Filed by JEPLAN Holdings, Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: AP Acquisition Corp

Commission File No.: 001-41176

Filed July 25, 2023

This filing reflects corrections to the English translation of

an article first published in Japanese in the September 2023 issue of Forbes Japan magazine, released in Japan on July 25,

2023, local time. The initial English translation of the Forbes Japan article was filed with the

Securities and Exchange Commission pursuant to Rule 425 under the Securities Act of 1933, as amended (and deemed filed pursuant to

Rule 14a-12 under the Securities Exchange Act of 1934, as amended) on July 25, 2023. The translation contained herein supersedes

in its entirety the prior filing on July 25, 2023.

While attempts to provide an accurate translation

of the original Forbes Japan article in Japanese have been made, due to linguistic nuances, slight differences may exist.

This translation is made as a matter of record

only and does not constitute an offer to sell or to solicit an offer to buy any securities in the United States.

TOWARDS CIRCULAR ECONOMY

Michihiko Iwamoto

Founder, Director, Executive Chairman of JEPLAN

To be listed on the NYSE for "Above Ground Resources."

A "hope" that companies from around the world seek to partner

with.

As we move toward a decarbonized society, there

is a Japanese venture company that is receiving an endless stream of offers of factory space and partnerships from Japan and abroad. It

all began 16 years ago with the fantasy of a salesman at a textile trading company who envisioned a world without conflict over resources.

[graphic/photograph with caption]

Text by Forbes JAPAN photographs by Naoto Ikeda

edit by Hirokuni Kanki

MICHIHIKO IWAMOTO

Born in Kagoshima Prefecture in 1964, he graduated

from the University of Kitakyushu (now the University of Kitakyushu) in 1988 and worked for a trading company specializing in textiles,

where he was engaged in sales. In 1995, he became deeply involved in textile recycling after the enactment of the Containers and Packaging

Recycling Law. In 2007, he co-founded Nihon Kankyo Sekkei (now JEPLAN) with current president Masaki Takao. In 2015, he was elected Ashoka

Fellow. In 2016, he became Director, Executive Officer, and Chairman.

If each does not do its part, the recycling frame

cannot turn.

As we were shooting

the cover photo with the bare steel frame and pipes of the plant in the background, Michihiko Iwamoto, Chairman of JEPLAN, laughed, "A

venture company shouldn't have such a huge plant." he said. Nevertheless, JEPLAN is expected to list on the New York Stock Exchange

(NYSE) within the year. The ten Japanese companies currently listed on the NYSE, including Sony, Honda, Toyota, and MUFG, are all large

corporations. If JEPLAN, a small- to medium-sized venture founded in 2007, can follow them, it would be a historic accomplishment for

the Japanese economy.

PET Refine Technology's chemical recycling plant

in Kawasaki is one of the world's largest, with an area that could fit 15 Tokyo Domes. The plant is a two-shift, 24-hour operation and

chemically processes polyethylene terephthalate (PET) resin bottles, or PET bottles, to produce small chunks of recycled PET resin called

"pellets. Beverage manufacturers purchase these pellets to make new PET bottles. The annual production capacity of PET resin amounts

to 22,000 tons.

In addition to the Kawasaki Plant, JEPLAN operates

the Kitakyushu Hibikinada Plant in Kitakyushu City, which also produces recycled polyester resin from polyester for use in clothing. This

one is for textile use, with an annual production capacity of 1,000 tons. Apparel makers can use this resin as a raw material to make

clothing. JEPLAN is currently attracting investment from around the world, as well as more than 50 factory invitations and partnerships.

The Roadmap to “World Peace" Charted

by the Two People

The reason why JEPLAN (formerly Nihon Kankyo Sekkei),

which Iwamoto and President Masaki Takao founded in 2007 with a total of 1.2 million yen, has attracted worldwide attention. It is because,

unlike a mere recycling company, JEPLAN is a "mechanism company" that creates "above-ground resources.

JEPLAN is not only involved in the commercial

plant and technology licensing business related to PET chemical recycling technology to recycle PET bottles and polyester fibers, but

also in the recycling of clothes, glasses, cell phones, and toys, as well as the production and sale of recovered, recycled, and manufactured

products under the "BRING" brand, which makes clothes from recovered clothes. To make this happen, JEPLAN also has a marketing

company aspect, planning and managing projects to recycle products while collaborating with domestic and international companies across

industries.

As of April 2023, 197 brands were participating

in the "BRING" project to collect unwanted clothes in stores, with 4,299 collection locations. Participating companies include

apparel manufacturers such as MUJI and MUJI brands, Patagonia, and department stores such as Takashimaya, Daimaru, and Matsuzakaya.

In August 2022, JEPLAN raised 2.4 billion

yen from investment firms Baillie Gifford, MPower Partners, Tokio Marine & Nichido Fire Insurance, and others for its network

for collecting unwanted clothing, as well as its licensing of proprietary technology, expertise in laying out and operating factories,

and development of apparel brands. Iwamoto enjoys the fact that "my business partners ask me, “What does JEPLAN want to do?”

Iwamoto says happily.

We just want to circulate "above ground resources”.

PET and polyester fiber are made from petroleum,

and if PET bottles and 100% polyester fiber clothing can be recycled with high quality and semi-permanently, what was once "trash"

can be used as a new "aboveground resource”. If aboveground resources can be recycled, CO2 emissions can be reduced, wars and

terrorism over underground resources can be reduced, and a peaceful world can be created. This is Iwamoto's vision.

He likens JEPLAN's form to that of a "general

trading company”. To understand the reason for JEPLAN's diversified business operations, one must go back 16 years to when Iwamoto

and Takao started JEPLAN.

Delusion" of cars running with clothes as

raw materials.

It was the movie "Back to the Future Part 2"

(1989) that got Iwamoto thinking about recycling. After seeing the "DeLorean," a car-type time machine powered by garbage, Iwamoto

was convinced that "In the future, garbage will become a resource. And it is Japanese technology that will make this possible”.

This desire became stronger at the textile trading

company where he found employment. He had doubts about the percentage of clothing in the total waste stream. Textiles are technically

difficult to recycle, and while about 20% is reused or recycled, the remaining 80% is buried or incinerated. It was a one-way street:

large quantities were made, used, and trashed.

Then one day in 2006, while reading the newspaper, I

learned that ethanol, a biofuel, could be produced from corn. It was possible to produce bioethanol from clothes made from the same plant,

cotton. If so, used T-shirts could be converted into a "resource" that could be sold as fuel. With this idea in mind, I

consulted Takao, a young drinking buddy of mine who was a graduate student at the University of Tokyo.

Iwamoto uses the word "delusion" when

describing his vision for JEPLAN. He says, "I have a fantasy that clothes can be used to make cars run, factories run, and fuel to

make airplanes fly”. He tells his fantasy to various people, invites others to join him, and together they work to bring it to fruition,

making the most of their respective fields of expertise.

Takao was one of the first people to go along

with this fantasy. With the cooperation of Osaka University, the two succeeded in breaking down (saccharifying) a 100% cotton T-shirt

to produce bioethanol. Iwamoto said cheerfully, "I started JEPLAN by saying, 'If I had a million yen’, I could build a

company”. President Takao says, "I don't remember thinking too much about it," but he did see the potential of the business.

I just felt that it had the potential to expand as a business in the future in relation to the development of the uniform recycling business,

and I thought it would be interesting," he said.

As expected, JEPLAN has expanded its business

from the idea and technology of making bioethanol from cotton products, to recycling polyester fiber from polyester fibers, and PET bottle

resin from PET bottles.

The "axis" that spins the wheel of recycling

However, "technology" is not the only

reason why JEPLAN has grown so much. JEPLAN's greatest strength lies in the fact that Iwamoto and Takao are involved in the recycling

process, while at the same time involving other companies and working together to create a form that will realize their vision of "recycling

everything," or "creating a complete recycling-oriented society”. This was the most realistic, albeit puzzling, solution

they arrived at as a result of their consideration of the conventional recycling philosophy and reality.

The recycling process usually consists of (1) manufacturers

making products, (2) consumers purchasing those products, and (3) reusing the unwanted products as resources instead of discarding

them.

Although manufacturers often take some measures

from the perspective of laws and regulations and corporate social responsibility (CSR), consumers actually have a greater role to play

by returning unused items to manufacturers and retailers. Therefore, a fully recycling- oriented society will not be realized unless a

B2B2C structure is established in which consumers (C) participate in the activities of companies (B2B). In reality, however, Iwamoto

says, "It is difficult to turn it around”. Where do we stumble? “Inevitably, people give up on the idea of recycling

because of “other companies”. In recycling, there are roles to be played by manufacturers (production), retailers (sales and

collection), consumers (purchase and bringing in), and recyclers (recycling). Only then can the axis be formed and the frame turn, but

the frame did not turn because of other companies. So, even if the logic is sound and a picture is drawn, it is difficult to realize a

complete recycling-oriented society. So we decided that we had no choice but to become the hub (axis)."

JEPLAN had the technology. However, Iwamoto

also knew that technology alone was not enough to make a business run. In his book, "The 'Future of No Waste' Will Come from This

Business," Iwamoto writes, "In reality, the most difficult part of making recycling a business is not the technology. The most

important point was how to “collect” the materials, that is, to create a lead line for collecting them”.

So what did Iwamoto and Takao do? They decided

to survey consumers, who hold the key to "collection." And when asked "what" and "where" they would like

to recycle, many answered "clothing" and "at the store where I bought it". Therefore, with the cooperation of Ryohin

Keikaku, Aeon Retail, Marui Group, and others, we decided to conduct a collection experiment. When we tested how in-store clothing collections

would affect store customer traffic and sales, we found that stores with in-store collection boxes performed better. It turned out that

stores with in-store collection boxes were more profitable.

Iwamoto and his team named and branded the clothing

collection project that made this flow line collection possible, integrating it with the plastic version of the project they started in

2012, which collects and recycles plastics, and evolving it into the aforementioned "BRING" brand.

Certainly, technology is an important weapon.

However, what differentiates us from other "recycling companies" as a business is our "structure" and "brand.

Iwamoto explains the "winning formula" as follows.

“The proprietary technology is what made

this mechanism possible. However, the technology is only one of the “cartridges” in the system. What is more important is

the mechanism to make it profitable. If we put up collection boxes, it will have a positive impact on customer attraction and sales. Companies

that understand this are paying us to recycle their brands.”

A "new planet" attracts people, goods,

and money.

When Apple introduced the iPhone, some people

said that a Japanese company could quickly create a similar product because it used many components from Japanese companies. However,

Apple differentiated itself by operating platforms such as iTunes and the App Store, and by establishing a market and structure that facilitated

developers' participation. It persistently negotiated contracts and copyrights with music labels and musicians, and offered Apple Music

for subscriptions. JEPLAN is attracting consumers.

Although JEPLAN is developing multifaceted initiatives, Iwamoto

asserts that “JEPLAN's management perspective never wavers because it thinks from the same "consumer perspective”. If

we don't develop technology to do what consumers most want to recycle, they won't look at us. Our recycling of diverse items is simply

responding to consumer needs." (Iwamoto)

In order to bring about a recycling-oriented society

as quickly as possible, it is necessary to make recycling a "personal matter" for consumers. Since 2015, Iwamoto has been

conducting various marketing activities to change consumer behavior, including an event in which consumers can drive actual cars powered

by bioethanol made from cotton. He asked the U.S. film company Universal Studios for cooperation under the guise of "efforts to create

a recycling-oriented society," and with the company's official approval, "recreated" the scene in the movie "Back

to the Future Part 2" where the DeLorean arrives in the future (October 21, 2015). Such attempts and initiatives will change

consumer awareness and create incentives for manufacturers and retailers to be more actively involved in the recycling society.

The powerful message of "creating a recycling-oriented

society" leads to business that transcends national borders. Just as Universal Studios headquarters resonated with JEPLAN, Iwamoto

says that partnerships with well-known overseas companies and numerous brands have led to increased trust and recognition of JEPLAN in

Japan. Meanwhile, the partnership with Axens, a French state-owned company, is encouraging the development of PET commercial plant business

around the world. By partnering with industry leaders, it is easier to gain the trust of other companies," Iwamoto said. Iwamoto

says that foreign investors strongly value such "involvement”.

For foreign investors,

they think more about a recycling-oriented society 10 to 20 years from now than they do about profits today. One investor said to me,

“You guys have created a planet!”. The gravity of the planet sucks in people, goods, money, and information. The important

thing is not to pursue immediate sales and profits, but to create a 'new planet' on which to gather them.

Iwamoto and Takao's goal with JEPLAN was to create

a planet free of underground resources, where a recycling-oriented society revolving around above-ground resources is complete. In the

process, they found another "planet" filled with blue oceans.

The following are notes other than those in the

text:

JEPLAN

JEPLAN was established in January 2007 with

capital of 8,681.7 million yen (including capital reserve). Formerly known as Nihon Kankyo Sekkei. With the vision of recycling all things,

JEPLAN aims to recycle limited resources by promoting manufacturing using its proprietary PET chemical recycling technology, business

development, and deployment of technology licenses. Masaki Takao was appointed President and Representative Director in 2016.

Photo Description 1

Polyester resin recycled from polyester fibers

using JEPLAN's chemical recycling technology (BHET method). In addition to reducing the use of petroleum resources required for manufacturing,

it also reduces CO2 emissions.

Photo Description 2

The DeLorean from the "Back to the Future"

movie series. PART 2 of the future version is fueled by garbage; at the 2015 event, JEPLAN recycled collected clothing into fuel,

just like in the movie, and drove the actual car.

BRING Technology Description 3

JEPLAN's patented proprietary technology extracts

BHET, the monomer that makes up PET resin, to a high degree of purity. After impurities are removed by a chemical process, they are repolymerized

into a polymer and returned to PET resin.

Photo Description 4

A project to collect used clothing and textiles

under the "BRING" brand. Collection boxes are set up in stores of participating companies, and non-polyester clothing is also

collected and recycled (with some exceptions).

Photo Description 5

JEPLAN Kitakyushu Hibikinada Plant, completed

in 2017. The plant will produce recycled resin for textiles from recovered clothing and polyester fibers from the manufacturing process.

The plant is also equipped with a line for extracting precious metals from cell phones.

Photo Description 6

The BRING Material site lists brands and manufacturers,

including Patagonia, that use BRING Material.

Photo Description 7

JEPLAN, which aims to play the role of a hub in

the "circle" of recycling, plans, manufactures, and wholesales its own brand of clothing, and operates a directly managed BRING

store (Ebisu, Tokyo).

Photo Description 8

President Takao and Chairman Iwamoto, who founded

JEPLAN in 2007, met at a cross- industrial exchange meeting. They met at a cross-industrial exchange meeting. President Takao took over

the management baton in 2016, and Chairman Iwamoto supports him as a spokesperson. Takao says, "I will do everything that Iwamoto

does not do”.

Photo Description 9

In front of a bag full of recycled PET resin awaiting

shipment. Iwamoto wears a jacket, T- shirt, and jeans all made by BRING. Will the time come in Japan when a company's attitude toward

the environment = a brand that is popular among people of all ages?

Photo Description 10

In May 2023, JEPLAN announced a partnership

with UAE-based Rebound, a company with international operations in the recycled plastics trading market, for the construction of a PET

chemical recycling plant (President Takao is on the far left). UAE will host COP28 in November.

Forward-Looking Statements

This document contains certain forward-looking

statements within the meaning of the federal securities laws with respect to a potential business combination by and among JEPLAN Holdings, Inc.,

a Japanese corporation (“PubCo”), AP Acquisition Corp, a Cayman Islands exempted company (“APAC”), JEPLAN MS, Inc.,

a Cayman Islands exempted company, and JEPLAN, Inc., a Japanese corporation (“JEPLAN”) and related transactions (collectively,

the “Potential Business Combination”), including statements regarding the anticipated timing of a listing on the New York

Stock Exchange, JEPLAN’s business plans and growth strategies, the technologies and products and services offered by JEPLAN and

the markets in which it operates, and JEPLAN’s projected future results. These forward-looking statements generally are identified

by the words “believe,” “project,” “forecast,” “predict,” “expect,” “anticipate,”

“estimate,” “intend,” “seek,” “strategy,” “future,” “outlook,”

“target,” “opportunity,” “plan,” “potential,” “may,” “seem,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar

expressions that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements

include, but are not limited to, predictions, projections and other statements about future events that are based on current expectations

and assumptions of JEPLAN’s, PubCo’s and APAC’s management, whether or not identified in this document, and, as a result,

are subject to risks and uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended

to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or

probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events

and circumstances are beyond the control of JEPLAN, PubCo, and APAC. Many factors could cause actual future events to differ materially

from the forward-looking statements in this document, including, but not limited to: (i) the risk that the Potential Business Combination

may not be completed in a timely manner or at all, which may adversely affect the price of PubCo’s securities, (ii) the risk

that the Potential Business Combination may not be completed by APAC’s business combination deadline and the potential failure to

obtain an extension of the business combination deadline if sought by APAC, (iii) the failure to satisfy the conditions to the consummation

of the Potential Business Combination, including the adoption of the business combination agreement by the respective shareholders of

APAC and JEPLAN, the satisfaction of the minimum cash amount following redemptions by APAC’s public shareholders and the receipt

of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue

the Potential Business Combination, (v) the occurrence of any event, change or other circumstance that could give rise to the termination

of the business combination agreement, (vi) the effect of the announcement or pendency of the Potential Business Combination on JEPLAN’s

business relationships, performance, and business generally, (vii) risks that the Potential Business Combination disrupts current

plans of JEPLAN and potential difficulties in its employee retention as a result of the Potential Business Combination, (viii) the

outcome of any legal proceedings that may be instituted against JEPLAN or APAC related to the business combination agreement or the Potential

Business Combination, (ix) failure to realize the anticipated benefits of the Proposed Business Combination, (x) the inability

to maintain the listing of APAC’s securities or to meet listing requirements and maintain the listing of PubCo’s securities

on the New York Stock Exchange, (xi) the risk that the price of PubCo’s securities may be volatile due to a variety of factors,

including changes in the highly competitive industries in which PubCo plans to operate, variations in performance across competitors,

changes in laws, regulations, technologies, natural disasters or health epidemics/pandemics, national security tensions, and macro-economic

and social environments affecting its business, and changes in the combined capital structure, (xii) the inability to implement business

plans, forecasts, and other expectations after the completion of the Potential Business Combination, identify and realize additional opportunities,

and manage its growth and expanding operations, (xiii) the risk that JEPLAN may not be able to successfully expand its products and

services domestically and internationally, (xiv) the risk that JEPLAN and its current and future collaborative partners are unable

to successfully market or commercialize JEPLAN’s proposed licensing solutions, or experience significant delays in doing so, (xv) the

risk that JEPLAN may never achieve or sustain profitability, (xvi) the risk that JEPLAN will need to raise additional capital to

execute its business plan, which many not be available on acceptable terms or at all, (xvii) the risk relating to scarce or poorly

collected raw materials for JEPLAN’s PET recycling business; (xviii) the risk that JEPLAN may not be able to consummate planned

strategic acquisitions, including joint ventures in connection with its proposed licensing business, or fully realize anticipated benefits

from past or future acquisitions, joint ventures, or investments; (xix) the risk that JEPLAN’s patent applications may not

be approved or may take longer than expected, and that JEPLAN may incur substantial costs in enforcing and protecting its intellectual

property; and (xx) the risk that JEPLAN may be subject to competition from current collaborative partners in the use of jointly developed

technology once applicable collaborative arrangements expire. The foregoing list of factors is not exhaustive. You should carefully consider

the foregoing factors, any other factors discussed in this document and the other risks and uncertainties described in the “Risk

Factors” sections of APAC’s Annual Report on Form 10-K for the year ended December, 31, 2022, which was filed with the

U.S. Securities and Exchange Commission (the “SEC”) on March 3, 2023 (the “2022 Form 10-K”), as such

factors may be updated from time to time in APAC’s filings with the SEC, the Registration Statement (as defined below) and proxy

statement/prospectus contained therein. These filings identify and address other important risks and uncertainties that could cause actual

events and results to differ materially from those contained in the forward-looking statements. There may be additional risks that neither

JEPLAN, PubCo nor APAC presently knows or that JEPLAN, PubCo, and APAC currently believe are immaterial that could also cause actual results

to differ from those contained in the forward-looking statements. Forward-looking statements reflect JEPLAN’s, PubCo’s, and

APAC’s expectations, plans, or forecasts of future events and views only as of the date they are made. JEPLAN, PubCo, and APAC anticipate

that subsequent events and developments will cause JEPLAN’s, PubCo’s, and APAC’s assessments to change. However, while

JEPLAN, PubCo, and APAC may elect to update these forward-looking statements at some point in the future, JEPLAN, PubCo, and APAC specifically

disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing JEPLAN’s, PubCo’s,

and APAC’s assessments of any date subsequent to the date of this document. Accordingly, readers are cautioned not to put undue

reliance on forward-looking statements, and JEPLAN, PubCo and APAC assume no obligation and do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise, unless required to by applicable securities law. Neither

JEPLAN, PubCo, nor APAC gives any assurance that PubCo will achieve its expectations.

Additional Information

This document relates to the Proposed Business

Combination by and among PubCo, APAC, Merger Sub, and JEPLAN. If the Proposed Business Combination is pursued, PubCo intends to file with

the SEC a registration statement on Form F-4 relating to the Potential Business Combination (the “Registration Statement”)

that will include a proxy statement/prospectus of APAC. The proxy statement/prospectus will be sent to all APAC and JEPLAN shareholders.

PubCo and APAC also will file other documents regarding the Potential Business Combination with the SEC. Before making any voting decision,

investors and security holders of APAC and JEPLAN are urged to read the Registration Statement, the proxy statement/prospectus contained

therein and all other relevant documents filed or that will be filed with the SEC in connection with the Potential Business Combination

as they become available because they will contain important information about JEPLAN, APAC, PubCo, and the Potential Business Combination.

Investors and security holders will be able to

obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by PubCo

and APAC through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by PubCo and APAC may be obtained

free of charge by written request to PubCo at 12-2 Ogimachi, Kawasaki-ku, Kawasaki-shi, Kanagawa, Japan or by telephone at +81 44-223-7898,

and to APAC at 10 Collyer Quay, #37-00 Ocean Financial Center, Singapore or by telephone at +65 6808-6510.

Participants in the Solicitation

JEPLAN, PubCo, and APAC and their respective directors

and officers and other members of management may, under SEC rules, be deemed to be participants in the solicitation of proxies from APAC’s

shareholders with the Potential Business Combination and the other matters set forth in the Registration Statement. Information about

APAC’s directors and executive officers and their ownership of APAC’s securities is set forth in APAC’s filings with

the SEC, including APAC’s 2022 Form 10-K. To the extent that holdings of APAC’s securities by its directors and executive

officers have changed since the amounts reflected in the 2022 Form 10-K, such changes will be reflected on Statements of Change in

Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may

be deemed participants in the Potential Business Combination may be obtained by reading the proxy statement/prospectus regarding the Potential

Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This document shall not constitute a “solicitation”

as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This document shall not constitute an offer to sell

or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering

of securities in the Proposed Business Combination shall be made except by means of a prospectus meeting the requirements of the U.S.

Securities Act of 1933, as amended.

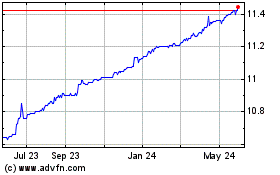

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

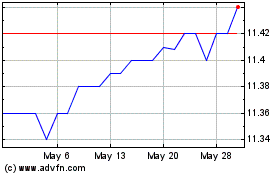

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Dec 2023 to Dec 2024