Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 October 2023 - 5:21AM

Edgar (US Regulatory)

First Trust Specialty Finance and

Financial Opportunities Fund (FGB)

Portfolio of Investments

August 31, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

COMMON STOCKS – BUSINESS DEVELOPMENT

COMPANIES – 97.8%

|

|

|

| Capital Markets – 97.8%

|

|

|

| 150,000

|

| Ares Capital Corp. (a)

|

| $2,923,500

|

| 50,000

|

| Bain Capital Specialty Finance, Inc.

|

| 787,500

|

| 390,000

|

| Barings BDC, Inc. (a)

|

| 3,619,200

|

| 332,000

|

| BlackRock TCP Capital Corp. (a)

|

| 4,096,880

|

| 160,000

|

| Blackstone Secured Lending Fund (a)

|

| 4,446,400

|

| 150,000

|

| Blue Owl Capital Corp. (a)

|

| 2,088,000

|

| 71,000

|

| Capital Southwest Corp. (a)

|

| 1,566,260

|

| 42,565

|

| Crescent Capital BDC, Inc. (a)

|

| 697,215

|

| 38,500

|

| FS KKR Capital Corp. (a)

|

| 787,710

|

| 135,000

|

| Goldman Sachs BDC, Inc. (a)

|

| 1,946,700

|

| 280,000

|

| Golub Capital BDC, Inc. (a)

|

| 4,026,400

|

| 340,000

|

| Hercules Capital, Inc. (a)

|

| 5,593,000

|

| 111,000

|

| Main Street Capital Corp. (a)

|

| 4,477,740

|

| 328,000

|

| New Mountain Finance Corp. (a)

|

| 4,188,560

|

| 10,000

|

| Oaktree Specialty Lending Corp.

|

| 200,600

|

| 129,657

|

| OFS Capital Corp. (a)

|

| 1,389,923

|

| 600,000

|

| PennantPark Investment Corp. (a)

|

| 3,972,000

|

| 44,000

|

| Portman Ridge Finance Corp.

|

| 871,200

|

| 177,000

|

| Sixth Street Specialty Lending, Inc. (a)

|

| 3,570,090

|

| 161,000

|

| SLR Investment Corp. (a)

|

| 2,448,810

|

| 48,000

|

| Trinity Capital, Inc.

|

| 703,200

|

| 105,000

|

| TriplePoint Venture Growth BDC Corp. (a)

|

| 1,169,700

|

|

|

| Total Common Stocks - Business Development Companies

|

| 55,570,588

|

|

|

| (Cost $58,409,498)

|

|

|

| COMMON STOCKS – 6.3%

|

|

|

| Banks – 1.0%

|

|

|

| 20,000

|

| Bank of America Corp.

|

| 573,400

|

|

|

| Capital Markets – 2.1%

|

|

|

| 11,000

|

| Blackstone, Inc.

|

| 1,170,070

|

|

|

| Financial Services – 2.8%

|

|

|

| 4,500

|

| Berkshire Hathaway, Inc., Class B (a) (b)

|

| 1,620,900

|

|

|

| Insurance – 0.4%

|

|

|

| 150

|

| Markel Group Inc. (b)

|

| 221,838

|

|

|

| Total Common Stocks

|

| 3,586,208

|

|

|

| (Cost $2,798,007)

|

|

|

| REAL ESTATE INVESTMENT TRUSTS – 5.9%

|

|

|

| Mortgage Real Estate

Investment Trusts – 5.9%

|

|

|

| 110,000

|

| AGNC Investment Corp. (a)

|

| 1,090,100

|

| Shares

|

| Description

|

| Value

|

|

|

|

|

| Mortgage Real Estate

Investment Trusts (Continued)

|

|

|

| 110,000

|

| Annaly Capital Management, Inc. (a)

|

| $2,229,700

|

|

|

| Total Real Estate Investment Trusts

|

| 3,319,800

|

|

|

| (Cost $4,188,659)

|

|

|

|

|

| Total Investments – 110.0%

|

| 62,476,596

|

|

|

| (Cost $65,396,164)

|

|

|

|

|

| Outstanding Loan – (15.1)%

|

| (8,600,000)

|

|

|

| Net Other Assets and Liabilities – 5.1%

|

| 2,940,702

|

|

|

| Net Assets – 100.0%

|

| $56,817,298

|

| (a)

| All or a portion of this security serves as collateral on the outstanding loan. At August 31, 2023, the segregated value of these securities amounts to $40,529,461.

|

| (b)

| Non-income producing security.

|

Valuation Inputs

The Fund is subject to

fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

| •

| Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

|

| •

| Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived

from observable market data.)

|

| •

| Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in

pricing the investment.

|

The inputs or

methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

First Trust Specialty Finance and

Financial Opportunities Fund (FGB)

Portfolio of Investments

(Continued)

August 31, 2023

(Unaudited)

A summary of the inputs

used to value the Fund’s investments as of August 31, 2023 is as follows:

|

| Total

Value at

8/31/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

| Common Stocks - Business Development Companies*

| $ 55,570,588

| $ 55,570,588

| $ —

| $ —

|

| Common Stocks*

| 3,586,208

| 3,586,208

| —

| —

|

| Real Estate Investment Trusts*

| 3,319,800

| 3,319,800

| —

| —

|

| Total Investments

| $ 62,476,596

| $ 62,476,596

| $—

| $—

|

| *

| See Portfolio of Investments for industry breakout.

|

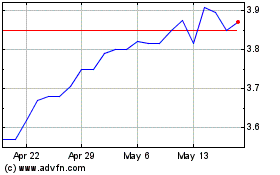

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Apr 2024 to May 2024

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From May 2023 to May 2024