Full Year 2024

- Reported net sales of $1.67 billion; Gross margins expanded 70

basis points

- Net operating cash flow of $148 million, free cash flow of $132

million

- Reduced net debt by $94 million with a consolidated leverage

ratio of 3.4x at year-end

- Realized approximately $25 million in cost savings during 2024,

with additional savings expected in 2025

- Loss per share of $1.06 includes impairment charges; Adjusted

EPS of $1.02, reflecting unfavorable foreign exchange trends

ACCO Brands Corporation (NYSE: ACCO) today reported financial

results for its fourth quarter and twelve months ended December 31,

2024.

"Fourth quarter sales and EPS were in line with our outlook,

excluding the impact of greater foreign currency headwinds. During

the year, we successfully executed on our key priorities and

realized approximately $25 million in cost savings. In addition, we

further increased our multi-year cost reduction program to $100

million of cumulative savings. These actions and our continued

commitment to managing costs led to improved gross margins, lower

SG&A and strong free cash flow. We also expanded our capital

allocation program, repurchasing $15 million in shares, while

strengthening our balance sheet through debt reduction," stated

ACCO Brands' President and Chief Executive Officer, Tom

Tedford.

"Our cost restructuring actions and continued focus on

productivity will provide us with an optimized structure that will

scale with organic and inorganic growth. Our primary focus moving

forward will be improving sales trends through new product

development, accretive acquisitions, price and promotional

excellence, brand building and other growth initiatives. These

actions will drive improved revenue outcomes and enhance our

profitability and cash flows," added Mr. Tedford.

Fourth Quarter Results

Net sales were $448.1 million, down 8.3 percent from $488.6

million in 2023. Adverse foreign exchange reduced sales by $11.9

million, or 2.4 percent. Comparable sales decreased 5.9 percent.

Both reported and comparable sales declines reflect softer global

demand for certain office-related products and lower demand for

back-to-school products in Brazil. The exit of lower margin

business in North America accounted for approximately 1.0 percent

of the decline. These declines were partially offset by growth in

the technology accessories categories.

Operating income was $42.0 million versus an operating loss of

$52.8 million in 2023, with the prior year's loss primarily due to

a non-cash goodwill impairment charge of $89.5 million. In 2024, we

recognized incremental restructuring charges of $10.7 million,

compared to $20.9 million in the prior-year period. Adjusted

operating income was $64.2 million, compared to $68.3 million in

2023. Both reported and adjusted operating income declines reflect

lower sales volume, which was partially offset by cost reduction

initiatives.

Net income was $20.6 million, or $0.21 per share, compared with

prior-year net loss of $59.4 million, or $(0.62) per share. The

prior year net loss is primarily due to the non-cash goodwill

impairment charge of $89.5 million, with no associated tax benefit,

as well as the higher restructuring charges noted above. In

addition, in the prior year, there were discrete tax benefits of

$19.8 million, due to tax legislation changes in Brazil and the

United States. Adjusted net income and adjusted earnings per share

in both 2024 and 2023 were $37.5 million and $0.39 per share,

respectively.

Full Year Results

Net sales were $1.67 billion, down 9.1 percent from $1.83

billion in 2023. Adverse foreign exchange reduced sales by $19.3

million, or 1.1 percent. Comparable sales decreased 8.0 percent.

Both reported and comparable sales declines reflect softer global

consumer and business demand for certain office-related product

categories and weaker back-to-school purchases by our customers in

the Americas segment. The exit of lower margin business in North

America was approximately 2.0 percent of the decline. These

declines were partially offset by growth in the technology

accessories categories.

Operating loss was $37.0 million versus operating income of

$44.7 million in 2023, primarily due to higher non-cash impairment

charges of $165.2 million related to goodwill and intangible

assets, partially offset by lower restructuring charges of $16.8

million. This compares to a non-cash goodwill impairment charge of

$89.5 million and restructuring charges of $27.2 million in the

prior year. Adjusted operating income was $189.7 million, compared

to $204.8 million in 2023. Both reported and adjusted operating

income declines reflect lower sales volume, partially offset by

cost reduction initiatives, lower incentive compensation expense

and improved product mix.

Net loss was $101.6 million, or $(1.06) per share, compared with

a net loss of $21.8 million, or $(0.23) per share, in 2023,

primarily due to the increase in non-cash impairment charges

related to goodwill and intangible assets, partially offset by

lower restructuring charges. In addition, in the prior year, there

were more discrete tax benefits of $15.3 million, primarily due to

tax legislation changes in Brazil and the United States. Adjusted

net income was $99.2 million compared with $105.6 million in 2023,

and adjusted earnings per share were $1.02 per share compared with

$1.09 per share in 2023. The decline in adjusted net income was due

to lower sales and adverse foreign exchange, partially offset by

cost reduction initiatives.

Capital Allocation and Dividend

For the full year, the Company improved its operating cash flow

to $148.2 million versus $128.7 million in the prior year, driven

primarily by improved working capital management. Free cash flow

was $132.3 million, compared to $114.9 million in the prior year.

The Company's consolidated leverage ratio as of December 31, 2024

was 3.4x.

In 2024, the Company reduced net debt by $94 million, paid

dividends of $28.4 million and repurchased 2.9 million shares for

$15.0 million.

On February 14, 2025, ACCO Brands announced that its board of

directors declared a regular quarterly cash dividend of $0.075 per

share. The dividend will be paid on March 26, 2025 to stockholders

of record at the close of business on March 14, 2025. At the

current stock price, on an annualized basis, ACCO Brands

shareholders are receiving an approximate 6 percent yield on their

investment.

Restructuring and Cost Savings Program

In January 2024, the Company announced a multi-year

restructuring and cost savings program, with anticipated annualized

pre-tax cost savings of at least $60 million when fully realized.

Given the macro uncertainties, the Company has increased its

savings target by $40 million and now anticipates the multi-year

program to yield approximately $100 million in annualized savings

by the end of 2026. In the fourth quarter of 2024, the Company took

restructuring charges of $10.7 million, related to these additional

actions.

Business Segment Results

ACCO Brands Americas – Fourth quarter segment net sales of

$251.3 million decreased 11.8 percent from $284.9 million in the

prior year. Adverse foreign exchange, primarily in Brazil and

Mexico, reduced sales by 3.9 percent. Comparable sales were $262.5

million, down 7.9 percent versus the prior year. Both reported and

comparable sales decreases were attributable to moderating demand

trends in Brazil for back-to-school products and softer demand for

certain consumer and business product categories. The exit of lower

margin business accounted for approximately 2.0 percent of the

decline. These declines were partially offset by modest growth in

the technology accessories categories.

Fourth quarter operating income was $31.2 million versus

operating loss of $62.6 million a year earlier, largely due to a

$89.5 million non-cash goodwill impairment charge we recorded in

the fourth quarter of 2023. Restructuring expense was $3.1 million,

compared to $16.5 million in the prior-year period. Adjusted

operating income was $41.6 million, down from $49.6 million in the

prior year. The decrease in adjusted operating income reflects

lower sales volume, partially offset by cost reduction

initiatives.

ACCO Brands International – Fourth quarter segment net sales of

$196.8 million decreased 3.4 percent from $203.7 million in the

prior year. Unfavorable foreign exchange reduced sales by 0.3

percent. Comparable sales were $197.5 million, down 3.1 percent

versus the prior year. Both reported and comparable sales declines

reflect reduced demand for certain office products, partially

offset by growth in the technology accessories categories and the

benefit of price increases.

Fourth quarter operating income was $24.0 million, an increase

from $23.4 million in the prior year, with adjusted operating

income of $32.4 million compared with $31.7 million in the prior

year. The improvement in both reflects the benefit of price

increases and cost reduction actions, partially offset by the

impact of lower sales volume.

2025 Outlook

"For 2025, we are providing a broader range of guidance for

sales and EPS given the current uncertainties related to tariffs,

foreign exchange exposure and economic headwinds affecting consumer

demand. The magnitude of impact from these factors on our business

remains unpredictable. We anticipate that year-over-year sales

trends will improve throughout the year as trends have stabilized

in many of our categories. The cost reductions in 2024, along with

our aggressive approach to managing our cost structure should allow

us to expand margin rates and maintain similar levels of EPS in

2025. Our robust free cash flow will enable us to continue our

capital allocation strategy of reducing debt, investing in our

business, paying our quarterly dividend, opportunistically

repurchasing shares and pursuing potential M&A," concluded Mr.

Tedford.

In the first quarter, the Company expects comparable sales to be

down in a range of 5.0% to 8.0% and adjusted loss per share within

a range of ($0.03) to ($0.05). First quarter loss per share,

reflects fixed cost deleveraging as this is seasonally the smallest

sales quarter of the year.

For the full year, the Company expects comparable sales to be

down in the range of 1.0% to 5.0%. Full year adjusted EPS is

expected to be within a range of $1.00 to $1.05. The Company

expects 2025 free cash flow to be within a range of $105 to $115

million with a consolidated leverage ratio within a range of 3.0x

to 3.3x.

Webcast

At 8:30 a.m. ET on February 21, 2025, ACCO Brands Corporation

will host a conference call to discuss the Company's fourth quarter

and full year 2024 results. The call will be broadcast live via

webcast. The webcast can be accessed through the Investor Relations

section of www.accobrands.com. The webcast will be in listen-only

mode and will be available for replay following the event.

About ACCO Brands Corporation

ACCO Brands, the Home of Great Brands Built by Great People,

designs, manufactures and markets consumer and end-user products

that help people work, learn, and play. Our widely recognized

brands include AT-A-GLANCE®, Five Star®, Kensington®, Leitz®,

Mead®, PowerA®, Swingline®, Tilibra® and many others. More

information about ACCO Brands Corporation (NYSE: ACCO) can be found

at www.accobrands.com.

Non-GAAP Financial Measures

In addition to financial results reported in accordance with

generally accepted accounting principles (GAAP), we have provided

certain non-GAAP financial information in this earnings release to

aid investors in understanding the Company's performance. Each

non-GAAP financial measure is defined and reconciled to its most

directly comparable GAAP financial measure in the "About Non-GAAP

Financial Measures" section of this earnings release.

Forward-Looking Statements

Statements contained herein, other than statements of historical

fact, particularly those anticipating future financial performance,

business prospects, growth, strategies, business operations and

similar matters, results of operations, liquidity and financial

condition, and those relating to cost reductions and anticipated

pre-tax savings and restructuring costs are "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on the beliefs and

assumptions of management based on information available to us at

the time such statements are made. These statements, which are

generally identifiable by the use of the words "will," "believe,"

"expect," "intend," "anticipate," "estimate," "forecast,"

"project," "plan," and similar expressions, are subject to certain

risks and uncertainties, are made as of the date hereof, and we

undertake no duty or obligation to update them. Forward-looking

statements are subject to the occurrence of events outside the

Company's control and actual results and the timing of events may

differ materially from those suggested or implied by such

forward-looking statements due to numerous factors that involve

substantial known and unknown risks and uncertainties. Investors

and others are cautioned not to place undue reliance on

forward-looking statements when deciding whether to buy, sell or

hold the Company’s securities.

Our outlook is based on certain assumptions which we believe to

be reasonable under the circumstances. These include, without

limitation, assumptions regarding consumer demand, tariffs, global

geopolitical and economic uncertainties, and fluctuations in

foreign currency exchange rates; and the other factors described

below.

Among the factors that could cause our actual results to differ

materially from our forward-looking statements are: a limited

number of large customers account for a significant percentage of

our sales; sales of our products are affected by general economic

and business conditions globally and in the countries in which we

operate; risks associated with foreign currency exchange rate

fluctuations; challenges related to the highly competitive business

environment in which we operate; our ability to develop and market

innovative products that meet consumer demands and to expand into

new and adjacent product categories; our ability to successfully

expand our business in emerging markets and the exposure to greater

financial, operational, regulatory, compliance and other risks in

such markets; the continued decline in the use of certain of our

products; risks associated with seasonality, the sufficiency of

investment returns on pension assets, risks related to actuarial

assumptions, changes in government regulations and changes in the

unfunded liabilities of a multi-employer pension plan; any

impairment of our intangible assets; our ability to secure, protect

and maintain our intellectual property rights, and our ability to

license rights from major gaming console makers and video game

publishers to support our gaming accessories business; our ability

to grow profitably through acquisitions, and successfully integrate

them; our ability to successfully execute our multi-year

restructuring and cost savings program and realize the anticipated

benefits; continued disruptions in the global supply chain; risks

associated with inflation and other changes in the cost or

availability of raw materials, transportation, labor, and other

necessary supplies and services and the cost of finished goods;

risks associated with outsourcing production of certain of our

products, information technology systems and other administrative

functions; the failure, inadequacy or interruption of our

information technology systems or its supporting infrastructure;

risks associated with a cybersecurity incident or information

security breach, including that related to a disclosure of

personally identifiable information; risks associated with our

indebtedness, including limitations imposed by restrictive

covenants, our debt service obligations, and our ability to comply

with financial ratios and tests; a change in or discontinuance of

our stock repurchase program or the payment of dividends; product

liability claims, recalls or regulatory actions; the impact of

litigation or other legal proceedings; the impact of additional tax

liabilities stemming from our global operations and changes in tax

laws, regulations and tax rates; our failure to comply with

applicable laws, rules and regulations and self-regulatory

requirements, the costs of compliance and the impact of changes in

such laws; changes in trade policy and regulations, including

changes in trade agreements and the imposition of tariffs, and the

resulting consequences; our ability to attract and retain qualified

personnel; the volatility of our stock price; risks associated with

circumstances outside our control, including those caused by

telecommunication failures, labor strikes, power and/or water

shortages, public health crises, such as the occurrence of

contagious diseases, severe weather events, war, terrorism and

other geopolitical incidents; and other risks and uncertainties

described in "Part I, Item 1A. Risk Factors" in our Annual Report

on Form 10-K for the year ended December 31, 2024, and in other

reports we file with the Securities and Exchange Commission.

ACCO Brands Corporation and

Subsidiaries

Condensed Consolidated Balance

Sheets

December 31, 2024

December 31, 2023

(in millions)

Assets

Current assets:

Cash and cash equivalents

$

74.1

$

66.4

Accounts receivable, net

348.9

430.7

Inventories

270.4

327.5

Other current assets

38.1

30.8

Total current assets

731.5

855.4

Total property, plant and equipment

505.5

599.6

Less: accumulated depreciation

(368.0

)

(429.5

)

Property, plant and equipment, net

137.5

170.1

Right of use asset, leases

81.0

91.0

Deferred income taxes

89.3

104.7

Goodwill

446.4

590.0

Identifiable intangibles, net

709.6

815.7

Other non-current assets

33.1

17.9

Total assets

$

2,228.4

$

2,644.8

Liabilities and Stockholders'

Equity

Current liabilities:

Notes payable

$

10.5

$

0.2

Current portion of long-term debt

40.8

36.5

Accounts payable

167.3

183.7

Accrued compensation

43.2

53.3

Accrued customer program liabilities

78.5

104.0

Lease liabilities

21.5

20.5

Other current liabilities

128.5

143.8

Total current liabilities

490.3

542.0

Long-term debt, net

783.3

882.2

Long-term lease liabilities

66.9

76.8

Deferred income taxes

111.9

125.6

Pension and post-retirement benefit

obligations

117.2

157.6

Other non-current liabilities

52.7

73.6

Total liabilities

1,622.3

1,857.8

Stockholders' equity:

Common stock

1.0

1.0

Treasury stock

(47.0

)

(45.1

)

Paid-in capital

1,911.8

1,913.4

Accumulated other comprehensive loss

(572.1

)

(526.3

)

Accumulated deficit

(687.6

)

(556.0

)

Total stockholders' equity

606.1

787.0

Total liabilities and stockholders'

equity

$

2,228.4

$

2,644.8

ACCO Brands Corporation and

Subsidiaries

Consolidated Statements of

Loss (Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions, except per share

data)

2024

2023

% Change

2024

2023

% Change

Net sales

$

448.1

$

488.6

(8.3)%

$

1,666.2

$

1,832.8

(9.1)%

Cost of products sold

292.6

318.6

(8.2)%

1,110.8

1,234.5

(10.0)%

Gross profit

155.5

170.0

(8.5)%

555.4

598.3

(7.2)%

Operating costs and expenses:

Selling, general and administrative

expenses

91.3

101.7

(10.2)%

365.7

393.5

(7.1)%

Amortization of intangibles

11.5

10.7

7.5 %

44.7

43.4

3.0 %

Restructuring

10.7

20.9

(48.8)%

16.8

27.2

(38.2)%

Impairment of goodwill and intangible

assets

—

89.5

(100.0)%

165.2

89.5

84.6 %

Total operating costs and expenses

113.5

222.8

(49.1)%

592.4

553.6

7.0 %

Operating income (loss)

42.0

(52.8

)

NM

(37.0

)

44.7

NM

Non-operating expense (income):

Interest expense

11.8

13.6

(13.2)%

52.6

58.6

(10.2)%

Interest income

(1.4

)

(0.9

)

55.6 %

(7.5

)

(7.1

)

5.6 %

Non-operating pension expense

0.5

1.3

(61.5)%

6.1

1.8

NM

Other (income) expense, net

(0.5

)

6.6

NM

(0.9

)

4.5

NM

Income (loss) before income tax

31.6

(73.4

)

NM

(87.3

)

(13.1

)

NM

Income tax expense (benefit)

11.0

(14.0

)

NM

14.3

8.7

64.4 %

Net income (loss)

$

20.6

$

(59.4

)

NM

$

(101.6

)

$

(21.8

)

NM

Per share:

Basic income (loss) per share

$

0.22

$

(0.62

)

NM

$

(1.06

)

$

(0.23

)

NM

Diluted income (loss) per share

$

0.21

$

(0.62

)

NM

$

(1.06

)

$

(0.23

)

NM

Weighted average number of shares

outstanding:

Basic

94.0

95.4

95.6

95.3

Diluted

95.9

95.4

95.6

95.3

Cash dividends declared per common

share

$

0.075

$

0.075

$

0.300

$

0.300

Statistics (as a % of Net sales, except

Income tax rate)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Gross profit (Net sales, less Cost of

products sold)

34.7

%

34.8

%

33.3

%

32.6

%

Selling, general and administrative

expenses

20.4

%

20.8

%

21.9

%

21.5

%

Operating income (loss)

9.4

%

(10.8

)%

(2.2

)%

2.4

%

Income (loss) before income tax

7.1

%

(15.0

)%

(5.2

)%

(0.7

)%

Net income (loss)

4.6

%

(12.2

)%

(6.1

)%

(1.2

)%

Income tax rate

34.8

%

19.1

%

(16.4

)%

(66.4

)%

ACCO Brands Corporation and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows (Unaudited)

Year Ended December

31,

(in millions)

2024

2023

Operating activities

Net loss

$

(101.6

)

$

(21.8

)

Gain on disposal of assets

(1.8

)

(0.3

)

Deferred income tax benefit

(6.9

)

(20.1

)

Depreciation

28.4

32.7

Amortization of debt issuance costs

2.8

3.0

Amortization of intangibles

44.7

43.4

Stock-based compensation

11.9

14.8

Loss on debt extinguishment

1.0

—

Non-cash charge for impairment of goodwill

and intangible assets

165.2

89.5

Changes in operating assets and

liabilities:

Accounts receivable

43.3

(38.6

)

Inventories

38.3

85.5

Other assets

(9.0

)

5.9

Accounts payable

(6.3

)

(68.0

)

Accrued expenses and other liabilities

(41.5

)

18.2

Accrued income taxes

(20.3

)

(15.5

)

Net cash provided by operating

activities

148.2

128.7

Investing activities

Additions to property, plant and

equipment

(15.9

)

(13.8

)

Proceeds from the disposition of

assets

3.6

2.6

Net cash used by investing activities

(12.3

)

(11.2

)

Financing activities

Proceeds from long-term borrowings

207.0

121.9

Repayments of long-term debt

(292.5

)

(199.2

)

Borrowings (repayments) of notes payable,

net

10.8

(10.2

)

Payments for debt issuance costs

(2.5

)

—

Dividends paid

(28.4

)

(28.5

)

Repurchases of common stock

(15.0

)

—

Payments related to tax withholding for

stock-based compensation

(2.0

)

(1.7

)

Net cash used by financing activities

(122.6

)

(117.7

)

Effect of foreign exchange rate changes on

cash and cash equivalents

(5.6

)

4.4

Net increase in cash and cash

equivalents

7.7

4.2

Cash and cash equivalents

Beginning of the period

$

66.4

$

62.2

End of the period

$

74.1

$

66.4

About Non-GAAP Financial Measures

We explain below how we calculate each of our non-GAAP financial

measures. This is followed by a reconciliation of our current

period and historical non-GAAP financial measures to the most

directly comparable GAAP financial measures.

We use our non-GAAP financial measures both to explain our

results to stockholders and the investment community and in the

internal evaluation and management of our business. We believe our

non-GAAP financial measures provide management and investors with a

more complete understanding of our underlying operational results

and trends, facilitate meaningful period-to-period comparisons and

enhance an overall understanding of our past and future financial

performance.

Our non-GAAP financial measures exclude certain items that may

have a material impact upon our reported financial results such as

restructuring charges, the impact of foreign currency exchange rate

fluctuations, unusual tax items, goodwill and indefinite lived

trade name impairments and charges, and other non-recurring items

that we consider to be outside of our core operations. On an

interim basis, we also calculate adjusted income tax expense using

our estimated annual income tax rate. These measures should not be

considered in isolation or as a substitute for, or superior to, the

directly comparable GAAP financial measures and should be read in

connection with the Company’s financial statements presented in

accordance with GAAP.

Our non-GAAP financial measures include the following:

Comparable Sales: Represents

net sales excluding the impact of material acquisitions, if any,

with current-period foreign operation sales translated at

prior-year currency rates. We believe comparable sales are useful

to investors and management because they reflect underlying sales

and sales trends without the effect of material acquisitions and

fluctuations in foreign exchange rates and facilitate meaningful

period-to-period comparisons. We sometimes refer to comparable

sales as comparable net sales.

Adjusted Operating Income

(Loss)/Adjusted Income (Loss) Before Taxes/Adjusted Net Income

(Loss)/Adjusted Net Income (Loss) Per Diluted Share:

Represents operating income (loss), income (loss) before taxes, net

income (loss), and net income (loss) per diluted share excluding

restructuring and goodwill and indefinite lived trade name

impairment charges, the amortization of intangibles, non-recurring

items, other income/expense, adjustments to reflect the estimated

annual tax rate and discrete income tax adjustments, including

income tax related to the foregoing. We believe these adjusted

non-GAAP financial measures are useful to investors and management

because they reflect our underlying operating performance before

items that we consider to be outside our core operations and

facilitate meaningful period-to-period comparisons. Senior

management’s incentive compensation is derived, in part, using

adjusted operating income and adjusted net income per diluted

share, which is derived from adjusted net income. We sometimes

refer to adjusted net income per diluted share as adjusted earnings

per share or adjusted EPS.

Adjusted Income Tax Expense

(Benefit): Represents income tax expense (benefit)

excluding the tax effect of the items that have been excluded from

adjusted income (loss) before taxes, unusual income tax items such

as the impact of tax audits and changes in laws, and other discrete

tax items. We believe our adjusted income tax expense (benefit) is

useful to investors because it reflects our income tax calculated

using the estimated annual tax rate before discrete tax items that

we consider to be outside our core operations and facilitates

meaningful period-to-period comparisons. For interim periods, the

income tax expense (benefit) is calculated using the estimated

annual income tax rate.

Adjusted EBITDA: Represents

net income excluding the effects of depreciation, stock-based

compensation expense, amortization of intangibles, interest

expense, net, other (income) expense, net, and income tax expense,

restructuring and goodwill and indefinite lived trade name

impairment charges, and other non-recurring items. We believe

adjusted EBITDA is useful to investors because it reflects our

underlying cash profitability and adjusts for certain non-cash

charges and other items that we consider to be outside our core

operations and facilitates meaningful period-to-period comparisons.

In addition, this calculation of adjusted EBITDA is used in our

loan agreement to calculate our leverage ratio covenant.

Free Cash Flow: Free cash

flow represents cash flow from operating activities less cash used

for additions to property, plant and equipment. We believe free

cash flow is useful to investors because it measures our available

cash flow for paying dividends, reducing debt, repurchasing shares

and funding acquisitions.

Consolidated Leverage Ratio:

Represents balance sheet debt plus unamortized debt origination

costs and less any cash and cash equivalents divided by adjusted

EBITDA.

We also provide forward-looking non-GAAP comparable sales,

adjusted earnings per share, free cash flow, adjusted EBITDA and

historical and forward-looking consolidated leverage ratio. We do

not provide a reconciliation of these forward-looking and

historical non-GAAP measures to GAAP because the GAAP financial

measure is not currently available and management cannot reliably

predict all the necessary components of such non-GAAP measures

without unreasonable effort or expense due to the inherent

difficulty of forecasting and quantifying certain amounts that are

necessary for such a reconciliation, including adjustments that

could be made for restructuring, integration and

acquisition-related expenses, the variability of our tax rate and

the impact of foreign currency fluctuation and material

acquisitions, and other charges reflected in our historical

results. The probable significance of each of these items is high

and, based on historical experience, could be material.

ACCO Brands Corporation and Subsidiaries

Reconciliation of GAAP to Adjusted Non-GAAP Information

(Unaudited) (In millions, except per share data)

The following tables set forth a reconciliation of certain

Consolidated Statements of Loss information reported in accordance

with GAAP to Adjusted Non-GAAP Information for the three months

ended December 31, 2024 and 2023.

Three Months Ended December

31, 2024

Operating

Income

% of

Sales

Income

before Tax

% of

Sales

Income

Tax

Expense

Tax

Rate

Net

Income

% of

Sales

Reported GAAP

$

42.0

9.4

%

$

31.6

7.1

%

$

11.0

34.8

%

$

20.6

4.6

%

Reported GAAP diluted loss per share

(EPS)

$

0.21

Restructuring

10.7

10.7

2.8

7.9

Amortization of intangibles

11.5

11.5

3.0

8.5

Refinancing costs

(B)

—

1.0

0.3

0.7

Gain on sale of property

—

(1.3

)

(0.3

)

(1.0

)

Discrete tax items and adjustments to

annual tax rate

(F)

—

—

(0.8

)

0.8

Adjusted Non-GAAP

$

64.2

14.3

%

$

53.5

11.9

%

$

16.0

29.9

%

$

37.5

8.4

%

Adjusted net income per diluted share

(Adjusted EPS)

$

0.39

Three Months Ended December

31, 2023

Operating

(Loss) Income

% of

Sales

(Loss) Income

before Tax

% of

Sales

Income Tax

(Benefit)

Expense

Tax

Rate

Net (Loss)

Income

% of

Sales

Reported GAAP

$

(52.8

)

(10.8

)%

$

(73.4

)

(15.0

)%

$

(14.0

)

19.1

%

$

(59.4

)

(12.2

)%

Reported GAAP diluted income per share

(EPS)

$

(0.62

)

Restructuring

20.9

20.9

5.2

15.7

Goodwill impairment charge

89.5

89.5

—

89.5

Amortization of intangibles

10.7

10.7

3.0

7.7

Exit certain products in the wellness

category

(D)

—

5.1

1.3

3.8

Discrete tax items and adjustments to

annual tax rate

(F)

—

—

19.8

(19.8

)

Adjusted Non-GAAP

$

68.3

14.0

%

$

52.8

10.8

%

$

15.3

29.0

%

$

37.5

7.7

%

Adjusted net income per diluted share

(Adjusted EPS)

$

0.39

ACCO Brands Corporation and Subsidiaries

Reconciliation of GAAP to Adjusted Non-GAAP Information

(Unaudited) (In millions, except per share data)

The following tables set forth a reconciliation of certain

Consolidated Statements of Loss information reported in accordance

with GAAP to Adjusted Non-GAAP Information for the twelve months

ended December 31, 2024 and 2023.

Twelve Months Ended December

31, 2024

Operating

(Loss)

Income

% of

Sales

(Loss)

Income

before Tax

% of

Sales

Income

Tax

Expense

Tax

Rate

Net (Loss)

Income

% of

Sales

Reported GAAP

$

(37.0

)

(2.2

)%

$

(87.3

)

(5.2

)%

$

14.3

(16.4

)%

$

(101.6

)

(6.1

)%

Reported GAAP diluted loss per share

(EPS)

$

(1.06

)

Restructuring

16.8

16.8

4.4

12.4

Goodwill impairment charge

127.5

127.5

—

127.5

Intangible assets impairment charge

37.7

37.7

9.6

28.1

Amortization of intangibles

44.7

44.7

12.0

32.7

Pension settlement

(A)

—

4.4

1.1

3.3

Refinancing costs

(B)

—

1.0

0.3

0.7

Gain on sale of property

—

(1.3

)

(0.3

)

(1.0

)

Net operating tax gains and losses

(E)

—

(1.8

)

(0.6

)

(1.2

)

Discrete tax items

(F)

—

—

1.7

(1.7

)

Adjusted Non-GAAP

$

189.7

11.4

%

$

141.7

8.5

%

$

42.5

30.0

%

$

99.2

6.0

%

Adjusted net income per diluted share

(Adjusted EPS)

$

1.02

Twelve Months Ended December

31, 2023

Operating

Income

% of

Sales

(Loss) Income

before Tax

% of

Sales

Income Tax

Expense

Tax

Rate

Net (Loss)

Income

% of

Sales

Reported GAAP

$

44.7

2.4

%

$

(13.1

)

(0.7

)%

$

8.7

(66.4

)%

$

(21.8

)

(1.2

)%

Reported GAAP diluted loss per share

(EPS)

$

(0.23

)

Restructuring

27.2

27.2

6.8

20.4

Goodwill impairment charge

89.5

89.5

—

89.5

Amortization of intangibles

43.4

43.4

11.6

31.8

Other asset write-off

(C)

—

1.1

0.3

0.8

Gain on sale of property

—

(1.5

)

(0.5

)

(1.0

)

Exit certain products in the wellness

category

(D)

—

5.1

1.3

3.8

Operating tax gains

(E)

—

(1.3

)

(0.4

)

(0.9

)

Discrete tax items

(F)

—

—

17.0

(17.0

)

Adjusted Non-GAAP

$

204.8

11.2

%

$

150.4

8.2

%

$

44.8

29.8

%

$

105.6

5.8

%

Adjusted net income per diluted share

(Adjusted EPS)

$

1.09

Notes to Reconciliations of GAAP to Adjusted

Non-GAAP Information and Net Loss to Adjusted EBITDA

(Unaudited)

A.

Settlement due to the wind-up of the ACCO

Brands Canada Salaried and Hourly pension plans.

B.

Represents the write-off of debt issuance

costs associated with the Company's debt refinancing.

C.

Represents the write-off of assets related

to a capital project.

D.

Represents charges for the exit of certain

products in the wellness category.

E.

Represents certain indirect tax credits in

Brazil.

F.

The income tax impact of discrete tax

items, including the effects of tax legislation in both Brazil and

the United States in 2023. The Company adjusts its tax rate to

30.0% which represents its full year non-GAAP estimated annual tax

rate as of December 31, 2024. The Company's full year non-GAAP

estimated annual tax rate remains subject to variation from the mix

of earnings across the Company's operating jurisdictions.

ACCO Brands Corporation and Subsidiaries

Reconciliation of Net (Loss) Income to Adjusted EBITDA

(Unaudited) (In millions)

The following table sets forth a reconciliation of net loss

reported in accordance with GAAP to Adjusted EBITDA.

Three months ended December

31,

Year ended December

31,

2024

2023

%

Change

2024

2023

%

Change

Net income (loss)

$20.6

$(59.4)

NM

$(101.6)

$(21.8)

NM

Stock-based compensation

2.7

4.4

(38.6)%

11.9

14.8

(19.6)%

Depreciation

7.2

7.5

(4.0)%

28.4

32.7

(13.1)%

Amortization of intangibles

11.5

10.7

7.5 %

44.7

43.4

3.0 %

Restructuring

10.7

20.9

(48.8)%

16.8

27.2

(38.2)%

Impairment of goodwill and intangible

assets

—

89.5

(100.0)%

165.2

89.5

42.5 %

Pension Settlement

—

—

NM

4.4

—

100.0 %

Interest expense, net

10.4

12.7

(18.1)%

45.1

51.5

(12.4)%

Other (income) expense, net

(0.5)

6.6

NM

(0.9)

4.5

NM

Income tax expense (benefit)

11.0

(14.0)

NM

14.3

8.7

64.4 %

Adjusted EBITDA (non-GAAP)

$73.6

$78.9

(6.7)%

$228.3

$250.5

(8.9)%

Adjusted EBITDA as a % of Net Sales

16.4 %

16.1 %

13.7 %

13.7 %

Reconciliation of Net Cash Provided by

Operating Activities to Free Cash Flow (Unaudited) (In

millions)

The following table sets forth a reconciliation of net cash

provided by operating activities reported in accordance with GAAP

to Free Cash Flow.

Three months

ended

December 31, 2024

Three months

ended

December 31, 2023

Year ended

December 31, 2024

Year ended

December 31, 2023

Net cash provided by operating

activities

$52.7

$58.0

$148.2

$128.7

Additions to property, plant and

equipment

(7.3)

(4.1)

(15.9)

(13.8)

Free Cash Flow (non-GAAP)

$45.4

$53.9

$132.3

$114.9

ACCO Brands Corporation and

Subsidiaries

Supplemental Business Segment

Information and Reconciliation (Unaudited)

(In millions)

2024

2023

Changes

Adjusted

Adjusted

Reported

Adjusted

Operating

Reported

Adjusted

Operating

Adjusted

Adjusted

Operating

Operating

Income

Operating

Operating

Income

Operating

Operating

Adjusted

Reported

Income

Adjusted

Income

(Loss)

Reported

Income

Adjusted

Income

(Loss)

Net Sales

Net Sales

Income

Income

Margin

Net Sales

(Loss)

Items

(Loss)

Margin

Net Sales

(Loss)

Items

(Loss)

Margin

$

%

(Loss) $

(Loss) %

Points

Q1:

ACCO Brands Americas

$197.2

$6.1

$6.2

$12.3

6.2%

$230.0

$12.3

$6.4

$18.7

8.1%

$(32.8)

(14.3)%

$(6.4)

(34.2)%

(190)

ACCO Brands International

161.7

12.8

4.1

16.9

10.5%

172.6

9.7

7.8

17.5

10.1%

(10.9)

(6.3)%

(0.6)

(3.4)%

40

Corporate

—

(13.0)

—

(13.0)

—

(11.9)

—

(11.9)

—

(1.1)

Total

$358.9

$5.9

$10.3

$16.2

4.5%

$402.6

$10.1

$14.2

$24.3

6.0%

$(43.7)

(10.9)%

$(8.1)

(33.3)%

(150)

Q2:

ACCO Brands Americas

$292.3

$(108.7)

$171.9

$63.2

21.6%

$336.4

$60.4

$6.4

$66.8

19.9%

$(44.1)

(13.1)%

$(3.6)

(5.4)%

170

ACCO Brands International

146.0

7.8

3.9

11.7

8.0%

157.2

7.1

4.6

11.7

7.4%

(11.2)

(7.1)%

—

—%

60

Corporate

—

(10.3)

—

(10.3)

—

(12.3)

—

(12.3)

—

2.0

Total

$438.3

$(111.2)

$175.8

$64.6

14.7%

$493.6

$55.2

$11.0

$66.2

13.4%

$(55.3)

(11.2)%

$(1.6)

(2.4)%

130

Q3:

ACCO Brands Americas

$259.1

$25.9

$10.8

$36.7

14.2%

$284.4

$33.8

$6.2

$40.0

14.1%

$(25.3)

(8.9)%

$(3.3)

(8.2)%

10

ACCO Brands International

161.8

9.5

7.6

17.1

10.6%

163.6

9.4

7.6

17.0

10.4%

(1.8)

(1.1)%

0.1

0.6%

20

Corporate

—

(9.1)

—

(9.1)

—

(11.0)

—

(11.0)

—

1.9

Total

$420.9

$26.3

$18.4

$44.7

10.6%

$448.0

$32.2

$13.8

$46.0

10.3%

$(27.1)

(6.0)%

$(1.3)

(2.8)%

30

Q4:

ACCO Brands Americas

$251.3

$31.2

$10.4

$41.6

16.6%

$284.9

$(62.6)

$112.2

$49.6

17.4%

$(33.6)

(11.8)%

$(8.0)

(16.1)%

(80)

ACCO Brands International

196.8

24.0

8.4

32.4

16.5%

203.7

23.4

8.3

31.7

15.6%

(6.9)

(3.4)%

0.7

2.2%

90

Corporate

—

(13.2)

3.4

(9.8)

—

(13.6)

0.6

(13.0)

—

3.2

Total

$448.1

$42.0

$22.2

$64.2

14.3%

$488.6

$(52.8)

$121.1

$68.3

14.0%

$(40.5)

(8.3)%

$(4.1)

(6.0)%

30

YTD:

ACCO Brands Americas

$999.9

$(45.5)

$199.3

$153.8

15.4%

$1,135.7

$43.9

$131.2

$175.1

15.4%

$(135.8)

(12.0)%

$(21.3)

(12.2)%

—

ACCO Brands International

666.3

54.1

24.0

78.1

11.7%

697.1

49.6

28.3

77.9

11.2%

(30.8)

(4.4)%

0.2

0.3%

50

Corporate

—

(45.6)

3.4

(42.2)

—

(48.8)

0.6

(48.2)

—

6.0

Total

$1,666.2

$(37.0)

$226.7

$189.7

11.4%

$1,832.8

$44.7

$160.1

$204.8

11.2%

$(166.6)

(9.1)%

$(15.1)

(7.4)%

20

See "Notes to Reconciliations of GAAP to

Adjusted Non-GAAP Information and Net Loss to Adjusted EBITDA

(Unaudited)" for further information regarding adjusted items.

ACCO Brands Corporation and

Subsidiaries

Supplemental Net Sales Change

Analysis (Unaudited)

% Change - Net Sales

$ Change - Net Sales (in

millions)

GAAP

Non-GAAP

GAAP

Non-GAAP

Net Sales Change

Currency Translation

Comparable Sales Change

(A)

Net Sales Change

Currency Translation

Comparable Sales Change

(A)

Comparable Sales

Q1 2024:

ACCO Brands Americas

(14.3)%

1.0 %

(15.3)%

$(32.8)

$2.4

$(35.2)

$194.8

ACCO Brands International

(6.3)%

(0.4)%

(5.9)%

(10.9)

(0.7)

(10.2)

162.4

Total

(10.9)%

0.4 %

(11.3)%

$(43.7)

$1.7

$(45.4)

$357.2

Q2 2024:

ACCO Brands Americas

(13.1)%

(0.4)%

(12.7)%

$(44.1)

$(1.5)

$(42.6)

$293.8

ACCO Brands International

(7.1)%

(2.0)%

(5.1)%

(11.2)

(3.2)

(8.0)

149.2

Total

(11.2)%

(1.0)%

(10.2)%

$(55.3)

$(4.7)

$(50.6)

$443.0

Q3 2024:

ACCO Brands Americas

(8.9)%

(2.3)%

(6.6)%

$(25.3)

$(6.4)

$(18.9)

$265.5

ACCO Brands International

(1.1)%

1.2 %

(2.3)%

(1.8)

2.0

(3.8)

159.8

Total

(6.0)%

(1.0)%

(5.0)%

$(27.1)

$(4.4)

$(22.7)

$425.3

Q4 2024:

ACCO Brands Americas

(11.8)%

(3.9)%

(7.9)%

$(33.6)

$(11.2)

$(22.4)

$262.5

ACCO Brands International

(3.4)%

(0.3)%

(3.1)%

(6.9)

(0.7)

(6.2)

197.5

Total

(8.3)%

(2.4)%

(5.9)%

$(40.5)

$(11.9)

$(28.6)

$460.0

2024 YTD:

ACCO Brands Americas

(12.0)%

(1.5)%

(10.5)%

$(135.8)

$(16.7)

$(119.1)

$1,016.6

ACCO Brands International

(4.4)%

(0.4)%

(4.0)%

(30.8)

(2.6)

(28.2)

668.9

Total

(9.1)%

(1.1)%

(8.0)%

$(166.6)

$(19.3)

$(147.3)

$1,685.5

(A) Comparable sales represents net sales

excluding material acquisitions, if any, and with current-period

foreign operation sales translated at the prior-year currency

rates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220144637/en/

For further information:

Christopher McGinnis Investor Relations (847) 796-4320

Kori Reed Media Relations (224) 501-0406

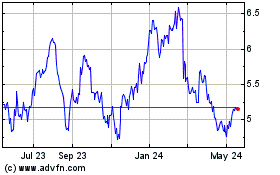

Acco Brands (NYSE:ACCO)

Historical Stock Chart

From Jan 2025 to Feb 2025

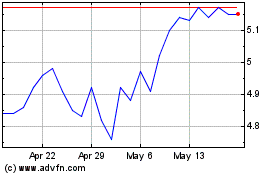

Acco Brands (NYSE:ACCO)

Historical Stock Chart

From Feb 2024 to Feb 2025