MORNING UPDATE: Man Securities Issues Alerts for PSFT, KLAC, VC, X, and SPLS

14 September 2004 - 12:10AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for PSFT, KLAC, VC, X,

and SPLS CHICAGO, Sept. 13 /PRNewswire/ -- Man Securities issues

the following Morning Update at 8:30 AM EDT with new PriceWatch

Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for PSFT, KLAC, VC, X, and SPLS,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "The trade deficit is costing the U.S.

economy at least 1.5 million jobs and is reducing economic growth

by at least one percentage point a year." -- Peter Morici,

professor, University of Maryland New PriceWatch Alerts for PSFT,

KLAC, VC, X, and SPLS... PRICEWATCH ALERTS - HIGH RETURN COVERED

CALL OPTIONS ----------- -- PeopleSoft Inc. (NASDAQ:PSFT) Last

Price 19.79 - JAN 17.50 CALL OPTION@ $3.00 -> 4.2 % Return

assigned* -- KLA-Tencor Corp. (NASDAQ:KLAC) Last Price 39.82 - DEC

37.50 CALL OPTION@ $4.50 -> 6.2 % Return assigned* -- Visteon

Corp. (NYSE:VC) Last Price 8.00 - DEC 7.50 CALL OPTION@ $0.90 ->

5.6 % Return assigned* -- U.S. Steel Corp. (NYSE:X) Last Price

38.68 - JAN 35.00 CALL OPTION@ $6.20 -> 7.8 % Return assigned*

-- Staples Inc. (NASDAQ:SPLS) Last Price 30.00 - DEC 30.00 CALL

OPTION@ $1.70 -> 6 % Return assigned* * To learn more about how

to use these alerts and for our FREE report, "The 18 Warning Signs

That Tell You When To Dump A Stock ", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "The Secrets of Smart Election Year Investing -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEelection NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW Overseas markets are

starting the week out in fine fashion led by a 180- degree

turnaround in the Nikkei. Of the 15 markets that we track, 13 are

currently in positive territory. The cumulative average return on

the group stands at a plus 0.449 percent. Looking at a daily chart

of the Nikkei, it appears that a reversal day was set in place.

That pattern occurs, looking at the past three daily bars, when the

high of day two is lower than the low of both days one and three

and separated by a chart gap. The lows of day one and three stood

at 11145.80 and 11131.00 respectively, while the high of day two

stands at 11090.00. In other words, this is a bullish pattern

setting up on the Nikkei. Not too much scheduled today except for a

regional manufacturing report offered up by the Kansas City Federal

Reserve and an earnings report out of a major soup company. The

economic calendar does indeed pick up covering topics ranging from

retail sales to business inventories and consumer prices to

consumer sentiment. The manufacturing sector will be highlighted

through several reports this week culminating with the monthly

industrial production and capacity utilization numbers. Oracle's

first quarter earnings report after the market close tomorrow would

seem to be the one that could impact the market this week. Be

prepared for the investing week ahead with Bernie Schaeffer's FREE

Monday Morning Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES With hurricanes Charley and Frances already having

swept through the state of Florida and wreaked major destruction,

poor Floridians may yet have to deal with yet another unwelcome

natural disaster in the shape of the monstrous hurricane Ivan - a

Category 4 storm packing winds around 145-155mph. Although the

storm veered west over the weekend, taking it away from making

landfall in central Florida, it remains over the warm Caribbean and

Gulf waters, so it could still strengthen and drift back eastwards

towards Florida sometime early on Tuesday. Many are suffering

throughout the storm-weary state - from the residents compelled to

evacuate and rebuild their homes and lives, to the insurance

companies left footing the bill. While the insurance companies

would have to pay out billion in claims, they wouldn't be able to

raise current insurance rates without attracting state insurance

regulator attention. According to estimates, Charley has already

caused about US$6.8 billion in losses, and Frances could cost

between US$3-10 billion. Anticipating that Ivan will come through

Florida, the markets are already responding by running from

insurance stocks like Allstate. At the 247Profits Group's Extreme

Volatility Speculator investment service, chief trader Ian Cooper

had his readers positioned on the short side of Allstate before

Frances swept ashore just over a week ago. While most insurance

companies can better withstand the pressures faced 12 year ago with

Hurricane Andrew, look for further downside in insurance companies

like Allstate. Find out more about Ian Cooper's highly-successful,

news-driven Extreme Volatility Speculator investment service and

how you can claim fast, consistent profits. Simply follow this link

to read his special FREE REPORT:

http://www.investorsobserver.com/agora7 TODAY'S ECONOMIC CALENDAR

10:00 a.m.: Second Quarter Manufacturing Profits. 11:00 a.m.:

August Kansas City Fed Mfg Index (last 20). 2:00 p.m.: August

Budget Statement (last minus $69.16 billion). Man Securities is one

of the world's leading option order execution firms. Man's in-house

broker team offers a level of personal service and experience

unavailable from no-frills discount brokers. To improve your

understanding of option pricing get Man's FREE "Margin/Option

Wizard software at: http://www.investorsobserver.com/mancd. Member

CBOE/NASD/SPIC. This Morning Update was prepared with data and

information provided by: InvestorsObserver.com - Better Strategies

for Making Money -> For Investors With a Sense of Humor. Only $1

for your first month plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

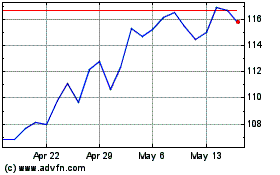

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

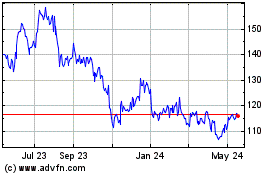

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024