Toronto Stocks Rise Amid Growing Investor Confidence

12 July 2016 - 6:53AM

Dow Jones News

By Ezequiel Minaya

Canadian stock prices rose Monday, as investors' confidence

continued to grow and the neighboring U.S. market set an intraday

record.

The S&P/TSX Composite Index added 102.04 points, or 0.7%, to

14361.88. Advancers outnumbered decliners 1,132 to 520. Trading

volume was 372.9 million shares.

The blue-chip S&P/TSX 60 Index rose 6.81 points, or 0.8%, to

834.08.

Data released last week showed Canada's unemployment rate edged

lower in June, mirroring the surprisingly strong jobs report seen

in Washington.

U.S. stocks, meanwhile, have been bolstered by signs of strength

in the U.S. economy and the Federal Reserve's cautious stance

toward raising interest rates. On Monday, the S&P 500 touched

an intraday record, topping levels last seen more than a year

ago.

In Canada, gold companies were among the bigger losers as

investors sought out more risk, leaving safe havens. Barrick Gold

Corp. slipped 0.6%.

Train- and plane-maker Bombardier Inc. was among top gainers

Monday, rising 5%. The company said it received Transport Canada

certification for its CS300 jetliner, the larger of two models of

its new single-aisle CSeries jets. The first jet will be delivered

in the fourth quarter to Latvia's airBaltic, while the smaller

CS100 begins flying passengers with Swiss International Air Lines

on Friday.

The company's chief aircraft salesman, Colin Bole, said Monday

that Bombardier would renew focus on selling its existing small

regional jets and turboprops.

Rising copper prices boosted shares of copper producers. The

metal was up on rising expectations of government stimulus in

China, the world's top consumer of the industrial metal. Shares of

First Quantum Minerals Ltd. rose 5%, HudBay Minerals Inc. added

6.7% and Teck Resources Ltd. gained 2.8%.

Meanwhile, Caledonia Mining Corp. was among the other companies

making notable moves. Shares increased 5% as the miner said

production in the second quarter was slightly higher than planned

at 12,509 ounces, up 20% from a year earlier and up 16% from the

first quarter. It said its production guidance for the year is

unchanged at about 50,000 ounces of gold.

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

July 11, 2016 16:38 ET (20:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

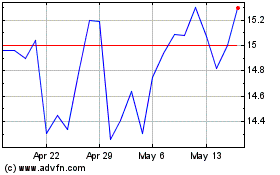

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

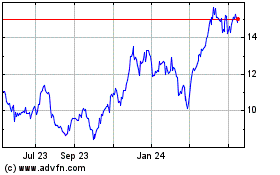

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Nov 2023 to Nov 2024