Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 November 2024 - 4:42AM

Edgar (US Regulatory)

Schedule of Investments (unaudited)

September 30, 2024

BlackRock Enhanced International Dividend Trust (BGY)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

|

|

|

|

Canadian National Railway Co.

|

|

|

|

Teck Resources Ltd., Class B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Novo Nordisk A/S, Class B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LVMH Moet Hennessy Louis Vuitton SE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deutsche Telekom AG, Class N, Registered Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Rakyat Indonesia Persero Tbk PT

|

|

|

|

|

|

|

FinecoBank Banca Fineco SpA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United Overseas Bank Ltd.

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argentaria SA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zurich Insurance Group AG, Class N

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United Kingdom (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AceVector Limited, Series I, (Acquired 01/25/22, Cost:

$3,948,600)(a)(b)(c)

|

|

|

|

Baker Hughes Co., Class A(d)(e)

|

|

|

|

General Electric Co.(d)(e)

|

|

|

|

|

|

|

|

|

Nestle SA, Class N, Registered Shares

|

|

|

|

Otis Worldwide Corp.(d)(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas Instruments, Inc.(d)(e)

|

|

|

|

Visa, Inc., Class A(d)(e)

|

|

|

|

|

|

|

|

|

Total Long-Term Investments — 101.5%

(Cost: $499,660,059)

|

|

|

|

Money Market Funds — 0.0%

|

|

BlackRock Liquidity Funds, T-Fund, Institutional Shares,

4.83%(f)(g)

|

|

|

|

Total Short-Term Securities — 0.0%

(Cost: $163,210)

|

|

Total Investments Before Options Written — 101.5%

(Cost: $499,823,269)

|

|

Options Written — (1.3)%

(Premiums Received: $(6,192,340))

|

|

Total Investments, Net of Options Written — 100.2%

(Cost: $493,630,929)

|

|

Liabilities in Excess of Other Assets — (0.2)%

|

|

|

|

|

|

|

Security is valued using significant unobservable inputs and is classified as Level

3 in the

fair value hierarchy.

|

|

|

Non-income producing security.

|

|

|

Restricted security as to resale, excluding 144A securities. The Trust held restricted

securities with a current value of $372,487, representing 0.1% of its net assets as

of

period end, and an original cost of $3,948,600.

|

|

|

All or a portion of the security has been pledged as collateral in connection with

outstanding OTC derivatives.

|

|

|

All or a portion of the security has been pledged and/or segregated as collateral

in

connection with outstanding exchange-traded options written.

|

|

|

|

|

|

Annualized 7-day yield as of period end.

|

Schedule of Investments

1

Schedule of Investments (unaudited)(continued)

September 30, 2024

BlackRock Enhanced International Dividend Trust (BGY)

Affiliates

Investments in issuers considered to be affiliate(s) of the Trust during the period

ended September 30, 2024 for purposes of Section 2(a)(3) of the Investment Company

Act of 1940, as amended, were as follows:

|

|

|

|

|

|

Change in

Unrealized

Appreciation

(Depreciation)

|

|

|

|

Capital Gain

Distributions

from

Underlying

Funds

|

BlackRock Liquidity Funds, T-Fund, Institutional Shares

|

|

|

|

|

|

|

|

|

|

|

|

Represents net amount purchased (sold).

|

Derivative Financial Instruments Outstanding as of Period End

Exchange-Traded Options Written

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baker Hughes Co., Class A

|

|

|

|

|

|

|

|

Baker Hughes Co., Class A

|

|

|

|

|

|

|

|

Canadian National Railway Co.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Teck Resources Ltd., Class B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baker Hughes Co., Class A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baker Hughes Co., Class A

|

|

|

|

|

|

|

|

Canadian National Railway Co.

|

|

|

|

|

|

|

|

Teck Resources Ltd., Class B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

Nestle SA, Class N, Registered Shares

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

United Overseas Bank Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FinecoBank Banca Fineco SpA

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

Novo Nordisk A/S, Class B

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

Goldman Sachs International

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argentaria SA

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Investments (unaudited)(continued)

September 30, 2024

BlackRock Enhanced International Dividend Trust (BGY)

OTC Options Written (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

United Overseas Bank Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United Overseas Bank Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zurich Insurance Group AG, Class N

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LVMH Moet Hennessy Louis Vuitton SE

|

Goldman Sachs International

|

|

|

|

|

|

|

|

Novo Nordisk A/S, Class B

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FinecoBank Banca Fineco SpA

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

Deutsche Telekom AG, Class N, Registered

Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argentaria SA

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LVMH Moet Hennessy Louis Vuitton SE

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

Novo Nordisk A/S, Class B

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FinecoBank Banca Fineco SpA

|

|

|

|

|

|

|

|

|

Nestle SA, Class N, Registered Shares

|

Morgan Stanley & Co. International PLC

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Investments

3

Schedule of Investments (unaudited)(continued)

September 30, 2024

BlackRock Enhanced International Dividend Trust (BGY)

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments at

the measurement date. These inputs to valuation techniques are categorized into a

fair value hierarchy consisting of three broad levels for financial reporting purposes as follows:

• Level 1 – Unadjusted price quotations in active markets/exchanges that the Trust has the ability to access for identical, unrestricted assets or liabilities;

• Level 2 – Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly or indirectly; and

• Level 3 – Inputs that are unobservable and significant to the entire fair value measurement for the asset or liability (including the Valuation Committee’s assumptions used in determining the fair value of financial instruments).

The hierarchy gives the highest priority to unadjusted quoted prices in active markets

for identical assets or liabilities (Level 1 measurements) and the lowest priority

to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised

in determining fair value is greatest for instruments categorized in Level 3. The

inputs used to measure fair value may fall into different levels of the fair value

hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification

is determined based on the lowest level input that is significant to the fair value measurement

in its entirety. Investments classified within Level 3 have significant unobservable

inputs used by the Valuation Committee in determining the price for Fair Valued Investments.

Level 3 investments include equity or debt issued by privately held companies or funds. There may not be a secondary market, and/or there are a limited number of investors.

The categorization of a value determined for financial instruments is based on the

pricing transparency of the financial instruments and is not necessarily an indication of the risks associated with investing in those securities. For information about the Trust’s policy regarding valuation of financial instruments, refer to its most recent financial

statements.

The following table summarizes the Trust’s financial instruments categorized in the fair value hierarchy. The breakdown of the Trust’s financial instruments into major categories is disclosed in the Schedule of Investments above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Financial Instruments(a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative financial instruments are options written. Options written are shown at

value.

|

Currency Abbreviation (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Investments (unaudited)(continued)

September 30, 2024

BlackRock Enhanced International Dividend Trust (BGY)

|

|

|

|

Subject to Appropriations

|

Schedule of Investments

5

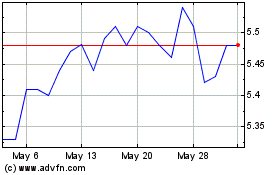

BlackRock Enhanced Inter... (NYSE:BGY)

Historical Stock Chart

From Dec 2024 to Jan 2025

BlackRock Enhanced Inter... (NYSE:BGY)

Historical Stock Chart

From Jan 2024 to Jan 2025