Dillard’s, Inc. Amends and Extends Senior Unsecured Revolving Credit Facility

10 August 2017 - 9:28PM

Business Wire

Dillard’s, Inc. (NYSE: DDS) (“Dillard’s” or “the Company”)

announced that it has amended and extended into a new $800 million

senior unsecured revolving credit facility consistent with the

Company’s liquidity needs. A $200 million expansion option remains

in place and pricing is unchanged. The new maturity date is August

9, 2022.

The credit facility is available to the Company for general

corporate purposes including, among other uses, working capital

financing, the issuance of letters of credit, capital expenditures

and, subject to certain restrictions, the repayment of existing

indebtedness and share repurchases. In accordance with the

financial covenants in the credit agreement, Dillard’s will not

permit the total leverage ratio to exceed 3.50 to 1.00 or the

coverage ratio to be less than 2.50 to 1.00.

The credit facility was arranged by JPMorgan Chase Bank,

N.A.

About Dillard’s

Dillard’s, Inc. ranks among the nation’s

largest fashion retailers with annual sales exceeding $6 billion.

The Company focuses on delivering style, service and value to its

shoppers by offering compelling apparel, cosmetics, and home

selections complemented by exceptional customer care. Dillard’s

stores offer a broad selection of merchandise and feature products

from both national and exclusive brand sources. The Company

operates 268 Dillard’s locations and 25 clearance centers spanning

29 states, plus an Internet store at www.dillards.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170810005196/en/

Dillard’s, Inc.Julie J. Bull, 501-376-5965

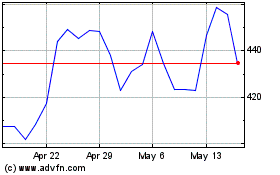

Dillards (NYSE:DDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

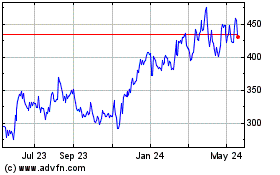

Dillards (NYSE:DDS)

Historical Stock Chart

From Apr 2023 to Apr 2024