Filed

by: Berry Global Group, Inc.

Commission

File No.: 001-35672

Pursuant

to Rule 425 under the Securities Act of 1933

Subject

Company: Glatfelter Corporation

(Commission

File No.: 001-03560)

Below

is a communication made by Berry Global Group, Inc. on May 30, 2024:

| An Important Message from Curt Begle, President, Berry Health, Hygiene & Specialties |

|

Dear

HHS team,

Today I am pleased

to provide a high-level overview of NewCo’s go-forward organizational structure along with the currently identified leadership positions

to be effective on the day of closing, with a focus on the roles related to the core business and organizational integration. Additional

announcements will be made in the future.

Over

the last few months, I’ve met with the Board of Directors of Glatfelter and Berry, as well as senior leaders from both organizations

to align and create the best operating model for NewCo to launch on day one ready to meet and exceed our business objectives and stakeholder

expectations.

NewCo’s

Operating Model

NewCo

will be structured using a regional operating model, with two primary regions:

| · | The

Americas (North, South, and Latin Americas) |

| · | EMEIA &

Asia (Europe, Middle East, India, Africa, & Asia) |

The

business structure will be very similar to how we operate today. For most HH&S team members, it will not impact current day to day

responsibilities. Employees with global responsibilities will continue to operate within their normal duties unless we determine those

roles would better serve in support of a region. In some cases, we may expand the scope of certain job responsibilities to best position

the team to deliver on the business needs.

NewCo

Leadership Team

While

the organizational structure sets a solid foundation for NewCo, success requires a collective effort of all valued team members. I am

excited to communicate a second round of appointments to leadership positions, representing both the current Glatfelter and HH&S

teams. Additional announcements will be made in the future.

| An Important Message from Curt Begle, President, Berry Health, Hygiene & Specialties |

|

David

Parks will assume the role of President – Americas. This position will include responsibility for the combined Glatfelter

and HH&S businesses in the America’s.

Achim

Schalk will assume the role of President - EMEIA & Asia. This position will include responsibility for the combined

Glatfelter and HH&S businesses in Europe and Asia.

Robert

Weilminster will lead Corporate Development, Strategy, Investor Relations and Integration. He will begin transitioning

his current responsibilities to David Parks this summer as he prepares for his new role.

Paul

Harmon will lead Global Innovation, Sustainability, Corporate Branding and Marketing.

Eileen

Beck is currently the Senior VP, Global Human Resources & Administration at Glatfelter and will assume the Global

role to lead Human Resources.

Kathy

Vanderheyden is currently VP of Operations for Glatfelter’s Airlaid and Hygiene business, along with global safety and

quality, and will assume the Global role to lead BEX & Integration, Quality, Regulatory and EHS.

Michele

Forsell will be responsible for our Global Finance Business Partners and will transition her General Manager duties of Building &

Construction to David Parks prior to closing.

Tracey

York will continue to play a key role in Human Resources, including Human Resources leader for the Americas.

Phil

Lerro is currently Glatfelter’s Chief Information Officer and will assume the role for NewCo.

| An Important Message from Curt Begle, President, Berry Health, Hygiene & Specialties |

|

It is important to note this is not the full team that

will report into each of these leaders. With this announcement, we will begin the important process of assembling these organizations

and will continue to share details as they emerge.

As

we transition to our new operating model, I want to personally thank Daniel Guerrero for his 25+ years of exemplary service.

In his many roles over the years, Daniel has been a steadfast leader and his contributions have been invaluable. I am forever grateful

for the bond we developed during our time together in HH&S. As he has done with so many of our employees during his tenure, Daniel

made me a better businessperson and became a close friend. Daniel will transition his current responsibilities to David Parks this summer

to ensure a smooth transition for the LATAM team and will contribute to the integration work streams through closing.

As

we share additional details regarding the newly named leaders and the organizational structure in the weeks ahead, I ask each of

you to continue to perform at your highest level to deliver on our 2024 commitments, which is extremely important as we set our New Company

up for success.

Stay

tuned for more exciting news over the summer months, which will include the announcement of our much-anticipated new name, logo, and

brand!

Curt

| An Important Message from Curt Begle, President, Berry Health, Hygiene & Specialties |

|

Cautionary

Statement Concerning Forward-Looking Statements

Statements

in this release that are not historical, including statements relating to the expected timing, completion and effects of the proposed

transaction between Berry Global Group, Inc., a Delaware corporation (“Berry”), and Glatfelter Corporation, a Pennsylvania

corporation (“Glatfelter” or the “Company”), are considered “forward-looking” within the meaning

of the federal securities laws and are presented pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act

of 1995. You can identify forward-looking statements because they contain words such as “believes,” “expects,”

“may,” “will,” “should,” “would,” “could,” “seeks,” “approximately,”

“intends,” “plans,” “estimates,” “projects,” “outlook,” “anticipates”

or “looking forward,” or similar expressions that relate to strategy, plans, intentions, or expectations. All statements

relating to estimates and statements about the expected timing and structure of the proposed transaction, the ability of the parties

to complete the proposed transaction, benefits of the transaction, including future financial and operating results, executive and Board

transition considerations, the combined company’s plans, objectives, expectations and intentions, and other statements that are

not historical facts are forward-looking statements. In addition, senior management of Berry and Glatfelter, from time to time may make

forward-looking public statements concerning expected future operations and performance and other developments.

Actual

results may differ materially from those that are expected due to a variety of factors, including without limitation: the occurrence

of any event, change or other circumstances that could give rise to the termination of the proposed transaction; the risk that Glatfelter

shareholders may not approve the transaction proposals; the risk that the necessary regulatory approvals may not be obtained or may be

obtained subject to conditions that are not anticipated or may be delayed; risks that any of the other closing conditions to the proposed

transaction may not be satisfied in a timely manner; risks that the anticipated tax treatment of the proposed transaction is not obtained;

risks related to potential litigation brought in connection with the proposed transaction; uncertainties as to the timing of the consummation

of the proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; risks and costs related to

the implementation of the separation of the business, operations and activities that constitute the global nonwovens and hygiene films

business of Berry (the “HHNF Business”) into Treasure Holdco, Inc., a Delaware corporation and a wholly owned subsidiary

of Berry (“Spinco”), including timing anticipated to complete the separation; any changes to the configuration of the businesses

included in the separation if implemented; the risk that the integration of the combined company is more difficult, time consuming or

costly than expected; risks related to financial community and rating agency perceptions of each of Berry and Glatfelter and its business,

operations, financial condition and the industry in which they operate; risks related to disruption of management time from ongoing business

operations due to the proposed transaction; failure to realize the benefits expected from the proposed transaction; effects of the announcement,

pendency or completion of the proposed transaction on the ability of the parties to retain customers and retain and hire key personnel

and maintain relationships with their counterparties, and on their operating results and businesses generally; and other risk factors

detailed from time to time in Glatfelter’s and Berry’s reports filed with the Securities and Exchange Commission (“SEC”),

including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents

filed with the SEC. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the

registration statements, proxy statement/prospectus and other documents that will be filed with the SEC in connection with the proposed

transaction. The foregoing list of important factors may not contain all of the material factors that are important to you. New factors

may emerge from time to time, and it is not possible to either predict new factors or assess the potential effect of any such new factors.

Accordingly, readers should not place undue reliance on those statements. All forward-looking statements are based upon information available

as of the date hereof. All forward-looking statements are made only as of the date hereof and neither Berry nor Glatfelter undertake

any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as

otherwise required by law.

Additional

Information and Where to Find It

This

communication may be deemed to be solicitation material in respect of the proposed transaction between Berry and Glatfelter. In connection

with the proposed transaction, Berry and Glatfelter intend to file relevant materials with the SEC, including a registration statement

on Form S-4 by Glatfelter that will contain a proxy statement/prospectus relating to the proposed transaction. In addition, Spinco

expects to file a registration statement in connection with its separation from Berry. This communication is not a substitute for the

registration statements, proxy statement/prospectus or any other document which Berry and/or Glatfelter may file with the SEC. STOCKHOLDERS

OF BERRY AND GLATFELTER ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND PROXY

STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders

will be able to obtain copies of the registration statements and proxy statement/prospectus (when available) as well as other filings

containing information about Berry and Glatfelter, as well as Spinco, without charge, at the SEC’s website, www.sec.gov. Copies

of documents filed with the SEC by Berry or Spinco will be made available free of charge on Berry’s investor relations website

at www.ir.berryglobal.com. Copies of documents filed with the SEC by Glatfelter will be made available free of charge on Glatfelter's

investor relations website at www.glatfelter.com/investors.

No

Offer or Solicitation

This

communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation

of an offer to sell, subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale,

issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration

or qualification under the securities laws of any such jurisdiction. No offer or sale of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with

applicable law.

Participants

in Solicitation

Berry

and its directors and executive officers, and Glatfelter and its directors and executive officers, may be deemed to be participants

in the solicitation of proxies from the holders of Glatfelter common stock and/or the offering of securities in respect of the

proposed transaction. Information about the directors and executive officers of Berry, including a description of their direct or

indirect interests, by security holdings or otherwise, is set forth under the caption “Security Ownership of Beneficial Owners

and Management” in the definitive proxy statement for Berry’s 2024 Annual Meeting of Stockholders, which was filed with

the SEC on January 4, 2024

(www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001378992/000110465924001073/tm2325571d6_def14a.htm). Information about

the directors and executive officers of Glatfelter including a description of their direct or indirect interests, by security

holdings or otherwise, is set forth under the caption “Security Ownership of Certain Beneficial Owners and Management”

in the proxy statement for Glatfelter's 2024 Annual Meeting of Shareholders, which was filed with the SEC on March 26, 2024

(www.sec.gov/ix?doc=/Archives/edgar/data/0000041719/000004171924000013/glt-20240322.htm). In addition, Curt Begle, the current

President of Berry’s Health, Hygiene & Specialties Division, will be appointed as Chief Executive Officer, James M.

Till, the current Executive Vice President and Controller of Berry, will be appointed as Executive Vice President, Chief Financial

Officer & Treasurer, and Tarun Manroa, the current Executive Vice President and Chief Strategy Officer of Berry, will be

appointed as Executive Vice President, Chief Operating Officer, of the combined company. Investors may obtain additional information

regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it

becomes available.

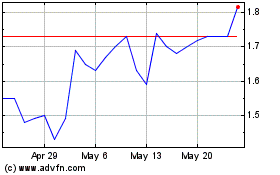

Glatfelter (NYSE:GLT)

Historical Stock Chart

From May 2024 to Jun 2024

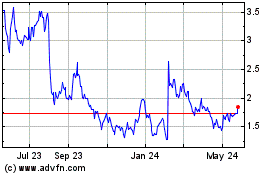

Glatfelter (NYSE:GLT)

Historical Stock Chart

From Jun 2023 to Jun 2024