UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Quarterly Period Ended June 30, 2024

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ________ to __________

Commission

file number: 001-41957

WETOUCH

TECHNOLOGY INC.

(Exact

name of registrant as specified in its charter)

| Nevada | | 20-4080330 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

No. 29, Third Main Avenue Shigao Town, Renshou County Meishan, Sichuan, China | | 620500 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s

telephone number, including area code: (86) 28-37390666

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | WETH | | Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☒

As

of August 15, 2024, there were 11,931,534 shares of the registrant’s common stock, par value $0.001 per share, issued and outstanding.

WETOUCH

TECHNOLOGY INC.

QUARTERLY

REPORT ON FORM 10-Q

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Quarterly Report on Form 10-Q (the “Quarterly Report”) contains “forward-looking statements” within the meaning

of Section 27A of the Securities Act, Section 21E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be preceded by, or contain, words such as “may,” “will,” “expect,” “anticipate,”

“intend,” “plan,” “believe,” “estimate,” “predict,” “potential,”

“might,” “could,” “would,” “should” or other words indicating future results, though

not all forward-looking statements necessarily contain these identifying words. All statements other than statements of historical fact

are statements that could be deemed forward-looking statements, including, without limitation, statements about our future business operations

and results, our strategy and competition. These statements represent our current expectations or beliefs concerning various future events

and involve numerous risks and uncertainties that could cause actual results to differ materially from expectations, including, but not

limited to:

| |

● |

Our

reliance on our top customers is significant. Failure to attract new customers or retain existing ones cost-effectively could materially

and adversely impact our business, financial condition, and results of operations. |

| |

● |

We

hold a substantial amount of accounts receivable, which may become uncollectible. |

| |

● |

Dismissing

BF Borgers may cause significant expenses or delays in financings or SEC filings, affecting our stock price and market access. |

| |

● |

You

are unlikely to collect judgments or exercise remedies against BF Borgers for their work as our auditor. |

| |

● |

We

face fines and penalties from the Chinese government for not completing required filings . |

| |

● |

Our

capacity to uphold the quality and safety standards of our products. |

| |

● |

Our

ability to compete effectively within the touchscreen display industry. |

| |

● |

Without

substantial additional financing, our ability to execute our business plan will be compromised. |

| |

● |

Failure

to secure a new parcel for constructing our new buildings and facilities, as well as acquiring and installing new production lines

on the new parcel, could materially and adversely affect our business, financial condition, and results of operations. |

| |

● |

Revocation

or unavailability of preferential tax treatments and government subsidies, or successful challenges to our tax liability calculation

by PRC tax authorities, may necessitate payment of tax, interest, and penalties exceeding our tax provisions. |

| |

● |

Significant

interruptions in the operations of our third-party suppliers could potentially disrupt our operations. |

| |

● |

Risks

associated with fluctuations in the cost, availability, and quality of raw materials may adversely affect our results of operations. |

| |

● |

We

are reliant on key executives and highly qualified managers, and retention cannot be assured. |

| |

● |

Absence

of long-term contracts with our suppliers allows them to reduce order quantities or terminate sales to us at any time. |

| |

● |

Failure

to adopt new technologies to evolving customer needs or emerging industry standards may materially and adversely affect our business. |

| |

● |

Lack

of business liability or disruption insurance exposes us to significant costs and business disruption. |

| |

● |

Adverse

regulatory developments in Mainland China may subject us to additional regulatory review, restrictions, disclosure requirements,

and regulatory scrutiny by the SEC, increasing compliance costs and hindering future securities offerings. |

| |

● |

Our

common stock may be prohibited from trading in the U.S. under the Holding Foreign Companies Accountable Act if PCAOB inspection of

our auditor is incomplete, leading to delisting or prohibition and potential decline in stock value. |

| |

● |

Changes

in China’s economic, political, or social conditions or government policies may adversely affect our business and operations. |

| |

● |

Uncertainties

regarding the PRC legal system, including enforcement and sudden changes in laws and regulations, could adversely affect us and limit

legal protections. |

| |

● |

Fluctuations

in exchange rates could materially and adversely affect our results of operations and your investment value. |

| |

● |

The

other risks and uncertainties discussed under the section titled “Risk Factors” beginning on page 13 of this Quarterly

Report and our other filings with the Securities and Exchange Commission. |

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance, or achievements. We undertake no obligation to update or revise any of the forward-looking statements, whether

as a result of new information, future events or otherwise, except as required by law.

You

should read this Quarterly Report with the understanding that our actual future results may be materially different from what we expect.

We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

Item

1. Financial Statements

WETOUCH

TECHNOLOGY INC. AND ITS SUBSIDIARIES

INDEX

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

WETOUCH

TECHNOLOGY INC. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash | |

$ | 98,374,302 | | |

$ | 98,040,554 | |

| Accounts receivable | |

| 10,826,787 | | |

| 7,455,252 | |

| Inventories | |

| 179,264 | | |

| 222,102 | |

| Prepaid expenses and other current assets | |

| 3,856,718 | | |

| 1,063,627 | |

| TOTAL CURRENT ASSETS | |

| 113,237,071 | | |

| 106,781,535 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 12,672,986 | | |

| 12,859,863 | |

| TOTAL ASSETS | |

$ | 125,910,057 | | |

$ | 119,641,398 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 917,153 | | |

$ | 640,795 | |

| Due to a related party | |

| 263,956 | | |

| - | |

| Income tax payable | |

| 1,093,839 | | |

| - | |

| Accrued expenses and other current liabilities | |

| 839,781 | | |

| 4,462,496 | |

| Convertible promissory notes payable | |

| - | | |

| 1,239,126 | |

| TOTAL CURRENT LIABILITIES | |

| 3,114,729 | | |

| 6,342,417 | |

| | |

| | | |

| | |

| Common stock purchase warrants liability | |

| 332,799 | | |

| 378,371 | |

| TOTAL LIABILITIES | |

$ | 3,447,528 | | |

$ | 6,720,788 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES (Note 13) | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Common stock, $0.001 par value, 15,000,000 shares authorized, 11,931,534 and 9,732,948 issued and outstanding as of June 30, 2024 and December 31, 2023, respectively* | |

$ | 11,932 | | |

$ | 9,733 | |

| Additional paid in capital* | |

| 52,501,680 | | |

| 43,514,125 | |

| Statutory reserve | |

| 7,195,092 | | |

| 7,195,092 | |

| Retained earnings | |

| 72,737,656 | | |

| 69,477,092 | |

| Accumulated other comprehensive loss | |

| (9,983,831 | ) | |

| (7,275,432 | ) |

| TOTAL STOCKHOLDERS’

EQUITY | |

| 122,462,529 | | |

| 112,920,610 | |

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY | |

$ | 125,910,057 | | |

$ | 119,641,398 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

WETOUCH

TECHNOLOGY INC. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF INCOME

AND

COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| REVENUES | |

$ | 12,234,575 | | |

$ | 12,774,432 | | |

$ | 27,111,834 | | |

$ | 26,207,893 | |

| COST OF REVENUES | |

| (7,373,757 | ) | |

| (6,521,015 | ) | |

| (18,913,058 | ) | |

| (13,915,676 | ) |

| GROSS PROFIT | |

| 4,860,818 | | |

| 6,253,417 | | |

| 8,198,776 | | |

| 12,292,217 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Selling expenses | |

| (289,716 | ) | |

| (81,360 | ) | |

| (749,508 | ) | |

| (132,065 | ) |

| General and administrative expenses | |

| (802,663 | ) | |

| (56,907 | ) | |

| (1,333,016 | ) | |

| (1,723,663 | ) |

| Research and development expenses | |

| (43,211 | ) | |

| (20,384 | ) | |

| (85,949 | ) | |

| (41,269 | ) |

| TOTAL OPERATING EXPENSES | |

| (1,135,590 | ) | |

| (158,651 | ) | |

| (2,168,473 | ) | |

| (1,896,997 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME FROM OPERATIONS | |

| 3,725,228 | | |

| 6,094,766 | | |

| 6,030,303 | | |

| 10,395,220 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 38,046 | | |

| 30,034 | | |

| 69,393 | | |

| 59,229 | |

| Interest expense | |

| - | | |

| (38,108 | ) | |

| (1,169,974 | ) | |

| (71,507 | ) |

| Other income | |

| - | | |

| - | | |

| 46,449 | | |

| - | |

| Gain on changes in fair value of common stock purchase warrants liability | |

| 37,751 | | |

| 142,386 | | |

| 45,572 | | |

| 44,784 | |

| TOTAL OTHER INCOME (EXPENSES) | |

| 75,797 | | |

| 134,312 | | |

| (1,008,560 | ) | |

| 32,506 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME BEFORE INCOME TAX EXPENSE | |

| 3,801,025 | | |

| 6,229,078 | | |

| 5,021,743 | | |

| 10,427,726 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME TAX EXPENSE | |

| (1,099,331 | ) | |

| (1,556,095 | ) | |

| (1,761,179 | ) | |

| (2,961,494 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME | |

$ | 2,701,694 | | |

$ | 4,672,983 | | |

$ | 3,260,564 | | |

$ | 7,466,232 | |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE INCOME (LOSS) | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (778,406 | ) | |

| (6,204,951 | ) | |

| (2,708,399 | ) | |

| (6,885,927 | ) |

| COMPREHENSIVE INCOME (LOSS) | |

$ | 1,923,288 | | |

$ | (1,531,968 | ) | |

$ | 552,165 | | |

$ | 580,305 | |

| | |

| | | |

| | | |

| | | |

| | |

| EARNINGS PER COMMON SHARE* | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.23 | | |

$ | 0.48 | | |

$ | 0.29 | | |

$ | 0.84 | |

| Diluted | |

$ | 0.23 | | |

$ | 0.48 | | |

$ | 0.29 | | |

$ | 0.84 | |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING* | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 11,931,534 | | |

| 9,682,721 | | |

| 11,325,873 | | |

| 8,841,712 | |

| Diluted | |

| 11,982,239 | | |

| 9,779,349 | | |

| 11,376,578 | | |

| 9,034,969 | |

The

accompanying notes are an integral part of these consolidated financial statements.

WETOUCH

TECHNOLOGY INC. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited)

| | |

Common stock at Par value $0.001 | | |

Additional paid-in | | |

Statutory | | |

Retained | | |

Accumulated other comprehensive | | |

Total stockholders’ | |

| | |

Shares | | |

Amount | | |

capital | | |

reserve | | |

Earnings | | |

loss | | |

equity | |

| Balance as of December 31 2022 | |

| 1,680,248 | | |

$ | 1,680 | | |

$ | 3,402,178 | | |

$ | 6,040,961 | | |

$ | 62,366,892 | | |

$ | (2,977,524 | ) | |

$ | 68,834,187 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued to private placement | |

| 8,000,000 | | |

| 8,000 | | |

| 39,992,000 | | |

| - | | |

| - | | |

| - | | |

| 40,000,000 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,793,249 | | |

| - | | |

| 2,793,249 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (680,976 | ) | |

| (680,976 | ) |

| Balance as of March 31, 2023 | |

| 9,680,248 | | |

$ | 9,680 | | |

$ | 43,394,178 | | |

$ | 6,040,961 | | |

$ | 65,160,141 | | |

$ | (3,658,500 | ) | |

$ | 110,946,460 | |

| Exercise of warrants issued to third parties in conjunction with

debt issuance in 2021 | |

| 15,000 | | |

| 15 | | |

| (15 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Net income | |

| | | |

| | | |

| | | |

| | | |

| 4,672,983 | | |

| | | |

| 4,672,983 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,204,951 | ) | |

| (6,204,951 | ) |

| Balance as of June 30, 2023 | |

| 9,695,248 | | |

$ | 9,695 | | |

$ | 43,394,163 | | |

$ | 6,040,961 | | |

$ | 69,833,124 | | |

$ | (9,863,451 | ) | |

$ | 109,414,492 | |

| | |

Common stock at Par value $0.001 | | |

Additional paid-in | | |

Statutory | | |

Retained | | |

Accumulated other comprehensive | | |

Total stockholders’ | |

| | |

Shares | | |

Amount | | |

capital | | |

reserve | | |

Earnings | | |

loss | | |

equity | |

| Balance as of December 31 2023* | |

| 9,732,948 | | |

$ | 9,733 | | |

$ | 43,514,125 | | |

$ | 7,195,092 | | |

$ | 69,477,092 | | |

$ | (7,275,432 | ) | |

$ | 112,920,610 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock from the 2024 Public Offering, net of issuance costs | |

| 2,160,000 | | |

| 2,160 | | |

| 8,987,594 | | |

| - | | |

| - | | |

| - | | |

| 8,989,754 | |

| Exercise of warrants issued in conjunction with legal/consultant services in 2020 and 2021 | |

| 35,861 | | |

| 36 | | |

| (36 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercise of warrants issued to third parties in conjunction with

debt issuance in 2021 | |

| 2,725 | | |

| 3 | | |

| (3 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 558,870 | | |

| - | | |

| 558,870 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,929,993 | ) | |

| (1,929,993 | ) |

| Balance as of March 31, 2024 | |

| 11,931,534 | | |

$ | 11,932 | | |

$ | 52,501,680 | | |

$ | 7,195,092 | | |

$ | 70,035,962 | | |

$ | (9,205,425 | ) | |

$ | 120,539,241 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,701,694 | | |

| - | | |

| 2,701,694 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (778,406 | ) | |

| (778,406 | ) |

| Balance as of June 30, 2024 | |

| 11,931,534 | | |

$ | 11,932 | | |

$ | 52,501,680 | | |

$ | 7,195,092 | | |

$ | 72,737,656 | | |

$ | (9,983,831 | ) | |

$ | 122,462,529 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

WETOUCH

TECHNOLOGY INC. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

For

the Six Months Ended June

30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities | |

| | |

| |

| Net income | |

$ | 3,260,564 | | |

$ | 7,466,232 | |

| Adjustments to reconcile net income to cash (used in) provided by operating activities | |

| | | |

| | |

| Depreciation | |

| 4,798 | | |

| 4,805 | |

| Amortization of discounts and issuance cost of the notes | |

| 5,715 | | |

| 15,151 | |

| Gain on changes in fair value of common stock purchase warrants liability | |

| (45,572 | ) | |

| (44,784 | ) |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (3,568,822 | ) | |

| (5,597,334 | ) |

| Amounts due from related parties | |

| - | | |

| (1,158 | ) |

| Inventories | |

| 36,878 | | |

| 239,546 | |

| Prepaid expenses and other current assets | |

| (2,817,799 | ) | |

| 339,335 | |

| Accounts payable | |

| 293,217 | | |

| 1,102,812 | |

| Amounts due to related parties | |

| - | | |

| 2,164 | |

| Income tax payable | |

| 1,101,760 | | |

| 1,551,492 | |

| Accrued expenses and other current liabilities | |

| (3,606,647 | ) | |

| 1,680,447 | |

| Net cash (used in) provided by operating activities | |

| (5,335,907 | ) | |

| 6,758,708 | |

| | |

| | | |

| | |

| Cash flows from investing activity | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (114,762 | ) | |

| - | |

| Net cash used in investing activity | |

| (114,762 | ) | |

| - | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from issuance of common stock, net of issue costs | |

| 8,989,754 | | |

| - | |

| Proceeds from stock issuance of private placement | |

| - | | |

| 40,000,000 | |

| Proceeds from advances from a related party | |

| 263,956 | | |

| - | |

| Proceeds from advances from a third party | |

| - | | |

| 82,145 | |

| Repayments of convertible promissory notes payable | |

| (1,400,750 | ) | |

| (35,000 | ) |

| Net cash provided by financing activities | |

| 7,852,960 | | |

| 40,047,145 | |

| | |

| | | |

| | |

| Effect of changes of foreign exchange rates on cash | |

| (2,068,543 | ) | |

| (5,841,497 | ) |

| Net increase in cash | |

| 333,748 | | |

| 40,964,356 | |

| Cash, beginning of period | |

| 98,040,554 | | |

| 51,250,505 | |

| Cash, end of period | |

$ | 98,374,302 | | |

$ | 92,214,861 | |

| Supplemental disclosures of cash flow information | |

| | | |

| | |

| Income tax paid | |

$ | 659,419 | | |

$ | 2,961,494 | |

| Interest paid | |

$ | 1,186,210 | | |

$ | - | |

| Issue costs charged to additional paid-in capital | |

$ | 1,810,246 | | |

$ | - | |

| Exercise of warrant shares | |

$ | 38,586 | | |

$ | - | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

WETOUCH

TECHNOLOGY INC. AND ITS SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1 — BUSINESS DESCRIPTION

Wetouch

Technology Inc. (“Wetouch”, or the “Company”), formerly known as Gulf West Investment Properties, Inc., was originally

incorporated in August 1992, under the laws of the state of Nevada.

On

October 9, 2020, the Company entered into a share exchange agreement (the “Share Exchange Agreement”) with Wetouch Holding

Group Limited (“BVI Wetouch”) and all the shareholders of BVI Wetouch (each, a “BVI Shareholder” and collectively,

the “BVI Shareholders”), to acquire all the issued and outstanding capital stock of BVI Wetouch in exchange for the issuance

to the BVI Shareholders an aggregate of 28,000,000 shares (1,400,000 shares post-Reverse Stock Split) of the Company’s common stock

(the “Reverse Merger”). In the Reverse Merger, each ordinary share of BVI Wetouch was exchanged for 2,800 shares (140 shares

post-Reverse Stock Split) of common stock of Wetouch. Immediately after the closing of the Reverse Merger on October 9, 2020, the Company

had a total of 31,396,394 (1,569,820 shares post-Reverse Stock Split) issued and outstanding shares of common stock. As a result of the

Reverse Merger, BVI Wetouch became a wholly-owned subsidiary of the Company.

BVI

Wetouch is a holding company whose only asset, held through a subsidiary, is 100% of the registered capital of Sichuan Wetouch Technology

Co., Ltd. (“Sichuan Wetouch”), a limited liability company organized under the laws of the People’s Republic of China

(“China” or the “PRC”). Sichuan Wetouch is primarily engaged in the business of research and development, manufacturing,

and distribution of touchscreen displays to customers both in the PRC and overseas. The touchscreen products, which are manufactured

by the Company, are primarily applied for use in financial terminals, automotive, Point of Sales, gaming, lottery, medical, Human-Machine

Interface (HMI), and other specialized industries.

The

Reverse Merger was accounted for as a recapitalization effected by a share exchange, wherein BVI Wetouch is considered the acquirer for

accounting and financial reporting purposes. The assets and liabilities of BVI Wetouch have been brought forward at their book value

and no goodwill has been recognized. The number of shares, par value amount, and additional paid-in capital in the prior years are retrospectively

adjusted accordingly.

Corporate

History of BVI Wetouch

BVI

Wetouch was incorporated under the laws of British Virgin Islands on August 14, 2020. It became the holding company of Hong Kong Wetouch

Electronics Technology Limited (“Hong Kong Wetouch”) on September 11, 2020.

Hong

Kong Wetouch Technology Limited (“HK Wetouch”), was incorporated as a holding company under the laws of Hong Kong Special

Administrative Region (the “SAR”) on December 3, 2020. On March 2, 2021, HK Wetouch acquired all shares of Hong Kong Wetouch.

Due to the fact that Hong Kong Wetouch and HK Wetouch are both under the same sole stockholder, the acquisition is accounted for under

common control.

In

June 2021, Hong Kong Wetouch completed its dissolution process pursuant to the minutes of its special stockholder meeting.

Sichuan

Wetouch was formed on May 6, 2011 in the PRC and became a wholly foreign-owned enterprise (“WFOE”) in the PRC on February

23, 2017. On July 19, 2016, Sichuan Wetouch was 100% held by HK Wetouch.

On

December 30, 2020, Sichuan Vtouch was incorporated in Chengdu, Sichuan, under the PRC laws.

In

March 2021, pursuant to local PRC government guidelines on local environmental issues and the national plan, Sichuan Wetouch was subject

to a government directed relocation order. Sichuan Vtouch took over the operating business of Sichuan Wetouch.

On

March 30, 2023, an independent third party acquired all shares of Sichuan Wetouch for a nominal amount.

As

a result of the above restructuring, HK Wetouch became the sole shareholder of Sichuan Vtouch.

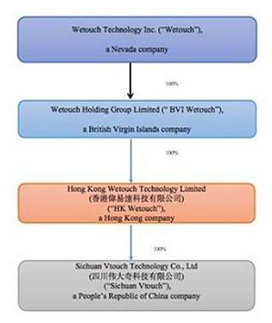

The

following diagram illustrates the Company’s current corporate structure:

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a)

Basis of Presentation and Principles of Consolidation

The

accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally

accepted in the United States of America (“U.S. GAAP”). Certain information and footnote disclosures normally included in

financial statements prepared in accordance with U.S. GAAP have been condensed or omitted as permitted by rules and regulations of the

United States Securities and Exchange Commission (the “SEC”). The condensed consolidated balance sheet as of December 31,

2023 was derived from the audited consolidated financial statements of Wetouch. The accompanying unaudited condensed consolidated financial

statements should be read in conjunction with the consolidated balance sheet of the Company as of December 31, 2023, and the related

consolidated statements of income and comprehensive income (loss), changes in stockholders’ equity and cash flows for the years

then ended.

In

the opinion of the management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of

the financial position as of June 30, 2024, the results of operations and cash flows for the six months ended June 30, 2024 and 2023

have been made. However, the results of operations included in such financial statements may not necessarily be indicative of annual

results.

Deconsolidation

of Sichuan Wetouch

On

March 30, 2023, upon transferring Sichuan Wetouch to a third-party individual for a nominal value, the Company was no longer able to

operate and exert control over Sichuan Wetouch whose operation has been taken over by Sichuan Vtouch since the first quarter of 2021.

As a result, Sichuan Wetouch was deconsolidated accordingly since the disposal date.

The

deconsolidated Sichuan Wetouch had assets, liabilities and the non-controlling interest on disposal date as the following:

| | |

March 30,

2023 | |

| Total assets as of deconsolidated date | |

$ | - | |

| Total liabilities as of deconsolidated date | |

| - | |

| Total gain or loss from deconsolidation | |

$ | - | |

Upon

the deconsolidation, the Company was no longer entitled to the assets and also legally released from the liabilities previously held

by the deconsolidated Sichuan Wetouch, derived nil gain or loss from the deconsolidation in the condensed consolidated statements of

operations and comprehensive income for the three months ended March 31, 2023. The disposal of Sichuan Wetouch did not represent a strategic

shift and did not have a major effect on the Company’s operation. There was no cash outflow for the disposal for the three months

ended March 31, 2023.

(b)

Uses of Estimates

In

preparing the consolidated financial statements in conformity with US GAAP, management makes estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. These estimates are based on information

as of the date of the consolidated financial statements. Significant estimates required to be made by management include, but are

not limited to, the allowance for estimated uncollectible receivables, fair values of financial instruments, inventory valuations,

useful lives of property, plant and equipment, the recoverability of long-lived assets, provision necessary for contingent

liabilities, and revenue recognition. Actual results could differ from those

estimates.

(c)

Significant Accounting Policies

For

a detailed discussion about Wetouch’s significant accounting policies, refer to Note 2 — “Summary of Significant Accounting

Policies,” in Wetouch’s consolidated financial statements included in Company’s 2023 audited consolidated financial

statements. Other than the revised accounting policy on property, plant and equipment, net, as below, during the six months ended June

30, 2024, there were no significant changes made to Wetouch significant accounting policies.

Property,

plant and equipment, net

Property,

plant and equipment are stated at cost less accumulated depreciation. Depreciation is calculated on a straight-line basis over the following

estimated useful lives:

| | | Useful life |

| Buildings | | 20 years |

| Machinery and equipment | | 10 years |

| Vehicles | | 10 years |

Expenditures

for maintenance and repairs, which do not materially extend the useful lives of the assets, are charged to expense as incurred.

Expenditures for major renewals and betterments which substantially extend the useful life of assets are capitalized. The cost and

related accumulated depreciation of assets retired or sold are removed from the respective accounts, and any gain or loss is

recognized in the consolidated statements of income and other comprehensive income (loss) as other income or expenses.

Construction

in progress, funded by Company’s working capital, represents manufacturing facilities and office building under construction, is

stated at cost and transferred to property, plant and equipment when it is substantially ready for its intended use. No depreciation

is recorded for construction in progress. The management estimate that construction in progress for our new facilities will be

completed by the end of first quarter of 2025 and will transfer construction in progress to property, plant and equipment to start depreciation.

NOTE

3 — ACCOUNTS RECEIVABLE

Accounts

receivable consisted of the following:

| | |

June 30,

2024 | | |

December 31, 2023 | |

| Accounts receivable | |

$ | 10,826,787 | | |

$ | 7,455,252 | |

The

Company’s accounts receivable primarily includes balance due from customers when the Company’s products are sold and delivered

to customers.

NOTE

4 — PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid

expenses and other current assets consisted of the following:

| | |

June 30,

2024 | | |

December 31,

2023 | |

| Advance to suppliers | |

$ | 327,144 | | |

$ | 334,852 | |

| Issuance cost related to convertible promissory notes | |

| - | | |

| 64,802 | |

| Prepayment for land use right (i) | |

| 540,130 | | |

| 537,998 | |

| Security deposit (ii) | |

| 54,078 | | |

| 53,865 | |

| Prepaid consulting service fees (iii) | |

| 1,962,716 | | |

| - | |

| Prepaid market research fees (iv) | |

| 955,000 | | |

| - | |

| Others receivable (v) | |

| 17,650 | | |

| 72,110 | |

| Prepaid expenses and other current assets | |

$ | 3,856,718 | | |

$ | 1,063,627 | |

NOTE

5 — PROPERTY, PLANT AND EQUIPMENT, NET

| | |

June 30,

2024 | | |

December 31, 2023 | |

| Buildings | |

$ | 11,851 | | |

$ | 12,130 | |

| Machinery and equipment | |

| 7,706 | | |

| 3,944 | |

| Vehicles | |

| 40,291 | | |

| 41,241 | |

| Construction in progress | |

| 12,640,712 | | |

| 12,825,896 | |

| Subtotal | |

| 12,700,560 | | |

| 12,883,211 | |

| Less: accumulated depreciation | |

| (27,574 | ) | |

| (23,348 | ) |

| Property, plant and equipment, net | |

$ | 12,672,986 | | |

$ | 12,859,863 | |

Depreciation

expense was $2,482 and $2,372 for the three months ended June 30, 2024 and 2023, respectively, and $4,798 and $4,805 for the six months

ended June 30, 2024 and 2023, respectively.

Pursuant

to local PRC government guidelines on local environment issues and the national overall plan, Sichuan Wetouch was subject to a government

directed relocation order to relocate by no later than December 31, 2021 with corresponding compensation. On March 18, 2021, pursuant

to the agreement with the local government and an appraisal report issued by a mutual agreed appraiser, Sichuan Wetouch received a compensation

of RMB115.2 million ($15.9 million) (the “Compensation Funds”) for the withdrawal of the right to use of state-owned land

(the “property”) and the demolition of all buildings, facilities, equipment and all other appurtenances on the land.

On March 16, 2021, in order to minimize interruption

of the Company’s business, Sichuan Vtouch entered into a leasing agreement with Sichuan Renshou Shigao Tianfu Investment

Co., Ltd. (later renamed as Meishan Huantian Industrial Co., Ltd.), a limited liability company owned by the local government, to lease

the property, and all buildings, facilities and equipment thereon (the “Demised Properties) of Sichuan Wetouch, commencing from

April 1, 2021 until December 31, 2021 at a monthly rent of RMB300,000 ($41,281). The lease was renewed on December 31, 2021 and August

9, 2024, respectively, with a monthly rent of RMB 400,000 ($55,042), the term of which has been extended to October 31, 2025 for the use

of the Demised Properties.

As

of June 30, 2024, the Company had commitment of RMB5.0 million (equivalent to $0.7 million) for construction in progress.

NOTE

6 — RELATED PARTY TRANSACTIONS

Amounts

due to a related party were as follows:

| | | Relationship | | June 30,

2024 | | | December 31,

2023 | | | Note |

| Chengdu Wetouch Intelligent Optoelectronics Co., Ltd. | | An affiliated of Ms. Jiaying Cai, director of the Company | | $ | 263,956 | | | $ | - | | | Payable to affiliate for expenses paid on behalf of the Company |

| Total | | | | $ | 263,956 | | | $ | - | | | |

Chengdu

Wetouch Intelligent Optoelectronics Co., Ltd., was incorporated on December 30, 2020 in Chengdu, Sichuan Province under the laws of PRC,

with Ms. Jiaying Cai, a director of the Company as its sole shareholder holding 100% of its equity interests.

NOTE

7 — INCOME TAXES

Wetouch

Wetouch

is subject to a tax rate of 21% per year beginning 2018, and files a U.S. federal income tax return.

BVI

Wetouch

Under

the current laws of the British Virgin Islands, BVI Wetouch, a wholly owned subsidiary of Wetouch, is not subject to tax on its income

or capital gains. In addition, no British Virgin Islands withholding tax will be imposed upon the payment of dividends by the Company

to its stockholders.

Hong

Kong

HK

Wetouch is subject to profit taxes in Hong Kong at a progressive rate of 16.5%.

PRC

Sichuan

Vtouch files income tax returns in the PRC. Effective from January 1, 2008, the PRC statutory income tax rate is 25% according to the

Corporate Income Tax (“CIT”) Law which was passed by the National People’s Congress on March 16, 2007.

Sichuan

Vtouch is subject to a 25% income tax rate.

The

effective income tax rates for the six months ended June 30, 2024 and 2023 were 25.4% and 28.4%, respectively.

The

estimated effective income tax rate for the year ending December 31, 2024 would be similar to actual effective tax rate of the six months

ended June 30, 2024.

NOTE

8 — ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued

expenses and other current liabilities consisted of the following:

| | |

June 30,

2024 | | |

December 31, 2023 | |

| Advance from customers (i) | |

$ | 190,489 | | |

$ | 182,277 | |

| Accrued payroll and employee benefits | |

| 82,340 | | |

| 84,280 | |

| Accrued interest expenses | |

| - | | |

| 240,805 | |

| Accrued private placement agent fees (ii) | |

| - | | |

| 1,200,000 | |

| Accrued consulting fees (iii) | |

| - | | |

| 1,370,972 | |

| Accrued litigation charges (iv) | |

| - | | |

| 45,828 | |

| Accrued professional fees | |

| 91,540 | | |

| 330,180 | |

| Accrued director fees | |

| 86,731 | | |

| 106,824 | |

| Other payable | |

| 384,694 | | |

| 469,591 | |

| Other tax payables (v) | |

| - | | |

| 143,035 | |

| Others (vi) | |

| 2,987 | | |

| 288,704 | |

| Accrued expenses and other current liabilities | |

$ | 839,781 | | |

$ | 4,462,496 | |

NOTE

9 — CONVERTIBLE PROMISSORY NOTES PAYABLE

a)

Convertible promissory notes

In

October, November, and December 2021, the Company, issued seven (7) convertible promissory notes (the “Notes”) of an

aggregate principal amount of $2,250,000, due in one year with discounted issuance price at 90.0%. The Notes bore interest

at a rate of 8.0% per annum, payable in one year and matured on October 27, November 5, November 16, November 29, and December 2,2022,

respectively. Net proceeds after debt issuance costs and debt discounts were approximately $1,793,000. Debt issuance costs in the amount

of $162,000 are recorded as deferred charges and included in the other current assets on the consolidated balance sheet. The debt discount

and debt issuance costs are amortized into interest expense using the effective interest method over the terms of the Notes.

The

details of the Notes are as follows:

Unless

the Notes are converted, the principal amounts of the Notes, and accrued interest at the rate of 8% per annum, are payable on the one-year

anniversary of the issuance of the Notes (the “Maturity Date”). If the Company fails to satisfy its loan obligation by the

Maturity Date, the default interest rate will be 16%.

The

Lenders have the right to convert any or all of the principal and accrued interest on the Notes into shares of common stock of the Company

on the earlier of (i) 180 calendar days after the issuance date of the Notes or (ii) the closing of a listing for trading of the common

stock of the Company on a national securities exchange offering resulting in gross proceeds to the Company of $15,000,000 or more (an

“Uplist Offering”). If the Company closes an Uplist Offering on or before the 180th calendar date after

the issuance date of the Notes, the conversion price shall be 70% of the per share offering price in the Uplist Offering; otherwise,

the conversion price is $15.0 per share.

Subject

to customary exceptions, if the Company issues shares or any securities convertible into shares of common stock at an effective price

per share lower than the conversion price of the Notes, the conversion rate of the Notes shall be reduced to such lower price.

Until

the Notes are either paid or converted in their entirety, the Company agreed with the Lenders not to sell any securities convertible

into shares of common stock of the Company (i) at a conversion price that is based on the trading price of the stock or (ii) with a conversion

price that is subject to being reset at a future date or upon an event directly or indirectly related to the business of the Company

or the market for the common stock. The Company also agreed to not issue securities at a future determined price.

The

Lenders have the right to require the Company to repay the Notes if the Company receives cash proceeds, including proceeds from customers

and the issuance of equity (including in the Uplist Offering). If the Company prepays the Notes prior to the Maturity Date, the Company

shall pay a 10% prepayment penalty.

From

December 28, 2022 to April 6, 2023, the lenders of five outstanding Notes and the Company entered into an amendment to the Notes (“Amendment

No. 1 to Promissory Note”) extending the term of the Notes for an additional 6 months.

From

August 29 to September 9, 2023, the lenders of the outstanding Notes and the Company entered into an amendment to the Notes (“Amendment

No. 2 to Promissory Note”) that upon the listing of the Company’s common stock on the Nasdaq Capital Market (the “Uplist”),

the Company shall within three (3) business days after the Uplist, pay to the Holders amounts equal to 105% of the total outstanding

balance of the Convertible Debenture.

During

the year ended December 31, 2023, principal and default charges totaling $1,200,000 were converted into 25,000 shares of common stock

of the Company.

During

the year ended December 31, 2023, principal, accrued and unpaid interest and default charges totaling $1,038,426 were converted into

69,228 shares of common stock of the Company. Two notes were fully converted

On

February 23, 2024, immediately upon the closing of the public offering (the “2024 Public Offering”), the Company made a full

payment of $2,586,960 under the remaining five outstanding promissory notes, including the principal of $1,400,750 and the related accrued

interests and default charges of $1,186,210.

During

the six months ended June 30, 2024 and 2023, amortization of discounts and issuance cost of the notes were $5,715 and $15,151, respectively.

For

the three months ended June 30, 2024 and 2023, the Company recognized interest expenses of the Notes in the amount of nil and $38,108,

respectively.

For

the six months ended June 30, 2024 and 2023, the Company

recognized interest expenses of the Notes in the amount of $1,169,974 and $71,507,

respectively.

b)

Warrants

Accounting

for Warrants

In

connection with the issuance of the Notes, the Company also issued to the lenders seven (7) three-year warrants (the “Note Warrants”)

to purchase an aggregate of 90,000 shares of the Company’s common stock (the “Warrant Shares”).

The

Note Warrants issued to the lenders granted the holders the rights to purchase up to 10,000 shares of common stock of the Company at

an exercise price of $25 per share. However, if the Company closes an Uplist Offering on or before the 180th calendar date

after the issuance date of the Note Warrants, then the exercise price shall be 125% of the offering price of a share in the Uplist Offering.

If the adjusted exercise price as a result of the Uplist Offering is less than $25 per share, then the number of shares for which the

Warrants are exercisable shall be increased such that the total exercise price, after taking into account the decrease in the per share

exercise price, shall be equal to the total exercise price prior to such adjustment.

The

lenders have the right to exercise the Note Warrants on a cashless basis if the highest traded price of a share of common stock of the

Company during the 150 trading days prior to exercise of the Note Warrants exceeds the exercise price, unless there is an effective registration

statement of the Company which covers the resale of the Lenders.

If

the Company issues shares or any securities convertible into shares at an effective price per share lower than the exercise price of

the Note Warrants, the exercise price of the Note Warrants shall be reduced to such lower price, subject to customary exceptions.

The

lenders may not convert the Notes or exercise the Note Warrants if such conversion or exercise will result in each of the lenders, together

with any affiliates, beneficially owning in excess of 4.9% of the Company’s outstanding shares of common stock immediately after

giving effect to such exercise unless such lender notifies the Company at least 61 days prior to such exercise.

During

the year ended December 31, 2022, three lenders exercised the Note Warrants cashlessly for 14,233 shares of common stock.

During

the year ended December 31, 2023, two lenders exercised the Note Warrants cashlessly for 22,338 shares of common stock.

During

the six months ended June 30, 2024, one lender exercised the Note Warrants cashlessly for 2,725 shares of common stock.

The

fair values of these warrants as of June 30, 2024 were calculated using the Black-Scholes option-pricing model with the following assumptions:

| | | | | | | | | June 30,

2024 | |

| | | Volatility

(%) | | | Expected

dividends

yield (%) | | | Weighted

average

expected

life (year) | | | Risk-free interest rate (%) (per annum) | | | Common stock purchase warrants liability as of December 31, 2023 ($) | | | Changes of fair value of common stock purchase warrants liability

(+ (loss)/(- (gain) ($) | | | Common stock purchase warrants liability as of June 30, 2024 ($) | |

| Convertible Note - Talos Victory (Note 9 (a)) | | | 567.0 | % | | | 0.0 | % | | | 0.6 | | | | 5.03 | % | | $ | 43,113 | | | $ | (7,160 | ) | | $ | 35,953 | |

| Convertible Note - First Fire (Note 9 (a)) | | | 567.0 | % | | | 0.0 | % | | | 0.6 | | | | 5.03 | % | | | 98,375 | | | | (12,551 | ) | | | 85,824 | |

| Convertible Note - LGH (Note 9 (a)) | | | 567.0 | % | | | 0.0 | % | | | 0.6 | | | | 5.03 | % | | | 98,517 | | | | (11,331 | ) | | | 87,186 | |

| Convertible Note - Fourth Man (Note 9 (a)) | | | 567.0 | % | | | 0.0 | % | | | 0.7 | | | | 5.03 | % | | | 41,639 | | | | (4,491 | ) | | | 37,148 | |

| Convertible Note - Jeffery Street (Note 9 (a)) | | | 567.0 | % | | | 0.0 | % | | | 0.7 | | | | 5.03 | % | | | 26,264 | | | | (2,726 | ) | | | 23,538 | |

| Convertible Note - Blue Lake (Note 9 (a)) | | | 567.0 | % | | | 0.0 | % | | | 0.7 | | | | 5.03 | % | | | 70,463 | | | | (7,313 | ) | | | 63,150 | |

| Total | | | | | | | | | | | | | | | Total | | | $ | 378,371 | | | $ | (45,572 | ) | | $ | 332,799 | |

(c)

Registration Rights Agreements

Pursuant

to the terms of the Registration Rights Agreements between the Company and lenders of the Notes, the Company agreed to file a registration

statement with the Securities and Exchange Commission to register the shares of common stock underlying the Notes and the shares issuable

upon exercise of the Note Warrants within sixty days from the date of each Registration Rights Agreement. The Company also granted the

lenders piggyback registration rights on such securities pursuant to the Purchase Agreements.

NOTE

10 — STOCKHOLDERS’ EQUITY

1)

Common Stock

The

Company’s authorized shares of common stock was 15,000,000 shares with par value of $0.001.

On

December 22, 2020, the Company issued 5,181 shares of common stock to The Crone Law Group, P.C. or its designees for legal services (see

Note 11).

On

January 1, 2021, the Company issued an aggregate of 15,541 shares to a third party service provider for consulting services that had

been rendered.

On

April 14, April 27 and September 1, 2022, the Company issued 5,777, 5,599 and 2,857 shares of common stock upon cashless exercise of

the Note Warrants to three lenders, respectively. (see Note 9 (b)).

During

the year ended December 31, 2022, the Company issued 6,211 shares of common stock to a third party upon exercise of warrants (see Note

11).

During

the year ended December 31, 2022, the Company issued 69,228 shares of common upon conversion of convertible promissory note payable (see

note 9 (a)).

On

January 19, 2023, the Company sold an aggregate of 8,000,000 shares of common stock to purchasers in a private placement for an aggregate

purchase price of $40,000,000, or $5.00 per share. On January 20, 2023, the Company received net proceeds of $40 million accordingly.

During

the year ended December 31, 2023, the Company issued 25,000 shares of common stock upon conversion of convertible promissory note payable

(see note 9 (a)).

During

the year ended December 31, 2023, the Company issued 22,338 shares of common stock to two third parties upon exercise of warrants (see

Note 9(b)).

On

February 20, 2024, the Company issued 2,160,000 shares of common stock at a public offering price of $5.00 per share. The Company’s

common stock began trading on the Nasdaq Capital Market under the ticker symbol “WETH” on February 21, 2024.

As

of June 30, 2024, there were 11,931,534 shares of common stock issued and outstanding.

2)

Reverse Stock Split

On

February 17, 2023, the Company’s board of directors authorized a reverse stock split of common stock with a ratio of not less than

one to five (1:5) and not more than one to eighty (1:80), with the exact amount and the timing of the reverse stock split to be determined

by the Chairman of the Board. Upon effectiveness of such reverse stock split, the number of authorized shares of the common stock of

the Company will also be decreased in the same ratio. Pursuant to Section 78.209 of the Nevada Revised Statutes, the reverse stock split

does not have to be approved by the stockholders of the Company.

On

July 16, 2023, the Company’s board of directors approved the reverse stock split of the Company’s common stock at a ratio

of 1-for-20. On July 16, 2023, the Company filed a certificate of change (with an effective date of July 16, 2023) with the Nevada Secretary

of State pursuant to Section 78.209 of the Nevada Revised Statutes to effectuate a 1-for-20 reverse stock split of its common stock.

On September 11, 2023, the reverse stock split was approved by the Financial Industry Regulatory Authority and took effect on September

12, 2023. All share information included in this report has been adjusted as if the reverse stock split occurred as of the earliest period

presented.

3)

Closing of the 2024 Public Offering

On

February 23, 2024, the Company closed its offering of 2,160,000 shares of common stock at a public offering price of $5.00 per share,

for aggregate gross proceeds of $10.8 million before deducting underwriting discounts, and other offering expenses.

The

Company complies with the requirements of FASB ASC Topic 340-10-S99-1, “Other Assets and Deferred Costs – SEC Materials”

(“ASC 340-10-S99”) and SEC Staff Accounting Bulletin Topic 5A, “Expenses of Offering”, and charged issuance costs

of $1,810,246 to additional paid-in capital during the six months ended June 30, 2024.

NOTE

11 — SHARE BASED COMPENSATION

The

Company applied ASC 718 and related interpretations in accounting for measuring the cost of share-based compensation over the period

during which the consultants are required to provide services in exchange for the issued shares. The fair value of above award was estimated

at the grant date using the Black-Scholes model for pricing the share compensation expenses.

On

December 22, 2020, the board of directors of the Company authorized the issuance of an aggregate of 5,181 shares and warrants to purchase

an aggregate of 10,518 shares of common stock to The Crone Law Group, P.C. or its designees for legal services that had been rendered.

The five-year warrants are exercisable at one cent per share.

5,181

shares of common stock underlying such warrants were vested on December 22, 2020 and 6,211 shares were issued upon exercise of these

warrants on September 21, 2022 and warrant to purchase 4,307 shares remained outstanding for The Crone law Group, P.C. or its designees

for legal services. The fair value of above award was estimated at the grant date using Black-Scholes model for pricing the share compensation

expenses. The fair value of the Black-Scholes model includes the following assumptions: expected life of 2.5 years, expected dividend

rate of 0%, volatility of 43.5% and an average interest rate of 0.11%.

On

January 1, 2021, the board of directors of the Company authorized the issuance of an aggregate of 15,541 shares and warrants to purchase

31,554 shares of common stock to a third party service provider for consulting services that had been rendered. These warrants have a

five-year term and are exercisable at one cent per share.

The

15,541 shares of common stock and warrants to purchase 31,554 shares of commons stock vested on January 1, 2021.

The

fair value of the above warrants was estimated at the grant date using Black-Scholes model for pricing the share compensation expenses.

The fair value of the Black-Scholes model includes the following assumptions: expected life of 2.5 years, expected dividend rate of 0%,

volatility of 51.3% and an average interest rate of 0.12%.

During

the six months ended June 30, 2024, warrants for 35,861 shares of common stock related to above mentioned services were exercised. There

were no warrants related to services remaining as of June 30, 2024.

As

of June 30, 2024 and 2023, the Company recognized relevant share-based compensation expense of nil and nil for the vested shares, and

nil and nil for the warrants, respectively.

NOTE

12 — RISKS AND UNCERTAINTIES

Credit

Risk – The carrying amount of accounts receivable included in the balance sheet represents the Company’s exposure

to credit risk in relation to its financial assets. No other financial asset carries a significant exposure to credit risk. The Company

performs ongoing credit evaluations of each customer’s financial condition. The Company maintains allowances for doubtful accounts

and such allowances in the aggregate have not exceeded management’s estimates.

The

Company has its cash in bank deposits primarily at state owned banks located in the PRC. Historically, deposits in PRC banks have been

secured due to the state policy of protecting depositors’ interests. The PRC promulgated a Bankruptcy Law in August 2006, effective

June 1, 2007, which contains provisions for the implementation of measures for the bankruptcy of PRC banks. The bank deposits with financial

institutions in the PRC are insured by the government authority for up to RMB500,000.

Interest

Rate Risk – The Company is exposed to the risk arising from changing interest rates, which may affect the ability of repayment

of existing debts and viability of securing future debt instruments within the PRC.

Currency

Risk - A majority of the Company’s revenue and expense transactions are denominated in RMB and a significant portion of

the Company’s assets and liabilities are denominated in RMB. RMB is not freely convertible into foreign currencies. In the PRC,

certain foreign exchange transactions are required by law to be transacted only by authorized financial institutions at exchange rates

set by the People’s Bank of China (“PBOC”). Remittances in currencies other than RMB by the Company in China must be

processed through the PBOC or other China foreign exchange regulatory bodies which require certain supporting documentation in order

to affect the remittance.

Concentrations

- The Company sells its products primarily to customers in the PRC and to some extent, the overseas customers in European countries

and East Asia, such as South Korea and Taiwan. For the three months ended June 30, 2024, five customers accounted for approximately 21.2%,

19.5%, 16.0%, 14.5% and 12.1%, respectively, of the Company’s total revenue. For the three months ended June 30, 2023, six customers

accounted for approximately 23.2%, 17.6%, 14.8%, 13.6%, 10.2% and 10.2%, respectively, of the Company’s revenue.

For

the six months ended June 30, 2024, five customers accounted for 21.9%, 20.0%, 15.2%, 13.9% and 11.6%, respectively, of the Company’s

total revenue. For the six months ended June 30, 2023, six customers accounted for 22.7%, 16.3%, 15.2%, 13.9%, 11.2% and 10.3%, respectively,

of the Company’s revenue.

The

Company’s top ten customers aggregately accounted for 100.0% and 99.9% of the total revenue for the three months ended June 30,

2024 and 2023, and approximately 99.3% and 99.6% for the six months ended June 30, 2024 and 2023.

As

of June 30, 2024, six customers accounted for approximately 30.1%, 18.4%, 11.1%, 11.0%, 10.7% and 10.6% of the total accounts receivable

balance, respectively.

The

Company purchases its raw materials through various suppliers. Raw material purchases from these suppliers which individually exceeded

10% of the Company’s total raw material purchases, accounted for an aggregate of approximately 27.1% (two suppliers) and 28.4%

(two suppliers) for the three months ended June 30, 2024 and 2023, respectively, and approximately 33.8% (three suppliers) and 25.3%

(two suppliers) for the six months ended June 30, 2024 and 2023, respectively.

NOTE

13 — COMMITMENTS AND CONTINGENCIES

Contingencies

The

Company’s common stock began trading on the Nasdaq Capital Market under the ticker symbol “WETH” on February 21, 2024.

The Company failed to timely complete the filing procedures with China Securities Regulatory Commission (“CSRC”) on overseas

offering and transfer of listing pursuant to the regulations below:

| 1) | Pursuant

to Article 13 and Article 8 and Article 25 of CSRC Announcement (2023) No. 43 -Trial Measures for the Administration of Overseas Issuance

and Listing of Securities for Domestic Enterprises” (the “Trial Measures”), which was effective on March 31, 2023 (

http://www.csrc.gov.cn/csrc/c101954/c7124478/content.shtml), when an issuer conducts an overseas offering or listing, it shall submit

overseas issuance and listing application documents to CSRC within three working days of submitting its application documents for transfer

and listing overseas; when a domestic enterprise transfers its listing overseas, it shall comply with the requirements of the overseas

first public listing requirements for issuance and listing, and shall file with the CSRC within 3 working days, after its submitting

application documents for transfer and listing overseas. |

| 2) | Article

27 of Trial Measures stipulates that if a domestic enterprise violates the provisions of Article 13 of these Measures and fails to perform

the filing procedures, or violates the provisions of Articles 8 and 25 of these Measures for overseas issuance and listing, CSRC shall

order it to make corrections and give a warning, and impose a fine of not less than RMB 1 million but not more than RMB 10 million. |

As

of the date of this Quarterly Report, the Company has not received any notice of penalty from the CSRC. Management will closely monitor

any notice or action from the CSRC.

Legal

Proceedings

From time to time, the Company and its subsidiaries

are parties to various legal actions arising in the ordinary course of business. Although Hong Kong Wetouch, Sichuan Wetouch, the deconsolidated

subsidiary of the Company (see Note 2-(a) - Deconsolidation of Sichuan Wetouch), Sichuan Vtouch and Mr. Guangde Cai, the

former Chairman and director of the Company, were named as defendants in several litigation matters, as of the date of this Quarterly

Report, some of which have been settled and Sichuan Wetouch, Hong Kong Wetouch and Mr. Guangde Cai were unconditionally and fully discharged

and released therefrom. Below is a summary of the above-mentioned litigation.

| i) | An equity dispute case with Yunqing Su with a disputed amount of RMB1,318,604 (equivalent to $185,721) |

On

June 22, 2017, Yunqing Su, a former shareholder of Sichuan Wetouch, entered an Equity Investment Agreement with Sichuan Wetouch and Guangde

Cai, agreed that Yunqing Su would invest RMB1 million (equivalent to $140,847) to purchase 370,370.37 original proposed listed shares

of the proposed listed company on Australian capital market, Sichuan Wetouch, and provided for the exit mechanism in the agreement.

However, the target company failed to be listed on Australian capital market prior to December 31, 2017 as agreed. On June 22, 2017,

Guangde Cai and Yunqing Su entered into a supplementary agreement, pursuant to which Guangde Cai shall repurchase all of Yunqing Su’s

equity interest and pay the interest. Sichuan Wetouch repaid Yunqing Su the interest of RMB220,000 (equivalent to $30,986) and the principal

of RMB128,000 (equivalent to $18,028) in November 2018. However, upon the expiration of the supplementary agreement, Sichuan Wetouch

and Guangde Cai failed to repay the remaining principal balance plus interest owed to Yunqing Su. Yunqing Su subsequently sued Sichuan

Wetouch and Guangde Cai in the Renshou County People’s Court of Sichuan Province, and the case was filed on February 9, 2022.

On

May 9, 2022, pursuant to a civil mediation statement issued by the Renshou County People’s Court of Sichuan Province, Sichuan Wetouch

and Guangde Cai agreed to repay Yunqing Su the remaining principal balance plus interest in the total amount of RMB 1,318,604 (equivalent

to $185,721). Sichuan Wetouch fully repaid the aforesaid amount on March 15, 2023.

| ii) | Legal case with Chengdu SME Credit Guarantee Co., Ltd. on a court acceptance fee of RMB338,418 (equivalent to $47,665) |

On

July 5, 2013, Sichuan Wetouch obtained a one-year loan of RMB60.0 million (equivalent to $8.5 million) from Bank of Chengdu, at an annual

interest rate of 8.61%. Chengdu SME Credit Guarantee Co., Ltd (“Chengdu SME”), a third party, provided a 70% guarantee and

Bank of Chengdu retained 30% of the risk. Chengdu Wetouch, a related party company with 98% equity interests owned by Mr. Guangde Cai,

the founder of the Company, and Mr. Guangde Cai provided joint and several liability guarantee for 100% of the loan.

On

July 31, 2014, Sichuan Wetouch repaid RMB5.0 million (equivalent to $0.7 million). The remaining loan of RMB55.0 million (equivalent

to $7.7 million) was extended twice due on August 22, 2018. Upon the loan becoming due, but unpaid by the Company, Chengdu SME repaid

the outstanding balance of RMB55 million (equivalent to $7.7 million) to Bank of Chengdu. The Company subsequently repaid RMB55 million

(equivalent to $7.7 million) to Chengdu SME; however, Chengdu SME filed two separate lawsuits against the Company to recover loan default

penalties from the Company. The loan default penalties were (a) RMB5.8 million (equivalent to $0.8 million) related to the 30% of the

remaining loan balance repaid by Chengdu SME and (b) RMB6.0 million (equivalent to $0.8 million) related to the 70% of the remaining

loan balance repaid by Chengdu SME. During the year ended December 31, 2017, the Company recorded loan default penalties, and related

liabilities, of $1.7 million.

Chengdu

SME applied to the Chengdu High-tech Court for enforcement of the above-mentioned loan default penalties of RMB5.8 million (equivalent

to $0.8 million) and RMB6.0 million (equivalent to $0.8 million) on December 30, 2018. On March 12, 2020, the Enforcement Settlement

Agreement issued by the Chengdu High-tech Court confirmed that Sichuan Wetouch still owed RMB5.8 million (equivalent to $0.8 million)

and RMB6.0 million (equivalent to $0.8 million), respectively, of the loan default penalties. The agreement did not specify which party

shall pay the court fee.

On

September 16, 2020, Sichuan Wetouch made a full repayment of RMB11.8 million (equivalent to $1.7 million) of the above loan default penalties

to Chengdu SME.

On

March 16, 2023, pursuant to an Enforcement Settlement Agreement entered among Chengdu SME, Sichuan Wetouch and Chengdu Wetouch, Chengdu

Wetouch agreed to pay the court acceptance fee of RMB338,418 (equivalent to $47,665). On March 17, 2023, Chengdu Wetouch made a full

payment of the above court fee to Chengdu SME.

| iii) | Legal case with Lifan Financial Leasing (Shanghai) Co., Ltd. and Sichuan Wetouch, Chengdu Wetouch, Meishan Wetouch and Xinjiang Wetouch Electronic Technology Co., Ltd. on a court acceptance fee of RMB250,470 (equivalent to $35,278) |

On

November 20, 2014, Lifan Financial Lease (Shanghai) Co., Ltd. (“Lifan Financial”) and Chengdu Wetouch entered into a Financial

Lease Contract (Sale and Leaseback), which stipulated that Lifan Financial shall lease the equipment to Chengdu Wetouch after the purchase

of the production equipment owned by Chengdu Wetouch at a purchase price lease principal of RMB20 million, with the rental interest rate

of the leased equipment at 8% per year, for a lease term of 24 months. Upon the expiration of the lease term, Lifan Financial shall transfer

the leased property to Chengdu Wetouch or a third party designated by Chengdu Wetouch at the price of RMB0 after Chengdu Wetouch has

fully fulfilled its obligations, including, without limitation, the payment of the rent, liquidated damages (if any) and other contractual

obligations. Guangde Cai, Sichuan Wetouch, Meishan Wetouch, an affiliated company of Mr. Guangde Cai and Xinjiang Wetouch Electronic

Technology Co., Ltd. (“Xinjiang Wetouch”) provided Lifan Financial with joint and several liability guarantee.

On

August 9, 2021, Lifan Financial filed a lawsuit against Chengdu Wetouch, Guangde Cai, Sichuan Wetouch, Meishan Wetouch and Xinjiang Wetouch

in the Chengdu Intermediate People’s Court. The court ruled that: 1) the Financial Lease Contract (Sale and Leaseback) was terminated;

2) the leased property was owned by Lifan Financial; 3) Chengdu Wetouch shall pay Lifan Financial all outstanding rent and interest thereon

in the total amount of RMB 22,905,807 (equivalent to $3.2 million) as well as the difference between the liquidated damages and the value

of the leased property recovered; etc.

The

parties executed a settlement agreement on March 7, 2023, in which the parties confirmed that the outstanding payment of RMB 22,905,807

(equivalent to $3.2 million) has been fully paid on December 23, 2021 and the above cases have been settled. As for the court acceptance

fees that were not previously agreed upon by the parties, Chengdu Wetouch agreed to pay the court acceptance fee of RMB 250,470 (equivalent

to $35,278). Chengdu Wetouch paid the aforesaid fees to Lifan Financial on March 10, 2023.

| iv) | Legal case with Sichuan Renshou Shigao Tianfu Investment Co., Ltd and Renshou Tengyi Landscaping Co., Ltd. on a court acceptance fee of RMB103,232 (equivalent to $14,540) |

On

March 19, 2014, Chengdu Wetouch, a related party, obtained a two- and half-year loan of RMB15.0 million (equivalent to $2.1 million)

from Chengdu Bank Co., Ltd. Gaoxin Branch (“Chengdu Bank Gaoxin Branch”) , with Chengdu Hi-tech Investment Group Co., Ltd.

(“CDHT Investment”) acting as guarantor to pay off the loan principal and related interests, while Sichuan Wetouch and Hong

Kong Wetouch as guarantors, were jointly and severally liable for such debts.

Upon

the loan due in January 2017, Chengdu Wetouch defaulted the loan, thus, CDHT Investment filed a lawsuit against Chengdu Wetouch, Sichuan

Wetouch, and Hong Kong Wetouch demanding a full repayment of such debts.

To

support the local economic development as well as Chengdu Wetouch, two government-backed companies, Sichuan Renshou Shigao Tianfu Investment

Co., Ltd. (“Sichuan Renshou”) and Renshou Tengyi Landscaping Co., Ltd. (“Renshou Tengyi”) provided their bank

deposits of RMB 12.0 million (equivalent to $1.7 million) as pledge, while Mr. Guangde Cai and Sichuan Wetouch also provided counter-guarantee.

Upon

the expiration of the guarantee, Chengdu Wetouch still defaulted on repayment of the above pledge. As a result, CDHT Investment levied

this collateral of RMB12.0 million. On November 21, 2019, subsequently, Sichuan Renshou and Renshou Tengyi filed with Chengdu Intermediate

People’s Court a lawsuit demanding an asset recovery of RMB12.0 million (equivalent to $1.7 million) pursuant to the counter guarantee

agreement.

On

December 2, 2019, pursuant to the reconciling agreement issued by Chengdu Intermediate People’s Court, the parties agreed to cancel

the demand to seize property of Sichuan Wetouch rather than the property of Chengdu Wetouch, and to waive freezing Guangde Cai’s

60% shareholding equity in Xinjiang Wetouch Electronic Technology Co., Ltd.

On

October 9, 2020, pursuant to a settlement and release agreement, Sichuan Wetouch, Hong Kong Wetouch and Guangde Cai are fully discharged

and released from any and all obligations under the outstanding debts, and from all liabilities under guarantee with Chengdu Wetouch

being responsible for the outstanding debts by December 31, 2020.

On

October 27, 2020, Chengdu Wetouch made a full payment of the above debts.

The

settlement and release agreement did not specify which party shall pay the court acceptance fee. On March 10, 2023, pursuant to an enforcement

settlement agreement entered among Sichuan Renshou, Renshou Tengyi, Sichuan Wetouch, Chengdu Wetouch, and other relevant parties, Sichuan

Wetouch agreed to pay the court acceptance fee of RMB103,232 (equivalent to $14,540). On March 17, 2023, Chengdu Wetouch made a full

payment of the above court fee to Sichuan Renshou.

| v) | Legal case with Chengdu High Investment Financing Guarantee Co. on a court acceptance fee of RMB250,000 (equivalent to $35,211) |

On

March 22, 2019, Chengdu High Investment Financing Guarantee Co., Ltd, (“Chengdu High Investment”) filed a lawsuit against

Hong Kong Wetouch in the Chengdu Intermediate People’s Court, claiming that Hong Kong Wetouch should assume the guarantee liability

for the debt payable by Chengdu Wetouch. On May 21, 2020, the court rendered a judgment ordering Hong Kong Wetouch to pay compensation

of RMB17,467,042 (equivalent to $2,460,181), interest, liquidated damages, liquidated damages for late performance, etc.

On

March 16, 2023, Chengdu Wetouch, Sichuan Wetouch and Chengdu High Investment entered into a settlement enforcement agreement, confirming

that Chengdu High Investment had received RMB17,547,197 (equivalent to $2,471,471) on October 27, 2020 paid by Chengdu Wetouch,

and the above case has been settled. As for the court acceptance fees that were not previously agreed upon by the parties, Chengdu Wetouch

agreed to pay the court acceptance fee of RMB 250,000 (equivalent to $35,211). Chengdu Wetouch paid the aforesaid fees to Chengdu High

Investment on March 20, 2023.

| vi) | Legal case with Hubei Lai’en Optoelectronics Technology Co., Ltd. on a product payment of RMB157,714 (equivalent to $22,213) |

Sichuan

Wetouch purchased products from Hubei Lai’en Optoelectronics Technology Co., Ltd. (“Hubei Lai’en) multiple times from

March to June 2019, but failed to pay the corresponding amount of RMB137,142.7 for the purchased products. On April 6, 2022, Hubei Lai’en

filed a lawsuit against Sichuan Wetouch in the Renshou County People’s Court of Sichuan Province, requesting payment of overdue

payment for the products and liquidated damages. On May 31, 2022, the Renshou County People’s Court rendered a judgment that Sichuan

Wetouch shall pay Hubei Lai’en the price of goods of RMB137,143 and liquidated damages of RMB 20,571. Sichuan Wetouch paid the

above amount to Hubei Lai’en on March 15, 2023.

| vi) | Legal case with Chengdu Hongxin Shunda Trading Co., Ltd. on settlement of accounts payable and related fund interests totalling RMB3,021,294 ($425,540) |

In March 2022, Sichuan Vtouch purchase steel products

from Chengdu Hongxin Shunda Trading Co., Ltd. (“Chengdu Hongxin”) for facility construction, but failed to settle the accounts

payable on time. In July 2023, Chengdu Hongxin filed a lawsuit to a local district court against the Company and its new facility constructors

(“the three defendants”) requesting the settlement of the remaining accounts payable and the corresponding fund interests,

penalties and legal fees, totalling of RMB3,021,294 ($425,540). The court judged Sichuan Vtouch to pay and ordered the freezing of bank

accounts of these three defendants. On September 25, 2023, the Company appealed to Chengdu Municipal Intermediate People’s Court,

arguing the calculation of fund interests and penalties ordered by the lower court unfair and not in line with the law regulations. On

March 26, 2024, the appellate court upheld the original judgment. In April 2024, Chengdu Hongxin sought enforcement of the judgment in