian Reais) |

| |

|

|

Attributable

to owners of the parent |

|

|

|

|

| |

|

|

|

|

Capital

reserve |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Notes

|

|

Issued

capital |

|

Additional

paid-in capital |

|

Transactions

among shareholders |

|

Special

reserve |

|

Other

reserves |

|

Total |

|

Treasury

shares |

|

Other

comprehensive income |

|

Retained

earnings |

|

Total |

|

Non-controlling

interests |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance

as of December 31, 2022 |

|

|

76 |

|

13,825,325 |

|

(445,062) |

|

61,127 |

|

377,429 |

|

13,818,819 |

|

(69,085) |

|

(432,701) |

|

(423,203) |

|

12,893,906 |

|

56,118 |

|

12,950,024 |

| Net

income for the period |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

940,762 |

|

940,762 |

|

3,475 |

|

944,237 |

| Other

comprehensive income for the period |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

112,979 |

|

— |

|

112,979 |

|

— |

|

112,979 |

| Total

comprehensive income |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

112,979 |

|

940,762 |

|

1,053,741 |

|

3,475 |

|

1,057,216 |

| Treasury

shares - delivered on business combination and sold |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

| Share-based

payments |

|

|

— |

|

— |

|

(647) |

|

— |

|

185,245 |

|

184,598 |

|

647 |

|

— |

|

— |

|

185,245 |

|

(114) |

|

185,131 |

| Shares

delivered under share-based payment arrangements |

|

|

— |

|

— |

|

(47,591) |

|

— |

|

(4,873) |

|

(52,464) |

|

53,270 |

|

— |

|

— |

|

806 |

|

— |

|

806 |

| Equity

transaction related to put options over non-controlling interest |

|

|

— |

|

— |

|

— |

|

— |

|

(20,341) |

|

(20,341) |

|

— |

|

— |

|

— |

|

(20,341) |

|

(321) |

|

(20,662) |

| Equity

transaction with non-controlling interests |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

49 |

|

49 |

| Dividends

paid |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(3,737) |

|

(3,737) |

| Others |

|

|

— |

|

— |

|

— |

|

— |

|

(22) |

|

(22) |

|

— |

|

— |

|

— |

|

(22) |

|

— |

|

(22) |

| Balance

as of September 30, 2023 |

|

|

76 |

|

13,825,325 |

|

(493,300) |

|

61,127 |

|

537,438 |

|

13,930,590 |

|

(15,168) |

|

(319,722) |

|

517,559 |

|

14,113,335 |

|

55,470 |

|

14,168,805 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance

as of December 31, 2023 |

|

|

76 |

|

13,825,325 |

|

(518,504) |

|

61,127 |

|

688,536 |

|

14,056,484 |

|

(282,709) |

|

(320,449) |

|

1,168,862 |

|

14,622,264 |

|

53,696 |

|

14,675,960 |

| Net

income for the period |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

1,408,787 |

|

1,408,787 |

|

5,986 |

|

1,414,773 |

| Other

comprehensive income for the period |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

116,252 |

|

— |

|

116,252 |

|

(393) |

|

115,859 |

| Total

comprehensive income |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

116,252 |

|

1,408,787 |

|

1,525,039 |

|

5,593 |

|

1,530,632 |

| Repurchase

of shares |

13.3 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(978,993) |

|

— |

|

— |

|

(978,993) |

|

— |

|

(978,993) |

| Share-based

payments |

|

|

— |

|

— |

|

— |

|

— |

|

129,090 |

|

129,090 |

|

— |

|

— |

|

— |

|

129,090 |

|

— |

|

129,090 |

| Shares

delivered under share-based payment arrangements |

|

|

— |

|

— |

|

(54,803) |

|

— |

|

— |

|

(54,803) |

|

56,038 |

|

— |

|

— |

|

1,235 |

|

— |

|

1,235 |

| Equity

transaction related to put options over non controlling interest |

|

|

— |

|

— |

|

— |

|

— |

|

(23,548) |

|

(23,548) |

|

— |

|

— |

|

— |

|

(23,548) |

|

1,316 |

|

(22,232) |

| Dividends

paid |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(6,177) |

|

(6,177) |

| Others |

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(538) |

|

(538) |

| Balance

as of September 30, 2024 |

|

|

76 |

|

13,825,325 |

|

(573,307) |

|

61,127 |

|

794,078 |

|

14,107,223 |

|

(1,205,664) |

|

(204,197) |

|

2,577,649 |

|

15,275,087 |

|

53,890 |

|

15,328,977 |

The accompanying notes

are an integral part of these unaudited interim condensed consolidated financial statements.

| |

|

|

| |

|

| |

Unaudited interim consolidated statement of cash flows |

| |

For the nine months ended September 30, 2024 and 2023 |

| |

(In thousands of Brazilian Reais) |

| |

|

|

Nine months ended September 30, |

| |

Notes |

|

2024 |

|

2023 |

| Operating activities |

|

|

|

|

|

| Net income for the period |

|

|

1,414,773 |

|

944,237 |

| Adjustments to reconcile net income for the period to net cash flows: |

|

|

|

|

|

| Depreciation and amortization |

9.2 |

|

705,392 |

|

657,138 |

| Deferred income tax and social contribution |

8.1 |

|

20,952 |

|

35,446 |

| Gain (loss) on investment in associates |

|

|

(266) |

|

2,443 |

| Accrued interest, monetary and exchange variations, net |

|

|

97,197 |

|

(207,162) |

| Provision for contingencies |

12.1 |

|

64,515 |

|

26,475 |

| Share-based payments expense |

18.1.4 |

|

158,359 |

|

181,645 |

| Allowance for expected credit losses |

|

|

118,975 |

|

99,616 |

| Loss on disposal of property, equipment and intangible assets |

19.5 |

|

5,789 |

|

53,240 |

| Effect of applying hyperinflation accounting |

|

|

3,836 |

|

2,447 |

| Loss on sale of subsidiary |

|

|

52,958 |

|

— |

| Fair value adjustment in financial instruments at FVPL |

19.1 |

|

(210,900) |

|

96,563 |

| Fair value adjustment in derivatives |

|

|

252,578 |

|

13,131 |

| Remeasurement of previously held interest in subsidiary acquired |

20.1.3 |

|

(7,467) |

|

— |

| Other |

|

|

— |

|

1,168 |

| Working capital adjustments: |

|

|

|

|

|

| Accounts receivable from card issuers |

|

|

(505,436) |

|

2,187,123 |

| Receivables from related parties |

|

|

23,491 |

|

11,988 |

| Recoverable taxes |

|

|

(28,066) |

|

156,487 |

| Prepaid expenses |

|

|

87,853 |

|

66,673 |

| Trade accounts receivable, banking solutions and other assets |

|

|

(28,803) |

|

44,848 |

| Loans operations portfolio |

|

|

(463,597) |

|

— |

| Accounts payable to clients |

|

|

(7,698,729) |

|

(3,641,277) |

| Taxes payable |

|

|

(164,457) |

|

66,505 |

| Labor and social security liabilities |

|

|

57,228 |

|

66,591 |

| Payment of contingencies |

12.1 |

|

(44,910) |

|

(27,751) |

| Trade accounts payable and other liabilities |

|

|

224,857 |

|

(34,771) |

| |

|

|

|

|

|

| Interest paid (a) |

|

|

(579,808) |

|

(480,201) |

| Interest income received, net of costs |

19.4 |

|

3,242,740 |

|

1,825,042 |

| Income tax paid |

|

|

(119,646) |

|

(83,316) |

| Net cash (used in) / provided by in operating activities |

|

|

(3,320,592) |

|

2,064,328 |

| |

|

|

|

|

(continued) |

| Investing activities |

|

|

|

|

|

| Purchases of property and equipment |

19.5 |

|

(561,056) |

|

(591,804) |

| Purchases and development of intangible assets |

19.5 |

|

(388,239) |

|

(333,170) |

| Proceeds from (acquisition of) short-term investments, net |

|

|

3,129,630 |

|

1,600,368 |

| Sale of subsidiary, net of cash disposed of |

|

|

(4,204) |

|

— |

| Proceeds from disposal of long-term investments – equity securities |

5.1 |

|

57,540 |

|

218,105 |

| Proceeds from the disposal of non-current assets |

19.5 |

|

4,394 |

|

515 |

| Acquisition of subsidiary, net of cash acquired |

|

|

(9,054) |

|

— |

| Payment for interest in subsidiaries acquired |

|

|

(162,237) |

|

(34,025) |

| Net cash (used in) / provided by investing activities |

|

|

2,066,774 |

|

859,989 |

The accompanying notes

are an integral part of these unaudited interim condensed consolidated financial statements.

| |

|

|

| |

|

| |

Unaudited interim consolidated statement of cash flows |

| |

For the nine months ended September 30, 2024 and 2023 |

| |

(In thousands of Brazilian Reais) |

| |

|

|

Nine months ended September 30, |

| |

Notes |

|

2024 |

|

2023 |

| Financing activities |

|

|

|

|

|

| Proceeds from institutional deposits and marketable debt securities |

5.6.2 |

|

4,150,349 |

|

371,380 |

| Payment of institutional deposits and marketable debt securities |

5.6.2 |

|

(1,872,710) |

|

(5,004) |

| Proceeds from other debt instruments, except lease |

5.6.2 |

|

4,487,263 |

|

3,888,209 |

| Payment to other debt instruments, except lease |

5.6.2 |

|

(2,569,765) |

|

(4,939,187) |

| Payment of principal portion of leases liabilities |

5.6.2 |

|

(53,228) |

|

(71,174) |

| Payment of derivative financial instruments designated for hedge accounting |

|

|

(112,772) |

|

— |

| Repurchase of own shares |

13.3 |

|

(978,993) |

|

— |

| Acquisition of non-controlling interests |

|

|

72 |

|

(1,369) |

| Dividends paid to non-controlling interests |

|

|

(6,177) |

|

(3,737) |

| Net cash (used in) / provided by financing activities |

|

|

3,044,039 |

|

(760,882) |

| |

|

|

|

|

|

| Effect of foreign exchange on cash and cash equivalents |

|

|

46,642 |

|

17,033 |

| Change in cash and cash equivalents |

|

|

1,836,863 |

|

2,180,468 |

| |

|

|

|

|

|

| Cash and cash equivalents at beginning of period |

4 |

|

2,176,416 |

|

1,512,604 |

| Cash and cash equivalents at end of period |

4 |

|

4,013,279 |

|

3,693,072 |

| Change in cash and cash equivalents |

|

|

1,836,863 |

|

2,180,468 |

_________________

(a) The amount of interest

paid includes payment of coupons of derivatives designated as cash flow hedge of financial liabilities.

The accompanying notes

are an integral part of these unaudited interim condensed consolidated financial statements.

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

StoneCo Ltd. (the “Company”),

is a Cayman Islands exempted company with limited liability, incorporated on March 11, 2014. The registered office of the Company is located

at 4th Floor, Harbour Place 103 South Church Street, P.O. box 10240 Grand Cayman E9 KY1-1002.

VCK Investment Fund Limited SAC

is the ultimate parent of HR Holdings LLC, which holds, approximately, 31% of the Company’s voting shares. VCK Investment Fund Limited

SAC is owned by the co-founder of the Company, Mr. Andre Street.

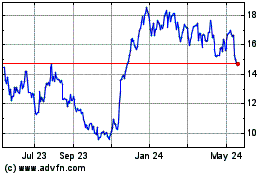

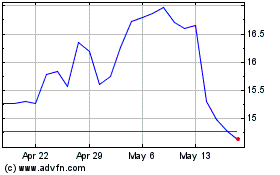

The Company’s shares are

publicly traded on Nasdaq under the ticker symbol STNE and its Brazilian Depository Receipts (BDRs) representing the underlying Company´s

shares are traded on the Brazilian stock exchange (B3) under the ticker symbol STOC31.

The Company and its subsidiaries

(collectively, the “Group”) provide financial services and software solutions to clients across in-store, mobile and online

device platforms helping them to better manage their businesses by increasing the productivity of their sales initiatives.

The interim condensed consolidated

financial statements of the Group for the nine months ended September 30, 2024 and 2023 were approved by the Audit Committee on November

11 , 2024.

1.1. Seasonality of operations

The Group’s revenues are

subject to seasonal fluctuations as a result of consumer spending patterns. Historically, revenues have been strongest during the last

quarter of the year as a result of higher sales during the Brazilian holiday season. This is due to the increase in the number and amount

of electronic payment transactions related to seasonal retail events. Adverse events that occur during these months could have a disproportionate

effect on the results of operations for the entire fiscal year. As a result of seasonal fluctuations caused by these and other factors,

results for an interim period may not be indicative of those expected for the full fiscal year.

| 2. | Basis of preparation and changes to the Group’s accounting policies and estimates |

2.1. Basis

of preparation

The interim condensed consolidated

financial statements for the nine months ended September 30, 2024 have been prepared in accordance with IAS 34 – Interim Financial

Reporting, issued by the International Accounting Standards Board (“IASB”).

The interim condensed consolidated

financial statements are presented in Brazilian Reais (“R$”), and all values are rounded to the nearest thousand (R$ 000),

except when otherwise indicated.

The interim condensed consolidated

financial statements do not include all the information and disclosures required in the annual financial statements and should be read

in conjunction with the Group’s annual consolidated financial statements as of December 31, 2023.

The accounting policies adopted

in this interim reporting period are consistent with those of the previous financial year, except for the following:

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

From January 1, 2024 onwards, the

Group recognizes revenues from membership fees deferred through the expected lifetime of the client. The new criteria has been adopted

and the Group has applied prospectively because the effect of the change and of the old criteria was not material to the consolidated

financial statements both for the current and past periods. For further details see Note 15.1.

Considering that the Group is diversifying

its sources of funding in the different markets (retail, banking, capital markets, institutional and other), as from June 30, 2024, a

revised classification of deposits and debt instruments has been adopted. The comparative balances as of December 31, 2023 have been retroactively

reclassified following the new criteria.

2.2. Estimates

The preparation of the Group’s

financial statements requires management to make judgments and estimates and to adopt assumptions that affect the amounts presented of

revenues, expenses, assets and liabilities at the financial statement date. Actual results may differ from these estimates.

Judgements, estimates and assumptions

are frequently revised, and any effects are recognized in the revision period and in any future affected periods. The objective of these

revisions is mitigating the risk of material differences between the estimated and actual results in the future.

In preparing these interim condensed

consolidated financial statements, the significant judgements and estimates made by management in applying the Group’s accounting

policies and the key sources of estimation uncertainty were the same as those from the consolidated financial statements for the year

ended December 31, 2023.

3.1. Subsidiaries

In accordance with IFRS 10 - Consolidated

Financial Statements, subsidiaries are all entities in which the Company holds control.

The following table shows the main

consolidated entities, which correspond to the Group’s most relevant operating vehicles.

| |

|

|

|

% of Group's equity interest |

| Entity name |

|

Principal activities |

|

September 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

|

|

| Stone Instituição de Pagamento S.A. (“Stone Pagamentos”) |

|

Merchant acquiring |

|

100.00 |

|

100.00 |

| Pagar.me Instituição de Pagamento S.A. (“Pagar.me”) |

|

Merchant acquiring |

|

100.00 |

|

100.00 |

| Stone Sociedade de Crédito Direto S.A. (“Stone SCD”) |

|

Financial services |

|

100.00 |

|

100.00 |

| Linx Sistemas e Consultoria Ltda. (“Linx Sistemas”) |

|

Technology services |

|

100.00 |

|

100.00 |

| Tapso Fundo de Investimento em Direitos Creditórios (“FIDC TAPSO”) |

|

Investment fund |

|

100.00 |

|

100.00 |

On February 7, 2024, the equity

interest of Ametista Serviços Digitais Ltda., Esmeralda Serviços Digitais Ltda., Diamante Serviços Digitais Ltda.,

and Safira Serviços Digitais Ltda. (collectively the “Pinpag") was sold, thus, the Group ceased to hold equity interest

in these entities.

In the first quarter of 2024, the

Group incorporated the companies Linx Impulse Ltda. ("Linx Impulse"), Stone Sociedade de Crédito, Financiamento e Investimento

S.A. ("Stone SCFI"), Sponte Educação Ltda. ("Sponte Educação") and Linx Automotivo Ltda.

(“Linx Automotivo”) all of which are wholly owned by the Group.

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

In the second quarter of 2024,

the Group incorporated the companies Linx People Ltda. (“Linx People”), Linx Saúde Ltda. (“Linx Saúde”),

Linx Commerce Ltda. (“Linx Commerce”) and Linx Enterprise Ltda. (“Linx Enterprise”) all of which are wholly owned

by the Group.

Other than the changes described

above there were no other changes in the interest held by the Group in its subsidiaries.

The Group holds call options to

acquire additional interests in some of its subsidiaries (Note 5.7) and issued put options to non-controlling investors (Note 5.10.1)

3.2. Associates

The following table shows all entities

in which the Group has significant influence.

| |

|

|

|

% of Group's equity interest |

| Entity name |

|

Principal activities |

|

September 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

|

|

| Agilize Tecnologia S.A ("Agilize") |

|

Technology services |

|

33.33 |

|

33.33 |

| Alpha-Logo Serviços de Informática S.A. (“Tablet Cloud”) |

|

Technology services |

|

25.00 |

|

25.00 |

| APP Sistemas S.A. (“APP”) (a) |

|

Technology services |

|

19.80 |

|

19.90 |

| Delivery Much Tecnologia S.A. (“Delivery Much”) |

|

Food delivery marketplace |

|

29.50 |

|

29.50 |

| Dental Office S.A. (“Dental Office”) |

|

Technology services |

|

20.00 |

|

20.00 |

| Neostore Desenvolvimento de Programas de Computador S.A. (“Neomode”) (b) |

|

Technology services |

|

42.25 |

|

40.02 |

| Trinks Serviços de Internet S.A. (“Trinks”) (c) |

|

Technology services |

|

— |

|

19.90 |

| (a) | In the first quarter of 2024, the equity interest held by the

Group was diluted by the issuance of new shares under a long-term incentive program. |

| (b) | On April 17, 2024, Linx Sistemas, a Group company, increased

its equity interest in Neomode through a loan conversion. |

| (c) | On May 2, 2024, Stne Participações S.A. (“STNE

Par”), a Group company, acquired 100% of the remaining shares of Trinks. STNE Par had already owned 19.90% of Trinks' share capital.

(Note 20.1) |

The Group holds call options to

acquire additional interests in some of its associates (Note 5.7).

| 4. | Cash and cash equivalents |

| |

|

September 30,

2024 |

|

December 31,

2023 |

| |

|

|

|

|

| Denominated in R$ |

|

3,970,342 |

|

2,128,425 |

| Denominated in US$ |

|

42,937 |

|

47,991 |

| Total |

|

4,013,279 |

|

2,176,416 |

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

5.1. Short

and Long-term investments

| |

|

Short-term |

|

Long-term |

|

September 30,

2024 |

| |

|

Listed securities |

|

Unlisted

securities |

|

Listed securities |

|

Unlisted

securities |

|

| |

|

|

|

|

|

|

|

|

|

|

| Bonds (a) |

|

|

|

|

|

|

|

|

|

|

| Brazilian sovereign bonds |

|

21,164 |

|

— |

|

— |

|

— |

|

21,164 |

| Structured notes linked to Brazilian sovereign bonds |

|

— |

|

293,391 |

|

— |

|

— |

|

293,391 |

| Time deposits |

|

57,643 |

|

— |

|

— |

|

— |

|

57,643 |

| Equity securities (b) |

|

— |

|

— |

|

— |

|

32,629 |

|

32,629 |

| Investment funds (c) |

|

— |

|

1,454 |

|

— |

|

— |

|

1,454 |

| Total |

|

78,807 |

|

294,845 |

|

— |

|

32,629 |

|

406,281 |

| |

|

|

|

|

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

|

|

373,652 |

| Non-current |

|

|

|

|

|

|

|

|

|

32,629 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Short-term |

|

Long-term |

|

December 31,

2023 |

| |

|

Listed securities |

|

Unlisted

securities |

|

Listed securities |

|

Unlisted

securities |

|

| |

|

|

|

|

|

|

|

|

|

|

| Bonds (a) |

|

|

|

|

|

|

|

|

|

|

| Brazilian sovereign bonds |

|

2,954,236 |

|

— |

|

— |

|

— |

|

2,954,236 |

| Structured notes linked to Brazilian sovereign bonds |

|

— |

|

473,259 |

|

— |

|

— |

|

473,259 |

| Time deposits |

|

51,933 |

|

— |

|

— |

|

— |

|

51,933 |

| Equity securities (b) |

|

— |

|

— |

|

— |

|

45,702 |

|

45,702 |

| Investment funds (c) |

|

— |

|

2,068 |

|

— |

|

— |

|

2,068 |

| Total |

|

3,006,169 |

|

475,327 |

|

— |

|

45,702 |

|

3,527,198 |

| |

|

|

|

|

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

|

|

3,481,496 |

| Non-current |

|

|

|

|

|

|

|

|

|

45,702 |

| (a) | As of September 30, 2024, bonds of listed securities are mainly

linked to the CDI and Selic benchmark interest rates. |

| (b) | Comprised of common shares of unlisted entities. All assets

at the reporting dates are unlisted securities that are not traded in an active market and recognized at fair value through other comprehensive

income. Fair value of unlisted equity instruments was determined based on negotiations of the securities. The change in fair value of

equity securities at FVOCI for the nine months ended September 30, 2024 was R$ 1,623, (R$ 2,857 for the nine months ended September 30,

2023).

On June 03, 2024, the Group sold its remaining stake in Cloudwalk INC for payment of R$ 57,540. The gain on the sale of R$ 35,647 was

recognized in other comprehensive income. |

| (c) | Comprised of foreign investment fund shares. |

Short and Long-term investments

are denominated in Brazilian Reais and U.S. dollars.

5.2. Accounts

receivable from card issuers and accounts payable to clients

5.2.1. Composition

of accounts receivable from card issuers

Accounts receivable are amounts

due from card issuers and acquirers for the transactions of clients with card holders, performed in the ordinary course of business.

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

| |

|

September 30,

2024 |

|

December 31,

2023 |

| |

|

|

|

|

| Accounts receivable from card issuers (a) |

|

25,788,315 |

|

23,364,806 |

| Accounts receivable from other acquirers (b) |

|

581,026 |

|

667,922 |

| Allowance for expected accounts receivable credit losses |

|

(59,122) |

|

(55,619) |

| Total |

|

26,310,219 |

|

23,977,109 |

| |

|

|

|

|

| Current |

|

26,207,888 |

|

23,895,512 |

| Non-current |

|

102,331 |

|

81,597 |

_________________

| (a) | Accounts receivable from card issuers, net of interchange fees,

as a result of processing transactions with clients. |

| (b) | Accounts receivable from other acquirers related to PSP (Payment

Service Provider) transactions. |

Part of the Group’s cash

requirement is to make prepayments to acquiring customers. The Group finances those requirements through different sources of funding

including the true sale of receivables to third parties. When such sales of receivables are carried out to entities in which the Group

has subordinated shares or quotas, the receivables sold remain in the statement of financial position, as these entities are consolidated

in the financial statements. As of September 30, 2024 a total of R$ 414,680 (December 31, 2023 - R$ 467,622) were consolidated through

FIDC ACR FAST and R$ 2,561,139 (December, 2023 - R$ null) through FIDC ACR I, of which the Group has subordinated shares. When the sale

of receivables is carried out to non-controlled entities and for transactions where continuous involvement is not present, the amounts

transferred are derecognized from the accounts receivable from card issuers. As of September 30, 2024, the sale of receivables that were

derecognized from accounts receivables from card issuers in the statement of financial position represent the main form of funding used

for the prepayment business.

Accounts receivable held by FIDCs

guarantee the obligations to FIDC quota holders.

5.2.2. Accounts

payable to clients

Accounts payable to clients represent

amounts due to accredited clients related to credit and debit card transactions, net of interchange fees retained by card issuers and

assessment fees paid to payment scheme networks as well as the Group’s net merchant discount rate fees which are collected by the

Group as an agent.

5.3. Trade

accounts receivable

5.3.1. Composition

of trade accounts receivable

Trade accounts receivables are

amounts due from clients mainly related to subscription services and equipment rental.

| |

|

September 30,

2024 |

|

December 31,

2023 |

| |

|

|

|

|

| Accounts receivable from subscription services |

|

263,937 |

|

293,304 |

| Accounts receivable from equipment rental |

|

113,319 |

|

114,252 |

| Chargeback |

|

95,162 |

|

72,401 |

| Services rendered |

|

36,140 |

|

51,456 |

| Receivables from registry operation |

|

14,497 |

|

22,347 |

| Cash in transit |

|

— |

|

24,172 |

| Allowance for expected credit losses |

|

(137,418) |

|

(117,553) |

| Others |

|

21,780 |

|

28,101 |

| Total |

|

407,417 |

|

488,480 |

| |

|

|

|

|

| Current |

|

381,379 |

|

459,947 |

| Non-current |

|

26,038 |

|

28,533 |

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

5.4. Loans

operations portfolio

Portfolio balances by product:

| |

|

September 30,

2024 |

|

December 31,

2023 |

| |

|

|

|

|

| Merchant portfolio |

|

863,997 |

|

309,677 |

| Credit card |

|

59,072 |

|

3,131 |

| Loans operations portfolio, gross |

|

923,069 |

|

312,808 |

| |

|

|

|

|

| Allowance for expected credit losses |

|

(125,265) |

|

(62,061) |

| Loans operations portfolio, net of allowance for expected credit losses |

|

797,804 |

|

250,747 |

| |

|

|

|

|

| Current |

|

653,745 |

|

209,957 |

| Non-current |

|

144,059 |

|

40,790 |

5.4.1. Non-performing

loans ("NPL")

Total outstanding of the contract

whenever the clients default on an installment:

| |

September 30, 2024 |

|

December 31, 2023 |

| |

Merchant

portfolio |

|

Credit card |

|

Total |

|

Merchant

portfolio |

|

Credit card |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

| Balances not overdue |

804,050 |

|

57,269 |

|

861,319 |

|

298,460 |

|

3,130 |

|

301,590 |

| Balances overdue by |

|

|

|

|

|

|

|

|

|

|

|

| <= 15 days |

11,531 |

|

561 |

|

12,092 |

|

4,350 |

|

1 |

|

4,351 |

| 15 < 30 days |

3,881 |

|

166 |

|

4,047 |

|

1,389 |

|

— |

|

1,389 |

| 31 < 60 days |

6,605 |

|

335 |

|

6,940 |

|

2,045 |

|

— |

|

2,045 |

| 61 < 90 days |

6,118 |

|

269 |

|

6,387 |

|

2,582 |

|

— |

|

2,582 |

| 91 < 180 days |

16,461 |

|

399 |

|

16,860 |

|

824 |

|

— |

|

824 |

| 181 < 360 days |

15,351 |

|

73 |

|

15,424 |

|

27 |

|

— |

|

27 |

| |

59,947 |

|

1,803 |

|

61,750 |

|

11,217 |

|

1 |

|

11,218 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Loans operations portfolio, gross |

863,997 |

|

59,072 |

|

923,069 |

|

309,677 |

|

3,131 |

|

312,808 |

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

5.4.2. Aging

by maturity

| |

September 30, 2024 |

|

December 31, 2023 |

| |

Merchant

portfolio |

|

Credit card |

|

Total |

|

Merchant

portfolio |

|

Credit card |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

| Installments not overdue |

|

|

|

|

|

|

|

|

|

|

|

| <= 15 days |

15,632 |

|

13,542 |

|

29,174 |

|

1,666 |

|

615 |

|

2,281 |

| 15 < 30 days |

30,698 |

|

9,564 |

|

40,262 |

|

11,244 |

|

851 |

|

12,095 |

| 31 < 60 days |

79,297 |

|

9,966 |

|

89,263 |

|

30,213 |

|

457 |

|

30,670 |

| 61 < 90 days |

79,349 |

|

6,803 |

|

86,152 |

|

27,696 |

|

321 |

|

28,017 |

| 91 < 180 days |

203,226 |

|

11,399 |

|

214,625 |

|

82,415 |

|

525 |

|

82,940 |

| 181 < 360 days |

285,983 |

|

6,474 |

|

292,457 |

|

113,005 |

|

318 |

|

113,323 |

| 361 < 720 days |

118,626 |

|

6 |

|

118,632 |

|

41,572 |

|

1 |

|

41,573 |

| > 720 days |

26,494 |

|

— |

|

26,494 |

|

61 |

|

— |

|

61 |

| |

839,305 |

|

57,754 |

|

897,059 |

|

307,872 |

|

3,088 |

|

310,960 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Installments overdue by |

|

|

|

|

|

|

|

|

|

|

|

| <= 15 days |

1,998 |

|

292 |

|

2,290 |

|

247 |

|

2 |

|

249 |

| 15 < 30 days |

3,720 |

|

107 |

|

3,827 |

|

657 |

|

41 |

|

698 |

| 31 < 60 days |

3,996 |

|

251 |

|

4,247 |

|

799 |

|

— |

|

799 |

| 61 < 90 days |

3,559 |

|

217 |

|

3,776 |

|

99 |

|

— |

|

99 |

| 91 < 180 days |

7,041 |

|

376 |

|

7,417 |

|

3 |

|

— |

|

3 |

| 181 < 360 days |

4,378 |

|

75 |

|

4,453 |

|

— |

|

— |

|

— |

| |

24,692 |

|

1,318 |

|

26,010 |

|

1,805 |

|

43 |

|

1,848 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Loans operations portfolio, gross |

863,997 |

|

59,072 |

|

923,069 |

|

309,677 |

|

3,131 |

|

312,808 |

5.4.3. Gross

carrying amount

The Group calculates an expected

credit loss allowance for its loans based on statistical models that consider both internal and external historical data, negative credit

information and guarantees, including information that addresses the behavior of each debtor. The Group calculates its loans operations

portfolio in three stages:

| (i) | Stage 1: corresponds to loans that do not present significant increase in credit risk since origination; |

| (ii) | Stage 2: corresponds to loans that presented significant increase in credit risk subsequent to origination. |

The Group determines

Stage 2 based on following criteria:

| (a) | absolute criteria: financial asset overdue more than 30 days, or; |

| (b) | relative criteria: in addition to the absolute criteria, the Group analyzes the evolution of the risk

of each financial instrument on a monthly basis, comparing the current behavior score attributed to each client with that attributed at

the time of recognition of the financial asset. Behavioral scoring considers credit behavior variables, such as default on other products

and market data about the customer. When the credit risk increases significantly since origination, the Stage 1 operation is moved to

Stage 2. |

For Stage 2, a

cure criterion is applied when the financial asset no longer meets the criteria for a significant increase in credit risk, as mentioned

above, and the loan is moved to Stage 1.

| (iii) | Stage 3: corresponds to impaired loans. |

The Group determines

Stage 3 based on following criteria:

| (a) | absolute criteria: financial asset overdue more than 90 days, or; |

| (b) | relative criteria: indicators that the financial asset will not be paid in full without activating a guarantee

or financial guarantee. |

The indication

that an obligation will not be paid in full includes the tolerance of financial instruments that imply the granting of advantages to the

counterparty following the deterioration of the counterparty's credit quality.

The Group also

assumes a cure criterion for Stage 3, with respect to the counterparty's repayment capacity, such as the percentage of total debt paid

or the time limit to liquidate current debt obligations.

Management regularly seeks forward

looking perspectives for future market developments including macroeconomic scenarios as well as its portfolio risk profile. Management

may adjust the ECL resulting from the models above in order to better reflect this forward looking perspective.

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

Reconciliation of gross portfolio

of loans operations, segregated by stages:

| Stage 1 |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Transfer to stage 2 |

|

Transfer to stage 3 |

|

Cure from stage 2 |

|

Cure from

stage 3 |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

296,282 |

|

558,522 |

|

(87,051) |

|

(5,431) |

|

32,834 |

|

1,363 |

|

— |

|

796,519 |

| Credit card |

|

3,131 |

|

55,848 |

|

(2,696) |

|

(205) |

|

751 |

|

100 |

|

— |

|

56,929 |

| |

|

299,413 |

|

614,370 |

|

(89,747) |

|

(5,636) |

|

33,585 |

|

1,463 |

|

— |

|

853,448 |

| Stage 2 |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Cure to

stage 1

|

|

Transfer to stage 3 |

|

Transfer from stage 1 |

|

Cure from

stage 3 |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

12,195 |

|

(2,490) |

|

(32,834) |

|

(37,297) |

|

87,051 |

|

729 |

|

— |

|

27,354 |

| Credit card |

|

— |

|

29 |

|

(751) |

|

(366) |

|

2,696 |

|

— |

|

— |

|

1,608 |

| |

|

12,195 |

|

(2,461) |

|

(33,585) |

|

(37,663) |

|

89,747 |

|

729 |

|

— |

|

28,962 |

| Stage 3 |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Cure to

stage 1 |

|

Cure to

stage 2 |

|

Transfer from stage 1 |

|

Transfer from stage 2 |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

1,200 |

|

(679) |

|

(1,363) |

|

(729) |

|

5,431 |

|

37,297 |

|

(1,033) |

|

40,124 |

| Credit card |

|

— |

|

64 |

|

(100) |

|

— |

|

205 |

|

366 |

|

— |

|

535 |

| |

|

1,200 |

|

(615) |

|

(1,463) |

|

(729) |

|

5,636 |

|

37,663 |

|

(1,033) |

|

40,659 |

| Consolidated 3 stages |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

309,677 |

|

555,353 |

|

(1,033) |

|

863,997 |

| Credit card |

|

3,131 |

|

55,941 |

|

— |

|

59,072 |

| |

|

312,808 |

|

611,294 |

|

(1,033) |

|

923,069 |

5.4.4. Allowance

for expected credit losses of loans operations

| Stage 1 |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Transfer to stage 2 |

|

Transfer to stage 3 |

|

Cure from stage 2 |

|

Cure from stage 3 |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

(57,576) |

|

(51,722) |

|

28,925 |

|

3,803 |

|

(3,783) |

|

(136) |

|

— |

|

(80,489) |

| Credit card |

|

(200) |

|

(4,784) |

|

1,208 |

|

152 |

|

(126) |

|

(16) |

|

— |

|

(3,766) |

| |

|

(57,776) |

|

(56,506) |

|

30,133 |

|

3,955 |

|

(3,909) |

|

(152) |

|

— |

|

(84,255) |

| Stage 2 |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Cure to

stage 1 |

|

Transfer to stage 3 |

|

Transfer from stage 1 |

|

Cure from stage 3 |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

(3,445) |

|

(7,097) |

|

3,783 |

|

26,108 |

|

(28,925) |

|

(267) |

|

— |

|

(9,843) |

| Credit card |

|

— |

|

36 |

|

126 |

|

279 |

|

(1,208) |

|

— |

|

— |

|

(767) |

| |

|

(3,445) |

|

(7,061) |

|

3,909 |

|

26,387 |

|

(30,133) |

|

(267) |

|

— |

|

(10,610) |

| Stage 3 |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Cure to

stage 1 |

|

Cure to

stage 2 |

|

Transfer from stage 1 |

|

Transfer from stage 2 |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

(840) |

|

(689) |

|

136 |

|

267 |

|

(3,803) |

|

(26,108) |

|

1,033 |

|

(30,004) |

| Credit card |

|

— |

|

19 |

0 |

16 |

|

— |

|

(152) |

|

(279) |

|

— |

|

(396) |

| |

|

(840) |

|

(670) |

|

152 |

|

267 |

|

(3,955) |

|

(26,387) |

|

1,033 |

|

(30,400) |

| Consolidated 3 stages |

|

December 31, 2023 |

|

Acquisition / (Settlement) |

|

Write-off |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

| Merchant portfolio |

|

(61,861) |

|

(59,508) |

|

1,033 |

|

(120,336) |

| Credit card |

|

(200) |

|

(4,729) |

|

— |

|

(4,929) |

| |

|

(62,061) |

|

(64,237) |

|

1,033 |

|

(125,265) |

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

| 5.5. | Financial assets from banking solutions |

As required by Brazilian Central

Bank (“BACEN”) regulation, client’s proceeds deposited in payment accounts must be fully collateralized by government

securities, and/or deposits at BACEN. At September 30, 2024, the amount of financial assets from banking solutions was R$ 7,558,492 (December

31, 2023 - R$ 6,397,898).

| 5.6. | Financial liabilities |

5.6.1. Retail deposits

| |

September 30,

2024 |

|

December 31,

2023 |

| |

|

|

|

| Deposits from retail clients |

6,695,772 |

|

6,119,455 |

| Time deposits from retail clients (a) |

120,980 |

|

— |

| |

6,816,752 |

|

6,119,455 |

| (a) | During the second quarter of 2024, the Company issued for the

first time Time deposits to its retail clients. Principal and interest of such liabilities are paid at maturity, which may vary significantly

in time but currently provide daily liquidity to clients. |

| | |  |

| |  |

| | Notes to Unaudited interim condensed consolidated financial statements |

| | September 30, 2024 |

| | (In thousands of Brazilian Reais) |

5.6.2. Changes in financial liabilities

The table below presents the movement

of financial liabilities other than Retail deposits:

| |

December 31, 2023 |

|

Additions |

|

Disposals |

|

Payment of principal |

|

Payment of interest |

|

Changes in exchange rates |

|

Fair value adjustment |

|

Interest |

|

September 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bonds |

2,402,698 |

|

— |

|

— |

|

(1,610,349) |

|

(114,617) |

|

365,718 |

|

— |

|

71,508 |

|

1,114,958 |

| Debentures, financial bills and commercial papers (a) |

1,116,252 |

|

2,147,200 |

|

— |

|

— |

|

(67,953) |

|

— |

|

— |

|

141,024 |

|

3,336,523 |

| Time deposits (b) |

— |

|

1,868,368 |

|

— |

|

(205,670) |

|

(1,810) |

|

— |

|

— |

|

21,537 |

|

1,682,425 |

| Obligations to open-end FIDC quota holders |

452,128 |

|

134,781 |

|

— |

|

(56,691) |

|

(3,576) |

|

— |

|

— |

|

43,860 |

|

570,502 |

| Institutional deposits and marketable debt securities |

3,971,078 |

|

4,150,349 |

|

— |

|

(1,872,710) |

|

(187,956) |

|

365,718 |