Form 8-K - Current report

08 November 2024 - 8:31AM

Edgar (US Regulatory)

false 0001736946 0001736946 2024-11-05 2024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 5, 2024

ARLO TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38618 |

|

38-4061754 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

|

|

|

|

| 2200 Faraday Ave., Suite #150 |

|

|

|

|

| Carlsbad, California |

|

|

|

92008 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

(408) 890-3900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.001 per share |

|

ARLO |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As previously disclosed, on August 22, 2022, the Board of Directors (the “Board”) of Arlo Technologies, Inc. (the “Company”) approved an executive retention plan and delegated authority to the Compensation and Human Capital Committee of the Board (the “Committee”) to approve individual retention agreements (the “Retention Agreements”) with the Company’s Chief Executive Officer, Matt McRae and General Counsel, Brian Busse. The Retention Agreements provide Messrs. McRae and Busse with certain cash bonus opportunities and equity grants that vest upon achievement by the Company of specified cumulative paid subscriber and gross margin goals over a five-year performance period beginning in September 2022.

On November 5, 2024, the Committee approved an amendment (the “Amendment”) to the Retention Agreements to provide that in lieu of the final incremental cash bonus that Messrs. McRae and Busse, respectively, are eligible to be paid upon achievement of 5,000,000 cumulative paid subscribers (the “Final Cash Retention Bonus”), the Company would instead grant each of Messrs. McRae and Busse a performance-vesting restricted stock unit award (the “Substitute Awards”). The number of performance stock units subject to each Substitute Award will be determined by dividing the value of the Final Cash Retention Bonus ($2,000,000 and $200,000 for Messrs. McRae and Busse, respectively) by the 30-day trailing average price per share of the Company’s common stock calculated as of the grant date of the Substitute Awards, which shall be the first trading day following the release of earnings for the third quarter of 2024. The Substitute Awards will vest in full upon achievement of all of the following issuance conditions: (i) achievement by the Company of 5,000,000 cumulative paid subscribers on or before September 30, 2027; (ii) determination that the blended margins on such cumulative paid subscriber accounts equal or exceed the Required Margin (as defined in the Retention Agreements); (iii) achievement by the Company of at least $300,000,000 in annual recurring revenue on or before September 30, 2027; and (iv) continuous service by Messrs. McRae and Busse through the later of (a) October 1, 2025, and (b) the date on which the last of the issuance conditions described in the foregoing clauses (i), (ii) and (iii) above are achieved.

A copy of the form of Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K. The above summary of the Amendment does not purport to be complete and is qualified in its entirety by reference to Exhibit 10.1.

On November 7, 2024, the Company made available a presentation regarding its executive compensation program to be used in meetings with its investors and stockholders. The presentation is attached hereto as Exhibit 99.1 and incorporated by reference herein. A copy of the presentation will also be available on the Company’s investor website under the Events & Presentations section at investor.arlo.com.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

| * |

Indicates management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| ARLO TECHNOLOGIES, INC. |

|

|

| By: |

|

/s/ Kurtis Binder |

|

|

|

| Name: |

|

Kurtis Binder |

| Title: |

|

Chief Financial Officer and

Chief Operating Officer |

Date: November 7, 2024

Exhibit 10.1

ARLO TECHNOLOGIES, INC.

RETENTION AGREEMENT AMENDMENT

[Matthew McRae][Brian Busse] (“You”, or the “Executive”) and Arlo Technologies, Inc. (the

“Company”) entered into that certain Retention Agreement effective as of November 6, 2024 (the “Retention Agreement”).

This letter agreement (this “Agreement”) modifies certain provisions of the Retention Agreement, as further described below.

Terms not otherwise defined herein shall have the same meaning ascribed to such term in the Retention Agreement.

1. Final Retention

Bonus. In lieu of an incremental Retention Bonus cash payout amount of $[2,000,000][200,000] (the “Cash Value”) otherwise payable upon achievement by the Company of five million (5,000,000) Cumulative Paid Subscribers on or

prior to the end of the Performance Period (such last day of the Performance Period, the “Performance Period End Date”) (the “Final Retention Bonus”), you will instead be granted performance stock units

(“PSUs”) that will vest in full upon achievement, as determined by the Compensation Committee, of all of the following issuance conditions (such PSUs, the “Substitute Award”):

(i) achievement by the Company of five million (5,000,000) Cumulative Paid Subscribers on or prior to the Performance Period End Date (the

“Cumulative Paid Subscriber Threshold”);

(ii) determination that the blended margins on such Cumulative Paid Subscriber

accounts equal or exceed the Required Margin (the “Margin Threshold”); provided, that, once the Cumulative Paid Subscriber Threshold has been achieved (upon determination of such by the Committee), such metric shall be deemed

to have been achieved at all times through and including the Performance Period End Date;

(iii) achievement by the Company of at least

three hundred million U.S. dollars ($300,000,000) in Annual Recurring Revenue prior to the Performance Period End Date (the “ARR Goal”); provided, that, once the ARR Goal has been achieved, such metric shall be deemed to have

been achieved at all times through and including the Performance Period End Date; and

(iv) your continuous service as a Service Provider

through the later of (a) October 1, 2025, (b) the date on which the last of the issuance conditions described in Clauses (i), (ii) and (iii) above are achieved, except as otherwise provided below.

The Compensation Committee may determine achievement of each of the issuance conditions described in Clauses (i), (ii) and (iii) above in

one action or in separate actions at different times and if the Compensation Committee has determined that all such issuance conditions described in Clauses (i), (ii) and (iii) have been met prior to the Performance Period End Date, the

Substitute Award shall automatically vest upon satisfaction of the issuance condition described in Clause (iv) without any further action by the Compensation Committee.

The number of stock units subject to the Substitute Award shall be determined by dividing the Cash Value by the

30-day trailing average price per share of the Company’s Common Stock calculated as of the date of grant, and inclusive of such grant date, as determined by the Company. The Substitute Award shall be

granted on or about November 8, 2024.

The complete terms of the Substitute Award will be set forth in a Notice of Grant and

Agreement to be provided to you.

“Annual Recurring Revenue” means the amount of paid service revenue expected to recur

annually, calculated by multiplying Recurring Paid Service Revenue for the most recently completed calendar month by 12. Recurring Paid Service Revenue means revenue recognized from paid accounts, excluding prepaid service revenue. For the

avoidance of doubt, Annual Recurring Revenue shall be calculated each month on or as reasonably practicable after the last business day of a calendar month, in the same manner as the Company calculates Annual Recurring Revenue for purposes of the

Company’s quarterly financial reports on Form 10-Q.

1

2. Impact of Employment Termination and Change in Control. For the avoidance of

doubt, the Substitute Award shall be subject to the terms and conditions described in Section IV of the Retention Agreement as if the Substitute Award were a Retention PSU.

3. Entire Agreement. This Agreement constitutes the entire agreement of the parties and supersedes the Retention Agreement with respect

to the terms expressly set forth herein and all other prior representations, understandings, undertakings or agreements (whether oral or written and whether expressed or implied) of the parties with respect to the subject matter of this Agreement,

including, for the avoidance of doubt, any other employment letter or agreement, severance policy or program, or equity award agreement. By signing below, you acknowledge and agree that you shall have no further rights to the cash Retention Bonus

payable upon Five (5) Million Cumulative Paid Subscribers as defined and further described in the Retention Agreement. This Agreement may be amended by the Board or Compensation Committee; provided that no amendment will adversely affect

your rights without your written consent.

4. Section 409A. The Company intends that all payments and benefits provided under this

Agreement or otherwise are exempt from, or comply with, the requirements of Section 409A of the Code and any guidance promulgated under Section 409A of the Code (collectively, “Section 409A”) so

that none of the payments or benefits will be subject to the additional tax imposed under Section 409A, and any ambiguities in this Agreement will be interpreted in accordance with this intent. No payment or benefits to be paid to you

(including settlement of Company equity awards that constitute deferred compensation under Section 409A), if any, under this Agreement or otherwise, when considered together with any other severance payments or separation benefits that are

considered deferred compensation under Section 409A (together, the “Deferred Payments”) will be paid or otherwise provided until you have a “separation from service” within the meaning of Section 409A. If,

at the time of your termination of employment, you are a “specified employee” within the meaning of Section 409A, then the payment of the Deferred Payments will be delayed to the extent necessary to avoid the imposition of the

additional tax imposed under Section 409A, which generally means that you will receive payment on the first payroll date that occurs on or after the date that is 6 months and 1 day following your termination of employment. The Company reserves

the right to amend this Agreement as it considers necessary or advisable, in its sole discretion and without your consent or that of any other individual, to comply with any provision required to avoid the imposition of the additional tax imposed

under Section 409A or to otherwise avoid income recognition under Section 409A prior to the actual payment of any benefits or imposition of any additional tax. Each payment, installment, and benefit payable under this Agreement is intended

to constitute a separate payment for purposes of U.S. Treasury Regulation Section 1.409A-2(b)(2). In no event will any member of the Company Group reimburse, indemnify, or hold you harmless for any taxes,

penalties and interest that may be imposed, or other costs that may be incurred, as a result of Section 409A.

5.

Miscellaneous.

(a) Limitation on Payments. The “Limitation on Payments” section of your CIC Agreement will also

apply to the Substitute Award, including determination of the Best Results Amount (as defined in your CIC Agreement).

(b) At-Will Employment; Jurisdiction. The benefits described in this Agreement are intended to provide a financial incentive to you and does not confer any rights to your continued employment with the Company.

Nothing in this Agreement shall alter your at-will employment relationship. Your rights and obligations under this Agreement will be governed by, and interpreted, construed and enforced in accordance with, the

laws of the State of California without regard to its or any other jurisdiction’s conflicts of laws principles. You and the Company hereby agree and consent to be subject to the exclusive jurisdiction and venue of the state and federal courts

located in the State of California, and hereby waive the right to assert the lack of personal or subject matter jurisdiction or improper venue in connection with any such suit, action or other proceeding.

(c) No Assignment. Neither this Agreement nor any of your rights and obligations under this Agreement may be assigned, transferred or

otherwise disposed of by you. The Company may assign its rights and obligations hereunder to any person or entity that succeeds to all or substantially all of Company’s business or that aspect of Company’s business in which you are

principally involved.

2

(d) Counterparts. This Agreement may be executed in counterparts, each of which will

be deemed an original, but all of which together will constitute one and the same instrument.

[Signature page follows.]

3

By its signature below, each of the parties signifies its acceptance of the terms of this

Agreement, in the case of the Company by its duly authorized officer.

|

|

|

|

|

|

|

| COMPANY |

|

|

|

ARLO TECHNOLOGIES, INC. |

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

| EXECUTIVE |

|

|

|

By: |

|

|

|

|

|

|

|

|

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

[Signature

Page]

Executive Compensation Program Update

November 2024 ©2024 – ALL RIGHTS RESERVED Exhibit 99.1

This presentation contains

forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The words “anticipate,” “expect,” “believe,” “will,” “may,” “should,”

“estimate,” “project,” “outlook,” “forecast” or other similar words are used to identify such forward-looking statements. However, the absence of these words does not mean that the statements are not

forward-looking. The forward-looking statements represent our expectations or beliefs concerning future events based on information available at the time such statements were made and include statements regarding our present expectations regarding

our compensation program and compensation structures we may, or may not, adopt in the future; potential future business, operating performance and financial condition, including descriptions of our expected revenue and profitability (and related

timing), GAAP and non-GAAP gross margins, operating margins, tax rates, expenses, cash outlook, free cash flow and free cash flow margin; strategic objectives and initiatives; the recurring revenue business model; expectations regarding market

expansion and future growth; and others. These statements are based on management's current expectations and are subject to certain risks and uncertainties, including the following: circumstances in the future may lead us to adopt executive

compensation approaches that are different than those described in this presentation; future demand for our products may be lower than anticipated; we may be unsuccessful in developing and expanding our sales and marketing capabilities; we may not

be able to increase sales of our paid subscription services; consumers may choose not to adopt our new product offerings or adopt competing products; product performance may be adversely affected by real world operating conditions; we may be

unsuccessful or experience delays in manufacturing and distributing our new and existing products; we may fail to manage costs and cost saving initiatives, the cost of developing new products and manufacturing and distribution of our existing

offerings.Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such

forward-looking statements. Further information on potential risk factors that could affect our business are detailed in our periodic filings with the Securities and Exchange Commission, including, but not limited to, those risks and uncertainties

listed in the section entitled “Risk Factors” in the most recently filed Annual Report and Quarterly Report filed with the Securities and Exchange Commission (the “SEC”) and subsequent filings with the SEC. Given these

circumstances, you should not place undue reliance on these forward-looking statements. We undertake no obligation to release publicly any revisions to any forward-looking statements contained herein to reflect events or circumstances after the date

hereof or to reflect the occurrence of unanticipated events. SAFE HARBOR DISCLOSURE

Letter from Chair of Compensation and

Human Capital Committee ARLO INVESTOR PRESENTATION: NOV 2024

At the 2024 annual meeting,

Arlo’s “say-on-pay” vote was unsuccessful, gaining support of approximately 41% of votes cast by our shareholders. Arlo’s management and Board of Directors were disappointed with this outcome and engaged in an outreach effort

to shareholders to understand their perspective and respond accordingly. As a result, we are providing additional details on our compensation philosophy which was designed in collaboration with a new compensation consultant and highlighting

immediate actions that we have taken to address the feedback received. Overview Third Quarter 2024 Financial Performance Key Changes Made to Executive Compensation Primary Shareholder Feedback A services-first enterprise drives consistent and

predictable financial performance: Service Revenue up 21% year-over-year Annual Recurring Revenue (ARR) up 21% year-over-year Subscriber growth up 70.4% year-over-year drives Service revenue growth and profitability Operating Income up almost 90%

YTD 2024 versus same period in 2023 Free Cash Flow (FCF) of $17.4 with FCF margin of 12.6% Before the 2024 Annual Meeting, the management team met with 10 shareholders that own 35% of Arlo’s common shares outstanding. Primary feedback received

was: Shareholders emphasized that (i) retention equity grants should only be used in extenuating circumstances and (ii) recurring equity grants should be performance-based and utilize multiple metrics to achieve sustainable shareholder value

creation. Shareholder feedback prompted immediate change: The annual equity grants awarded in January 2024 were already 100% performance-based equity awards (PSUs) and this will continue in 2025 The Compensation and Human Capital Committee affirms

that it has no intention to use special off-cycle equity awards other than for new hires or promotions for the foreseeable future PSU plan design for 2025 will continue to include multiple metrics which are not duplicative in nature to provide

incentive for continued shareholder returns

“Investors are against the use

of retention awards except in extenuating circumstances.” “Concerns about company using duplicative CPS goals across multiple PSU Grants.” “Total compensation for executives (inclusive of retention awards) perceived as high

relative to peers.” “Desire for annual executive PSU awards to include multiple metrics rather than a singular subscriber metric.” Main Concerns Raised by Shareholders and Arlo Response Arlo Response: The Compensation and Human

Capital Committee affirms that it has no intention to use “special” or off-cycle cash or equity retention awards other than for new hires or promotions for the foreseeable future. Arlo Response: Committee chair works with external

compensation consultant in the development of peer group. We are sharing peer group suggestions with companies like ISS and Glass Lewis to ensure proper alignment and comparisons for compensation. Arlo Response: The approved retention award was

unique and designed to address circumstances faced by the company. There are no programs with overlapping goals or duplicative metrics in 2024 and no intention of overlapping metrics in the future. Arlo Response: The 2022 retention program has two

metric triggers: number of paid subscribers and minimum service gross margins of 60%. Future awards will also have additional metrics. “Investors are against the use of retention awards except in extenuating circumstances.” Additional

Information: We approved a retention award program in 2022 and since that date there have been no additional retention programs. The retention award was used to address extenuating circumstances the company was facing at that time. The Compensation

and Human Capital Committee affirms that it has no intention to use any further retention awards for the foreseeable future.

Additional Metrics in PSU Design

Multiple metrics drive sustained value creation Annual Awards are 100% Performance-Based Aligns value with achievement of desired goals Hired new compensation consulting firm New firm worked with high growth tech and Fortune-500 Companies No

intention to use Special Off-Cycle Equity Awards for the foreseeable future New hires and promotions Strong Stock Ownership Guidelines Ownership in top quartile of peer group No Overlapping Performance Metrics for Cash Bonus and PSUs List of

significant changes in response to investor concerns: Modified 2022 Retention Program to replace final cash bonus Replaced with equity that includes additional performance metric for payout

Overview of Executive Compensation

Program Philosophy: The Compensation and Human Capital Committee ensures Arlo employs exceptional talent, retention and compensation practices that align with a carefully selected peer group related to our size and industry. Arlo provides

compensation to executive officers in a manner as to attract, reward and retain the best available personnel for positions of substantial responsibility. We are guided by our talent philosophy which links leadership, talent, compensation and

performance. It is underpinned by 5 core tenets: Performance, Behaviors, Differentiation, Accountability, and Transparency. Base Salary Provides financial stability and security using fixed salary Market driven pay dependent on experience and

relevant skillset Performance Based Bonus Motivates and rewards employees for achieving rigorous annual corporate performance goals Focuses executives on sustained performance and critical long-term goals Provides short-term incentive for key

executives Equity Based Incentives (performance stock units and time-based RSUs) Motivates and rewards for long-term company performance Aligns pay with long-term stockholder value Attracts highly qualified executives and encourages long-term

employment Equity awards granted in prior years provide retention value based on achievement of stock price performance, cash balance goals and total stockholder return metrics

Background on 2022 Executive Retention

Program Plan Adoption - 1.7M CPS October 2, 2022 Q322 Services GM – 66.7% 2M CPS Achieved March 16, 2023 Q422 Services GM – 69.7% 3M CPS Achieved February 29, 2024 Q423 Service GM – 74.4% 4M CPS Achieved July 9, 2024 Q224 Service

GM – 76.4% Arlo in its entire history has only implemented one Executive Retention program. The company was facing extenuating circumstances at the time and in consultation with our previous compensation consultants, the Executive Retention

plan was implemented in 2022. Arlo was in the midst of a transformation into a world-class services organization with recurring revenue and industry-leading KPIs driven by a subscription model. Arlo was cash constrained in 2022 and as a result used

equity awards as a primary component of the retention plan to conserve cash and maintain its liquidity position. Retaining the C-Suite was critical part of this effort. Two CFOs, a CIO and other key executives already left, and the company was faced

with the need to retain the CEO and General Counsel in order to execute on its transformation plan. Adopted one-time special retention plan for the CEO and General Counsel: Equity vesting under plan based on Cumulative Paid Subscriber (CPS) and

Gross Margin Milestones GM = Gross Margin. All Gross Margin occurrences reference non-GAAP results.

Retrospective on 2022 Retention Plan

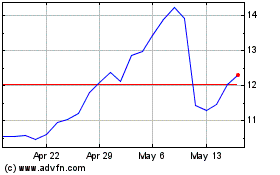

167% Total Shareholder Return Aug 2022 to Current We recognize that retention packages are not a desired approach within the investor community, but looking back, we believe the 2022 retention plan yielded significantly positive results. Retained

CEO and General Counsel who were then able to recruit critical talent, including a new CFO and COO, CTO and Chief Revenue Officer This management team’s successful transformation of Arlo into a world-class services organization that met almost

all of the significant milestones in the retention plan and built a reputation for operational excellence The retention of executives and transformation of the business resulted in a significant boost to Arlo’s financial outlook: Cash, cash

equivalents and short-term investments of $147M as of third quarter 2024 Positive free cash flow of $43M for the 9 months ended September 29, 2024 Announcement of a $50M Share Repurchase Program Delivered 167% in total shareholder return from August

2022 to now, surpassing both the S&P 500 and the Russell 2000 indices ARLO INVESTOR PRESENTATION: NOV 2024

Relationship between Pay and

Performance Subscriber Growth *Current subscribers 4.24 million Annual Recurring Revenue *Current ARR $241.6M up 21% Operating Margin *Current Operating Income 7.9% up 140 basis points Paid subscribers are up 25x since IPO and 2.2x since original

long-range plan Annual recurring revenue is up 16x since IPO and 2.1x since original long-range plan Operating Margin is up +12.3% since IPO and +7.7% since original long-range plan We believe that our Pay for Performance Strategy is generating

positive results Consistent with our philosophy, we pay our executives based on performance measures that are intended to drive long-term growth and value creation for our shareholders. We link executive compensation and our shareholder interests by

structuring a meaningful portion of our executive officers’ annual target total compensation to be both “at-risk” and variable in nature. *Current metrics are as of period ended September 29, 2024

Future Compensation Structure No

Special Awards The Compensation and Human Capital Committee has no intention to use special off-cycle equity awards for the foreseeable future other than for new hires or promotions. Any special awards will be performance-based vesting with multiple

metrics that are not duplicative in nature. PSU Structure Annual equity awards will be made entirely in the form of PSUs and no overlapping performance goals with existing PSUs or annual cash performance bonus Based on shareholder feedback, the PSU

design for 2025 will include multiple metrics Conversion of Final Cash Tranche of 2022 Retention Award Conversion of final tranche of 2022 retention awards from cash to PSUs which vest after achieving all of the following conditions: 1-year from

conversion 5M Subscribers ARR Target of $300M Blended Gross Margin – 60% After November 7, 2024, the 2022 Retention Program is completed 2024 Highlights No Cash Compensation Increases Performance bonus program based on achievement against

rigorous operating income goals and other metrics Annual equity awards are 100% PSUs. based on achievement of cumulative paid subscriber and operating income goals. Stock ownership requirements in top quartile of peer group We would like to thank

the investment community for their feedback as a part of this process and we look forward to your continuing engagement in the future.

Reconciliations of GAAP Measures to

Non-GAAP Measures Gross Profit, In Thousands, except percentage data

Reconciliations of GAAP Measures to

Non-GAAP Measures Operating Income (Loss), In Thousands, except percentage data

Reconciliations of GAAP Measures to

Non-GAAP Measures Free Cash Flow (Usage), In Thousands, except percentage data

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

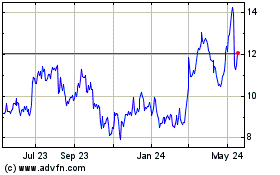

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

From Jan 2024 to Jan 2025