Amended Tender Offer Statement by Third Party (sc To-t/a)

17 July 2015 - 8:03PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934.

(Amendment No. 2)

BIGLARI

HOLDINGS INC.

(Name of Subject Company (Issuer))

THE LION FUND II, L.P.

(Name of Filing Person (Offeror and Affiliate of Issuer))

Common stock, stated value $0.50 per share

(Title of Class of Securities)

857873103

(CUSIP Number

of Class of Securities)

Sardar Biglari

Chairman

and Chief Executive Officer

Biglari Capital Corp., General Partner of The Lion Fund II, L.P.

17802 IH 10 West, Suite 400

San Antonio, Texas 78257

Telephone: (210) 344-3400

(Name, address, and telephone number of person authorized to receive notices and communications on behalf of filing persons)

with copies to:

Edward Horton, Esq.

Seward & Kissel LLP

One Battery Park Plaza

New York, NY 10004

(212)

574-1200

CALCULATION OF FILING FEE

|

|

|

| Transaction Valuation*: |

|

Amount of Filing Fee: |

| $258,851,040 |

|

$30,078.50 |

| |

| * |

Calculated by multiplying the $420.00 per share tender offer purchase price by 616,312, the number of shares of common stock purchased in the offer. The amount of the filing fee was calculated in accordance with Rule

0-11(b) of the Securities Exchange Act of 1934, as amended, and equals $116.20 for each $1,000,000 of the value of the transaction. The full amount of the filing fee has been offset as set forth below. |

| x |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: $30,078.50 |

|

Filing Party: The Lion Fund II, L.P |

| Form or Registration No.: Schedule TO (File No. 005-30771) |

|

Date Filed: June 4, 2015 and July 2, 2015 |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

x |

third-party tender offer subject to Rule 14d-1. |

| |

¨ |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going-private transaction subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d-2 |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: x

INTRODUCTORY STATEMENT

This Amendment No. 1 to the Tender Offer Statement on Schedule TO (as amended, the “Schedule TO”) relates to a Tender Offer (as

defined herein) by The Lion Fund II, L.P., a Delaware limited partnership (the “Offeror”), to purchase up to 575,000 of the outstanding shares of common stock, $0.50 par value (the “Common Stock”) of Biglari Holdings Inc. (the

“Company”), an Indiana corporation (the “Shares”), at a price of $420.00 per share, net to the seller in cash without interest and subject to any withholding taxes required by applicable law, on the terms and subject to the

conditions set forth in the Offer to Purchase dated June 4, 2015 (the “Offer to Purchase”) and in the related Letter of Transmittal and Important Instructions and Information (which together, as they may be amended or supplemented

from time to time, constitute the “Offer”), copies of which are attached to this Schedule TO as Exhibits (a)(1)(i), (a)(1)(ii) and (a)(1)(iii), respectively. The Offeror is an affiliate of the Company, as described below. This Tender Offer

Statement on Schedule TO (including exhibits) is intended to satisfy the reporting requirements of Rules 14d-1 under the Securities Exchange Act of 1934, as amended.

Copies of the Offer to Purchase, the related Letter of Transmittal and Important Instructions and Information, and certain other relevant

documents are filed as exhibits hereto. The information in the Offer to Purchase is hereby incorporated by reference in response to all the items of this Schedule TO, except those items as to which information is specifically provided therein.

| Item 11. |

Additional Information. |

Item 11 of the Schedule TO is hereby amended and

supplemented by adding the following information:

Based on the final count provided by the Depository, the total number of Shares validly

tendered in the Offer was 618,867 shares. Pursuant to the terms of the Offer, the Offeror elected to increase the number of Shares accepted for payment by 41,312, or 2% of the outstanding shares of Common Stock of the Company. The number of Shares

that the Offeror purchased from each tendering shareholder was prorated so that the Offeror purchased in the Offer a total of 616,312 shares.

See the Exhibit Index immediately following the signature page, which Exhibit

Index is incorporated herein by reference.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

| Date: July 16, 2015 |

|

|

|

The Lion Fund II, L.P. |

|

|

|

|

|

|

|

|

By: |

|

Biglari Capital Corp., its General Partner |

|

|

|

|

|

|

|

|

By: |

|

/s/ Sardar Biglari |

|

|

|

|

Name: |

|

Sardar Biglari |

|

|

|

|

Title: |

|

Chairman and Chief Executive Officer |

EXHIBIT INDEX

|

|

|

|

|

| (a)(1)(i) |

|

Offer to Purchase, dated June 4, 2015 |

|

|

| (a)(1)(ii) |

|

Letter of Transmittal (including IRS Form W-9 and Guidelines for Certification of Taxpayer Identification Number on IRS Form W-9) |

|

|

| (a)(1)(iii) |

|

Important Instructions and Information |

|

|

| (a)(1)(iv) |

|

Notice of Guaranteed Delivery |

|

|

| (a)(1)(v) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees |

|

|

| (a)(1)(vi) |

|

Form of Summary Advertisement |

|

|

| (a)(5)(i) |

|

Press release announcing the commencement of the Offer, dated June 4, 2015 |

|

|

| (a)(5)(ii) |

|

Press release issued by The Lion Fund II, L.P., dated July 2, 2015 |

|

|

| (d)(1) |

|

Stock Purchase Agreement, dated July 1, 2013, by and between Biglari Holdings Inc. and Sardar Biglari, incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on July 2, 2013. |

|

|

| (d)(2) |

|

Shared Services Agreement, dated July 1, 2013, by and between Biglari Holdings Inc. and Biglari Capital Corp., incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by the Company on July 2,

2013. |

|

|

| (d)(3) |

|

Amended and Restated Incentive Bonus Agreement, dated as of September 28, 2010, by and between the Company and Sardar Biglari, incorporated by reference to Annex A to the Company’s definitive Proxy Statement dated September 28,

2011. |

|

|

| (d)(4) |

|

First Amendment, dated as of July 1, 2013, to the Amended and Restated Incentive Bonus Agreement, dated as of September 28, 2010, by and between Biglari Holdings Inc. and Sardar Biglari, incorporated by reference to Exhibit 10.3 to

the Current Report on Form 8-K filed by the Company on July 2, 2013. |

|

|

| (d)(5) |

|

Trademark License Agreement, dated as of January 11, 2013, by and between Biglari Holdings Inc. and Sardar Biglari, incorporated by reference to the Current Report on Form 8-K filed by the Company on January 11, 2013. |

|

|

| (d)(6) |

|

Trademark Sublicense Agreement, entered as of May 14, 2013, by and among Biglari Holdings Inc., Steak n Shake, LLC and Steak n Shake Enterprises, Inc., incorporated by reference to the Quarterly Report on Form 10-Q for the quarterly

period ended April 10, 2013 filed by the Company on May 17, 2013. |

|

|

| (d)(7) |

|

Amended and Restated Partnership Agreement of The Lion Fund II, L.P., as amended on June 3, 2015, incorporated by reference to the Current Report on Form 8-K filed by the Company on June 4, 2015. |

| * |

Filed as an exhibit to this Schedule TO. |

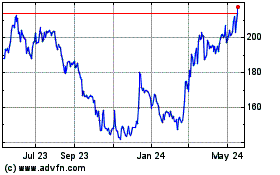

Biglari (NYSE:BH)

Historical Stock Chart

From Mar 2024 to Apr 2024

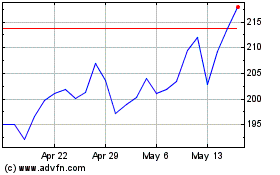

Biglari (NYSE:BH)

Historical Stock Chart

From Apr 2023 to Apr 2024