Boston Omaha Corporation (NYSE: BOC) (the “Company”, “we”, or

“our”) announced its financial results for the second quarter ended

June 30, 2024, in connection with filing its Quarterly Report on

Form 10-Q with the Securities and Exchange Commission.

We show below summary financial data for the second quarter of

2024 and 2023. Our Quarterly Report on Form 10-Q can be found at

www.bostonomaha.com. A supplemental presentation providing

additional financial information for the second quarter of 2024 can

be found on our investor relations website at

https://investor.bostonomaha.com.

For the Three Months Ended For the Six Months Ended

June 30, June 30,

2024

2023

2024

2023

Billboard Rentals, Net

$

11,437,468

$

10,835,524

$

22,134,128

$

21,137,747

Broadband Services

9,787,983

8,695,235

19,471,412

17,235,141

Premiums Earned

4,737,056

3,458,627

8,740,115

6,565,900

Insurance Commissions

527,055

594,540

1,029,743

1,070,666

Investment and Other Income

598,221

632,468

1,265,116

1,022,725

Total Revenues

27,087,783

24,216,394

52,640,514

47,032,179

Depreciation and Amortization Expense

5,456,140

4,844,059

10,794,267

9,353,403

Net Loss from Operations

(4,396,615

)

(1,642,904

)

(6,454,896

)

(4,619,696

)

Net Other Income

2,357,407

3,357,575

231,444

1,242,900

Net (Loss) Income Attributable to Common Stockholders

$

(2,235,219

)

$

1,541,612

$

(5,043,300

)

$

(1,779,542

)

Basic and Diluted Net (Loss) Income per Share

$

(0.07

)

$

0.05

$

(0.16

)

$

(0.06

)

June 30, December 31,

2024

2023

Total Unrestricted Cash & Investments (1)

$

40,564,748

$

71,269,580

Total Assets

723,064,123

768,207,092

Total Liabilities

157,663,397

151,754,831

Redeemable Noncontrolling Interest

-

15,638,013

Total Boston Omaha Stockholders' Equity

530,478,942

538,207,426

Noncontrolling Interests (2)

34,921,784

62,606,822

Total Equity

$

565,400,726

$

600,814,248

(1)

Investments consist of U.S. treasury

securities classified as trading securities and marketable equity

securities, of which $2,385,983 is held by our insurance entities

at June 30, 2024. Marketable equity securities excludes Sky Harbour

Group Corporation (“Sky Harbour”) Class A common stock as we

account for our 18.6% stake (as measured at June 30, 2024) under

the equity method.

(2)

Noncontrolling interests are related to

third party capital raised within our build for rent fund as well

as within our 24th Street commercial real estate funds.

During the second quarter of fiscal 2024, we incurred $4.1

million in one-time employee costs and professional fees associated

with the separation and stock repurchase agreement of our former

Co-CEO.

In the second quarter of fiscal 2024, “Net Other Income”

included non-cash gains of $3.0 million from unconsolidated

affiliates mainly related to our share of Sky Harbour’s income from

operations, which we account for under the equity method, and

interest and dividend income of $0.3 million. These items were

partially offset by $0.5 million in other investment losses mainly

driven by a $4.0 million unrealized loss on our Sky Harbour

warrants, which was partially offset by (i) $2.0 million in

non-cash gains associated with the transfer of Sky Harbour Class A

common stock to our former Co-CEO as a part of his separation and

stock repurchase agreement, (ii) $0.9 million in realized gains on

the sale of 246,389 shares of Sky Harbour Class A common stock, and

(iii) other investment income of $0.6 million primarily related to

changes in the fair value of the BFR Fund mainly driven by the

underlying real estate properties, and interest expense of $0.4

million mainly incurred under Link's term loan and revolver.

Our investment in Sky Harbour Class A common stock and warrants

was valued at $91.8 million on our consolidated balance sheet as of

June 30, 2024. If our investment in Sky Harbour Class A common

stock was accounted for at fair value based on its quoted market

price (currently valued using equity method accounting), then our

total investment in Sky Harbour Class A common stock and warrants

would be valued at $124.6 million as of June 30, 2024.

As a reminder, generally accepted accounting principles (“GAAP”)

require us to include the unrealized changes in market prices of

investments in public securities in our reported earnings (3).

While we intend to hold securities for the longer term, we may in

the future choose to sell them for a variety of reasons resulting

in realized losses or gains.

Cash inflow from operations for the six months ended June 30,

2024 was $6.9 million, compared to a cash inflow of $4.4 million

for the six months ended June 30, 2023.

Our book value per share was $16.86 at June 30, 2024, compared

to $17.19 at December 31, 2023.

As of June 30, 2024, we had 30,931,349 shares of Class A common

stock and 527,780 shares of Class B common stock issued and

outstanding.

As of August 12, 2024, we had 30,931,349 shares of Class A

common stock and 527,780 shares of Class B common stock issued and

outstanding.

About Boston Omaha Corporation

Boston Omaha Corporation is a public holding company with four

majority owned businesses engaged in outdoor advertising, broadband

telecommunications services, surety insurance and asset

management.

(3)

Excludes Sky Harbour Class A common stock

as we account for our investment under the equity method.

Forward-Looking Statements

Any statements in this press release about the Company’s future

expectations, plans and prospects, including statements about our

financing strategy, future operations, future financial position

and results, market growth, total revenue, as well as other

statements containing the words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,”

“might,” “plan,” “potential,” “predict,” “project,” “should,”

“target,” “will,” or “would” and similar expressions, constitute

forward-looking statements within the meaning of the safe harbor

provisions of The Private Securities Litigation Reform Any

statements in this press release about the Company’s future

expectations, plans and prospects, including statements about our

financing strategy, future operations, future financial position

and results, market growth, total revenue, as well as other

statements containing the words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,”

“might,” “plan,” “potential,” “predict,” “project,” “should,”

“target,” “will,” or “would” and similar expressions, constitute

forward-looking statements within the meaning of the safe harbor

provisions of The Private Securities Litigation Reform Act of 1995.

The Company may not actually achieve the plans, intentions or

expectations disclosed in the Company’s forward-looking statements,

and you should not place undue reliance on the Company’s

forward-looking statements. Actual results or events could differ

materially from the plans, intentions and expectations disclosed in

the forward-looking statements the Company make as a result of a

variety of risks and uncertainties, including risks related to the

Company’s estimates regarding the potential market opportunity for

the Company’s current and future products and services, the impact

of the COVID-19 pandemic, the competitive nature of the industries

in which we conduct our business, general business and economic

conditions, our ability to acquire suitable businesses, our ability

to successfully integrate acquired businesses, the effect of a loss

of, or financial distress of, any reinsurance company which

reinsures the Company’s insurance operations, the risks associated

with our investments in both publicly traded securities and

privately held businesses, our history of losses and ability to

maintain profitability in the future,

the Company’s expectations regarding the Company’s sales,

expenses, gross margins and other results of operations, and the

other risks and uncertainties described in the “Risk Factors”

sections of the Company’s public filings with the Securities and

Exchange Commission (the “SEC”) on Form 10-K for the year ended

December 31, 2023, as well as other risks and uncertainties which

may be described in any subsequent quarterly report on Form 10-Q

filed by the Company and the other reports the Company files with

the SEC. Copies of our SEC filings are available on our website at

www.bostonomaha.com. In addition, the forward-looking statements

included in this press release represent the Company’s views as of

the date hereof. The Company anticipates that general economic

conditions and subsequent events and developments may cause the

Company’s views to change. However, while the Company may elect to

update these forward-looking statements at some point in the

future, the Company specifically disclaims any obligation to do so.

These forward-looking statements should not be relied upon as

representing the Company’s views as of any date subsequent to the

date hereof.

Our investor relations website is

https://investor.bostonomaha.com and we encourage investors to use

it as a way of easily finding information about us. We promptly

make available on this website, free of charge, the reports that we

file or furnish with the SEC, corporate governance information, and

select press releases, which may contain material information about

us, and you may subscribe to be notified of new information posted

to this site.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813974429/en/

Boston Omaha Corporation Josh Weisenburger, 402-210-2633

contact@bostonomaha.com

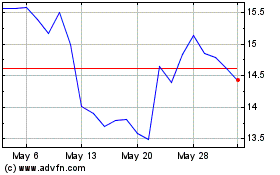

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From Dec 2023 to Dec 2024