Form 8-K - Current report

20 September 2024 - 6:05AM

Edgar (US Regulatory)

false

0001603207

0001603207

2024-09-18

2024-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2024

NOTABLE

LABS, LTD.

(Exact

name of registrant as specified in charter)

| Israel |

|

001-36581 |

|

Not

Applicable |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 320

Hatch Drive |

|

| Foster

City, California |

|

94404 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including area code: (415) 851-2410

N/A

(Former

name or former address, if changed since last report)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary

Shares, par value NIS 0.35 each |

|

NTBL |

|

The

Nasdaq Capital Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On

September 18, 2024, the Board of Directors of Notable Labs, Ltd. (the “Company” or “Notable”) approved a streamlined

operating plan which includes exploring strategic alternatives focused on maximizing shareholder value.

In

order to conserve cash in connection with the streamlined operating plan, the Board of Directors also approved: (i) immediately pausing

the implementation of the planned Phase 2 study of Volasertib in relapsed/refractory AML (r/r AML), and (ii) a reduction in the Company’s

employee workforce and outside consultants by approximately 65%, which the Company expects to substantially complete by September 24,

2024. The Company anticipates recognizing approximately $0.1 million in total charges in connection with the reduction in force, which

costs are expected to be substantially recognized in the third and fourth quarters of 2024. These charges will consist primarily of cash

charges for termination benefits. The charges the Company expects to incur in connection with this reduction in workforce and the implementation

of a strategic alternatives process are subject to a number of assumptions, risks and uncertainties, and actual results may materially

differ. The Company may also incur other material charges not currently contemplated due to events that may occur as a result of, or

associated with, these actions.

Forward-Looking

Statements

This

report contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, including but not limited to, express or implied statements regarding Notable’s strategic

alternatives process; streamlined operating plan; the expected costs of the reduction in force and the timing of recognition of such

charges; Notable’s future operations and goals; the potential benefits of any therapeutic

candidates or platform technologies of Notable; the timing of any clinical milestones of Notable’s therapeutic candidates; the

cash runway of the company; and other statements that are not historical fact. All statements other than statements of historical fact

contained in this communication are forward-looking statements. These forward-looking statements are made as of the date they were first

issued, and are based on the then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions

of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances

that are beyond Notable’s control. Notable’s actual results could differ materially from those stated or implied in forward-looking

statements due to a number of factors, including but not limited to (i) uncertainties associated with Notable’s platform technologies,

as well as risks associated with the clinical development and regulatory approval of product candidates, including potential delays in

the commencement, enrollment and completion of clinical trials; (ii) risks related to the inability of Notable to obtain sufficient additional

capital to continue to advance these product candidates and any preclinical programs; (iii) uncertainties in obtaining successful clinical

results for product candidates and unexpected costs that may result therefrom; (iv) risks related to the failure to realize any value

from product candidates and preclinical programs being developed and anticipated to be developed in light of inherent risks and difficulties

involved in successfully bringing product candidates to market; (v) risks associated with Notable’s future financial and operating

results, including its ability to become profitable; (vi) Notable’s ability to retain key personnel; (vii) Notable’s ability

to manage the requirements of being a public company; (viii) uncertainties relating to the Israel-Hamas war; (ix) Notable’s ability

to obtain orphan drug designation, and the associated benefits, for any of its drug candidates; (x) Notable’s inability to obtain

regulatory approval for any of its drug candidates; and (xi) changes in, or additions to international, federal, state or local legislative

requirements, such as changes in or additions to tax laws or rates, pharmaceutical regulations, and other regulations. Actual results

and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks

and uncertainties. These and other risks and uncertainties are more fully described in periodic filings with the U.S. Securities and

Exchange Commission (“SEC”), including the factors described in the section titled “Risk Factors” in the Annual

Report on Form 10-K of Notable Labs, Ltd. for the year ended December 31, 2023 as filed with the SEC, and in other subsequent filings

with the SEC. You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as

of the dates indicated in the forward-looking statements. Notable expressly disclaims any obligation or undertaking to release publicly

any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto

or any change in events, conditions or circumstances on which any such statements are based.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

NOTABLE

LABS, LTD. |

| |

|

|

| Date:September

19, 2024 | By: |

/s/

Kaile A. Zagger |

| |

Name:

|

Kaile A. Zagger |

| |

Title: |

Chief Restructuring Officer and Interim Chief Executive Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

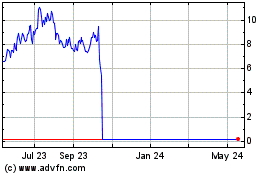

Vascular Biogenics (NASDAQ:VBLT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vascular Biogenics (NASDAQ:VBLT)

Historical Stock Chart

From Jan 2024 to Jan 2025