0001130713false00011307132025-03-082025-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

MARCH 8, 2025

Date of Report (date of earliest event reported)

Beyond, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-41850 | | 87-0634302 |

| (State or other jurisdiction of | | (Commission File Number) | | (I.R.S. Employer |

| incorporation or organization) | | | | Identification Number) |

433 W. Ascension Way, 3rd Floor

Murray, Utah 84123

(Address of principal executive offices)

(801) 947-3100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | BYON | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Principal Executive Officer

On March 8, 2025, the Board of Directors (the “Board”) of Beyond, Inc. (the “Company”) appointed Marcus Lemonis, Executive Chairman of the Board, as the Company’s principal executive officer, effective as of March 10, 2025 (the “Effective Date”), replacing Dave Nielsen as the principal executive officer.

Mr. Nielsen’s employment with the Company was terminated on the Effective Date. The Company expects to enter into a separation agreement with Mr. Nielsen, containing a general release of claims in exchange for certain separation benefits as provided under the Company’s Key Employee Severance Plan, in which Mr. Nielsen is a “Tier 2” participant, and in Mr. Nielsen’s offer letter with the Company.

Mr. Lemonis will continue in his role as Executive Chairman of the Board. A description of each of the items required to be disclosed by Item 5.02(c)(2) of Form 8-K can be found in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (the “SEC”) on March 28, 2024, and is incorporated by reference herein.

In connection with Mr. Lemonis’s appointment as the principal executive officer, on the Effective Date, the Board granted to Mr. Lemonis (i) an award of 500,000 restricted stock units, with such restricted stock units to vest in three equal installments on March 10, 2026, March 10, 2027 and March 10, 2028, subject to Mr. Lemonis’ continuous service through such dates, and subject to the provisions of the Company’s 2005 Equity Incentive Plan (the “2005 Plan”) and the restricted stock unit award agreement governing such grant; and (ii) 500,000 performance shares (assuming the “Target” achievement of each performance metric; maximum achievement of each performance metric would result in the vesting of 135% of the “Target” number of performance shares), subject to Mr. Lemonis’ continuous service through the applicable vesting dates, and subject to the provisions of the 2005 Plan and the performance share award grant notice and performance share award agreement governing such grant ((i) and (ii) together, the “PEO Grants”). The portion of the PEO Grants that exceed the current 100,000 restricted stock unit award cap and exceed the current 250,000 performance share award cap under the Company’s 2005 Plan will be subject to stockholder approval of the 2005 Plan Amendment (as defined below) at the Company’s 2025 Annual Meeting of Stockholders.

Mr. Lemonis previously entered into the Company’s indemnification agreement for certain executive officers.

On March 8, 2025, the Board approved an amendment to the 2005 Plan to increase the annual limit on the number of restricted stock units and performance shares that may be issued to any eligible participant to accommodate the PEO Grant, subject to stockholder approval of such amendment at the Company’s 2025 Annual Meeting of Stockholders (the “2005 Plan Amendment”). The foregoing description of the amendment is qualified in its entirety by reference to the amendment, which will be filed as an exhibit to the Company’s proxy statement for the Company’s 2025 Annual Meeting of Stockholders.

President

On March 8, 2025, the Board appointed Adrianne Lee, the Company’s Chief Financial & Administrative Officer, as the Company’s President and Chief Financial Officer, effective as of the Effective Date. Ms. Lee will continue in her role as the Company’s principal financial officer.

A description of each of the items required to be disclosed by Item 5.02(c)(2) of Form 8-K can be found in the Company’s definitive proxy statement filed with the SEC on March 28, 2024, and is incorporated by reference herein.

In connection with Ms. Lee’s appointment as the Company’s President and Chief Financial Officer, Ms. Lee will be entitled to an annual base salary of $700,000 and an annual target bonus of 75% of her annual base salary. Additionally, effective as of the Effective Date, Ms. Lee was granted (i) an award of restricted stock units with an aggregate value on the grant date equal to $100,000, with such restricted stock units to vest in three equal installments on February 4, 2026, February 4, 2027 and February 4, 2028, subject to Ms. Lee’s continuous service through such dates, and subject to the provisions of the 2005 Plan and the restricted stock unit award agreement governing such grant; and (ii) an award of performance shares with an aggregate value on the grant date equal to $100,000 (assuming the “Target” achievement of each performance metric; maximum achievement of each performance metric would result in the vesting of 135% of the “Target” number of performance shares), subject to Ms. Lee’s continuous service through the applicable vesting dates, and subject to the provisions of the 2005 Plan and the performance share award grant notice and performance share award agreement governing such grant.

Ms. Lee previously entered into the Company’s indemnification agreement for certain executive officers.

Chief Accounting Officer and Principal Accounting Officer

On March 8, 2025, the Board appointed Leah Putnam, age 35, as the Company’s Chief Accounting Officer and principal accounting officer, effective as of the Effective Date.

Prior to her appointment as the Company’s Chief Accounting Officer, Ms. Putnam served as the Company’s Vice President of Finance and Controller since February 2024. Ms. Putnam has served as Vice President, Financial Planning and Analysis and Senior Director of Financial Planning Analysis since 2020. She also held several corporate finance, financial systems, and data governance roles at The Hertz Corporation from 2018 to 2020. There is no family relationship between Ms. Putnam and any of the Company’s other directors or executive officers. Ms. Putnam has no material interest in any transaction that is required to be disclosed under Item 404(a) of Regulation S-K.

In connection with Ms. Putnam’s appointment as the Company’s Chief Accounting Officer and principal accounting officer, Ms. Putnam will be entitled to an annual base salary of $325,000 and an annual target bonus of 50% of her annual base salary. Ms. Putnam will also be a “Tier 3 Participant” in the Company’s Key Employee Severance Plan, copy of which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 24, 2023. Additionally, effective as of the Effective Date, Ms. Putnam was granted (i) an award of restricted stock units with an aggregate value on the grant date equal to $31,250, with such restricted stock units to vest in three equal installments on February 4, 2026, February 4, 2027 and February 4, 2028, subject to Ms. Putnam’s continuous service through such dates, and subject to the provisions of the 2005 Plan and the restricted stock unit award agreement governing such grant; and (ii) an award of performance shares with an aggregate value on the grant date equal to $143,750 (assuming the “Target” achievement of each performance metric; maximum achievement of each performance metric would result in the vesting of 135% of the “Target” number of performance shares), subject to Ms. Putnam’s continuous service through the applicable vesting dates, and subject to the provisions of the 2005 Plan and the performance share award grant notice and performance share award agreement governing such grant.

Ms. Putnam is expected to enter into the Company’s indemnification agreement for certain executive officers.

Chief Operating Officer

On March 8, 2025, the Board appointed Alexander Thomas, age 35, to serve as the Company’s Chief Operating Officer, effective as of the Effective Date.

Prior to his appointment as the Company’s Chief Operating Officer, Mr. Thomas served as the Company’s SVP of Finance and Corporate Development since April 2024. Prior to that time, Mr. Thomas, served as SVP of Overstock, and Vice President, International & Pricing, and Senior Director of Financial Planning and Analysis starting 2020. Previously he held various strategic finance roles at The Hertz Corporation from 2018 to 2020. There is no family relationship between either of Mr. Thomas and any of the Company’s other directors or executive officers. Mr. Thomas has no material interest in any transaction that is required to be disclosed under Item 404(a) of Regulation S-K.

In connection with Mr. Thomas’s appointment as the Company’s Chief Operating Officer, Mr. Thomas will be entitled to an annual base salary of $350,000 and an annual target bonus of 50% of his annual base salary. Additionally, effective as of the Effective Date, Mr. Thomas was granted (i) an award of restricted stock units with an aggregate value on the grant date equal to $100,000, with such restricted stock units to vest in three equal installments on February 4, 2026, February 4, 2027 and February 4, 2028, subject to Mr. Thomas’s continuous service through such dates, and subject to the provisions of the 2005 Plan and the restricted stock unit award agreement governing such grant; and (ii) an award of performance shares with an aggregate value on the grant date equal to $100,000 (assuming the “Target” achievement of each performance metric; maximum achievement of each performance metric would result in the vesting of 135% of the “Target” number of performance shares), subject to Mr. Thomas’s continuous service through the applicable vesting dates, and subject to the provisions of the 2005 Plan and the performance share award grant notice and performance share award agreement governing such grant.

Mr. Thomas is expected to enter into the Company’s indemnification agreement for certain executive officers.

Item 7.01 Regulation FD.

On March 10, 2025, the Company issued a press release regarding the executive appointments mentioned above. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference to this Item 7.01.

A copy of the press release is furnished with this report as Exhibit 99.1. The information in this Current Report on Form 8-K and in Exhibit 99.1 is furnished herewith and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as may expressly be set forth in any such filing by specific reference.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K and corresponding Exhibits contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include all statements other than statements of historical fact, including but not limited to statements regarding leadership changes, related compensation, indemnification, or separation agreements or arrangements, our organizational structure, and the timing of any of the foregoing. Actual results could differ materially for a variety of known and unknown risks, uncertainties, and other important factors including but not limited to those included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 25, 2025, and in our subsequent filings with the SEC.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit No. | Description of Exhibit |

| Press Release, dated March 10, 2025 |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Furnished

SIGNATURE

| | | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | |

| | BEYOND, INC. |

| | |

| By: | /s/ Adrianne Lee |

| | Adrianne Lee |

| | President & Chief Financial Officer |

| Date: | March 10, 2025 |

Exhibit 99.1

Beyond Accelerating Transformation Appointing Marcus Lemonis as its Principal Executive Officer and Adrianne Lee as President & CFO

— Leadership changes reinforce mandate to faster return to profitability

— Management commits to an additional annualized $15 million fixed cost reduction

MURRAY, Utah – March 10, 2025 - Beyond, Inc. (NYSE:BYON), owner of Bed Bath & Beyond, Overstock, and buybuy BABY announced today that its Board of Directors appointed Executive Chairman Marcus Lemonis to serve as the Company’s Principal Executive Officer and appointed Adrianne Lee to serve as its President & CFO.

Mr. Lemonis commented, “The last year has been about identifying Beyond’s strategic priorities of delivering significant improvement in the key metrics of Adjusted EBITDA, gross margin and reduced fixed costs as well as unlocking the value of our blockchain investments. We are committed to making money and returning this business to growth and will not let any obstacles deter that goal. This leadership team is best suited to carry out our mandate of delivering profitable commerce.”

As part of these leadership transitions,

•Leah Putnam, former Vice President of Finance & Controller, has been appointed Chief Accounting Officer;

•Alexander Thomas, former SVP of Finance and Corporate Development, will now serve as Chief Operating Officer of Beyond; and

•Dave Nielsen is no longer the Company’s President and PEO.

“I am honored to take on expanded responsibilities as President & CFO,” said Ms. Lee. “Over the past year, I’ve had the opportunity to work closely with the team and know what is needed to accelerate change. I look forward to driving our strategic priorities and positioning Beyond for long-term success. Importantly, in the near-term, that means identifying and driving tactics to return our core commerce business back to profitability and extracting value from our blockchain investments. We announced an important step today by committing to an annualized fixed cost reduction of $15 million primarily related to our Technology Transformation.”

Mr. Lemonis joined as a director of Beyond in October 2023 and was appointed Chairman of the Board in December 2023. In February 2024, Mr. Lemonis assumed the role of Executive Chairman. Under the expanded leadership role of Executive Chairman and Principal Executive Officer, Mr. Lemonis will continue to drive the execution of Beyond's strategic priorities of rebuilding a profitable commerce business while leveraging innovative technology, strategic partnerships and brand expansion to ultimately deliver growth.

Adrianne Lee, who has served as the Company’s Chief Financial Officer for the past five years, will take on an expanded role of President & CFO. In this capacity, Ms. Lee will work closely with Mr. Lemonis to accelerate the Company on its path to profitability to support future growth and success.

“Adrianne embodies the style of leadership this company will excel with. A demanding expectation for performance, capital allocation and an ever-changing customer experience,” said Lemonis. “She leverages her extensive experience in finance, administration, and corporate strategy, to demonstrate the kind of decisive leadership I expect.”

About Beyond

Beyond, Inc. (NYSE:BYON), based in Murray, Utah, is an ecommerce focused affinity company that owns or has ownership interests in various retail brands, offering a comprehensive array of products and services that enable its customers to unlock their homes’ potential through its vast data cooperative. The Company currently owns Bed Bath & Beyond, Overstock, and other related brands and websites. The Company regularly posts information and updates on its Newsroom and Investor Relations pages on its website, Beyond.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements include all statements other than statements of historical fact, including but not limited to statements regarding the impact of executive transitions, roles and responsibilities, anticipated business results, profitability, and strategies, anticipated cost reductions and their intended benefits, and the timing of any of the foregoing. Actual results could differ materially due to a variety of known and unknown risks, uncertainties, and other important factors including but not limited to those included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the Securities and Exchange Commission (the “SEC”) on February 25, 2025, and in our subsequent filings with the SEC.

Contact Information

Investor Relations

ir@beyond.com

pr@beyond.com

v3.25.0.1

Cover Page

|

Mar. 08, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 08, 2025

|

| Entity Registrant Name |

Beyond, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-41850

|

| Entity Tax Identification Number |

87-0634302

|

| Entity Address, Address Line One |

433 W. Ascension Way, 3rd Floor

|

| Entity Address, City or Town |

Murray

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84123

|

| City Area Code |

801

|

| Local Phone Number |

947-3100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

BYON

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001130713

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

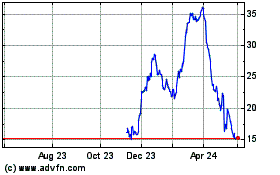

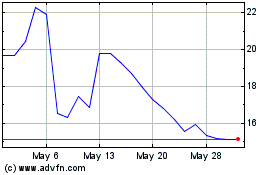

Beyond (NYSE:BYON)

Historical Stock Chart

From Feb 2025 to Mar 2025

Beyond (NYSE:BYON)

Historical Stock Chart

From Mar 2024 to Mar 2025