0000936340false00009363402024-08-012024-08-010000936340us-gaap:CommonStockMember2024-08-012024-08-010000936340dte:SeriesE20175.25JuniorSubordinatedDebenturesDue2077Member2024-08-012024-08-010000936340dte:SeriesG20204375JuniorSubordinatedDebenturesDue2080Member2024-08-012024-08-010000936340dte:SeriesE20214375JuniorSubordinatedDebenturesDue2081Member2024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

Commission File Number: 1-11607

DTE Energy Company

| | | | | | | | |

| Michigan | | 38-3217752 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S Employer Identification No.) |

Registrants address of principal executive offices: One Energy Plaza, Detroit, Michigan 48226-1279

Registrants telephone number, including area code: (313) 235-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of Each Class | | Trading Symbol(s) | | Name of Exchange on which Registered |

| Common stock, without par value | | DTE | | New York Stock Exchange |

| | | | |

| 2017 Series E 5.25% Junior Subordinated Debentures due 2077 | | DTW | | New York Stock Exchange |

| | | | |

| 2020 Series G 4.375% Junior Subordinated Debentures due 2080 | | DTB | | New York Stock Exchange |

| | | | |

| 2021 Series E 4.375% Junior Subordinated Debentures due 2081 | | DTG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

DTE Energy Company (“DTE Energy”) is furnishing the Securities and Exchange Commission (“SEC”) the financial statements for its indirect wholly-owned subsidiary, DTE Gas Company, for the quarter ended June 30, 2024. The financial statements were posted to DTE Energy's website at www.dteenergy.com on August 1, 2024. The financial statements are furnished as Exhibit 99.1 and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Current Report on Form 8-K under Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Financial Statements of DTE Gas Company for the quarter ended June 30, 2024. |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Forward-Looking Statements:

This Form 8-K contains forward-looking statements that are subject to various assumptions, risks and uncertainties. It should be read in conjunction with the “Forward-Looking Statements” section in DTE Energy's 2023 Form 10-K and 2024 Form 10-Qs (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy that discuss important factors that could cause DTE Energy's actual results to differ materially. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this report as a result of new information or future events or developments.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 1, 2024

| | | | | |

| DTE Energy Company |

| (Registrant) |

| |

| /s/Tracy J. Myrick |

| Tracy J. Myrick |

| Chief Accounting Officer |

| |

Exhibit 99.1

DTE Gas Company

Unaudited Consolidated Financial Statements as of and for the Three and Six Months Ended June 30, 2024

| | | | | | | | |

| ASU | | Accounting Standards Update issued by the FASB |

| | |

| Company | | DTE Gas Company and subsidiary companies |

| | |

| Customer Choice | | Michigan legislation giving customers the option of retail access to alternative suppliers for natural gas |

| | |

| DTE Energy | | DTE Energy Company, directly or indirectly the parent of DTE Electric Company, DTE Gas, and numerous non-utility subsidiaries |

| | |

| DTE Gas | | DTE Gas Company (an indirect wholly-owned subsidiary of DTE Energy) and subsidiary companies |

| | |

| EGLE | | Michigan Department of Environment, Great Lakes, and Energy, formerly known as Michigan Department of Environmental Quality |

| | |

| EPA | | U.S. Environmental Protection Agency |

| | |

| FASB | | Financial Accounting Standards Board |

| | |

| FERC | | Federal Energy Regulatory Commission |

| | |

| GCR | | A Gas Cost Recovery mechanism authorized by the MPSC that allows DTE Gas to recover through rates its natural gas costs |

| | |

| MGP | | Manufactured Gas Plant |

| | |

| MPSC | | Michigan Public Service Commission |

| | |

| TCJA | | Tax Cuts and Jobs Act of 2017, which reduced the corporate Federal income tax rate from 35% to 21% |

| | |

| Topic 606 | | FASB issued ASU No. 2014-09, Revenue from Contracts with Customers, as amended |

| | |

| VIE | | Variable Interest Entity |

DTE Gas Company

Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Operating Revenues | $ | 285 | | | $ | 309 | | | $ | 990 | | | $ | 1,004 | |

| | | | | | | |

| Operating Expenses | | | | | | | |

Cost of gas | 36 | | | 52 | | | 293 | | | 298 | |

Operation and maintenance | 127 | | | 126 | | | 261 | | | 250 | |

Depreciation and amortization | 54 | | | 51 | | | 108 | | | 101 | |

Taxes other than income | 31 | | | 28 | | | 63 | | | 59 | |

| Asset (gains) losses and impairments, net | — | | | — | | | — | | | (1) | |

| 248 | | | 257 | | | 725 | | | 707 | |

| Operating Income | 37 | | | 52 | | | 265 | | | 297 | |

| | | | | | | |

| Other (Income) and Deductions | | | | | | | |

Interest expense | 28 | | | 23 | | | 57 | | | 49 | |

Interest income | (5) | | | (2) | | | (6) | | | (4) | |

Non-operating retirement benefits, net | — | | | (1) | | | (1) | | | (1) | |

Other income | (2) | | | (3) | | | (4) | | | (6) | |

Other expenses | — | | | 1 | | | 1 | | | 2 | |

| 21 | | | 18 | | | 47 | | | 40 | |

| Income Before Income Taxes | 16 | | | 34 | | | 218 | | | 257 | |

| | | | | | | |

| Income Tax Expense | 4 | | | 9 | | | 52 | | | 62 | |

| | | | | | | |

| Net Income | $ | 12 | | | $ | 25 | | | $ | 166 | | | $ | 195 | |

See Notes to Consolidated Financial Statements (Unaudited)

DTE Gas Company

Consolidated Statements of Comprehensive Income (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Net Income | $ | 12 | | | $ | 25 | | | $ | 166 | | | $ | 195 | |

| | | | | | | |

| | | | | | | |

| Other comprehensive income | — | | | — | | | — | | | — | |

| Comprehensive Income | $ | 12 | | | $ | 25 | | | $ | 166 | | | $ | 195 | |

See Notes to Consolidated Financial Statements (Unaudited)

DTE Gas Company

Consolidated Statements of Financial Position (Unaudited)

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| (In millions) |

| ASSETS |

Current Assets | | | |

Cash and cash equivalents | $ | — | | | $ | — | |

Accounts receivable (less allowance for doubtful accounts of $30 and $21, respectively) | | | |

Customer | 166 | | | 308 | |

Affiliates | 10 | | | 10 | |

Other | 4 | | | 2 | |

Inventories | | | |

Gas | 55 | | | 75 | |

Materials and supplies | 38 | | | 34 | |

Gas customer choice deferred asset | 32 | | | 42 | |

Notes receivable | | | |

Affiliates | 213 | | | — | |

Other | 5 | | | 4 | |

Regulatory assets | 4 | | | 9 | |

| | | |

Other | 9 | | | 29 | |

| 536 | | | 513 | |

| | | |

Investments | 47 | | | 45 | |

| | | |

Property | | | |

Property, plant, and equipment | 8,334 | | | 8,029 | |

| Accumulated depreciation and amortization | (2,053) | | | (1,990) | |

| 6,281 | | | 6,039 | |

Other Assets | | | |

Regulatory assets | 608 | | | 618 | |

| Notes receivable | 49 | | | 50 | |

| | | |

| | | |

Prepaid pension costs — affiliates | 122 | | | 110 | |

Prepaid postretirement costs — affiliates | 273 | | | 255 | |

| | | |

Other | 33 | | | 30 | |

| 1,085 | | | 1,063 | |

| Total Assets | $ | 7,949 | | | $ | 7,660 | |

See Notes to Consolidated Financial Statements (Unaudited)

DTE Gas Company

Consolidated Statements of Financial Position (Unaudited) — Continued

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| (In millions, except shares) |

| LIABILITIES AND SHAREHOLDER'S EQUITY |

Current Liabilities | | | |

Accounts payable | | | |

Affiliates | $ | 22 | | | $ | 33 | |

Other | 226 | | | 220 | |

| Accrued Interest | 24 | | | 24 | |

Short-term borrowings | | | |

| Affiliates | 1 | | | 2 | |

Other | — | | | 77 | |

| | | |

| | | |

Gas inventory equalization | 40 | | | — | |

Regulatory liabilities | 19 | | | 20 | |

| | | |

| | | |

Other | 48 | | | 46 | |

| 380 | | | 422 | |

| | | |

| Long-Term Debt | 2,535 | | | 2,534 | |

| | | |

Other Liabilities | | | |

Deferred income taxes | 912 | | | 881 | |

Regulatory liabilities | 866 | | | 848 | |

Asset retirement obligations | 195 | | | 190 | |

Accrued pension liability — affiliates | 25 | | | 29 | |

Accrued postretirement liability — affiliates | 2 | | | 3 | |

| | | |

Other | 31 | | | 32 | |

| 2,031 | | | 1,983 | |

| Commitments and Contingencies (Notes 4 and 8) | | | |

| | | |

Shareholder's Equity | | | |

| Common stock ($1 par value, 15,100,000 shares authorized, and 10,300,000 shares issued and outstanding for both periods) | 1,753 | | | 1,532 | |

Retained earnings | 1,250 | | | 1,189 | |

| | | |

| Total Shareholder's Equity | 3,003 | | | 2,721 | |

| Total Liabilities and Shareholder's Equity | $ | 7,949 | | | $ | 7,660 | |

See Notes to Consolidated Financial Statements (Unaudited)

DTE Gas Company

Consolidated Statements of Cash Flows (Unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| June 30, |

| 2024 | | 2023 |

| (In millions) |

| Operating Activities | | | |

| Net Income | $ | 166 | | | $ | 195 | |

| Adjustments to reconcile Net Income to Net cash from operating activities: | | | |

| Depreciation and amortization | 108 | | | 101 | |

| Allowance for equity funds used during construction | (1) | | | (1) | |

| Deferred income taxes | 26 | | | 36 | |

| Asset (gains) losses and impairments, net | — | | | (1) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable, net | 140 | | | 221 | |

| Inventories | 16 | | | 12 | |

| Prepaid pension costs — affiliates | (12) | | | (14) | |

| Prepaid postretirement benefit costs — affiliates | (18) | | | (16) | |

| Accounts payable | (5) | | | (2) | |

| Gas inventory equalization | 40 | | | 41 | |

| Accrued pension liability — affiliates | (4) | | | (4) | |

| Accrued postretirement liability — affiliates | (1) | | | — | |

| Regulatory assets and liabilities | 40 | | | 67 | |

| Other current and noncurrent assets and liabilities | 21 | | | 24 | |

| Net cash from operating activities | 516 | | | 659 | |

| Investing Activities | | | |

| Plant and equipment expenditures | (339) | | | (339) | |

| | | |

| Notes receivable — affiliates | (213) | | | (154) | |

| Other | (2) | | | (3) | |

| Net cash used for investing activities | (554) | | | (496) | |

| Financing Activities | | | |

| | | |

| Redemption of long-term debt | — | | | (25) | |

| Capital contribution by parent company | 221 | | | 216 | |

| Short-term borrowings, net — affiliates | (1) | | | (15) | |

| Short-term borrowings, net — other | (77) | | | (242) | |

| Dividends paid on common stock | (105) | | | (96) | |

| Other | — | | | (1) | |

| Net cash from (used for) financing activities | 38 | | | (163) | |

| Net Increase in Cash and Cash Equivalents | — | | | — | |

| Cash and Cash Equivalents at Beginning of Period | — | | | — | |

| Cash and Cash Equivalents at End of Period | $ | — | | | $ | — | |

| | | |

| Supplemental disclosure of non-cash investing and financing activities | | | |

| Plant and equipment expenditures in accounts payable | $ | 90 | | | $ | 68 | |

See Notes to Consolidated Financial Statements (Unaudited)

DTE Gas Company

Consolidated Statements of Changes in Shareholder's Equity (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Retained Earnings | | | | |

| Shares | | Amount | | | | | Total |

| (Dollars in millions, shares in thousands) |

| Balance, December 31, 2023 | 10,300 | | | $ | 10 | | | $ | 1,522 | | | $ | 1,189 | | | | | $ | 2,721 | |

| Net Income | — | | | — | | | — | | | 154 | | | | | 154 | |

| Dividends declared on common stock | — | | | — | | | — | | | (53) | | | | | (53) | |

| Capital contribution by parent company | — | | | — | | | 221 | | | — | | | | | 221 | |

| | | | | | | | | | | |

| Balance, March 31, 2024 | 10,300 | | | $ | 10 | | | $ | 1,743 | | | $ | 1,290 | | | | | $ | 3,043 | |

| Net Income | — | | | — | | | — | | | 12 | | | | | 12 | |

| Dividends declared on common stock | — | | | — | | | — | | | (52) | | | | | (52) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, June 30, 2024 | 10,300 | | | $ | 10 | | | $ | 1,743 | | | $ | 1,250 | | | | | $ | 3,003 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Retained Earnings | | | | |

| Shares | | Amount | | | | | Total |

| (Dollars in millions, shares in thousands) |

| Balance, December 31, 2022 | 10,300 | | | $ | 10 | | | $ | 1,306 | | | $ | 1,086 | | | | | $ | 2,402 | |

| Net Income | — | | | — | | | — | | | 170 | | | | | 170 | |

| Dividends declared on common stock | — | | | — | | | — | | | (47) | | | | | (47) | |

| Capital contribution by parent company | — | | | — | | | 216 | | | — | | | | | 216 | |

| | | | | | | | | | | |

| Balance, March 31, 2023 | 10,300 | | | $ | 10 | | | $ | 1,522 | | | $ | 1,209 | | | | | $ | 2,741 | |

| Net Income | — | | | — | | | — | | | 25 | | | | | 25 | |

| Dividends declared on common stock | — | | | — | | | — | | | (49) | | | | | (49) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, June 30, 2023 | 10,300 | | | $ | 10 | | | $ | 1,522 | | | $ | 1,185 | | | | | $ | 2,717 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

See Notes to Consolidated Financial Statements (Unaudited)

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited)

NOTE 1 — ORGANIZATION AND BASIS OF PRESENTATION

Corporate Structure

DTE Gas is a public utility engaged in the purchase, storage, transportation, distribution, and sale of natural gas to approximately 1.3 million customers throughout Michigan and the sale of storage and transportation capacity. The Company is regulated by the MPSC and certain activities are regulated by the FERC. In addition, the Company is regulated by other federal and state regulatory agencies including the EPA and EGLE.

Basis of Presentation

The Consolidated Financial Statements should be read in conjunction with the Notes to Consolidated Financial Statements included in the Company's 2023 Consolidated Financial Statements furnished on Form 8-K.

The accompanying Consolidated Financial Statements are prepared using accounting principles generally accepted in the United States of America. These accounting principles require management to use estimates and assumptions that impact reported amounts of assets, liabilities, revenues and expenses, and the disclosure of contingent assets and liabilities. Actual results may differ from the Company's estimates.

The Consolidated Financial Statements are unaudited but, in the Company's opinion include all adjustments necessary to present a fair statement of the results for the interim periods. All adjustments are of a normal recurring nature, except as otherwise disclosed in these Consolidated Financial Statements and Notes to Consolidated Financial Statements. Financial results for this interim period are not necessarily indicative of results that may be expected for any other interim period or for the fiscal year ending December 31, 2024.

Principles of Consolidation

The Company consolidates all majority-owned subsidiaries and investments in entities in which it has controlling influence. Non-majority owned investments are accounted for using the equity method when the Company is able to significantly influence the operating policies of the investee. When the Company does not influence the operating policies of an investee, the equity investment is valued at cost minus any impairments, if applicable. The Company eliminates all intercompany balances and transactions.

The Company evaluates whether an entity is a VIE whenever reconsideration events occur. The Company consolidates VIEs for which it is the primary beneficiary. If the Company is not the primary beneficiary and an ownership interest is held, the VIE is accounted for under the equity method of accounting. When assessing the determination of the primary beneficiary, the Company considers all relevant facts and circumstances, including: the power, through voting or similar rights, to direct the activities of the VIE that most significantly impact the VIE's economic performance and the obligation to absorb the expected losses and/or the right to receive the expected returns of the VIE. The Company performs ongoing reassessments of all VIEs to determine if the primary beneficiary status has changed.

The Company holds a variable interest in a natural gas pipeline entity through purchases under a long-term transportation capacity contract. The Company does not have a controlling influence in and does not consolidate the pipeline entity. As of June 30, 2024, the carrying amount of liabilities in the Company's Consolidated Statements of Financial Position that relate to its variable interest under the long-term contract are primarily related to working capital accounts and generally represent the amounts owed by the Company for transportation associated with the current billing cycle under the contract. The Company has not provided any significant form of financial support associated with the long-term contract. There is no material potential exposure to loss as a result of the Company's variable interest through the long-term contract.

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

Income Taxes

Tax rates are affected by estimated annual permanent items, regulatory adjustments, and discrete items that may occur in any given period, but are not consistent from period to period. The table below summarizes how the Company's effective income tax rates have varied from the statutory federal income tax rate:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Statutory federal income tax rate | 21.0 | % | | 21.0 | % | | 21.0 | % | | 21.0 | % |

| Increase (decrease) due to: | | | | | | | |

| State and local income taxes, net of federal benefit | 5.7 | | | 5.6 | | | 6.0 | | | 5.8 | |

| TCJA regulatory liability amortization | (2.8) | | | (1.8) | | | (2.9) | | | (2.7) | |

| Other | (0.3) | | | 2.2 | | | (0.3) | | | 0.2 | |

| Effective income tax rate | 23.6 | % | | 27.0 | % | | 23.8 | % | | 24.3 | % |

The Company had income tax payables with DTE Energy of $5 million and $13 million at June 30, 2024 and December 31, 2023 respectively, which are related to federal and state taxes and included in Accounts payable — affiliates on the Consolidated Statements of Financial Position.

Allocated Stock-Based Compensation

The Company received an allocation of costs from DTE Energy associated with stock-based compensation of $3 million for the three months ended June 30, 2024 and 2023, while such allocation was $5 million and $6 million for the six months ended June 30, 2024 and 2023, respectively.

Financing Receivables

Financing receivables are primarily composed of trade receivables, notes receivable, and unbilled revenue. The Company's financing receivables are stated at net realizable value.

The Company monitors the credit quality of financing receivables on a regular basis by reviewing credit quality indicators and monitoring for trigger events, such as a credit rating downgrade or bankruptcy. Credit quality indicators include, but are not limited to, ratings by credit agencies where available, collection history, collateral, counterparty financial statements and other internal metrics. Utilizing such data, the Company has determined three internal grades of credit quality. Internal grade 1 includes financing receivables for counterparties where credit rating agencies have ranked the counterparty as investment grade. To the extent credit ratings are not available, the Company utilizes other credit quality indicators to determine the level of risk associated with the financing receivable. Internal grade 1 may include financing receivables for counterparties for which credit rating agencies have ranked the counterparty as below investment grade; however, due to favorable information on other credit quality indicators, the Company has determined the risk level to be similar to that of an investment grade counterparty. Internal grade 2 includes financing receivables for counterparties with limited credit information and those with a higher risk profile based upon credit quality indicators. Internal grade 3 reflects financing receivables for which the counterparties have the greatest level of risk, including those in bankruptcy status.

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

The following represents the Company's financing receivables by year of origination, classified by internal grade of credit risk, including current year-to-date gross write-offs, if any. The related credit quality indicators and risk ratings utilized to develop the internal grades have been updated through June 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| Year of Origination |

| 2024 | | 2023 | | 2022 and Prior | | Total |

| (In millions) |

| Notes receivable | | | | | | | |

Internal grade 1(a) | $ | 213 | | | $ | — | | | $ | — | | | $ | 213 | |

| Internal grade 2 | 3 | | | 6 | | | 9 | | | 18 | |

| Total notes receivable | $ | 216 | | | $ | 6 | | | $ | 9 | | | $ | 231 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net investment in leases, internal grade 1 | $ | — | | | $ | — | | | $ | 36 | | | $ | 36 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

_______________________________________

(a)Reflects Notes receivable — affiliate balance of $213 million.

The allowance for doubtful accounts on accounts receivable for the Company is generally calculated using an aging approach that utilizes rates developed in reserve studies. The Company establishes an allowance for uncollectible accounts based on historical losses and management's assessment of existing and future economic conditions, customer trends and other factors. Customer accounts are generally considered delinquent if the amount billed is not received by the due date, which is typically in 21 days, however, factors such as assistance programs may delay aggressive action. The Company generally assesses late payment fees on trade receivables based on past-due terms with customers. Customer accounts are written off when collection efforts have been exhausted. The time period for write-off is 150 days after service has been terminated.

The allowance for doubtful accounts for other receivables is generally calculated based on specific review of probable future collections based on receivable balances generally in excess of 30 days. Existing and future economic conditions, customer trends and other factors are also considered. Receivables are written off on a specific identification basis and determined based upon the specific circumstances of the associated receivable.

Notes receivable are primarily comprised of a finance lease receivable and loans that are included in Notes Receivable on the Consolidated Statements of Financial Position.

The Company establishes an allowance for credit loss for principal and interest amounts due that are estimated to be uncollectible in accordance with the contractual terms of the note receivable. In determining the allowance for credit losses for notes receivable, the Company considers the historical payment experience and other factors that are expected to have a specific impact on the counterparty's ability to pay including existing and future economic conditions. Notes receivable are typically considered delinquent when payment is not received for periods ranging from 60 to 120 days. If amounts are no longer probable of collection, the Company may consider the note receivable impaired, adjust the allowance, and cease accruing interest (nonaccrual status).

Cash payments received on nonaccrual status notes receivable, that do not bring the account contractually current, are first applied to the contractually owed past due interest, with any remainder applied to principal. Accrual of interest is generally resumed when the note receivable becomes contractually current.

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

The following tables present a roll-forward of the activity for the Company's financing receivables credit loss reserves:

| | | | | | | | | | | | | |

| Trade accounts receivable | | | | | | | | |

| (In millions) |

| Beginning reserve balance, January 1, 2024 | $ | 21 | | | | | | | | | |

| Current period provision | 17 | | | | | | | | | |

| | | | | | | | | |

| Write-offs charged against allowance | (16) | | | | | | | | | |

| Recoveries of amounts previously written off | 8 | | | | | | | | | |

| Ending reserve balance, June 30, 2024 | $ | 30 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Trade accounts receivable | | Other receivables | | | | | | Total |

| (In millions) |

| Beginning reserve balance, January 1, 2023 | $ | 27 | | | $ | 1 | | | | | | | $ | 28 | |

| Current period provision | 16 | | | — | | | | | | | 16 | |

| | | | | | | | | |

| Write-offs charged against allowance | (38) | | | (1) | | | | | | | (39) | |

| Recoveries of amounts previously written off | 16 | | | — | | | | | | | 16 | |

| Ending reserve balance, December 31, 2023 | $ | 21 | | | $ | — | | | | | | | $ | 21 | |

Uncollectible expense is primarily comprised of the current period provision for allowance for doubtful accounts. Uncollectible expense was $6 million and $4 million for the three months ended June 30, 2024 and 2023, respectively, and $17 million and $18 million for the six months ended June 30, 2024 and 2023, respectively.

There are no material amounts of past due financing receivables for the Company as of June 30, 2024.

NOTE 3 — REVENUE

Disaggregation of Revenue

The following is a summary of disaggregated revenues for the Company:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Gas sales | $ | 198 | | | $ | 211 | | | $ | 755 | | | $ | 801 | |

| End User Transportation | 53 | | | 54 | | | 135 | | | 140 | |

| Intermediate Transportation | 16 | | | 16 | | | 45 | | | 47 | |

Other(a) | 18 | | | 28 | | | 55 | | | 16 | |

| Total Gas operating revenues | $ | 285 | | | $ | 309 | | | $ | 990 | | | $ | 1,004 | |

_______________________________________

(a)Includes revenue adjustments related to various regulatory mechanisms, including the GCR, which may vary based on changes in the cost of gas.

Revenues included the following which were outside the scope of Topic 606:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Alternative Revenue Programs | $ | 2 | | | $ | 1 | | | $ | 8 | | | $ | 4 | |

| Other revenues | $ | 4 | | | $ | 2 | | | $ | 6 | | | $ | 5 | |

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

Transaction Price Allocated to the Remaining Performance Obligations

In accordance with optional exemptions available under Topic 606, the Company did not disclose the value of unsatisfied performance obligations for (1) contracts with an original expected length of one year or less, (2) with the exception of fixed consideration, contracts for which revenue is recognized at the amount to which the Company has the right to invoice for goods provided and services performed, and (3) contracts for which variable consideration relates entirely to an unsatisfied performance obligation.

Such contracts consist of varying types of performance obligations, including the supply and delivery of energy related products and services. Contracts with variable volumes and/or variable pricing have also been excluded as the related consideration under the contract is variable at inception of the contract. Contract lengths vary from cancellable to multi-year.

The Company expects to recognize revenue for the following amounts related to fixed consideration associated with remaining performance obligations in each of the future periods noted:

| | | | | |

| (In millions) |

| 2024 | $ | 52 | |

| 2025 | 105 | |

| 2026 | 102 | |

| 2027 | 75 | |

| 2028 | 55 | |

| 2029 and thereafter | 232 | |

| $ | 621 | |

NOTE 4 — REGULATORY MATTERS

2024 Gas Rate Case Filing

The Company filed a rate case with the MPSC on January 8, 2024 requesting an increase in base rates of $266 million based on a projected twelve-month period ending September 30, 2025, and an increase in return on equity from 9.9% to 10.25%. The request reflects a net increase to customer rates of only $160 million, as an existing IRM surcharge of $106 million would be rolled into the new base rates. The requested increase is primarily due to increased investments in plant related to system reliability and pipeline safety and inflationary impacts on operating costs, partially offset by higher sales. A final MPSC order in this case is expected in November 2024.

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

NOTE 5 — FAIR VALUE

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date in a principal or most advantageous market. Fair value is a market-based measurement that is determined based on inputs, which refer broadly to assumptions that market participants use in pricing assets or liabilities. These inputs can be readily observable, market corroborated, or generally unobservable inputs. The Company makes certain assumptions it believes that market participants would use in pricing assets or liabilities, including assumptions about risk, and the risks inherent in the inputs to valuation techniques. Credit risk of the Company and its counterparties is incorporated in the valuation of assets and liabilities through the use of credit reserves, the impact of which was immaterial at June 30, 2024 and December 31, 2023. The Company believes it uses valuation techniques that maximize the use of observable market-based inputs and minimize the use of unobservable inputs.

A fair value hierarchy has been established that prioritizes the inputs to valuation techniques used to measure fair value in three broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). In some cases, the inputs used to measure fair value might fall in different levels of the fair value hierarchy. All assets and liabilities are required to be classified in their entirety based on the lowest level of input that is significant to the fair value measurement in its entirety. Assessing the significance of a particular input may require judgment considering factors specific to the asset or liability and may affect the valuation of the asset or liability and its placement within the fair value hierarchy. The Company classifies fair value balances based on the fair value hierarchy defined as follows:

•Level 1 — Consists of unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access as of the reporting date.

•Level 2 — Consists of inputs other than quoted prices included within Level 1 that are directly observable for the asset or liability or indirectly observable through corroboration with observable market data.

•Level 3 — Consists of unobservable inputs for assets or liabilities whose fair value is estimated based on internally developed models or methodologies using inputs that are generally less readily observable and supported by little, if any, market activity at the measurement date. Unobservable inputs are developed based on the best available information and subject to cost-benefit constraints.

As of June 30, 2024 and December 31, 2023, the Company had $10 million and $8 million of equity securities, respectively, which are recorded at fair value on a recurring basis and classified as Level 1 assets. These assets, which exclude the cash surrender value of life insurance investments, were included in Investments on the Consolidated Statements of Financial Position for both periods.

The following table presents the carrying amount and fair value of financial instruments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Carrying | | Fair Value | | Carrying | | Fair Value |

| Amount | | Level 1 | | Level 2 | | Level 3 | | Amount | | Level 1 | | Level 2 | | Level 3 |

| (In millions) |

| Notes receivable — affiliates | $ | 213 | | | $ | — | | | $ | — | | | $ | 213 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Notes receivable — other, excluding lessor finance leases | $ | 18 | | | $ | — | | | $ | — | | | $ | 18 | | | $ | 18 | | | $ | — | | | $ | — | | | $ | 18 | |

| Short-term borrowings — affiliates | $ | 1 | | | $ | — | | | $ | — | | | $ | 1 | | | $ | 2 | | | $ | — | | | $ | — | | | $ | 2 | |

| Short-term borrowings — other | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 77 | | | $ | — | | | $ | 77 | | | $ | — | |

Long-term debt(a) | $ | 2,535 | | | $ | — | | | $ | 1,209 | | | $ | 1,003 | | | $ | 2,534 | | | $ | — | | | $ | 1,245 | | | $ | 1,076 | |

_______________________________________

(a)Includes debt due within one year. Carrying value also includes unamortized debt discounts and issuance costs.

For further fair value information on financial and derivative instruments, see Note 6 to the Consolidated Financial Statements, "Financial and Other Derivative Instruments."

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

NOTE 6 — FINANCIAL AND OTHER DERIVATIVE INSTRUMENTS

The Company recognizes all derivatives at their fair value as Derivative assets or liabilities on the Consolidated Statements of Financial Position unless they qualify for certain scope exceptions, including the normal purchases and normal sales exception. Further, derivatives that qualify and are designated for hedge accounting are classified as either hedges of a forecasted transaction or the variability of cash flows to be received or paid related to a recognized asset or liability (cash flow hedge); or as hedges of the fair value of a recognized asset or liability or of an unrecognized firm commitment (fair value hedge). For cash flow hedges, the derivative gain or loss is deferred in Accumulated other comprehensive income (loss) and later reclassified into earnings when the underlying transaction occurs. For fair value hedges, changes in fair values for the derivative and hedged item are recognized in earnings each period. For derivatives that do not qualify or are not designated for hedge accounting, changes in fair value are recognized in earnings each period.

The Company's primary market risk exposure is associated with commodity prices, credit, and interest rates. The Company has risk management policies to monitor and manage market risks. The Company purchases, stores, transports, distributes, and sells natural gas, and buys and sells transportation and storage capacity. The Company has fixed-priced contracts for portions of its expected natural gas supply requirements through March 2027. Substantially all of these contracts meet the normal purchases and normal sales exception and are therefore accounted for under the accrual method. Forward transportation and storage contracts are generally not derivatives and are therefore accounted for under the accrual method.

NOTE 7 — SHORT-TERM CREDIT ARRANGEMENTS AND BORROWINGS

The Company has a $300 million unsecured revolving credit agreement that can be used for general corporate borrowings but is intended to provide liquidity support for the Company's commercial paper program. Borrowings under the revolver are available at prevailing short-term interest rates. The facility will expire in October 2028. As of June 30, 2024, the Company did not have any commercial paper or revolver borrowings outstanding.

The unsecured revolving credit agreement requires the Company to maintain a total funded debt to capitalization ratio of no more than 0.65 to 1. In the agreement, "total funded debt" means all indebtedness of the Company and its consolidated subsidiaries, including finance lease obligations, hedge agreements, and guarantees of third parties' debt, but excluding contingent obligations, nonrecourse and junior subordinated debt, and, except for calculations at the end of the second quarter, certain short-term debt. "Capitalization" means the sum of (a) total funded debt plus (b) "consolidated net worth," which is equal to consolidated total equity of the Company and its consolidated subsidiaries (excluding pension effects under certain FASB statements), as determined in accordance with accounting principles generally accepted in the United States of America. At June 30, 2024, the total funded debt to total capitalization ratio for the Company was 0.46 to 1 and was in compliance with this financial covenant.

NOTE 8 — COMMITMENTS AND CONTINGENCIES

Environmental

Contaminated and Other Sites — Prior to the construction of major interstate natural gas pipelines, gas for heating and other uses was manufactured locally from processes involving coal, coke, or oil. The facilities, which produced gas, have been designated as MGP sites. The Company owns or previously owned 14 former MGP sites. Investigations have revealed contamination related to the by-products of gas manufacturing at each site. Cleanup of eight MGP sites is complete, and those sites are closed. The Company has also completed partial closure of four additional sites. Cleanup activities associated with the remaining sites will continue over the next several years. The MPSC has established a cost deferral and rate recovery mechanism for investigation and remediation costs incurred at former MGP sites. In addition to the MGP sites, the Company is also in the process of cleaning up other contaminated sites, including gate stations, gas pipeline releases, and underground storage tank locations. As of June 30, 2024 and December 31, 2023, the Company had $25 million and $26 million, respectively, accrued for remediation. These costs are not discounted to their present value. Any change in assumptions, such as remediation techniques, nature and extent of contamination, and regulatory requirements, could impact the estimate of remedial action costs for the sites and affect the Company's financial position and cash flows. The Company anticipates the cost amortization methodology approved by the MPSC, which allows for amortization of the MGP costs over a ten-year period beginning with the year subsequent to the year the MGP costs were incurred, will prevent the associated investigation and remediation costs from having a material adverse impact on the Company's results of operations.

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

Air — In March 2023, the EPA published the Good Neighbor Rule, which includes provisions for compressor engines operated for the transportation of natural gas. The status of the rule remains uncertain as litigation is ongoing. At this time, the Company does not expect a significant financial impact.

In March 2024, the EPA finalized the National Ambient Air Quality Standards for fine particulate matter, particles of pollution with diameters generally 2.5 micrometers and smaller (PM2.5). It is likely that areas of Michigan in which the Company operates will be designated as non-attainment in the future and the state will be required to develop a State Implementation Plan for such areas. No impact is expected in the near term, and any long-term financial impacts cannot be assessed at this time.

Guarantees

In certain limited circumstances, the Company enters into contractual guarantees. The Company may guarantee another entity’s obligation in the event it fails to perform and may provide guarantees in certain indemnification agreements. The Company may also provide indirect guarantees for the indebtedness of others.

Labor Contracts

There are several bargaining units for the Company's approximate 1,150 represented employees, which represents 67% of the Company's total employees. Approximately 32% of the represented employees have contracts expiring within one year.

Purchase Commitments

The Company has made certain commitments in connection with 2024 annual capital expenditures that are expected to be approximately $715 million.

Other Contingencies

The Company is involved in certain other legal, regulatory, administrative, and environmental proceedings before various courts, arbitration panels, and governmental agencies concerning claims arising in the ordinary course of business. These proceedings include certain contract disputes, additional environmental reviews and investigations, audits, inquiries from various regulators, and pending judicial matters. The Company cannot predict the final disposition of such proceedings. The Company regularly reviews legal matters and records provisions for claims that it can estimate and are considered probable of loss. The resolution of these pending proceedings is not expected to have a material effect on the Consolidated Financial Statements in the periods they are resolved.

For discussion of contingencies related to regulatory matters, see Note 4 to the Consolidated Financial Statements, "Regulatory Matters."

DTE Gas Company

Notes to Consolidated Financial Statements (Unaudited) - (Continued)

NOTE 9 — RETIREMENT BENEFITS AND TRUSTEED ASSETS

The Company participates in various plans that provide defined benefit pension and other postretirement benefits for DTE Energy and its affiliates. The plans are primarily sponsored by DTE Energy's subsidiary, DTE Energy Corporate Services, LLC, and cover substantially all employees of the Company. Plan participants of all plans are solely DTE Energy and affiliate participants.

The Company accounts for its participation in the represented qualified pension plan by applying single-employer accounting. Non-represented participation in qualified pension plans, and non-represented and represented participation in non-qualified pension plans, are accounted for by applying multiemployer accounting. Participation in other postretirement benefit plans is accounted for by applying multiple-employer accounting. Within multiemployer and multiple-employer plans, participants pool plan assets for investment purposes and to reduce the cost of plan administration. The primary difference between plan types is that assets contributed in multiemployer plans can be used to provide benefits for all participating employers, while assets contributed within a multiple-employer plan are restricted for use by the contributing employer.

The following tables detail the components of net periodic benefit costs (credits) for represented pension benefits and total other postretirement benefits:

| | | | | | | | | | | | | | | | | | | | | | | |

| Pension Benefits | | Other Postretirement Benefits |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Three Months Ended June 30, | | | | | | | |

| Service cost | $ | 2 | | | $ | 2 | | | $ | 1 | | | $ | 1 | |

| Interest cost | 5 | | | 6 | | | 4 | | | 3 | |

| Expected return on plan assets | (9) | | | (10) | | | (10) | | | (8) | |

| Amortization of: | | | | | | | |

| Net actuarial loss | 1 | | | — | | | 1 | | | 2 | |

| Prior service credit | — | | | — | | | (1) | | | (1) | |

| Net periodic benefit credit | $ | (1) | | | $ | (2) | | | $ | (5) | | | $ | (3) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Pension Benefits | | Other Postretirement Benefits |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Six Months Ended June 30, | | | | | | | |

| Service cost | $ | 4 | | | $ | 4 | | | $ | 2 | | | $ | 2 | |

| Interest cost | 11 | | | 12 | | | 7 | | | 7 | |

| Expected return on plan assets | (19) | | | (20) | | | (20) | | | (18) | |

| Amortization of: | | | | | | | |

| Net actuarial loss | 2 | | | — | | | 3 | | | 5 | |

| Prior service credit | — | | | — | | | (2) | | | (2) | |

| Net periodic benefit credit | $ | (2) | | | $ | (4) | | | $ | (10) | | | $ | (6) | |

DTE Energy's subsidiaries accounted for under multiemployer guidance are responsible for their share of qualified and non-qualified pension benefit costs. The Company's allocated portion of pension benefit costs for non-represented plans included in regulatory assets and liabilities, other income and deductions, and capital expenditures were credits of $5 million for both the three months ended June 30, 2024 and 2023, and $7 million and $11 million for the six months ended June 30, 2024 and 2023, respectively. These amounts may include recognized contractual termination benefit charges, curtailment gains, and settlement charges.

Pension and Other Postretirement Contributions

The Company is not expecting to make any contributions to the represented or non-represented qualified pension plans or postretirement benefit plans in 2024. Plans may be updated at the discretion of management and depending on economic and financial market conditions.

v3.24.2.u1

Document and Entity Information Document

|

Aug. 01, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity File Number |

1-11607

|

| Entity Registrant Name |

DTE Energy Co

|

| Entity Incorporation, State or Country Code |

MI

|

| Entity Tax Identification Number |

38-3217752

|

| Entity Address, Address Line One |

One Energy Plaza

|

| Entity Address, City or Town |

Detroit

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48226-1279

|

| City Area Code |

313

|

| Local Phone Number |

235-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000936340

|

| Amendment Flag |

false

|

| Common stock, without par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, without par value

|

| Trading Symbol |

DTE

|

| Security Exchange Name |

NYSE

|

| 2017 Series E 5.25% Junior Subordinated Debentures due 2077 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2017 Series E 5.25% Junior Subordinated Debentures due 2077

|

| Trading Symbol |

DTW

|

| Security Exchange Name |

NYSE

|

| 2020 Series G 4.375% Junior Subordinated Debentures due 2080 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2020 Series G 4.375% Junior Subordinated Debentures due 2080

|

| Trading Symbol |

DTB

|

| Security Exchange Name |

NYSE

|

| Series E, 2021, 4.375% Junior Subordinated Debentures Due 2081 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2021 Series E 4.375% Junior Subordinated Debentures due 2081

|

| Trading Symbol |

DTG

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dte_SeriesE20175.25JuniorSubordinatedDebenturesDue2077Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dte_SeriesG20204375JuniorSubordinatedDebenturesDue2080Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dte_SeriesE20214375JuniorSubordinatedDebenturesDue2081Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

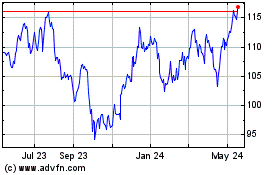

DTE Energy (NYSE:DTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

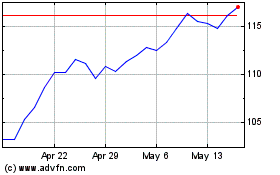

DTE Energy (NYSE:DTE)

Historical Stock Chart

From Nov 2023 to Nov 2024