Equity Commonwealth (NYSE: EQC) today reported financial results

for the quarter ended March 31, 2024.

Financial results for the quarter ended March 31,

2024

Net income attributable to common shareholders was $23.4

million, or $0.22 per diluted share, for the quarter ended March

31, 2024. This compares to net income attributable to common

shareholders of $20.7 million, or $0.19 per diluted share, for the

quarter ended March 31, 2023. The increase in net income was

primarily due to an increase in interest income from higher average

interest rates and a decrease in income tax expense.

Funds from Operations, or FFO, as defined by the National

Association of Real Estate Investment Trusts, for the quarter ended

March 31, 2024, were $27.8 million, or $0.26 per diluted share.

This compares to FFO for the quarter ended March 31, 2023 of $25.1

million, or $0.22 per diluted share. The following items impacted

FFO for the quarter ended March 31, 2024, compared to the

corresponding 2023 period:

- $0.01 per diluted share increase in interest and other income,

net; and

- $0.01 per diluted share decrease in income tax expense.

Normalized FFO was $27.6 million, or $0.25 per diluted share,

for the quarter ended March 31, 2024. This compares to Normalized

FFO for the quarter ended March 31, 2023 of $25.3 million, or $0.23

per diluted share. The following items impacted Normalized FFO for

the quarter ended March 31, 2024, compared to the corresponding

2023 period:

- $0.01 per diluted share increase in interest and other income,

net; and

- $0.01 per diluted share decrease in income tax expense.

Normalized FFO begins with FFO and eliminates certain items

that, by their nature, are not comparable from period to period,

non-cash items, and items that obscure the company’s operating

performance. Definitions of FFO, Normalized FFO and reconciliations

to net income, determined in accordance with U.S. generally

accepted accounting principles, or GAAP, are included at the end of

this press release.

As of March 31, 2024, the company’s cash and cash equivalents

balance was $2.2 billion.

Same property results for the quarter ended March 31,

2024

The company’s same property portfolio at the end of the quarter

consisted of 4 properties totaling 1.5 million square feet.

Operating results were as follows:

- The same property portfolio was 75.4% leased as of March 31,

2024, compared to 81.2% as of December 31, 2023, and 81.6% as of

March 31, 2023.

- The same property portfolio commenced occupancy was 74.6% as of

March 31, 2024, compared to 80.0% as of December 31, 2023, and

77.0% as of March 31, 2023.

- Same property NOI increased 4.3% when compared to the same

period in 2023, primarily due to a decrease in pre-leasing

demolition costs and an increase in lease termination fees,

partially offset by a decrease in average commenced occupancy.

- Same property cash NOI decreased 6.9% when compared to the same

period in 2023, primarily due to a decrease in average commenced

occupancy, partially offset by a decrease in pre-leasing demolition

costs.

- The company entered into leases for approximately 18,000 square

feet, including renewal leases for approximately 15,000 square feet

and new leases for approximately 3,000 square feet.

- The GAAP rental rate on new and renewal leases was 0.5% lower

compared to the prior GAAP rental rate for the same space.

- The cash rental rate on new and renewal leases was 2.8% lower

compared to the prior cash rental rate for the same space.

The definitions and reconciliations of same property NOI and

same property cash NOI to net income, determined in accordance with

GAAP, are included at the end of this press release. The same

property portfolio at the end of the quarter included properties

continuously owned from January 1, 2023 through March 31, 2024.

Business update

Since taking responsibility for the company in 2014, the EQC

team has remained focused in its efforts and executed a disciplined

strategy. We have:

- Completed $7.6 billion of dispositions, including the sale of

164 properties totaling 44 million square feet and three land

parcels,

- Distributed $1.8 billion, or $14.75 per Common Share, to our

common shareholders,

- Repurchased $652 million of our Common Shares at a weighted

average, dividend adjusted price of $17.63 per share,

- Repaid debt and preferred equity of $3.3 billion, and

- Generated a cash balance of $2.2 billion, or $19.95 per

share.

Throughout this time, one of our guiding principles has been to

be responsive to evolving market conditions. For the first six

years, following this principle was relatively straightforward –

valuations were at or near all-time highs, and we concluded that it

was in shareholders’ best interests to sell assets. We sold $7.6

billion of assets between 2015 and early 2020. When the Covid-19

pandemic hit, office values plummeted. We have also evaluated

numerous investment opportunities, seeking to acquire a business

with strong fundamentals and a compelling risk-reward profile that

would create long-term value for our shareholders. To date, we have

not found such an opportunity.

Today, we are continuing our efforts to maximize shareholder

value. We remain focused on opportunities in our pipeline where we

can create long-term value for our shareholders, while concurrently

taking steps to facilitate the potential wind down of our business.

Before the end of this year, we expect to either announce a

transaction or move forward with a plan to wind down our

business.

Earnings conference call & supplemental operating and

financial information

Equity Commonwealth will host a conference call to discuss first

quarter results on Thursday, May 2, 2024, at 9:00 A.M. CT. The

conference call will be available via live audio webcast on the

Investor Relations section of the company’s website

(www.eqcre.com). A replay of the audio webcast will also be

available following the call.

A copy of EQC’s First Quarter 2024 Supplemental Operating and

Financial Information is available in the Investor Relations

section of EQC’s website at www.eqcre.com.

About Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is a Chicago based, internally

managed and self-advised real estate investment trust (REIT) with

commercial office properties in the United States. EQC’s portfolio

is comprised of four properties totaling 1.5 million square

feet.

Regulation FD Disclosures

We use any of the following to comply with our disclosure

obligations under Regulation FD: press releases, SEC filings,

public conference calls, or our website. We routinely post

important information on our website at www.eqcre.com, including

information that may be deemed to be material. We encourage

investors and others interested in the company to monitor these

distribution channels for material disclosures.

Forward-Looking Statements

Some of the statements contained in this press release

constitute forward-looking statements within the meaning of the

federal securities laws. Any forward-looking statements contained

in this press release are intended to be made pursuant to the safe

harbor provisions of Section 21E of the Securities Exchange Act of

1934, as amended. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. You can identify

forward-looking statements by the use of forward-looking

terminology, including but not limited to, “may,” “will,” “should,”

“could,” “would,” “expects,” “intends,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” or “potential” or the negative

of these words and phrases or similar words or phrases which are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. You can also identify

forward-looking statements by discussions of strategy, plans or

intentions.

The forward-looking statements contained in this press release

reflect our current views about future events and are subject to

numerous known and unknown risks, uncertainties, assumptions and

changes in circumstances that may cause our actual results to

differ significantly from those expressed in any forward-looking

statement. We do not guarantee that the transactions and events

described will happen as described (or that they will happen at

all). We disclaim any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future

events or other changes. For a further discussion of these and

other factors that could cause our future results to differ

materially from any forward-looking statements, see the section

entitled “Risk Factors” in our most recent Annual Report on Form

10-K and subsequent quarterly reports on Form 10-Q.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited, amounts in thousands,

except share data)

March 31, 2024

December 31, 2023

ASSETS

Real estate properties:

Land

$

44,060

$

44,060

Buildings and improvements

371,550

367,827

415,610

411,887

Accumulated depreciation

(180,266

)

(180,535

)

235,344

231,352

Cash and cash equivalents

2,170,834

2,160,535

Rents receivable

16,593

15,737

Other assets, net

16,915

17,417

Total assets

$

2,439,686

$

2,425,041

LIABILITIES AND EQUITY

Accounts payable, accrued expenses and

other

$

20,833

$

27,298

Rent collected in advance

2,166

1,990

Distributions payable

3,359

5,640

Total liabilities

$

26,358

$

34,928

Shareholders’ equity:

Preferred shares of beneficial interest,

$0.01 par value: 50,000,000 shares authorized;

Series D preferred shares; 6.50%

cumulative convertible; 4,915,196 shares issued and outstanding,

aggregate liquidation preference of $122,880

$

119,263

$

119,263

Common shares of beneficial interest,

$0.01 par value: 350,000,000 shares authorized; 107,223,284 and

106,847,438 shares issued and outstanding, respectively

1,072

1,068

Additional paid in capital

3,935,501

3,935,873

Cumulative net income

3,952,384

3,926,979

Cumulative common distributions

(4,864,195

)

(4,864,440

)

Cumulative preferred distributions

(735,673

)

(733,676

)

Total shareholders’ equity

2,408,352

2,385,067

Noncontrolling interest

4,976

5,046

Total equity

$

2,413,328

$

2,390,113

Total liabilities and equity

$

2,439,686

$

2,425,041

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited, amounts in thousands,

except per share data)

Three Months Ended

March 31,

2024

2023

Revenues:

Rental revenue

$

13,893

$

14,226

Other revenue (1)

1,297

1,350

Total revenues

$

15,190

$

15,576

Expenses:

Operating expenses

$

6,534

$

7,256

Depreciation and amortization

4,357

4,310

General and administrative

8,323

8,555

Total expenses

$

19,214

$

20,121

Interest and other income, net

29,512

28,376

Income before income taxes

25,488

23,831

Income tax expense

(30

)

(1,080

)

Net income

$

25,458

$

22,751

Net income attributable to noncontrolling

interest

(53

)

(66

)

Net income attributable to Equity

Commonwealth

$

25,405

$

22,685

Preferred distributions

(1,997

)

(1,997

)

Net income attributable to Equity

Commonwealth common shareholders

$

23,408

$

20,688

Weighted average common shares outstanding

— basic (2)

107,216

109,720

Weighted average common shares outstanding

— diluted (2)(3)

108,224

111,300

Earnings per common share attributable to

Equity Commonwealth common shareholders:

Basic

$

0.22

$

0.19

Diluted

$

0.22

$

0.19

(1)

Other revenue is primarily comprised of

parking revenue that does not represent a component of a lease.

(2)

Weighted average common shares outstanding

for the three months ended March 31, 2024 and 2023 includes 129 and

113 unvested, earned RSUs, respectively.

(3)

As of March 31, 2024, we had 4,915 series

D preferred shares outstanding. The series D preferred shares were

convertible into 4,032 common shares as of March 31, 2024 and 2023.

The series D preferred shares are anti-dilutive for GAAP EPS for

all periods presented.

CALCULATION OF FUNDS FROM

OPERATIONS (FFO) AND NORMALIZED FFO

(Unaudited, amounts in thousands,

except per share data)

Three Months Ended

March 31,

2024

2023

Calculation of FFO

Net income

$

25,458

$

22,751

Real estate depreciation and

amortization

4,346

4,299

FFO attributable to Equity

Commonwealth

29,804

27,050

Preferred distributions

(1,997

)

(1,997

)

FFO attributable to EQC common

shareholders and unitholders

$

27,807

$

25,053

Calculation of Normalized FFO

FFO attributable to EQC common

shareholders and unitholders

$

27,807

$

25,053

Straight-line rent adjustments

(223

)

279

Normalized FFO attributable to EQC

common shareholders and unitholders

$

27,584

$

25,332

Weighted average common shares and units

outstanding — basic (1)

107,439

110,044

Weighted average common shares and units

outstanding — diluted (1)

108,447

111,624

FFO attributable to EQC common

shareholders and unitholders per share and unit — basic

$

0.26

$

0.23

FFO attributable to EQC common

shareholders and unitholders per share and unit — diluted

$

0.26

$

0.22

Normalized FFO attributable to EQC common

shareholders and unitholders per share and unit — basic

$

0.26

$

0.23

Normalized FFO attributable to EQC common

shareholders and unitholders per share and unit — diluted

$

0.25

$

0.23

(1)

Our calculations of FFO and Normalized FFO

attributable to EQC common shareholders and unitholders per share

and unit - basic for the three months ended March 31, 2024 and 2023

include 223 and 324 LTIP/Operating Partnership Units, respectively,

that are excluded from the calculation of basic earnings per common

share attributable to EQC common shareholders (only).

We compute FFO in accordance with

standards established by Nareit. Nareit defines FFO as net income

(loss), calculated in accordance with GAAP, excluding real estate

depreciation and amortization, gains (or losses) from sales of

depreciable property, impairment of depreciable real estate and our

portion of these items related to equity investees and

noncontrolling interests. Our calculation of Normalized FFO differs

from Nareit’s definition of FFO because we exclude certain items

that we view as nonrecurring or impacting comparability from period

to period. FFO and Normalized FFO are supplemental non-GAAP

financial measures. We consider FFO and Normalized FFO to be

appropriate measures of operating performance for a REIT, along

with net income (loss), net income (loss) attributable to EQC

common shareholders and cash flow from operating activities.

We believe that FFO and Normalized FFO

provide useful information to investors because by excluding the

effects of certain historical amounts, such as depreciation

expense, FFO and Normalized FFO may facilitate a comparison of our

operating performance between periods and with other REITs. FFO and

Normalized FFO do not represent cash generated by operating

activities in accordance with GAAP and should not be considered as

alternatives to net income (loss), net income (loss) attributable

to EQC common shareholders or cash flow from operating activities,

determined in accordance with GAAP, or as indicators of our

financial performance or liquidity, nor are these measures

necessarily indicative of sufficient cash flow to fund all of our

needs. These measures should be considered in conjunction with net

income (loss), net income (loss) attributable to EQC common

shareholders and cash flow from operating activities as presented

in our condensed consolidated statements of operations and

condensed consolidated statements of cash flows. Other REITs and

real estate companies may calculate FFO and Normalized FFO

differently than we do.

CALCULATION OF SAME PROPERTY

NET OPERATING INCOME (NOI) AND SAME PROPERTY CASH BASIS NOI

(Unaudited, amounts in

thousands)

For the Three Months

Ended

3/31/2024

12/31/2023

9/30/2023

6/30/2023

3/31/2023

Calculation of Same Property NOI and

Same Property Cash Basis NOI:

Rental revenue

$

13,893

$

13,824

$

13,928

$

13,358

$

14,226

Other revenue (1)

1,297

1,322

1,284

1,232

1,350

Operating expenses

(6,534

)

(6,542

)

(6,722

)

(6,942

)

(7,256

)

NOI

$

8,656

$

8,604

$

8,490

$

7,648

$

8,320

Straight-line rent adjustments

(223

)

(538

)

(107

)

273

279

Lease termination fees

(616

)

(630

)

(173

)

(33

)

(177

)

Cash Basis NOI

$

7,817

$

7,436

$

8,210

$

7,888

$

8,422

Cash Basis NOI from non-same properties

(2)

16

7

(5

)

(4

)

(4

)

Same Property Cash Basis NOI

$

7,833

$

7,443

$

8,205

$

7,884

$

8,418

Non-cash rental income and lease

termination fees from same properties

839

1,168

280

(240

)

(102

)

Same Property NOI

$

8,672

$

8,611

$

8,485

$

7,644

$

8,316

Reconciliation of Same Property NOI to

GAAP Net Income:

Same Property NOI

$

8,672

$

8,611

$

8,485

$

7,644

$

8,316

Non-cash rental income and lease

termination fees from same properties

(839

)

(1,168

)

(280

)

240

102

Same Property Cash Basis NOI

$

7,833

$

7,443

$

8,205

$

7,884

$

8,418

Cash Basis NOI from non-same properties

(2)

(16

)

(7

)

5

4

4

Cash Basis NOI

$

7,817

$

7,436

$

8,210

$

7,888

$

8,422

Straight-line rent adjustments

223

538

107

(273

)

(279

)

Lease termination fees

616

630

173

33

177

NOI

$

8,656

$

8,604

$

8,490

$

7,648

$

8,320

Depreciation and amortization

(4,357

)

(4,184

)

(4,436

)

(4,514

)

(4,310

)

General and administrative

(8,323

)

(7,504

)

(7,061

)

(13,854

)

(8,555

)

Interest and other income, net

29,512

29,670

29,269

27,352

28,376

Income before income taxes

$

25,488

$

26,586

$

26,262

$

16,632

$

23,831

Income tax (expense) benefit

(30

)

40

(30

)

(796

)

(1,080

)

Net income

$

25,458

$

26,626

$

26,232

$

15,836

$

22,751

(1)

Other revenue is primarily comprised of

parking revenue that does not represent a component of a lease.

(2)

Cash Basis NOI from non-same properties

for all periods presented includes the operations of disposed

properties.

NOI is income from our real estate

including lease termination fees received from tenants less our

property operating expenses. NOI excludes amortization of

capitalized tenant improvement costs and leasing commissions and

corporate level expenses. Cash Basis NOI is NOI excluding the

effects of straight-line rent adjustments, lease value amortization

and lease termination fees. The year-to-date same property versions

of these measures include the results of properties continuously

owned from January 1, 2023 through March 31, 2024. Properties

classified as held for sale within our condensed consolidated

balance sheets are excluded from the same property versions of

these measures.

We consider these supplemental non-GAAP

financial measures to be appropriate supplemental measures to net

income (loss) because they may help to understand the operations of

our properties. We use these measures internally to evaluate

property level performance, and we believe that they provide useful

information to investors regarding our results of operations

because they reflect only those income and expense items that are

incurred at the property level and may facilitate comparisons of

our operating performance between periods and with other REITs.

Cash Basis NOI is among the factors considered with respect to

acquisition, disposition and financing decisions. These measures do

not represent cash generated by operating activities in accordance

with GAAP and should not be considered as an alternative to net

income (loss), net income (loss) attributable to Equity

Commonwealth common shareholders or cash flow from operating

activities, determined in accordance with GAAP, or as indicators of

our financial performance or liquidity, nor are these measures

necessarily indicative of sufficient cash flow to fund all of our

needs. These measures should be considered in conjunction with net

income (loss), net income (loss) attributable to EQC common

shareholders and cash flow from operating activities as presented

in our condensed consolidated statements of operations and

condensed consolidated statements of cash flows. Other REITs and

real estate companies may calculate these measures differently than

we do.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501127589/en/

Bill Griffiths (312) 646-2801 ir@eqcre.com

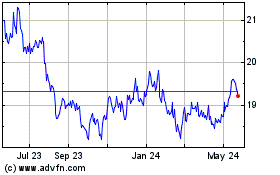

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Nov 2024 to Dec 2024

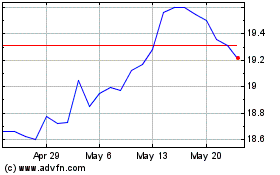

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Dec 2023 to Dec 2024