Magna Stays Neutral - Analyst Blog

02 April 2013 - 1:00AM

Zacks

On Mar 26, we maintained our Neutral recommendation on

Magna International Inc. (MGA) based on its better

performance in the fourth quarter of 2012 and increased customer

preferences for light passenger vehicles. However, we are concerned

about the rising raw material costs and the company’s increasing

debt burden.

Why Maintained?

On Mar 1, Magna reported earnings per share of $1.49 in the fourth

quarter of 2012, which increased 12.9% from $1.32 in the year-ago

quarter and outpaced the Zacks Consensus Estimate of $1.14.

Revenues went up 10.8% to $8.03 billion, exceeding the Zacks

Consensus Estimate of $7.75 billion. The increase in revenues was

driven by improvement in North American and Rest of World (ROW)

production sales and higher tooling, engineering and other sales

together with improved complete vehicle assembly sales.

Following the release of the fourth quarter results, the Zacks

Consensus Estimate for 2013 went up 2.2% to $5.49 per share.

Meanwhile, the Zacks Consensus Estimate for 2014 improved 3.7% to

$6.53 per share. Currently, Magna maintains a Zacks Rank #3

(Hold).

Magna will benefit from the increased customer preferences for

light passenger vehicles. In addition, the strict U.S. government

regulation to curb emissions will boost the demand for auto parts

and other fuel efficient components.

However, import of parts and other valuable accessories from

low-cost countries like India, China, Brazil, Japan and other ASEAN

countries will mar the results of the company. In addition, rising

raw material costs will be challenging for auto parts and

accessories manufacturers such as Magna.

Other Stocks to Look For

Few stocks that are performing well in the industry where Magna

operates include Gentherm Incorporated (THRM),

Visteon Corp. (VC) and Denso

Corp. (DNZOY). All these companies carry a Zacks Rank #1

(Strong Buy).

DENSO CORP (DNZOY): Get Free Report

MAGNA INTL CL A (MGA): Free Stock Analysis Report

GENTHERM INC (THRM): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

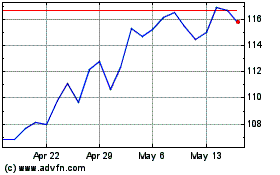

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

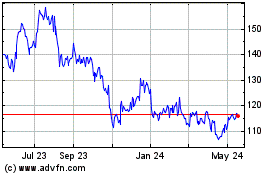

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024