Ares Management Corporation (“Ares” or the “Company”) (NYSE:

ARES) today announced that it has priced an offering (the

“Offering”) of $750,000,000 aggregate principal amount of its

5.600% Senior Notes due 2054 (the “notes”). The notes will be fully

and unconditionally guaranteed by Ares Holdings L.P., Ares

Management LLC, Ares Investments Holdings LLC, Ares Finance Co.

LLC, Ares Finance Co. II LLC, Ares Finance Co. III LLC and Ares

Finance Co. IV LLC. The Offering is expected to close on October

11, 2024, subject to the satisfaction of customary closing

conditions.

The notes will bear interest at a rate of 5.600% per annum.

Interest on the notes will be payable semi-annually in arrears on

April 11 and October 11 of each year, commencing April 11,

2025.

The net proceeds from the Offering will be approximately $737.7

million, after deducting the underwriting discount, but before

offering expenses. Ares intends to use the net proceeds from the

Offering for (i) the payment of a portion of the cash consideration

due in respect of Ares’ previously announced acquisition of the

international business of GLP Capital Partners Limited and certain

of its affiliates, excluding its operations in Greater China (“GCP

International”), and existing capital commitments to certain

managed funds (the “GCP Acquisition”) and related fees, costs and

expenses and/or (ii) general corporate purposes, including

repayment of debt, other strategic acquisitions and growth

initiatives. Pending such use, Ares may invest the net proceeds in

short-term investments.

Morgan Stanley & Co. LLC, Citigroup Global Markets Inc., RBC

Capital Markets, LLC, SMBC Nikko Securities America, Inc., and

Truist Securities, Inc. are acting as joint book-running managers

for the Offering. Ares Management Capital Markets LLC, Barclays

Capital Inc., BNY Mellon Capital Markets, LLC, BofA Securities,

Inc., Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC,

J.P. Morgan Securities LLC, MUFG Securities Americas Inc., UBS

Securities LLC, U.S. Bancorp Investments, Inc., Wells Fargo

Securities, LLC, AmeriVet Securities, Inc., Loop Capital Markets

LLC, R. Seelaus & Co., LLC, Samuel A Ramirez & Company,

Inc., and Siebert Williams Shank & Co., LLC are acting as

co-managers for the Offering. The Offering is being made pursuant

to an effective shelf registration statement on file with the U.S.

Securities and Exchange Commission (the “SEC”).

The Offering is being made only by means of a preliminary

prospectus supplement and accompanying prospectus. An electronic

copy of the preliminary prospectus supplement, together with the

accompanying prospectus, is available on the SEC’s website at

www.sec.gov. Alternatively, copies of the preliminary prospectus

supplement and accompanying prospectus may be obtained by

contacting Morgan Stanley, 180 Varick Street, 2nd Floor, New York,

New York 10014, Attention: Prospectus Department; or Citigroup

Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, New York 11717, or by email at

prospectus@citi.com, or by telephone: (800) 831-9146.

This press release does not constitute an offer to sell or a

solicitation of an offer to purchase the notes or any other

securities, nor does it constitute an offer, solicitation or sale

in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful.

About Ares Management Corporation

Ares Management Corporation (NYSE: ARES) is a leading global

alternative investment manager offering clients complementary

primary and secondary investment solutions across the credit, real

estate, private equity and infrastructure asset classes. We seek to

provide flexible capital to support businesses and create value for

our stakeholders and within our communities. By collaborating

across our investment groups, we aim to generate consistent and

attractive investment returns throughout market cycles. As of June

30, 2024, Ares Management Corporation's global platform had over

$447 billion of assets under management, with more than 2,950

employees operating across North America, Europe, Asia Pacific and

the Middle East.

Forward-Looking Statements

Statements included herein contain forward-looking statements

within the meaning of the federal securities laws. You can identify

these forward-looking statements by the use of forward-looking

words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates,”

“foresees” or negative versions of those words, other comparable

words or other statements that do not relate to historical or

factual matters. The forward-looking statements are based on our

beliefs, assumptions and expectations of our future performance,

taking into account all information currently available to us. Such

forward-looking statements are subject to various risks and

uncertainties, including our ability to consummate the Offering and

the GCP Acquisition and to effectively integrate GCP International

into our operations and to achieve the expected benefits therefrom,

and assumptions, including those relating to the GCP Acquisition,

the Offering and the intended use of proceeds, our operations,

financial results, financial condition, business prospects, growth

strategy and liquidity. Some of these factors are described in the

Annual Report on Form 10-K for the year ended December 31, 2023,

including under the headings “Item 1A. Risk Factors” and “Item 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and in the Quarterly Report on Form 10-Q

filed with the SEC on August 7, 2024, including under the heading

“Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.” These factors should not be

construed as exhaustive and should be read in conjunction with the

risk factors and other cautionary statements that are included in

this report and in our other periodic filings. If one or more of

these or other risks or uncertainties materialize, or if our

underlying assumptions prove to be incorrect, our actual results

may vary materially from those indicated in these forward-looking

statements. New risks and uncertainties arise over time, and it is

not possible for the Company to predict those events or how they

may affect us. Therefore, you should not place undue reliance on

these forward-looking statements. Any forward-looking statement

speaks only as of the date on which it is made. Ares does not

undertake any obligation to update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009487858/en/

Investors: Greg Mason or Carl Drake

irares@aresmgmt.com +1-888-818-5298

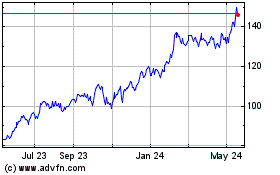

Ares Management (NYSE:ARES)

Historical Stock Chart

From Feb 2025 to Mar 2025

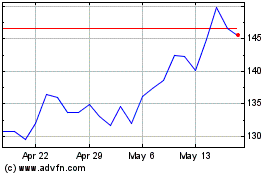

Ares Management (NYSE:ARES)

Historical Stock Chart

From Mar 2024 to Mar 2025