FALSE000170643100017064312024-02-212024-02-210001706431exch:XNAS2024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2024

________________________________________

Vir Biotechnology, Inc.

(Exact name of Registrant as Specified in Its Charter)

________________________________________

| | | | | | | | |

| Delaware | 001-39083 | 81-2730369 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | |

1800 Owens Street, Suite 900 | | |

San Francisco, California | | 94158 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (415) 906-4324

(Former Name or Former Address, if Changed Since Last Report)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value | | VIR | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, Vir Biotechnology, Inc. (the “Company”) and Glaxo Wellcome UK Limited (“GSK” and, together with the Company, the “Parties”) entered into a Definitive Collaboration Agreement on May 18, 2021 (the “DCA”). Under the terms of the DCA, the Parties agreed to collaborate on three separate programs, among them a program to research, develop and commercialize the Company’s monoclonal antibodies for the prevention, treatment or prophylaxis of the influenza virus (such program, the “Influenza Program”).

On February 21, 2024, the Parties entered into a letter agreement (the “Letter Agreement”) pursuant to which the Parties mutually agreed to terminate their collaboration on the Influenza Program under the DCA. More specifically, pursuant to the Letter Agreement, (i) all influenza products included within the Influenza Program which, as of February 21, 2024, included VIR-2482XX2 (also known as VIR-2372) and VIR-2981 (the “Existing Terminated Influenza Products”), are removed from the scope of the DCA, (ii) the Company’s exclusivity obligations to GSK under the DCA with respect to the Influenza Program are terminated and of no further force or effect, (iii) GSK’s option to VIR-2482 is terminated and of no further force or effect and the Company will have no further obligations to GSK with respect to VIR-2482, (iv) the Company will make payments of tiered royalties to GSK on net sales of any Existing Terminated Influenza Products, and variants or improvements thereof, in the low single digits, subject to certain deductions in certain circumstances, (v) the Company will have no further obligations to GSK with respect to any Existing Terminated Influenza Product or variants or improvements thereof (other than commercially reasonable efforts to develop and commercialize Existing Terminated Influenza Products or variants or improvement thereof in Major Markets (as defined in the DCA)), and (vi) the Company shall have the right to further develop and commercialize VIR-2482 or any Existing Terminated Influenza Product, and variants or improvements thereof, independently, alone, or via an affiliate or with a third party, in any case without restriction.

The Letter Agreement also includes certain clarifications and terminations of specific provisions of the DCA in light of the termination of the collaboration on the Influenza Program, including provisions relating to the Parties’ opt-out rights, as well other matters relating to the transfer of technology, materials, documentation and existing manufacturing commitments.

Except for the provisions of the Letter Agreement, the DCA remains in force in accordance with its terms.

The foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter Agreement, a copy of which will be filed as an exhibit to a subsequent filing with the Securities and Exchange Commission.

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, the Company issued a press release announcing its financial results for the fourth quarter and the year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02, including the attached Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | VIR BIOTECHNOLOGY, INC. |

| | | |

| Date: | February 22, 2024 | By: | /s/ Sung Lee |

| | | Sung Lee

Executive Vice President and Chief Financial Officer |

Vir Biotechnology Provides Corporate Update and Reports

Fourth Quarter and Full Year 2023 Financial Results

– Prior data from the Phase 2 SOLSTICE trial in chronic hepatitis delta participants demonstrated that after only 12 weeks of combination therapy, 100% (6/6) of participants had HDV RNA less than the lower limit of quantification –

– Phase 2 SOLSTICE trial on track to complete enrollment ahead of schedule with initial data expected in the second quarter; greater than 90% of participants dosed –

– Prior Phase 2 MARCH Part B chronic hepatitis B data demonstrated that tobevibart may play an important role in achieving a functional cure; 48-week end of treatment data readout on track for the fourth quarter –

– $1.63 billion in cash, cash equivalents and investments as of December 31, 2023 –

– Conference call scheduled for February 22, 2024 at 1:30 p.m. PT / 4:30 p.m. ET –

SAN FRANCISCO, February 22, 2024 – Vir Biotechnology, Inc. (Nasdaq: VIR) today provided a corporate update and reported financial results for the fourth quarter and full year ended December 31, 2023.

“Vir is poised to have a transformational year, with catalysts expected in the second and fourth quarters, which build off last year’s clinical trial progress in our chronic hepatitis delta and B programs. We believe these data readouts, notably the SOLSTICE delta update in the second quarter, hold tremendous promise for patients as we work towards solutions for these deadly diseases,” said Marianne De Backer, M.Sc., Ph.D., MBA, Vir’s Chief Executive Officer. “Our financial strength allows us to fund multiple clinical programs through major inflection points while enabling the flexibility to invest in external innovation opportunities.”

Pipeline Programs

Chronic Hepatitis Delta (CHD)

•The Company presented initial SOLSTICE data from a small subset of participants in a late-breaker presentation at the American Association for the Study of Liver Diseases (AASLD) The Liver Meeting in November 2023.

◦After 12 weeks of combination treatment with tobevibart and elebsiran, 5 out of 6 participants achieved undetectable HDV RNA and 6 out of 6 were below the lower limit of quantification.

•The SOLSTICE trial is ongoing with enrollment currently ahead of schedule for completion in the first quarter of 2024 due to the high level of physician and patient interest. This portion of the SOLSTICE trial is investigating the combination of tobevibart and elebsiran given every 4 weeks in one cohort, and tobevibart monotherapy given

every 2 weeks in another cohort. Of the 30 participants anticipated to be enrolled in each cohort, approximately 44% have compensated cirrhosis.

•The Company expects to report data on a subset of participants in the second quarter: 12-week treatment data for 15 participants per regimen as well as 24-week data for 10 participants per regimen. Complete 24-week treatment data for 30 participants per regimen is expected in the fourth quarter of 2024.

Chronic Hepatitis B (CHB)

•The Company presented new MARCH Part B data at AASLD The Liver Meeting in November 2023.

◦The data demonstrated an approximately three-fold higher response rate when adding tobevibart to a regimen of elebsiran with or without peginterferon after 24 weeks of treatment (15.0% for tobevibart + elebsiran + peginterferon alpha and 14.3% for tobevibart + elebsiran).

•The MARCH Part B trial is ongoing with 48-week end of treatment data expected in the fourth quarter of 2024.

•The Phase 2 PREVAIL platform trial and its THRIVE/STRIVE sub-protocols are ongoing. The platform is evaluating combinations of tobevibart, elebsiran and/or peginterferon alpha in two CHB patient populations with the potential to evaluate other populations in the future. Initial data from this platform trial is expected in the first half of 2025.

Human Immunodeficiency Virus (HIV)

•The Phase 1 trial of VIR-1388, an investigational novel T cell vaccine for the prevention of HIV, remains ongoing with initial immunogenicity data expected in the second half of 2024.

◦The trial is supported by the National Institute of Allergy and Infectious Diseases, part of the National Institutes of Health, and the Bill & Melinda Gates Foundation, and is being conducted by the HIV Vaccine Trials Network.

◦In December, Nature Medicine recognized the Phase 1 trial of VIR-1388 as one of the “11 clinical trials that will shape medicine in 2024”.

COVID-19

•Later this year, the Company expects to file a health authority application to support a Phase 1 trial evaluating VIR-7229, a potential broadly neutralizing next-generation COVID antibody that has been AI-engineered to have increased potency, breadth and resistance to viral escape.

◦The development of VIR-7229 has been supported in whole or in part with federal funds from the Department of Health and Human Services (HHS); Administration for Strategic Preparedness and Response (ASPR); Biomedical Advanced Research and Development Authority (BARDA), under Other Transaction Number: 75A50122C00081.

Influenza

•The full analysis of data from the Phase 2 PENINSULA trial is expected in the second quarter in a scientific publication.

•On February 21, 2024, the Company and GSK terminated their collaboration to research, develop and commercialize the Company’s monoclonal antibodies for the prevention, treatment, or prophylaxis of the influenza virus under the Definitive

Collaboration Agreement established in May 2021 to reflect that Vir retains sole rights to continue advancing its investigational therapies for influenza independently or with other partners.

•The Company is actively pursuing external partnership opportunities for its next-generation influenza A and B antibodies and Antibody Drug Conjugates (ADCs).

Preclinical Pipeline Candidates

•Vir is continuing to advance next-generation antibodies using its proprietary platform, which leverages dAIsYTM (data AI structure and antibody), an AI engine, allowing the Company to bring high-quality drug candidates to the clinic more efficiently.

•The Company expects the filing of multiple new INDs in the next 12-24 months, including:

◦VIR-2981, an investigational neuraminidase-targeting mAb against both influenza A and B viruses.

◦VIR-8190, an investigational mAb against respiratory syncytial virus (RSV) and human metapneumovirus.

◦VIR-1949, an investigational therapeutic T cell vaccine based on Vir’s human cytomegalovirus (HCMV) vector platform that is designed to treat precancerous lesions caused by the human papillomavirus.

Corporate Update

•In December of 2023, the Company announced strategic imperatives to focus its capital allocation on programs with the highest potential for patient impact and value creation, which include:

◦Closing R&D facilities in St. Louis, Missouri and Portland, Oregon in 2024. Research activities will continue at the Company’s sites in San Francisco, California and Bellinzona, Switzerland.

◦Eliminating approximately 12%, or 75 positions, including reductions from the Company’s discontinuation of its small molecule group which was initiated in the third quarter of 2023. The reductions will be substantially completed by the end of the first quarter of 2024.

◦Through these actions, the Company expects to reduce its cost structure by at least $40 million annually.

•On February 20, 2024, the Company announced that Executive Vice President and Chief Medical Officer, Phil Pang, M.D., Ph.D., has decided to step down to spend more time with his family. Dr. Pang’s last day will be March 31, 2024. The Company has initiated a search for a successor.

Fourth Quarter and Full Year 2023 Financial Results

Cash, Cash Equivalents and Investments: As of December 31, 2023, the Company had approximately $1.63 billion in cash, cash equivalents and investments. Cash, cash equivalents and investments declined by approximately $108 million during the fourth quarter of 2023.

Revenues: Total revenues for the quarter ended December 31, 2023 were $16.8 million compared to $49.4 million for the same period in 2022. Total revenues for the full year of 2023 were $86.2 million compared to $1.6 billion in 2022.

Revenues were comprised of the following components:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | | | Year Ended

December 31, | | |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| (in millions) | | | | (in millions) | | |

| Collaboration revenue | $ | 8.9 | | | $ | 21.6 | | | (58.8)% | | $ | 37.3 | | | $ | 1,505.5 | | | (97.5)% |

| Contract revenue | 0.7 | | | 0.2 | | | >100.0% | | 2.2 | | | 52.7 | | | (95.8)% |

| License revenue from a related party | — | | | — | | | —% | | — | | | 22.3 | | | (100.0)% |

| Grant revenue | 7.2 | | | 27.6 | | | (73.9)% | | 46.7 | | | 35.3 | | | 32.3% |

| Total revenues | $ | 16.8 | | | $ | 49.4 | | | (66.0)% | | $ | 86.2 | | | $ | 1,615.8 | | | (94.7)% |

Note: Numbers may not add due to rounding. | | | | | | |

•Collaboration revenue: The decrease in collaboration revenue for the fourth quarter and the full year of 2023 compared to the same periods in 2022 was driven by lower profit share from sales of sotrovimab under the Company’s 2020 GSK agreement.

•Contract revenue: Contract revenue for the fourth quarter of 2023 and 2022 was nominal. The decrease in contract revenue for the full year of 2023 compared to 2022 was primarily driven by the recognition of deferred revenue related to GSK’s selection of RSV in the third quarter of 2022 under the Company’s 2021 GSK agreement.

•License revenue from a related party: The decrease in license revenue for the full year of 2023 compared to 2022 was driven by certain revenues recognized under the collaboration with Brii Biosciences in the third quarter of 2022.

•Grant revenue: The decrease in grant revenue for the fourth quarter of 2023 compared to the same period in 2022 and the increase in grant revenue for the full year of 2023 compared to 2022 were primarily driven by the timing of revenue recognized under the Company’s grant with BARDA supporting the Company’s Phase 2 PENINSULA trial of VIR-2482.

Cost of Revenue: Cost of revenue for the fourth quarter of 2023 was nominal compared to $6.0 million for the same period in 2022. Cost of revenue for the full year of 2023 was $2.8 million compared to $146.3 million in 2022. The decreases were due to lower third-party royalties owed on the sales of sotrovimab.

Research and Development Expenses (R&D): R&D expenses for the fourth quarter of 2023 were $111.9 million, which included severance charges of $2.6 million and $16.5 million of non-cash stock-based compensation expense, compared to $155.2 million for the same period in 2022, which included $13.4 million of non-cash stock-based compensation expense. The decrease was primarily driven by the wind down of clinical studies involving VIR-2482 in the fourth quarter of 2023. R&D expenses for the full year of 2023 were $589.7 million, which included $62.7 million of non-cash stock-based compensation expense, compared to $474.6 million in 2022, which included $53.2 million of non-cash stock-based compensation expense. The increase was primarily driven by the Phase 2 PENINSULA trial of VIR-2482 and related manufacturing costs and, to a lesser extent, the advancement of our CHB and CHD clinical programs.

Selling, General and Administrative Expenses (SG&A): SG&A expenses for the fourth quarter of 2023 were $43.1 million, which included $1.9 million of severance charges and $11.8

million of non-cash stock-based compensation expense, compared to $38.7 million for the same period in 2022, which included $11.5 million of non-cash stock-based compensation expense. SG&A expenses for the full year of 2023 were $178.0 million, which included $48.6 million of non-cash stock-based compensation expense, compared to $161.8 million in 2022, which included $48.9 million of non-cash stock-based compensation expense. The increase for both the fourth quarter and full year were primarily driven by higher personnel-related costs.

Other Income (Loss): Other income for the fourth quarter of 2023 was $18.3 million compared to other loss of $(1.1) million for the same period in 2022. The increase was primarily due to higher foreign exchange loss incurred in the fourth quarter of 2022, partially offset by higher unrealized loss of equity investments in the same period of 2023. Other income for the full year of 2023 was $56.1 million compared to other loss of $(78.8) million in 2022. The increase was primarily due to higher unrealized loss of equity investments incurred in 2022 and higher interest income earned in 2023.

Benefit from (Provision for) Income Taxes: Benefit from income taxes for the fourth quarter of 2023 was $4.8 million compared to $50.0 million for the same period in 2022. Benefit from income taxes for the year of 2023 was $13.1 million compared to a provision for income taxes of $(238.4) million in 2022. The benefit from income taxes in the fourth quarter and the year of 2023 was primarily due to a pre-tax loss and our ability to carry back the R&D credit to 2022. The benefit from income taxes in the fourth quarter of 2022 was primarily due to the Company’s pre-tax loss. The swing from a provision for income taxes in 2022 to a benefit from income taxes in 2023 was due to the higher collaboration revenue from sotrovimab sales that resulted in pre-tax income in 2022.

Net (Loss) Income: Net loss attributable to Vir for the fourth quarter of 2023 was $(116.0) million, or $(0.86) per share, basic and diluted, compared to a net loss of $(101.6) million, or $(0.76) per share, basic and diluted, for the same period in 2022. Net loss attributable to Vir for the year of 2023 was $(615.1) million, or $(4.59) per share, basic and diluted, compared to a net income of $515.8 million, or $3.89 per share, basic and $3.83 per share, diluted, in 2022.

2024 Financial Guidance

Vir is providing full year 2024 guidance below (in millions):

| | | | | | | | | | | |

| GAAP combined R&D and SG&A expense range: | $ | 650 | | to | $ | 680 | |

| | | |

The following expenses are included in the GAAP combined R&D and SG&A expense range: | | | |

| Stock-based compensation expense | $ | 115 | | to | $ | 105 | |

| Restructuring charges* | $ | 35 | | to | $ | 25 | |

* Restructuring charges are primarily non-cash expenditures, related to the closing of two R&D sites previously announced on December 13, 2023.

Approximately three to four percent of the GAAP combined R&D and SG&A expense will be funded by grants. These grants are recognized as revenue.

The GAAP combined R&D and SG&A expense guidance does not include the effect of GAAP adjustments caused by events that may occur subsequent to the publication of this guidance, including, but not limited to, business development activities, litigation, in-process R&D impairments, and changes in the fair value of contingent considerations.

Conference Call

Vir will host a conference call to discuss the fourth quarter and full year results at 1:30 p.m. PT / 4:30 p.m. ET today. A live webcast will be available on https://investors.vir.bio/ and will be archived on www.vir.bio for 30 days.

About Tobevibart

Tobevibart is an investigational subcutaneously administered antibody designed to block entry of hepatitis B and hepatitis delta viruses into hepatocytes and to reduce the level of virions and subviral particles in the blood. Tobevibart, which incorporates Xencor’s Xtend™ and other Fc technologies, has been engineered to potentially function as a T cell vaccine against hepatitis B virus and hepatitis delta virus, as well as to have an extended half-life. Tobevibart was identified using Vir’s proprietary mAb discovery platform.

About Elebsiran

Elebsiran is an investigational subcutaneously administered hepatitis B virus-targeting small interfering ribonucleic acid (siRNA) that Vir believes has the potential to stimulate an effective immune response and have direct antiviral activity against hepatitis B virus and hepatitis delta virus. It is the first siRNA in the clinic to include Enhanced Stabilization Chemistry Plus (ESC+) technology to enhance stability and minimize off-target activity, which potentially could result in an increased therapeutic index. Elebsiran is the first asset in the Company’s collaboration with Alnylam Pharmaceuticals, Inc. to enter clinical trials.

About VIR-2482

VIR-2482 is an investigational hemagglutinin targeting, intramuscularly administered influenza A-neutralizing monoclonal antibody. In vitro, it has been shown to cover all major strains of influenza A that have arisen since the 1918 flu pandemic. VIR-2482 is designed as a prophylactic for influenza A. VIR-2482 incorporates Xencor’s Xtend™ and was identified using Vir’s proprietary mAb discovery platform.

The PENINSULA trial has been supported in whole or in part with federal funds from the Department of Health and Human Services (HHS); Administration for Strategic Preparedness and Response (ASPR); Biomedical Advanced Research and Development Authority (BARDA), under Other Transaction Number: 75A50122C00081.

About VIR-2981

VIR-2981 is an investigational neuraminidase-targeting monoclonal antibody against influenza viruses. It targets a region of the neuraminidase protein that is highly conserved across influenza A and B strains and is designed to inhibit the influenza neuraminidase, a key viral protein that facilitates release of new viruses in infected individuals. Preclinical data demonstrate the antibody’s breadth and potency against all major strains of seasonal and pandemic influenza viruses and support the potential of this antibody in the prevention of influenza illness. VIR-2981 was identified using Vir’s proprietary mAb discovery platform.

About VIR-1388

VIR-1388 is a preclinical subcutaneously administered HIV T cell vaccine based the T cell-based viral vector platform and has been designed to elicit abundant T cells that recognize HIV epitopes with the goal of creating a safe and effective HIV vaccine.

About Sotrovimab

Sotrovimab is an investigational SARS-CoV-2 neutralizing monoclonal antibody that was developed in collaboration with GSK. The antibody binds to an epitope on SARS-CoV-2 shared with SARS-CoV-1 (the virus that causes SARS). Sotrovimab, which incorporates Xencor, Inc.’s Xtend™ technology, has been designed to achieve high concentration in the lungs to achieve optimal penetration into airway tissues affected by SARS-CoV-2 and to have an extended half-life. Sotrovimab was identified using Vir’s proprietary mAb discovery platform. Sotrovimab is currently not authorized in the US.

About VIR-7229

VIR-7229 is an investigational next generation COVID-19 monoclonal antibody with a distinct combination of potency, breadth and viral inescapability. VIR-7229 is designed as a prophylactic for COVID-19 and was identified using Vir’s proprietary mAb discovery platform. VIR-7229 incorporates Xencor, Inc.’s Xtend™ technology and is affinity matured using machine learning to increase its effectiveness in binding to SARS-CoV and SARS-CoV-2 variants.

The development of VIR-7229 has been supported in whole or in part with federal funds from the Department of Health and Human Services (HHS); Administration for Strategic Preparedness and Response (ASPR); Biomedical Advanced Research and Development Authority (BARDA), under Other Transaction Number: 75A50122C00081.

About VIR-8190

VIR-8190 is an investigational dual specificity monoclonal antibody that has the ability to potently neutralize both respiratory syncytial virus (RSV) and human metapneumovirus (hMPV) strains. RSV and HMPV are recognized as significant causes of lower respiratory tract disease in high-risk populations, including infants and immunocompromised individuals. VIR-8190 was identified using Vir’s proprietary mAb discovery platform.

About VIR-1949

VIR-1949 is an investigational therapeutic vaccine based the T cell-based viral vector platform that is designed to treat HPV-related high-grade squamous epithelial pre-cancer lesions (HSIL) and cancers. This vaccine uses HCMV as the vaccine vector. Based on preclinical data, HCMV vectors have the potential to induce high frequencies of antigen-specific, tissue-localizing effector memory T cells.

About Vir Biotechnology, Inc.

Vir Biotechnology, Inc. is an immunology company focused on powering the immune system to transform lives by treating and preventing infectious diseases and other serious conditions, including viral-associated diseases. Vir has assembled two technology platforms that are designed to modulate the immune system by exploiting critical observations of natural immune processes. Its current clinical development pipeline consists of product candidates targeting hepatitis delta and hepatitis B viruses and human immunodeficiency virus. Vir has several preclinical candidates in its pipeline, including those targeting influenza A and B, COVID-19,

RSV/MPV and HPV. Vir routinely posts information that may be important to investors on its website.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “plan,” “potential,” “aim,” “expect,” “anticipate,” “promising” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements are based on Vir’s expectations and assumptions as of the date of this press release. Forward-looking statements contained in this press release include, but are not limited to, statements regarding Vir’s strategy and plans; Vir’s cash balance; Vir’s financial guidance; Vir’s future financial and operating results and its expectations related thereto; potential of, and expectations for, Vir’s pipeline; Vir’s clinical and preclinical development programs, clinical trials, including the enrollment of Vir’s clinical trials, and the expected timing of data readouts and presentations; the potential benefits, safety, and efficacy of Vir’s investigational therapies; and risks and uncertainties associated with drug development and commercialization. Many important factors may cause differences between current expectations and actual results, including uncertainty as to whether the anticipated benefits of the BARDA collaboration can be achieved; unexpected safety or efficacy data or results observed during clinical trials or in data readouts; the timing and outcome of Vir’s planned interactions with regulatory authorities; difficulties in obtaining regulatory approval; uncertainty as to whether the anticipated benefits of Vir’s collaborations with other companies can be achieved; difficulties in collaborating with other companies; challenges in accessing manufacturing capacity; clinical site activation rates or clinical trial enrollment rates that are lower than expected; successful development and/or commercialization of alternative product candidates by Vir’s competitors; changes in expected or existing competition; delays in or disruptions to Vir’s business or clinical trials, Vir’s use of artificial intelligence and machine learning in its efforts to engineer next-generation proteins and in other research and development efforts; the timing and amount of actual expenses, including, without limitation, Vir’s anticipated combined GAAP R&D and SG&A expenses; geopolitical changes or other external factors; and unexpected litigation or other disputes. Drug development and commercialization involve a high degree of risk, and only a small number of research and development programs result in commercialization of a product. Results in early-stage clinical trials may not be indicative of full results or results from later-stage or larger-scale clinical trials and do not ensure regulatory approval. You should not place undue reliance on these statements or the scientific data presented. Other factors that may cause actual results to differ from those expressed or implied in the forward-looking statements in this press release are discussed in Vir’s filings with the U.S. Securities and Exchange Commission, including the section titled “Risk Factors” contained therein. Except as required by law, Vir assumes no obligation to update any forward-looking statements contained herein to reflect any change in expectations, even as new information becomes available.

VIR BIOTECHNOLOGY, INC.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 241,576 | | | $ | 848,631 | |

| Short-term investments | 1,270,980 | | | 1,521,517 | |

| Restricted cash and cash equivalents, current | 13,268 | | | 12,681 | |

| Equity investments | 9,853 | | | 31,892 | |

| Prepaid expenses and other current assets | 52,549 | | | 104,356 | |

| Total current assets | 1,588,226 | | | 2,519,077 | |

| Intangible assets, net | 22,565 | | | 32,755 | |

| Goodwill | 16,937 | | | 16,937 | |

| Property and equipment, net | 96,018 | | | 105,609 | |

| Operating right-of-use assets | 71,182 | | | 82,557 | |

| Restricted cash and cash equivalents, noncurrent | 6,448 | | | 6,656 | |

| Long-term investments | 105,275 | | | 23,927 | |

| Other assets | 12,409 | | | 14,570 | |

| TOTAL ASSETS | $ | 1,919,060 | | | $ | 2,802,088 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 6,334 | | | $ | 6,422 | |

| Accrued and other liabilities | 104,220 | | | 489,090 | |

| Deferred revenue, current | 64,853 | | | 15,517 | |

| Total current liabilities | 175,407 | | | 511,029 | |

| Deferred revenue, noncurrent | 1,526 | | | 53,207 | |

| Operating lease liabilities, noncurrent | 111,673 | | | 123,837 | |

| Contingent consideration, noncurrent | 25,960 | | | 24,937 | |

| Other long-term liabilities | 14,258 | | | 11,115 | |

| TOTAL LIABILITIES | 328,824 | | | 724,125 | |

| Commitments and contingencies (Note 10) | | | |

| STOCKHOLDERS’ EQUITY: | | | |

Preferred stock, $0.0001 par value; 10,000,000 shares authorized as of December 31, 2023 and 2022, respectively; no shares issued and outstanding as of December 31, 2023 and 2022 | — | | | — | |

Common stock, $0.0001 par value; 300,000,000 shares authorized as of December 31, 2023 and 2022, respectively; 134,781,286 and 133,236,687 shares issued and outstanding as of December 31, 2023 and 2022, respectively | 13 | | | 13 | |

| Additional paid-in capital | 1,828,862 | | | 1,709,835 | |

| Accumulated other comprehensive loss | (815) | | | (9,122) | |

| (Accumulated deficit) retained earnings | (237,824) | | | 377,237 | |

| TOTAL STOCKHOLDERS’ EQUITY | 1,590,236 | | | 2,077,963 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 1,919,060 | | | $ | 2,802,088 | |

VIR BIOTECHNOLOGY, INC.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Collaboration revenue | $ | 8,858 | | | $ | 21,609 | | | $ | 37,266 | | | $ | 1,505,469 | |

| Contract revenue | 744 | | | 180 | | | 2,228 | | | 52,714 | |

| License revenue from a related party | — | | | — | | | — | | | 22,289 | |

| Grant revenue | 7,185 | | | 27,621 | | | 46,686 | | | 35,325 | |

| Total revenues | 16,787 | | | 49,410 | | | 86,180 | | | 1,615,797 | |

| Operating expenses: | | | | | | | |

| Cost of revenue | 798 | | | 5,996 | | | 2,765 | | | 146,319 | |

| Research and development | 111,915 | | | 155,173 | | | 589,671 | | | 474,648 | |

| Selling, general and administrative | 43,090 | | | 38,743 | | | 178,049 | | | 161,762 | |

| Total operating expenses | 155,803 | | | 199,912 | | | 770,485 | | | 782,729 | |

| (Loss) income from operations | (139,016) | | | (150,502) | | | (684,305) | | | 833,068 | |

| Other income (loss): | | | | | | | |

| Change in fair value of equity investments | (992) | | | 8,879 | | | (21,888) | | | (111,140) | |

| Interest income | 20,736 | | | 16,172 | | | 86,990 | | | 28,092 | |

| Other (expense) income, net | (1,485) | | | (26,187) | | | (8,991) | | | 4,260 | |

| Total other income (loss) | 18,259 | | | (1,136) | | | 56,111 | | | (78,788) | |

| (Loss) income before benefit from (provision for) income taxes | (120,757) | | | (151,638) | | | (628,194) | | | 754,280 | |

| Benefit from (provision for) income taxes | 4,784 | | | 50,035 | | | 13,077 | | | (238,443) | |

| Net (loss) income | $ | (115,973) | | | $ | (101,603) | | | $ | (615,117) | | | $ | 515,837 | |

| Net loss attributable to noncontrolling interest | $ | — | | | $ | — | | | $ | (56) | | | $ | — | |

| Net (loss) income attributable to Vir | $ | (115,973) | | | $ | (101,603) | | | $ | (615,061) | | | $ | 515,837 | |

| Net (loss) income per share attributable to Vir, basic | $ | (0.86) | | | $ | (0.76) | | | $ | (4.59) | | | $ | 3.89 | |

| Net (loss) income per share attributable to Vir, diluted | $ | (0.86) | | | $ | (0.76) | | | $ | (4.59) | | | $ | 3.83 | |

| Weighted-average shares outstanding, basic | 134,608,811 | | 133,154,960 | | 134,130,924 | | 132,606,767 |

| Weighted-average shares outstanding, diluted | 134,608,811 | | 133,154,960 | | 134,130,924 | | 134,810,908 |

Contacts:

Media

Carly Scaduto

Senior Director, Media Relations

cscaduto@vir.bio

+1 314-368-5189

Investors

Richard Lepke

Senior Director, Investor Relations

rlepke@vir.bio

+1 978-973-9986

v3.24.0.1

Cover

|

Feb. 21, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity Registrant Name |

Vir Biotechnology, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39083

|

| Entity Tax Identification Number |

81-2730369

|

| Entity Address, Address Line One |

1800 Owens Street

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94158

|

| City Area Code |

415

|

| Local Phone Number |

906-4324

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value

|

| Trading Symbol |

VIR

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001706431

|

| NASDAQ - ALL MARKETS |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNAS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

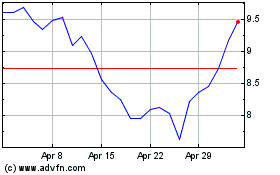

Vir Biotechnology (NASDAQ:VIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vir Biotechnology (NASDAQ:VIR)

Historical Stock Chart

From Apr 2023 to Apr 2024