Virgin Atlantic to Cut Jobs as Transatlantic Demand Continues to Dwindle

04 September 2020 - 11:07PM

Dow Jones News

By Adriano Marchese

Virgin Atlantic said Friday that it will cut more than a

thousand jobs across the company as part of a 1.2-billion-pound

($1.59 billion) restructuring package as the airline prepares for

meager transatlantic demand and continued pandemic-related

uncertainty for the rest of 2020.

Transatlantic flights represent around 70% of the airline's

network, which has taken a hit since the pandemic forced many

airlines to ground their fleets in response to global travel

restrictions in March.

Even as restrictions were lifted, quarantine requirements for

travelers arriving in the U.K. from the U.S. have been subject to

two weeks of quarantine, further dampening demand.

The airline said it is calling on the governments of the U.K.

and the U.S. to introduce testing regimes in lieu of travel

restrictions.

"Based on current outlook, the airline is planning to a scenario

in which transatlantic flying from the U.K. does not extend beyond

current skeleton operations until the beginning of 2021," the

company said.

In this scenario, Virgin Atlantic said capacity operated across

its network in the fourth quarter would be around only 25% of 2019

levels, and revenue in 2021 could be half of what it was in

2019.

The airline's restructuring plan is intended to deliver the

refinancing package over the next 18 months, which will complement

self-help measures already taken by the airline.

"Unfortunately, despite actions already taken to reshape and

resize the business, regrettably the airline must go further one

last time with changes at scale, to ensure it emerges from this

crisis," it added.

Virgin Atlantic said it has begun a 45-day consultation period

with unions Unite and Balpa regarding the layoff of 1,150 employees

across all functions.

Additionally, the company said it is introducing a voluntary

company-led and financed furlough scheme for a further 600 crew

when the U.K.'s coronavirus job retention scheme expires in

October.

The company also noted that global institutional alternative

asset management firm, Davidson Kempner Capital Management, is

providing GBP170 million in secured financing, and that it will

receive an additional GBP450 million in deferrals from a number of

its largest creditors and suppliers.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

September 04, 2020 08:52 ET (12:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

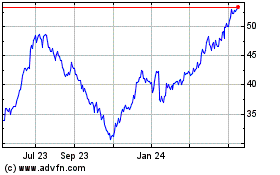

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jul 2023 to Jul 2024