false

0001843477

0001843477

2023-12-29

2023-12-29

0001843477

SVII:UnitseachconsistingofoneClassAordinarysharedollar00001parvalueonerightandonehalfofoneredeemablepublicwarrantMember

2023-12-29

2023-12-29

0001843477

us-gaap:CommonClassAMember

2023-12-29

2023-12-29

0001843477

SVII:Rightsincludedaspartoftheunitstoacquireonetenth110ofoneshareofClassAordinaryshareMember

2023-12-29

2023-12-29

0001843477

SVII:RedeemablepublicwarrantsincludedaspartoftheunitseachwholewarrantexercisableforoneClassAordinaryshareatanexercisepriceofdollar11.50Member

2023-12-29

2023-12-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 29, 2023

SPRING VALLEY

ACQUISITION CORP. II

(Exact name of registrant as specified in its

charter)

|

Cayman Islands

(State or other jurisdiction

of incorporation) |

001-41529

(Commission

File Number) |

98-1579063

(IRS Employer

Identification No.) |

2100 McKinney Ave., Suite 1675

Dallas, TX 75201

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code: (214) 308-5230

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of

each class |

Trading

Symbol(s) |

Name of each

exchange

on which registered |

| Units, each consisting of one Class A ordinary share,

$0.0001 par value, one right and one-half of one redeemable public warrant |

SVIIU |

The Nasdaq Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per

share |

SVII |

The Nasdaq Stock Market LLC |

| Rights included as part of the units to acquire one-tenth

(1/10) of one share of Class A ordinary share |

SVIIR |

The Nasdaq Stock Market LLC |

| Redeemable

public warrants included as part of the units; each whole warrant exercisable for one Class A ordinary share at an exercise price of

$11.50 |

SVIIW |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Trust Account Contribution

On December 4, 2023, Spring Valley Acquisition

Corp. II (the “Company”) mailed a definitive proxy statement to its shareholders of record as of November 30,

2023 in connection with the extraordinary general meeting in lieu of an annual general meeting of the Company to be held at 10:00 a.m.,

Eastern Time, on January 10, 2024 (the “Shareholder Meeting”). At the Shareholder Meeting, the Company’s

shareholders will be asked to vote on, among other things, a proposal to amend the Company’s amended and restated memorandum and

articles of association (the “Articles”) to extend the date by which the Company has to consummate a business combination

(the “Extension”) from 15 months from the closing of the Company’s initial public offering (the “IPO”)

to 36 months from the closing of the IPO, or such earlier date as is determined by the Company’s board of directors (the “Board”),

in its sole discretion, to be in the best interests of the Company (the “Extension Amendment Proposal” and, such

date, the “Extended Date”).

On

December 29, 2023, the Company announced that if the Extension is approved at the Shareholder Meeting and the Extension is

implemented, the Company’s Sponsor, Spring Valley Acquisition Sponsor II, LLC (the “Sponsor”), has agreed to make

monthly deposits directly to the Company’s trust account (the “Trust

Account”) of $0.02 for each Class A ordinary share, par value $0.0001 per share (the “Class A

ordinary shares”), of the Company outstanding and not redeemed in connection with the Shareholder Meeting, up to a

maximum of $150,000 per month (each deposit, a “Contribution”) The

maximum aggregate amount of all Contributions will not exceed $3,150,000. Such Contributions, which will be paid monthly (or

a pro rata portion thereof if less than a full month), will begin on January 11, 2024, and thereafter on the fifteenth day of

each subsequent month (or if such fifteenth day is not a business day, on the business day immediately preceding such fifteenth day)

until the earlier of (i) the consummation of a business combination, and (ii) the Extended Date (or any earlier date of

termination, dissolution or winding up of the Company in accordance with its Articles or as otherwise determined in the sole

discretion of the Board) (the earlier of (i) and (ii), the “Maturity

Date”). Such Contributions will be made pursuant to a non-interest bearing, unsecured promissory note (the “Promissory

Note”) issued by the Company to the Sponsor. The Promissory Note will be repayable by the Company to the Sponsor upon

the Maturity Date. Any Contribution is conditioned on the approval of the Extension Amendment Proposal by the Company’s

shareholders and the implementation of the Extension. The funds in the Company’s trust account remain invested in U.S.

government treasury obligations with a maturity of 185 days or less or in money market funds investing solely in U.S. government

treasury obligations.

In connection with the Extension, the Company

anticipates that the per share price at which Class A ordinary shares will be redeemed from cash held in the Trust Account (the “Redemption

Payment Amount”) will be approximately $10.79 per share. The actual Redemption Payment Amount will be determined as of January 8,

2024.

Intent to Convert Class B ordinary shares

On December 29, 2023, the Sponsor and

the other holders of the Company’s Class B ordinary shares, par value $0.0001 per share (the “Class B

ordinary shares”), notified the Company that, pending approval at the Shareholder Meeting of the proposal to amend the

Articles to change certain provisions which restrict the Class B ordinary shares from converting to Class A ordinary

shares prior to the consummation of an initial business combination, of their intentions to elect as soon as practicable after the

Shareholder Meeting to convert an aggregate of 7,666,666 Class B ordinary shares held by them to the same number of

Class A ordinary shares (the “Class B Conversion”). As of

December 29, 2023, after giving effect to the Class B Conversion, there will be 1 Class B ordinary share

outstanding.

About Spring Valley Acquisition Corp. II

Spring Valley Acquisition Corp. II (NASDAQ:

SVII) is a special purpose acquisition company (SPAC) formed for the purpose of effecting a merger, share exchange, asset acquisition,

share purchase, reorganization or similar business combination. SVII is seeking to pursue an initial business combination target that

capitalizes on the expertise and ability of SVII’s management team, particularly its executive officers in the broadly-defined sustainability

industry. For more information about SVII, please visit www.sv-ac.com.

Additional Information and Where to Find

It

On December 4, 2023, SVII filed a definitive

proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission (the “SEC”)

in connection with its solicitation of proxies for the Shareholder Meeting. SVII filed a supplement to the Proxy Statement with the SEC

on December 4, 2023. Investors and security holders are able to obtain free copies of the Proxy Statement, related supplements and

all other relevant documents filed or that will be filed with the SEC by SVII through the website maintained by the SEC at www.sec.gov. In

addition, the documents filed by SVII may be obtained free of charge from SVII’s website at www.sv-ac.com or by written request

to SVII at Spring Valley Acquisition Corp. II at 2100 McKinney Ave, Suite 1675, Dallas, TX 75201. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SVII ARE URGED TO READ THE PROXY STATEMENT AND ALL

OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE EXTENSION AS THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE EXTENSION.

Forward-Looking Statements

This press release contains certain forward-looking

statements within the meaning of the federal securities laws with respect to the Contributions, including statements regarding the benefits

of an anticipated initial business combination, the anticipated timing of an initial business combination, and actual results may differ

from its expectations, estimates and projections (which, in part, are based on certain assumptions) and consequently, you should not rely

on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,”

“could,” “should,” “believes,” “predicts,” “potential,” “continue,”

and similar expressions are intended to identify such forward-looking statements. Although these forward-looking statements are based

on assumptions that SVII believes are reasonable, these assumptions may be incorrect. These forward-looking statements also involve

significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Factors that may

cause such differences include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted in connection

with any proposed business combination; (2) the inability to complete any proposed business combination or related transactions,

including as a result of redemptions or the failure by shareholders to adopt the Extension Amendment Proposal; (3) inability to raise

sufficient capital to fund our business plan, including limitations on the amount of capital raised in any proposed business combination

as a result of redemptions or otherwise; (4) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary

regulatory approvals or complete regulatory reviews required to complete any business combination; (5) the risk that any proposed

business combination disrupts current plans and operations; (6) the inability to recognize the anticipated benefits of any proposed

business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage

growth profitably, maintain relationships with customers and suppliers and retain key employees; (7) costs related to the proposed

business combination; (8) changes in the applicable laws or regulations; (9) economic uncertainty caused by the impacts of

rising levels of inflation and interest rates; and (10) other risks and uncertainties separately provided to you and indicated from

time to time described in filings and potential filings by SVII with the SEC.

The foregoing list of factors is not exhaustive.

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied

on by investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. You should carefully consider

the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Proxy Statement,

SVII’s Annual Report on Form 10-K, its subsequent Quarterly Reports on Form 10-Q, the Proxy Statement and any

supplements thereto, and other documents filed (or to be filed) by SVII from time to time with the SEC. These filings identify and address

other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. These risks and uncertainties may be amplified by the conflict between Russia and Ukraine, Israel and Palestine and rising

levels of inflation and interest rates, which have caused significant economic uncertainty. Forward-looking statements speak only as of

the date they are made. Investors are cautioned not to put undue reliance on forward-looking statements, and SVII assumes no obligation

and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise,

except as required by securities and other applicable laws.

No Offer or Solicitation

This press release is for informational purposes only and is neither an offer to purchase, nor a solicitation

of an offer to sell, subscribe for or buy, any securities or the solicitation of any vote in any jurisdiction pursuant to the Extension

or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Participants in the Solicitation

SVII and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies

from SVII's shareholders, in favor of the approval of the Extension. For information regarding SVII's directors and executive officers,

please see SVII's Annual Report on Form 10-K, its subsequent Quarterly Reports on Form 10-Q, and the other documents filed (or to be filed)

by SVII from time to time with the SEC. Additional information regarding the interests of those participants and other persons who may

be deemed participants in the Extension may be obtained by reading the registration statement and the proxy statement/prospectus and other

relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding

paragraphs.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Dated: December 29, 2023 |

Spring Valley Acquisition Corp. II |

| |

|

| |

By: |

/s/ Robert Kaplan |

| |

Name: |

Robert Kaplan |

| |

Title: |

Chief Financial Officer and Vice President of Business Development |

v3.23.4

Cover

|

Dec. 29, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 29, 2023

|

| Entity File Number |

001-41529

|

| Entity Registrant Name |

SPRING VALLEY

ACQUISITION CORP. II

|

| Entity Central Index Key |

0001843477

|

| Entity Tax Identification Number |

98-1579063

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

2100 McKinney Ave.

|

| Entity Address, Address Line Two |

Suite 1675

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

214

|

| Local Phone Number |

308-5230

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, $0.0001 par value, one right and one-half of one redeemable public warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share,

$0.0001 par value, one right and one-half of one redeemable public warrant

|

| Trading Symbol |

SVIIU

|

| Security Exchange Name |

NASDAQ

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 per

share

|

| Trading Symbol |

SVII

|

| Security Exchange Name |

NASDAQ

|

| Rights included as part of the units to acquire one-tenth (1/10) of one share of Class A ordinary share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Rights included as part of the units to acquire one-tenth

(1/10) of one share of Class A ordinary share

|

| Trading Symbol |

SVIIR

|

| Security Exchange Name |

NASDAQ

|

| Redeemable public warrants included as part of the units, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable

public warrants included as part of the units; each whole warrant exercisable for one Class A ordinary share at an exercise

|

| Trading Symbol |

SVIIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SVII_UnitseachconsistingofoneClassAordinarysharedollar00001parvalueonerightandonehalfofoneredeemablepublicwarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SVII_Rightsincludedaspartoftheunitstoacquireonetenth110ofoneshareofClassAordinaryshareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SVII_RedeemablepublicwarrantsincludedaspartoftheunitseachwholewarrantexercisableforoneClassAordinaryshareatanexercisepriceofdollar11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

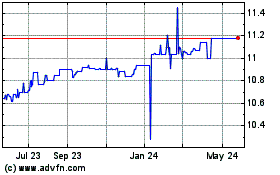

Spring Valley Acquisitio... (NASDAQ:SVIIU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Spring Valley Acquisitio... (NASDAQ:SVIIU)

Historical Stock Chart

From Jan 2024 to Jan 2025