E2open Ocean Shipping Index Cites Ongoing Conflict, Extreme Weather and Threat of Labor Strikes as Key Drivers of Port Congestion and Longer Transit Times

08 November 2024 - 1:15AM

Business Wire

Latest report indicates year-over-year increase of up to 10

days for average global ocean shipment durations

E2open Parent Holdings, Inc. (NYSE: ETWO), the connected supply

chain SaaS platform with the largest multi-enterprise network, has

published the latest edition of its Ocean Shipping Index, a

quarterly benchmark report that provides insight for

decision-making around global ocean shipments. The report data

reveals a considerable year-over-year (YoY) increase in global

average shipment duration, from 58 days in Q3 2023 to 68 days in Q3

2024, along with a two-day increase from Q2 2024. The most

significant contributor to the increase in YoY was the actual

transit time of six days, driven by geopolitical unrest and longer

dwell time at congested ports.

The e2open Ocean Shipping Index empowers shippers with

data-driven insights to better anticipate and adapt to factors

contributing to delays. The report is based on ocean shipping

activity in e2open’s vast network of over 480,000 connected

enterprises and managing billions of transactions and more than 70

million containers annually. Providing details down to booking

date, e2open’s Ocean Shipping Index arms the market with unique and

timely insights for proactive and optimal decision-making.

“The latest Ocean Shipping Index data reflects the impact of

ongoing conflicts like the Red Sea attacks, compounded in recent

months by short-term disruptions such as extreme weather and the

threat of labor strikes,” said Pawan Joshi, EVP products and

strategy for e2open. “The report shows that even when disruptions

are short-term, they compound uncertainty, and the effects can

continue to ripple through supply chains months later. Given the

persistent volatility of the environment in which companies must

operate their global supply chains, data-driven strategies are

invaluable for shippers and carriers to mitigate the risk and

impact of extended transit times.”

Key takeaways from the latest e2open Ocean Shipping Index report

covering the third quarter of 2024 include:

- Shipment duration from Asia to Europe increased a staggering 18

days compared to Q3 2023, rising from 62 days to an average of 80

days from initial booking to clearing the gate at the final port.

The most significant contributors to the increase in the YoY

duration are booking time (five days) and actual transit time (13

days).

- Exports from Europe to Asia averaged 83 days from booking to

receipt, up 12 days from Q3 2023. Actual transit time of nine days

is the most significant contributor. Asia to South America

performed the same, up 12 days from the comparable quarter last

year, averaging 83 days.

- South American shipments headed to North America had an average

transit time of 63 days, up seven days form last quarter and 12

days year-over-year. Key contributors to the increase were booking

time (three days), origin port loading (two days) and actual

transit time (seven days).

- Shipment durations from South America to Asia increased by 12

days year-over-year in Q3 2024, averaging 87 days. This was

primarily due to longer booking, loading, and transit times.

- Overall, global ocean shipments averaged 68 days from initial

booking to clearing the gate at the final port. This represents an

increase of two days versus Q2 2024 and up 10 days from the

duration seen in Q3 2023 (58 days).

Read the full e2open Ocean Shipping Index for additional data

points and insights; view and subscribe at e2open.com. This report

is one of several benchmark reports available from e2open to help

companies manage increasingly complex and rapidly shifting global

supply chains.

About e2open

E2open is the connected supply chain software platform that

enables the world’s largest companies to transform the way they

make, move, and sell goods and services. With the broadest

cloud-native global platform purpose-built for modern supply

chains, e2open connects more than 480,000 manufacturing, logistics,

channel, and distribution partners as one multi-enterprise network

tracking over 16 billion transactions annually. Our SaaS platform

anticipates disruptions and opportunities to help companies improve

efficiency, reduce waste, and operate sustainably. Moving as one.™

Learn More: www.e2open.com.

E2open and “Moving as one.” are the registered trademarks of

E2open, LLC. All other trademarks, registered trademarks and

service marks are the property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107331644/en/

Media Contact: 5W PR for e2open e2open@5wpr.com

Corporate Contact: Kristin Seigworth VP Communications, e2open

kristin.seigworth@e2open.com pr@e2open.com

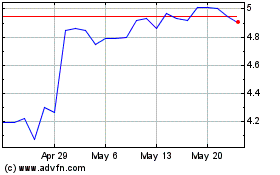

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Dec 2024 to Jan 2025

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Jan 2024 to Jan 2025