0001477720FALSE00014777202024-03-112024-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 11, 2024

__________________________

Asana, Inc.

(Exact name of Registrant as Specified in Its Charter)

__________________________

| | | | | | | | |

| Delaware | 001-39495 | 26-3912448 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| 633 Folsom Street, | Suite 100 | |

| San Francisco, | CA | 94107 |

| (Address of Principal Executive Offices) | (Zip Code) |

(415) 525-3888

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

__________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, $0.00001 par

value | | ASAN | | New York Stock Exchange |

| | | | Long-Term Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 11, 2024, Asana, Inc. issued a press release announcing its financial results for the quarter and fiscal year ended January 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information furnished under this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASANA, INC. |

| | |

| Dated: March 11, 2024 | By: | /s/ Eleanor Lacey |

| | Eleanor Lacey |

| | General Counsel and Corporate Secretary |

Asana Announces Fourth Quarter and Fiscal Year 2024 Results

$142 million improvement in cash flows from operating activities year over year

Annual revenues from customers spending $100,000 or more grew 29% year over year

March 11, 2024 – San Francisco, CA – Asana, Inc. (NYSE: ASAN)(LTSE: ASAN), a leading work management platform, today reported financial results for its fourth quarter and fiscal year ended January 31, 2024.

“Asana’s Q4 and fiscal year results beat expectations on the top and bottom line. Overall revenue growth was better than our guidance, and operating margin improved significantly during the year, as we target to be free cash flow positive by the end of this year," said Dustin Moskovitz, co-founder and chief executive officer of Asana. “Looking out to fiscal 2025, we have a unique opportunity to solve collaborative work problems with AI and the Asana Work Graph because organizations can leverage the most relevant and reliable context to make teams and organizations most effective.”

Fourth Quarter Fiscal 2024 Financial Highlights

•Revenues: Revenues were $171.1 million, an increase of 14% year over year.

•Operating Loss: GAAP operating loss was $67.9 million, or 40% of revenues, an improvement year over year compared to GAAP operating loss of $99.2 million, or 66% of revenues, in the fourth quarter of fiscal 2023. Non-GAAP operating loss was $15.6 million, or 9% of revenues, an improvement year over year compared to non-GAAP operating loss of $37.4 million, or 25% of revenues, in the fourth quarter of fiscal 2023.

•Net Loss: GAAP net loss was $62.4 million, compared to GAAP net loss of $95.0 million in the fourth quarter of fiscal 2023. GAAP net loss per share was $0.28, compared to GAAP net loss per share of $0.44 in the fourth quarter of fiscal 2023. Non-GAAP net loss was $10.1 million, compared to non-GAAP net loss of $33.2 million in the fourth quarter of fiscal 2023. Non-GAAP net loss per share was $0.04, compared to non-GAAP net loss per share of $0.15 in the fourth quarter of fiscal 2023.

•Cash Flow: Cash flows from operating activities were negative $15.3 million, compared to negative $31.1 million in the fourth quarter of fiscal 2023. Free cash flow was negative $17.0 million, compared to negative $26.5 million in the fourth quarter of fiscal 2023.

Fiscal 2024 Financial Highlights

•Revenues: Revenues were $652.5 million, an increase of 19% year over year.

•Operating Loss: GAAP operating loss was $270.0 million, or 41% of revenues, compared to GAAP operating loss of $407.8 million, or 75% of revenues, in fiscal 2023. Non-GAAP operating loss was $58.1 million, or 9% of revenues, compared to non-GAAP operating loss of $207.3 million, or 38% of revenues, in fiscal 2023.

•Net Loss: GAAP net loss was $257.0 million, compared to GAAP net loss of $407.8 million in fiscal 2023. GAAP net loss per share was $1.17, compared to GAAP net loss per share of $2.04 in fiscal 2023. Non-GAAP net loss was $45.1 million, compared to non-GAAP net loss of $207.2 million in fiscal 2023. Non-GAAP net loss per share was $0.20, compared to non-GAAP net loss per share of $1.04 in fiscal 2023.

•Cash Flow: Cash flows from operating activities were negative $17.9 million, compared to negative $160.1 million in fiscal 2023. Free cash flow was negative $30.4 million, compared to negative $159.6 million in fiscal 2023.

Business Highlights

•The number of Core customers, or customers spending $5,000 or more on an annualized basis, in Q4 grew to 21,646, an increase of 11% year over year. Revenues from Core customers in Q4 grew 16% year over year.

•The number of customers spending $100,000 or more on an annualized basis in Q4 grew to 607, an increase of 20% year over year.

•Overall dollar-based net retention rate in Q4 was over 100%.

•Dollar-based net retention rate for Core customers in Q4 was 105%.

•Dollar-based net retention rate for customers spending $100,000 or more on an annualized basis in Q4 was 115%.

•Announced the opening of a new office location in Warsaw, Poland, marking Asana’s 13th global office and sixth office within the EMEA region.

•Hosted Asana’s biggest event of the year, the Work Innovation Summit, bringing together Asanas, our customers, and industry visionaries to dive into the new era of work.

•Released research from The Work Innovation Lab on the state of collaboration technology with research-backed insights on how to declutter and optimize a business’ technology toolkit.

Financial Outlook

For the first quarter of fiscal 2025, Asana expects:

•Revenues of $168.0 million to $169.0 million, representing year over year growth of 10% to 11%.

•Non-GAAP operating loss of $23.0 million to $21.0 million, with 13.7% to 12.4% operating loss margin.

•Non-GAAP net loss per share of $0.09 to $0.08, assuming basic and diluted weighted average shares outstanding of approximately 226 million.

For fiscal 2025, Asana expects:

•Revenues of $716.0 million to $722.0 million, representing year over year growth of 10% to 11%.

•Non-GAAP operating loss of $61.0 million to $55.0 million, with 8.5% to 7.6% operating loss margin.

•Non-GAAP net loss per share of $0.22 to $0.19, assuming basic and diluted weighted average shares outstanding of approximately 230 million.

These statements are forward-looking and actual results may materially differ. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause Asana’s actual results to materially differ from these forward-looking statements.

A reconciliation of non-GAAP outlook measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, many of these costs and expenses that may be incurred in the future. Asana has provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for its fourth quarter and fiscal year 2024 non-GAAP results included in this press release.

Earnings Conference Call Information

Asana will hold a conference call and live webcast today to discuss these results at 1:30 p.m. Pacific Time. A live webcast and replay will be available on the Asana Investor Relations webpage at: https://investors.asana.com.

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include, but are not limited to, statements about our ability to execute on our current strategies, our technology and brand position, Asana’s outlook for the fiscal quarter ending April 30, 2024 and the full fiscal year ending January 31, 2025, Asana’s outlook for free cash flow for calendar year 2024, expected benefits of our offerings, Asana’s market position, and potential market opportunities. Forward-looking statements generally relate to future events or Asana’s future financial or operating performance. Forward-looking statements include all statements that are not historical facts and in some cases can be identified by terms such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “continue,” “could,” “potential,” “may,” “will,” “goal,” or similar expressions and the negatives of those terms. However, not all forward-looking statements contain these identifying words. Forward-looking statements involve known and unknown risks, uncertainties and other factors, including factors beyond Asana’s control, that may cause Asana’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks include, but are not limited to, risks and uncertainties related to: Asana’s ability to achieve future growth and sustain its growth rate, Asana’s ability to attract and retain customers and increase sales to its customers, Asana’s ability to develop and release new products and services and to scale its platform, including the successful integration of artificial intelligence, Asana’s ability to increase adoption of its platform through Asana’s self-service model, Asana’s ability to maintain and grow its relationships with strategic partners, the highly competitive and rapidly evolving market in which Asana participates, Asana’s international expansion strategies, broader macroeconomic conditions and the residual impacts of the COVID-19 pandemic. Further information on risks that could cause actual results to differ materially from forecasted results are included in Asana’s filings with the SEC, including Asana’s Quarterly Report on Form 10-Q for the quarter ended October 31, 2023 and subsequent filings with the SEC. Any forward-looking statements contained in this press release are based on assumptions that Asana believes to be reasonable as of this date. Except as required by law, Asana assumes no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements.

Use of Non-GAAP Financial Measures

To supplement Asana’s consolidated financial statements, which are prepared and presented in accordance with GAAP, Asana utilizes certain non-GAAP financial measures to assist in understanding and evaluating its core operating performance. In this release, Asana’s non-GAAP gross profit, gross margin, operating expenses, operating expenses as a percentage of revenue, operating loss, operating margin, net loss, net loss per share, and free cash flow are not presented in accordance with GAAP and are not intended to be used in lieu of GAAP presentations of results of operations. These non-GAAP financial measures, which may be different from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of Asana’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures which can be found in the accompanying financial statements included with this press release.

Asana is presenting these non-GAAP financial measures because it believes that these non-GAAP financial measures provide useful information about its financial performance, enhance the overall understanding of Asana’s past performance and future prospects,

facilitate period-to-period comparisons of operations against other companies in Asana’s industry, and allow for greater transparency with respect to important metrics used by Asana’s management for financial and operational decision-making.

Asana believes excluding the following items from its non-GAAP financial measures is useful to investors and others in assessing Asana’s operating performance due to the following factors:

•Share-based compensation expenses. Although share-based compensation is an important aspect of the compensation of our employees and executives, management believes it is useful to exclude share-based compensation expenses to better understand the long-term performance of Asana’s core business and to facilitate comparison of its results to those of peer companies.

•Employer payroll tax associated with RSUs. The amount of employer payroll tax-related items on employee stock transactions is dependent on Asana’s stock price and other factors that are beyond its control and that do not correlate to the operation of the business.

•Non-cash and non-recurring expenses. Non-cash expenses include charges for impairment of long-lived assets. Non-recurring expenses include costs related to restructuring. Asana believes the exclusion of certain non-cash and non-recurring items provides useful supplemental information to investors and facilitates the analysis of its operating results and comparison of operating results across reporting periods.

There are a number of limitations related to the use of non-GAAP financial measures as compared to GAAP financial measures, including that the non-GAAP financial measures exclude stock-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense in Asana’s business and an important part of its compensation strategy.

In addition to the non-GAAP financial measures outlined above, Asana also uses the non-GAAP financial measure of free cash flow, which is defined as net cash from operating activities less cash used for purchases of property and equipment and capitalized internal-use software costs, plus non-recurring expenditures such as capital expenditures from the purchases of property and equipment associated with the build-out of Asana’s corporate headquarters and costs related to restructuring. Asana believes free cash flow is an important liquidity measure of the cash that is available, after capital expenditures and operational expenses, for investment in its business and to make acquisitions. Asana believes that free cash flow is useful to investors as a liquidity measure because it measures Asana’s ability to generate or use cash. There are a number of limitations related to the use of free cash flow as compared to net cash from operating activities, including that free cash flow includes capital expenditures, the benefits of which are realized in periods subsequent to those when expenditures are made.

Definitions of Business Metrics

Customers spending $5,000 or more on an annualized basis, or Core customers

We define customers spending $5,000 or more, which we also refer to as Core customers, as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts.

Customers spending $100,000 or more on an annualized basis

We define customers spending $100,000 or more as those organizations on a paid subscription plan that had $100,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts.

Dollar-based net retention rate

Asana’s reported dollar-based net retention rate equals the simple arithmetic average of its quarterly dollar-based net retention rate for the four quarters ending with the most recent fiscal quarter. Asana calculates its dollar-based net retention rate by comparing its revenues from the same set of customers in a given quarter, relative to the comparable prior-year period. To calculate Asana’s dollar-based net retention rate for a given quarter, Asana starts with the revenues in that quarter from customers that generated revenues in the same quarter of the prior year. Asana then divides that amount by the revenues attributable to that same group of customers in the prior-year quarter. Current period revenues include any upsells and are net of contraction or attrition over the trailing 12 months, but exclude revenues from new customers in the current period. Asana expects its dollar-based net retention rate to fluctuate in future periods due to a number of factors, including the expected growth of its revenue base, the level of penetration within its customer base, and its ability to retain its customers.

About Asana

Asana empowers organizations to work smarter. Asana has over 150,000 customers and millions of users in 200+ countries and territories. Customers like Amazon, Roche, and T-Mobile rely on Asana to manage everything from goal setting and tracking to capacity planning, to product launches. For more information, visit www.asana.com.

Disclosure of Material Information

Asana announces material information to its investors using SEC filings, press releases, public conference calls, and on its investor relations page of Asana’s website at https://investors.asana.com. Asana uses these channels, as well as social media, including its X (formerly Twitter) account (@asana), its blog (blog.asana.com), its LinkedIn page (www.linkedin.com/company/asana), its Instagram account (@asana), its Facebook page (www.facebook.com/asana/), and Threads profiles (@asana and @moskov), to communicate with investors and the public about Asana, its products and services and other matters. Therefore, Asana encourages investors, the media and others interested in Asana to review the information it makes public in these locations, as such information could be deemed to be material information.

Catherine Buan

Asana Investor Relations

ir@asana.com

Alexandra Tadeu

Asana Corporate Communications

press@asana.com

ASANA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Twelve Months Ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 171,135 | | | $ | 150,231 | | | $ | 652,504 | | | $ | 547,212 | |

Cost of revenues(1) | 17,392 | | | 15,205 | | | 64,524 | | | 56,559 | |

| Gross profit | 153,743 | | | 135,026 | | | 587,980 | | | 490,653 | |

| Operating expenses: | | | | | | | |

Research and development(1) | 82,973 | | | 81,262 | | | 324,688 | | | 297,209 | |

Sales and marketing(1) | 103,921 | | | 114,733 | | | 391,955 | | | 434,961 | |

General and administrative(1) | 34,797 | | | 38,245 | | | 141,334 | | | 166,309 | |

| Total operating expenses | 221,691 | | | 234,240 | | | 857,977 | | | 898,479 | |

| Loss from operations | (67,948) | | | (99,214) | | | (269,997) | | | (407,826) | |

| Interest income and other income (expense), net | 7,314 | | | 7,152 | | | 20,624 | | | 6,933 | |

| Interest expense | (1,005) | | | (875) | | | (3,952) | | | (2,000) | |

| Loss before provision for income taxes | (61,639) | | | (92,937) | | | (253,325) | | | (402,893) | |

| Provision for income taxes | 759 | | | 2,089 | | | 3,705 | | | 4,875 | |

| Net loss | $ | (62,398) | | | $ | (95,026) | | | $ | (257,030) | | | $ | (407,768) | |

| Net loss per share: | | | | | | | |

| Basic and diluted | $ | (0.28) | | | $ | (0.44) | | | $ | (1.17) | | | $ | (2.04) | |

| Weighted-average shares used in calculating net loss per share: | | | | | | | |

| Basic and diluted | 224,300 | | | 214,195 | | | 220,406 | | | 200,034 | |

_______________

(1) Amounts include stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Twelve Months Ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 372 | | | $ | 458 | | | $ | 1,549 | | | $ | 1,658 | |

| Research and development | 28,691 | | | 29,477 | | | 112,619 | | | 100,083 | |

| Sales and marketing | 15,779 | | | 15,476 | | | 59,217 | | | 58,504 | |

| General and administrative | 7,007 | | | 7,717 | | | 29,033 | | | 28,717 | |

Total stock-based compensation expense (1) | $ | 51,849 | | | $ | 53,128 | | | $ | 202,418 | | | $ | 188,962 | |

__________________

(1)The table above includes $0.9 million of stock-based compensation expense for the three and twelve months ended January 31, 2023 that was incurred as a result of the restructuring.

ASANA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| | January 31, 2024 | | January 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 236,663 | | | $ | 526,563 | |

| Marketable securities | 282,801 | | | 2,739 | |

| Accounts receivable, net | 88,327 | | | 82,363 | |

| Prepaid expenses and other current assets | 51,925 | | | 48,726 | |

| Total current assets | 659,716 | | | 660,391 | |

| Property and equipment, net | 96,543 | | | 94,984 | |

| | | |

| Operating lease right-of-use assets | 181,731 | | | 176,189 | |

| | | |

| Other assets | 23,970 | | | 23,399 | |

| Total assets | $ | 961,960 | | | $ | 954,963 | |

| | | |

| Liabilities and Stockholders’ Equity |

| Current liabilities | | | |

| Accounts payable | $ | 6,907 | | | $ | 7,554 | |

| Accrued expenses and other current liabilities | 75,821 | | | 83,488 | |

Deferred revenue, current | 265,306 | | | 226,443 | |

| Operating lease liabilities, current | 19,179 | | | 14,831 | |

| Total current liabilities | 367,213 | | | 332,316 | |

| Term loan, net | 43,618 | | | 46,696 | |

| Deferred revenue, noncurrent | 5,916 | | | 7,156 | |

| Operating lease liabilities, noncurrent | 215,084 | | | 210,012 | |

Other liabilities | 3,733 | | | 2,209 | |

| Total liabilities | 635,564 | | | 598,389 | |

| | | |

| | | |

| Stockholders’ equity | | | |

| Common stock | 2 | | | 2 | |

| Additional paid-in capital | 1,821,216 | | | 1,595,001 | |

| Accumulated other comprehensive loss | (236) | | | (873) | |

| Accumulated deficit | (1,494,586) | | | (1,237,556) | |

| Total stockholders’ equity | 326,396 | | | 356,574 | |

| Total liabilities and stockholders’ equity | $ | 961,960 | | | $ | 954,963 | |

ASANA, INC.

SUMMARY OF CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Twelve Months Ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities | | | | | | | |

| Net loss | $ | (62,398) | | | $ | (95,026) | | | $ | (257,030) | | | $ | (407,768) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

| Allowance for expected credit losses | 1,068 | | | 873 | | | 3,140 | | | 1,918 | |

| Depreciation and amortization | 3,937 | | | 3,162 | | | 14,344 | | | 12,669 | |

| | | | | | | |

| Amortization of deferred contract acquisition costs | 6,001 | | | 4,589 | | | 21,972 | | | 15,098 | |

| Stock-based compensation expense | 51,849 | | | 53,128 | | | 202,418 | | | 188,962 | |

| Net amortization (accretion) of premium (discount) on marketable securities | (1,823) | | | 12 | | | (3,391) | | | 62 | |

| | | | | | | |

| Non-cash lease expense | 4,092 | | | 4,169 | | | 18,090 | | | 15,595 | |

| Impairment of long-lived assets | — | | | — | | | 5,009 | | | — | |

| Amortization of credit facility issuance costs | 31 | | | 28 | | | 122 | | | 41 | |

| | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | (21,778) | | | (23,802) | | | (9,527) | | | (25,179) | |

| Prepaid expenses and other current assets | (11,830) | | | (1,887) | | | (25,594) | | | (24,042) | |

| Other assets | (1,210) | | | (907) | | | (468) | | | (4,108) | |

| Accounts payable | (4,181) | | | (1,058) | | | (569) | | | (4,391) | |

| Accrued expenses and other liabilities | 11,679 | | | 10,314 | | | (5,206) | | | 25,539 | |

| Deferred revenue | 15,780 | | | 18,761 | | | 37,623 | | | 59,375 | |

| Operating lease liabilities | (6,554) | | | (3,455) | | | (18,864) | | | (13,829) | |

| | | | | | | |

| Net cash used in operating activities | (15,337) | | | (31,099) | | | (17,931) | | | (160,058) | |

| Cash flows from investing activities | | | | | | | |

| Purchases of marketable securities | (34,821) | | | — | | | (319,133) | | | (72,216) | |

| Sales of marketable securities | 6 | | | — | | | 18 | | | — | |

| Maturities of marketable securities | 17,500 | | | 33,661 | | | 43,141 | | | 143,865 | |

| Purchases of property and equipment | (500) | | | (2,211) | | | (7,721) | | | (5,351) | |

| | | | | | | |

| Capitalized internal-use software costs | (1,115) | | | (854) | | | (5,440) | | | (1,806) | |

| Net cash provided by (used in) investing activities | (18,930) | | | 30,596 | | | (289,135) | | | 64,492 | |

| Cash flows from financing activities | | | | | | | |

| Proceeds from term loan, net of issuance costs | — | | | 49,555 | | | — | | | 49,555 | |

| Repayment of term loan | (625) | | | (35,666) | | | (3,125) | | | (38,333) | |

| | | | | | | |

| | | | | | | |

| Proceeds from private placement—related party, net of offering costs | — | | | (95) | | | — | | | 347,289 | |

| Repurchases of common stock | — | | | (7) | | | — | | | (9) | |

| Proceeds from exercise of stock options | 987 | | | 1,146 | | | 4,843 | | | 5,773 | |

| Proceeds from employee stock purchase plan | — | | | 1 | | | 15,069 | | | 17,116 | |

| Taxes paid related to net share settlement of equity awards | (3) | | | — | | | (10) | | | — | |

| Net cash provided by financing activities | 359 | | | 14,934 | | | 16,777 | | | 381,391 | |

| Effect of foreign exchange rates on cash and cash equivalents | 2,257 | | | 1,542 | | | 389 | | | 335 | |

| Net increase (decrease) in cash and cash equivalents | (31,651) | | | 15,973 | | | (289,900) | | | 286,160 | |

| Cash, cash equivalents, and restricted cash | | | | | | | |

| Beginning of period | 268,314 | | | 510,590 | | | 526,563 | | | 240,403 | |

| End of period | $ | 236,663 | | | $ | 526,563 | | | $ | 236,663 | | | $ | 526,563 | |

ASANA, INC.

Reconciliation of GAAP to Non-GAAP Data

(in thousands, except percentages)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Twelve Months Ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of gross profit and gross margin | | | | | | | |

| GAAP gross profit | $ | 153,743 | | | $ | 135,026 | | | $ | 587,980 | | | $ | 490,653 | |

| Plus: stock-based compensation and related employer payroll tax associated with RSUs | 376 | | | 425 | | | 1,585 | | | 1,651 | |

| Plus: restructuring costs | — | | | 550 | | | — | | | 550 | |

| Non-GAAP gross profit | $ | 154,119 | | | $ | 136,001 | | | $ | 589,565 | | | $ | 492,854 | |

| GAAP gross margin | 89.8 | % | | 89.9 | % | | 90.1 | % | | 89.7 | % |

| Non-GAAP adjustments | 0.3 | % | | 0.6 | % | | 0.3 | % | | 0.4 | % |

| Non-GAAP gross margin | 90.1 | % | | 90.5 | % | | 90.4 | % | | 90.1 | % |

| Reconciliation of operating expenses | | | | | | | |

| GAAP research and development | $ | 82,973 | | | $ | 81,262 | | | $ | 324,688 | | | $ | 297,209 | |

| Less: stock-based compensation and related employer payroll tax associated with RSUs | (28,981) | | | (29,676) | | | (115,397) | | | (101,892) | |

| Adjustment for: restructuring (costs) benefit | — | | | (35) | | | — | | | (35) | |

| Non-GAAP research and development | $ | 53,992 | | | $ | 51,551 | | | $ | 209,291 | | | $ | 195,282 | |

| GAAP research and development as percentage of revenue | 48.5 | % | | 54.1 | % | | 49.8 | % | | 54.3 | % |

| Non-GAAP research and development as percentage of revenue | 31.5 | % | | 34.3 | % | | 32.1 | % | | 35.7 | % |

| | | | | | | |

| GAAP sales and marketing | $ | 103,921 | | | $ | 114,733 | | | $ | 391,955 | | | $ | 434,961 | |

| Less: stock-based compensation and related employer payroll tax associated with RSUs | (15,891) | | | (14,904) | | | (60,329) | | | (58,648) | |

| Adjustment for: restructuring (costs) benefit | — | | | (6,582) | | | 173 | | | (6,582) | |

| Non-GAAP sales and marketing | $ | 88,030 | | | $ | 93,247 | | | $ | 331,799 | | | $ | 369,731 | |

| GAAP sales and marketing as percentage of revenue | 60.7 | % | | 76.4 | % | | 60.1 | % | | 79.5 | % |

| Non-GAAP sales and marketing as percentage of revenue | 51.4 | % | | 62.1 | % | | 50.9 | % | | 67.6 | % |

| | | | | | | |

| GAAP general and administrative | $ | 34,797 | | | $ | 38,245 | | | $ | 141,334 | | | $ | 166,309 | |

| Less: stock-based compensation and related employer payroll tax associated with RSUs | (7,089) | | | (7,585) | | | (29,725) | | | (29,095) | |

| | | | | | | |

| Less: impairment of long-lived assets | — | | | — | | | (5,009) | | | — | |

| Adjustment for: restructuring (costs) benefit | — | | | (2,093) | | | (26) | | | (2,093) | |

| Non-GAAP general and administrative | $ | 27,708 | | | $ | 28,567 | | | $ | 106,574 | | | $ | 135,121 | |

| GAAP general and administrative as percentage of revenue | 20.3 | % | | 25.5 | % | | 21.7 | % | | 30.4 | % |

Non-GAAP general and administrative as percentage of revenue | 16.2 | % | | 19.0 | % | | 16.3 | % | | 24.7 | % |

| Reconciliation of operating loss and operating margin | | | | | | | |

| GAAP loss from operations | $ | (67,948) | | | $ | (99,214) | | | $ | (269,997) | | | $ | (407,826) | |

| Plus: stock-based compensation and related employer payroll tax associated with RSUs | 52,337 | | | 52,590 | | | 207,036 | | | 191,286 | |

| | | | | | | |

| Plus: impairment of long-lived assets | — | | | — | | | 5,009 | | | — | |

Adjustment for: restructuring costs (benefit) (1) | — | | | 9,260 | | | (147) | | | 9,260 | |

| Non-GAAP loss from operations | $ | (15,611) | | | $ | (37,364) | | | $ | (58,099) | | | $ | (207,280) | |

| GAAP operating margin | (39.7) | % | | (66.0) | % | | (41.4) | % | | (74.5) | % |

| Non-GAAP adjustments | 30.6 | % | | 41.1 | % | | 32.5 | % | | 36.6 | % |

| Non-GAAP operating margin | (9.1) | % | | (24.9) | % | | (8.9) | % | | (37.9) | % |

ASANA, INC.

Reconciliation of GAAP to Non-GAAP Data

(in thousands, except percentages and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Twelve Months Ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of net loss | | | | | | | |

| GAAP net loss | $ | (62,398) | | | $ | (95,026) | | | $ | (257,030) | | | $ | (407,768) | |

| Plus: stock-based compensation and related employer payroll tax associated with RSUs | 52,337 | | | 52,590 | | | 207,036 | | | 191,286 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Plus: impairment of long-lived assets | — | | | — | | | 5,009 | | | — | |

Adjustment for: restructuring costs (benefit) (1) | — | | | 9,260 | | | (147) | | | 9,260 | |

| Non-GAAP net loss | $ | (10,061) | | | $ | (33,176) | | | $ | (45,132) | | | $ | (207,222) | |

| Reconciliation of net loss per share | | | | | | | |

| GAAP net loss per share, basic | $ | (0.28) | | | $ | (0.44) | | | $ | (1.17) | | | $ | (2.04) | |

| Non-GAAP adjustments to net loss | 0.24 | | | 0.29 | | | 0.97 | | | 1.00 | |

| Non-GAAP net loss per share, basic | $ | (0.04) | | | $ | (0.15) | | | $ | (0.20) | | | $ | (1.04) | |

| Weighted-average shares used in GAAP and non-GAAP per share calculation, basic and diluted | 224,300 | | | 214,195 | | | 220,406 | | | 200,034 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

_______________

(1)Restructuring costs for the three and twelve months ended January 31, 2023 were composed of severance and related charges of $8.4 million and stock-based compensation expense of $0.9 million. These charges are non-recurring and not reflective of underlying trends in our business.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Twelve Months Ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Computation of free cash flow | | | | | | | |

| Net cash provided by (used in) investing activities | $ | (18,930) | | | $ | 30,596 | | | $ | (289,135) | | | $ | 64,492 | |

| Net cash provided by financing activities | $ | 359 | | | $ | 14,934 | | | $ | 16,777 | | | $ | 381,391 | |

| Net cash used in operating activities | $ | (15,337) | | | $ | (31,099) | | | $ | (17,931) | | | $ | (160,058) | |

| Less: purchases of property and equipment | (500) | | | (2,211) | | | (7,721) | | | (5,351) | |

| Less: capitalized internal-use software costs | (1,115) | | | (854) | | | (5,440) | | | (1,806) | |

| Plus: restructuring costs paid | — | | | 7,663 | | | 707 | | | 7,663 | |

| Plus: purchases of property and equipment from build-out of corporate headquarters | — | | | — | | | — | | | 2 | |

| | | | | | | |

| Free cash flow | $ | (16,952) | | | $ | (26,501) | | | $ | (30,385) | | | $ | (159,550) | |

Cover

|

Mar. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 11, 2024

|

| Entity Registrant Name |

Asana, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39495

|

| Entity Tax Identification Number |

26-3912448

|

| Entity Address, Address Line One |

633 Folsom Street,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

San Francisco,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94107

|

| City Area Code |

(415)

|

| Local Phone Number |

525-3888

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.00001 par value

|

| Trading Symbol |

ASAN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001477720

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

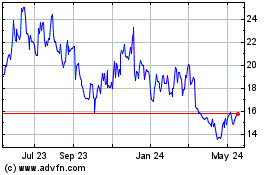

Asana (NYSE:ASAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

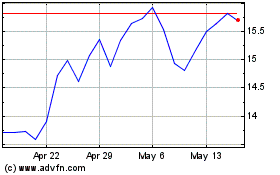

Asana (NYSE:ASAN)

Historical Stock Chart

From Apr 2023 to Apr 2024