UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 14, 2023

WORLDWIDE WEBB ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

001-40920 |

|

98-1587626 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

|

|

| 770 E Technology Way F13-16

Orem, UT |

|

84997 |

| (Address of principal executive offices) |

|

(Zip Code) |

(415) 629-9066

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

WWACU |

|

Nasdaq Global Market |

| Class A ordinary shares, par value $0.0001 per share |

|

WWAC |

|

Nasdaq Global Market |

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

WWACW |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth

company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

Worldwide Webb Acquisition Corp., a Cayman Islands exempted company (the “Company” or “WWAC”), previously announced that it

entered into a Business Combination Agreement, dated as of March 11, 2023, among WWAC, WWAC Amalgamation Sub Pte. Ltd., a Singapore private company and wholly-owned Subsidiary of WWAC (“Amalgamation Sub”), and Aark Singapore Pte.

Ltd., a Singapore private company (“AARK”), pursuant to which, among other things, and subject to the terms and conditions set forth therein, Amalgamation Sub and AARK will amalgamate and continue as one company, with AARK being the

surviving entity and becoming a subsidiary of WWAC and as a result thereof, Aeries Technology Business Accelerators Pte. Ltd. (“Aeries”) becoming a subsidiary of WWAC (the “Business Combination”).

Attached as Exhibit 99.1 and incorporated herein by reference is the management presentation dated July 14, 2023, for use by the Company

and Aeries in meetings with certain of their shareholders as well as other persons with respect to the Business Combination, as described in this Current Report on Form 8-K.

The foregoing (including Exhibit 99.1) is being furnished pursuant to Item 7.01 of

Form 8-K and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the

liabilities of that section, nor will the foregoing be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

2

Where You Can Find Additional Information

This Current Report on Form 8-K relates to a proposed business combination transaction among WWAC and Aeries

Technology. In connection with the proposed transaction, WWAC filed with the SEC the proxy statement to solicit shareholder approval of the proposed business combination. The definitive proxy statement (if and when available) will be delivered to

WWAC’s shareholders. WWAC may also file other relevant documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF WWAC ARE URGED TO READ THE PROXY STATEMENT AND

ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION.

Investors and security holders may obtain free copies of the proxy statement (when available) and other documents that are

filed or will be filed with the SEC by WWAC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by WWAC will be available free of charge at Worldwide Webb Acquisition Corp., 770 E Technology Way F13-16, Orem, UT 84097, attention: Chief Executive Officer.

Participants in the Solicitation

WWAC and its directors and executive officers are participants in the solicitation of proxies from the shareholders of WWAC in respect of the proposed

transaction. Information about WWAC’s directors and executive officers and their ownership of WWAC’s Class A ordinary shares is set forth in WWAC’s Annual Report on Form 10-K for

the year ended December 31, 2022 filed with the SEC on March 31, 2023, and in WWAC’s other periodic and current reports filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of

their direct and indirect interests, by security holdings or otherwise, is contained in the proxy statement, and WWAC may also file other relevant materials with the SEC in respect of the proposed transaction when they become available. You may

obtain free copies of these documents as described in the preceding paragraph.

Aeries Technology, Aeries and their respective directors and executive

officers may also be deemed to be participants in the solicitation of proxies from the shareholders of WWAC in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding

their interests in the proposed business combination is included in the proxy statement.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains certain statements that are not historical facts but are

forward-looking statements within the meaning of Section 21E of the U.S. Securities Exchange Act of 1934, as amended, and Section 27A of the U.S. Securities Act of 1933, as amended, for purposes of the safe harbor provisions under the

United States Private Securities Litigation Reform Act of 1995. These forward-looking statements include but are not limited to statements regarding the anticipated benefits of the proposed transaction, the combined company becoming a publicly

listed company, the anticipated impact of the proposed transaction on the combined companies’ business and future financial and operating results, and the anticipated timing of closing of the proposed transaction. Words such as “may,”

“should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases that denote future expectations or intent regarding the combined company’s

financial results, operations, and other matters are intended to identify forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The outcome of the events described in these forward-looking

statements is subject to known and unknown risks, uncertainties, and other factors that may cause future events to differ materially from the forward-looking statements in this report, including but not limited to: (i) the ability to complete

the proposed transaction within the time frame anticipated or at all; (ii) the failure to realize the anticipated benefits of the proposed transaction or those benefits taking longer than anticipated to be realized; (iii) the risk that the

transaction may not be completed in a timely manner or at all, which may adversely affect the price of WWAC’s securities; (iv) the risk that the transaction may not be completed by WWAC’s business combination deadline; (v) the

failure to satisfy the conditions to the consummation of the transaction, including the approval of the Business Combination Agreement by the shareholders of WWAC, the satisfaction of the minimum cash on hand condition following redemptions by the

public shareholders of WWAC and the receipt of any governmental and regulatory approvals; (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the Business Combination Agreement;

(vii) unexpected costs or unexpected liabilities that may result from the proposed transactions, whether or not consummated; (viii) the impact of COVID-19 on Aeries’ business and/or

the ability of the parties to complete the proposed transaction; (ix) the effect of disruption from the announcement or pendency of the transaction on Aeries’ business relationships, performance, and business generally; (x) risks that

the proposed transaction disrupts current plans and operations of Aeries and potential difficulties in Aeries employee retention as a result of the proposed transaction; (xi) the outcome of any legal proceedings that may be instituted against

Aeries or WWAC related to the Business Combination Agreement or the proposed transaction; (xii) the ability to maintain the listing of WWAC’s securities on the Nasdaq Global Market; (xiii) potential volatility in the price of

WWAC’s securities due to a variety of factors, including economic conditions and the effects of these conditions on Aeries’ clients’ businesses and levels of activity, risks related to an economic downturn or recession in India, the

United States and other countries around the world, fluctuations in earnings, fluctuations in foreign exchange rates, Aeries’ ability to manage growth, intense competition in IT services including those factors which may affect Aeries’

cost advantage, wage increases in India, the ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, industry

3

segment concentration, Aeries’ ability to manage the international operations, withdrawal or expiration of governmental fiscal incentives, political instability and regional conflicts, legal

restrictions on raising capital or acquiring companies outside India, changes in laws and regulations affecting Aeries’s business and changes in the combined company’s capital structure; (xiv) the ability to implement business plans,

identify and realize additional opportunities and achieve forecasts and other expectations after the completion of the proposed transaction; (xv) the risk that the post-combination company may never achieve or sustain profitability;

(xvi) WWAC’s potential need to raise additional capital to execute its business plan, which capital may not be available on acceptable terms or at all; (xvii) the risk that the post-combination company experiences difficulties in

managing its growth and expanding operations; and (xviii) the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries. The forward-looking statements contained in this communication are also

subject to additional risks, uncertainties, and factors, including those described in WWAC’s most recent Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q and other documents filed or to be filed with the SEC by WWAC from time to time. The forward-looking statements included in this communication are made only as of the date hereof. None of

Aeries, WWAC or any of their affiliates undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, subsequent events, circumstances or otherwise, except as may

be required by any applicable securities laws.

No Offer or Solicitation

This Current Report on Form 8-K is not intended to and shall not constitute an offer to sell or the

solicitation of an offer to sell or to buy any securities or a solicitation of any vote or approval and is not a substitute for the proxy statement or any other document that WWAC may file with the SEC or send to WWAC’s shareholders in

connection with the proposed transaction, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Management Presentation dated July 14, 2023. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: July 14, 2023

|

|

|

| WORLDWIDE WEBB ACQUISITION CORP. |

|

|

| By: |

|

/s/ Daniel S. Webb |

| Name: |

|

Daniel S. Webb |

| Title: |

|

Chief Executive Officer, Chief Financial Officer and Director |

5

Exhibit 99.1 Management Presentation July 2023

Disclaimer…(1/2) This presentation contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts, and further include, without limitation, statements reflecting our

current views with respect to, among other things, our operations, our financial performance, our industry, the impact of the COVID-19 global pandemic on our business, and other non-historical statements including the statements in the

“Financial Outlook” section of this presentation. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “predicts,” “intends,” “trends,” “plans,” “estimates,”

“anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Certain statements in this presentation concerning our future growth

prospects, financial expectations and plans for navigating the COVID-19 impact on our employees, clients and stakeholders are forward-looking statements intended to qualify for the 'safe harbor' under the Private Securities Litigation Reform Act of

1995, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. The risks and uncertainties relating to these statements include, but are not limited to,

risks and uncertainties regarding COVID-19 and the effects of government and other measures seeking to contain its spread, risks related to an economic downturn or recession in India, the United States and other countries around the world, changes

in political, business, and economic conditions, fluctuations in earnings, fluctuations in foreign exchange rates, our ability to manage growth, intense competition in IT services including those factors which may affect our cost advantage, wage

increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, industry segment concentration, our ability to

manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks or system failures, our ability to successfully complete and integrate potential acquisitions, liability for damages

on our service contracts, the success of the companies in which has made strategic investments, withdrawal or expiration of governmental fiscal incentives, political instability and regional conflicts, legal restrictions on raising capital or

acquiring companies outside India, unauthorized use of our intellectual property and general economic conditions affecting our industry and the outcome of pending litigation and government investigation. Additional risks that could affect our future

operating results are more fully described in our United States Securities and Exchange Commission filings. These filings are available at www.sec.gov. Aeries may, from time to time, make additional written and oral forward-looking statements,

including statements contained in the Company's filings with the Securities and Exchange Commission and our reports to shareholders. The Company does not undertake to update any forward-looking statements that may be made from time to time by or on

behalf of the Company unless it is required by law. This presentation includes certainfinancial measures not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including Net Income,

Net Income Margin, Earnings Per Share, EBITDA, and EBITDA Margin, which are used by management in making operating decisions, allocatingfinancial resources, and internal planning and forecasting, and for business strategy purposes, have

certain limitations, and should not be construed as alternatives tofinancial measures determined in accordance with GAAP. The non-GAAP measures as defined by us may not be comparable to similar non-GAAP measures presented by other

companies. Our presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that our future results will be u naffe cted by other unusual or non-recurring

items. Because GAAPfinancial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP measures.

For the same reasons, we are unable to address the probablesignificance of the unavailable information, which could be material to future results. This presentation includes market and industry data and forecasts that we have derived from

independent consultant reports, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Independent consultant reports, industry publications and other published industry

sources generally indicate that the information contained therein was obtained from sources believed to be reliable. Although we believe that these third-party sources are reliable, we do not guarantee the accuracy or completeness of this

information, and we have not independently veri fied this information. Some market data and statistical information are also based on our good faith estimates, which are derived from management’s knowledge of our industry and such

independent sources referred to above. Certain market, ranking and industry data included elsewhere in this presentation, including the size of certain markets and our size or position and the positions of our competitors within these markets,

including our services relative to our competitors, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained

from surveys, reports by market researchfirms, our clients, suppliers, trade and business organizations and other contacts in the markets in which we operate and have not been veri fied by independent sources. References herein to our

being a leader in a market or product category refer to our belief that we have a leading market share position in eachspecified market, unless the context otherwise requires. As there are no publicly available sources supporting this belief,

it is based solely on our internal analysis of our sales as compared to our estimates of sales of our competitors. In addition, the discussion herein regarding our various end markets is based on how we define the end markets for our products,

which products may be either part of larger overall end markets or end markets that include other types of products and services. Our internal data and estimates are based upon information obtained from trade and business organizations and other

contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that such information is reliable, we have not had this information veri fied by any independent sources. All

trademarks, service marks, and trade names appearing in this presentation are the property of their respective holders. 2

…Disclaimer (2/2) Use of Projections This Presentation contains

financial forecasts for the Company with respect to certain financial results for the Company’s fiscal years 2020 through 2025. Neither WWAC’s nor Company’s independent auditors have audited, studied, reviewed, compiled or

performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this

Presentation. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above- mentioned projected information has been provided for

purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks

and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the

Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person

that the results contained in the prospective financial information will be achieved. Where You Can Find Additional Information This Presentation relates to a proposed business combination transaction among Worldwide Webb Acquisition Corp

(“WWAC”) and Aark Singapore Pte Ltd (“AARK”) pursuant to which AARK and Aeries would become subsidiaries of WWAC, and WWAC would be renamed Aeries Technology, Inc. In connection with the proposed transaction, WWAC intends to

file with the SEC a proxy statement to solicit shareholder approval of the proposed business combination (“proxy statement”). The definitive proxy statement (if and when available) will be delivered to WWAC’s shareholders. WWAC may

also file other relevant documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF WWAC ARE URGED TO READ THE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT

ARE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders may obtain free copies of the proxy statement (if and when available) and other documents that are filed or will be filed with the SEC by WWAC through the website maintained by the SEC at www.sec.gov. Copies of the

documents filed with the SEC by WWAC will be available free of charge at Worldwide Webb Acquisition Corp., 770 E Technology Way F13-16, Orem, UT 84097, attention: Chief Executive Officer. Participants in the Solicitation WWAC and its directors and

executive officers are participants in the solicitation of proxies from the shareholders of WWAC in respect of the proposed transaction. Information about WWAC’s directors and executive officers and their ownership of WWAC’s Class A

ordinary shares is set forth in WWAC’s Annual Report on Form 10-K for the partial-year ended December 31, 2021 filed with the SEC on April 1, 2022, and as amended on August 24, 2022. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they

become available. You may obtain free copies of these documents as described in the preceding paragraph. Aeries, Aark Singapore Pte Ltd and their respective directors and executive officers may also be deemed to be participants in the solicitation

of proxies from the stockholders of WWAC in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination will be

included in the proxy statement for the proposed business combination. No Offer or Solicitation This Presentation is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or to buy any securities or a

solicitation of any vote or approval and is not a substitute for the proxy statement or any other document that WWAC may file with the SEC or send to WWAC’s shareholders in connection with the proposed transaction, nor shall there be any sale

of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. 3

Executive Summary – Today’s Presenters P A Sudhir Ajay Khare

Daniel Webb Chief Revenue Officer, COO - US CEO and Director Group Chief Executive Officer 30+ years experience in auditing, consulting, Extensive business operations experience and Previously a technology investment banker at M&A, business

setup and growth strategies. is responsible for client management, business Bank of America and Citi and private equity Member of the Managing Committee of development and operational delivery. Works investor at HarbourVest Partners having ASSOCHAM

and Co-Chairman of its National closely with private equity firms and their worked on transactions totaling approximately Council for Business Facilitation and Global portfolio companies for value creation. $40 billion in transaction value for

disruptive Competitiveness technology companies 4 4

Aeries Scores 10/10 on all Acquisition Criteria 1 Market Leading

Platform with Differentiated Product Offering Sustainable Growth Opportunity 2 3 Large and Addressable Market 4 Attractive Unit Economics 5 Data Directed Decision Making 6 Purpose-Driven with High Ethical Standards 7 Visionary Management Team with

Proven Track Record 8 Accelerating Growth Drivers 5 5

Transaction Summary Transaction Overview Illustrative Pro Forma

Valuation • Worldwide Webb Acquisition Corp. (Nasdaq: WWAC) intends to complete a business combination with Aark Singapore Pte Ltd, and its subsidiary (“Aeries Technology” or 89% Redemptions “Aeries”), a leading a

global professional services and consulting partner for business Total shares outstanding 53.9 leadership teams, private equity sponsors, and their portfolio companies Implied investor cost basis /share $4.84 • Bonus shares are set aside to

reduce redemptions and raise capital Equity value $261 Less: net cash (60) • Bonus shares reduce the implied cost basis for investors that do not redeem. At 89% redemptions or above the implied cost basis is $4.84 Total enterprise value $201

• Aeries existing shareholders and management are rolling 100% of their equity into the transaction Illustrative Sources and Uses Illustrative Pro-Forma Ownership $4.84 / Share 89% Redemptions $4.84 / Share SPAC cash in trust $26 Additional

Capital 50 89% Redemptions Aeries rollover equity 167 New Investors 33% Sponsor promote - anchor investors 6 WWAC Sponsor 3% Bonus shares at $0/share 0 Existing Rollover Equity 64% Value of extension shares given at $4.84/share 5 Sponsor promote -

founder shares 7 Total 100% Total Sources $261 • Note: Bonus Shares may be used to incentivize non-redemption agreements, PIPE investments, extensions or other capital raising purposes. This analysis assumes 2.713mm bonus shares are used for

non-redemptions. This scenario assumes $50mm of additional Cash to Balance Sheet $61 capital is raised at $4.84 per share. Pro forma share count excludes the potential earnout by the sponsor, warrants and ESOP. Cash in trust Transaction fees 15 is

dependent on redemptions, this analysis assumes 89% redemptions. The sponsor gave 1.25mm founder promote shares to their anchor Aeries rollover equity 167 investors at IPO. The sponsor is further reducing their promote by canceling 1.5mm promote

shares and subjecting 1.5mm shares to an earnout. Earnout requires $50mm+ to be raised in the transaction. If earned, the earnout will vest 1/3, 1/3, 1/3 at $12.00, $14.00 and Sponsor promote - anchor investors 6 $16.00 per share, respectively.

Aeries net debt is assumed to be $1mm. Values in millions except per share data. Ownership is pro forma Bonus shares at $0/share 0 for exchange rights being exercised. Bonus shares were reduced from 3.75mm by 987,000 shares for non redemption

agreements at Value of extension shares given at $4.84/share 5 extension and 50,000 shares for Aeries employees. Sponsor promote - founder shares 7 We have not raised $50mm of additional capital. We will seek to do so in connection with the

transaction. We have announced a $5mm Total Uses $261 PIPE which is included in the $50mm of additional capital in this illustrative analysis. 6

Bonus Shares Are Being Issued To Incentivize Non-Redemption •

Bonus shares effectively lower the cost basis for public investors that do not redeem at deSPAC • 2,713,000 bonus shares remain available for those who don’t redeem • Sponsor promote has been reduced to help fund bonus shares

• There were 79% redemptions at the time of extension, leaving 4.7mm shares remaining • The table below gives the illustrative cost basis to investors based on non-redemption scenarios if 2.713mm bonus shares were given to non- redeeming

shareholders at various redemption levels Illustrative Redemptions 79% 85% 89% 95% SPAC Non Redeeming Shares 4. 7 3.5 2.5 1.2 (+) Bonus Shares 2.71 2.71 2.71 1.25 Total Shares Issued to SPAC S/H 7. 4 6.2 5. 2 2. 4 SPAC Non Redeeming Shares 4.7 3.5

2.5 1.2 (x) Illustrative $10.10 Purchase Price $ 10.10 $ 10.10 $ 10.10 $ 10.10 Cost of Non Redeeming Shares 47.7 34.8 25.2 11.6 (/) Total Shares to SPAC S/H 7. 4 6. 2 5. 2 2. 4 Illustrative Cost Basis to SPAC S/H $ 6.41 $ 5.65 $ 4.84 $ 4.84

Illustrative Value to Non-Redeeming S/H at $10.10 at Close $ 15.91 $ 18.04 $ 21.08 $ 21.08 Illustrative Bonus For Not Reedeming 58% 79% 109% 109% Note: Bonus Shares may be used to incentivize non-redemption agreements, additional capital raised in

connection with the transaction, extensions or other capital raising purposes. This analysis assumes 2.713mm bonus shares are used for non-redemptions, but they can be used for other purposes 7 7

Key Stats RULE OF 60 39% Growth | 21% EBITDA Margin in CY23E We

Transform the Cost Experienced and We Are Experts at Structure of Our Customers Tenured Employee Base Scaling Quickly 53% $50mm >1500 2.2x ~65% Revenue CAGR CY22E Revenue Annualized Customer Hiring average 80+ per month Increase in Hiring over

CY22 – CY24E Savings ~700+ Engineers FY 21 Strong Company Our Employees Love Our Customers Culture Working at Aeries Depend on Us Profitable! 1.8% 8% 94% 93 Product led Growth Operating Cash Flow Positive Average S&M as % of Revenue since

2013 (Year 2) Employee Satisfaction Net Promoter Score Average Annual Employee Churn in FY21 & FY22 Score since 2020 8

Market Leading Platform with Differentiated Offering The “Old

Way” Tech-Enabled Services The Aeries Way ‘Purpose Built’ & ‘Future Ready’ Outsourcing – Vendors Flexible, less expensive labor pool Flexible and least expensive labor pool (NOTE: in our assessment, compared

to leading technology outsourcing Less innovation (no strategic alignment at senior levels, no providers with India presence, our model is at least 30% more cost visibility into operations beyond specific outsourced function) effective) Significant

innovation through strategic alignment at senior levels and Not viewed as part of the team - breeds mismanagement, poor performance and burned-out staff visibility across the organization Part of the team, with opportunity for promotion and

recognition Implementing strategic decisions with vendor is expensive, (career path progression) resulting into higher employee satisfaction arduous, and slow and lower attrition Insulates from regulatory and tax issues Inhouse Sourcing - Owned

Subsidiary Flexibility in scaling teams up or down as per changing business needs Aligned, innovative team Deliver best practices with visibility to winning playbooks from multiple Difficult and expensive tax and regulatory requirements companies

Costly to quickly scale up or down Disruptive model that delivers overall cost and operational efficiencies with the ability to deliver digital transformation solutions Cannot benchmark best practices across multiple companies tailor made for

customer’s growth strategy 9 9

Data Directed Decision Making WELL DEFINED GOVERNANCE PROVEN PROCESSES

SOFTWARE & AUTOMATION IT PROCESSES & & COMMUNICATION MATRIX STANDARDIZATION Transparent yet robust tracking and Documented processes across entire Internally developed applications for Certified customer data integrity & reporting

mechanisms: engagement lifecycle: operational excellence & support: privacy policies in place: § Weekly Status Tracker § Standardized Quotes, MSA, SoW§ Resource360 (Resource Utilization)§ ISO 27001, PCI-DSS, SOC2 Type 2

compliance § Monthly Steering Committee § Templatized Implementation Plans§ Mitra Contracts (HR Onboarding) § Adapted for Client Business - Data § Quarterly Business Reviews § Customized Business Expansion § Book

My Seat (Hybrid Office) Privacy, Security Environment, DR / Planning Process § Escalation Matrices § Procure360 (Procurement Workflow) BCP 10

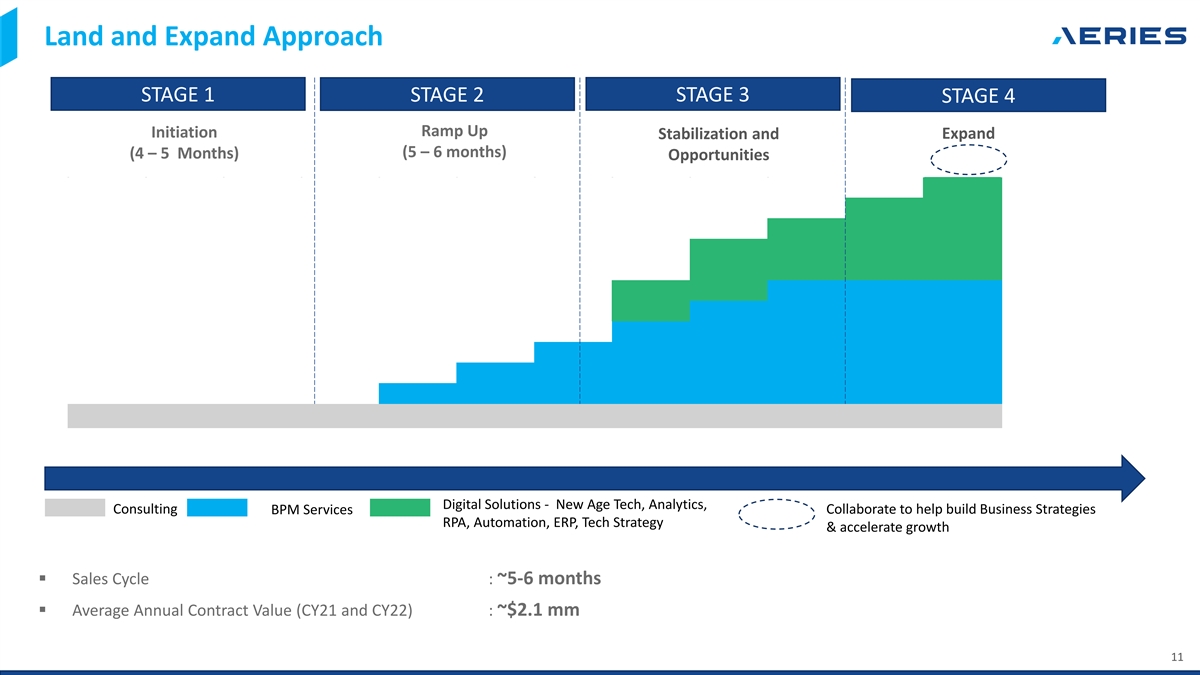

Land and Expand Approach STAGE 1 STAGE 2 STAGE 3 STAGE 4 Ramp Up

Initiation Expand Stabilization and (5 – 6 months) (4 – 5 Months) Opportunities Digital Solutions - New Age Tech, Analytics, Consulting Collaborate to help build Business Strategies BPM Services RPA, Automation, ERP, Tech Strategy &

accelerate growth § Sales Cycle : ~5-6 months § Average Annual Contract Value (CY21 and CY22) : ~$2.1 mm 11 11

Our Model Creates a Flywheel of Growth The cost economics and Part of

the playbook for value creation for More value creation Lower cost efficiencies that the “Aeries Stakeholders e.g. PE & Portfolio Companies Way” delivers along with cost for stakeholders structure and subsequent network effects

effective transformation High Customer Satisfaction & Net Promoter's CUSTOMER Score are a key ingredient in customer satisfaction and hence referrals EXPERIENCE Lower attrition vs industry, C-level client Elevating our customers’ digital

alignment, best practices ALIGNED TEAMS strategy to align with the ever- INNOVATION sharing & employee shortening business cycles and growth gain competitive advantage Right fit and work culture ensures BETTER high E-SAT – leading to

better talent TALENT acquisition and retention Details of each flywheel driver is in appendix 12 12

Value creation for Aeries stakeholders We have free organic growth as

we get As other PE partners acquire our clients, Strong Net Promoter Score helps us As key employees from clients implemented into each new PE we have the opportunity to show our gain client referrals and move companies, they bring us in investment

strengths and gain new partners testimonials THE NETWORK EFFECT 13

Large and Addressable Market Bottom-Up TAM Top-Down TAM (c) ~$420

Billion ~$504 Billion Global IT Spend $ 5.3 trillion US IT Spend in 2022 PORTFOLIO TAM (33% of global IT spend) COMPANIES (a) ~$34 Billion of PE firms $ 1.8 trillion Software + IT Business TAM MID-MARKET Services spend (b) COMPANIES ~$386 Billion $

900 billion IT Business Services spend $ 504 Billion NORTH AMERICAN IT SERVICES SPEND TERMS: CALCULATIONS: SOURCE: 1 2 Ø TAM = Total Available Market 1: EY –AIC PE Economic Contribution Report May ’21 a) Total Portfolio Companies x

ACV = 16K x $2.1mm = ~$34 Billion Ø ACV = Average Contract Value 3 2 2: Aeries Internal b) Total mid-market companies x ACV = 184K* x $2.1mm = ~386 Billion Ø *Subtracted 16K PE PortCos from # Mid-market Cos 3: Crunchbase 4 5 c) USA IT

Spend x Percentage Contribution of IT Business Services = $1.8 trillion x 28% 14 Ø Mid-Market: 200-700 employees & <$100-$800 mm revenues 4 & 5: CompTIA – IDC Industry Outlook Report 2022

Sustainable Product Led Growth BUILDING ‘MOAT’ ACCELERATE

CROSS & UPSELL AROUND OUR BUSINESS MODEL § Renewed focus on selling products & solutions § Continue to build on success in PE community – to existing clients expand NETWORK EFFECT § Vertical Heads & SET champion in

place § Hiring dedicated senior industry professionals, based in USA EXPAND INTO INORGANIC GROWTH MID-MARKET ENTERPRISES § Well crafted inorganic growth strategy – geography § Hiring dedicated Business Development Managers

coverage, capabilities, service area mix, new age & Inside Sales Manager technology solutions and analytics § Rest of team in place to kick-start § Phase I – tuck in acquisitions § Phase II – transformative

acquisitions 15 15

AI & Digital Transformation Capabilities Natural Cloud Business

Cognitive Machine Generative Language Infrastructure Systems RPA Learning AI Processing Chatbots Predictive Analytics Anomaly Detection A Dedicated Falcon Code Review Generative AI Virtual Assistants Research & LLaMA Forecasting Models Cognitive

Process Automation Innovation Division Platform Expertise Use Cases A ARI RIA A | | S Sm ma art rtE Ex xt tr ra act ct | S | Se en ns sE ES SG G | W | Wo ork rkS Sp pa ace ce | | C Cy yb be erD rDe ef fe en nc ce e | S | Sm ma art rt P Pa at ti ie

en nt t M Mo on ni it to ori rin ng g | M | MI IT TRA RA C Co on nt tr ra ac ct ts s P Pl la at tf fo or rm m | | Dec Decen ent tr ra al li iz zed ed F Fi ina nan nc ce | e | S So oc ci ia al l B Be eh ha avi vio or r AI AI S SAM AMPL PLE E S SOL

OLU UT TI IO ONS NS D DE EV VE EL LOPE OPED D 16

Digital Transformation Scope We help clients drive their Digital

Strategy by upskilling with Technology, Automation and Best Practices ENHANCE MODERNIZE ENABLE Customer Experience Operational Processes New Business Models • Customer Acquisition Automation • Business Systems (ERP, CRM, HCM) •

Consult, Implement, Operate, • AI based Sales & Marketing • Operating Model Redesign Monitor Automation • Re-strategize Products • Decision Intelligence • Customer Journey Mapping & • Pivot to

‘Mobile First’ Strategy • Data Lake, Data Warehouse, AI/ML Automation • Introduce 'Marketplace' model • Cloud Infrastructure • Enhanced Customer Engagement • Consult, Migrate, Operate, Monitor • Add

'Freemium' Tier to offering • Product Design Consulting • Modern IT Infrastructure • Integrate Generative AI • User Experience • Shift Left & AI based IT Ops • Incorporate Emerging Technologies • Design

Engineering • AI based Cybersecurity • SOC as a Service 17 17

Attractive Unit Economics – Improving LTV / CAC CY 21 CY 22

$2.3mm $0.14mm $1.7mm $0.17mm Lifetime Value Lifetime Value Customer Acquisition Cost Customer Acquisition Cost 10.1x 15.9x CY 21 and CY22 calculations are based on estimated financials LTV = Average Contract Value x Average Gross Margin x Average

Contract Tenure CAC = Total S&M Cost / New Customers added in a year 18 18

Revenue Growth Drivers 53% PRIVATE EQUITY RELATIONSHIPS CAGR Diversify

Private Equity Investor Relationships to target Portfolio $116.8 Companies REVENUE RETENTION High Visibility on Significant Ready Pipeline for Same Store 26% $68.7 y-o-y Growth Growth $49.6 CUSTOMER ACQUISITION FRAMEWORK $39.4 Focused investments in

customer acquisition framework in the US EMERGING TECH REVENUES Augment emerging technology products, platforms and tailored CY21 CY22 CY23 (E) CY24 (E) scalable solutions leveraging client access Notes: All figures in US$ Mm All figures are

unaudited SERVICE AREA EXPANSION Next level of growth is secured by differentiated partnership approach Tech-based services expansion into diverse amenable functional geared towards strong & lasting relationships with client stakeholders, areas

management and focus on New-age Tech Solutions and Digital Transformation leveraging on ready client access INORGANIC GROWTH STRATEGY Note: The company follows fiscal year (Apr – Mar) as Financial Year. The pre-adjusted financial information

in this slide CY21 and CY22 Financials are based on unaudited, carve-out, is prepared in accordance with local GAAP. Well crafted inorganic growth strategy – geography coverage, consolidated financial statements. Investors are encouraged to

evaluate each CY23(E) and CY24(E) represent forward looking information and is for adjustment and the reasons we consider it capabilities, service area mix illustrative purposes only and should not be relied upon as necessarily appropriate for

supplemental analysis. being indicative of future results. See the disclaimer for our forward- looking statements 19

EBITDA Growth & Increased Cash Flow Drivers $40.0 35% 30% 30%

INCREMENTAL REVENUE GROWTH $30.0 25% $35.0 22% Focused efforts on Revenue augmentation 20% 17% $20.0 (cross-sell and upsell) to lead profitable growth 16% 15% 10% $10.0 $14.8 5% $8.3 $6.2 DIGITAL REVENUES (EMERGING TECH) $0.0 0% CY21 CY22 CY23 (E)

CY24 (E) Migration to digital transformation revenues EBITDA EBITDA % helps improve margins Notes: All figures in US$ Mm All figures are unaudited Focus on digital driven, data-led new-age technology solutions helps improve clients’ business

outcomes and results into progressively higher operating margins for Aeries Note: The company follows fiscal year (Apr-Mar) as Financial Year. The pre-adjusted financial information in this slide CY21 and CY22 Financials are based on unaudited,

carve-out, is prepared in accordance with local GAAP. consolidated financial statements. Investors are encouraged to evaluate each CY23(E) and CY24(E) represent forward looking information and is adjustment and the reasons we consider it for

illustrative purposes only and should not be relied upon as appropriate for supplemental analysis. necessarily being indicative of future results. See the disclaimer for our forward-looking statements 20

Visionary Senior Executive Team with Proven Track Record Raman Kumar 2

DECADES OF WORKING TOGETHER! Chairman Accomplished serial entrepreneur with an established track record of building successful technology companies. Founder & former Chairman / CEO of NASDAQ-listed M*Modal. P A Sudhir Chief Executive Officer

• Aeries leadership team, partnering with SAC PCG, played a critical role in Creation of M-Modal (1998 – 2012) - a Leading Global provider of clinical 30+ years experience in auditing, consulting, M&A, business setup and growth

strategies. Member of the Managing Committee of documentation, Advanced Speech Understanding™ and Natural Language ASSOCHAM and Co-Chairman of its National Council for Business Understanding™ technologies, Medical Coding, HIM

Professional Services and Facilitation and Global Competitiveness Healthcare Analytics solutions. Sold M-Modal for $1.1bn to One Equity Partners. Unni Nambiar • Founded CASHe in 2016, a digital lending platform. Incubated, developed and Chief

Technology Officer tested the AI powered engine and created the IP, which was built upon cutting Technology leader with 29 years of experience building enterprise, edge proprietary technology and decisioning-engine led by a self-adaptive, cloud

& mobility products across diverse verticals. Passionate about scalable and modular AI platform leveraging social behavioral data from building world class products using cutting edge technology innovations. alternative sources. •

Partnered with a Private Equity Firm, AHP, carved out DeliverHealth Solutions Ajay Khare from Nuance Communications in 2021 to create one of the largest provider of Chief Revenue Officer, COO - US Healthcare tech-enabled services through an

industry-leading “Healthcare Extensive business operations experience and is responsible for Service Delivery Platform” client management, business development and operational delivery. Works closely with private equity firms and their

portfolio companies for value creation. 21 21

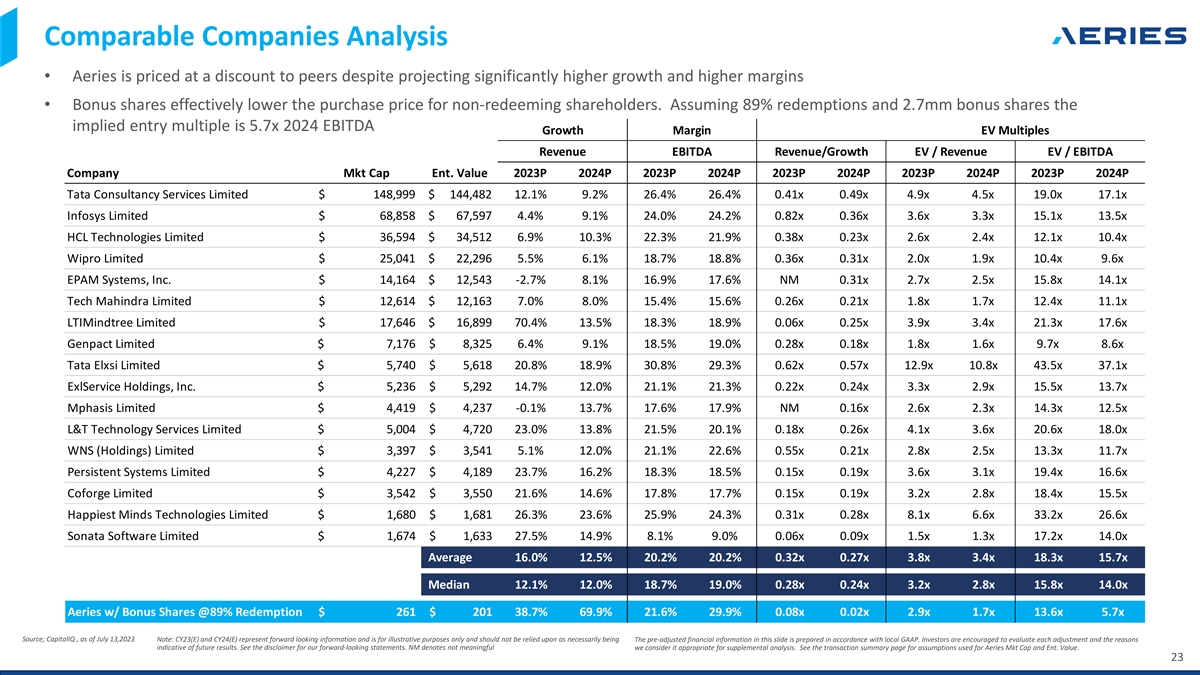

Comparable Companies Analysis 22

Comparable Companies Analysis • Aeries is priced at a discount to

peers despite projecting significantly higher growth and higher margins • Bonus shares effectively lower the purchase price for non-redeeming shareholders. Assuming 89% redemptions and 2.7mm bonus shares the implied entry multiple is 5.7x 2024

EBITDA Growth Margin EV Multiples Revenue EBITDA Revenue/Growth EV / Revenue EV / EBITDA Company Mkt Cap Ent. Value 2023P 2024P 2023P 2024P 2023P 2024P 2023P 2024P 2023P 2024P Tata Consultancy Services Limited $ 148,999 $ 144,482 12.1% 9.2% 26.4%

26.4% 0.41x 0.49x 4.9x 4.5x 19.0x 17.1x Infosys Limited $ 68,858 $ 67,597 4.4% 9.1% 24.0% 24.2% 0.82x 0.36x 3.6x 3.3x 15.1x 13.5x HCL Technologies Limited $ 36,594 $ 34,512 6.9% 10.3% 22.3% 21.9% 0.38x 0.23x 2.6x 2.4x 12.1x 10.4x Wipro Limited $

25,041 $ 22,296 5.5% 6.1% 18.7% 18.8% 0.36x 0.31x 2.0x 1.9x 10.4x 9.6x EPAM Systems, Inc. $ 14,164 $ 12,543 -2.7% 8.1% 16.9% 17.6% NM 0.31x 2.7x 2.5x 15.8x 14.1x Tech Mahindra Limited $ 12,614 $ 12,163 7.0% 8.0% 15.4% 15.6% 0.26x 0.21x 1.8x 1.7x

12.4x 11.1x LTIMindtree Limited $ 17,646 $ 16,899 70.4% 13.5% 18.3% 18.9% 0.06x 0.25x 3.9x 3.4x 21.3x 17.6x Genpact Limited $ 7,176 $ 8,325 6.4% 9.1% 18.5% 19.0% 0.28x 0.18x 1.8x 1.6x 9.7x 8.6x Tata Elxsi Limited $ 5,740 $ 5,618 20.8% 18.9% 30.8%

29.3% 0.62x 0.57x 12.9x 10.8x 43.5x 37.1x ExlService Holdings, Inc. $ 5,236 $ 5,292 14.7% 12.0% 21.1% 21.3% 0.22x 0.24x 3.3x 2.9x 15.5x 13.7x Mphasis Limited $ 4,419 $ 4,237 -0.1% 13.7% 17.6% 17.9% NM 0.16x 2.6x 2.3x 14.3x 12.5x L&T Technology

Services Limited $ 5,004 $ 4,720 23.0% 13.8% 21.5% 20.1% 0.18x 0.26x 4.1x 3.6x 20.6x 18.0x WNS (Holdings) Limited $ 3,397 $ 3,541 5.1% 12.0% 21.1% 22.6% 0.55x 0.21x 2.8x 2.5x 13.3x 11.7x Persistent Systems Limited $ 4,227 $ 4,189 23.7% 16.2% 18.3%

18.5% 0.15x 0.19x 3.6x 3.1x 19.4x 16.6x Coforge Limited $ 3,542 $ 3,550 21.6% 14.6% 17.8% 17.7% 0.15x 0.19x 3.2x 2.8x 18.4x 15.5x Happiest Minds Technologies Limited $ 1,680 $ 1,681 26.3% 23.6% 25.9% 24.3% 0.31x 0.28x 8.1x 6.6x 33.2x 26.6x Sonata

Software Limited $ 1,674 $ 1,633 27.5% 14.9% 8.1% 9.0% 0.06x 0.09x 1.5x 1.3x 17.2x 14.0x Average 16.0% 12.5% 20.2% 20.2% 0.32x 0.27x 3.8x 3.4x 18.3x 15.7x Median 12.1% 12.0% 18.7% 19.0% 0.28x 0.24x 3.2x 2.8x 15.8x 14.0x Aeries w/ Bonus Shares @89%

Redemption $ 261 $ 201 38.7% 69.9% 21.6% 29.9% 0.08x 0.02x 2.9x 1.7x 13.6x 5.7x Source; CapitalIQ , as of July 13,2023 Note: CY23(E) and CY24(E) represent forward looking information and is for illustrative purposes only and should not be relied

upon as necessarily being The pre-adjusted financial information in this slide is prepared in accordance with local GAAP. Investors are encouraged to evaluate each adjustment and the reasons indicative of future results. See the disclaimer for our

forward-looking statements. NM denotes not meaningful we consider it appropriate for supplemental analysis. See the transaction summary page for assumptions used for Aeries Mkt Cap and Ent. Value. 23 23

Appendix - Supporting Slides 24

Management Team Brian McCann Narayan Shetkar Jai Shankar Vishwakarma

Piyush Maheshwari Sheetal Sawant Business Development Chief Strategy Officer Product Development Chief of Staff, Office of CEO Human Resources Senior advisor to Aeries, an important 22 years of rich experience in Over 18 years of experience across

23 years of experience in setting up and Focus on enhancing HR-business contributor to our strategy to accelerate Management Consulting & Investment technology & building products. He has overseeing offshore operations, M&A, operating

model to strengthen our growth plans with our focus on Banking. He is responsible for expertise on AI, ML, blockchain, Due diligence, Refinancing, Integration employee engagement, human resource Private Equity firms and mid –sized supporting

and executing the Inorganic quantum computing, AR/ VR along with and ERP implementation. Leads client strategy and policy, including talent businesses in the United States growth strategy a large variety of tech stacks. shared service delivery

including F&A management, employee benefits and other G&A shared services Salma Curmally Murthy Suravarapu Maulik Doshi Sachin Aghor Nilesh Agrawal Legal & Compliance Marketing & Sales Finance Controller Technology & Service

Delivery Business Systems & Applications 15+ years of experience in India & global Leads the marketing & sales operations, 16+ years of experience leading large- Leads client Engineering operations and Leads Business Systems &

Applications legal and operations. Responsible for’ including identifying new engagement scale organizations through strategic & supports Digital Transformations using practice providing consulting and service Corporate Legal Strategy and

smooth models, reviewing Aeries’ Go-To-Market business transformation, enabling Robotic Process Automations (RPA), delivery for leading ERP, CRM, HCM, functioning of Client related legal & strategy, enhancing digital marketing growth with

financial stability and Custom Solution development, AI-based other applications (SAP, NetSuite, compliance matters Oracle, Dynamics, SFDC etc.) and marketing collaterals. creating business value. Data Analytics and Emerging technologies Sudhir

Kumar Jitin Singh Anand Jay Bhansali Navin Ninan Vijay Kumar Talent Acquisition IT Business Solutions Operations PMO IT Strategy & Solutions Responsible for streamlining Aeries Leads Aeries' PMO function to provide a Leads client IT operations

across Over 18 years of experience across 25+ years in IT leadership, defining Operations and ensuring issue seamless customer experience and multiple geographies supporting technology & building products. He has technology road map, solution

designing expertise on AI, ML, blockchain, for enterprise IT initiatives & technology resolution and smooth functioning, in supplement Aeries' growth strategy, enterprise IT Operations, IT Solutions, quantum computing, AR/ VR along with addition

to managing PMO, Talent specially in Transitions, Process Transitions, Transformation, Cloud infrastructure projects. Acquisition and Facilities Teams. excellence & Project management space. migrations & AI Ops Automations. a large variety

of tech stacks. 25

Digital Transformation Offerings – Engineering & Service

Delivery Aeries Technology Delivery team acts as a Digital Transformation CoE for our clients. The team collaborates with Aeries R&D Innovation Group to identify and build productized and re-usable IP for Aeries. Data Sciences Robotic Process

Custom Solutions Service Delivery – AI Based Analytics Automation (RPA) • Design Thinking to solve customer • Aeries Data Science Advisory practices • Bots to automate multiple processes • Industry specific process

management problem & build bespoke platforms. interpretable machine learning: across F&A, Sales & Service Renewals, • Strong expertise in lift and shift & explanation of attributes impacting HR & Payroll, Customer Care and

IT • Collective experience in areas of (but process improvements to provide predictions and prediction scores, to Operations not limited to) compliance significant savings understand impacting attributes. management, legal document •

Aeries has built robots to 1) interact • Ability to quickly build expertise in management, audit management, • We collaborate with our client's with multiple web-based systems (Client client/business specific processes contract

management and account functional teams through the following ERPs, Outlook, SharePoint, Ticketing through discovery and documentation management. phases: Discover, Define, Build and Systems, etc..), 2) perform complex Deploy. operations such as

extracting • Well integrated digital transformation • Efficiently prototype and ideate though unstructured data from invoices, team helps realize further process out the discovery phase, resulting in • Aeries maps available data

assets to purchase orders (using Aeries improvements better alignment with our clients and the customer and product 360 deg SmartExtract) to improve efficiency and delivery of MVP within 8 weeks. view to build and deploy robust models •

Omnichannel Customer Support Ability quality and cash flows to predict propensity to churn / renew / to support multiple languages for voice buy etc. process through various geographies • Ability to build get team operational in 6-8 weeks

Platforms Platforms Platforms Platforms 26 26

Digital Transformation Offerings - IT Infrastructure Industry and

function agnostic with ability to setup/deliver IT Services & Security Managed Services Modern IT Infrastructure Managed Cloud Services SOC & GRC 24/7/365 • AI OPS, SDWAN • Cloud Contact center Sol • Infrastructure

Management • Build| Manage 24/ 7 SOC|SOC Maturity • Intelligent IT operations • Global Serv Desk NOC - SOC • Azure, AWS, Google Cloud Assessment |Red Team • SaaS ITSM • Remote / VIP Support • Cloud

Transformation, Network • Zero Trust, DLP & Endpoint Refresh • IT Infra Automation • Gov Risk & Compliance • Integrated IAM | Cloud IAM • Migration, DR& BCP • EUC- AI Self service Agents • Cloud

Maintenance & | Privilege IAM | Identity Life Support • Security Monitoring, Services and Cycle Management • Incident – Prob- Ch Mgmt. Support • Backup & Disaster Recovery • Logs & Audits Conditional •

MDM & Proactive Support • Billing and Optimization Access Control Compliance • Automated Alerts, Reports • Automation and Integrations Platforms 27 27

Collaborative Approach to Governance Functions Performed Level of

Participation VISION STRATEGIC Steering Committee § Provide relationship vision & leadership Overall direction setting, § Provide thought leadership Exec Team Exec Team approvals and leadership § Promote partnership and growth

Weekly/Monthly Meeting § Resolve escalated issues MANAGERIAL Program Management DECISION Overall responsibility for § Monitor, track the progress of the program Aeries Business Director, VPs delivery of Implementation Heads § Ensure

team participation project, joint status reviews, § Monitor, manage, and control risk first level of escalation, Business Process Ensuring timely sign-offs CoE Head § Manage stakeholder communications Owners § Plan for continuous

improvement Daily/Weekly Meeting (Regular cadence) Daily Execution OPERATION OPERATIONAL Responsible for status § Day-to-day activities, checks & day to day issue CoE Head§ Discussions, interactions, issue resolution End Users Managers

clarifications, sign-off Manager FTEs § Design, develop, test, support Aeries Client Daily Cadence 28

AI based Analytics - Customer Churn Propensity Analysis ABOUT THE

CLIENT: The client is a US-based leading provider of managed services, delivering unified communications, managed IT & network connectivity. HIGH-LEVEL PROJECT OBJECTIVE BACKGROUND INFORMATION/CONTEXT RESULTS Develop a

churn propensity The project ran 100% virtually, due to COVID-19 ~450 ‘High-risk’ model to identify customers with a high risk of churn, Customer enabling opportunities to Churn accounts for $7-8M in lost revenue on an annual basis

actively reduce attrition Accounts Modest reductions in churn can have a material impact on revenue performance and extend the “tail” of profitable legacy customers provided to Account This initiative is one component of a broader

programmatic approach to churn reduction, inclusive of: Managers for action • defining a Customer Success function, hiring SVP Customer Success, customer contract changes, process improvements, compensation adjustments, and behavioral/cultural

changes $6.1M ≥ 65% Model Performance Annual Churn Scores Data Revenue Collection 13-week project, 1 Accuracy 97% Model Initial Data with three distinct Deployment Examination PROJECT modeling phases. 3 phases evolved from 6 features Initial

outreach and 73% accuracy to 30 features and Continuous delivery 1 Precision 92% SCOPE & 97% accuracy of model Exploratory and visibility to the Model Data Results Development client APPROACH Analysis Feature 1 Recall 94% Engineering $75K $78K

New Open Bookings Proposals 1. Aeries worked with the client to devise a churn propensity model and focused on integrated voice and data customers ($6.1M in annual revenue), given relatively high churn propensity & increased $-potential for

churn avoidance. 29 Aeries – Highly Confidential

Custom Solutions - Global Tax Compliance Solution for a Telco Company

ABOUT THE CLIENT: The client is a global technology company, that markets and sells to communications service providers and to enterprises. CHALLENGES SOLUTION OUTCOMES The client was facing the following • The workflow Aeries built a

white-labelled solution for tax compliance, which was customized to the needs of challenges with the tax compliance management tool along the client. software they were using: with new features, • Expansion constraints effected the

enhancements and client The solution was dynamic, which could scale with the increasing needs of the client. scalability of the client at each stage. feedback was built in 30 days. • Security and confidentiality concerns, It was available

entity wide, with an incorporated ability to edit and add entities. as data was stored on the software • The solution ensured that server. the cost for the client Security concerns were solved, as the solution ran securely on the

client’s intranet. Hence, their • Limited scope of customization: for any reduced significantly, as data was under their control. change or addition of an entity, the there was just a one-time client had to contact the software charge

for the solution, Role based access was made available, giving the client the option to work with consultants. provider each time. Hence, the client along with a nominal had a limited number of entities in the maintenance charge. software and

tracked the rest manually. The solution had the ability to import data in multiple formats. • The Client was able to • Admin access was unavailable, and the handle all its entities on a client incurred additional cost for each single

software, which There was also an ability to send notification email to all the stakeholders. change and data addition. improved efficiency. • Live dashboard was available to get a status Thank you, Aeries team, for the great work done.

It’s been a great pleasure working with of all entities. you. The team is very responsive and are great problem solvers. With this solution we will CLIENT SPEAK never again miss another deadline. • Zero compliance misses reported. 30

Aeries – Highly Confidential

Next Gen Tech – Blockchain based lending using Smart Contracts

ABOUT THE CLIENT: The client is a leading mobile-based lending platform. CHALLENGES SOLUTIONS OUTCOMES To build a secure peer Aeries built a blockchain based solution which uses Distributed Ledger enabled Digital Tokens using Smart • Client

announces to peer money transfer Contracts on the client’s lending platform.` market release of a solution using a distributed trust The Distributed Ledger Technology allows the platform to record transactions in a secure and transparent

manner peer-to-peer money platform. by creating an immutable audit trail. transfer solution. The platform has been designed to function as a shared infrastructure across customers, multiple external • Safe, secure and stakeholders, including

regulators, credit bureaus and potentially other parties interested in participating in the transparent distributed infrastructure transactions Smart Contract based Distributed Ledger records all lending transactions in an open and transparent

manner, thus enabled by allowing the fintech company and the borrower to execute a trusted lending transaction that is Blockchain The key innovation also involves tokenizing the loan amounts borrowed by the customers into Smart Contract

infrastructure. Digital Tokens which are stored on the Ledger and accessible by the customer in the app. All transactions are securely and accurately stored on the distributed ledger using advanced cryptography and can be accessed only by password

protected crypto keys. 50,000 tokens Transaction gets restored to registered on a Transaction gets bank account Customer can Smart Contract registered on a Smart transfer the based Distributed Contract based PROCESS tokens to Ledger Distributed

Ledger another Technology App Technology person OR FLOW Customer restore the 1,00,000 borrows from tokens in his Tokens credited client bank in the form of cash 50,000 tokens restored to Money transferred to bank account customer in the form of

Tokens (Digital Token) 31 Aeries – Highly Confidential

Robotic Process Automation - Automated Accounts Payable Process ABOUT

THE CLIENT: The client is a mid-sized technology company in e-commerce space with F&A under Shared Service supporting its decentralized global operation. CHALLENGES SOLUTIONS OUTCOMES • Traditionally, the client would manually •

Complete automation Aeries documented the existing workflow and approval mechanism to get end to end perform repetitive tasks in the Accounts understanding of the process. of 60% of total invoice Payable process, such as download the invoices,

register the invoices into ERP volume resulted into After multiple walkthroughs & discussions, identified the principal problems: and match the invoices with the PO. no human • Time taken to process each invoice • The invoices were

in multiple formats • Keeping track of invoices routed through different stages for approval, making the intervention for data from vendors, and the data needed to be overall process inefficient. extracted from these invoices to be input

extraction and ERP into the ERP. update Aeries identified multiple document imaging solutions with integrated workflow • The entire process of extraction and management, as well as ERP modules and internal automations as potential solutions.

• Month close process registration of data was done by humans, and the client desired to implement an which was completed Basis client consensus, 3rd party workflow management has been successfully automated system to manage this on BD 3 has

been implemented. process. reduced to BD 1 • Higher accuracy with lesser manual Extraction of required data fields intervention OCR Platform • Successfully able to PROCESS downsize the AP clerks Enter invoice details into FLOW ERP &

Validate with PO by 60% Automated Workflow AP mailbox 32 Aeries – Highly Confidential

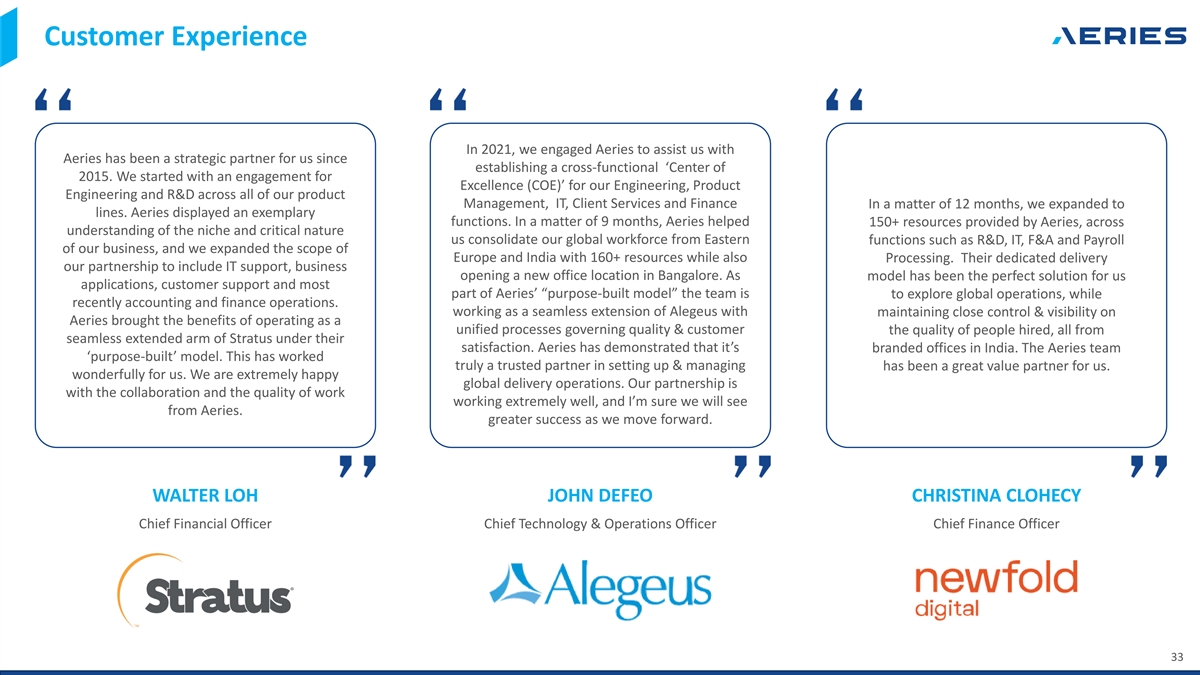

Customer Experience In 2021, we engaged Aeries to assist us with Aeries

has been a strategic partner for us since establishing a cross-functional ‘Center of 2015. We started with an engagement for Excellence (COE)’ for our Engineering, Product Engineering and R&D across all of our product Management, IT,

Client Services and Finance In a matter of 12 months, we expanded to lines. Aeries displayed an exemplary functions. In a matter of 9 months, Aeries helped 150+ resources provided by Aeries, across understanding of the niche and critical nature us

consolidate our global workforce from Eastern functions such as R&D, IT, F&A and Payroll of our business, and we expanded the scope of Europe and India with 160+ resources while also Processing. Their dedicated delivery our partnership to

include IT support, business opening a new office location in Bangalore. As model has been the perfect solution for us applications, customer support and most part of Aeries’ “purpose-built model” the team is to explore global

operations, while recently accounting and finance operations. working as a seamless extension of Alegeus with maintaining close control & visibility on Aeries brought the benefits of operating as a unified processes governing quality &

customer the quality of people hired, all from seamless extended arm of Stratus under their satisfaction. Aeries has demonstrated that it’s branded offices in India. The Aeries team ‘purpose-built’ model. This has worked truly a

trusted partner in setting up & managing has been a great value partner for us. wonderfully for us. We are extremely happy global delivery operations. Our partnership is with the collaboration and the quality of work working extremely well, and

I’m sure we will see from Aeries. greater success as we move forward. WALTER LOH JOHN DEFEO CHRISTINA CLOHECY Chief Financial Officer Chief Technology & Operations Officer Chief Finance Officer 33

Talent Acquisition: Differential Strategy BEST PRACTICES EXPERT

RECRUITERS • Well Defined and flexible Hiring Process/ Policy • Experienced domain specialists assigned to each BU • Emphasis on “Hire Right” - assessment on both technical and behavioral fitment • Trained on

interviewing skills, behavioral assessment • Metrics driven, recruitment analytics for monitoring/ reporting • Understanding on labor market/trends • Employer branding through videos, targeted campaigns on social media platforms

• Regular training/upskilling interventions • Emphasis on positive hiring experience for both hiring managers and candidates • Dedicated RCs to handle all transactional tasks • Collaborative Interview, Selection and

On-boarding process DIVERSIFIED SOURCING CHANNEL CUTTING EDGE TECHNOLOGY • Domain specialist hiring vendors in different geographies • Advanced applicants tracking system • Job boards, Social Media • AI/ML enabled CV

screening for faster process • Wide talent reach – top organizations & universities • Digital selection platform • Focused employee referral campaigns, recruitment drives Process Flow Client Engagement Dedicated

Calibration on Detailed Develop Sourcing Initiate Screening/ Release Onboarding Hiring Team the requirements Market Study & Screening Plan Hiring Assessment Offers Candidate Engagement 34 34

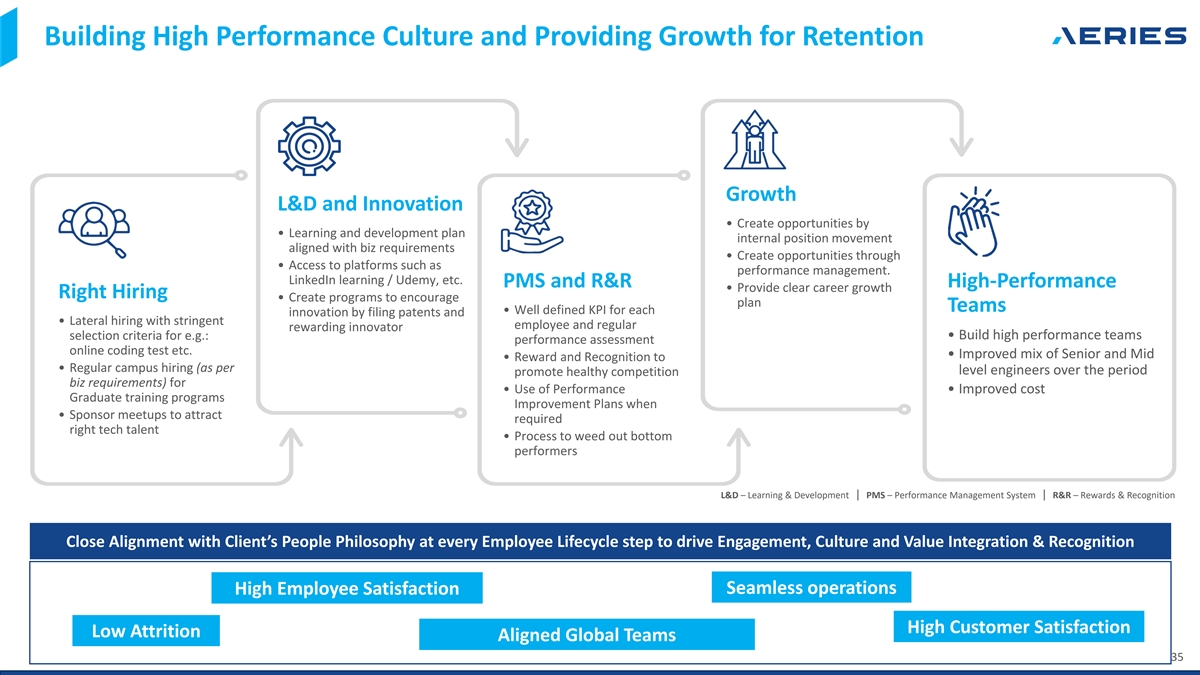

Building High Performance Culture and Providing Growth for Retention

Growth L&D and Innovation • Create opportunities by • Learning and development plan internal position movement aligned with biz requirements • Create opportunities through • Access to platforms such as performance

management. LinkedIn learning / Udemy, etc. PMS and R&R High-Performance • Provide clear career growth Right Hiring • Create programs to encourage plan Teams • Well defined KPI for each innovation by filing patents and •

Lateral hiring with stringent employee and regular rewarding innovator selection criteria for e.g.: • Build high performance teams performance assessment online coding test etc. • Improved mix of Senior and Mid • Reward and

Recognition to • Regular campus hiring (as per level engineers over the period promote healthy competition biz requirements) for • Use of Performance • Improved cost Graduate training programs Improvement Plans when • Sponsor

meetups to attract required right tech talent • Process to weed out bottom performers L&D – Learning & Development | PMS – Performance Management System | R&R – Rewards & Recognition Close Alignment with

Client’s People Philosophy at every Employee Lifecycle step to drive Engagement, Culture and Value Integration & Recognition Seamless operations High Employee Satisfaction High Customer Satisfaction Low Attrition Aligned Global Teams

35

Aeries Talent Pool 8% 56% > 1500 Employees as on Dec 2022 2020-22

Attrition at Aeries Engineers Hiring average 80+ per month [compared to CY2021 market average of 15%) rd 9yrs 3 100 + Average years of industry experience Of our employees are in senior critical 125 of our employees were promoted for our Employees

(38% are over 10+ roles within a client’s global teams (e.g. SMEs, in 2022 as part of the collaborated years of industry experience) Team Leads, Managers, Senior Management) appraisal cycle with the clients 36

Purpose-Driven with High Ethical Standards Our core Values hold us

together as an organization and help us in achieving our Goals I work with my colleagues at Aeries as well I aim to provide pioneering services and I am honest and open in my business dealings, transactions and as with my client counterparts as one

team, solutions through an ‘out-of-the-box’ mindset, communications, taking care to protect the confidentiality of the organization supporting and recognizing each other’s and a persistent inclination to challenge and and our

clients. strengths, to achieve the collective goal of improve the status-quo. Aeries and of our clients. Collaboration Transparency Innovation Customer Accountability Integrity Centricity I take ownership and responsibility for my I treat my

customer as the most I believe in always doing the right words, actions, and results, that leads to important part of our business, thing and act with virtue to make building trust with internal and external ensuring that the work I do delivers

ethical choices that are in the best stakeholders. value to them; with a flexible, interests of our organization and transparent and responsive approach clients. that is the Aeries’ ‘one-team’ culture. 37 37

Environmental, Social, and Governance (ESG) Aeries is committed to a

holistic approach to sustainability that covers managing risks and opportunities towards environmental, social and governance parameters. Profile Factors Environmental Social Governance Aeries considers the protection of Striving for positive social

change At Aeries, creating a robust natural resources and reduction of has always been at the heart of governance structure and carbon footprint as its Aeries’ purpose, culture and work. oversight is in its DNA. Our code of responsibility, as

we carry out our In addition, Customer Engagement conduct, core values and focus on business operations in a is a critical part of Aeries core cyber security govern our way of sustainable manner, to minimize values to provide best value, working and

help us achieve our the environmental impact of its individual approach, and agility to goals in accordance with corporate business activities. each of our clients. governance practices. 38 38

Value creation for stakeholders - Clients For Clients – Owners

and management stakeholders Margin Expansion: § Providing Cost Savings through global resource utilization and process optimization Operational Excellence: § Providing best in class talent, best practices Business Expansion: § Ability

to expand global locations for talent and business capabilities. Improving time-to-market Digital Transformation: § Digital First solutions to help client achieve their objectives Future Readiness § For ever shortening business cycle WE

ARE PART OF THE PLAYBOOK FOR VALUE CREATION FOR OUR PRIVATE EQUITY PARTNERS 39

Lower Cost Structure Lower cost structure – sustained throughout

full relationship, not one time § Unique engagement model provides cost transparency & discipline for clients § Best in class talent with lowest cost structure for clients. § In our internal analysis and based on client feedback,

we have seen cost savings up to 30% compared to competitors § As per clients and based on our assessment, clients save ~65% cost for comparable US based resources § Best practices, process optimization and digital transformation keeps the

cost of operations optimized § Better pricing for our customers § Consistent, predictable Revenue, collection & Margins for Aeries § Pre-defined exit clause provides transparency for clients and creates stickiness for Aeries 40

40

Adjusted EBITDA Reconciliation Adjusted EBITDA $ in million CY2021

CY2022 CY2023 CY2024 Adjusted EBITDA is a non-GAAP financial measure. We present Adjusted EBITDA as a supplement measure of our performance. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to

GAAP measures of performance. The presentation of Adjusted EBITDA should not be Profit for the year $1.1 -$0.3 $10.7 $25.6 construed as an inference that our future results will be unaffected by unusual or non-recurring items. Other income $0.0 $0.0

$0.0 $0.0 We define Adjusted EBITDA as net loss (income) plus (a) income tax expense, Finance costs $0.1 $0.1 $0.1 $0.1 (b) interest expense, net, (c) depreciation and amortization and (d) Other Income. We believe Adjusted EBITDA is useful to

investors in evaluating our operating Depreciation and amortization expense $1.2 $1.2 $0.9 $1.6 performance because: Taxes $3.7 $2.2 $3.2 $7.7 • securities analysts and other interested parties use such calculations as a measure of financial

performance and debt service capabilities; and EBIDTA $6.0 $4.2 $14.8 $35.0 • it is used by our management for internal reporting and planning purposes, including aspects of our consolidated operating budget and capital expenditures

Adjustments The pre-adjusted financial information in this slide is prepared in accordance (+) Non-Core expenses $0.2 $4.1 $0.0 $0.0 with local GAAP. Investors are encouraged to evaluate each adjustment and the reasons we consider it appropriate for

supplemental analysis. Adjusted EBITDA $6.2 $8.3 $14.8 $35.0 Additionally, the financial information includes forward-looking information, which provide our current expectations or forecasts of future events, including those relating to the business

combination. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control or the control of Aeries) or other assumptions that may cause actual results or performance to be materially different from

those expressed or implied by these forward-looking statements. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these

limitations include: • it does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments or foreign exchange gain/loss; • it does not reflect changes in, or cash requirements for,

working capital; • it does not reflect significant interest expense or the cash requirements necessary to service interest or principal payments on our outstanding debt; • it does not reflect payments made or future requirements for

income taxes; and • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or paid in the future and Adjusted EBITDA does not reflect cash requirements for such

replacements or payments Note: The company follows fiscal year as Financial Year. CY Financials are unaudited, carve-out, consolidated, prepared using estimates and represent forward looking information, and is for illustrative purposes only ,and

should not be relied upon as necessarily being indicative of future results 41

Thank You Global Locations THE AMERICAS INDIA UAE ASIA Raleigh Raleigh

Mumbai Dubai Singapore Dubai Guadalajara India Guadalajara Hyderabad Bangalore Singapore www.aeriestechnology.com +1 919 228 6404 info@aeriestechnology.com

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From Apr 2024 to May 2024

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From May 2023 to May 2024