Gaming and Leisure Properties, Inc. (NASDAQ:GLPI) (“GLPI” or

“the Company”), announced today that it has entered into a binding

term sheet with Bally’s Corporation (NYSE: BALY) (“Bally’s”)

pursuant to which the Company intends to acquire the real property

assets of Bally’s Kansas City Casino (“Bally’s Kansas City”) and

Bally’s Shreveport Casino & Hotel (“Bally’s Shreveport”) as

well as the land under Bally’s permanent Chicago casino, and

provide construction financing for the Bally’s Chicago Casino

Resort (“Bally’s Chicago”) for aggregate consideration of

approximately $1.585 billion representing a blended 8.3% initial

cash yield. In addition, GLPI secured adjustments to improve the

purchase price and related cap rate related to the existing,

previously announced, contingent purchase option for Bally’s

Lincoln Casino Resort (“Bally’s Lincoln”), as well as the addition

of a right for GLPI to call the asset beginning on October 1, 2026.

$1.19 Billion Chicago Flagship Casino

Development Investment GLPI intends to fund construction

hard costs of up to $940 million at an 8.5% initial cash yield with

the remainder to be funded by Bally’s with the sale leaseback

proceeds related to Bally’s Kansas City and Bally’s Shreveport

along with other funding sources such as Bally’s Chicago’s planned

initial public offering and cash flows from operations. Funding is

expected to occur from August 2024 through December 2026. GLPI will

own all funded improvements, which will be leased to Bally’s with

rent commencing at a rate of 8.5% as advances are made. The total

project’s costs are currently expected to be approximately $1.8

billion, inclusive of construction, land, and rent.

In addition to the development funding of hard

costs, GLPI also intends to acquire the Chicago land for

approximately $250 million before development begins. Upon GLPI’s

purchase of the Chicago land, rent will commence under a new lease

carrying a 15-year initial term with an initial cash yield of 8.0%.

The new lease will be cross-defaulted with the construction

development funding agreement. Upon completion of the improvements

and acquisition of the land, GLPI will own substantially all of the

real estate land and improvements related to the Chicago casino and

hotel for a total investment of $1.19 billion and blended initial

cash investment yield of 8.4%. Upon stabilization of the property’s

operations, the rent coverage for the lease is expected to be in

the range of 2.0x – 2.4x.

$395 Million Kansas City and Shreveport Sale Leaseback

InvestmentGLPI will purchase the real property assets of

both Bally’s Kansas City and Bally’s Shreveport for total

consideration of $395 million. The two properties will be in a new

Bally’s Master Lease that will be cross-defaulted with the existing

Bally’s Master Lease with initial cash rent pursuant to the

agreement for the two new properties of $32.2 million, representing

an 8.2% initial cash capitalization rate. Total rent coverage on

the Kansas City and Shreveport assets is expected to be 2.2x in the

initial year post acquisition. The Company expects to close on the

proposed Bally’s Kansas City and Bally’s Shreveport sale leaseback

transactions as early as Q4 2024 subject to customary regulatory

and other approvals.

In total, the Chicago, Kansas City, and

Shreveport transactions represent a blended 8.3% yield and are

expected to be funded on a staggered basis with cash on hand,

retained operational cash flow, availability on GLPI’s revolving

credit facility, and proceeds from potential capital markets

activity.

The transactions are subject to several

conditions as well as certain third-party consents and regulatory

approvals. Key conditions include but are not limited to: (a) valid

assignment of the current ground lease to GLPI or acquisition by

GLPI of the fee interest in Chicago; (b) the final structure and

pro forma capitalization of Bally’s following the proposed Standard

General acquisition, or similar transaction, in the event any

agreement is reached with the board of directors of Bally’s; (c)

completion of customary due diligence on the Chicago site; and (d)

receipt of all necessary gaming regulatory and other third party

approvals.

Adjustments to Improve Bally’s Lincoln

Purchase Option GLPI and Bally’s have further agreed to

adjust GLPI’s existing contingent purchase option for Bally’s

Lincoln to reflect a purchase price of $735 million, which has been

reduced from $771 million. The purchase price adjustment results in

the initial cash yield’s favorable adjustment from 7.6% to 8.0%

based on $58.8 million initial cash rent. GLPI has also been

granted a call right, subject only to regulatory approval,

beginning on October 1, 2026 to ensure that GLPI has the

opportunity to acquire the property prior to the expiration of the

current option period.

Peter Carlino, Chairman and CEO of GLPI

commented, “We are delighted to partner again with Bally’s on this

series of highly attractive transactions that will benefit our

shareholders and represent a win-win for both parties. These

transactions will be accretive to our financial results, delivering

an 8.3% blended initial cash yield and are structured with

conservative rent coverage. GLPI is ideally positioned for these

transactions as structured given our strong balance sheet, visible

recurring cash flows, low leverage and the extensive casino

development and construction experience that our team uniquely

brings to the opportunity. This multi-faceted deal is another

example of our ability to be innovative in our approach to creating

opportunities for our shareholders in conjunction with our

best-in-class regional gaming tenants in what remains a volatile

interest rate and challenging transaction environment. Furthermore,

these transactions will expand and diversify our already

industry-leading regional gaming property portfolio while adding a

downtown asset in a world-class city, and the nation’s third

largest metropolitan area, to our unmatched geographic breadth. We

look forward to working with the Bally’s team as they begin

development of what promises to be a must-visit destination casino

resort property in the heart of Chicago.”

Soo Kim, Chairman of Bally’s, added, “GLPI has

been a great partner for many years. We are excited to expand our

relationship as we leverage their development and financing

expertise to grow Bally’s with the world class Chicago casino

development. Chicago is a vitally important market for our company

and our permanent downtown facility will become our company’s

flagship property when it opens in late 2026. We are thrilled to

have the investment from GLPI as we begin construction of Bally’s

Chicago, and we are confident that this critical project funding

milestone will be well-received by our host community and the

various stakeholders in Chicago.”

Wells Fargo acted as financial advisor to Gaming

and Leisure Properties. Goodwin Procter LLP acted as legal

advisor to Gaming and Leisure Properties.

About Bally’s Transaction Related

PropertiesBally’s Chicago will be a nearly 1 million

square-foot casino resort located on the Chicago River, roughly 1.5

miles from the temporary Bally’s casino site. The single-level,

178,000 square-foot casino will feature approximately 3,300 slot

machines and 173 table games (including poker). Once fully

completed, the property will feature a 500-room hotel with a

portion of the rooms above the casino and the remainder in an

adjacent 27-floor tower. The hotel will include a full-service spa,

fitness center and pool, along with a rooftop bar. Bally’s Chicago

will offer a premium steakhouse, noodle bar, nightclub, food hall

and other bars and lounges. It will also include more than 100,000

square feet of event and meeting space and nearly 3,000 valet and

self-park parking spaces. The property will also have more than two

acres of public green space and a riverwalk for casino patrons and

the community to enjoy.

Bally’s Kansas City is located on the Missouri

River in Kansas City, Missouri and recently completed a $50 million

renovation and expansion. The property features a 42,000 square

foot casino with over 900 slot machines, 24 table games and more

than 50 video poker and keno terminals. It also offers three

restaurants including a location of the award-winning Chickie’s

& Pete’s sports bar, a full-service bar, nearly 3,000 square

feet of event space and several entertainment lounges.

Bally’s Shreveport is located along the Red

River in downtown Shreveport, Louisiana. The property features a

30,000 square foot casino with more than 950 slot machines, over 50

table games, a poker room and a Bally Bet Sportsbook. It has a

400-room hotel with full-service spa, three on-site restaurants

including an award-winning fine dining steakhouse and a noodle bar,

event spaces, live entertainment and two on-site nightclubs.

Bally’s Lincoln is located in Lincoln, Rhode

Island and recently completed a roughly $100 million expansion and

improvement project. The updated property features 188,000 square

feet of gaming space with more than 3,900 slot machines, 114 table

games, the Sportsbook Bar & Grill and a race book with live

simulcast wagering spread across both smoking and non-smoking

sections. The property also offers a 136-room hotel, three fine

dining restaurants, two food courts, eight bars including a cigar

bar, a 29,000 square foot event center and two live entertainment

venues.

About Gaming and Leisure Properties,

Inc.GLPI is engaged in the business of acquiring,

financing, and owning real estate property to be leased to gaming

operators in triple-net lease arrangements, pursuant to which the

tenant is responsible for all facility maintenance, insurance

required in connection with the leased properties and the business

conducted on the leased properties, taxes levied on or with respect

to the leased properties and all utilities and other services

necessary or appropriate for the leased properties and the business

conducted on the leased properties.

About Bally’s

CorporationBally's Corporation is a global

casino-entertainment company with a growing omni-channel presence.

It currently owns and manages 15 casinos across 10 states, a golf

course in New York, a horse racetrack in Colorado, and has access

to OSB licenses in 18 states. It also owns Bally's Interactive

International, formerly Gamesys Group, a leading, global, online

gaming operator, Bally Bet, a first-in-class sports betting

platform, and Bally Casino, a growing iCasino platform.

With 10,600 employees, the Company's casino

operations include approximately 15,300 slot machines, 580 table

games and 3,800 hotel rooms. Upon completing the construction of a

permanent casino facility in Chicago, IL, and a land-based casino

near the Nittany Mall in State College, PA, Bally's will own and/or

manage 16 casinos across 11 states. Bally’s also has rights to

developable land in Las Vegas. It shares trade on the New

York Stock Exchange under the ticker symbol "BALY".

Forward-Looking StatementsThis

press release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including our expectations regarding the benefits of the

transaction to our shareholders. Forward-looking statements can be

identified by the use of forward-looking terminology such as

“expects,” “believes,” “estimates,” “intends,” “may,” “will,”

“should” or “anticipates” or the negative or other variation of

these or similar words, or by discussions of future events,

strategies or risks and uncertainties. Such forward-looking

statements are inherently subject to risks, uncertainties and

assumptions about GLPI and its subsidiaries, including risks

related to the following: GLPI’s ability to successfully consummate

the announced transactions with Bally’s, including the ability of

the parties to satisfy the various conditions to advancing loan

proceeds, including receipt of all required regulatory approvals

and other approvals and consents, or other delays or impediments to

completing the proposed transactions; the potential negative impact

of recent high levels of inflation (which have been exacerbated by

the armed conflict between Russia and Ukraine) on our tenants'

operations; GLPI's ability to maintain its status as a REIT; our

ability to access capital through debt and equity markets in

amounts and at rates and costs acceptable to GLPI; the impact of

our substantial indebtedness on our future operations; changes in

the U.S. tax law and other state, federal or local laws, whether or

not specific to REITs or to the gaming or lodging industries; and

other factors described in GLPI’s Annual Report on Form 10-K for

the year ended December 31, 2023, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K, each as filed with the Securities

and Exchange Commission. All subsequent written and oral

forward-looking statements attributable to GLPI or persons acting

on GLPI’s behalf are expressly qualified in their entirety by the

cautionary statements included in this press release. GLPI

undertakes no obligation to publicly update or revise any

forward-looking statements contained or incorporated by reference

herein, whether as a result of new information, future events or

otherwise, except as required by law. In light of these risks,

uncertainties and assumptions, the forward-looking events discussed

in this press release may not occur as presented or at all.

|

Contact:Gaming and Leisure Properties,

Inc.

Matthew Demchyk, Chief Investment

Officer610/401-2900

investorinquiries@glpropinc.com |

Investor

Relations Joseph Jaffoni, Richard Land, James Leahy at

JCIR212/835-8500glpi@jcir.com |

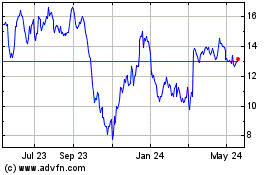

Ballys (NYSE:BALY)

Historical Stock Chart

From Dec 2024 to Jan 2025

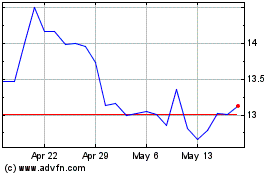

Ballys (NYSE:BALY)

Historical Stock Chart

From Jan 2024 to Jan 2025