Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

10 December 2021 - 10:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2021

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Banco Bradesco S.A. (Company) informs its shareholders and the market

in general that the Board of Directors, in a meeting held today, approved proposal of the Company´s Board of Executive Officers

held also on this date (12.9.2021), for payment, to the company´s shareholders, of dividends and supplementary interest on shareholders´

equity, in the total amount of R$2,200,000,000.00, as follows:

|

|

a)

|

dividends, in the amount of R$2,000,000,000.00, being R$0.196595372 per common share and

R$0.216254909 per preferred share, without withholding income tax, pursuant Article 10 of Law No. 9,249/95; and

|

|

|

b)

|

supplementary interest on shareholders´ equity, in the amount of R$200,000,000.00, being

R$0.019659537 per common share and R$0.021625491 per preferred share, which will be paid by the net amount of R$0.016710606

per common share and R$0,018381667 per preferred share, considering the withholding income tax deduction of 15 percent (15%),

except for the legal entity shareholders who are exempt from such taxation, who will receive by the declared amount.

|

The above-mentioned dividends and interest:

|

|

1)

|

will benefit the shareholders who are registered in the Company’s records on December 20, 2021 (entitlement

basis date), with the shares being traded "ex- dividends/supplementary interest on shareholders´ equity" as of December

21, 2021;

|

|

|

2)

|

will be calculated in the mandatory dividends for the fiscal year, established in the Bylaws; and

|

|

|

3)

|

will be paid on December 30, 2021, as follows:

|

|

|

·

|

to the shareholders whose shares are deposited

at the Company and who keep their register and banking data updated, by means of credit in the current accounts in a Financial Institution

appointed by them; and

|

|

|

·

|

to the shareholders whose shares are deposited

at B3 S.A. - Brasil, Bolsa, Balcão, by means of Institutions and/or Brokerage Houses which keep their shareholding position in

custody.

|

The shareholders who do not have their data updated must go to a Bradesco

Branch of their preference, with their Individual Taxpayer’s ID, Identification Document and proof of residence to update their

information and receive the respective amounts to which they are entitled.

The dividends/interest on shareholders’ equity relating to the

shares in custody on B3 S.A. - Brasil, Bolsa, Balcão will be passed on to their holders through the respective custody agents.

Following, the statement of the amounts paid and payable relating

to 2021:

|

Amounts Paid

|

R$

|

|

Monthly interest on shareholders’ equity relating to the months from January to November

|

1,864,609,005.54

|

|

Supplementary interest on shareholders’ equity, relating to first semester of 2021, declared on 7.2.2021 and paid on 7.12.2021

|

5,000,000,000.00

|

|

Subtotal – amounts paid(*)

|

6,864,609,005.54

|

|

|

|

Amounts Payable

|

|

|

Monthly interest on shareholders’ equity relating to the month of December, to be paid on January 3, 2022

|

175,480,508.69

|

|

Dividends/Supplementary interest on shareholders´ equity resolved on December 9, 2021 to be paid on December 30, 2021

|

2,200,000,000.00

|

|

Subtotal – amounts payable

|

2,375,480,508.69

|

|

|

|

Total

|

9,240,089,514.23

|

(*) it considers the bonus approved at the EGM of March

10, 2021

Per share in R$

|

Type

|

Monthly interest on shareholders’ equity accrued in the year

|

Supplementary interest on shareholders´ equity of the 1st semester

of 2021

|

Dividends/Supplementary interest on shareholders´ equity

|

Total

|

|

Dividends

|

Interest

|

|

Common Shares

|

0.206997912

|

0.490007301

|

0.196595372

|

0.019659537

|

0.913260122

|

|

Preferred Shares

|

0.227697708

|

0.539008031

|

0.216254909

|

0.021625491

|

1.004586139

|

The Company may, based on the result to be calculated at the end of

the fiscal year of 2021, distribute new interest on shareholders’ equity and/or dividends to the shareholders.

The dividends/supplementary interest on shareholders’ equity

hereby approved represents, approximately, 12 times the monthly interest paid, net of withholding income tax, and will be included in

the calculation of the mandatory dividends for the fiscal year provided for in the bylaws.

Cidade de Deus, Osasco, SP, December 9, 2021

Banco Bradesco S.A.

Leandro de Miranda Araujo

Executive Deputy and

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 9, 2021

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/Leandro de Miranda Araujo

|

|

|

|

Leandro de Miranda Araujo

Executive Deputy Officer and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

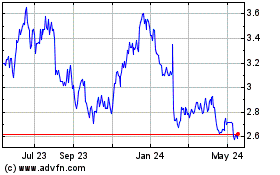

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Jan 2025 to Feb 2025

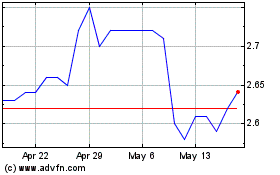

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Feb 2024 to Feb 2025