- Net sales of $2.46 billion, an increase of 5% on a reported

basis or 4% on an organic basis from 2023

- Reported net income of $245 million, compared to $118 million

in 2023, an increase of 107% on a reported basis

- Record Adjusted EBITDA of $535 million, compared to $482

million in 2023, an increase of 11% on a reported basis and 13% on

a constant currency basis

- Cash flows from operating activities of $362 million; record

free cash flow of $294 million

- Introduces 2025 full year financial guidance for Adjusted

EBITDA in the range of $520 million to $540 million

Element Solutions Inc (NYSE:ESI) (“Element Solutions” or the

“Company”), a global and diversified specialty chemicals company,

today announced its financial results for the three and twelve

months ended December 31, 2024.

Executive Commentary

President and Chief Executive Officer Benjamin Gliklich

commented, “Element Solutions had an outstanding year in 2024. We

produced record results, improved our portfolio and positioned the

Company for longer-term outperformance. Against an inconsistent

macro backdrop, we delivered 13% constant currency adjusted EBITDA

growth, significantly outpacing our end-markets. We have been

successful penetrating some of the fastest growing, highest value

niches in the electronics consumables market, which should continue

to deliver profit growth well in excess of the broader ecosystem in

2025. We have also driven margins back towards prior record levels

for Element Solutions, while total volumes remained materially

below their previous peaks. This supports our expectation that we

can continue to deliver both solid growth from a cyclical recovery

over time – in addition to the secular demand growth in electronics

– and margin expansion. The anticipated closing of the Graphics

business sale this quarter will improve the overall portfolio and

its longer-term growth rate, while providing significant

flexibility on the balance sheet for long-term, value accretive

capital allocation. More than just a good year behind us, our

results in 2024 provide conviction in future value creation.”

Mr. Gliklich continued, “Expectations for 2025 suggest a demand

environment similar to 2024. The industrial markets are not seen to

be recovering, and an acceleration in the overall electronics

industry is uncertain. However, the growth niches within our

markets and the execution that delivered our performance in 2024

should remain on track. Demand continues to grow in

high-performance computing and data storage applications. We

continue to extend our penetration of the EV market with our

differentiated power electronics solutions, and we expect market

growth and our share gains in high-value semiconductor markets to

continue. The two major non-operational impacts we expect on

year-over-year adjusted EBITDA in 2025 are a reduction of

approximately $30 million from the sale of the Graphics business

and an anticipated translational foreign exchange impact from a

stronger US dollar of $15 million based on rates at the end of

January. At the midpoint, our full year 2025 adjusted EBITDA

guidance range would translate to 8% growth without those two

impacts. This would be strong growth in light of expected market

conditions. We also expect opportunities this year to deploy our

balance sheet capacity and deliver growth in per share earnings

beyond what is reflected in our full year outlook. We have

momentum, opportunity and, most importantly, a high-performing team

enthusiastic about delivering on our compelling multi-year growth

potential. I am grateful for each of these, but our people chief

among them.”

Fourth Quarter 2024 Highlights

(compared with fourth quarter 2023):

- Net sales on a reported basis for the fourth quarter of 2024

were $624 million, an increase of 9% over the fourth quarter of

2023. Organic net sales increased 6%.

- Electronics: Net sales increased 14% to $401 million. Organic

net sales increased 7%.

- Industrial & Specialty: Net sales increased 1% to $223

million. Organic net sales increased 3%.

- Fourth quarter of 2024 earnings per share (EPS) performance:

- GAAP diluted EPS was $0.23, as compared to $0.32 for the same

period last year.

- Adjusted EPS was $0.35, as compared to $0.32 for the same

period last year.

- Reported net income for the fourth quarter of 2024 was $55

million, as compared to $77 million for the fourth quarter of 2023,

a decrease of 29%.

- Net income margin decreased by 470 basis points to 8.8%.

- Adjusted EBITDA for the fourth quarter of 2024 was $130

million, as compared to $120 million for the fourth quarter of

2023, an increase of 8%. On a constant currency basis, adjusted

EBITDA increased 9%.

- Electronics: Adjusted EBITDA was $87 million, an increase of

11%. On a constant currency basis, adjusted EBITDA increased

11%.

- Industrial & Specialty: Adjusted EBITDA was $43 million, an

increase of 4%. On a constant currency basis, adjusted EBITDA

increased 7%.

- Adjusted EBITDA margin decreased by 10 basis points to 20.8%.

On a constant currency basis, adjusted EBITDA margin decreased by

10 basis points.

Full Year 2024 Highlights (compared

with full year 2023):

- Net sales on a reported basis for the full year 2024 were $2.46

billion, an increase of 5% over the prior full year period. Organic

net sales increased 4%.

- Electronics: Net sales increased 10% to $1.56 billion. Organic

net sales increased 7%.

- Industrial & Specialty: Net sales decreased 3% to $896

million. Organic net sales decreased 1%.

- Full year 2024 EPS performance:

- GAAP diluted EPS was $1.00, as compared to $0.48 for 2023.

- Adjusted EPS was $1.44, as compared to $1.29 for 2023.

- Reported net income for the full year 2024 was $245 million, as

compared to $118 million for 2023.

- Net income margin increased by 490 basis points to 10.0%.

- Adjusted EBITDA for the full year 2024 was $535 million, as

compared to $482 million for 2023. On a constant currency basis,

adjusted EBITDA increased 13%.

- Electronics: Adjusted EBITDA was $362 million, an increase of

14%. On a constant currency basis, adjusted EBITDA increased

16%.

- Industrial & Specialty: Adjusted EBITDA was $173 million,

an increase of 5%. On a constant currency basis, adjusted EBITDA

increased 8%.

- Adjusted EBITDA margin increased by 110 basis points to 21.8%.

On a constant currency basis, adjusted EBITDA margin increased by

120 basis points.

2025 Guidance

For the full year 2025, the Company expects adjusted EBITDA to

be in the range of $520 million to $540 million and free cash flow

conversion to be comparable year over year. In addition, the

Company expects first quarter 2025 adjusted EBITDA to be

approximately $125 million.

Recent Developments

Portfolio Optimization - On September 1, 2024, the Company

entered into an agreement to sell its flexographic printing plate

business, MacDermid Graphics Solutions, for approximately $325

million. MacDermid Graphics Solutions constitutes substantially all

of the Company's Graphics Solutions business. The transaction is

expected to close in the first quarter of 2025, subject to

customary closing conditions and adjustments.

Improved Balance Sheet through Debt and Interest Rate Reduction

- In October 2024, the Company completed the syndication of $1.04

billion of new term loans B-3 which resulted in an interest rate

reduction of 25 basis points to SOFR plus a spread of 1.75% per

annum. In connection with this repricing, the Company fully paid

down its $1.14 billion term loans B-2, therefore reducing its

borrowing under its credit agreement by $100 million. The net

proceeds of the new term loans and cash on hand were used to prepay

in full the Company's term loans B-2.

Cash Dividends - On February 12, 2025, the Board of Directors of

the Company declared a cash dividend of $0.08 per outstanding share

of its common stock. The dividend is expected to be paid on March

17, 2025 to stockholders of record at the close of business on

March 3, 2025. For the full year 2024, approximately $78.2 million

was returned to the Company's stockholders in the form of cash

dividends.

Conference Call

Element Solutions will host a webcast/dial-in conference call to

discuss its 2024 fourth quarter and full year financial results at

8:30 a.m. (Eastern Time) on Wednesday, February 19, 2025.

Participants on the call will include President and Chief Executive

Officer Benjamin H. Gliklich and Chief Financial Officer Carey J.

Dorman.

To listen to the call by telephone, please dial 888-510-2346

(domestic) or 646-960-0111 (international) and provide the

Conference ID: 3799230. The call will be simultaneously webcast at

www.elementsolutionsinc.com. A replay of the call will be available

after completion of the live call at

www.elementsolutionsinc.com.

About Element Solutions

Element Solutions Inc is a leading global specialty chemicals

company whose businesses supply a broad range of solutions that

enhance the performance of products people use every day. Developed

in multi-step technological processes, these innovative solutions

enable customers' manufacturing processes in several key

industries, including consumer electronics, power electronics,

semiconductor fabrication, communications and data storage

infrastructure, automotive systems, industrial surface finishing,

consumer packaging and offshore energy.

More information about the Company is available at

www.elementsolutionsinc.com.

Forward-Looking

Statements

This release is intended to qualify for the safe harbor from

liability established by the Private Securities Litigation Reform

Act of 1995 as it contains "forward-looking statements" within the

meaning of the federal securities laws. These statements will often

contain words such as "expect," "anticipate," "project," "will,"

"should," "believe," "intend," "plan," "assume," "estimate,"

"predict," "seek," "continue," "outlook," "may," "might," "aim,"

"can have," "likely," "potential," "target," "hope," "goal,"

"priority," "guidance" or "confident" and variations of such words

and similar expressions. Examples of forward-looking statements

include, but are not limited to, statements, beliefs, projections

and expectations regarding the Company's position for longer-term

outperformance; profit growth and margin expansion; the expected

benefits of the Graphics business sale; future value creation;

market trends, growth, execution and demand expectations in 2025;

growth strategy in the EV and semiconductor markets;

non-operational adjusted EBITDA impacts in 2025; first quarter 2025

guidance for adjusted EBITDA; full year 2025 guidance for adjusted

EBITDA and adjusted EBITDA growth, and free cash flow conversion;

opportunities to deploy balance sheet capacity; and growth in

adjusted earnings per share beyond full year guidance. These

projections and statements are based on management's estimates,

assumptions or expectations with respect to future events and

financial performance, and are believed to be reasonable, though

are inherently uncertain and difficult to predict. Such projections

and statements are based on the assessment of information available

as of the current date, and the Company does not undertake any

obligations to provide any further updates. Actual results could

differ materially from those expressed or implied in the

forward-looking statements if one or more of the underlying

estimates, assumptions or expectations prove to be inaccurate or

are unrealized. Important factors that could cause actual results

to differ materially from those suggested by the forward-looking

statements include, but are not limited to, the war in Ukraine and

the Israel-Hamas conflict and other hostilities in the Middle-East

as well as actions in response thereto and their impact on market

conditions and the global economy; tariffs and other changes in

trade policy in the U.S. and other countries; capital requirements

and need for and availability of financing; the impact of

government regulations on our ability to conduct operations; the

impact of changes to privacy, cybersecurity, environmental, global

trade, tax and other governmental regulations; impairments,

including those on goodwill and other intangible assets; price

volatility and cost environment; inflation and fluctuations in

foreign exchange rates; our liquidity, cash flows and capital

allocation; funding sources and capital expenditures; outstanding

debt and debt leverage ratio; shares repurchases; debt and/or

equity issuance or retirement; expected returns to stockholders;

and the impact of acquisitions, divestitures, restructurings,

refinancings, impairments and other unusual items, including the

Company's ability to integrate and obtain the anticipated benefits,

results and synergies from these items or other related strategic

initiatives. Additional information concerning these and other

factors that could cause actual results to vary is, or will be,

included in the Company's periodic and other reports filed with the

Securities and Exchange Commission. The Company undertakes no

obligation to update any forward-looking statements, whether as a

result of new information, future events or otherwise.

ELEMENT SOLUTIONS INC

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

(dollars in millions, except per share

amounts)

2024

2023

2024

2023

Net sales

$

624.2

$

573.4

$

2,456.9

$

2,333.2

Cost of sales

368.2

353.1

1,421.2

1,414.7

Gross profit

256.0

220.3

1,035.7

918.5

Operating expenses:

Selling, technical, general and

administrative

166.7

151.0

628.8

596.8

Research and development

14.4

13.8

63.0

68.1

Goodwill impairment

—

—

—

80.0

Total operating expenses

181.1

164.8

691.8

744.9

Operating profit

74.9

55.5

343.9

173.6

Other (expense) income:

Interest expense, net

(13.9

)

(12.3

)

(56.3

)

(49.3

)

Foreign exchange gains (losses)

1.1

(0.7

)

25.1

7.9

Other income (expense), net

4.7

(4.9

)

(25.0

)

(3.1

)

Total other expense

(8.1

)

(17.9

)

(56.2

)

(44.5

)

Income before income taxes and

non-controlling interests

66.8

37.6

287.7

129.1

Income tax (expense) benefit

(12.0

)

40.4

(44.8

)

(13.0

)

Net income from continuing

operations

54.8

78.0

242.9

116.1

(Loss) income from discontinued

operations, net of tax

—

(0.8

)

1.6

2.1

Net income

54.8

77.2

244.5

118.2

Net income attributable to non-controlling

interests

(0.1

)

(0.1

)

(0.3

)

(0.1

)

Net income attributable to common

stockholders

$

54.7

$

77.1

$

244.2

$

118.1

Earnings per

share

Basic from continuing operations

$

0.23

$

0.32

$

1.00

$

0.48

Basic from discontinued operations

—

—

0.01

0.01

Basic attributable to common

stockholders

$

0.23

$

0.32

$

1.01

$

0.49

Diluted from continuing operations

$

0.23

$

0.32

$

1.00

$

0.48

Diluted from discontinued operations

—

—

0.01

0.01

Diluted attributable to common

stockholders

$

0.23

$

0.32

$

1.01

$

0.49

Weighted average

common shares outstanding

Basic

242.2

241.5

242.1

241.4

Diluted

242.7

241.9

242.6

241.8

ELEMENT SOLUTIONS INC

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

December 31,

(dollars in millions)

2024

2023

Assets

Cash and cash equivalents

$

359.4

$

289.3

Accounts receivable, net of allowance for

doubtful accounts of $10.3 and $12.6 at December 31, 2024 and 2023,

respectively

439.6

461.8

Inventories

246.2

298.9

Prepaid expenses

22.7

32.5

Other current assets

136.9

115.0

Current assets held for sale

65.2

—

Total current assets

1,270.0

1,197.5

Property, plant and equipment, net

276.8

296.9

Goodwill

2,132.0

2,336.7

Intangible assets, net

732.0

879.3

Deferred income tax assets

133.3

120.5

Other assets

140.9

143.2

Non-current assets held for sale

188.9

—

Total assets

$

4,873.9

$

4,974.1

Liabilities and stockholders'

equity

Accounts payable

$

121.3

$

140.6

Current installments of long-term debt

10.4

11.5

Accrued expenses and other current

liabilities

229.3

217.3

Current liabilities held for sale

18.7

—

Total current liabilities

379.7

369.4

Debt

1,813.6

1,921.0

Pension and post-retirement benefits

22.2

28.1

Deferred income tax liabilities

93.9

108.9

Other liabilities

152.6

202.4

Non-current liabilities held for sale

13.5

—

Total liabilities

2,475.5

2,629.8

Stockholders' equity

Common stock, 400.0 shares authorized

(2024: 267.2 shares issued; 2023: 266.2 shares issued)

2.7

2.7

Additional paid-in capital

4,214.1

4,196.9

Treasury stock (2024: 25.0 shares; 2023:

24.6 shares)

(349.5

)

(341.9

)

Accumulated deficit

(1,017.1

)

(1,183.3

)

Accumulated other comprehensive loss

(467.2

)

(345.9

)

Total stockholders' equity

2,383.0

2,328.5

Non-controlling interests

15.4

15.8

Total equity

2,398.4

2,344.3

Total liabilities and stockholders'

equity

$

4,873.9

$

4,974.1

ELEMENT SOLUTIONS INC

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

2024

2023

(dollars in millions)

Q1

Q2

Q3

Q4

FY

FY

Cash flows from operating

activities:

Net income

$

56.0

$

93.3

$

40.4

$

54.8

$

244.5

$

118.2

Net income from discontinued operations,

net of tax

—

1.6

—

—

1.6

2.1

Net income from continuing operations

56.0

91.7

40.4

54.8

242.9

116.1

Reconciliation of net income to net cash

flows provided by operating activities:

Depreciation and amortization

40.3

40.1

39.4

37.8

157.6

166.7

Deferred income taxes

(5.4

)

(37.4

)

9.2

(5.6

)

(39.2

)

(69.9

)

Foreign exchange (gains) losses

(7.8

)

(4.7

)

(12.4

)

0.5

(24.4

)

(10.6

)

Incentive stock compensation

4.1

3.6

3.8

3.3

14.8

9.4

Goodwill impairment

—

—

—

—

—

80.0

Other, net

3.7

1.3

13.6

4.3

22.9

42.2

Changes in assets and liabilities, net of

acquisitions:

Accounts receivable

(4.8

)

(27.4

)

(12.2

)

14.5

(29.9

)

(6.8

)

Inventories

(23.9

)

(20.1

)

22.6

29.2

7.8

(9.5

)

Accounts payable

0.7

14.3

(15.1

)

(0.9

)

(1.0

)

0.3

Accrued expenses

(14.5

)

13.5

18.9

15.1

33.0

9.9

Prepaid expenses and other current

assets

6.7

(9.3

)

(0.9

)

(0.7

)

(4.2

)

1.9

Other assets and liabilities

3.1

1.0

(8.8

)

(13.6

)

(18.3

)

3.9

Net cash flows provided by operating

activities

58.2

66.6

98.5

138.7

362.0

333.6

Cash flows from investing

activities:

Capital expenditures

(19.0

)

(14.5

)

(12.6

)

(22.3

)

(68.4

)

(52.7

)

Proceeds from disposal of property, plant

and equipment

—

—

—

—

—

1.4

Acquisitions, net of cash acquired

(3.9

)

—

—

—

(3.9

)

(214.8

)

Other, net

—

(6.4

)

—

4.9

(1.5

)

15.9

Net cash flows used in investing

activities

(22.9

)

(20.9

)

(12.6

)

(17.4

)

(73.8

)

(250.2

)

Cash flows from financing

activities:

Debt proceeds, net of discount

—

—

—

1,040.1

1,040.1

1,297.1

Repayments of borrowings

(2.9

)

(2.9

)

(2.8

)

(1,144.0

)

(1,152.6

)

(1,264.1

)

Dividends

(20.0

)

(19.4

)

(19.4

)

(19.4

)

(78.2

)

(77.4

)

Payment of financing fees

(2.1

)

—

—

(1.1

)

(3.2

)

(6.3

)

Other, net

(7.7

)

0.9

(6.0

)

0.1

(12.7

)

(8.0

)

Net cash flows used in financing

activities

(32.7

)

(21.4

)

(28.2

)

(124.3

)

(206.6

)

(58.7

)

Net cash flows provided by operating

activities of discontinued operations

—

1.6

—

—

1.6

2.2

Effect of exchange rate changes on cash

and cash equivalents

(5.6

)

(2.9

)

9.0

(13.6

)

(13.1

)

(3.2

)

Net (decrease) increase in cash and

cash equivalents

(3.0

)

23.0

66.7

(16.6

)

70.1

23.7

Cash and cash equivalents at beginning of

period

289.3

286.3

309.3

376.0

289.3

265.6

Cash and cash equivalents at end of

period

$

286.3

$

309.3

$

376.0

$

359.4

$

359.4

$

289.3

Supplemental

disclosure information of continuing operations:

Cash paid for interest

$

24.2

$

8.4

$

24.3

$

7.9

$

64.8

$

56.1

Cash paid for income taxes

$

14.2

$

25.3

$

21.3

$

26.4

$

87.2

$

73.7

ELEMENT SOLUTIONS INC

ADDITIONAL FINANCIAL

INFORMATION

(Unaudited)

I. SUMMARY RESULTS

Three Months Ended December

31,

Twelve Months Ended December

31,

(dollars in millions)

2024

2023

Reported

Constant Currency

Organic

2024

2023

Reported

Constant Currency

Organic

Net Sales

Electronics

$

401.4

$

352.3

14

%

14

%

7

%

$

1,561.4

$

1,414.7

10

%

12

%

7

%

Industrial & Specialty

222.8

221.1

1

%

3

%

3

%

895.5

918.5

(3

)%

(1

)%

(1

)%

Total

$

624.2

$

573.4

9

%

10

%

6

%

$

2,456.9

$

2,333.2

5

%

7

%

4

%

Net Income

Total

$

54.8

$

77.2

(29

)%

$

244.5

$

118.2

107

%

Adjusted EBITDA

Electronics

$

86.8

$

78.3

11

%

11

%

$

361.5

$

317.7

14

%

16

%

Industrial & Specialty

43.1

41.5

4

%

7

%

173.2

164.6

5

%

8

%

Total

$

129.9

$

119.8

8

%

9

%

$

534.7

$

482.3

11

%

13

%

Three Months Ended

December 31,

Constant Currency

Twelve Months Ended

December 31,

Constant Currency

2024

2023

Change

2024

Change

2024

2023

Change

2024

Change

Net Income Margin

Total

8.8%

13.5%

(470)bps

10.0%

5.1%

490bps

Adjusted EBITDA Margin

Electronics

21.6%

22.2%

(60)bps

21.6%

(60)bps

23.1%

22.5%

60bps

23.3%

80bps

Industrial & Specialty

19.4%

18.8%

60bps

19.5%

70bps

19.3%

17.9%

140bps

19.5%

160bps

Total

20.8%

20.9%

(10)bps

20.8%

(10)bps

21.8%

20.7%

110bps

21.9%

120bps

II. CAPITAL STRUCTURE

(dollars in millions)

Maturity

Interest Rate

December 31, 2024

Instrument

Term Loans

(1

)

12/18/2030

SOFR plus 1.75%

$

1,038.8

Total First Lien Debt

1,038.8

Senior Notes due 2028

9/1/2028

3.875%

800.0

Total Debt

1,838.8

Cash Balance

359.4

Net Debt

$

1,479.4

Adjusted Shares Outstanding

(2

)

244.5

Market Capitalization

(3

)

$

6,217.6

Total Capitalization

$

7,697.0

(1)

Element Solutions swapped its floating

term loan rate to a fixed rate for all of its outstanding term

loans through the use of interest rate swaps and cross-currency

swaps which mature in January 2025 or December 2028, as applicable.

At December 31, 2024, 100% of the Company's debt was fixed.

(2)

See "Adjusted Common Shares Outstanding at

December 31, 2024 and 2023" following the footnotes under the

"Adjusted Earnings Per Share (EPS)" reconciliation table below.

(3)

Based on the closing price of the shares

of Element Solutions of $25.43 at December 31, 2024.

III. SELECTED FINANCIAL DATA

Three Months Ended December

31,

Twelve Months Ended December

31,

(dollars in millions)

2024

2023

2024

2023

Interest expense

$

16.6

$

15.4

$

67.5

$

58.9

Interest paid

7.9

7.4

64.8

56.1

Income tax expense (benefit)

12.0

(40.4

)

44.8

13.0

Income taxes paid

26.4

24.7

87.2

73.7

Capital expenditures

22.3

16.4

68.4

52.7

Proceeds from disposal of property, plant

and equipment

—

—

—

1.4

IV. SUPPLEMENTAL INFORMATION

2024

2023

(dollars in millions)

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Net Sales

Electronics

$

349.2

$

391.7

$

419.1

$

401.4

$

339.6

$

355.8

$

367.0

$

352.3

Industrial & Specialty

225.8

221.0

225.9

222.8

234.8

230.3

232.3

221.1

Total

$

575.0

$

612.7

$

645.0

$

624.2

$

574.4

$

586.1

$

599.3

$

573.4

Net Income (Loss)

Total

$

56.0

$

93.3

$

40.4

$

54.8

$

43.0

$

29.7

$

(31.7

)

$

77.2

Adjusted EBITDA

Electronics

$

83.9

$

92.2

$

98.6

$

86.8

$

72.7

$

76.3

$

90.4

$

78.3

Industrial & Specialty

43.1

42.9

44.1

43.1

39.6

39.8

43.7

41.5

Total

$

127.0

$

135.1

$

142.7

$

129.9

$

112.3

$

116.1

$

134.1

$

119.8

Non-GAAP Measures

To supplement its financial measures prepared in accordance with

GAAP, Element Solutions presents in this release the following

non-GAAP financial measures: EBITDA, adjusted EBITDA, adjusted

EBITDA margin, adjusted EPS, adjusted common shares outstanding,

free cash flow, organic net sales growth, first quarter 2025

guidance for adjusted EBITDA, and full year 2025 guidance for

adjusted EBITDA and adjusted EBITDA growth, and free cash flow

conversion expectations. The Company also evaluates and presents

its results of operations on a constant currency basis.

Management internally reviews these non-GAAP measures to

evaluate performance and liquidity on a comparative

period-to-period basis in terms of absolute performance, trends and

expected future performance with respect to the Company’s business,

and believes that these non-GAAP measures provide investors with an

additional perspective on trends and underlying operating results

on a period-to-period comparable basis. The Company also believes

that investors find this information helpful in understanding the

ongoing performance of its operations as well as their ability to

generate cash separate from items that may have a disproportionate

positive or negative impact on its financial results in any

particular period or that are considered to be associated with its

capital structure. These non-GAAP financial measures, however, have

limitations as analytical tools, and should not be considered in

isolation from, a substitute for, or superior to, the related

financial information that Element Solutions reports in accordance

with GAAP. The principal limitation of these non-GAAP financial

measures is that they exclude significant expenses and income that

are required by GAAP to be recorded in the Company’s financial

statements, and may not be completely comparable to similarly

titled measures of other companies due to potential differences in

calculation methods. In addition, these measures are subject to

inherent limitations as they reflect the exercise of judgment by

management about which items are excluded or included in

determining these non-GAAP financial measures. Investors are

encouraged to review the definitions and reconciliations of these

non-GAAP financial measures to their most comparable GAAP financial

measures included in this press release, and not to rely on any

single financial measure to evaluate the Company's businesses.

The Company provides first quarter 2025 guidance for adjusted

EBITDA and full year 2025 guidance for adjusted EBITDA, adjusted

EBITDA growth and free cash flow conversion only on a non-GAAP

basis. Reconciliations of such forward-looking non-GAAP measures to

GAAP are excluded in reliance upon the exception provided by Item

10(e)(1)(i)(B) of Regulation S-K due to the inherent difficulty in

forecasting and quantifying, without unreasonable efforts, certain

amounts that are necessary for such reconciliations, including

adjustments that could be made for restructurings, refinancings,

impairments, divestitures, integration and acquisition-related

expenses, share-based compensation amounts, non-recurring, unusual

or unanticipated charges, expenses or gains, adjustments to

inventory and other charges reflected in its reconciliations of

historic numbers, the amount of which, based on historical

experience, could be significant.

Constant Currency:

The Company discloses net sales and adjusted EBITDA on a

constant currency basis by adjusting results to exclude the impact

of changes due to the translation of foreign currencies of its

international locations into U.S. dollar. Management believes this

non-GAAP financial information facilitates period-to-period

comparison in the analysis of trends in business performance,

thereby providing valuable supplemental information regarding its

results of operations, consistent with how the Company internally

evaluates its financial results.

The impact of foreign currency translation is calculated by

converting the Company's current-period local currency financial

results into U.S. dollar using the prior period's exchange rates

and comparing these adjusted amounts to its prior period reported

results. The difference between actual growth rates and constant

currency growth rates represents the estimated impact of foreign

currency translation.

Organic Net Sales Growth:

Organic net sales growth is defined as net sales excluding the

impact of foreign currency translation, changes due to the

pass-through pricing of certain metals, and acquisitions and/or

divestitures, as applicable. Management believes this non-GAAP

financial measure provides investors with a more complete

understanding of the underlying net sales trends by providing

comparable net sales over differing periods on a consistent

basis.

The following table reconciles GAAP net sales growth to organic

net sales growth for the three and twelve months ended December 31,

2024:

Three Months Ended December

31, 2024

Reported Net Sales

Growth

Impact of Currency

Constant Currency

Change in Pass-Through Metals

Pricing

Acquisitions

Organic Net Sales

Growth

Electronics

14%

0%

14%

(7)%

—%

7%

Industrial & Specialty

1%

2%

3%

—%

—%

3%

Total

9%

1%

10%

(4)%

—%

6%

NOTE: Totals may not sum due to

rounding.

Twelve Months Ended December

31, 2024

Reported Net Sales

Growth

Impact of Currency

Constant Currency

Change in Pass-Through Metals

Pricing

Acquisitions

Organic Net Sales

Growth

Electronics

10%

1%

12%

(4)%

(1)%

7%

Industrial & Specialty

(3)%

2%

(1)%

—%

0%

(1)%

Total

5%

2%

7%

(3)%

0%

4%

NOTE: Totals may not sum due to

rounding.

For the three months ended December 31, 2024, Electronics'

consolidated results were positively impacted by $23.6 million of

pass-through metals pricing.

For the twelve months ended December 31, 2024, Electronics'

consolidated results were positively impacted by $59.7 million of

pass-through metals pricing and $8.1 million of acquisitions and

Industrial & Specialty's consolidated results were positively

impacted by $0.5 million of acquisitions.

Adjusted Earnings Per Share (EPS):

Adjusted EPS is a key metric used by management to measure

operating performance and trends as management believes the

exclusion of certain expenses in calculating adjusted EPS

facilitates operating performance comparisons on a period-to-period

basis. Adjusted EPS is defined as net income adjusted to reflect

adjustments consistent with the Company's definition of adjusted

EBITDA. Additionally, the Company eliminates amortization expense

associated with intangible assets, incremental depreciation

associated with the step-up of fixed assets and incremental cost of

sales associated with the step-up of inventories recognized in

purchase accounting for acquisitions.

Further, the Company adjusts its effective tax rate to 20%, as

described in footnote (9) under the reconciliation table below.

This effective tax rate, which reflects the Company’s estimated

long-term expectations for taxes to be paid on its adjusted

non-GAAP earnings, is consistent with how management evaluates the

Company’s financial performance. The Company also believes that

providing a fixed rate facilitates comparisons of business

performance from period to period. This non-GAAP effective tax rate

is lower than the average of the statutory tax rates applicable to

the Company’s jurisdictional mix of earnings, primarily because it

reflects tax benefits derived from U.S. tax attribute

carryforwards, which consist of operating losses and tax

credits.

The resulting adjusted net income is then divided by the

Company's adjusted common shares outstanding. Adjusted common

shares outstanding represent the shares outstanding as of the

balance sheet date for the quarter-to-date period and an average of

each quarter for the year-to-date period, plus shares issuable upon

exercise or vesting of all outstanding equity awards (assuming a

performance achievement target level for equity awards with targets

considered probable).

The following table reconciles GAAP "Net income" to "Adjusted

net income" and presents the number of adjusted common shares

outstanding used in calculating adjusted EPS for each period

presented below:

Three Months Ended December

31,

Twelve Months Ended December

31,

(dollars in millions, except per share

amounts)

2024

2023

2024

2023

Net income

$

54.8

$

77.2

$

244.5

$

118.2

Loss (income) from discontinued

operations, net of tax

—

0.8

(1.6

)

(2.1

)

Net income attributable to the

non-controlling interests

(0.1

)

(0.1

)

(0.3

)

(0.1

)

Reversal of amortization expense

(1

)

28.2

30.8

117.6

124.1

Adjustment to reverse incremental

depreciation expense from acquisitions

(1

)

0.3

0.3

1.3

1.5

Inventory step-up

(1

)

—

3.3

—

3.3

Restructuring expense

(2

)

2.1

5.1

7.8

11.4

Acquisition, divestiture and integration

expense

(3

)

10.4

3.5

21.7

16.8

Foreign exchange losses (gains) on

intercompany loans

(4

)

0.3

(2.1

)

(23.9

)

(9.7

)

Debt refinancing costs

(5

)

0.4

7.8

0.8

7.8

Goodwill impairment

(6

)

—

—

—

80.0

Kuprion Acquisition research and

development charge

(7

)

—

—

3.9

15.7

Other, net

(8

)

(1.8

)

10.3

22.8

11.9

Tax effect of pre-tax non-GAAP

adjustments

(9

)

(8.0

)

(11.8

)

(30.4

)

(52.6

)

Adjustment to estimated effective tax

rate

(9

)

(1.3

)

(47.9

)

(12.7

)

(12.8

)

Adjusted net income

$

85.3

$

77.2

$

351.5

$

313.4

Adjusted earnings per share

(10

)

$

0.35

$

0.32

$

1.44

$

1.29

Adjusted common shares

outstanding

(10

)

244.5

243.8

244.5

243.9

(1)

The Company eliminates the amortization

expense associated with intangible assets, incremental depreciation

associated with the step-up of fixed assets and incremental cost of

sales associated with the step-up of inventories recognized in

purchase accounting for acquisitions. The Company believes these

adjustments provide insight with respect to the cash flows

necessary to maintain and enhance its product portfolio.

(2)

The Company adjusts for costs of

restructuring its operations, including those related to its

acquired businesses. The Company adjusts these costs because it

believes they are not reflective of ongoing operations.

(3)

The Company adjusts for costs associated

with acquisition, divestiture and integration activity, including

costs of obtaining related financing, legal and accounting fees and

transfer taxes. The Company adjusts these costs because it believes

they are not reflective of ongoing operations.

(4)

The Company adjusts for foreign exchange

gains and losses on intercompany loans because it expects the

period-to-period movement of the applicable currencies to offset on

a long-term basis and because these gains and losses are not fully

realized due to their long-term nature. The Company does not

exclude foreign exchange gains and losses on short-term

intercompany and third-party payables and receivables.

(5)

The Company adjusts for costs related to

the prepayment of its prior term loans because it believes these

costs are not reflective of ongoing operations.

(6)

The Company recorded a non-cash impairment

charge of $80.0 million related to its Graphics Solutions reporting

unit in its Industrial & Specialty segment in the third quarter

of 2023. The Company adjusts this cost because it believes it is

not reflective of ongoing operations.

(7)

The Company adjusts for research and

development costs associated with contingent consideration and the

purchase accounting related to the acquisition of Kuprion, Inc. The

Company adjusts these costs because it believes they are not

reflective of ongoing operations.

(8)

The Company's adjustments include a

non-cash available-for-sale debt security impairment charge of

$11.4 million in the third quarter of 2024 and highly inflationary

accounting losses for its operations in Turkey of $3.8 million and

$9.9 million for the years ended December 31, 2024 and 2023,

respectively. In addition, the Company adjusts for certain

professional consulting fees and unrealized gains/losses on metals

derivative contracts. The Company adjusts for the

available-for-sale debt security impairment and certain

professional consulting fees because it believes they are not

reflective of ongoing operations. The Company adjusts for highly

inflationary accounting impacts for its operations in Turkey and

unrealized gains/losses on metals derivative contracts as it

believes it provides a more meaningful comparison of its

performance between periods.

(9)

The Company uses a non-GAAP effective tax

rate of 20%. This rate, which reflects the Company's estimated

long-term expectations for taxes to be paid on its adjusted

non-GAAP earnings, is consistent with how management evaluates the

Company's financial performance. The Company also believes that

providing a fixed rate facilitates comparisons of business

performance from period to period. This non-GAAP effective tax rate

is lower than the average of the statutory tax rates applicable to

the Company's jurisdictional mix of earnings, primarily because it

reflects tax benefits derived from U.S. tax attribute

carryforwards, which consist of operating losses and tax credits.

These economic benefits are expected to recur through 2028. Without

taking into account these benefits derived from its U.S. tax

attribute carryforwards and other similar adjustments, the

Company's non-GAAP effective tax rate would have been 23.9% which

would have resulted in a $0.07 reduction in Adjusted EPS for the

year ended December 31, 2024.

(10)

The Company defines "Adjusted common

shares outstanding" as the number of shares of its common stock

outstanding as of the balance sheet date for the quarter-to-date

period and an average of each quarter for the year-to-date period,

plus the shares issuable upon exercise or vesting of all

outstanding equity awards (assuming a performance achievement

target level for equity awards with targets considered probable).

The Company adjusts the number of its outstanding common shares for

this calculation as it believes it provides a better understanding

of its results of operations on a per share basis. See the table

below for further information.

Adjusted Common Shares Outstanding at December 31, 2024 and

2023

The following table shows the Company's adjusted common shares

outstanding at each period presented:

2024

2023

(amounts in millions)

Q4

FY Average

Q4

FY Average

Basic common shares outstanding

242.2

242.1

241.5

241.5

Number of shares issuable upon vesting of

granted Equity Awards

2.3

2.4

2.3

2.4

Adjusted common shares

outstanding

244.5

244.5

243.8

243.9

EBITDA and Adjusted EBITDA:

EBITDA represents earnings before interest, provision for income

taxes, depreciation and amortization. Adjusted EBITDA is defined as

EBITDA, excluding the impact of additional items included in GAAP

earnings which the Company believes are not representative or

indicative of its ongoing business or are considered to be

associated with its capital structure, as described in the

footnotes located under the "Adjusted Earnings Per Share (EPS)"

reconciliation table above. Adjusted EBITDA for each segment also

includes an allocation of corporate costs, such as compensation

expense and professional fees. Management believes adjusted EBITDA

and adjusted EBITDA margin provide investors with a more complete

understanding of the long-term profitability trends of the

Company's business and facilitate comparisons of its profitability

to prior and future periods.

The following table reconciles GAAP "Net income" to "Adjusted

EBITDA" for each of the periods presented:

2024

(dollars in millions)

Q1

Q2

Q3

Q4

FY

Net income

$

56.0

$

93.3

$

40.4

$

54.8

$

244.5

Add (subtract):

Income from discontinued operations, net

of tax

—

(1.6

)

—

—

(1.6

)

Income tax expense (benefit)

13.5

(17.5

)

36.8

12.0

44.8

Interest expense, net

13.9

14.3

14.2

13.9

56.3

Depreciation expense

10.1

10.3

10.0

9.6

40.0

Amortization expense

30.2

29.8

29.4

28.2

117.6

EBITDA

123.7

128.6

130.8

118.5

501.6

Adjustments to reconcile to Adjusted

EBITDA:

Restructuring expense (income)

(2

)

2.3

3.5

(0.1

)

2.1

7.8

Acquisition, divestiture and integration

expense

(3

)

1.7

3.3

6.3

10.4

21.7

Foreign exchange (gains) losses on

intercompany loans

(4

)

(6.8

)

(3.9

)

(13.5

)

0.3

(23.9

)

Debt refinancing costs

(5

)

—

—

0.4

0.4

0.8

Kuprion Acquisition research and

development charge

(7

)

3.9

—

—

—

3.9

Other, net

(8

)

2.2

3.6

18.8

(1.8

)

22.8

Adjusted EBITDA

$

127.0

$

135.1

$

142.7

$

129.9

$

534.7

NOTE: For the footnote descriptions,

please refer to the footnotes located under the "Adjusted Earnings

Per Share (EPS)" reconciliation table above.

2023

(dollars in millions)

Q1

Q2

Q3

Q4

FY

Net income (loss)

$

43.0

$

29.7

$

(31.7

)

$

77.2

$

118.2

Add (subtract):

(Income) loss from discontinued

operations, net of tax

—

(2.9

)

—

0.8

(2.1

)

Income tax expense (benefit)

16.9

21.2

15.3

(40.4

)

13.0

Interest expense, net

11.7

12.0

13.3

12.3

49.3

Depreciation expense

9.5

10.1

11.8

11.2

42.6

Amortization expense

29.6

31.0

32.7

30.8

124.1

EBITDA

110.7

101.1

41.4

91.9

345.1

Adjustments to reconcile to Adjusted

EBITDA:

Inventory step-up

(1

)

—

—

—

3.3

3.3

Restructuring expense

(2

)

2.3

1.9

2.1

5.1

11.4

Acquisition, divestiture and integration

expense

(3

)

3.9

4.4

5.0

3.5

16.8

Foreign exchange (gains) losses on

intercompany loans

(4

)

(5.6

)

(8.5

)

6.5

(2.1

)

(9.7

)

Debt refinancing costs

(5

)

—

—

—

7.8

7.8

Goodwill impairment

(6

)

—

—

80.0

—

80.0

Kuprion Acquisition research and

development charge

(7

)

—

15.7

—

—

15.7

Other, net

(8

)

1.0

1.5

(0.9

)

10.3

11.9

Adjusted EBITDA

$

112.3

$

116.1

$

134.1

$

119.8

$

482.3

Free Cash Flow:

Free cash flow is defined as net cash flows from operating

activities less net capital expenditures. Net capital expenditures

include capital expenditures less proceeds from the disposal of

property, plant and equipment. Free cash flow conversion from

adjusted EBITDA is a liquidity ratio defined as cash flows from

operations minus gross capital expenditures, divided by adjusted

EBITDA. Management believes that free cash flow, which measures the

Company’s ability to generate cash from its business operations, is

an important financial measure for evaluating the Company's

liquidity. Free cash flow and free cash flow conversion should be

considered as additional measures of liquidity to, rather than as

substitutes for, net cash provided by operating activities.

The following table reconciles "Cash flows from operating

activities" to "Free cash flow" for the periods presented:

Three Months Ended December

31,

Twelve Months Ended December

31,

(dollars in millions)

2024

2023

2024

2023

Cash flows from operating

activities

$

138.7

$

111.8

$

362.0

$

333.6

Capital expenditures

(22.3

)

(16.4

)

(68.4

)

(52.7

)

Proceeds from disposal of property, plant

and equipment

—

—

—

1.4

Free cash flow

$

116.4

$

95.4

$

293.6

$

282.3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218115486/en/

Investor Relations Contact: Varun Gokarn Vice President,

Strategy and Finance Element Solutions Inc 1-203-952-0369

IR@elementsolutionsinc.com

Media Contact: Scott Bisang / Ed Hammond / Tali Epstein

Collected Strategies 1-212-379-2072 esi@collectedstrategies.com

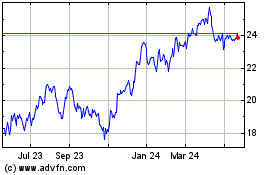

Element Solutions (NYSE:ESI)

Historical Stock Chart

From Jan 2025 to Feb 2025

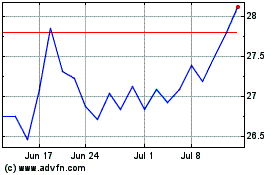

Element Solutions (NYSE:ESI)

Historical Stock Chart

From Feb 2024 to Feb 2025