| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM 6-K |

|

| REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO |

| RULE 13A-16 OR 15D-16 UNDER THE SECURITIES |

| EXCHANGE ACT OF 1934 |

|

| For the month of February 2025 |

|

| Commission File Number: 001-38904 |

|

| FLEX LNG Ltd. |

| (Translation of registrant's name into English) |

|

| Par-La-Ville Place |

| 14 Par-La-Ville Road |

| Hamilton |

| Bermuda |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as Exhibit 99.1 is a press release of FLEX LNG Ltd. (the “Company”), dated February 4, 2025, announcing the Company’s unaudited financial results for the fourth quarter and for the year ended December 31, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

FLEX LNG Ltd. (registrant) |

| By: | /s/ Oystein Kalleklev |

| Name: Oystein Kalleklev |

| Title: Chief Executive Officer of Flex LNG Management AS (Principal Executive Officer of FLEX LNG Ltd.) |

Date: February 4, 2025

Interim Financial Information

Flex LNG Ltd.

Fourth Quarter 2024

February 4, 2025

February 4, 2025 - Hamilton, Bermuda

Flex LNG Ltd. ("we", "us", "our", "Flex LNG", or the “Company”) today announced its unaudited financial results for the year ended December 31, 2024.

Highlights:

A summary of our financial highlights for the quarter are below:

| | | | | | | | | | | | | |

| | Q4 2024 | Q3 2024 | | |

| Vessel operating revenues | | $90.9m | $90.5m | | |

| Net income | | $45.2m | $17.4m | | |

| Earnings per share (basic) | | $0.84 | $0.32 | | |

| | | | | |

| Cash and cash equivalents | | $437.2m | $289.5m | | |

| Vessels and equipment, net | | $2,154.5m | $2,171.7m | | |

| Long-term debt | | $(1,810.2)m | $(1,673.1)m | | |

| | | | | |

Non-GAAP Measures 1 | | | | | |

| Time Charter Equivalent rate | | $75,319 | $75,426 | | |

| Adjusted EBITDA | | $68.7m | $70.4m | | |

| Adjusted net income | | $30.8m | $28.7m | | |

| Adjusted earnings per share (basic) | | $0.57 | $0.53 | | |

(1)Time Charter Equivalent rate, Adjusted EBITDA, Adjusted net income/(loss) and Adjusted earnings/(loss) per share are non-GAAP measures. A reconciliation to the most directly comparable GAAP measure is included at the end of this earnings report.

A summary of key events for the quarter:

•In October 2024, the Company closed the sale and leaseback agreement with an Asian-based lease provider for the vessel, Flex Endeavour (the "Flex Endeavour Sale and Leaseback") and received net cash proceeds of $160.0 million. Under the terms of the agreement, the vessel was sold for a consideration of $160.0 million, with a bareboat charter of approximately 9.9 years. The bareboat rate payable under the lease has a fixed element based on a fixed rate of interest and a variable element based on term Secured Overnight Financing Rate ("SOFR") plus a margin. The Company has the option to terminate the lease and repurchase the vessel at fixed price after approximately 8.5 years. Flex Endeavour was unencumbered at the end of Q3 2024, therefore cash proceeds of $160.0 million resulted in an increase in Cash and cash equivalents and Long-term debt in the fourth quarter 2024;

•In November 2024, the Company signed an amendment under the Flex Enterprise $150 Million Facility to convert the non-amortizing term loan tranche of $83.7 million to a non-amortizing revolving credit facility. The Company's revolving credit facility capacity therefore increased to $413.7 million in the fourth quarter 2024;

•In November 2024, the charterer of Flex Courageous and Flex Resolute, agreed to amend and extend by way of addendum to the existing time charters, to include a new firm period from 2029 to 2032 following the

| | | | | |

1 | Flex LNG Ltd. Fourth Quarter Results 2024 |

last two year option under the original time charter contract. The addendum includes additional options for the Charterer to extend each vessel by up to seven years in periods of two years, two years and three years;

•In November 2024, the charterer of Flex Constellation sent notice that they will not utilize their extension option under the time charter. The vessel is expected to be re-delivered from the existing contract late in the first quarter of 2025. Following the re-delivery, the vessel will be marketed for short-term contracts, until the commencement of a new 15 year time charter contract during the first or second quarter of 2026;

•In November 2024, Flex Constellation signed a new time charter contract with a large Asian utility and asset backed LNG trader for a period of 15 years. The time charter contract will commence during the first or second quarter of 2026, and has a firm period ending in 2041, including options for the charterer to extend the vessel by additional two years up to 2043;

•On February 3, 2025, the Company's Board of Directors decided to initiate the process of applying for a voluntarily delisting of the shares on Oslo Stock Exchange. The application to delist from Oslo Stock Exchange will require a resolution from the Annual General Meeting. It is the intention of the Company to recommend such proposal on the agenda for the 2025 Annual General Meeting. For further information, refer to Note 16 - Subsequent Events;

•The Company declared a dividend for the fourth quarter 2024 of $0.75 per share. The dividend is payable on or about March 5, 2025 to shareholders, on record as of February 20, 2025.

| | | | | |

2 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Øystein M Kalleklev, CEO of Flex LNG Management AS, commented:

We are pleased to deliver stellar financial performance for the fourth quarter in line with our previous guidance. Our Time Charter Equivalent rate for the fleet of $75,319/day was slightly ahead of guidance of $73-75,000/day. Adjusted EBITDA was $68.7 million, also in line with guidance of close to $70 million. We recorded substantial profits on our portfolio of interest rate swaps as we increased our interest rate hedging significantly during the interest rate slump at the beginning of September. During the fourth quarter, interest rates rallied, and we therefore booked $20.1 million of gains on these derivatives of which $5.1 million were realized during the quarter. Hence, adjusted net income for the fourth quarter came in at $30.8 million, corresponding to earnings per share and adjusted earnings per share of $0.84 and $0.57 respectively.

During 2024, and in the fourth quarter particularly, we were able to secure new attractive backlog which will insulate us from the current market weakness. In November, we announced extension of the Time Charters for Flex Courageous and Flex Resolute where we added up to 10 years of new charter period for each ship from 2029 onwards, in which the three first years are firm. During the first quarter of 2024, the charterer also extended these time charters by two years each from 2025 to 2027 with a further option to extend these two ships from 2027 to 2029, coinciding with the new charter period from 2029. Furthermore, in December, we announced a new 15-year Time Charter for Flex Constellation from 2026 to 2041 where the charterer has the option to extend the ship up to 2043. Flex LNG is thus very well positioned with 62 years of minimum charter backlog equal to about five years of contract backlog per ship, on average. Furthermore, this backlog may grow to 96 years in the event charterers utilize all their extension options.

In the latter part of 2024, we also carried out some further optimization of our balance sheet with two refinancings worth $430 million enabling us to raise net cash proceeds of $97 million while at the same time both lowering our interest costs and increasing our debt maturity profile. Additionally, we increased our non-amortizing revolving credit facilities from $330 million to $414 million which reduces the cost of having such on-demand credit accessible. As a result, we closed the year with $437 million of cash-at-hand with first debt maturity in 2028.

The short to medium term outlook for LNG shipping is challenging given the numerous ship deliveries ahead of ramped up new export capacity. As such, we think 2024 to 2027 will probably resemble the period 2014 to 2017. There is one key difference, we will likely see a sharp increase in the demolition of older, less efficient tonnage, primarily steam tonnage which will prepare the ground for improved markets, similar to what was experienced in 2017. In any case, Flex LNG utilized the upturn in 2021 to 2023 well to build both a fortress balance sheet and charter backlog and we are well prepared for the current weak market. We are therefore guiding financial performance in 2025 to be in line with what we achieved in 2024.

Our dividend is also steady with the Board once again declaring an ordinary quarterly dividend per share of $0.75. This is our fourteenth ordinary quarterly dividend of $0.75 per share and when adding the special dividends, we will have paid out $610 million of dividends to our shareholders the last 3.5 years.

| | | | | |

3 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Business Update and Fleet Overview

In November 2024, the charterer of Flex Constellation sent notice that they will not utilize their extension option under the time charter agreement. The vessel is expected to be redelivered from the existing contract late in the first quarter of 2025. Following the redelivery, the vessel will be marketed for short-term contracts, until the commencement of a new 15 year time charter contract during the first or second quarter of 2026.

In November 2024, Flex Constellation signed a new time charter contract with a large Asian utility and asset backed LNG trader for a period of 15 years. The time charter contract will commence during the first or second quarter of 2026, and has a firm period ending in 2041, including options for the charterer to extend the vessel by additional two years up to 2043.

In November 2024, the charterer of Flex Courageous and Flex Resolute, agreed to amend and extend by way of addendum to the existing time charter contracts, to include a new firm period from 2029 to 2032 following the last two year option under the original time charter contract. The addendum includes additional options for the Charterer to extend each vessel by up to seven years in periods of two years, two years and three years.

As at the date of this report, the firm contract coverage is 90.0% for the remainder of 2025, and the aggregate firm contract backlog for the fleet is 62 years based on the earliest charter expirations, which could increase to 96 years if our charterers exercise all of the contracted options.

We achieved technical uptime, on our vessels of 99.0% in the fourth quarter 2024 and 99.7% for the year ended December 31, 2024. This excludes offhire days for scheduled drydockings in 2024.

For the remainder of 2025, we have 14.5% exposure to the spot market depending on charterers' exercising the extension options. The 2025 market exposure is related to our market-linked contract for Flex Artemis and the open period in respect of Flex Constellation.

| | | | | |

4 | Flex LNG Ltd. Fourth Quarter Results 2024 |

The following table sets forth an overview of our fleet as of February 4, 2025:

| | | | | | | | | | | | | | | | | | | | | | | |

| Vessel Name | Year Built | Shipyard(1) | Cargo Capacity (cbm) | Propulsion(2) | Boil off rate | Charter expiration(3) | Expiration with Charterer options(4) |

| Flex Endeavour | 2018 | HO | 173,400 | MEGI+PRS | 0.075% | Q1 2032 | Q1 2033 |

| Flex Enterprise | 2018 | HO | 173,400 | MEGI+PRS | 0.075% | Q2 2029 | NA |

| Flex Ranger | 2018 | SHI | 174,000 | MEGI | 0.085% | Q1 2027 | NA |

| Flex Rainbow | 2018 | SHI | 174,000 | MEGI | 0.085% | Q1 2033 | NA |

Flex Constellation(6) | 2019 | HO | 173,400 | MEGI+PRS | 0.075% | Q1 2025 | Q1 2043 |

Flex Courageous(5) | 2019 | HO | 173,400 | MEGI+PRS | 0.075% | Q1 2027 | Q1 2039 |

| Flex Aurora | 2020 | HSHI | 174,000 | X-DF | 0.085% | Q2 2026 | Q2 2028 |

| Flex Amber | 2020 | HSHI | 174,000 | X-DF | 0.085% | Q2 2029 | NA |

| Flex Artemis | 2020 | HO | 173,400 | MEGI+FRS | 0.035% | Q3 2025 | Q3 2030 |

Flex Resolute(5) | 2020 | HO | 173,400 | MEGI+FRS | 0.035% | Q1 2027 | Q1 2039 |

| Flex Freedom | 2021 | HO | 173,400 | MEGI+FRS | 0.035% | Q1 2027 | Q1 2029 |

| Flex Volunteer | 2021 | HSHI | 174,000 | X-DF | 0.085% | Q1 2026 | Q1 2028 |

| Flex Vigilant | 2021 | HSHI | 174,000 | X-DF | 0.085% | Q2 2031 | Q2 2033 |

(1) As used in this report, "HO" means Hanwha Ocean (formerly known as Daewoo Ship building and Marine Engineering Co. Ltd.), "SHI" means Samsung Heavy Industries, and "HSHI" means Hyundai Samho Heavy Industries Co. Ltd. Each is located in South Korea.

(2) "MEGI" refers to M-type Electronically Controlled Gas Injection propulsion systems and "X-DF" refers to Generation X Dual Fuel propulsion systems. "FRS" and "PRS" refers to Full or Partial Re-liquefaction Systems.

(3) The expiration of our charters is considered the firm period known to the Company as of February 4, 2025, however these are generally subject to re-delivery windows ranging from 15 to 45 days before or after the expiration date.

(4) Where charterers have extension option(s) to be declared on a charter; the expiration provided assumes all extension options have been declared by the charterer for illustrative purposes.

(5) The charterer of Flex Courageous and Flex Resolute, amended and extended the time charter contracts, to include a new firm period from Q1 2029 to Q1 2032, following the end of the last two year option period from Q1 2027 to Q1 2029 under the original time charter contracts. The addendum includes additional options for the Charterer to extend each vessel up to Q1 2039.

| | | | | |

5 | Flex LNG Ltd. Fourth Quarter Results 2024 |

(6) In November 2024, Flex Constellation signed a new time charter contract with a large Asian utility and asset backed LNG trader for a period of 15 years. The charter will commence during the first or second quarter of 2026, and has a firm period ending in 2041. The contract includes options for the charterer to extend the vessel by additional two years up to 2043.

Finance update

As of December 31, 2024, the Company had cash and cash equivalents of $437.2 million, which includes an aggregate of $413.7 million of fully drawn revolving tranches under the $270 Million Facility, $290 Million Facility and the Flex Enterprise $150 Million Facility.

As of December 31, 2024, the Company had total long-term debt of $1,810.2 million, with the current portion of $106.7 million and non-current portion of $1,703.5 million.

In October 2024, the Company closed the sale and leaseback agreement with an Asian-based lease provider for the vessel, Flex Endeavour (the "Flex Endeavour Sale and Leaseback") and received net cash proceeds of $160.0 million. Under the terms of the agreement, the vessel was sold for a consideration of $160.0 million, with a bareboat charter of approximately 9.9 years. The bareboat rate payable under the lease has a fixed element based on a fixed rate of interest and a variable element based on term SOFR plus a margin. The Company has the option to terminate the lease and repurchase the vessel at fixed price after approximately 8.5 years. Flex Endeavour was unencumbered at the end of Q3 2024, therefore cash proceeds of $160.0 million resulted in an increase in Cash and cash equivalents and Long-term debt in the fourth quarter 2024.

In November 2024, the Company signed an amendment under the Flex Enterprise $150 Million Facility to convert the non-amortizing term loan tranche of $83.7 million to a non-amortizing revolving credit facility. The Company's revolving credit facility capacity therefore increased to $413.7 million in the fourth quarter 2024.

In order to reduce the risks associated with fluctuations in interest rates, the Company has entered into interest rate swap transactions, whereby floating rate has been swapped to a fixed rate of interest. As of December 31, 2024, the Company has fixed interest rates on an aggregate notional principal amount of $635.0 million. The interest rate swaps have a fixed rate of interest based on SOFR with a weighted average fixed interest rate of 1.96% and a weighted average duration of 3.8 years.

| | | | | |

6 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Results for the three months ended December 31, 2024 and September 30, 2024

The Company recorded vessel operating revenues of $90.9 million for the fourth quarter 2024, compared to $90.5 million in the third quarter 2024. The increase in revenue is due to the amendment and extension of the original time charter contracts for Flex Resolute and Flex Courageous in November 2024. In addition, the Company recorded revenue of $1.4 million related to European Union Allowances (EUAs) in the fourth quarter 2024. These EUAs are receivable from our Charterers under the time charter contracts for voyages subject to the European Union's Emissions Trading System (EU ETS), which became applicable to the maritime industry in 2024. An equivalent amount has been recorded under Voyage expenses for the period. This has been offset by the decrease in spot market rates, which affected the variable rate contract for Flex Artemis, and repair and maintenance work, which resulted in 12.5 offhire days in the fourth quarter.

Voyage expenses, which include voyage specific expenses, broker commissions, EUAs and bunker consumption, were $1.8 million in the fourth quarter 2024, compared to $0.3 million in the third quarter 2024, The increase in voyage expenses is due to the accrual of $1.4 million in relation to the obligation to settle EUAs under the EU ETS.

Vessel operating expenses were $17.6 million in the fourth quarter 2024, compared to $17.8 million in the third quarter 2024.

Administrative expenses were $2.7 million in the fourth quarter 2024, compared to $1.9 million in the third quarter 2024.

Depreciation was $19.0 million in the fourth quarter 2024, compared to $19.0 million in the third quarter 2024.

Interest income was $1.5 million in the fourth quarter 2024, compared to $0.9 million in the third quarter 2024.

Interest expense was $25.5 million in the fourth quarter 2024, compared to $26.3 million in the third quarter 2024.

Extinguishment costs of long-term debt were $nil in the fourth quarter 2024, compared to $0.6 million in the third quarter 2024.

The Company recorded a gain on derivatives of $20.1 million in the fourth quarter 2024, which includes an unrealized gain of $15.0 million, as a result of the change in fair value of our interest rate swap derivatives and a net realized gain of $5.1 million on interest rate swap settlements in the period. This compares to a net loss on derivatives for the third quarter 2024 of $8.0 million, which included a net unrealized loss of $10.5 million and a net realized gain of $2.5 million.

| | | | | |

7 | Flex LNG Ltd. Fourth Quarter Results 2024 |

The Company recorded a foreign exchange loss of $0.5 million in the fourth quarter 2024, compared to a $0.1 million gain in the third quarter 2024.

The Company recorded other financial items expense of $0.2 million in the fourth quarter 2024, compared to an expense of $0.1 million in the third quarter 2024.

Net income for the fourth quarter 2024 was $45.2 million and basic earnings per share were $0.84, compared to a net income of $17.4 million and basic earnings per share of $0.32 for the third quarter 2024.

Adjusted EBITDA1 was $68.7 million for the fourth quarter 2024, compared to $70.4 million for the third quarter 2024.

Adjusted net income1 for the fourth quarter 2024 was $30.8 million and adjusted earnings per share of $0.57, compared to an adjusted net income of $28.7 million and adjusted earnings per share of $0.53 for the third quarter 2024.

The time charter equivalent rate1 for the fourth quarter 2024 was $75,319 per day compared to $75,426 per day for the third quarter 2024.

Results for the year ended December 31, 2024 and December 31, 2023

Vessel operating revenues were $356.3 million for the year ended December 31, 2024 compared to $371.0 million for the year ended December 31, 2023. The decrease in vessel operating revenues is primarily due to the decline in the spot market affecting one vessel on a variable rate contract, Flex Artemis. In addition to this, the declaration of extension options for the vessels Flex Resolute and Flex Courageous under the original time charter contracts in early 2024 resulted in a decrease in revenue for the year ended 2024. However, the amendment to the time charter contracts for both of these vessels in November 2024 resulted in a positive revenue effect for the fourth quarter 2024. These effects are offset by the completion of two drydocks in 2024 for the vessels Flex Constellation and Flex Courageous, compared to a total of four drydocks in 2023, thus resulting in lower offhire days for the period.

Voyage expenses, which include voyage specific expenses, broker commissions, EUAs and bunker consumption, were $3.4 million for the year ended December 31, 2024 compared to $1.7 million for the year ended December 31, 2023.

Vessel operating expenses were $69.9 million for the year ended December 31, 2024, compared to $68.4 million for the year ended December 31, 2023. The increase in vessel operating expenses is a result of some of the vessels

1 Time Charter Equivalent rate, Adjusted EBITDA, Adjusted net income/(loss) and Adjusted earnings/(loss) per share are non-GAAP measures. A reconciliation to the most directly comparable GAAP measure is included in the end of this earnings report.

| | | | | |

8 | Flex LNG Ltd. Fourth Quarter Results 2024 |

reaching running hour milestones resulting in additional cost in relation to routine main engine and auxiliary engine maintenance.

Administrative expenses were $9.8 million for the year ended December 31, 2024 compared to $10.5 million for the year ended December 31, 2023. The decrease in administrative expenses is principally due to a decrease in performance related bonuses in 2024 when compared to 2023.

Depreciation for the year ended December 31, 2024 amounted to $75.5 million compared to $73.4 million for the year ended December 31, 2023. The increase in depreciation is as a result of six drydocks completed between 2023 and 2024, which were capitalized at a higher cost than the initial drydock component capitalized upon the delivery of each vessel from the shipyard.

Interest income was $4.5 million in the year ended December 31, 2024, compared to $4.9 million in the year ended December 31, 2023.

Interest expense was $105.6 million in the year ended December 31, 2024, compared to $108.7 million in the year ended December 31, 2023.

Extinguishment costs of long-term debt were $0.6 million in the year ended December 31, 2024, compared to $10.2 million in the year ended December 31, 2023. In 2023, the Company recorded a write-off of unamortized debt issuance costs of $8.8 million and direct exit costs of $1.4 million in relation to the extinguishment of the $629 Million Facility and the Flex Amber Sale and Leaseback as part of the Company's refinancing under the balance sheet optimization programme.

The Company recorded a gain on derivatives of $22.8 million in the year ended December 31, 2024, which includes a net unrealized gain on derivatives of $1.8 million and a net realized gain of $21.0 million. This compares to a net gain on derivatives of $18.3 million in the year ended December 31, 2023, which includes a net unrealized loss of $6.7 million and a net realized gain of $25.0 million. The unrealized gain or loss on derivatives is primarily derived from the movements in the fair value of the interest rate swaps which will fluctuate based on changes in the total notional amount and the movement in the long-term floating rate of interest during the period. The realized gain/(loss) on derivative settlements will be affected by changes in the shorter term floating rate of interest compared to the respective agreements' fixed rate of interest.

The Company recorded a foreign exchange loss of $0.7 million in the year ended December 31, 2024, compared to a loss of $0.4 million in the year ended December 31, 2023.

| | | | | |

9 | Flex LNG Ltd. Fourth Quarter Results 2024 |

The Company recorded other financial items expense of $0.4 million in the year ended December 31, 2024, compared to an expense of $0.9 million in the year ended December 31, 2023.

The Company reported a net income of $117.7 million and basic earnings per share of $2.19 for the year ended December 31, 2024, compared to a net income of $120.0 million and basic earnings per share of $2.24 for the year ended December 31, 2023.

Adjusted EBITDA2 for the year ended December 31, 2024, was $272.9 million compared to $289.6 million for the year ended December 31, 2023.

Adjusted net income2 for the year ended December 31, 2024, was $127.7 million and basic adjusted earnings per share of $2.37, compared to an adjusted net income of $137.3 million and basic adjusted earnings per share of $2.56 for the year ended December 31, 2023.

The time charter equivalent rate2 for the year ended December 31, 2024, was $74,927 per day compared to $79,461 per day for the year ended December 31, 2023.

Cash Flow for the three months ended December 31, 2024 and September 30, 2024

Total cash, cash equivalents and restricted cash was $437.2 million as at December 31, 2024, compared to $289.6 million as at September 30, 2024.

Net cash provided by operating activities in the fourth quarter 2024 was $52.3 million, compared to $48.2 million in the third quarter 2024. In the fourth quarter 2024, net income, after adjusting for non-cash items, was $50.4 million compared to $49.0 million in the third quarter 2024. Expenditure in relation to upcoming 2025 drydockings was $1.7 million for the fourth quarter 2024, compared to $0.8 million for the third quarter 2024. The Company had positive working capital adjustments of $3.6 million for the fourth quarter 2024, compared to positive working capital adjustments of $0.6 million in the third quarter 2024.

Net cash used in investing activities was $nil in the fourth quarter 2024 and $0.0 million in the third quarter 2024.

Net cash provided by financing activities was $95.8 million in the fourth quarter 2024, compared to $129.0 million used in financing activities in the third quarter 2024.

2 Time Charter Equivalent rate, Adjusted EBITDA, Adjusted net income/(loss) and Adjusted earnings/(loss) per share are non-GAAP measures. A reconciliation to the most directly comparable GAAP measure is included in the end of this earnings report.

| | | | | |

10 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Balance Sheet as at December 31, 2024

In the year ended December 31, 2024, the net book value of vessels and equipment was $2,154.5 million compared to $2,217.3 million as at December 31, 2023. The movement is explained by depreciation of $75.5 million and drydocking additions of $12.6 million, of which $2.2 million relates long lead items for planned five-year special surveys in 2025.

As at December 31, 2024, total long-term debt was $1,810.2 million, compared to $1,812.1 million as at December 31, 2023, of which the current portion of long-term debt was $106.7 million and $103.9 million respectively.

In the year ended December 31, 2024, the following material factors resulted in an increase in the Company's long-term debt:

•Closing proceeds of $160.0 million from the Flex Endeavour Sale and Leaseback;

•Drawdown of $270.0 million under the term and revolving tranches of the $270 Million Facility; and

•Regular amortization of debt issuance costs of $2.5 million.

Whereas, the following material factors resulted in a decrease in the Company's long-term debt:

•Regular repayment of debt of $102.4 million;

•Prepayment of $80.8 million and $250.0 million, which was the full amount outstanding under the term and revolving credit facility under the $375 Million Facility; and

•Financing costs of $1.4 million and $1.5 million in relation to the refinancing of the $270 Million Facility and the $160 Million Flex Endeavour Sale and Leaseback respectively.

As at December 31, 2024, total equity was $806.6 million compared to $847.7 million as at December 31, 2023. This decrease in equity consists of distributions paid of $161.7 million, offset by net income of $117.7 million and $3.0 million relating to share-based compensation and distributed treasury shares for year ended December 31, 2024.

| | | | | |

11 | Flex LNG Ltd. Fourth Quarter Results 2024 |

LNG Market Update

The year 2024 concluded with high gas prices, driven by robust European gas consumption during the last quarter of 2024 that pushed the TTF to $14.5/MMBtu, a 27% year-over-year increase. This significant price increase was fuelled by periods of low renewable energy production in Europe and heightened geopolitical uncertainty from Ukraine's fulfillment of its promise to halt the transit of Russian gas through its territory, as the transit agreement expired on January 1, 2025. Asian spot prices mirrored the TTF's upward trajectory, albeit at a slight discount and thereby eliminating any arbitrage opportunities, ending 2024 at $14.1/MMBtu (vs. $11.9/MMBtu at YE2023). Q4-2024 was also a period with increased nuclear power availability in South Korea and Japan and relatively mild weather in North-East Asia. With JKM prices above $14/MMBtu equal to oil price on energy equivalent basis of ~$80boe, several price-sensitive emerging economies begin shifting to more affordable energy alternatives, notably coal.

Driven by relatively low LNG prices in the first half of 2024, Asia's LNG imports grew by 7% year-over-year, reaching 292 million tonnes (MT) for the full-year of 2024, up from 274 MT in 2023. China led this expansion, increasing imports by 6% to 78.5 MT in 2024, just ~2 MT below the record year of 2021. The mature JKT markets – Japan, South Korea, and Taiwan – collectively grew their LNG imports by 3% to a total of 139 MT. Among them, South Korea's imports rose by 3.5% to 47.7 MT, while Taiwan saw the highest growth at 8.3%, reaching 22.4 MT. India also saw robust demand, with LNG imports surging 14% to 26.5 MT. In contrast, Europe scaled back its LNG imports in 2024 following flat growth between 2022 and 2023. European LNG imports declined by 18%, from 125.4 MT in 2023 to 103.1 MT in 2024. The sharpest reductions occurred in the UK, where imports halved from 14.8 MT to 7.4 MT, and in Spain, which imported 4.1 MT less than the previous year. This decline was driven by increased pipeline gas exports from Norway and demand-side shifts, including the gradual deindustrialization of energy-intensive industries.

Despite achieving its 90% storage capacity target by the end of August – well ahead of the EU’s November 1st deadline – European gas storage levels have since dropped significantly, marking the fastest depletion rate since 2021. The rapid drawdown has been driven by diminished wind power output, low winter temperatures, and Ukraine’s suspension of Russian pipeline gas flows to Europe. As of early February, European storage levels stand at approx. 53%, down from ~70% at the same time last year.

According to data from Kpler, global LNG exports grew marginally in 2024, rising just 0.2% to 414 MT—the slowest growth ever recorded. The US increased its LNG exports by 1.2% (+1.1 MT), reaching 87.2 MT. Combined, the US, Australia, and Qatar accounted for 248 MT, or 60% of total global exports, reflecting a modest year-over-year increase of 1.6 MT. Other notable supply-side trends included Russia (+3.9% to 33.6 MT), Malaysia (+3.8% to 28.0 MT), and Nigeria (+8.6% to 14.6 MT). Russia increased utilization at the Yamal LNG facility and commissioned its Arctic LNG 2 project; however, output at the latter was curtailed in Q4 due to a limited buyer pool amid Western sanctions. Malaysia’s Petronas increased exports from its Bintulu LNG plant by 1.4 MT, while LNG loadings from

| | | | | |

12 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Nigeria’s Bonny LNG terminal rose by 1.2 MT. Altogether, these three countries – Russia, Malaysia, Nigeria – contributed 3.5 MT of additional LNG supply in 2024. However, these gains were largely offset by sharp declines by Egypt, who for the first time since 2018, became a net importer. Exports from Egypt dropped from 3.4 MT in 2023 to just 0.5 MT in 2024 due to rising domestic demand and falling production from the Zohr gas field.

The US LNG industry achieved significant milestones in December 2024 with two new export facilities commencing production, the first since March 2022. Venture Global’s Plaquemines LNG plant in Louisiana began production on December 14, followed by its first shipment to Germany on December 26. Shortly thereafter, Cheniere’s Corpus Christi Liquefaction Stage 3 (CCL Stage 3) in Texas produced its first LNG on December 30. Plaquemines LNG, poised to become one of the world’s largest facilities with a total capacity of 20 MTPA, began operations just 30 months after its FID, marking a rapid timeline. Its capacity is expected to be fully online by mid-2027. Meanwhile, CCL Stage 3, an expansion of Cheniere’s existing Corpus Christi terminal, will gradually bring its seven midscale trains online, contributing 10.4 MTPA by the end of 2026.

The newly inaugurated U.S. President Trump issued an executive order directing the resumption of export permit processing for new LNG projects. This decision reverses the pause on permit approvals imposed by former President Biden a year earlier and it’s expected to provide significant momentum to new FIDs. Notable projects that could benefit include Louisiana LNG (formerly Driftwood LNG, 27.6 MTPA), CP2 (20 MTPA), Lake Charles (16.5 MTPA), Rio Grande T1-3 (11.7 MTPA), and Delfin FLNG (13.3 MTPA). In total, at least 100 MTPA of new projects or expansions are set to gain from this policy shift.

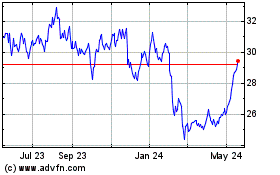

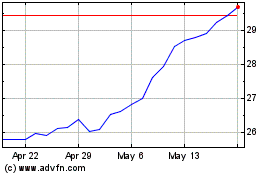

Spot dayrates for modern two-stroke vessels averaged ~$30,000/day in the fourth quarter of 2024 vs. $170,000/day in Q4-2023, according to Spark. We have experienced the weakest spot market on record during the winter market of 2024/25, according to Clarksons SIN, with no sign of the traditional seasonal demand surge typically observed entering the winter period. For the full year of 2024, the spot rates averaged $52,000/day, compared to $117,000/day in FY2023. This decline is attributed to a mismatch between the flurry of LNGC newbuildings delivered from the yards and muted new LNG volume supply. Looking ahead, no significant market rebalancing in favour of shipowners is expected, as the oversupply of new tonnage is anticipated to persist over the next 24 months. Shipbrokers are currently quoting spot rates at less than $10,000/day for modern tonnage.

The soft market sentiment continues to impact short-term term rates, exerting pressure on one-year and three-year TC rates. According to shipbrokers, current one-year TC rates are quoted at approximately $30–$35,000/day, while three-year TC rates at $45,000/day. These levels highlight significant vessel availability in the 2025–2027 period. In contrast, longer-term rates have shown greater resilience. For contracts of five years or more, rates are quoted at $85–$90,000/day, supported by stable newbuild prices, currently quoted at around $255 million.

| | | | | |

13 | Flex LNG Ltd. Fourth Quarter Results 2024 |

With 2024 now behind us, the total number of signed newbuilding orders reached 79. These include 49 orders for the “industry standard” 174,000 cbm vessels, four for 175,000 cbm, one for 180,000 cbm, one for 200,000 cbm (an FSRU), and 24 orders for QatarEnergy’s 271,000 cbm vessels. The 79 shipbuilding contracts signed in 2024 compares to 72 in 2023, 176 in 2022, and 86 in 2021. QatarEnergy has completed its major LNG shipbuilding program, which includes 128 vessels – 104 conventional 174,000 cbm sized and 24 QC-MAX vessels of 271,000 cbm sized – by finalizing a charter agreement with MOL and COSCO Shipping. A joint venture, with MOL and COSCO Shipping each owning a 50% share, will manage the six QC-Max LNG carriers ordered in September 2024.

The Red Sea regained attention following the announcement of an Israel-Hamas ceasefire agreement and the Houthis' declaration of safe passage for non-Israeli ships. Although the Houthis have stated that they will halt attacks, many shipping firms remain cautious about resuming operations in the region. The long-term viability of safe passage depends on a sustained ceasefire, and rushing back prematurely could lead to further disruptions in schedules and trade routes, given the region's persistent instability. If Phase 2 of the Israel-Hamas agreement progresses successfully later this year, it could serve as a catalyst for increased Red Sea transits and lower ton-miles. However, the reopening of the Suez Canal route primarily benefits Qatari cargo flows to Europe. The U.S. LNG cargoes traveling via the Panama Canal to Asia would continue the same sailing distance, effectively double the sailing distance compared to exports to Europe. As a result, the reopening of Suez will likely have limited impact on the overall LNG shipping demand.

| | | | | |

14 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Fourth Quarter 2024 Result Presentation

Flex LNG will release its financial results for the fourth quarter 2024 on Tuesday February 4, 2025.

In connection with the earnings release, we will host a video webcast at 3:00 p.m. CET (9:00 a.m. EST). In order to attend the webcast use the following link:

https://events.webcast.no/flexlng/IqCHF6PFRyOkoOhpdu6c/PMSD499mqOAthrQTOvYK

A Q&A session will be held after the conference/webcast. Information on how to submit questions will be given at the beginning of the session.

The presentation material which will be used in the conference/webcast can be downloaded on www.flexlng.com and replay details will also be available at this website. None of the information contained on the Company's website is incorporated into or forms a part of this report.

| | | | | |

15 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Forward-Looking Statements

Matters discussed in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. The words "believe," "expect," "forecast," "anticipate," "estimate," "intend," "plan," "possible," "potential," "pending," "target," "project," "likely," "may," "will," "would," "should," "could" and similar expressions identify forward-looking statements.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although management believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond the Company’s control, there can be no assurance that the Company will achieve or accomplish these expectations, beliefs or projections. As such, these forward-looking statements are not guarantees of the Company’s future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements. The Company undertakes no obligation, and specifically declines any obligation, except as required by applicable law or regulation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for the Company to predict all of these factors. Further, the Company cannot assess the effect of each such factor on its business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

In addition to these important factors, other important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward-looking statements include: unforeseen liabilities, future capital expenditures, the strength of world economies and currencies, inflationary pressures and central bank policies intended to combat overall inflation and rising interest rates and foreign exchange rates, general market conditions, including fluctuations in charter rates and vessel values, changes in demand in the LNG tanker market, the impact of public health threats, changes in the Company’s operating expenses, including bunker prices, drydocking and insurance costs, the fuel efficiency of the Company’s vessels, the market for the Company’s vessels, availability of financing and refinancing, ability to comply with covenants in such financing arrangements, failure of counterparties to fully perform their contracts with the Company, changes in governmental rules and regulations or actions taken by regulatory authorities, including those that may limit the commercial useful lives of LNG tankers, customers' increasing emphasis on environmental and safety concerns, potential liability from pending

| | | | | |

16 | Flex LNG Ltd. Fourth Quarter Results 2024 |

or future litigation, global and regional economic and political conditions or developments, armed conflicts, including the war between Russia and Ukraine, as well as the developments in the Middle East, including continued conflicts between Israel and Hamas and the conflict regarding the Houthi attack in the Red Sea, trade wars, tariffs, embargoes and strikes, the impact of the U.S. presidential and congressional election results affecting the economic, future government laws and regulations and trade policy matters, such as the imposition of tariffs and other import restrictions, business disruptions, including supply chain disruption and congestion, due to natural or other disasters or otherwise, potential physical disruption of shipping routes due to accidents, climate-related incidents, or political events, vessel breakdowns and instances of off-hire, and other factors, including those that may be described from time to time in the reports and other documents that the Company files with or furnishes to the U.S. Securities and Exchange Commission (“Other Reports”). For a more complete discussion of certain of these and other risks and uncertainties associated with the Company, please refer to the Other Reports.

| | | | | |

17 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Board of Directors of Flex LNG Ltd.

February 4, 2025

| | | | | |

| Ola Lorentzon |

| Chairman of the Board of Directors |

| | |

| Nikolai Grigoriev |

| Director |

| | | | | |

18 | Flex LNG Ltd. Fourth Quarter Results 2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

Unaudited Interim Financial Information

Condensed Consolidated Interim Statements of Operations | | | |

| (figures in thousands of $, except per share data) | | | | |

| | Three months ended | | Year ended |

| | December 31, | September 30, | December 31, | | December 31, | December 31, |

| | Note | 2024 | 2024 | 2023 | | 2024 | 2023 |

| Vessel operating revenues | | 90,934 | | 90,483 | | 97,234 | | | 356,349 | | 371,022 | |

| Voyage expenses | | (1,793) | | (273) | | (222) | | | (3,368) | | (1,678) | |

| Vessel operating expenses | | (17,597) | | (17,836) | | (18,421) | | | (69,918) | | (68,357) | |

| Administrative expenses | | (2,651) | | (1,876) | | (2,110) | | | (9,788) | | (10,467) | |

| Depreciation | 7 | (19,015) | | (19,012) | | (18,757) | | | (75,482) | | (73,363) | |

| Operating income | | 49,878 | | 51,486 | | 57,724 | | | 197,793 | | 217,157 | |

| Interest income | | 1,471 | | 937 | | 950 | | | 4,467 | | 4,868 | |

| Interest expense | | (25,467) | | (26,315) | | (27,655) | | | (105,588) | | (108,724) | |

Extinguishment costs of long-term debt | | — | | (637) | | — | | | (637) | | (10,238) | |

(Loss)/gain on derivatives | 10 | 20,089 | | (8,032) | | (11,622) | | | 22,838 | | 18,281 | |

| Foreign exchange (loss)/gain | | (486) | | 84 | | 255 | | | (665) | | (350) | |

| Other financial items | | (206) | | (97) | | (257) | | | (392) | | (877) | |

| Income before tax | | 45,279 | | 17,426 | | 19,395 | | | 117,816 | | 120,117 | |

| Income tax expense | | (62) | | (18) | | (4) | | | (132) | | (78) | |

| Net income | | 45,217 | | 17,408 | | 19,391 | | | 117,684 | | 120,039 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | 3 | 0.84 | | 0.32 | | 0.36 | | | 2.19 | | 2.24 | |

| Diluted | 3 | 0.84 | | 0.32 | | 0.36 | | | 2.18 | | 2.22 | |

| | | | | | | |

| | | | | | | |

Unaudited Interim Financial Information

Condensed Consolidated Statements of Comprehensive Income |

| (figures in thousands of $) | | | | |

| | | | | | | |

| | Three months ended | | Year ended |

| | December 31, | September 30, | December 31, | | December 31, | December 31, |

| | | 2024 | 2024 | 2023 | | 2024 | 2023 |

Net income for the period | | 45,217 | | 17,408 | | 19,391 | | | 117,684 | | 120,039 | |

| Total other comprehensive income/(loss) | | — | | — | | — | | | — | | — | |

| Total comprehensive income | | 45,217 | | 17,408 | | 19,391 | | | 117,684 | | 120,039 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| | | | | |

19 | Flex LNG Ltd. Fourth Quarter Results 2024 |

| | | | | | | | | | | | | | | | | |

Unaudited Interim Financial Information

Condensed Consolidated Interim Balance Sheets | | |

| (figures in thousands of $, except per share data) | | |

| | December 31, | September 30, | | December 31, |

| Note | 2024 | 2024 | | 2023 |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | 4 | 437,154 | | 289,519 | | | 410,425 | |

| Restricted cash | 4 | 49 | | 54 | | | 119 | |

| Inventory | | 4,824 | | 4,968 | | | 5,091 | |

| Other current assets | 5 | 31,666 | | 37,192 | | | 26,640 | |

| Receivables due from related parties | 12 | 686 | | 757 | | | 786 | |

| | | | | |

| Total current assets | | 474,379 | | 332,490 | | | 443,061 | |

| | | | | |

| Non-current assets | | | | | |

| Derivative instruments | 10 | 40,090 | | 25,514 | | | 48,829 | |

| | | | | |

| | | | | |

| Vessels and equipment, net | 7 | 2,154,465 | | 2,171,735 | | | 2,217,301 | |

| Other fixed assets | | 5 | | 5 | | | 2 | |

| Total non-current assets | | 2,194,560 | | 2,197,254 | | | 2,266,132 | |

| Total Assets | | 2,668,939 | | 2,529,744 | | | 2,709,193 | |

| | | | | |

| EQUITY AND LIABILITIES | | | | | |

| Current liabilities | | | | | |

| Current portion of long-term debt | 8,9 | 106,708 | | 95,361 | | | 103,870 | |

| Derivative instruments | 10 | — | | 375 | | | — | |

| Payables due to related parties | 12 | 523 | | 369 | | | 384 | |

| Accounts payable | | 2,002 | | 2,381 | | | 3,508 | |

| Other current liabilities | 6 | 49,544 | | 51,639 | | | 45,505 | |

| Total current liabilities | | 158,777 | | 150,124 | | | 153,267 | |

| | | | | |

| Non-current liabilities | | | | | |

| Long-term debt | 8,9 | 1,703,529 | | 1,577,692 | | | 1,708,273 | |

| | | | | |

| Total non-current liabilities | | 1,703,529 | | 1,577,692 | | | 1,708,273 | |

| Total Liabilities | | 1,862,306 | | 1,727,816 | | | 1,861,540 | |

| | | | | |

| Equity | | | | | |

| Share capital (December 31, 2024: 54,520,325 shares issued, par value $0.01 per share (September 30, 2024, par value $0.01 per share and December 31, 2023: 54,520,325 shares issued, par value $0.10 per share)) | 13 | 545 | | 545 | | | 5,452 | |

| Treasury shares at cost (December 31, 2024: 432,557 (September 30, 2024: 432,557 and December 31, 2023: 784,007)) | 14 | (4,224) | | (4,224) | | | (7,560) | |

| Additional paid in capital | 13 | 904,268 | | 904,214 | | | 1,204,634 | |

Contributed Surplus | 13 | 183,535 | | 224,101 | | | — | |

| | | | | |

| | | | | |

| Accumulated deficit | | (277,491) | | (322,708) | | | (354,873) | |

| Total equity | | 806,633 | | 801,928 | | | 847,653 | |

| Total Equity and Liabilities | | 2,668,939 | | 2,529,744 | | | 2,709,193 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| | | | | |

20 | Flex LNG Ltd. Fourth Quarter Results 2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

Unaudited Interim Financial Information

Condensed Consolidated Interim Statements of Cash Flows | | | | |

| (figures in thousands of $) | | | | |

| | Three months ended | | Year ended |

| | December 31, | September 30, | December 31, | | December 31, | December 31, |

| Note | 2024 | 2024 | 2023 | | 2024 | 2023 |

| | | | | | | |

| OPERATING ACTIVITIES | | | | | | | |

| Net income | | 45,217 | | 17,408 | | 19,391 | | | 117,684 | | 120,039 | |

Adjustments to reconcile net income to net cash provided by operating activities | | | | | | | |

| Depreciation | 7 | 19,015 | | 19,012 | | 18,757 | | | 75,482 | | 73,363 | |

Extinguishment costs of long-term debt | | — | | 637 | | — | | | 637 | | 10,238 | |

| Amortization of debt issuance costs | | 613 | | 666 | | 617 | | | 2,503 | | 2,490 | |

| Share-based payments | 15 | 54 | | 288 | | 363 | | | 1,063 | | 1,749 | |

| Foreign exchange (gain)/loss | | 486 | | (84) | | (255) | | | 800 | | 350 | |

| Change in fair value of derivative instruments | 10 | (14,951) | | 10,497 | | 18,673 | | | (1,838) | | 6,686 | |

| | | | | | | |

| | | | | | | |

| Drydocking expenditure | 7 | (1,745) | | (797) | | (185) | | | (12,645) | | (20,714) | |

| Other | | 2 | | (27) | | — | | | (223) | | (3) | |

| Changes in operating assets and liabilities, net: | | | | | | | |

| Inventory | | 144 | | (17) | | 67 | | | 267 | | 169 | |

| Other current assets | 5 | 5,698 | | 3,447 | | 2,033 | | | (3,702) | | (10,313) | |

| Receivables due from related parties | 12 | 71 | | (201) | | (131) | | | 100 | | (726) | |

| Payables due to related parties | 12 | 154 | | (102) | | 26 | | | 139 | | 56 | |

| Accounts payable | | (379) | | (377) | | (21) | | | (1,506) | | 1,714 | |

| Other current liabilities | 6 | (2,095) | | (2,185) | | (5,075) | | | 4,038 | | (10,064) | |

| Net cash provided by operating activities | | 52,284 | | 48,164 | | 54,260 | | | 182,799 | | 175,034 | |

| | | | | | | |

| INVESTING ACTIVITIES | | | | | | | |

| Purchase of other fixed assets | | — | | (4) | | — | | | (4) | | (2) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash used in investing activities | | — | | (4) | | — | | | (4) | | (2) | |

| | | | | | | |

| FINANCING ACTIVITIES | | | | | | | |

| | | | | | | |

| Repayment of long-term debt | 9 | (22,914) | | (26,565) | | (26,437) | | | (102,440) | | (110,827) | |

| Proceeds from revolving credit facilities | 9 | 383,675 | | 85,000 | | 400,000 | | | 1,268,675 | | 1,756,667 | |

| Repayment of revolving credit facilities | 9 | (383,675) | | (335,000) | | (400,000) | | | (1,518,675) | | (1,606,667) | |

| Prepayment of long-term debt | 9 | — | | (80,769) | | — | | | (80,769) | | (595,344) | |

| Proceeds from long-term debt | 9 | 160,000 | | 270,000 | | — | | | 430,000 | | 650,000 | |

| Extinguishment costs paid on long-term debt | 9 | — | | — | | — | | | — | | (1,433) | |

| Proceeds from termination of derivative instruments | 10 | (408) | | 222 | | — | | | 10,169 | | — | |

| Financing costs | | (279) | | (2,510) | | (16) | | | (2,801) | | (7,712) | |

| | | | | | | |

| Proceeds from distribution of treasury shares | 15 | — | | 1,025 | | — | | | 1,909 | | — | |

| Dividends paid | 3 | (40,566) | | (40,403) | | (47,019) | | | (161,674) | | (181,225) | |

Net cash provided by/ (used in) financing activities | | 95,833 | | (129,000) | | (73,472) | | | (155,606) | | (96,541) | |

| | | | | | | |

| | | | | |

21 | Flex LNG Ltd. Fourth Quarter Results 2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

Unaudited Interim Financial Information

Condensed Consolidated Interim Statements of Cash Flows | | | | |

| (figures in thousands of $) | | | | |

| | Three months ended | | Year ended |

| | December 31, | September 30, | December 31, | | December 31, | December 31, |

| Note | 2024 | 2024 | 2023 | | 2024 | 2023 |

| Effect of exchange rate changes on cash | | (487) | | 156 | | 255 | | | (531) | | (348) | |

| Net increase/(decrease) in cash, cash equivalents and restricted cash | | 147,630 | | (80,684) | | (18,957) | | | 26,658 | | 78,143 | |

| | | | | | | |

| Cash, cash equivalents and restricted cash at the beginning of the period | 4 | 289,573 | | 370,255 | | 429,501 | | | 410,544 | | 332,401 | |

| Cash, cash equivalents and restricted cash at the end of the period | 4 | 437,203 | | 289,573 | | 410,544 | | | 437,203 | | 410,544 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| | | | | |

22 | Flex LNG Ltd. Fourth Quarter Results 2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

Unaudited Interim Financial Information

Condensed Consolidated Interim Statement of Changes in Equity | | |

| (figures in thousands of $, except per share data) | | |

For the year ended December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Shares Outstanding | | Share Capital | Treasury Shares | Additional Paid in Capital | Contributed Surplus | Accumulated Deficit | | Total Equity |

| | | | | | | | | | |

| At January 1, 2024 | | 53,736,318 | | | 5,452 | | (7,560) | | 1,204,634 | | — | | (354,873) | | | 847,653 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Share-based payments | | — | | | — | | — | | 358 | | — | | — | | | 358 | |

| Net income | | — | | | — | | — | | — | | — | | 33,224 | | | 33,224 | |

Dividends paid | | — | | | — | | — | | — | | — | | (40,302) | | | (40,302) | |

| At March 31, 2024 | | 53,736,318 | | | 5,452 | | (7,560) | | 1,204,992 | | — | | (361,951) | | | 840,933 | |

| | | | | | | | | | |

| | | | | | | | | | |

Transfer arising from change in par value of shares | | — | | | (4,907) | | — | | — | | 4,907 | | — | | | — | |

Transfer to contributed surplus | | — | | | — | | — | | (300,000) | | 300,000 | | — | | | — | |

| Distributed treasury shares | | 134,514 | | | — | | 1,297 | | (413) | | — | | — | | | 884 | |

| Share-based payments | | — | | | — | | — | | 363 | | — | | — | | | 363 | |

| Net income | | — | | | — | | — | | — | | — | | 21,835 | | | 21,835 | |

| Dividends paid | | — | | | — | | — | | — | | (40,403) | | — | | | (40,403) | |

At June 30, 2024 | | 53,870,832 | | | 545 | | (6,263) | | 904,942 | | 264,504 | | (340,116) | | | 823,612 | |

| Distributed treasury shares | | 216,936 | | | — | | 2,039 | | (1,015) | | — | | — | | | 1,024 | |

| Share-based payments | | — | | | — | | — | | 287 | | — | | — | | | 287 | |

| Net income | | — | | | — | | — | | — | | — | | 17,408 | | | 17,408 | |

| Dividends paid | | — | | | — | | — | | — | | (40,403) | | — | | | (40,403) | |

| At September 30, 2024 | | 54,087,768 | | | 545 | | (4,224) | | 904,214 | | 224,101 | | (322,708) | | | 801,928 | |

| | | | | | | | | | |

| Share-based payments | | — | | | — | | — | | 54 | | — | | — | | | 54 | |

| Net income | | — | | | — | | — | | — | | — | | 45,217 | | | 45,217 | |

| Dividends paid | | — | | | — | | — | | — | | (40,566) | | — | | | (40,566) | |

| At December 31, 2024 | | 54,087,768 | | | 545 | | (4,224) | | 904,268 | | 183,535 | | (277,491) | | | 806,633 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| | | | | |

23 | Flex LNG Ltd. Fourth Quarter Results 2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

Unaudited Interim Financial Information

Condensed Consolidated Interim Statement of Changes in Equity | | |

| (figures in thousands of $, except per share data) | | |

For the year ended December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Shares Outstanding | | Share Capital | Treasury Shares | Additional Paid in Capital | Accumulated Deficit | | Total Equity |

| | | | | | | | | |

| At January 1, 2023 | | 53,682,140 | | | 5,452 | | (8,082) | | 1,203,407 | | (293,687) | | | 907,090 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Share-based payments | | — | | | — | | — | | 692 | | — | | | 692 | |

| Net income | | — | | | — | | — | | — | | 16,531 | | | 16,531 | |

| Dividends paid | | — | | | — | | — | | — | | (53,682) | | | (53,682) | |

| At March 31, 2023 | | 53,682,140 | | | 5,452 | | (8,082) | | 1,204,099 | | (330,838) | | | 870,631 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Share-based payments | | — | | | — | | — | | 341 | | — | | | 341 | |

| Net income | | — | | | — | | — | | — | | 39,016 | | | 39,016 | |

| Dividends paid | | — | | | — | | — | | — | | (40,262) | | | (40,262) | |

At June 30, 2023 | | 53,682,140 | | | 5,452 | | (8,082) | | 1,204,440 | | (332,084) | | | 869,726 | |

| Distributed treasury shares | | 54,178 | | | — | | 522 | | (522) | | — | | | — | |

| Share-based payments | | — | | | — | | — | | 353 | | — | | | 353 | |

| Net income | | — | | | — | | — | | — | | 45,101 | | | 45,101 | |

| Dividends paid | | — | | | — | | — | | — | | (40,262) | | | (40,262) | |

| At September 30, 2023 | | 53,736,318 | | | 5,452 | | (7,560) | | 1,204,271 | | (327,245) | | | 874,918 | |

| | | | | | | | | |

| Share-based payments | | — | | | — | | — | | 363 | | — | | | 363 | |

| Net income | | — | | | — | | — | | — | | 19,391 | | | 19,391 | |

| Dividends paid | | — | | | — | | — | | — | | (47,019) | | | (47,019) | |

| At December 31, 2023 | | 53,736,318 | | | 5,452 | | (7,560) | | 1,204,634 | | (354,873) | | | 847,653 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| | | | | |

24 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Notes to the Interim Consolidated Accounts

Note 1: General information

Flex LNG Ltd. (together with its subsidiaries, the "Company" or "Flex LNG") is a limited liability company, originally incorporated in the British Virgin Islands and registered in Bermuda as of June 2017. The Company's activities are focused on seaborne transportation of liquefied natural gas ("LNG"). The Company's ordinary shares are listed on the New York Stock Exchange (the "NYSE") and the Oslo Stock Exchange (the "OSE") under the symbol "FLNG". The interim financial information is unaudited.

Note 2: Accounting principles

Basis of accounting

The unaudited interim condensed consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). The unaudited interim condensed consolidated financial statements do not include all the disclosures required in an annual report, and should be read in conjunction with the annual consolidated financial statements and notes for the year ended December 31, 2023 included in the Company's Annual Report on Form 20-F, filed with the Securities and Exchange Commission (the "SEC") on March 5, 2024.

Significant accounting policies

The accounting policies adopted in the preparation of the unaudited condensed consolidated interim financial statements are consistent with those followed in the preparation of the Company’s annual financial statements for the year ended December 31, 2023.

Recent accounting pronouncements

Recently issued accounting pronouncements are not expected to materially impact the Company.

Note 3: Earnings per share

Basic earnings per share amounts are calculated by dividing the net income/(loss) by the weighted average number of ordinary shares outstanding during that period.

Diluted earnings per share amounts are calculated by dividing the net income/(loss) by the weighted average number of shares outstanding during the period, plus the weighted average number of ordinary shares that would be outstanding if all the dilutive potential ordinary shares were issued, excluding those purchased by the Company and held as treasury shares. If in the period there is a loss, then any potential ordinary shares have been excluded from the calculation of diluted loss per share as their effect would be anti-dilutive.

| | | | | |

25 | Flex LNG Ltd. Fourth Quarter Results 2024 |

The following reflects the net income/(loss) and share data used in the earnings per share calculation.

| | | | | | | | | | | | | | | | | | | | | | | |

| (figures in thousands of $, except per share data) | | | | | |

| | Three months ended | | Year ended |

| | December 31, | September 30, | December 31, | | December 31, | December 31, |

| | | 2024 | 2024 | 2023 | | 2024 | 2023 |

| Net income | | 45,217 | | 17,408 | | 19,391 | | | 117,684 | | 120,039 | |

| | | | | | | |

| Weighted average number of ordinary shares | | 53,939,768 | | 53,881,486 | | 53,736,318 | | | 53,851,304 | | 53,697,594 | |

| Share options | | 16,255 | | 154,650 | | 239,871 | | | 177,648 | | 288,095 | |

| Weighted average number of ordinary shares, adjusted for dilution | | 53,956,023 | | 54,036,136 | | 53,976,189 | | | 54,028,952 | | 53,985,689 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | | 0.84 | | 0.32 | | 0.36 | | | 2.19 | | 2.24 | |

| Diluted | | 0.84 | | 0.32 | | 0.36 | | | 2.18 | | 2.22 | |

| | | | | | | |

Dividends/Distributions paid per share | | (0.75) | | (0.75) | | (0.88) | | | (3.00) | | (3.38) | |

On November 11, 2024, the Company’s Board of Directors declared a cash distribution for the third quarter of 2024 of $0.75 per share. This distribution was paid on December 11, 2024, to shareholders on record as of November 27, 2024.

Note 4: Cash, cash equivalents and restricted cash

The following identifies the balance sheet line items included in cash, cash equivalents and restricted cash as presented in the consolidated statements of cash flows:

| | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | |

| | December 31, | September 30, | | December 31, |

| | 2024 | 2024 | | 2023 |

| Cash and cash equivalents | | 437,154 | | 289,519 | | | 410,425 | |

| Restricted cash | | 49 | | 54 | | | 119 | |

| | 437,203 | | 289,573 | | | 410,544 | |

Restricted cash consists of cash that is restricted by law for the Norwegian tax authorities in relation to social security of employees.

| | | | | |

26 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Note 5: Other current assets

Other current assets includes the following:

| | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | |

| | December 31, | September 30, | | December 31, |

| | 2024 | 2024 | | 2023 |

| Trade accounts receivable, net | | 1,404 | | 6,539 | | | 447 | |

| Accrued income | | 19,741 | | 18,903 | | | 12,114 | |

| Prepaid expenses | | 6,742 | | 9,825 | | | 7,498 | |

| Other receivables | | 3,779 | | 1,925 | | | 6,581 | |

| | 31,666 | | 37,192 | | | 26,640 | |

Note 6: Other current liabilities

Other current liabilities includes the following:

| | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | |

| | December 31, | September 30, | | December 31, |

| | 2024 | 2024 | | 2023 |

| Accrued expenses | | 12,236 | | 14,293 | | | 12,582 | |

| Deferred charter revenue | | 37,124 | | 37,030 | | | 32,441 | |

| Other current liabilities | | 50 | | 182 | | | 482 | |

| Provisions | | 134 | | 134 | | | — | |

| | 49,544 | | 51,639 | | | 45,505 | |

| | | | | |

27 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Note 7: Vessels and equipment, net

Movements in the year ended December 31, 2024 for vessels and equipment, net is summarized as follows:

| | | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | | |

| | | | | | |

| | Vessels and equipment | Drydocks | | | Total |

| | | | | | |

| Cost | | | | | | |

| At January 1, 2024 | | 2,467,470 | | 43,214 | | | | 2,510,684 | |

| Additions | | — | | 12,645 | | | | 12,645 | |

| | | | | | |

| Disposals | | — | | (5,000) | | | | (5,000) | |

| At December 31, 2024 | | 2,467,470 | | 50,859 | | | | 2,518,329 | |

| | | | | | |

| Accumulated depreciation | | | | | | |

| At January 1, 2024 | | (275,371) | | (18,012) | | | | (293,383) | |

| Charge | | (65,904) | | (9,578) | | | | (75,482) | |

| Disposals | | — | | 5,000 | | | | 5,000 | |

| At December 31, 2024 | | (341,275) | | (22,590) | | | | (363,865) | |

| | | | | | |

| Net book value | | | | | | |

| At January 1, 2024 | | 2,192,099 | | 25,202 | | | | 2,217,301 | |

| At December 31, 2024 | | 2,126,195 | | 28,269 | | | | 2,154,465 | |

In April 2024 and May 2024, we successfully completed the drydockings of Flex Constellation and Flex Courageous, respectively, in accordance with the guided timing and cost.

Note 8: Capital commitments

As of December 31, 2024, the Company's only capital commitments relate to long-term debt obligations, summarized as follows:

| | | | | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | | |

| | Sale and leaseback | Period repayment | Balloon repayment | | Total |

| 1 year | | 60,317 | | 48,589 | | — | | | 108,906 | |

| 2 years | | 61,504 | | 48,589 | | — | | | 110,093 | |

| 3 years | | 62,749 | | 48,589 | | — | | | 111,338 | |

| 4 years | | 64,078 | | 48,588 | | 102,632 | | | 215,298 | |

| 5 years | | 65,426 | | 21,256 | | 290,154 | | | 376,836 | |

| Thereafter | | 712,565 | | 8,286 | | 180,000 | | | 900,851 | |

| Total | | 1,026,639 | | 223,897 | | 572,786 | | | 1,823,322 | |

Sale and leaseback's, which are classified as financing arrangements, include loan amortization and the final amounts payable in connection with repurchase obligations payable at the end of their respective charters.

| | | | | |

28 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Note 9: Long-term debt

As of December 31, 2024, the Company had a long-term debt obligations of $1,810.2 million (December 31, 2023: $1,812.1 million).

As of December 31, 2024, the Company's long-term debt obligations, net of debt issuance costs, are summarized as follows;

| | | | | | | | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | | | |

| Facility Name | Type | Maturity Date | | Current portion | Non-current portion | | Total |

| Flex Resolute $150 Million Facility | Term | December 2028 | | 7,633 | | 125,555 | | | 133,188 | |

| Flex Enterprise $150 Million Facility | Term and revolving | June 2029 | | 9,720 | | 117,888 | | | 127,608 | |

| $290 Million Facility | Term and revolving | March 2029 | | 14,245 | | 247,826 | | | 262,071 | |

| $270 Million Facility | Term and revolving | February 2030 | | 16,042 | | 252,800 | | | 268,842 | |

| $320 Million Sale and Leaseback | Sale and leaseback | May 2032 | | 18,418 | | 248,062 | | | 266,480 | |

| $330 Million Sale and Leaseback | Sale and leaseback | February 2035 | | 16,709 | | 276,836 | | | 293,545 | |

| Flex Rainbow Sale and Leaseback | Sale and leaseback | February 2033 | | 8,956 | | 153,972 | | | 162,928 | |

| Flex Volunteer Sale and Leaseback | Sale and leaseback | December 2031 | | 7,305 | | 130,100 | | | 137,405 | |

| Flex Endeavour Sale and Leaseback | Sale and leaseback | June 2034 | | 7,680 | | 150,490 | | | 158,170 | |

| | | | 106,708 | | 1,703,529 | | | 1,810,237 | |

Note 10: Financial Instruments

In order to reduce the risk associated with fluctuations in interest rates, the Company has interest rate swap agreements, whereby floating interest has been swapped to a fixed rate of interest on an aggregate net notional principal of $635.0 million as of December 31, 2024 (December 31, 2023: $720.0 million).

Our interest rate swap contracts as of December 31, 2024, of which none are designated as hedging instruments, are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | Notional principal | | Weighted Average Maturity Date | | Weighted Average Fixed Interest Rate | | Interest Rate Benchmark |

| Receiving floating, pay fixed | | 560,000 | | | March 2029 | | 2.08 | % | | SOFR |

| Receiving floating, pay fixed | | 75,000 | | | August 2025 | | 0.99 | % | | SOFR + CAS (1) |

(1) The reference rate for these interest rate swap agreements are based on SOFR plus a Credit Adjustment Spread of 0.26161% based on the LIBOR fallback protocol.

| | | | | |

29 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Movements in the year ended December 31, 2024 for the derivative instrument assets and liabilities is summarized as follows:

| | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | |

| | | | | |

| | Derivative Instrument Asset | Derivative Instrument Liability | | Total |

| | | | | |

| At January 1, 2024 | | 48,829 | | — | | | 48,829 | |

| Change in fair value of derivative instruments | | 1,838 | | — | | | 1,838 | |

Termination of derivative instruments | | (10,577) | | — | | | (10,577) | |

| At December 31, 2024 | | 40,090 | | — | | | 40,090 | |

Gain/(Loss) on derivatives as recorded on the Company's unaudited condensed consolidated statements of operations is summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | |

| | Three months ended | | Year ended |

| | December 31, | September 30, | December 31, | | December 31, | December 31, |

| | | 2024 | 2024 | 2023 | | 2024 | 2023 |

| Change in fair value of derivative instruments | | 14,951 | | (10,497) | | (18,673) | | | 1,838 | | (6,686) | |

Realized gain on derivative instruments | | 5,138 | | 2,465 | | 7,051 | | | 21,000 | | 24,967 | |

Gain/(Loss) on derivatives | | 20,089 | | (8,032) | | (11,622) | | | 22,838 | | 18,281 | |

Note 11: Fair Value of Financial Assets and Liabilities

The principal financial assets of the Company at December 31, 2024 and December 31, 2023, consist primarily of cash and cash equivalents, restricted cash, other current assets, receivables due from related parties and derivative instruments receivable. The principal financial liabilities of the Company consist of payables due to related parties, accounts payable, other current liabilities, derivative instruments payable and long-term debt.

The fair value measurements requirement applies to all assets and liabilities that are being measured and reported on a fair value basis. The assets and liabilities carried at fair value should be classified and disclosed in one of the following three categories based on the inputs used to determine its fair value:

Level 1: Quoted market prices in active markets for identical assets or liabilities;

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data;

Level 3: Unobservable inputs that are not corroborated by market data.

The fair value of the Company's cash, cash equivalents and restricted cash approximates their carrying amounts reported in the accompanying condensed consolidated balance sheets.

| | | | | |

30 | Flex LNG Ltd. Fourth Quarter Results 2024 |

The fair value of other current assets, receivables from related parties, payables due to related parties, accounts payable and other current liabilities approximate their carrying amounts in the accompanying condensed consolidated balance sheets.

The fair value of floating rate debt has been determined using Level 2 inputs and is considered to be equal to the carrying value since it bears variable interest rates, which are reset on a quarterly or semi-annual basis. The carrying value of the floating rate debt is shown net of debt issuance costs, while fair value of floating rate debt is shown gross.

The fair value of fixed rate debt has been determined using Level 2 inputs being the discounted expected cash flows of the outstanding debt.

The following table includes the estimated fair value and carrying value of those assets and liabilities.

| | | | | | | | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | December 31, | | December 31, |

| | | 2024 | | 2023 |

| Fair value hierarchy level | | Carrying value of asset (liability) | Fair value

asset (liability) | | Carrying value of asset (liability) | Fair value asset

(liability) |

| Cash and cash equivalents | Level 1 | | 437,154 | | 437,154 | | | 410,425 | | 410,425 | |

| Restricted cash | Level 1 | | 49 | | 49 | | | 119 | | 119 | |

| Derivative instruments receivable | Level 2 | | 40,090 | | 40,090 | | | 48,829 | | 48,829 | |

| | | | | | | |

| Floating rate debt | Level 2 | | (1,672,832) | | (1,684,666) | | | (1,667,749) | | (1,680,623) | |

| Fixed rate debt | Level 2 | | (137,405) | | (116,060) | | | (144,394) | | (128,218) | |

There have been no transfers between different levels in the fair value hierarchy during the year ended December 31, 2024.

Assets Measured at Fair Value on a Recurring Basis

The fair value (Level 2) of interest rate swap derivative agreements is the present value of the estimated future cash flows that we would receive or pay to terminate the agreements at the balance sheet date, taking into account, as applicable, fixed interest rates on interest rate swaps, current interest rates, forward rate curves and the credit worthiness of both us and the derivative counterparty.

Concentration of Risk

There is a concentration of credit risk with respect to cash and cash equivalents to the extent that substantially all of the amounts are carried with SEB (S&P Global rating: A+), Danske Bank (S&P Global rating: A+) and DNB (S&P Global rating: AA-).

| | | | | |

31 | Flex LNG Ltd. Fourth Quarter Results 2024 |

Note 12: Related party transactions

We transact business with the following related parties and affiliated companies (and respective subsidiaries), being companies in which Geveran Trading Co. Ltd ("Geveran") and companies associated with Geveran have significant influence or control, including: SFL Corporation Ltd, Seatankers Management Co. Ltd, Paratus Energy Services Ltd, Golden Ocean Group Limited, Frontline Plc, Northern Ocean Limited, Avance Gas Holding Ltd, Front Ocean Management Ltd.

Related Party Balances

A summary of receivables due from related parties and affiliated companies are as follows:

| | | | | | | | | | | | | | | | | |

| (figures in thousands of $) | | | | | |

| | December 31, | September 30, | | December 31, |

| | 2024 | 2024 | | 2023 |

| | | | | |

| Seatankers Services (UK) LLP | | — | | — | | | 9 | |

| | | | | |

Frontline (Management) Cyprus Limited | | 686 | | 757 | | | 8 | |

| Frontline Management (Bermuda) Limited | | — | | — | | | 510 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |