NASDAQ false 0001826011 0001826011 2024-02-20 2024-02-20 0001826011 us-gaap:CommonClassAMember 2024-02-20 2024-02-20 0001826011 us-gaap:WarrantMember 2024-02-20 2024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 20, 2024

Banzai International, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39826 |

|

85-3118980 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

435 Ericksen Ave, Suite 250 Bainbridge Island, Washington |

|

98110 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (206) 414-1777

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

BNZI |

|

The Nasdaq Global Market |

| Redeemable Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

BNZIW |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 20, 2024, Banzai International, Inc. (the “Company”) issued a press release announcing, among other things, its estimate of annual recurring revenue (“ARR”) for December 2023 and its target ARR for December 2024, and that the Company has entered into a non-binding letter of intent to acquire Mixed Analytics, a data analytics company (the “LOI”). A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated into this Item 2.02 by reference.

| Item 7.01 |

Regulation FD Disclosure. |

The disclosure set forth in Item 2.02 regarding the LOI is incorporated into this Item 7.01 by reference.

Also on February 20, 2024, the Company issued a new investor presentation. A copy of the investor presentation is attached as Exhibit 99.2 to this Current Report and is incorporated into this Item 7.01 by reference. The investor presentation is also available on the Company’s investor relations website at ir.banzai.io.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 20, 2024

|

|

|

| BANZAI INTERNATIONAL, INC. |

|

|

|

|

|

| By: |

|

/s/ Joseph Davy |

|

|

Joseph Davy |

|

|

Chief Executive Officer |

Exhibit 99.1

Banzai Gives Business Update Including

End-of-Year 2023 ARR, Additional Executed LOI and End-of-Year 2024 ARR Target

| |

• |

|

ARR for December 2023 was $4.6 million |

| |

• |

|

Executed LOI to Acquire Mixed Analytics, a Data Analytics Solution |

| |

• |

|

Banzai Targets December 2024 ARR to be $8.1 - $10 million |

SEATTLE, WA – February 20, 2024 – Banzai International, Inc. (NASDAQ: BNZI) (“Banzai” or the

“Company”), a leading marketing technology company that provides essential marketing and sales solutions, today announced a business update that includes December 2023 Annual Recurring Revenue (“ARR”), the execution of a non-binding letter of intent (the “LOI”) to acquire Mixed Analytics as well as the Company’s target December 2024 ARR.

Banzai has estimated its December 2023 ARR at $4.6 million. Banzai selected ARR as a key performance metric next to GAAP measures, as it annualizes

contracted recurring revenue components of term subscriptions and represents a key metric on which the Company evaluates potential targets under its acquisition strategy.

“We are excited to report an uptick in ARR toward the end of last year and look forward to the growth ahead of us,” said Mark Musburger, CFO of

Banzai. “While we will report our Full Year 2024 earnings after we complete the year, we believe the market will benefit from an update on an important performance measurement to help assess our business at this point and going

forward.”

Acquisition of Mixed Analytics Would Further Strengthen Suite of Integrated MarTech Solutions

Banzai also announced today that is has signed a non-binding LOI to acquire Mixed Analytics, a data analytics solution

that offers an API Connector, enabling users to turn Google Sheets into a data pipeline for direct API data importation from numerous sources like Facebook, YouTube, Instagram, Mailchimp and more. Mixed Analytics helps marketers solve the problem of

consistent, flexible data integration to Google Sheets.

The profitable and growing company was founded in 2012 and serves customers from various

industries including HubSpot, Google, eBay, Monday.com, L’Oreal and Coinbase. Banzai intends to integrate the capabilities of Mixed Analytics with other Banzai products as part of the Company’s acquisition and cross-selling strategy.

Ana Kravitz, Founder of Mixed Analytics, commented: “Mixed Analytics was built to make API data more accessible and easier to navigate. It allows

marketers to pull marketing and sales data from thousands of applications into their spreadsheets so they can analyze their data and uncover insights in one place. I’m excited about the possibility of Mixed Analytics joining Banzai’s

portfolio. Their expertise in marketing technology and data-driven solutions makes it the perfect home for the future of Mixed Analytics.”

End-of-Year 2024 Target

Banzai targets December 2024 ARR to be $8.1 - $10 million, based on the Company’s December 2023 ARR, organic growth during the year as

demonstrated by January 2024 customer wins and reactivations, and currently signed non-binding LOIs to acquire IGLeads, Cliently, Boast and Mixed Analytics. The targeted December

2024 ARR does not include any additional intended acquisitions.

The midpoint target, or $9.1 million, foresees a 97% increase in ARR, which would be

equally attributable to organic growth and the acquisitions currently under LOI. Banzai’s management anticipates tracking the Company’s progress to its targeted December 2024 ARR as part of the Company’s 2024 quarterly earnings

reports.

“We continue to believe that 2024 will be a breakout year for Banzai. We’ve signed over 150 new customers in January alone and have

signed LOIs to acquire four mission-critical MarTech companies,” said Joe Davy, CEO and Founder of Banzai. “Additionally, we are seeing a robust pipeline for potential future acquisitions, as the trend for consolidation in our

industry is gaining momentum.”

Annual recurring revenue refers to revenue, normalized on an annual basis, that Banzai expects to receive from its

customers for providing them with products or services. The December 2024 ARR information provided above is based on Banzai’s current estimates of internal growth, the completion of the IGLeads, Cliently, Boast and Mixed

Analytics acquisitions and those companies contributing ARR based on current levels and is not a guarantee of future performance. These statements are forward-looking and actual ARR may differ materially. Refer to the “Forward-Looking

Statements” section below for information on the factors that could cause Banzai’s actual ARR to differ materially from these forward-looking statements.

About Banzai

Banzai is a marketing technology company

that provides essential marketing and sales solutions for businesses of all sizes. On a mission to help their customers achieve their mission, Banzai enables companies of all sizes to target, engage, and measure both new and existing customers more

effectively. Banzai customers include Square, Hewlett Packard Enterprise, Thermo Fisher Scientific, Thinkific, Doodle and ActiveCampaign, among thousands of others. Learn more at www.banzai.io. For investors, please visit

https://ir.banzai.io/

Forward-Looking Statements

Certain statements included in this press release are forward-looking statements within the meaning of “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “target,” “continue,”

“anticipate,” “intend,” “expect,” “should,” “would,” “propose,” “plan,” “project,” “forecast,” “predict,” “potential,” “seek,”

“future,” “outlook,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements include, but are not limited to statements regarding growth in annualized recurring revenue for 2024, growth in Banzai’s business generally, Banzai’s proposed acquisitions and their completion and the

potential success and financial contributions of those acquisitions, if completed, the pipeline for future acquisitions by Banzai, estimates and forecasts of, financial and performance metrics, including ARR, projections of

market opportunity and market share, expectations and timing related to commercial product launches or success, ability to accelerate and otherwise be successful pursuing Banzai’s go-to-market strategy and capitalize on commercial opportunities . These statements are based on various assumptions, whether or not identified in this press release, and on

the current expectations of Banzai’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any

investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. These forward-looking statements are subject to a number of risks and uncertainties, including: the rate of ongoing customer acquisitions; the

failure to enter into definitive agreements with, or complete the acquisition of, Mixed Analytics and other proposed acquisition targets; the failure to identify and enter into definitive agreements with, or complete the acquisition of, acquisition

targets that the company is currently analyzing or may identify in the future; the failure to maintain Nasdaq listing of Banzai’s securities; changes in domestic and foreign business, market, financial, political and legal conditions;

uncertainty of the projected financial information with respect to Banzai; Banzai’s ability to successfully and timely develop, sell and expand its technology and products, and otherwise implement its growth strategy; risks relating to

Banzai’s operations and business, including information technology and cybersecurity risks, loss of customers and deterioration in relationships between Banzai and its employees; increased competition; potential disruption of current plans,

operations and infrastructure of Banzai as a result of operating as a new public company; difficulties managing growth and expanding operations; the impact of geopolitical, macroeconomic and market conditions; the ability to successfully select,

execute or integrate future acquisitions into the business, which could result in material adverse effects to operations and financial conditions; and those factors discussed in its Annual Report on Form 10-K

and subsequent Quarterly Reports , the registration statement on Form S-4 declared effective on November 13, 2023, and the definitive proxy statement / prospectus contained therein, in each case, under

the heading “Risk Factors,” the registration statement on Form S-1 declared effective on February 14, 2024, and the definitive proxy statement / prospectus contained therein, in each case, under

the heading “Risk Factors,” and other documents of Banzai filed, or to be filed, with the Securities and Exchange Commission. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from

the results implied by these forward-looking statements. In addition, forward-looking statements reflect Banzai’s expectations, plans or forecasts of future events and views as of the date of this press release. Banzai anticipates that

subsequent events and developments will cause Banzai’s assessments to change. However, while Banzai may elect to update these forward-looking statements at some point in the future, Banzai specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as representing Banzai’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Contacts:

Investors

Ralf Esper

Gateway Group

949-574-3860

bnzi@gateway-grp.com

Media

Raven Carpenter

BLASTmedia

banzai@blastmedia.com

Exhibit 99.2 Investor Presentation February 2024

Disclaimers Basis of Presentation This Presentation (this

“Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential investment in Banzai International, Inc. (“Banzai” or

the “Company”) and for no other purpose . By accepting, reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below . No Offer or Solicitation This Presentation and any oral

statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities of the Company in any jurisdiction, nor shall there be any sale, issuance

or transfer of any securities of the Company in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction . This Presentation does not constitute either advice or a

recommendation regarding any securities . No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom . Customer Data Unless otherwise noted,

all customer data included herein represents only Banzai Demio customers, excluding Banzai customers that are not Demio customers, for the period from [January 1, 2019, through October 5], 2023 . Banzai management believes this subset of customers

is most representative of the Company's business going forward . Industry and Market Data No representations or warranties, express, implied or statutory are given in, or in respect of, this Presentation, and no person may rely on the information

contained in this Presentation . To the fullest extent permitted by law, in no circumstances will Banzai, or any of its respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents

be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation

thereto or otherwise arising in connection therewith . This Presentation discusses trends and markets that Banzai’s leadership team believes will impact the development and success of Banzai based on its current understanding of the

marketplace . Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Banzai has not independently verified the data

obtained from these sources and cannot assure you of the reasonableness of any assumptions used by these sources or the data’s accuracy or completeness . Any data on past performance or modeling contained herein is not an indication as to

future performance . This data is subject to change . Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Banzai or its respective representatives as investment, legal or tax

advice . The Recipient should seek independent third party legal, regulatory, accounting and/or tax advice regarding this Presentation . In addition, this Presentation does not purport to be all- inclusive or to contain all of the information that

may be required to make a full analysis of Banzai. Recipients of this Presentation should each make their own evaluation of Banzai and of the relevance and adequacy of the information and should make such other investigations as they deem necessary

.. Banzai assumes no obligation to update the information in this Presentation . Forward Looking Statements Certain statements included in this Presentation are forward - looking statements within the meaning of “safe harbor” provisions

of the United States Private Securities Litigation Reform Act of 1995, including for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by

the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,”

“plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target,” and similar expressions

that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward - looking . These forward - looking statements include, but are not

limited to : (1) statements regarding estimates and forecasts of other financial and performance metrics and projections of market conditions and opportunity ; (2) changes in the market for Banzai’s services and technology, and Banzai’s

expectations regarding expansion and opportunities ; (3) Banzai’s unit economics ; (4) developments of Banzai; (5) current and future potential commercial and customer relationships ; (6) ability to operate efficiently at scale; and (7)

anticipated investments in additional capital resources and research and development and the effect of these investments ; and (8) Banzai’s acquisition strategy, including Banzai’s expectations regarding market conditions and available

opportunities, Banzai’s ability to execute on such strategy and the expected benefits of such strategy . These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of

Banzai’s management and are not predictions of actual performance . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of

Banzai. 2

Disclaimers (Continued) Forward Looking Statements (cont’d) These

forward - looking statements are subject to a number of risks and uncertainties, including : changes in domestic and foreign business, market, financial, political and legal conditions ; risks relating to the uncertainty of the projected financial

information with respect to Banzai; Banzai’s ability to successfully and timely develop, sell and expand its technology and products, and otherwise implement its growth strategy ; risks relating to Banzai’s operations and business,

including information technology and cybersecurity risks, loss of key customers and deterioration in relationships between Banzai and its employees ; risks related to increased competition ; risks relating to potential disruption of current plans,

operations and infrastructure of Banzai; risks that Banzai is unable to secure or protect its intellectual property ; risks that the Banzai experiences difficulties managing its growth and expanding operations ; the ability to compete with existing

or new companies that could cause downward pressure on prices, fewer customer orders, reduced margins, the inability to take advantage of new business opportunities, and the loss of market share ; the impact of geopolitical, macroeconomic and market

conditions ; and the ability to successfully select, execute or integrate future acquisitions into the business, which could result in material adverse effects to the Company’s operations and financial conditions ; and those factors discussed

in the Company’s prospectus filed on November 13, 2023 , the registration statement on Form S- 4 (together with all amendments thereto) filed on August 31, 2023 , and the definitive proxy statement / prospectus contained therein, and the

registration statement on Form S- 1, initially filed on December 29, 2023 , in each case, under the heading “Risk Factors,” and in those other documents that the Company has filed, or will file, with the SEC. If any of these risks

materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . The risks and uncertainties above are not exhaustive, and there may be additional risks that

Banzai presently does not know or that Banzai currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect

Banzai’s expectations, plans or forecasts of future events and views as of the date of this Presentation . Banzai anticipates that subsequent events and developments will cause Banzai’s assessments to change . However, while Banzai may

elect to update these forward - looking statements at some point in the future, Banzai specifically disclaims any obligation to do so. These forward - looking statements should not be relied upon as representing Banzai’s assessments as of any

date subsequent to the date of this Presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements . Trademarks Banzai own or have rights to various trademarks, service marks and trade names that they use in

connection with the operation of their respective businesses . This Presentation also contains trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners . The use or display of third

parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with Banzai, an endorsement or sponsorship by or of Banzai, or a guarantee that Banzai will work or will

continue to work with such third parties . Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, ® or © symbols, but such references are not

intended to indicate, in any way, that Banzai or the any third - party will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights .

Non - GAAP Financial Measures Some of the financial information and data contained in this Presentation, such as Adjusted EBITDA (“Adjusted EBITDA”), Adjusted EBITDA margin and free cash flow, have not been prepared in accordance with

United States generally accepted accounting principles (“GAAP”). Adjusted EBITDA is defined as net income (loss) before interest expense, income tax expense (benefit), depreciation and amortization, as adjusted to exclude non- cash items

or certain transactions that management does not believe are indicative of ongoing Company operating performance, which include bad debt and distributions to shareholders . These non - GAAP financial measures, and other measures that are calculated

using such non - GAAP measures, are an addition to, and not a substitute for or superior to the most directly comparable financial measures prepared in accordance with GAAP. Banzai believes these non- GAAP measures of financial results provide

useful information to management and investors regarding certain financial and business trends relating to Banzai’s financial condition and results of operations . Banzai’s management uses these non - GAAP measures for trend analyses,

for purposes of determining management incentive compensation, and for budgeting and planning purposes . Banzai believes that the use of these non - GAAP financial measures provide an additional tool for investors to use in evaluating projected

operating results and trends in and in comparing Banzai’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors . However, there are a number of limitations related to the use

of these non - GAAP measures and their nearest GAAP equivalent . For example, other companies may calculate these non- GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Banzai’s non -

GAAP measures may not be directly comparable to a similarly titled measures of other companies . See the Appendix for reconciliations of these non- GAAP financial measures to the most directly comparable GAAP measures . 3

EXECUTIVE SUMMARY Investment Summary Highlights The Moment for MarTech

Consolidation Attractive Retention Th e d iverg enc e b et ween M&A volume a nd t h e g rowing Banzai’s in t e g ra t e d p la t fo rm c a p it a lize s o n e conomie s of numb e r of ma rke t ing t e ch nolog y (“Ma rTe ch ”)

c omp a nie s s ca le a n d c o mp le me n ta ry c usto me r b a se s to ma ximize p re se nts a n e xcit ing cons olid a t ion op p ort unit y. cros s - s e lling op p ort unit ie s . Award - Winning Products $28B+ Total Addressable Market Custome

rs p ra ise Banzai’s award - winning p rod uct s for t h e ir $ 28B+ t o t a l a d d re s s a b le ma rke t a c ro ss th e Ma rTe ch va lue us e r- friend ly int erfa ces a nd p owerful fea t ures . c h a in d rive n b y t a ilwin d s o f d ig

it a l c h a n n e ls . Disciplined Acquisition Playbook 19 M&A Transactions Supported by Team Ban zai has e s t ab lis he d a c le a r a c q uisitio n stra te g y wit h The Man ag e me n t t e am has s up p o rt e d 19 M&A t ra ns a ct ions

we ll- d e fine d e va lua t ion a nd s ucce s s crit e ria . in t he p as t d e c ad e a s b uye r, s e lle r, or op e ra t or. 4

Customer Problem 5

CUSTOMER PROBLEM The Four Hats of the CMO Engage Measure Integrate

Attract 6

CUSTOMER PROBLEM Explosion in MarTech Vendors 7,258% Growth in Ove r 12

Ye a rs Mart e ch for 20 24 , Ch iefmart ec 7

Marketers struggle with an explosion of SaaS vendors. Enterprises use an

average of 120+ marketing tools for their daily operations , leading to disjointed customer 1 experiences and messy data . (1) Netskope Cloud Report, August 2019 8

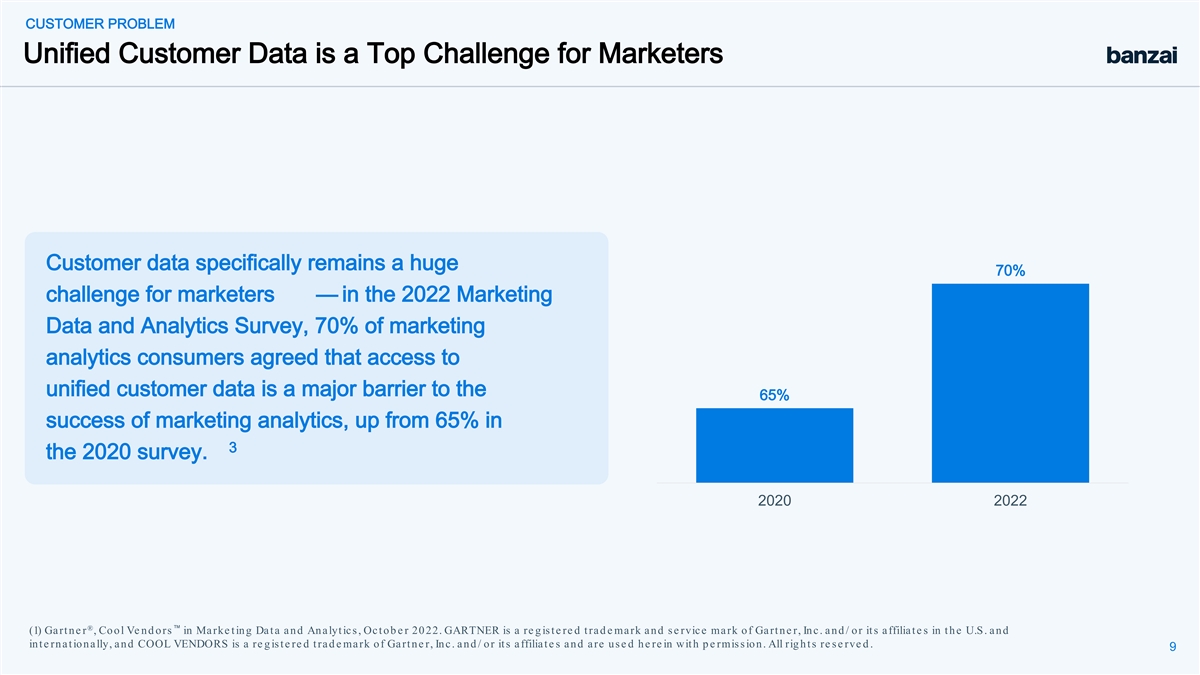

CUSTOMER PROBLEM Unified Customer Data is a Top Challenge for Marketers

Customer data specifically remains a huge 70% challenge for marketers — in the 2022 Marketing Data and Analytics Survey, 70% of marketing analytics consumers agreed that access to unified customer data is a major barrier to the 65% success of

marketing analytics, up from 65% in 3 the 2020 survey. 2020 2022 ® ™ (1) Gart ne r , Cool Ve nd ors in Marke t ing Dat a and Analyt ics , Oct ob e r 20 22. GARTNER is a re g is t e re d t rad e mark and s e rvice mark of Gart ne r, Inc.

and / or it s a ffilia t e s in t h e U.S. a n d int e rnat ionally, and COOL VENDORS is a re g is t e re d t rad e mark of Gart ne r, Inc. and / or it s affiliat e s and are us e d h e re in wit h p e rmis s io n . All rig h t s re s e rve d .

9

CUSTOMER PROBLEM Ease of Integration is the Top Criteria for Marketers

Marketers are Requiring Solutions that Integrate 50% Seamlessly of marketers consider data centralization capabilities as the most important factor when 2 choosing a new marketing technology solution. ® ™ (1) Gart ne r , Cool Ve nd ors in

Marke t ing Dat a and Analyt ics , Oct ob e r 20 22. GARTNER is a re g is t e re d t rad e mark and s e rvice mark of Gart ne r, Inc. and / or it s a ffilia t e s in t h e U.S. a n d int e rnat ionally, and COOL VENDORS is a re g is t e re d t rad e

mark of Gart ne r, Inc. and / or it s affiliat e s and are us e d h e re in wit h p e rmis s io n . All rig h t s re s e rve d . 10

CUSTOMER SOLUTION Banzai Provides Seamless Integration Through

Consolidation Ba n za i is b uild in g a fa mily o f mis s io n c rit ic a l ma rke t in g s o lut io n s t h at s e a mle s s ly int e g ra t e ou t of t h e b ox. 11

Market Opportunity 12

MARKET OPPORTUNITY MarTech is an Attractive Vertical Over t h e p a s t

five yea rs , MarTe ch h a s p rove n t o b e a n a t t ra c t ive in ve s tme n t , yie ld ing rob us t re t urns a nd c ons is t e n t ly out p e rforming t h e ma rke t . 1 1 MarTe ch St oc k P e rforma nc e (%) S &P 50 0 P e rfo rma n c e

(%) 344.0% 59.9% Jan-18 Sep-23 Not e : MarTe ch St ock P e rformance is ind e xe d on ave rag e p e rformance of ADBE, CRM, HUBS, TTD, ORCL, WIX, CRTO, and MGNI; S&P 50 0 P e rformance is ind e xe d on SP 50 p e rformance (1) Fa c t S et , S ep

t emb er 20 23 13

MARKET OPPORTUNITY Lower VC Funding Pressuring MarTech SaaS 2 MarTech

and Enterprise SaaS VC Deal Activity Tech Companies Continue to Downsize 1 1 De a l Va lue ($ M) De a l Count Numb e r of Te c h Comp a nie s wit h La yoffs 639 274 230 $19,078 182 133 126 113 99 99 96 96 $7,639 93 2018 2023E* Nov-22 Aug-23 *YTD

annualized figure based on Q1 2023 deal value (1) PitchBook Launch Report: Enterprise SaaS, May 2023 (2) Layoffs.fyi , September 2023vv 14

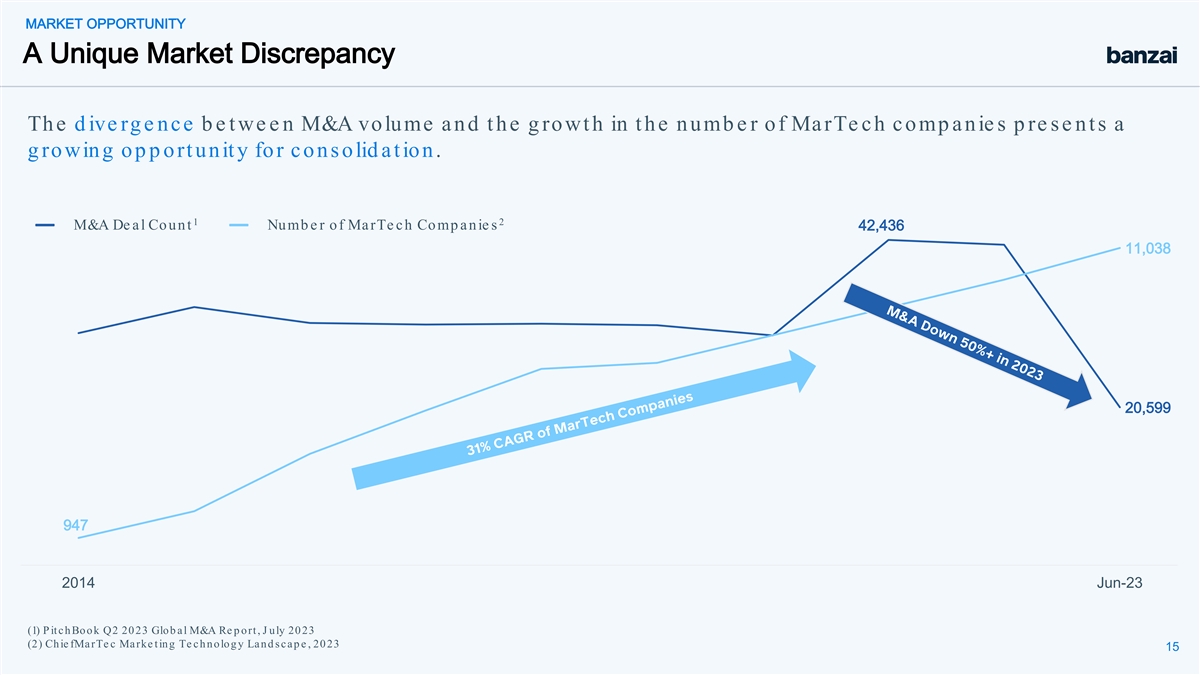

MARKET OPPORTUNITY A Unique Market Discrepancy Th e d iverg ence b e t

we e n M&A volume a nd t h e g rowt h in t h e numb e r of MarTe ch c omp a nie s p re s e nt s a g rowing op p ort unit y for c ons olid a t io n. 1 2 M&A De a l Count Numb e r o f MarTe ch Comp a nie s 42,436 11,038 20,599 947 2014 Jun-23

(1) P it ch Book Q2 20 23 Glob a l M&A Re p ort , J uly 20 23 (2) Ch iefMarTec Ma rke t ing Te c h nolog y La nd s c a p e , 20 23 15

Many MarTech companies are looking to 1 sell, but buyers are at a 10-

year low . (1) PitchBook “Q2 2023 Global M&A Report” as of 7/26/2023 16

MARKET OPPORTUNITY Buyer Universe for Rolling Up MarTech Industry S t

ra t e g ic b uye rs a re foc us e d on wh a le s , p re s e nt in g a n op p ort unit y for s mall- c a p / p riva t e c o n s o lid a t io n. Small Scale Acquisition Focus Large Scale Acquisition Focus Private Equity Strategic 17

MARKET OPPORTUNITY The Prize for Winning is Big Banzai’s

Serviceable Available Market United States B2B MarTech Spend 2023E Banzai $28.1B TAM $39.4B $20.2B 2023E Banzai $5.4B SAM 2020 2026E Ban zai’s Se rvice ab le Availab le Marke t (SAM) is e xp e c t e d t o g row t o Banzai’s Tot al

Availab le Marke t (TAM) is e xp e ct e d t o g row t o $ 8.4 B b y 20 26E, a t a CAGR o f 16.0 7% (20 20 - 20 26E) $ 39.4 B b y 20 26 E, a t a CAGR o f 11.8% (20 20 - 20 26E) So urc e : Wint e rb e rry Group St ra t e g ic Due Dilig e nc e Re p o

rt fo r Ba n za i, Ap ril 20 23 18

Company Overview 19

Banzai is consolidating mission - critical, sub - scale MarTech

products. Our secret sauce is customer expansion through cross - sales . 20

COMPANY OVERVIEW Acquisition Strategy: Evaluation Playbook Evaluation

Playbook Success Playbook Financial Performance Banzai's Evaluation Playbook is ARR / EBITDA Regulation S - X YOY Growth focused on growth and Strategic Fit profitability profile, and Product/Platform Market Opportunities Cross - Sell Enhancement

strategic cross - sale potential . Customer Metrics Growth NRR Churn Synergy Product/System Cost Efficiencies Integration 21

COMPANY OVERVIEW Acquisition Strategy: Success Playbook Evaluation

Playbook Success Playbook Rule of 40 Banzai's Success Playbook Revenue Growth % EBITDA Margin % focuses on customer retention, NPV & IRR expansion, efficiency, and Actual Performance vs. Forecast Assumes appropriate hurdle rate growth. Customer

Expansion Unit Economics Cross - Sell Reduced Churn KPIs Relative to Plan LTV/CAC CSAT/NPS Impact on Combined Entity 22

COMPANY OVERVIEW Our Secret - Sauce is Customer Expansion Banzai's

secret sauce is our Customer Expansion flywheel. As we grow our organic customer base, and as we add Customer more solutions to our family of Expansion products, our ability to drive cross - sales increases, compounding over time. 23

COMPANY OVERVIEW Customer Experience Strategy • Market Segment

Data - Driven Customer • Industry Expansion Strategy • Engagement Scores We us e d a t a - d rive n t a rg e t in g t o d e t e rmin e o p t ima l c us t ome r s e g me nt s for e xp a ns ion a nd c ros s - s a le s , • Key

Accounts an d b uild re le van t CX s t rat e g ie s fo r e ach. • CSQLs 24

COMPANY OVERVIEW Customer Retention and Expansion is Banzai’s Top

Priority Support CSAT 24/7 Support Onboarding Retention Response Time Onboarding CSAT #1 COMPANY OBJECTIVE Customer Support Education Webinars Net Revenue Retention Onboarding Engagement Scores is Our Top Priority Premium NRR Onboarding Premium Our

Cus t ome r Exp e rie nce org is s e t up t o Renewals ult ima t e ly s up p o rt NRR. Customer Success Premium All of our KP Is s up p ort t h is p rima ry comp a ny Expansion Customer Marketing Key Account g o a l b y p o s it ive ly imp a c t in

g e xp a ns ion, Renewals re a ct iva t ions , d owng ra d e s , a n d ch urn. Self Serve Key Account Referrals Expansion Expansion CSQL Upgrades Reactivations Cancellation 25 Saves

COMPANY OVERVIEW Banzai Develops Mission - Critical MarTech Solutions

26

COMPANY OVERVIEW Demio 27

COMPANY OVERVIEW Boost 28

COMPANY OVERVIEW Reach 29

COMPANY OVERVIEW Banzai Delivers Award Winning Products Source: G2

Awards, CloudRatings , Hubspot 30

COMPANY OVERVIEW Our Customers Love Us 1,900+ 800+ 3,100 1,000+ 250 +

Ho st e d Se ssio n s Inc re a s e d Re g is t ra t ions Inc re a s e d Re g is t ra t ions Hos t e d Se s s ions Hos t e d Se s s ions (YTD 20 22) (20 20 —20 23) (20 20 —20 23) 2,200+ 155+ 1,300+ 15% < 30 Inc re a s e d Re g is t ra

t ions Ho st e d Se ssio n s Inc re a s e d Re g is t ra t ions In cre as e d At t e n d an ce Rat e Minut e s t o Se t up on De mio (20 20 —20 22) 40% 300+ 5x 3x 890 + Inc re a s e in P ros p e c t Ho st e d Se ssio n s Inc re a s e in Conve

rs ion Ra t e We b ina r Conve rs ions Hos t e d Se s s ions At t e nd a nc e (20 20 —20 23) (20 21—20 23) 31

Management Overview 32

MANAGEMENT OVERVIEW Leadership With Demonstrated Acquisition Track

Record Coh e s ive ma na g e me nt t e a m wit h long working h is t ory a t Avalara, Ve rivox, a nd ot h e r le a d ing c omp a nie s t h a t h a s s up p o rte d 19 M&A t ra ns a c t ion s o ve r t h e p a s t d e c a d e . Joe Davy Mark

Musburger Simon Baumer CEO CFO CTO GM, Avalara Director, Avalara VP Engineering, Founded Banzai in Verivox 2016 Ashley Levesque Rachel Stanley VP of Marketing VP of Customer Experience 33

MANAGEMENT OVERVIEW Executive Team M&A Track Record 2022 2022 2021

2020 2020 2018 Undisclosed Broker Business Unit 2018 2017 2017 2017 2015 2015 Digital Brokerage Business 2015 2014 2014 2013 2010 2007 Tax Technology eFileSolutions Services Note: List does not include all M&A transactions executed by the

management team 34

SUMMARY Marketing Technology Opportunity Marketing Technology is a Huge

& Fast Growing Opportunity 11,0 0 0 + MarTe ch S a a S c o mp a n ie s p re s e n t a ma jo r 1 op p ort unit y for c ons olid a t io n. 2 $ 28B TAM, g ro win g b y 11.8% CAGR fro m 20 20 t o 20 26 3 M&A d own 50 %+ in 20 23, c re a t ing ma

ny a t t ra c t ive op p ort unit ie s Ba n za i is b uild in g a n d a c q uirin g mis s io n- crit ical Ma rke t ing Te c h n o lo g y s olut ions a c ros s t h re e Ba n za i c urre n t ly se rve s 3,000+ c ust o me rs, p re se n t in g a g re a

t op p ortunity for cus tome r org anic & inorg anic e xp ans ion fun c t io n s , t o c re a t e a fa mily o f s e a mle s s ly int e g ra t e d s olu t ions for our c us t ome rs . Exp e rie n c e d t e a m wh o h a s s uc c e s s fully e xe c

ut e d o n Sa a S s trate g y Re c urring re ve nue mod e l, hig h p rofit ma rg ins , a nd s ig nific a nt op e rating le ve rag e comb ine d with rap id g rowth Attract Engage Measure Integrate (1) ChiefMarTec Marketing Technology Landscape, 2023

(2) Winterberry Group Strategic Due Diligence Report for Banzai, April 2023 (3) From 2021 through June 30, 2023; PitchBook Q2 2023 Global M&A Report, July 2023 35

APPENDIX Risk Factors Summary Actual events, circumstances, or results

are difficult or impossible to predict and may differ materially from those contemplated in any forward - looking statements made in this Presentation and are due to a variety of risks and uncertainties, each of which could materially and adversely

impact Banzai’s operations, financial results and business as a whole, including, but not limited to, that Banzai: is dependent upon customer renewals, the addition of new customers, increased revenue from existing customers and the continued

growth of the market for its platform ; may fail to or respond effectively to rapidly changing technology, evolving industry standards and changing customer needs or requirements, and its platform may become less competitive as a result ; may not

successfully execute on its strategy and continue to develop and effectively market solutions that anticipate and respond to the needs of its customers ; may fail to properly manage its technical operations infrastructure, experience service

outages, undergo delays in the deployment of its applications, or its applications may fail to perform properly ; has completed acquisitions and may acquire or invest in other companies or technologies in the future, which could divert

management’s attention, result in additional dilution to its stockholders, increase expenses, disrupt operations or harm operating results ; may not realize some or all of the expected benefits of its acquisition strategy ; may not effectively

integrate the businesses or technologies it acquires, if any; may fail to further enhance its brand and maintain its existing brand awareness or expand its customer base; may fail to effectively develop and expand its marketing, sales, customer

service, operations, and capabilities or achieve broader market acceptance of its platform ; to manage its growth effectively, execute its business plan, maintain high levels of service or address competitive challenges adequately ; and may face

significant competition . Other risks and uncertainties include changes in domestic and foreign business, market, financial, political and legal conditions ; risks relating to the uncertainty of the projected financial information and assumptions

regarding available and serviceable markets ; Banzai’s ability to successfully and timely develop, sell and expand its technology and products, and otherwise implement its growth strategy ; risks relating to Banzai’s operations and

business, including information technology and cybersecurity risks, loss of customers and deterioration in relationships between Banzai and its employees ; risks related to increased competition ; risks relating to potential disruption of current

plans, operations and infrastructure of Banzai; risks that Banzai experiences difficulties managing its growth and expanding operations ; the impact of geopolitical, macroeconomic and market conditions ; the ability to successfully select, execute

or integrate future acquisitions into the business ; and those factors discussed in the Company’s prospectus filed on November 13, 2023 , the registration statement on Form S- 4 (together with all amendments thereto) initially filed on August

31, 2023 , and the definitive proxy statement / prospectus contained therein, and the registration statement on Form S- 1initially filed on December 29, 2023 in each case, under the heading “Risk Factors,” and in those documents that the

Company has filed, or will file, with the SEC. If any of these risks materialize or its assumptions prove incorrect, actual results could differ materially from the results implied by statements made in this Presentation . There may be additional

risks that Banzai does not presently know or that Banzai currently believes are immaterial that could also cause actual results to differ from those contained in forward - looking statements . Accordingly, you should not place undue reliance on its

forward - looking statements . 36

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

7GC (NASDAQ:VIIAU)

Historical Stock Chart

From Apr 2024 to May 2024

7GC (NASDAQ:VIIAU)

Historical Stock Chart

From May 2023 to May 2024