Fourth-Quarter Highlights

- Total Client Assets of $176.1 billion

- Long-term gross flows of $6.6 billion

- Long-term net flows of ($1.7) billion

- GAAP operating margin of 48.1%

- GAAP net income per diluted share of $1.17

- Adjusted EBITDA margin of 54.0%

- Adjusted net income with tax benefit per diluted share of

$1.45

- Board authorizes 7% increase in regular quarterly cash dividend

to $0.47

- New $200 million share repurchase plan

Victory Capital Holdings, Inc. (NASDAQ: VCTR) (“Victory Capital”

or “the Company”) today reported financial results for the quarter

ended December 31, 2024.

“2024 was a transformational year for Victory Capital,” said

David Brown, Chairman and Chief Executive Officer. “During 2024, we

entered into a strategic relationship with Amundi Asset Management

S.A.S ("Amundi”) that will elevate our Company in several ways.

Through the acquisition of its U.S. business, the former Pioneer

Investments, we will further diversify and deepen our investment

capabilities as well as strengthen our U.S. intermediary

distribution efforts. Simultaneously, the 15-year exclusive

distribution agreement will globalize our Company by substantially

broadening and deepening our distribution reach outside of the

U.S.

“We remain on track to close the acquisition by the end of the

first quarter of 2025, and we are reaffirming our previous guidance

of $100 million in expense synergies.

“Our business and financial performance for the fourth quarter

and full year produced record results. We achieved the highest

adjusted earnings per diluted share with tax benefit, adjusted

EBITDA, and adjusted EBITDA margin in the history of our firm for

both the quarterly and full-year periods.

“Our Investment Franchises and Solutions platform continued to

deliver strong investment performance for our clients. The

percentage of our AUM outperforming benchmarks over the respective

3-, 5-, and 10-year periods was 59%, 73%, and 79% at year end. In

addition, 66% of our AUM in mutual funds and ETFs was rated four or

five stars overall by Morningstar.

“We continued to return capital to our shareholders during the

quarter. In December, the Board authorized a new $200 million share

repurchase program expanding on the prior $100 million

authorization that was completed during the quarter. The Board also

authorized a 7% increase in our quarterly cash dividend to $0.47

per share, which will be paid in March and is the highest quarterly

dividend payout in our Company history.

“As always, we continue to focus on serving our clients, which

is our top priority.”

1 Total AUM includes both discretionary

and non-discretionary client assets.

2 The Company reports its financial

results in accordance with generally accepted accounting principles

(“GAAP”). Adjusted EBITDA and Adjusted Net Income are not defined

by GAAP and should not be regarded as an alternative to any

measurement under GAAP. Please refer to the section “Information

Regarding Non-GAAP Financial Measures” at the end of this press

release for an explanation of Non-GAAP financial measures and a

reconciliation to the nearest GAAP financial measure.

The table below presents AUM, and certain GAAP and non-GAAP

(“adjusted”) financial results. Due to rounding, AUM values and

other amounts in this press release may not add up precisely to the

totals provided.

(in millions except per share amounts

or as otherwise noted)

For the Three Months

Ended

For the Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2024

2024

2023

2024

2023

Assets Under Management1 Ending $

171,930

$

176,113

$

161,322

$

171,930

$

161,322

Average

175,741

171,876

151,870

169,658

153,455

AUM Long-term Flows2 Long-term Gross $

6,615

$

5,876

$

6,357

$

25,255

$

22,651

Long-term Net

(1,729

)

(2,631

)

(1,334

)

(7,090

)

(5,584

)

AUM Money Market/Short-term Flows Money Market / Short-term

Gross $

178

$

244

$

188

$

912

$

853

Money Market / Short-term Net

(140

)

(5

)

(47

)

(287

)

(391

)

AUM Total Flows Total Gross $

6,793

$

6,120

$

6,545

$

26,167

$

23,504

Total Net

(1,870

)

(2,636

)

(1,381

)

(7,377

)

(5,976

)

Consolidated Financial Results (GAAP) Revenue $

232.4

$

225.6

$

205.8

$

893.5

$

821.0

AUM revenue realization (in bps)

52.5

52.1

53.6

52.6

53.4

Operating expenses

120.6

105.3

119.5

466.0

492.6

Income from operations

111.7

120.4

86.3

427.5

328.5

Operating margin

48.1

%

53.3

%

41.9

%

47.8

%

40.0

%

Net income

76.9

82.0

55.2

288.9

213.2

Earnings per diluted share $

1.17

$

1.24

$

0.82

$

4.38

$

3.12

Cash flow from operations

91.8

99.8

97.1

340.0

330.3

Adjusted Performance Results (Non-GAAP)3 Adjusted EBITDA $

125.5

$

121.3

$

107.6

$

475.6

$

418.0

Adjusted EBITDA margin

54.0

%

53.7

%

52.3

%

53.2

%

50.9

%

Adjusted net income

85.0

78.9

67.4

312.9

269.7

Tax benefit of goodwill and acquired intangible assets

10.1

10.1

9.7

40.2

38.3

Adjusted net income with tax benefit

95.1

89.0

77.0

353.1

307.9

Adjusted net income with tax benefit per diluted share $

1.45

$

1.35

$

1.15

$

5.36

$

4.51

1 Total AUM includes both discretionary

assets under management and non-discretionary assets under

advisement and excludes other assets.

2 Long-term AUM is defined as total AUM

excluding Money Market and Short-term assets.

3 The Company reports its financial

results in accordance with GAAP. Adjusted EBITDA and Adjusted Net

Income are not defined by GAAP and should not be regarded as an

alternative to any measurement under GAAP. Please refer to the

section “Information Regarding Non-GAAP Financial Measures” at the

end of this press release for an explanation of Non-GAAP financial

measures and a reconciliation to the nearest GAAP financial

measure.

AUM, Flows and Investment Performance

At December 31, 2024, Victory Capital had total client assets of

$176.1 billion, assets under management of $171.9 billion, and

other assets of $4.2 billion. Total AUM decreased by $4.2 billion

to $171.9 billion at December 31, 2024, compared with $176.1

billion at September 30, 2024. The decrease was due to negative

market action of $2.2 billion and net outflows of $1.9 billion.

Total gross flows for the fourth quarter were $6.8 billion,

including long-term gross flows of $6.6 billion.

As of December 31, 2024, Victory Capital offered 124 investment

strategies through its 11 autonomous Investment Franchises and

Solutions Platform. The table below presents outperformance against

benchmarks by AUM as of December 31, 2024.

Percentage of AUM Outperforming Benchmark

Trailing

Trailing

Trailing

Trailing

1-Year

3-Years

5-Years

10-Years

47%

59%

73%

79%

Fourth Quarter 2024 Compared with Third Quarter 2024

Revenue increased 3.0% to $232.4 million in the fourth quarter,

compared with $225.6 million in the third quarter, primarily due to

higher average AUM over the comparable period. GAAP operating

margin contracted 520 basis points in the fourth quarter to 48.1%,

down from 53.3% in the third quarter primarily due to a $15.6

million increase in compensation related expenses partially offset

by a $2.9 million decrease in acquisition-related costs. Fourth

quarter GAAP net income decreased 6.2% to $76.9 million, or $1.17

per diluted share, down from $82.0 million, or $1.24 per diluted

share, in the prior quarter.

Adjusted net income with tax benefit increased 6.8% to $95.1

million, or $1.45 per diluted share in the fourth quarter, up from

$89.0 million, or $1.35 per diluted share, in the third quarter.

Adjusted EBITDA increased 3.5% to $125.5 million in the fourth

quarter, versus $121.3 million in the third quarter. Adjusted

EBITDA margin expanded 30 basis points in the fourth quarter of

2024 to 54.0% compared with 53.7% in the prior quarter.

Fourth Quarter 2024 Compared with Fourth Quarter 2023

Revenue for the three months ended December 31, 2024, increased

12.9% to $232.4 million, compared with $205.8 million in the same

quarter of 2023 as a result of higher average AUM over the

comparable period. Operating expenses increased 1.0% to $120.6

million, compared with $119.5 million in last year’s fourth quarter

due to the combination of increases in compensation and acquisition

related expenses, partially offset by a non-cash difference in

amounts recorded to the change in the fair value of consideration

payable for acquisitions as well as a decrease in general and

administrative expenses. GAAP operating margin expanded 620 basis

points to 48.1% in the fourth quarter, from 41.9% in the same

quarter of 2023. GAAP net income increased 39.4% to $76.9 million,

or $1.17 per diluted share, in the fourth quarter compared with

$55.2 million, or $0.82 per diluted share, in the same quarter of

2023.

Adjusted net income with tax benefit increased 23.5% to $95.1

million, or $1.45 per diluted share, in the fourth quarter,

compared with $77.0 million, or $1.15 per diluted share in the same

quarter last year. Adjusted EBITDA increased 16.7% to $125.5

million, compared with $107.6 million in the same quarter of last

year. Year-over-year, adjusted EBITDA margin expanded 170 basis

points to 54.0% in the fourth quarter of 2024, compared with 52.3%

in the same quarter last year.

Year Ended December 31, 2024 Compared with Year Ended

December 31, 2023

Revenue for the year ended December 31, 2024, increased 8.8% to

$893.5 million, compared with $821.0 million in the same period of

2023. The increase was primarily due to higher average AUM.

Operating expenses decreased 5.4% to $466.0 million for the year

ended December 31, 2024, compared with $492.6 million in the same

period in 2023 due to the combination of a non-cash $20.5 million

difference in amounts recorded to the change in the fair value of

consideration payable for acquisitions as well as a decreases in

compensation related expenses, distribution and other asset based

expenses, and depreciation and amortization expense, partially

offset by an increase in acquisition-related costs. GAAP operating

margin was 47.8% for the year ended December 31, 2024, a 780 basis

point increase from the 40.0% recorded in the same period in 2023.

GAAP net income increased 35.5% to $288.9 million, or $4.38 per

diluted share, in 2024 compared with $213.2 million, or $3.12 per

diluted share, in 2023.

Adjusted net income with tax benefit increased 14.7% to $353.1

million for the year ended December 31, 2024, up from $307.9

million in 2023. On a per-share basis, adjusted net income with tax

benefit increased 18.8% to $5.36 per diluted share for the year

ended December 31, 2024 compared to $4.51 per diluted share in

2023. For the year ended December 31, 2024, adjusted EBITDA

increased 13.8% to $475.6 million, compared with $418.0 million for

the same period in 2023. Year-over-year, adjusted EBITDA margin

expanded 230 basis points to 53.2% for the year ended December 31,

2024, compared with 50.9% in the previous year.

Balance Sheet / Capital Management

The total debt outstanding as of December 31, 2024 was

approximately $972 million and consisted of an existing term loan

balance of $625 million and the 2021 Incremental Term Loans balance

of $347 million.

The Company’s Board of Directors approved a regular quarterly

cash dividend of $0.47 per share. The dividend is payable on March

10, 2025, to shareholders of record on February 18, 2025.

Conference Call, Webcast and Slide Presentation

The Company will host a conference call tomorrow morning,

February 7, at 8:00 a.m. ET to discuss the results. Analysts and

investors may participate in the question-and-answer session. To

participate in the conference call, please call 1-800-715-9871

(domestic) or 1-646-307-1963 (international), shortly before 8:00

a.m. ET and reference the Victory Capital Conference Call. A live,

listen-only webcast will also be available via the investor

relations section of the Company’s website at https://ir.vcm.com.

Prior to the call, a supplemental slide presentation that will be

used during the conference call will be available on the Events and

Presentations page of the Company’s investor relations website. For

anyone who is unable to join the live event, an archive of the

webcast will be available for replay shortly after the call

concludes.

About Victory Capital

Victory Capital is a diversified global asset management firm

with total assets under management of $171.9 billion, and $176.1

billion in total client assets, as of December 31, 2024. The

Company employs a next-generation business strategy that combines

boutique investment qualities with the benefits of a fully

integrated, centralized operating and distribution platform.

Victory Capital provides specialized investment strategies to

institutions, intermediaries, retirement platforms and individual

investors. With 11 autonomous Investment Franchises and a Solutions

Business, Victory Capital offers a wide array of investment

products and services, including mutual funds, ETFs, separately

managed accounts, alternative investments, third-party ETF model

strategies, collective investment trusts, private funds, a 529

Education Savings Plan, and brokerage services.

Victory Capital is headquartered in San Antonio, Texas, with

offices and investment professionals in the U.S. and around the

world. To learn more please visit www.vcm.com or follow Victory

Capital on Facebook, Twitter, and LinkedIn.

FORWARD-LOOKING STATEMENTS

This earnings release may contain forward-looking statements

within the meaning of applicable U.S. federal and non-U.S.

securities laws. These statements may include, without limitation,

any statements preceded by, followed by or including words such as

“target,” “believe,” “expect,” “aim,” “intend,” “may,”

“anticipate,” “assume,” “budget,” “continue,” “estimate,” “future,”

“objective,” “outlook,” “plan,” “potential,” “predict,” “project,”

“will,” “can have,” “likely,” “should,” “would,” “could” and other

words and terms of similar meaning or the negative thereof and

include, but are not limited to, statements regarding the proposed

transaction and the outlook for Victory Capital’s or Amundi’s

future business and financial performance. Such forward-looking

statements involve known and unknown risks, uncertainties and other

important factors beyond Victory Capital’s and Amundi’s control and

could cause Victory Capital’s and Amundi’s actual results,

performance or achievements to be materially different from the

expected results, performance or achievements expressed or implied

by such forward-looking statements.

Although it is not possible to identify all such risks and

factors, they include, among others, the following: continued

geopolitical uncertainty including the conflicts in Ukraine and

Israel, risks that the conditions to closing the transaction with

Amundi US will be satisfied and the transaction will close on the

anticipated timeline, if at all; risks associated with expected

benefits, or impact on our business, of the proposed transaction,

including our ability to achieve any expected synergies; reductions

in AUM based on investment performance, client withdrawals,

difficult market conditions and other factors such as a pandemic;

the nature of the Company’s contracts and investment advisory

agreements; the Company’s ability to maintain historical returns

and sustain its historical growth; the Company’s dependence on

third parties to market its strategies and provide products or

services for the operation of its business; the Company’s ability

to retain key investment professionals or members of its senior

management team; the Company’s reliance on the technology systems

supporting its operations; the Company’s ability to successfully

acquire and integrate new companies; the concentration of the

Company’s investments in long-only small- and mid-cap equity and

U.S. clients; risks and uncertainties associated with non-U.S.

investments; the Company’s efforts to establish and develop new

teams and strategies; the ability of the Company’s investment teams

to identify appropriate investment opportunities; the Company’s

ability to limit employee misconduct; the Company’s ability to meet

the guidelines set by its clients; the Company’s exposure to

potential litigation (including administrative or tax proceedings)

or regulatory actions; the Company’s ability to implement effective

information and cyber security policies, procedures and

capabilities; the Company’s substantial indebtedness; the potential

impairment of the Company’s goodwill and intangible assets;

disruption to the operations of third parties whose functions are

integral to the Company’s ETF platform; the Company’s determination

that Victory Capital is not required to register as an "investment

company" under the 1940 Act; the fluctuation of the Company’s

expenses; the Company’s ability to respond to recent trends in the

investment management industry; the level of regulation on

investment management firms and the Company’s ability to respond to

regulatory developments; the competitiveness of the investment

management industry; the level of control over the Company retained

by Crestview GP; and other risks and factors listed under "Risk

Factors" and elsewhere in the Company’s filings with the SEC.

Such forward-looking statements are based on numerous

assumptions regarding Victory Capital’s present and future business

strategies and the environment in which it will operate in the

future. Any forward-looking statement made in this press release

speaks only as of the date hereof. Except as required by law,

Victory Capital assumes no obligation to update these

forward-looking statements, or to update the reasons actual results

could differ materially from those anticipated in the

forward-looking statements, even if new information becomes

available in the future.

Victory Capital Holdings, Inc.

and Subsidiaries

Unaudited Consolidated

Statements of Operations

(in thousands except per share

data and percentages)

For the Three Months

Ended

For the Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2024

2024

2023

2024

2023

Revenue Investment management fees $

183,826

$

177,809

$

160,677

$

704,583

$

640,876

Fund administration and distribution fees

48,545

47,819

45,117

188,894

180,152

Total revenue

232,371

225,628

205,794

893,477

821,028

Expenses Personnel compensation and benefits

58,857

43,243

53,949

217,214

220,992

Distribution and other asset-based expenses

36,924

36,828

36,438

146,489

149,596

General and administrative

14,268

14,029

16,702

56,694

56,287

Depreciation and amortization

7,514

7,510

7,984

30,176

41,647

Change in value of consideration payable for acquisition of

business

294

(1,600

)

4,000

2,694

23,236

Acquisition-related costs

2,135

5,075

83

11,285

217

Restructuring and integration costs

634

180

320

1,411

595

Total operating expenses

120,626

105,265

119,476

465,963

492,570

Income from operations

111,745

120,363

86,318

427,514

328,458

Operating margin

48.1

%

53.3

%

41.9

%

47.8

%

40.0

%

Other income (expense) Interest income and other

income (expense)

1,768

3,551

3,765

10,441

8,732

Interest expense and other financing costs

(14,657

)

(16,414

)

(16,561

)

(63,836

)

(61,282

)

Loss on debt extinguishment

(263

)

—

—

(363

)

—

Total other expense, net

(13,152

)

(12,863

)

(12,796

)

(53,758

)

(52,550

)

Income before income taxes

98,593

107,500

73,522

373,756

275,908

Income tax expense

(21,654

)

(25,517

)

(18,316

)

(84,892

)

(62,751

)

Net income $

76,939

$

81,983

$

55,206

$

288,864

$

213,157

Earnings per share of common stock Basic $

1.19

$

1.26

$

0.85

$

4.47

$

3.22

Diluted

1.17

1.24

0.82

4.38

3.12

Weighted average number of shares outstanding Basic

64,428

64,875

65,309

64,607

66,202

Diluted

65,519

66,057

66,935

65,928

68,214

Dividends declared per share $

0.44

$

0.41

$

0.32

$

1.555

$

1.28

Victory Capital Holdings, Inc.

and Subsidiaries

Reconciliation of GAAP to

Non-GAAP Measures1

(unaudited; in thousands

except per share data and percentages)

For the Three Months

Ended

For the Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2024

2024

2023

2024

2023

Net income (GAAP) $

76,939

$

81,983

$

55,206

$

288,864

$

213,157

Income tax expense

(21,654

)

(25,517

)

(18,316

)

(84,892

)

(62,751

)

Income before income taxes $

98,593

$

107,500

$

73,522

$

373,756

$

275,908

Interest expense

13,971

15,649

15,532

60,799

57,820

Depreciation

2,228

2,210

2,273

8,959

8,842

Other business taxes

376

366

305

1,525

1,707

Amortization of acquisition-related intangible assets

5,286

5,300

5,711

21,217

32,805

Stock-based compensation

1,007

972

1,503

4,246

6,496

Acquisition, restructuring and exit costs

3,063

(11,513

)

5,586

1,735

28,982

Debt issuance costs

981

775

3,128

3,385

5,394

Adjusted EBITDA $

125,505

$

121,259

$

107,560

$

475,622

$

417,954

Adjusted EBITDA margin

54.0

%

53.7

%

52.3

%

53.2

%

50.9

%

Net income (GAAP) $

76,939

$

81,983

$

55,206

$

288,864

$

213,157

Adjustment to reflect the operating performance of the Company

Other business taxes

376

366

305

1,525

1,707

Amortization of acquisition-related intangible assets

5,286

5,300

5,711

21,217

32,805

Stock-based compensation

1,007

972

1,503

4,246

6,496

Acquisition, restructuring and exit costs

3,063

(11,513

)

5,586

1,735

28,982

Debt issuance costs

981

775

3,128

3,385

5,394

Tax effect of above adjustments

(2,679

)

1,025

(4,061

)

(8,028

)

(18,847

)

Adjusted net income $

84,973

$

78,908

$

67,378

$

312,944

$

269,694

Adjusted net income per diluted share $

1.30

$

1.19

$

1.01

$

4.75

$

3.95

Tax benefit of goodwill and acquired intangible

assets $

10,141

$

10,141

$

9,655

$

40,171

$

38,252

Tax benefit of goodwill and acquired intangible assets per

diluted share $

0.15

$

0.15

$

0.14

$

0.61

$

0.56

Adjusted net income with tax benefit $

95,114

$

89,049

$

77,033

$

353,115

$

307,946

Adjusted net income with tax benefit per diluted share

$

1.45

$

1.35

$

1.15

$

5.36

$

4.51

1 The Company reports its financial

results in accordance with GAAP. Adjusted EBITDA and Adjusted Net

Income are not defined by GAAP and should not be regarded as an

alternative to any measurement under GAAP. Please refer to the

section “Information Regarding Non-GAAP Financial Measures” at the

end of this press release for an explanation of Non-GAAP financial

measures and a reconciliation to the nearest GAAP financial

measure.

Victory Capital Holdings, Inc.

and Subsidiaries

Unaudited Consolidated Balance

Sheets

(In thousands, except for

shares)

December 31, 2024 December 31, 2023 Assets

Cash and cash equivalents $

126,731

$

123,547

Investment management fees receivable

83,307

71,888

Fund administration and distribution fees receivable

16,014

14,238

Other receivables

1,346

1,444

Prepaid expenses

8,634

5,785

Investments in proprietary funds, at fair value

605

534

Deferred compensation plan investments, at fair value

34,608

31,274

Property and equipment, net

11,874

19,578

Goodwill

981,805

981,805

Other intangible assets, net

1,260,614

1,281,832

Other assets

22,053

10,691

Total assets $

2,547,591

$

2,542,616

Liabilities and stockholders' equity Accounts payable

and accrued expenses $

57,951

$

56,477

Accrued compensation and benefits

51,648

55,456

Consideration payable for acquisition of business

139,894

217,200

Deferred compensation plan liability

34,608

31,274

Deferred tax liability, net

157,120

128,714

Other liabilities

20,871

11,225

Long-term debt(1)

963,862

989,269

Total liabilities

1,425,954

1,489,615

Stockholders' equity: Common stock; $0.01 par value

per share: 2024 - 600,000,000 shares authorized, 83,947,949 shares

issued and 63,653,212 shares outstanding; 2023 - 600,000,000 shares

authorized, 82,404,305 shares issued and 64,254,714 shares

outstanding

839

824

Additional paid-in capital

752,371

728,283

Treasury stock, at cost: 2024 - 20,294,737 shares; 2023 -

18,149,591 shares

(574,856

)

(444,286

)

Accumulated other comprehensive income

18,683

31,328

Retained earnings

924,600

736,852

Total stockholders' equity

1,121,637

1,053,001

Total liabilities and stockholders’ equity $

2,547,591

$

2,542,616

1 Balances at December 31, 2024 and 2023

are shown net of unamortized loan discount and debt issuance costs

in the amount of $8.3 million and $12.4 million, respectively. The

gross amount of the debt outstanding was $972.2 million and

$1,001.7 million as of December 31, 2024 and 2023,

respectively.

Victory Capital Holdings, Inc.

and Subsidiaries

Total Client Assets

(unaudited; in

millions)

For the Three Months Ended

December 31,

September 30,

December 31,

2024

2024

2023

Beginning AUM $

176,113

$

168,681

$

148,879

Beginning other assets1

4,981

5,094

4,627

Beginning total client assets

181,094

173,775

153,506

AUM net cash flows

(1,870

)

(2,636

)

(1,381

)

Other assets net cash flows

(675

)

(446

)

200

Total client assets net cash flows

(2,545

)

(3,082

)

(1,181

)

AUM market appreciation (depreciation)

(2,237

)

10,076

13,853

Other assets market appreciation (depreciation)

(141

)

333

462

Total client assets market appreciation (depreciation)

(2,378

)

10,409

14,315

AUM realizations and distributions

—

(2

)

(27

)

Acquired & divested assets / Net transfers

(76

)

(7

)

(2

)

Ending AUM

171,930

176,113

161,322

Ending other assets

4,165

4,981

5,289

Ending total client assets

176,096

181,094

166,611

Average total client assets2

180,104

176,806

156,734

For the Year Ended

December 31,

December 31,

2024

2023

Beginning AUM $

161,322

$

147,762

Beginning other assets1

5,289

5,190

Beginning total client assets

166,611

152,952

AUM net cash flows

(7,377

)

(5,976

)

Other assets net cash flows

(1,627

)

(591

)

Total client assets net cash flows

(9,004

)

(6,567

)

AUM market appreciation (depreciation)

18,100

21,188

Other assets market appreciation (depreciation)

504

690

Total client assets market appreciation (depreciation)

18,604

21,878

AUM realizations and distributions

(2

)

(100

)

Acquired & divested assets / Net transfers

(113

)

(1,552

)

Ending AUM

171,930

161,322

Ending other assets

4,165

5,289

Ending total client assets

176,096

166,611

Average total client assets3

174,542

158,268

1 Includes low-fee (2 to 4 bps)

institutional assets, previously reported in the Solutions asset

class within the by asset class table and in Separate Accounts and

Other Pooled Vehicles within the by vehicle table. These assets are

included as part of Victory’s Regulatory Assets Under Management

reported in Form ADV Part 1.

2 For the three-month periods ending

December 31, 2024, September 30, 2024 and December 31, 2023 total

client assets revenue realization was 51.3 basis points, 50.8 basis

points and 52.1 basis points, respectively.

3 For the year ended December 31, 2024 and

2023 total client assets revenue realization was 51.2 basis points

and 51.9 basis points, respectively.

Victory Capital Holdings, Inc.

and Subsidiaries

Total Assets Under

Management1

(unaudited; in

millions)

For the Three Months Ended

December 31,

September 30,

December 31,

2024

2024

2023

Beginning assets under management $

176,113

$

168,681

$

148,879

Gross client cash inflows

6,793

6,120

6,545

Gross client cash outflows

(8,663

)

(8,756

)

(7,926

)

Net client cash flows

(1,870

)

(2,636

)

(1,381

)

Market appreciation (depreciation)

(2,237

)

10,076

13,853

Realizations and distributions

—

(2

)

(27

)

Acquired & divested assets / Net Transfers

(76

)

(7

)

(2

)

Ending assets under management

171,930

176,113

161,322

Average assets under management

175,741

171,876

151,870

For the Year Ended

December 31,

December 31,

2024

2023

Beginning assets under management $

161,322

$

147,762

Gross client cash inflows

26,167

23,504

Gross client cash outflows

(33,545

)

(29,480

)

Net client cash flows

(7,377

)

(5,976

)

Market appreciation (depreciation)

18,100

21,188

Realizations and distributions

(2

)

(100

)

Acquired assets / Net transfers

(113

)

(1,552

)

Ending assets under management

171,930

161,322

Average assets under management

169,658

153,455

1 Total AUM includes both discretionary

assets under management and non-discretionary assets under

advisement and excludes other assets.

Victory Capital Holdings, Inc.

and Subsidiaries

Other Assets

(Institutional)1

(unaudited; in

millions)

For the Three Months

December 31,

September 30,

December 31,

2024

2024

2023

Beginning other assets (institutional) $

4,981

$

5,094

$

4,627

Gross client cash inflows

—

—

200

Gross client cash outflows

(675

)

(446

)

—

Net client cash flows

(675

)

(446

)

200

Market appreciation (depreciation)

(141

)

333

462

Realizations and distributions

—

—

—

Acquired & divested assets / Net transfers

—

—

—

Ending other assets (institutional)

4,165

4,981

5,289

Average other assets (institutional)2

4,363

4,930

4,864

For the Year Ended

December 31,

December 31,

2024

2023

Beginning other assets (institutional) $

5,289

$

5,190

Gross client cash inflows

467

600

Gross client cash outflows

(2,094

)

(1,191

)

Net client cash flows

(1,627

)

(591

)

Market appreciation (depreciation)

504

690

Realizations and distributions

—

—

Acquired & divested assets / Net transfers

—

—

Ending other assets (institutional)

4,165

5,289

Average other assets (institutional)3

4,883

4,813

1 Includes low-fee (2 to 4 bps)

institutional assets, previously reported in the Solutions asset

class within the by asset class table and in Separate Accounts and

Other Pooled Vehicles within the by vehicle table. These assets are

included as part of Victory’s Regulatory Assets Under Management

reported in Form ADV Part 1.

2 For the three-month periods ending

December 31, 2024, September 30, 2024 and December 31, 2023 total

other assets (institutional) revenue realization was 3.2 basis

points, 3.4 basis points and 3.6 basis points, respectively.

3 For the year ended December 31, 2024 and

2023 total other assets (institutional) revenue realization was 3.4

basis points and 3.6 basis points, respectively.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Asset Class

(unaudited; in

millions)

For the Three Months Ended By Asset Class

Global / U.S. Mid U.S. Small Fixed

U.S. Large Non-U.S. Alternative Total

Money Market/ Total Cap Equity Cap

Equity Income Cap Equity Equity

Solutions Investments Long-term

Short-term AUM1 December 31, 2024 Beginning

assets under management $

32,333

$

15,591

$

25,081

$

14,239

$

19,752

$

62,544

$

3,178

$

172,720

$

3,393

$

176,113

Gross client cash inflows

1,163

393

987

75

1,535

2,291

170

6,615

178

6,793

Gross client cash outflows

(1,881

)

(1,215

)

(1,391

)

(413

)

(1,023

)

(2,037

)

(384

)

(8,344

)

(319

)

(8,663

)

Net client cash flows

(718

)

(822

)

(404

)

(338

)

513

254

(214

)

(1,729

)

(140

)

(1,870

)

Market appreciation (depreciation)

(1,008

)

21

(342

)

279

(1,143

)

(100

)

13

(2,279

)

43

(2,237

)

Realizations and distributions

—

—

—

—

—

—

—

—

—

—

Acquired assets / Net transfers

(24

)

(6

)

66

(32

)

(26

)

(105

)

3

(125

)

48

(76

)

Ending assets under management $

30,584

$

14,785

$

24,402

$

14,148

$

19,095

$

62,593

$

2,980

$

168,586

$

3,344

$

171,930

September 30, 2024 Beginning assets under management

$

31,015

$

15,182

$

24,398

$

13,983

$

18,459

$

58,936

$

3,390

$

165,362

$

3,320

$

168,681

Gross client cash inflows

975

584

1,344

73

578

2,143

179

5,876

244

6,120

Gross client cash outflows

(2,300

)

(1,278

)

(1,640

)

(486

)

(485

)

(1,877

)

(443

)

(8,508

)

(249

)

(8,756

)

Net client cash flows

(1,325

)

(694

)

(296

)

(413

)

94

265

(263

)

(2,631

)

(5

)

(2,636

)

Market appreciation (depreciation)

2,649

1,105

973

690

1,212

3,368

51

10,049

27

10,076

Realizations and distributions

—

—

—

—

—

—

(2

)

(2

)

—

(2

)

Acquired assets / Net transfers

(5

)

(2

)

6

(21

)

(13

)

(25

)

3

(58

)

51

(7

)

Ending assets under management $

32,333

$

15,591

$

25,081

$

14,239

$

19,752

$

62,544

$

3,178

$

172,720

$

3,393

$

176,113

December 31, 2023 Beginning assets under management $

28,235

$

14,650

$

23,790

$

11,596

$

14,807

$

49,371

$

3,222

$

145,671

$

3,208

$

148,879

Gross client cash inflows

1,008

555

1,072

62

1,251

1,910

498

6,357

188

6,545

Gross client cash outflows

(1,548

)

(938

)

(1,890

)

(329

)

(657

)

(1,977

)

(352

)

(7,691

)

(234

)

(7,926

)

Net client cash flows

(541

)

(383

)

(818

)

(267

)

595

(67

)

146

(1,334

)

(47

)

(1,381

)

Market appreciation (depreciation)

2,917

1,698

1,392

1,320

1,387

5,012

91

13,816

38

13,853

Realizations and distributions

—

—

—

—

—

—

(27

)

(27

)

—

(27

)

Acquired assets / Net transfers

(8

)

(6

)

(8

)

(15

)

(16

)

(20

)

(1

)

(74

)

72

(3

)

Ending assets under management $

30,604

$

15,959

$

24,355

$

12,635

$

16,772

$

54,296

$

3,431

$

158,051

$

3,271

$

161,322

1Total AUM includes both discretionary

assets under management and non-discretionary assets under

advisement and excludes other assets.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Asset Class

(unaudited; in

millions)

For the Year Ended By Asset Class Global

/ U.S. Mid U.S. Small Fixed U.S.

Large Non-U.S. Alternative Total Money

Market/ Total Cap Equity Cap Equity

Income Cap Equity Equity Solutions

Investments Long-term Short-term AUM1

December 31, 2024 Beginning assets under management $

30,604

$

15,959

$

24,355

$

12,635

$

16,772

$

54,296

$

3,431

$

158,051

$

3,271

$

161,322

Gross client cash inflows

4,516

2,043

4,912

284

3,762

8,634

1,105

25,255

912

26,167

Gross client cash outflows

(7,685

)

(4,195

)

(5,905

)

(1,540

)

(2,893

)

(8,509

)

(1,618

)

(32,345

)

(1,200

)

(33,545

)

Net client cash flows

(3,169

)

(2,152

)

(993

)

(1,256

)

869

125

(513

)

(7,090

)

(287

)

(7,377

)

Market appreciation (depreciation)

3,189

1,035

924

2,873

1,570

8,290

47

17,929

172

18,100

Realizations and distributions

—

—

—

—

—

—

(2

)

(2

)

—

(2

)

Acquired assets / Net transfers

(40

)

(58

)

116

(104

)

(115

)

(118

)

17

(301

)

188

(113

)

Ending assets under management $

30,584

$

14,785

$

24,402

$

14,148

$

19,095

$

62,593

$

2,980

$

168,586

$

3,344

$

171,930

December 31, 20231 Beginning assets under management

$

27,892

$

15,103

$

26,353

$

10,973

$

14,160

$

46,317

$

3,663

$

144,460

$

3,302

$

147,762

Gross client cash inflows

5,090

2,741

4,024

284

2,581

6,337

1,593

22,651

853

23,504

Gross client cash outflows

(5,536

)

(3,859

)

(6,129

)

(1,286

)

(2,304

)

(7,119

)

(2,002

)

(28,235

)

(1,245

)

(29,480

)

Net client cash flows

(446

)

(1,117

)

(2,105

)

(1,002

)

276

(781

)

(409

)

(5,584

)

(391

)

(5,976

)

Market appreciation (depreciation)

3,153

1,978

1,595

2,809

2,431

8,804

270

21,039

149

21,188

Realizations and distributions

—

—

—

—

—

—

(100

)

(100

)

—

(100

)

Acquired assets / Net transfers

5

(4

)

(1,487

)

(145

)

(96

)

(43

)

7

(1,763

)

211

(1,552

)

Ending assets under management $

30,604

$

15,959

$

24,355

$

12,635

$

16,772

$

54,296

$

3,431

$

158,051

$

3,271

$

161,322

1Total AUM includes both discretionary

assets under management and non-discretionary assets under

advisement and excludes other assets.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Vehicle

(unaudited; in

millions)

For the Three Months Ended By Vehicle

Separate Accounts Mutual and Other

Funds1 ETFs2 Vehicles3 Total AUM4

December 31, 2024 Beginning assets under management $

117,044

$

6,694

$

52,375

$

176,113

Gross client cash inflows

3,545

1,167

2,082

6,793

Gross client cash outflows

(5,865

)

(130

)

(2,667

)

(8,663

)

Net client cash flows

(2,320

)

1,036

(586

)

(1,870

)

Market appreciation (depreciation)

(1,063

)

(146

)

(1,028

)

(2,237

)

Realizations and distributions

—

—

—

—

Acquired assets / Net transfers

(15

)

(76

)

15

(76

)

Ending assets under management $

113,645

$

7,508

$

50,777

$

171,930

September 30, 2024 Beginning assets under management

$

112,584

$

5,440

$

50,657

$

168,681

Gross client cash inflows

3,553

992

1,575

6,120

Gross client cash outflows

(5,526

)

(158

)

(3,073

)

(8,756

)

Net client cash flows

(1,973

)

834

(1,498

)

(2,636

)

Market appreciation (depreciation)

6,443

426

3,208

10,076

Realizations and distributions

—

—

(2

)

(2

)

Acquired assets / Net transfers

(10

)

(7

)

10

(7

)

Ending assets under management $

117,044

$

6,694

$

52,375

$

176,113

December 31, 2023 Beginning assets under management $

101,138

$

4,710

$

43,031

$

148,879

Gross client cash inflows

4,126

343

2,076

6,545

Gross client cash outflows

(5,887

)

(356

)

(1,682

)

(7,926

)

Net client cash flows

(1,761

)

(13

)

394

(1,381

)

Market appreciation (depreciation)

9,466

273

4,115

13,853

Realizations and distributions

—

—

(27

)

(27

)

Acquired assets / Net transfers

(41

)

—

39

(3

)

Ending assets under management $

108,802

$

4,970

$

47,551

$

161,322

1 Includes institutional and retail share

classes, money market and VIP funds.

2 Represents only ETF assets held by third

parties. Excludes ETF assets held by other Victory Capital

products.

3 Includes collective trust funds, wrap

program accounts, UMAs, UCITS, private funds and non-U.S. domiciled

pooled vehicles.

4 Total AUM includes both discretionary

assets under management and non-discretionary assets under

advisement and excludes other assets.

Victory Capital Holdings, Inc.

and Subsidiaries

Assets Under Management by

Vehicle

(unaudited; in

millions)

For the Year Ended By Vehicle

Separate Accounts Mutual and Other

Funds1 ETFs2 Vehicles3 Total

December 31, 2024 Beginning assets under management $

108,802

$

4,970

$

47,551

$

161,322

Gross client cash inflows

14,954

3,089

8,124

26,167

Gross client cash outflows

(22,408

)

(915

)

(10,222

)

(33,545

)

Net client cash flows

(7,454

)

2,174

(2,097

)

(7,377

)

Market appreciation (depreciation)

12,561

404

5,136

18,100

Realizations and distributions

—

—

(2

)

(2

)

Acquired assets / Net transfers

(263

)

(40

)

189

(113

)

Ending assets under management $

113,645

$

7,508

$

50,777

$

171,930

December 31, 2023 Beginning assets under management $

99,447

$

5,627

$

42,688

$

147,762

Gross client cash inflows

15,594

969

6,942

23,504

Gross client cash outflows

(21,276

)

(1,567

)

(6,637

)

(29,480

)

Net client cash flows

(5,682

)

(599

)

305

(5,976

)

Market appreciation (depreciation)

15,114

(56

)

6,130

21,188

Realizations and distributions

—

—

(100

)

(100

)

Acquired assets / Net transfers4

(77

)

(3

)

(1,471

)

(1,552

)

Ending assets under management $

108,802

$

4,970

$

47,551

$

161,322

1 Includes institutional and retail share

classes, money market and VIP funds.

2 Represents only ETF assets held by third

parties. Excludes ETF assets held by other Victory Capital

products.

3 Includes collective trust funds, wrap

program accounts, UMAs, UCITS, private funds and non-U.S. domiciled

pooled vehicles.

4 Total AUM includes both discretionary

assets under management and non-discretionary assets under

advisement and excludes other assets.

Information Regarding Non-GAAP

Financial Measures

Victory Capital uses non-GAAP financial measures referred to as

Adjusted EBITDA and Adjusted Net Income to measure the operating

profitability of the Company. These measures eliminate the impact

of one-time acquisition, restructuring and integration costs and

demonstrate the ongoing operating earnings metrics of the Company.

The Company has included these non-GAAP measures to provide

investors with the same financial metrics used by management to

assess the operating performance of the Company.

Adjusted EBITDA

Adjustments made to GAAP Net Income to calculate Adjusted

EBITDA, as applicable, are:

- Adding back income tax expense;

- Adding back interest paid on debt and other financing costs,

net of interest income;

- Adding back depreciation on property and equipment;

- Adding back other business taxes;

- Adding back amortization expense on acquisition-related

intangible assets;

- Adding back stock-based compensation expense associated with

equity awards issued from pools created in connection with the

management-led buyout and various acquisitions and as a result of

equity grants related to the IPO;

- Adding back direct incremental costs of acquisitions, including

restructuring costs;

- Adding back debt issuance cost expense;

- Adjusting for earnings/losses on equity method

investments.

Adjusted Net Income

Adjustments made to GAAP Net Income to calculate Adjusted Net

Income, as applicable, are:

- Adding back other business taxes;

- Adding back amortization expense on acquisition-related

intangible assets;

- Adding back stock-based compensation expense associated with

equity awards issued from pools created in connection with the

management-led buyout and various acquisitions and as a result of

any equity grants related to the IPO;

- Adding back direct incremental costs of acquisitions, including

restructuring costs;

- Adding back debt issuance cost expense;

- Subtracting an estimate of income tax expense applied to the

sum of the adjustments above.

Tax Benefit of Goodwill and Acquired

Intangible Assets

Due to Victory Capital’s acquisitive nature, tax deductions

allowed on acquired intangible assets and goodwill provide it with

additional significant supplemental economic benefit. The tax

benefit of goodwill and intangible assets represent the tax

benefits associated with deductions allowed for intangible assets

and goodwill generated from prior acquisitions in which the Company

received a step-up in basis for tax purposes. Acquired intangible

assets and goodwill may be amortized for tax purposes, generally

over a 15-year period. The tax benefit from amortization on these

assets is included to show the full economic benefit of deductions

for all acquired intangible assets with a step-up in tax basis.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206913675/en/

Investors: Matthew Dennis, CFA Chief of Staff Director,

Investor Relations 216-898-2412 mdennis@vcm.com

Media: Jessica Davila Director, Global Communications

210-694-9693 jessica_davila@vcm.com

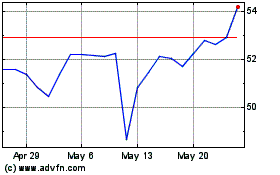

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Feb 2024 to Feb 2025