UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2023

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

PRESS RELEASE

EDENOR SURPASSES PRIOR YEAR INVESTMENT LEVEL MOVING

FORWARD ALONG THE PATH OF THE SECTOR’S NORMALIZATION

Buenos Aires, March 9, 2023, The Board

of Directors of Empresa Distribuidora y Comercializadora Norte S.A. (“Edenor”) approved today its financial statements

for the year ended December 31, 2022, which show a loss of ARS 17,468 million.

Although Edenor’s results of operations

for fiscal year 2022 reflect a 7% loss in revenue and a 26% loss in the gross margin in real terms, the adjustment of the electricity

rate schedule, including the Distribution Own Cost, which will be implemented as from April 1 and June 1, will help set the course for

the sector’s normalization.

The Company continues to make every effort

to maintain the quality levels of the electricity service, with record results in terms of its customers’ perception of the Company’s

performance and with the technical service quality global indicators, including SAIDI and SAIFI, being the best the Company has ever achieved

in its history.

MAIN FINANCIAL INDICATORS

The figures relating to the previous year

have been restated to reflect the changes in the purchasing power of the Argentine peso, in accordance with International Accounting Standard

No. 29 and the provisions of General Resolution No. 777/2018 of the National Securities Commission.

(*) Operating loss before taxes and

finance costs. In 2022, includes the effects of the Memorandum of Agreement on the Regularization of Payment Obligations for a gain of

$ 18,136.

The gross margin, called Distribution

Added Value (VAD), the Distributor’s actual income, fell 26%, as compared to the previous year, in real terms as a consequence of

the long overdue adjustment of electricity rates.

The EBIT resulted in a loss of ARS

13,113 million, in line with the decrease in the gross margin in addition to a general increase in operating costs.

Furthermore, in the fiscal year the Company

recognized a result, on a one-time-only basis, as a consequence of the Agreement on the Regularization of Payment Obligations entered

into in December 2022 by the Company, the Federal Government and the ENRE, for ARS 18,136 million and ARS 2,650 million, which impact

the Company’s operating results.

The loss for the year ended December

31, 2022 amounted to ARS 17,468 million, due mainly to both the deterioration of the operating result and a greater financial burden resulting

from the deferral of the payment of obligations with the Wholesale Electricity Market.

As for Investments, in 2022, they

amounted to ARS 33,900 million, which in constant values represents 7% more than the investments recorded in 2021. This indicates that

we continued implementing our plan and improving the quality of the service.

OPERATING INDICATORS

Electricity sales in 2022 increased

5.1% to 22,826 GWh, as compared to the 21,710 GWh sold in the previous year, whereas the level of customers remained constant, achieving

an improvement in the development of unrecognized energy losses, which decreased 7% as compared to the previous year.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Germán Ranftl |

|

|

Germán Ranftl |

|

|

Chief Financial Officer |

Date:

March 10, 2023

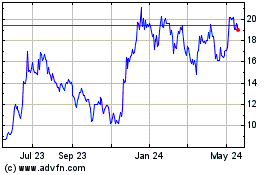

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Dec 2024 to Jan 2025

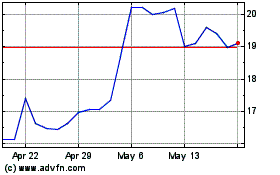

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jan 2024 to Jan 2025