TIAA Bank Buys $1.5 Billion Lease Portfolio From GE Capital

17 November 2018 - 1:04AM

Dow Jones News

By Chris Wack

TIAA Bank on Friday said it purchased a $1.5 billion portfolio

of health-care equipment leases and loans from GE Capital's

Healthcare Equipment Finance business.

The Jacksonville, Fla.-based bank said in a release that the

acquisition expands its commercial banking business and allows it

to provide a full range of financial solutions to institutional

clients and serve more health-care providers.

The two companies also entered into a five-year vendor financing

agreement for U.S. customers of GE Healthcare. GE Healthcare

Equipment Finance's leadership, infrastructure and sales force will

be integrated into GE Healthcare in 2019 and the team will continue

to originate and service transactions under a co-branding

arrangement with TIAA Bank.

The acquired health-care portfolio includes loans and leases to

about 1,100 hospitals, as well as 3,600 physician practices and

diagnostic and imaging centers across the U.S.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

November 16, 2018 08:49 ET (13:49 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

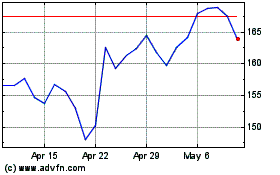

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2024 to May 2024

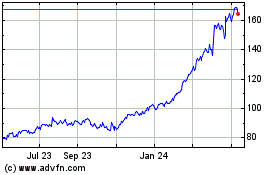

GE Aerospace (NYSE:GE)

Historical Stock Chart

From May 2023 to May 2024