GENWORTH FINANCIAL INC false 0001276520 0001276520 2025-02-18 2025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

February 18, 2025

Date of Report

(Date of earliest event reported)

GENWORTH FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-32195 |

|

80-0873306 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 11011 West Broad Street, Glen Allen, Virginia |

|

23060 |

| (Address of principal executive offices) |

|

(Zip Code) |

(804) 281-6000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $.001 per share |

|

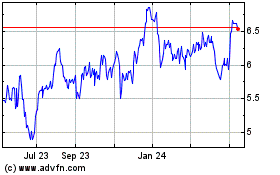

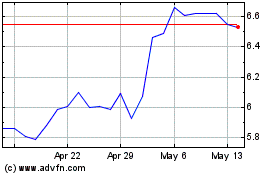

GNW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 18, 2025, Genworth Financial, Inc. (the “Company”) issued (1) a press release announcing its financial results for the quarter ended December 31, 2024, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference, and (2) a financial supplement for the quarter ended December 31, 2024, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K (including the exhibits) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the company under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. The information contained in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

The following materials are furnished as exhibits to this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

GENWORTH FINANCIAL, INC. |

|

|

|

|

| Date: February 18, 2025 |

|

|

|

By: |

|

/s/ Darren W. Woodell |

|

|

|

|

|

|

Darren W. Woodell |

|

|

|

|

|

|

Vice President and Controller |

|

|

|

|

|

|

(Principal Accounting Officer) |

Exhibit 99.1

Genworth Financial Announces Fourth Quarter 2024 Results

Strategic Highlights

| |

• |

|

Expanded the CareScout Quality Network to all 50 states, covering over 86% of the aged 65-plus census population in the United States |

| |

• |

|

Continued progress on the LTC1 multi-year rate action plan

with $40M of gross incremental premium approvals; approximately $31.2B estimated net present value achieved since 2012 from in-force rate actions (IFAs) |

| |

• |

|

Executed $51M in share repurchases in the quarter at an average price of $7.32 per share; $186M executed in 2024

at an average price of $6.52 per share; $565M in share repurchases program-to-date through February 14th at an

average price of $5.69 per share |

| |

• |

|

Repurchased $31M in principal of holding company debt at a discount during the quarter |

Financial Highlights

| |

• |

|

Net income2 of $299M, or $0.68 per diluted share, and

adjusted operating income2,3 of $273M, or $0.623 per diluted share in 2024 |

| |

• |

|

Net loss2 of $1M and adjusted operating income2,3 of $15M in the fourth quarter |

| |

• |

|

Enact reported adjusted operating income of $137M2 in the

fourth quarter; distributed $84M in capital returns to Genworth |

| |

• |

|

Completed annual assumption updates with unfavorable impacts to adjusted operating income (loss) in LTC and Life

and Annuities of $52M |

| |

• |

|

U.S. life insurance companies’ RBC4 ratio of 306%5 reflects strong statutory pre-tax income of $378M5 in 2024 and an increase in the value of the limited

partnership portfolio, partially offset by higher required capital as the portfolio grows |

| |

• |

|

Genworth holding company cash and liquid assets of $294M6 at

quarter-end |

Richmond, VA (February 18, 2025) – Genworth Financial, Inc. (NYSE: GNW) today

reported results for the quarter ended December 31, 2024.

|

|

|

|

|

“I’m pleased with our financial and operational achievements in 2024,” said Tom McInerney, President & CEO. “We advanced progress on our multi-year rate action plan and returned substantial capital to

shareholders using cash flows from Enact, which delivered record adjusted operating income for the full year. Meanwhile, we set the stage for future growth by scaling the CareScout Quality Network and preparing the launch of a new CareScout LTC

insurance company. We entered 2025 on solid financial footing, and Genworth will continue to deliver for shareholders while empowering more families to navigate the aging journey with confidence.” |

1

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Metrics |

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q4 2023 |

|

| (Amounts in millions, except per share data) |

| Net income (loss)2 |

|

$ |

(1 |

) |

|

$ |

85 |

|

|

$ |

(212 |

) |

| Net income (loss) per diluted share2 |

|

$ |

— |

|

|

$ |

0.19 |

|

|

$ |

(0.47 |

) |

| Adjusted operating income (loss)2,3 |

|

$ |

15 |

|

|

$ |

48 |

|

|

$ |

(230 |

) |

| Adjusted operating income (loss) per diluted

share2,3 |

|

$ |

0.04 |

|

|

$ |

0.11 |

|

|

$ |

(0.51 |

) |

| Weighted-average diluted shares7 |

|

|

431.0 |

|

|

|

435.8 |

|

|

|

449.4 |

|

Consolidated GAAP Financial Highlights

| |

• |

|

Net loss in the quarter was driven by LTC, partially offset by strong Enact operating performance

|

| |

• |

|

Net investment losses, net of taxes, decreased net income by $32 million in the current quarter, compared

with net investment gains of $52 million in the prior quarter and $30 million in the prior year. The investment losses in the current quarter were driven primarily by derivatives and an increase in the allowance for credit losses

|

| |

• |

|

Changes in the fair value of market risk benefits and associated hedges, net of taxes, increased net income by

$2 million in the quarter driven primarily by a favorable change in interest rates, compared with decreases of $17 million in the prior quarter and $11 million in the prior year |

| |

• |

|

Net investment income, net of taxes, was $626 million in the quarter, up from $614 million in the prior

quarter driven by higher income from limited partnerships |

2

Enact

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Operating Metrics |

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q4 2023 |

|

| (Dollar amounts in millions) |

| Adjusted operating income2 |

|

$ |

137 |

|

|

$ |

148 |

|

|

$ |

129 |

|

| Primary new insurance written |

|

$ |

13,266 |

|

|

$ |

13,591 |

|

|

$ |

10,453 |

|

| Loss ratio |

|

|

10 |

% |

|

|

5 |

% |

|

|

10 |

% |

| Equity8 |

|

$ |

4,068 |

|

|

$ |

4,097 |

|

|

$ |

3,785 |

|

| |

• |

|

Current quarter results reflected a pre-tax reserve release of

$56 million primarily from favorable cure performance and loss mitigation activities. The prior quarter and prior year included pre-tax reserve releases of $65 million and $53 million,

respectively |

| |

• |

|

Net investment income of $62 million in the current quarter was up from $57 million in the prior year

from higher yields and higher average invested assets |

| |

• |

|

Primary insurance in-force increased two percent versus the prior year to

$269 billion driven by new insurance written (NIW) and continued elevated persistency |

| |

• |

|

Primary NIW was up 27 percent versus the prior year primarily driven by higher estimated originations

|

| |

• |

|

New delinquencies increased 17 percent to 13,717 from 11,706 in the prior year primarily from continued

seasoning of large, newer books and increased six percent sequentially primarily from hurricane-related new delinquencies, which historical experience indicates cure at a higher rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Metric |

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q4 2023 |

|

| PMIERs Sufficiency Ratio5,9 |

|

|

167 |

% |

|

|

173 |

% |

|

|

161 |

% |

| |

• |

|

Enact paid a quarterly dividend of $0.185 per share in the current quarter |

| |

• |

|

Estimated PMIERs sufficiency ratio of 167 percent, $2,052 million above requirements

|

Long-Term Care Insurance

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Operating Metrics |

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q4 2023 |

|

| (Amounts in millions) |

| Adjusted operating loss |

|

$ |

(104 |

) |

|

$ |

(46 |

) |

|

$ |

(151 |

) |

| Premiums |

|

$ |

587 |

|

|

$ |

581 |

|

|

$ |

615 |

|

| Net investment income |

|

$ |

499 |

|

|

$ |

483 |

|

|

$ |

489 |

|

| Liability remeasurement gains (losses) |

|

$ |

(117 |

) |

|

$ |

(28 |

) |

|

$ |

(188 |

) |

| Cash flow assumption updates |

|

|

(20 |

) |

|

|

63 |

|

|

|

(61 |

) |

| Actual variances from expected experience |

|

|

(97 |

) |

|

|

(91 |

) |

|

|

(127 |

) |

| |

• |

|

Premiums decreased versus the prior year primarily driven by lower renewal premiums as a result of benefit

reduction elections in connection with IFAs and legal settlements and from policy terminations |

| |

• |

|

Net investment income increased from higher income from limited partnerships |

3

| |

• |

|

Current quarter liability remeasurement loss included adverse actual variances from expected experience primarily

from lower terminations and higher claims and an unfavorable impact from assumption updates. The unfavorable impact from assumption updates was primarily related to healthy life assumptions and benefit utilization to better align with recent

experience. These unfavorable impacts were largely offset by a favorable impact from assumption updates for future IFA approvals based on recent experience, as well as short-term incidence assumptions for incurred but not reported claims

|

Life and Annuities

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Adjusted Operating Income (Loss) |

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q4 2023 |

|

| (Amounts in millions) |

| Life Insurance |

|

$ |

2 |

|

|

$ |

(40 |

) |

|

$ |

(206 |

) |

| Fixed Annuities |

|

|

1 |

|

|

|

6 |

|

|

|

9 |

|

| Variable Annuities |

|

|

2 |

|

|

|

7 |

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Life and Annuities |

|

$ |

5 |

|

|

$ |

(27 |

) |

|

$ |

(183 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Life Insurance

| |

• |

|

Life insurance results in the current quarter included a net favorable $30 million pre-tax impact from model and assumption updates. The favorable model refinement related to certain universal life (UL) products with secondary guarantees and was partially offset by $28 million of unfavorable pre-tax assumption updates to mortality for UL contracts originating from term life conversions and interest rates |

| |

• |

|

Current quarter mortality experience was favorable compared to the prior quarter and prior year

|

| |

• |

|

Prior year results included an unfavorable $226 million pre-tax

impact from assumption updates |

Annuities

| |

• |

|

Annuity results in the current quarter included an unfavorable $18 million

pre-tax impact from annual assumption updates primarily related to lapse assumptions for fixed indexed and variable annuity products; prior year results included a favorable impact from assumption updates

|

| |

• |

|

Current quarter results reflected lower net spread income primarily from block runoff |

4

U.S. Life Insurance Companies10 Statutory Results5 and RBC5

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollar amounts in millions) |

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q4 2023 |

|

| Statutory pre-tax income (loss)5,11 |

|

$ |

(33 |

) |

|

$ |

(18 |

) |

|

$ |

148 |

|

| Long-Term Care Insurance |

|

|

(78 |

) |

|

|

(9 |

) |

|

|

(9 |

) |

| Life Insurance |

|

|

49 |

|

|

|

(29 |

) |

|

|

82 |

|

| Fixed Annuities |

|

|

6 |

|

|

|

3 |

|

|

|

16 |

|

| Variable Annuities |

|

|

(10 |

) |

|

|

17 |

|

|

|

59 |

|

| GLIC Consolidated RBC Ratio4,5 |

|

|

306 |

% |

|

|

317 |

% |

|

|

303 |

% |

| |

• |

|

Statutory pre-tax income was $378 million in 2024, with a pre-tax loss of $33 million in the current quarter |

| |

• |

|

LTC continued to benefit from premium increases and benefit reductions from IFAs, though lower than the prior

quarter and prior year as the Choice II legal settlement is now materially complete. LTC results also included a $79 million increase in cash flow testing reserves in GLICNY, partially offset by a net $20 million pre-tax benefit from assumption updates |

| |

• |

|

Life insurance results included a favorable $75 million pre-tax

impact from assumption updates, primarily related to favorable changes to the prescribed assumptions for certain term UL and UL products with secondary guarantees, including interest rates and mortality improvement; prior year included a favorable

$99 million pre-tax impact from assumption updates |

| |

• |

|

Fixed annuity results reflected less favorable mortality and lower net spread income primarily from block runoff

compared to prior year |

| |

• |

|

Variable annuity results included an unfavorable $50 million pre-tax

assumption update related to expenses from declining policies in force, partially offset by a $35 million pre-tax net benefit from equity markets and interest rates |

| |

• |

|

Current quarter estimated GLIC consolidated RBC ratio was 306 percent, driven by strong statutory pre-tax income in 2024 and an increase in the value of the limited partnership portfolio, partially offset by higher required capital as this portfolio grows |

| |

• |

|

Cash flow testing margin in GLIC for 2024 was within the

$0.5-$1.0 billion range after the completion of assumption updates |

Corporate and

Other

| |

• |

|

The current quarter adjusted operating loss was $23 million, down from $27 million in the prior quarter

driven by lower operating expenses |

5

Holding Company Cash and Liquid Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions) |

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q4 2023 |

|

| Holding Company Cash and Liquid

Assets12 |

|

$ |

294 |

6 |

|

$ |

369 |

6 |

|

$ |

350 |

|

| |

• |

|

Cash and liquid assets were $294 million at the end of the quarter, including approximately

$186 million of advance cash payments from the company’s subsidiaries held for future obligations |

| |

• |

|

Cash inflows during the current quarter consisted of $84 million from Enact capital returns and

$40 million of other inflows related to advance cash payments from subsidiaries and other miscellaneous items |

| |

• |

|

Current quarter cash outflows included $102 million in net tax payments, $51 million in share

repurchases, $19 million related to debt servicing costs and the repurchase of $31 million in principal of holding company debt at a discount |

Returns to Shareholders

| |

• |

|

In the fourth quarter of 2024, the company repurchased $51 million of its common stock at an average price

of $7.32 per share leaving 421 million shares outstanding at the end of the quarter |

| |

• |

|

Executed $565 million in share repurchases

program-to-date through February 14th at an average price of $5.69 per share |

About Genworth Financial

Genworth Financial, Inc. (NYSE:

GNW) is a Fortune 500 company focused on empowering families to navigate the aging journey with confidence, now and in the future. Headquartered in Richmond, Virginia, Genworth provides guidance, products, and services that help people understand

their caregiving options and fund their long-term care needs. Genworth is also the parent company of publicly traded Enact Holdings, Inc. (Nasdaq: ACT), a leading U.S. mortgage insurance provider. For more information on Genworth, visit

genworth.com, and for more information on Enact Holdings, Inc. visit enactmi.com.

6

Conference Call Information

Investors are encouraged to read this press release, summary presentation and financial supplement which are now posted on the company’s website,

https://investor.genworth.com.

Genworth will conduct a conference call on February 19, 2025 at 9:00 a.m. (ET) to discuss its fourth quarter

results, which will be accessible via:

| |

• |

|

Telephone: 888-208-1820 or 323-794-2110 (outside the U.S.); conference ID # 5461958; or |

| |

• |

|

Webcast: https://investor.genworth.com/news-events/ir-calendar

|

Allow at least 15 minutes prior to the call time to register for the call. A replay of the webcast will be available on the

company’s website for one year.

Contact Information:

|

|

|

| Investors: |

|

Brian Johnson |

|

|

InvestorInfo@genworth.com |

|

|

| Media: |

|

Amy Rein |

|

|

Amy.Rein@genworth.com |

7

Use of Non-GAAP Measures

Management evaluates performance and allocates resources based on a non-GAAP financial measure entitled “adjusted

operating income (loss).” Management evaluates adjusted operating income (loss) as a key measure to assess performance and support new business initiatives because the measure more accurately reflects overall operating performance, as it

minimizes the impact of macroeconomic volatility. The company’s legacy U.S. life insurance subsidiaries, which comprise the Long-Term Care Insurance and Life and Annuities segments, are managed on a standalone basis; therefore, the company does

not allocate capital to its Long-Term Care Insurance and Life and Annuities segments.

The company defines adjusted operating income (loss) as income

(loss) from continuing operations excluding the after-tax effects of income (loss) attributable to noncontrolling interests, net investment gains (losses), changes in fair value of market risk benefits

attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual

non-operating items. A component of the company’s net investment gains (losses) is the result of estimated future credit losses, the size and timing of which can vary significantly depending on market

credit cycles. In addition, the size and timing of other investment gains (losses) can be subject to the company’s discretion and are influenced by market opportunities, as well as asset-liability matching considerations. The company excludes

net investment gains (losses), changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt,

restructuring costs and infrequent or unusual non-operating items from adjusted operating income (loss) because, in the company’s opinion, they are not indicative of overall operating performance.

While some of these items may be significant components of net income (loss) determined in accordance with GAAP, the company believes that adjusted operating

income (loss), and measures that are derived from or incorporate adjusted operating income (loss), are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business.

Adjusted operating income (loss) is not a substitute for net income (loss) determined in accordance with GAAP. In addition, the company’s definition of adjusted operating income (loss) may differ from the definitions used by other companies.

Adjustments to reconcile net income (loss) to adjusted operating income (loss) assume a 21 percent tax rate and are net of the portion attributable

to noncontrolling interests. Changes in fair value of market risk benefits and associated hedges are adjusted to exclude changes in reserves, attributed fees and benefit payments.

The tables at the end of this press release provide a reconciliation of net income (loss) to adjusted operating income (loss) for the three and twelve months

ended December 31, 2024 and 2023, as well as the three months ended September 30, 2024 and reflect adjusted operating income (loss) as determined in accordance with accounting guidance related to segment reporting.

Statutory Accounting Data

The company presents certain

supplemental statutory data for GLIC and its consolidating life insurance subsidiaries that has been prepared on the basis of statutory accounting principles (SAP). GLIC and its consolidating life insurance subsidiaries file financial statements

with state insurance regulatory authorities and the National Association of Insurance Commissioners that are prepared using SAP, an accounting basis either prescribed or permitted by such authorities. Due to differences in methodology between SAP

and GAAP, the values for assets, liabilities and equity, and the recognition of income and expenses, reflected in financial statements prepared in accordance with GAAP are materially different from those reflected in financial statements prepared

under SAP. This supplemental statutory data should not be viewed as an alternative to, or used in lieu of, GAAP.

8

This supplemental statutory data includes the company action level RBC ratio for GLIC and its consolidating

life insurance subsidiaries as well as combined statutory pre-tax earnings from the principal U.S. life insurance companies, GLIC, GLAIC and GLICNY. Statutory pre-tax

earnings represent the net gain from operations, including the impact from in-force rate actions, before dividends to policyholders, refunds to members and federal income taxes and before realized capital

gains or (losses). The combined product level statutory pre-tax earnings are grouped on a consistent basis as those provided on page six of the statutory Annual Statements. Management uses and provides this

supplemental statutory data because it believes it provides a useful measure of, among other things, statutory pre-tax earnings and the adequacy of capital. Management uses this data to measure against its

policy to manage the U.S. life insurance companies with internally generated capital.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will,” “may” or

words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Examples of forward-looking statements include statements the company makes relating to

potential dividends or share repurchases; future return of capital by Enact Holdings, Inc. (Enact Holdings), including share repurchases, and quarterly and special dividends; the cumulative economic benefit of approved and future rate actions

contemplated in the company’s long-term care insurance multi-year in-force rate action plan; the timing of any future insurance offering through the company’s CareScout business (CareScout); future

financial performance, including the expectation that adverse quarterly variances between actual and expected experience could persist resulting in future remeasurement losses in the company’s long-term care insurance business; future financial

condition of the company’s businesses; liquidity and new lines of business or new insurance and other products and services, such as those the company is pursuing with CareScout; and statements the company makes regarding the outlook of the

U.S. economy.

Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent

uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements due to global political, economic, inflation, business, competitive,

market, regulatory and other factors and risks, including but not limited to, the following:

| |

• |

|

the inability to successfully launch new lines of business, including long-term care insurance and other products

and services the company is pursuing with CareScout; |

| |

• |

|

the company’s failure to maintain self-sustainability of its legacy life insurance subsidiaries, including

as a result of the inability to achieve desired levels of in-force rate actions and/or the timing of future premium rate increases and associated benefit reductions taking longer to achieve than originally

assumed; other regulatory actions negatively impacting the company’s life insurance businesses; |

| |

• |

|

inaccuracies or changes in estimates, assumptions, methodologies, valuations, projections and/or models, which

result in inadequate reserves or other adverse results (including as a result of any changes in connection with quarterly, annual or other reviews); |

| |

• |

|

the impact on holding company liquidity caused by an inability to receive dividends or any other returns of

capital from Enact Holdings, and limited sources of capital and financing and the need to seek additional capital on unfavorable terms; |

| |

• |

|

adverse changes to the structure or requirements of Federal National Mortgage Association (Fannie Mae), Federal

Home Loan Mortgage Corporation (Freddie Mac) or the U.S. mortgage insurance market; an increase in the number of loans insured through federal government mortgage insurance programs, including those offered by the Federal Housing Administration; the

inability of Enact Holdings and/or its U.S. mortgage insurance subsidiaries to continue to meet the requirements mandated by PMIERs (or any adverse changes thereto), inability to meet minimum statutory capital requirements of applicable regulators

or the mortgage insurer eligibility requirements of Fannie Mae or Freddie Mac; |

9

| |

• |

|

changes in economic, market and political conditions, labor shortages and fluctuating interest rates;

unanticipated financial events, which could lead to market-wide liquidity problems and other significant market disruption resulting in losses, defaults or credit rating downgrades of other financial institutions; deterioration in economic

conditions, a recession or a decline in home prices, all of which could be driven by many potential factors; political and economic instability or changes in government policies, including U.S. federal tax laws or rates, and at regulatory agencies

as a result of the change in the U.S. Administration in January 2025; and fluctuations in international securities markets; |

| |

• |

|

downgrades in financial strength and credit ratings and potential adverse impacts to liquidity; counterparty

credit risks; defaults by counterparties to reinsurance arrangements or derivative instruments; defaults or other events impacting the value of invested assets; |

| |

• |

|

changes in tax rates or tax laws, or changes in accounting and reporting standards; |

| |

• |

|

litigation and regulatory investigations or other actions, including commercial and contractual disputes with

counterparties; |

| |

• |

|

the inability to retain, attract and motivate qualified employees or senior management; |

| |

• |

|

changes in the composition of Enact Holdings’ business or undue concentration by customer or geographic

region; |

| |

• |

|

the impact from deficiencies in the company’s disclosure controls and procedures or internal control over

financial reporting; |

| |

• |

|

the occurrence of natural or man-made disasters, including geopolitical

tensions and war (including the Russian invasion of Ukraine, the Israel-Hamas conflict and economic competition between the United States and China), a public health emergency, including pandemics, or climate change; |

| |

• |

|

the inability to effectively manage information technology systems (including artificial intelligence), cyber

incidents or other failures, disruptions or security breaches of the company or its third-party vendors, as well as unknown risks and uncertainties associated with artificial intelligence; |

| |

• |

|

the inability of third-party vendors to meet their obligations to the company; |

| |

• |

|

the lack of availability, affordability or adequacy of reinsurance to protect the company against losses;

|

| |

• |

|

a decrease in the volume of high

loan-to-value home mortgage originations or an increase in the volume of mortgage insurance cancellations; |

| |

• |

|

unanticipated claims against Enact Holdings’ delegated underwriting and loss mitigation programs;

|

| |

• |

|

the impact of medical advances such as genetic research and diagnostic imaging, emerging new technology,

including artificial intelligence and related legislation; and |

| |

• |

|

other factors described in the risk factors contained in Item 1A of the company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on February 29, 2024. |

The company

provides additional information regarding these risks and uncertainties in its Annual Report on Form 10-K. Unlisted factors may present significant additional obstacles to the realization of forward-looking

statements. Accordingly, for the foregoing reasons, the company cautions the reader against relying on any forward-looking statements. The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be required under applicable securities laws.

10

Condensed Consolidated Statements of Income

(Amounts in millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

December 31, |

|

|

Twelve months ended

December 31, |

|

|

Three months

ended

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

(Unaudited) |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Premiums |

|

$ |

876 |

|

|

$ |

904 |

|

|

$ |

3,480 |

|

|

$ |

3,636 |

|

|

$ |

874 |

|

| Net investment income |

|

|

793 |

|

|

|

810 |

|

|

|

3,160 |

|

|

|

3,183 |

|

|

|

777 |

|

| Net investment gains (losses) |

|

|

(41 |

) |

|

|

38 |

|

|

|

13 |

|

|

|

23 |

|

|

|

66 |

|

| Policy fees and other income |

|

|

154 |

|

|

|

159 |

|

|

|

642 |

|

|

|

646 |

|

|

|

163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

1,782 |

|

|

|

1,911 |

|

|

|

7,295 |

|

|

|

7,488 |

|

|

|

1,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benefits and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benefits and other changes in policy reserves |

|

|

1,199 |

|

|

|

1,233 |

|

|

|

4,766 |

|

|

|

4,783 |

|

|

|

1,213 |

|

| Liability remeasurement (gains) losses |

|

|

88 |

|

|

|

416 |

|

|

|

153 |

|

|

|

587 |

|

|

|

34 |

|

| Changes in fair value of market risk benefits and associated hedges |

|

|

(3 |

) |

|

|

14 |

|

|

|

(13 |

) |

|

|

(12 |

) |

|

|

21 |

|

| Interest credited |

|

|

101 |

|

|

|

124 |

|

|

|

453 |

|

|

|

503 |

|

|

|

102 |

|

| Acquisition and operating expenses, net of deferrals |

|

|

253 |

|

|

|

248 |

|

|

|

977 |

|

|

|

942 |

|

|

|

259 |

|

| Amortization of deferred acquisition costs and intangibles |

|

|

62 |

|

|

|

63 |

|

|

|

249 |

|

|

|

264 |

|

|

|

62 |

|

| Interest expense |

|

|

27 |

|

|

|

30 |

|

|

|

115 |

|

|

|

118 |

|

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total benefits and expenses |

|

|

1,727 |

|

|

|

2,128 |

|

|

|

6,700 |

|

|

|

7,185 |

|

|

|

1,719 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations before income taxes |

|

|

55 |

|

|

|

(217 |

) |

|

|

595 |

|

|

|

303 |

|

|

|

161 |

|

| Provision (benefit) for income taxes |

|

|

20 |

|

|

|

(36 |

) |

|

|

158 |

|

|

|

104 |

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations |

|

|

35 |

|

|

|

(181 |

) |

|

|

437 |

|

|

|

199 |

|

|

|

121 |

|

| Loss from discontinued operations, net of taxes |

|

|

(5 |

) |

|

|

(2 |

) |

|

|

(10 |

) |

|

|

— |

|

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

30 |

|

|

|

(183 |

) |

|

|

427 |

|

|

|

199 |

|

|

|

118 |

|

| Less: net income attributable to noncontrolling interests |

|

|

31 |

|

|

|

29 |

|

|

|

128 |

|

|

|

123 |

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) available to Genworth Financial, Inc.’s common stockholders |

|

$ |

(1 |

) |

|

$ |

(212 |

) |

|

$ |

299 |

|

|

$ |

76 |

|

|

$ |

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations available to Genworth Financial, Inc.’s common

stockholders per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.01 |

|

|

$ |

(0.47 |

) |

|

$ |

0.71 |

|

|

$ |

0.16 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.01 |

|

|

$ |

(0.47 |

) |

|

$ |

0.70 |

|

|

$ |

0.16 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) available to Genworth Financial, Inc.’s common stockholders per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

— |

|

|

$ |

(0.47 |

) |

|

$ |

0.69 |

|

|

$ |

0.16 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

— |

|

|

$ |

(0.47 |

) |

|

$ |

0.68 |

|

|

$ |

0.16 |

|

|

$ |

0.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

425.3 |

|

|

|

449.4 |

|

|

|

433.9 |

|

|

|

468.8 |

|

|

|

430.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted7 |

|

|

431.0 |

|

|

|

449.4 |

|

|

|

439.4 |

|

|

|

474.9 |

|

|

|

435.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

Reconciliation of Net Income (Loss) to Adjusted Operating Income (Loss)

(Amounts in millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

December 31, |

|

|

Twelve months ended

December 31, |

|

|

Three months

ended

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

(Unaudited) |

|

| Net income (loss) available to Genworth Financial, Inc.’s common stockholders |

|

$ |

(1 |

) |

|

$ |

(212 |

) |

|

$ |

299 |

|

|

$ |

76 |

|

|

$ |

85 |

|

| Add: net income attributable to noncontrolling interests |

|

|

31 |

|

|

|

29 |

|

|

|

128 |

|

|

|

123 |

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

30 |

|

|

|

(183 |

) |

|

|

427 |

|

|

|

199 |

|

|

|

118 |

|

| Less: loss from discontinued operations, net of taxes |

|

|

(5 |

) |

|

|

(2 |

) |

|

|

(10 |

) |

|

|

— |

|

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations |

|

|

35 |

|

|

|

(181 |

) |

|

|

437 |

|

|

|

199 |

|

|

|

121 |

|

| Less: net income from continuing operations attributable to noncontrolling interests |

|

|

31 |

|

|

|

29 |

|

|

|

128 |

|

|

|

123 |

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations available to Genworth Financial, Inc.’s common

stockholders |

|

|

4 |

|

|

|

(210 |

) |

|

|

309 |

|

|

|

76 |

|

|

|

88 |

|

| Adjustments to income (loss) from continuing operations available to Genworth Financial,

Inc.’s common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment (gains) losses, net13 |

|

|

39 |

|

|

|

(38 |

) |

|

|

(17 |

) |

|

|

(25 |

) |

|

|

(66 |

) |

| Changes in fair value of market risk benefits attributable to interest rates, equity markets and

associated hedges14 |

|

|

(24 |

) |

|

|

13 |

|

|

|

(43 |

) |

|

|

(22 |

) |

|

|

17 |

|

| (Gains) losses on early extinguishment of debt,

net15 |

|

|

(2 |

) |

|

|

(1 |

) |

|

|

2 |

|

|

|

(2 |

) |

|

|

(2 |

) |

| Expenses related to restructuring |

|

|

1 |

|

|

|

— |

|

|

|

12 |

|

|

|

4 |

|

|

|

— |

|

| Taxes on adjustments |

|

|

(3 |

) |

|

|

6 |

|

|

|

10 |

|

|

|

10 |

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income (loss) |

|

$ |

15 |

|

|

$ |

(230 |

) |

|

$ |

273 |

|

|

$ |

41 |

|

|

$ |

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Enact segment |

|

$ |

137 |

|

|

$ |

129 |

|

|

$ |

585 |

|

|

$ |

552 |

|

|

$ |

148 |

|

| Long-Term Care Insurance segment |

|

|

(104 |

) |

|

|

(151 |

) |

|

|

(176 |

) |

|

|

(242 |

) |

|

|

(46 |

) |

| Life and Annuities segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Life Insurance |

|

|

2 |

|

|

|

(206 |

) |

|

|

(94 |

) |

|

|

(275 |

) |

|

|

(40 |

) |

| Fixed Annuities |

|

|

1 |

|

|

|

9 |

|

|

|

30 |

|

|

|

50 |

|

|

|

6 |

|

| Variable Annuities |

|

|

2 |

|

|

|

14 |

|

|

|

26 |

|

|

|

37 |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Life and Annuities segment |

|

|

5 |

|

|

|

(183 |

) |

|

|

(38 |

) |

|

|

(188 |

) |

|

|

(27 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and Other |

|

|

(23 |

) |

|

|

(25 |

) |

|

|

(98 |

) |

|

|

(81 |

) |

|

|

(27 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income (loss) |

|

$ |

15 |

|

|

$ |

(230 |

) |

|

$ |

273 |

|

|

$ |

41 |

|

|

$ |

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) available to Genworth Financial, Inc.’s common stockholders per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

— |

|

|

$ |

(0.47 |

) |

|

$ |

0.69 |

|

|

$ |

0.16 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

— |

|

|

$ |

(0.47 |

) |

|

$ |

0.68 |

|

|

$ |

0.16 |

|

|

$ |

0.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.04 |

|

|

$ |

(0.51 |

) |

|

$ |

0.63 |

|

|

$ |

0.09 |

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.04 |

|

|

$ |

(0.51 |

) |

|

$ |

0.62 |

|

|

$ |

0.09 |

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

425.3 |

|

|

|

449.4 |

|

|

|

433.9 |

|

|

|

468.8 |

|

|

|

430.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted7 |

|

|

431.0 |

|

|

|

449.4 |

|

|

|

439.4 |

|

|

|

474.9 |

|

|

|

435.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

Footnote Definitions

| 1 |

Long-term care insurance. |

| 2 |

All references reflect amounts available to Genworth’s common stockholders. |

| 3 |

This is a financial measure that is not calculated based on U.S. Generally Accepted Accounting Principles

(GAAP). See the Use of Non-GAAP Measures section of this press release for additional information. |

| 4 |

Risk-based capital ratio based on company action level for Genworth Life Insurance Company (GLIC) consolidated.

|

| 5 |

Company estimate for the fourth quarter of 2024 due to timing of the preparation and filing of the statutory

financial statement(s). |

| 6 |

Includes approximately $186 million and $162 million of advance cash payments from the company’s

subsidiaries held for future obligations as of December 31, 2024 and September 30, 2024, respectively. |

| 7 |

Under applicable accounting guidance, companies in a loss position are required to use basic weighted-average

common shares outstanding in the calculation of diluted loss per share. Therefore, as a result of the loss from continuing operations available to Genworth Financial, Inc.’s common stockholders for the three months ended December 31, 2023,

the company was required to use basic weighted-average common shares outstanding in the calculation of diluted loss per share for the three months ended December 31, 2023 as the inclusion of shares for performance stock units, restricted stock

units and other equity-based awards of 6.3 million would have been antidilutive to the calculation. If the company had not incurred a loss from continuing operations available to Genworth Financial, Inc.’s common stockholders for the three

months ended December 31, 2023, dilutive potential weighted-average common shares outstanding would have been 455.7 million. |

| 8 |

Reflects Genworth’s ownership of equity including accumulated other comprehensive income (loss) and

excluding noncontrolling interests of $937 million, $944 million and $855 million as of December 31, 2024, September 30, 2024 and December 31, 2023, respectively. |

| 9 |

The Private Mortgage Insurer Eligibility Requirements (PMIERs) sufficiency ratio is calculated as available

assets divided by required assets as defined within PMIERs. |

| 10 |

Genworth’s principal U.S. life insurance companies: GLIC, Genworth Life and Annuity Insurance Company

(GLAIC) and Genworth Life Insurance Company of New York (GLICNY). |

| 11 |

Net gain from operations before dividends to policyholders, refunds to members and federal income taxes for

GLIC, GLAIC and GLICNY, and before realized capital gains or (losses). |

| 12 |

Holding company cash and liquid assets comprises assets held in Genworth Holdings, Inc. (the issuer of

outstanding public debt) which is a wholly-owned subsidiary of Genworth Financial, Inc. |

| 13 |

Net investment (gains) losses were adjusted for the portion attributable to noncontrolling interests of

$2 million for the three months ended December 31, 2024, and $4 million and $2 million for the twelve months ended December 31, 2024 and 2023, respectively. |

| 14 |

Changes in fair value of market risk benefits and associated hedges were adjusted to exclude changes in

reserves, attributed fees and benefit payments of $(21) million and $(1) million for the three months ended December 31, 2024 and 2023, respectively, $(30) million and $(10) million for the twelve months ended December 31, 2024 and 2023,

respectively, and $(4) million for the three months ended September 30, 2024. |

| 15 |

(Gains) losses on early extinguishment of debt were net of the portion attributable to noncontrolling interests

of $2 million for the twelve months ended December 31, 2024. |

13

Exhibit 99.2

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

FOURTH QUARTER 2024

Note:

Unless

otherwise stated, all references in this financial supplement to income (loss) from continuing operations, income (loss) from continuing operations per share, net income (loss), net income (loss) per share, adjusted operating income (loss), adjusted

operating income (loss) per share, book value and book value per share should be read as income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders, income (loss) from continuing operations available to

Genworth Financial, Inc.’s common stockholders per share, net income (loss) available to Genworth Financial, Inc.’s common stockholders, net income (loss) available to Genworth Financial, Inc.’s common stockholders per share, non-U.S. Generally Accepted Accounting Principles (U.S. GAAP) adjusted operating income (loss) available to Genworth Financial, Inc.’s common stockholders, non-GAAP

adjusted operating income (loss) available to Genworth Financial, Inc.’s common stockholders per share, book value available to Genworth Financial, Inc.’s common stockholders and book value available to Genworth Financial, Inc.’s

common stockholders per share, respectively.

2

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

FOURTH QUARTER 2024

Dear Investor,

Thank you for your continued interest in Genworth Financial, Inc.

Please see the accompanying press release and summary presentation posted to the company’s website at https://investor.genworth.com for additional

information regarding its fourth quarter 2024 earnings results.

In the fourth quarter of 2024, the company completed its annual assumption review in its

long-term care and life insurance businesses. Additional information on these updates is included on pages 22 and 25.

Investors are encouraged to listen to

the company’s earnings call on the fourth quarter 2024 results at 9:00 a.m. (ET) on February 19, 2025. The company’s conference call will be accessible via telephone and internet. The dial-in

number for Genworth’s February 19 conference call is 888-208-1820 or

323-794-2110 (outside the U.S.); conference ID #5461958. To participate in the call by webcast, register at least 15 minutes in advance at http://investor.genworth.com.

Regards,

Brian Johnson, Investor Relations

InvestorInfo@genworth.com

3

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

FOURTH QUARTER 2024

Use of Non-GAAP Measures

Management evaluates performance and allocates resources based on a non-GAAP financial measure entitled “adjusted

operating income (loss).” Management evaluates adjusted operating income (loss) as a key measure to assess performance and support new business initiatives because the measure more accurately reflects overall operating performance, as it

minimizes the impact of macroeconomic volatility. The company’s legacy U.S. life insurance subsidiaries, which comprise the Long-Term Care Insurance and Life and Annuities segments, are managed on a standalone basis; therefore, the company does

not allocate capital to its Long-Term Care Insurance and Life and Annuities segments.

The company defines adjusted operating income (loss) as income

(loss) from continuing operations excluding the after-tax effects of income (loss) attributable to noncontrolling interests, net investment gains (losses), changes in fair value of market risk benefits

attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual

non-operating items. A component of the company’s net investment gains (losses) is the result of estimated future credit losses, the size and timing of which can vary significantly depending on market

credit cycles. In addition, the size and timing of other investment gains (losses) can be subject to the company’s discretion and are influenced by market opportunities, as well as asset-liability matching considerations. The company excludes

net investment gains (losses), changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt,

restructuring costs and infrequent or unusual non-operating items from adjusted operating income (loss) because, in the company’s opinion, they are not indicative of overall operating performance.

While some of these items may be significant components of net income (loss) determined in accordance with U.S. GAAP, the company believes that adjusted

operating income (loss), and measures that are derived from or incorporate adjusted operating income (loss), are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the

business. Adjusted operating income (loss) is not a substitute for net income (loss) determined in accordance with U.S. GAAP. In addition, the company’s definition of adjusted operating income (loss) may differ from the definitions used by

other companies.

Adjustments to reconcile net income (loss) to adjusted operating income (loss) assume a 21% tax rate and are net of the portion

attributable to noncontrolling interests. Changes in fair value of market risk benefits and associated hedges are adjusted to exclude changes in reserves, attributed fees and benefit payments.

The table on page 9 of this financial supplement provides a reconciliation of net income (loss) to adjusted operating income (loss) for the periods presented

and reflects adjusted operating income (loss) as determined in accordance with accounting guidance related to segment reporting. This financial supplement includes other non-GAAP measures management believes

enhances the understanding and comparability of performance by highlighting underlying business activity and profitability drivers. These additional non-GAAP measures are on pages 37 to 39 of this financial

supplement.

Statutory Accounting Data

The company

presents certain supplemental statutory data for Genworth Life Insurance Company (GLIC) and its consolidating life insurance subsidiaries that has been prepared on the basis of statutory accounting principles (SAP). GLIC and its consolidating life

insurance subsidiaries file financial statements with state insurance regulatory authorities and the National Association of Insurance Commissioners that are prepared using SAP, an accounting basis either prescribed or permitted by such authorities.

Due to differences in methodology between SAP and U.S. GAAP, the values for assets, liabilities and equity, and the recognition of income and expenses, reflected in financial statements prepared in accordance with U.S. GAAP are materially different

from those reflected in financial statements prepared under SAP. This supplemental statutory data should not be viewed as an alternative to, or used in lieu of, U.S. GAAP.

This supplemental statutory data includes the impact from in-force rate actions on

pre-tax long-term care insurance statutory earnings. Statutory pre-tax earnings represent the net gain from operations, including the impact from in-force rate actions, before dividends to policyholders, refunds to members and federal income taxes and before realized capital gains or (losses). Management uses and provides this supplemental statutory data

because it believes it provides a useful measure of, among other things, statutory pre-tax earnings and the adequacy of capital. Management uses this data to measure against its policy to manage the U.S. life

insurance companies with internally generated capital.

4

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

FOURTH QUARTER 2024

Results of Operations and Selected Operating Performance Measures

The company allocates tax to its businesses at the U.S. corporate federal income tax rate of 21%. Each segment is then adjusted to reflect the unique tax

attributes of that segment, such as permanent differences between U.S. GAAP and tax law. The difference between the consolidated provision for income taxes and the sum of the provision for income taxes in each segment is reflected in Corporate and

Other.

The annually-determined tax rates and adjustments to each segment’s provision for income taxes are estimates which are subject to review and

could change from year to year. U.S. GAAP generally requires an annualized effective tax rate to be used for interim reporting periods, utilizing projections of full year results. However, in certain circumstances, it is appropriate to record the

actual effective tax rate for the period if a reliable estimate cannot be made for the full year. Although the company used the annualized projected effective tax rate during the interim reporting period ending March 31, 2024 for all segments,

the company concluded that using an actual effective tax rate reflecting actual year-to-date income (loss) provides a better estimate for its Long-Term Care Insurance

and Life and Annuities segments for interim reporting. Accordingly, for the three months ended June 30, 2024 and September 30, 2024, the company utilized the actual effective tax rate for the interim period to record the provision for

income taxes for its Long-Term Care Insurance and Life and Annuities segments and the annualized projected effective tax rate for its Enact segment and Corporate and Other. This method was also utilized for the three months ended March 31,

2023, June 30, 2023 and September 30, 2023.

This financial supplement contains selected operating performance measures including “new

insurance written,” “insurance in-force” and “risk in-force,” which are commonly used in the insurance industry as measures of operating

performance.

Management regularly monitors and reports new insurance written for the company’s Enact segment as a measure of volume of new business

generated in a period. The company considers new insurance written to be a measure of the operating performance of its Enact segment because it represents a measure of new sales of mortgage insurance policies during a specified period, rather than a

measure of revenues or profitability during that period.

Management also regularly monitors and reports insurance

in-force and risk in-force for the company’s Enact segment. Insurance in-force is a measure of the aggregate unpaid

principal balance as of the respective reporting date for loans insured by the company’s U.S. mortgage insurance subsidiaries. Risk in-force is based on the coverage percentage applied to the estimated

current outstanding loan balance. These metrics are presented on a direct basis and exclude reinsurance. The company considers insurance in-force and risk in-force to be

measures of the operating performance of its Enact segment because they represent measures of the size of its business at a specific date which will generate revenues and profits in a future period, rather than measures of its revenues or

profitability during that period.

Management also regularly monitors and reports a loss ratio and an expense ratio for the company’s Enact segment.

The company considers the loss ratio, which is the ratio of benefits and other changes in policy reserves to net earned premiums, to be a measure of underwriting performance. The expense ratio is the ratio of general expenses to net earned premiums.

Enact’s general expenses consist of acquisition and operating expenses, net of deferrals, and amortization of deferred acquisition costs and intangibles. The company believes these ratios help to enhance the understanding of the operating

performance of the Enact segment.

These operating performance measures enable the company to compare its operating performance across periods without

regard to revenues or profitability related to policies or contracts sold in prior periods or from investments or other sources.

5

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

FOURTH QUARTER 2024

Financial Highlights

(amounts in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance Sheet Data |

|

December 31,

2024 |

|

|

September 30,

2024 |

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

| Total Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other

comprehensive income (loss) |

|

$ |

10,136 |

|

|

$ |

10,182 |

|

|

$ |

10,146 |

|

|

$ |

10,100 |

|

|

$ |

10,035 |

|

| Total accumulated other comprehensive income

(loss)(1) |

|

|

(1,642 |

) |

|

|

(1,871 |

) |

|

|

(1,687 |

) |

|

|

(2,094 |

) |

|

|

(2,555 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Genworth Financial, Inc.’s stockholders’ equity |

|

$ |

8,494 |

|

|

$ |

8,311 |

|

|

$ |

8,459 |

|

|

$ |

8,006 |

|

|

$ |

7,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per share |

|

$ |

20.16 |

|

|

$ |

19.40 |

|

|

$ |

19.49 |

|

|

$ |

18.21 |

|

|

$ |

16.74 |

|

| Book value per share, excluding accumulated other comprehensive income (loss) |

|

$ |

24.05 |

|

|

$ |

23.77 |

|

|

$ |

23.38 |

|

|

$ |

22.98 |

|

|

$ |

22.46 |

|

| Common shares outstanding as of the balance sheet date |

|

|

421.4 |

|

|

|

428.4 |