Honeywell Beats Estimates (revised) - Analyst Blog

24 October 2011 - 6:24PM

Zacks

Honeywell International Inc.’s (HON) reported

third-quarter 2011 earnings results, reporting earnings per share

from continuing operations of $1.10, beating the Zacks Consensus

Estimate of 99 cents.

Total Revenue

Total revenue was $9.3 billion, an increase of 14% y/y.

Organically, total revenue was up 8% year over year, led by strong

performance in every market.

The company reported a revenue increase in all its segments.

Segment Performance

Aerospace segment sales climbed 8% year over year to $2.9 billion,

led by increased Commercial original equipment sales and raised

aftermarket volumes. This increase was partially offset by lower

military and government services sales. An increased volume,

favorable mix, and productivity net of inflation increased

operating margin by 80 bps to 17.3% during the quarter. However,

higher research and development costs partially affected the

segment margin.

Automation and Control Solutions segment sales increased by 14%

year over year to $3.9 billion, led by high product volumes and

Solution sales. The segment benefitted from good performance in the

emerging market, introduction of new products and favorable macro

trends. Sales in the quarter included 4% favorable impact from

foreign currency. The segment’s operating profit increased 15%

during the quarter.

Transportation System revenue of $960 million for the quarter,

increased by 22% year over year as a result of increased global

passenger and commercial vehicle Turbo volumes, new launches, and

favorable impact from foreign exchange of 9%. Augmented sales

volume and better productivity, increased the segment’s operating

profit by 32%. This was, however, partially offset by material

Inflation.

Specialty Material sales increased by 25% during the quarter to

$1.5 billion, led by good sales from UOP and development of

catalysts and new product applications in Advanced Materials.

Acquisition of the phenol plant also benefitted the segment

revenue. The segment operating profit increased by 31%, benefitting

from increased revenue, offset by inflation and unfavorable margin

impact from the phenol plant acquisition.

Income

The company incurred total SG&A expense of approximately $1.3

billion in the quarter versus approximately $1.1 billion in the

third quarter of 2010. Net income of the company was $863 million

compared with $596 million in the prior-year period.

Balance Sheet

Cash and cash equivalents were $3.9 billion with long-term debt of

$6.9 billion and shareowner’s equity of $11.8 billion.

Free cash flow in the quarter was $884 million, excluding pension

contributions of $400 million.

Outlook

The company’s result for the quarter is quite impressive as its

performance gained momentum in all business segment. Led by good

first-quarter 2011 performance and improving market condition,

Honeywell increased its 2011 sales and earnings per share

outlook.

Sales for the the year are expected to be in the range of $36.5

billion-$36.7 billion, up by approximately 13% over 2010. Sales

expectations for 2011 excludes the divested CPG business. Earnings

per share is expected to be in the range of $4.00-$4.05, up 33% to

35% over 2010. Free cash flow is expected to be about $3.5 billion.

Free cash flow expectation excludes US pension contribution.

Honeywell’s short-cycle businesses as well as its commercial

aerospace spares and residential and commercial retrofit businesses

are performing impressively well and are expected to support future

growth outlook of the company. The short-cycle businesses of the

company, like Turbo Technologies, Advanced Materials and ACS

Products, continues to perform well. The company’s long-cycle

backlog continued to be at near record levels.

Based in Morris Township, N.J., Honeywell International Inc. is a

Fortune 100 company providing technical and manufacturing support

to customers worldwide with aerospace products and services;

control technologies for buildings, homes and industry; automotive

products; turbochargers; and specialty materials. The major

competitors of Honeywell are

Borg Warner (BWA),

United Technologies Corp. (UTX) and

Johnson Controls Inc. (JCI).

We currently maintain our Neutral rating on Honeywell, with a Zacks

#3 Rank (Hold recommendation) over the next one to three

months.

(We are re-posting this article to correct an inaccuracy. The

original article, posted last week, should not be relied

upon.)

BORG WARNER INC (BWA): Free Stock Analysis Report

HONEYWELL INTL (HON): Free Stock Analysis Report

JOHNSON CONTROL (JCI): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

Zacks Investment Research

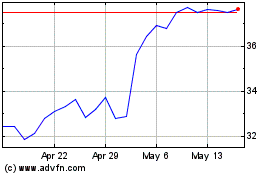

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jun 2024 to Jul 2024

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jul 2023 to Jul 2024