Wintrust Financial Corporation (“Wintrust”) (Nasdaq: WTFC) and

Macatawa Bank Corporation (“Macatawa”) today jointly announced the

completion of their previously announced merger whereby Wintrust

acquired Macatawa in an all-stock transaction. Macatawa was the

parent company of Macatawa Bank, which is headquartered in Holland,

Michigan and operates a network of 26 full-service branches located

throughout communities in Kent, Ottawa and northern Allegan

counties, including Grand Rapids.

Founded in 1997, Macatawa Bank has an exemplary

history of serving its communities. As of June 30, 2024, it had

approximately $2.7 billion in assets, $2.3 billion in deposits and

$1.3 billion in loans. Macatawa Bank’s approach to customer service

is similar to that at each of the fifteen other Wintrust Community

Banks and their more than 170 banking locations. Like Wintrust,

Macatawa Bank prides itself on delivering outstanding service to

both consumer and commercial clients.

Timothy S. Crane, President and CEO of Wintrust,

said, “Macatawa Bank provides an ideal platform to expand into West

Michigan with a very solid bank. The bank has a strong core deposit

base, exceptional asset quality, a client focused culture, and a

committed leadership team. Together, we will be a formidable,

community-minded competitor to the other banks in the area. We look

forward to providing Macatawa Bank’s customers with an expanded

array of products and services and are thrilled to welcome Macatawa

Bank clients and team members to the Wintrust

family.”

Richard L. Postma, who served as Chairman of the

Board of Macatawa prior to the merger, said, “Wintrust provides

Macatawa Bank with the ability to retain and enhance its uniquely

personalized consumer and commercial community presence in the West

Michigan area by retaining the Macatawa Bank name, its key

employees, branches, and a legally constituted community bank

board, as a separately chartered bank and the only Wintrust

subsidiary bank located within the State of Michigan. We are

confident that this transaction, which combines similar cultures

and operating philosophies, will result in a continued community

bank that offers all the enhanced services, products and technology

of Wintrust to meet the evolving banking needs of our

customers.”

As provided for in the merger agreement, Richard

L. Postma has been appointed to the Board of Directors of

Wintrust.

Terms of the Transaction

The aggregate purchase price to Macatawa

shareholders is approximately $510.3 million, or $14.85 per share.

In the transaction, each of Macatawa’s 34,361,562 common shares

outstanding at the time of the merger were converted into the right

to receive merger consideration paid in shares of Wintrust common

stock. Accordingly, each common share of Macatawa outstanding at

the time of merger was converted into the right to receive 0.137

shares of Wintrust common stock, with cash paid in lieu of

fractional shares. The transaction is not expected to have a

material effect on Wintrust’s 2024 earnings per share.

Advisors

Morgan Stanley & Co. LLC acted as financial

advisor and Warner Norcross + Judd LLP acted as legal advisor to

Macatawa in the transaction. ArentFox Schiff LLP served as legal

advisor to Wintrust.

About Wintrust

Wintrust is a financial holding company, now

with assets of approximately $62 billion, whose common stock is

traded on the NASDAQ Global Select Market. Built on the "HAVE IT

ALL" model, Wintrust offers sophisticated technology and resources

of a large bank while focusing on providing service-based community

banking to each and every customer. As a result of the acquisition

of Macatawa, Wintrust now operates sixteen community bank

subsidiaries, with over 200 banking locations located in the

greater Chicago, southern Wisconsin, west Michigan and southwest

Florida market areas. Additionally, Wintrust operates various

non-bank business units including business units which provide

commercial and life insurance premium financing in the United

States, a premium finance company operating in Canada, a company

providing short-term accounts receivable financing and value-added

out-sourced administrative services to the temporary staffing

services industry, a business unit engaging primarily in the

origination and purchase of residential mortgages for sale into the

secondary market throughout the United States, and companies

providing wealth management services and qualified intermediary

services for tax-deferred exchanges.

About Macatawa Bank

Headquartered in Holland, Michigan, Macatawa

Bank offers a full range of banking, retail and commercial lending,

wealth management and ecommerce services to individuals, businesses

and governmental entities from a network of 26 full-service

branches located throughout communities in Kent, Ottawa and

northern Allegan counties. The bank is recognized for its local

management team and decision making, along with providing customers

excellent service, a rewarding experience and superior financial

products. Macatawa Bank has been recognized for thirteen years as

one of “West Michigan’s 101 Best and Brightest Companies to Work

For”.

Forward-Looking Statements

This communication contains forward-looking

statements within the meaning of the federal securities laws

relating to the acquisition of Macatawa by Wintrust and integration

of Macatawa with Wintrust, the combination of their businesses and

projected revenue, as well as profitability and earnings outlook.

All statements other than statements of historical fact are

statements that could be deemed forward-looking statements,

including all statements regarding the intent, belief or current

expectations. Investors and security holders are cautioned that

such statements are predictions, are not guarantees of future

performance and actual events or results may differ materially.

Completion of the integration activities, expected financial

results or other plans are subject to a number of risks and

uncertainties.

Additional risks and uncertainties may include,

but are not limited to, the risk that expected cost savings,

revenue synergies and other financial benefits from the merger may

not be realized or take longer than expected to realize.

For further information regarding additional

factors that could cause results to differ materially from those

contained in the forward-looking statements, see “Risk Factors” and

the forward-looking statement disclosure contained in the Annual

Report on Form 10-K for the most recently ended fiscal year of

Wintrust, and subsequent Quarterly Report on Form 10-Q as well as

other documents subsequently filed by Wintrust with the Securities

and Exchange Commission. Forward-looking statements included in

this press release speak only as of the date made and Wintrust

assumes no obligation and disclaims any intent to update or revise

any forward-looking statement, whether because of new information,

future events or otherwise, except as required by

law.

FOR MORE INFORMATION CONTACT:Timothy S. Crane,

President and CEO – Wintrust Financial Corporation, (847)

939-9000David A. Dykstra, Vice Chair and COO – Wintrust Financial

Corporation, (847) 939-9000Richard L. Postma, Chairman – Macatawa

Bank Corporation, (616) 392-1517

Wintrust Website address: www.wintrust.comMacatawa Website

address: www.macatawabank.com

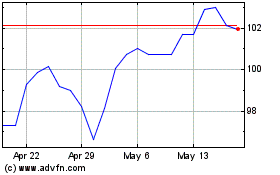

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Oct 2024 to Nov 2024

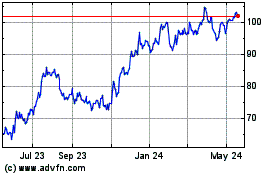

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Nov 2023 to Nov 2024