Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

17 March 2022 - 7:06AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of March 2022

Commission

File Number: 333-231839

CHINA

SXT PHARMACEUTICALS, INC.

(Translation

of registrant’s name into English)

178

Taidong Rd North, Taizhou

Jiangsu,

China

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXPLANATORY

NOTE

On

March 14, 2022, China SXT Pharmaceuticals, Inc., a British Virgin Islands corporation (the “Company”) entered into

a securities purchase agreement (the “Purchase Agreement”) with Streeterville Capital, LLC, a Utah limited liability

company (the “Investor”), pursuant to which the Company issued the Investor an unsecured promissory note on March

16, 2022 in the original principal amount of $2,804,848.00 (the “Note”), convertible into ordinary shares, $0.004

par value per share, of the Company (the “Ordinary Shares”), for $2,636,557.00 in gross proceeds.

The

Note bears interest at a rate of 6% per annum compounding daily. All outstanding principal and accrued interest on the Note will become

due and payable twelve months after the purchase price of the Note is delivered by Purchaser to the Company (the “Purchase Price

Date”). The Note includes an original issue discount of $168,291.00 along with $20,000.00 for Investor’s fees, costs

and other transaction expenses incurred in connection with the purchase and sale of the Note. The Company may prepay all or a portion

of the Note at any time by paying 120% of the outstanding balance elected for pre-payment. The Investor has the right to redeem the Note

at any time ninety (90) days after the Purchase Price Date, subject to maximum monthly redemption amount of $600,000. Redemptions may

be satisfied in cash or Ordinary Shares at the Company’s election during the period ninety (90) days after the Purchase Price Date

and six months after the Purchase Price Date. However, the Company will be required to pay the redemption amount in cash, in the event

there is an Equity Conditions Failure (as defined in the Note). If Company chooses to satisfy a redemption in Ordinary Shares, such Ordinary

Shares shall be issued at a redemption conversion price of the lower of (i) the Lender Conversion Price (as defined in the Note) which

is initially $0.30 and (ii) 80% of the average of the lowest VWAP during the fifteen (15) trading days immediately preceding the redemption

notice is delivered. In addition, the Investor agreed that in any given calendar week (being from Sunday to Saturday of that week), the

number of Ordinary Shares sold by it in the open market will not be more than fifteen percent (15%) of the weekly trading volume for

the Ordinary Shares during any such week.

Under

the Purchase Agreement, while the Note is outstanding, the Company agreed to keep adequate public information available and maintain

its Nasdaq listing. Upon the occurrence of a Trigger Event (as defined in the Note), the Investor shall have the right to increase the

balance of the Note by 15% for Major Trigger Event (as defined in the Note) and 5% for Minor Trigger Event (as defined in the Note).

In addition, the Note provides that upon occurrence of an Event of Default, the interest rate shall accrue on the outstanding balance

at the rate equal to the lesser of 15% per annum or the maximum rate permitted under applicable law.

The

Note offered in the Offering was issued pursuant to the Company’s shelf registration statement on Form F-3 (File No. 333-252664)

filed with the Securities and Exchange Commission (the “SEC”) on February 2, 2021 and declared effective on February

10, 2021 (the “Registration Statement”), as supplemented by the preliminary prospectus supplement dated March 14,

2022 related to this offering and filed with SEC March 16, 2022.

The

foregoing descriptions of the Purchase Agreement and the Note are summaries of the material terms of such agreements, do not purport

to be complete and are qualified in their entirety by reference to the Purchase Agreement and the Note, which are attached hereto as

Exhibits 10.1 and 10.2.

This

current report on form 6-K is incorporated by reference into the Company’s registration statements on Form F-3 (File No. 333-252664).

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Dated:

March 16, 2022

| |

China

SXT Pharmaceuticals, Inc. |

| |

|

|

| |

By: |

/s/

Feng Zhou |

| |

Name: |

Feng

Zhou |

| |

Title: |

Chief

Executive Officer |

3

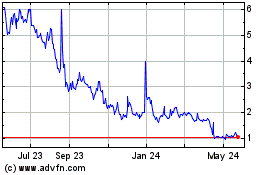

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Dec 2024 to Jan 2025

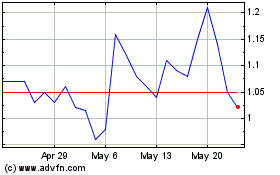

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Jan 2024 to Jan 2025