Discover® Global Network Study: 91% of Asia-Pacific Businesses Prioritize Fraud Prevention Services, Appeal for Virtual Card Numbers Grows

26 August 2024 - 12:30PM

Business Wire

As the need for digital commercial payments

continues to increase, APAC businesses must find ways to mitigate

fraud for employees and their business expenses

Discover® Global Network, a leading global payment

network, released the second portion of its 2024 Payment State of

the Union, the most comprehensive study of its kind, with key

insights in the commercial payments landscape. This portion of the

research study, which is commissioned by Discover Global Network

and conducted by 451 Research of S&P Global Market

Intelligence, surveyed thousands of decision-makers at corporations

and small and medium sized enterprises within APAC and globally to

understand their commercial payment priorities, challenges, and

future adoption plans. At Global Fintech Fest, Discover Global

Network will share further insight into emerging trends from a

regional and global perspective. The following results are key

takeaways from respondents in the APAC market.

Traditional Payment Methods Remain Prevalent, APAC Businesses

are Increasingly Looking to Digitize Their Commercial Payments.

- Credit cards (61%), ACH/EFT/Wire/Direct debit (54%) and cash

(47%) are the most used payment methods for business expenses.

- (61%) of APAC businesses are actively investing or open to

investing in commercial payment solutions.

- Over the next 12 months, businesses envision increasing the use

of digital payment methods for employee business travel (50%),

employee compensation (46%) and payments to suppliers (45%)

“While commercial payments are increasingly adopting digital

solutions, the transition is not progressing at the same pace as

seen in consumer payments due to the complexities of expense

management,” said Chris Winter, head of international markets

(APAC) at Discover Global Network. “As technology continues to

advance across the industry and region, it is important that

businesses seek to improve the security of their commercial

payments programs to defend against fraudulent activity of all

kinds.”

As Payment Approaches are Modernized, APAC Businesses are

Prioritizing Expense Management, Strong Security and Fraud

Features

- Expense management tools (47%), providing a greater variety of

payment options to business providers (39%), and streamlining

account receivable processes (39%) are the most important

commercial payment initiatives to APAC businesses.

- Within commercial payments solutions, the most important

features are business travel expense management (92%), strong

security features (91%), and fraud prevention services (90%).

Digital Transformation of Commercial Payments is Ongoing, but

Challenges Remain

- Lack of visibility across expense types (35%), difficulties

tracking/managing expenses (34%), and waiting on outstanding

receivables to make payments (33%) are APAC businesses greatest

pain points when making payments and managing expenses.

- Travel expenses not aligning with in-trip costs (38%), timely

reimbursement for employees (38%), and the inability to track,

manage, and forecast employee travel (34%) are the most challenging

when it comes to managing employee travel expenses.

- Integrating data from a variety of sources (47%), too much time

spent on data cleaning/formatting (47%) and integrating relevant

business systems (44%) are the most challenging when managing

commercial payments data.

Expense management and business travel are some of the top

priorities for APAC businesses; however, these areas present

significant challenges.

Virtual Card Numbers (VCN) are Poised for Substantial Growth

- 53% of APAC businesses don’t currently offer or use VCN and 66%

of APAC businesses don’t use VCN to pay for business expenses.

- VCNs have one of the highest rates of future implementation as

(29%) of APAC businesses plan to invest in VCN or are currently in

the discovery phase of implementation.

- Businesses that have implemented VCN have benefitted from

improved transaction security and reduced risk (65%), greater

business efficiencies (64%), and improved expense reconciliation

(59%) the most.

“Virtual card numbers provide businesses with opportunities to

enhance their payment capabilities and better serve their business

needs and employees. It’s great to see so many businesses looking

to adopt VCN solutions,” said Winter. “Whether businesses are

exploring VCN for increased security or to improve their expense

reconciliation capabilities, Discover Global Network can help

businesses of all sizes benefit from our solution.”

Global Fintech Fest

Chris Winter of Discover and 451 Research’s Sophia Furber will

host an in-depth mainstage discussion about the dynamic world of

commercial payments and findings from the Payments State of the

Union.

- When: Wednesday, August 28 10:50 AM Local Time

- Where: Jasmine1, Jio World Convention Centre, Mumbai

India

- What: Commercial Payments Progressing Towards a Digital

Future: With the rapid evolution of technology, opportunity rises

for the commercial payments sector. From enhancing security

solutions to improving user experience, the possibilities are

endless.

“This year’s survey found interesting trends in the APAC region

with businesses underscoring the importance of partnering with

financial institutions that prioritize fraud prevention as much as

they prioritize innovation. Businesses are aware of the risks if

they don’t focus on security,” said Sophia Furber, Research Analyst

at 451 Research, part of S&P Global Market Intelligence. “A key

consideration for businesses now, and in the future, is partnering

with financial institution that is identifying future forward

trends while staying committed to security.”

For a deeper dive into these findings, visit (or download) the

full study.

Survey Methodology

A global survey of 2,706 director-level or higher respondents

across small to medium-sized enterprises and corporations was

commissioned by Discover Global Network and conducted by 451

Research, part of S&P Global Market Intelligence, an

independent research firm, in Q1 2024. Markets surveyed include

Australia, Brazil, Ecuador, India, Japan, South Africa, Spain, UK

and the US.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The company issues the Discover® card, America's cash rewards

pioneer, and offers personal loans, home loans, checking and

savings accounts and certificates of deposit through its banking

business. It operates the Discover® Global Network comprised of

Discover Network, with millions of merchants and cash access

locations; PULSE®, one of the nation's leading ATM/debit networks;

and Diners Club International®, a global payments network with

acceptance around the world. For more information, visit

www.discover.com/company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240825227113/en/

Katie Gaynor +1-513-478-0851 katiegaynor@discover.com

@Discover_News

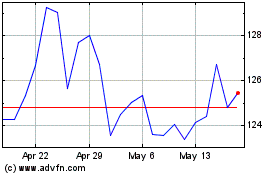

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Oct 2024 to Nov 2024

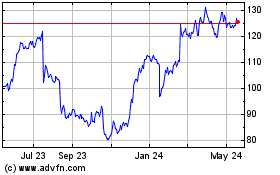

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Nov 2023 to Nov 2024