UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

| | | | | | | | |

| Hamilton Beach Brands Holding Company |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 001-38214 | 31-1236686 |

(State or other jurisdiction

of incorporation or organization) | (Commission File No.) | (I.R.S. Employer

Identification No.) |

| | |

4421 WATERFRONT DR.

GLEN ALLEN, VA | | 23060 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

| Lawrence K. Workman, Jr. (804) 273-9777 |

(Name and telephone number, including area code, of the

person to contact in connection with this report.) |

|

| Check the appropriate box to indicate the rule pursuant to which this Form is being submitted, and provide the period to which the information in this form applies: |

|

ý Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

¨ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended ____________.

|

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

The Conflict Minerals Report for the calendar year ended December 31, 2023 filed herewith as Exhibit 1.01 is publicly available at https://www.hamiltonbeach.com/social-accountability-policy.

Item 1.02 Exhibit

The Conflict Minerals Report required by Item 1.01 is filed herewith as Exhibit 1.01.

Section 2 - Resource Extraction Issuer Disclosure

Not applicable.

Section 3 - Exhibits

Item 3.01 Exhibits

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | | | | |

| | Hamilton Beach Brands Holding Company (Registrant) | |

| Date: | May 23, 2024 | /s/ Lawrence K. Workman, Jr. | |

| | Lawrence K. Workman, Jr. | |

| | Senior Vice President, General Counsel and Secretary | |

Exhibit 1.01

Conflict Minerals Report for the Year Ended December 31, 2023

Introduction

Hamilton Beach Brands Holding Company (collectively with its consolidated subsidiaries, “Hamilton Beach Holding”, “the Company”, “we”, “us” and “our”) operates through its indirect, wholly-owned subsidiary Hamilton Beach Brands, Inc and its subsidiaries. We are a leading designer, marketer and distributor of a wide range of branded small electric household and specialty housewares appliances, as well as commercial products for restaurants, fast food chains, bars and hotels, and are a provider of connected devices and software for healthcare management. Our operations, including the operations of our consolidated subsidiaries, may at times manufacture, or contract to manufacture, products for which conflict minerals (as defined below) are necessary to the functionality or production of those products (collectively, our “products”).

This Conflict Minerals Report (this “Report”) has been prepared pursuant to Rule 13p-1 and Form SD promulgated under the Securities Exchange Act of 1934, as amended, for the reporting period from January 1, 2023 to December 31, 2023 (the “Reporting Period”).

Statements in this Report, which express a belief, expectation, or intention, as well as those that are not historical fact, are forward-looking statements, including statements related to our compliance efforts and expected actions identified under the “Improvement Plan” section of this Report. These forward-looking statements are subject to various risks, uncertainties, and assumptions, including, among other matters, our customers’ requirements to use certain suppliers, our suppliers’ responsiveness and cooperation with our due diligence efforts, our ability to implement improvements in our conflict minerals program and our ability to identify and mitigate related risks in our supply chain. If one or more of these or other risks materialize, actual results may vary materially from those expressed in or implied by the forward-looking statements. For a more complete discussion of these and other risk factors, see our other filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2023. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report, and we undertake no obligation to update or revise any forward-looking statement, except to the extent required by applicable law.

Rule 13p-1, through Form SD, requires the disclosure of certain information if a company manufactures or contracts to manufacture products for which certain conflict minerals are necessary to the functionality or production of such products. Form SD defines “conflict minerals” as: (i)(a) columbite-tantalite (or coltan), (b) cassiterite, (c) gold, and (d) wolframite, or their derivatives, which are currently limited to tantalum, tin and tungsten; or (ii) any other mineral or its derivatives determined by the U.S. Secretary of State to be financing conflict in the Democratic Republic of the Congo or an adjoining country (collectively, the “Covered Countries”).

If an issuer has reason to believe that any of the conflict minerals in its supply chain may have originated in the Covered Countries and that they may not be from recycled or scrap sources, or if it is unable to determine the country of origin of those conflict minerals, then the issuer must submit a Report to the SEC that includes, among other matters, a description of the due diligence measures that it undertook with respect to the conflict minerals' source and chain of custody. This Report relates to the process undertaken for our products that were manufactured, or contracted to be manufactured, during the Reporting Period and that contain conflict minerals.

We have filed with the SEC our Form SD, which includes this Report as Exhibit 1.01, for the Reporting Period. This Report is also publicly available at https://hamiltonbeach.com/social-accountability-policy.

Executive Summary

We performed a Reasonable Country of Origin Inquiry ("RCOI") on suppliers believed to provide us with materials or components containing conflict minerals necessary to the manufacturing of our products during the Reporting Period. This good faith RCOI was reasonably designed to determine whether any of the conflict minerals included in our products originated in the Covered Countries and whether any of such conflict minerals may be from recycled or scrap sources, in accordance with Form SD and related guidance provided by the SEC. Our global supply chain is complex. Because we do not purchase minerals directly from mines, smelters or refiners, there are many third parties in the supply chain between us and the original sources of any conflict minerals. As a result, we rely on our direct suppliers and manufacturers to provide information regarding the origin of any conflict minerals contained in the components or parts that they provide to us for incorporation into our products. Through the RCOI process, we determined that the Company does not contract to manufacture products that contain gold, tantalum, or tungsten, but it does contract to manufacture products that contain tin. As a result of this process, our suppliers identified 53 tin smelters and refineries (“smelters”) that could potentially provide materials containing tin in our supply chain. Of these 53 smelters, we identified five as sourcing (or there was a reason to believe they may be sourcing) from the Covered Countries. The Company's due diligence review indicated that all five of these smelters have been audited by the Responsible Minerals Assurance Process (“RMAP”).

Company Management Systems

The Company established a management system according to Step 1 of the Organization for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High Risk Areas (the “OECD Guidelines”). The Company’s system included the following:

•Step 1A - Adopt, and clearly communicate to suppliers and the public, a company policy for the supply chain of minerals originating from conflict-affected and high-risk areas.

◦Implemented a conflict minerals policy;

◦Publicized the policy at https://hamiltonbeach.com/social-accountability-policy; and

◦Communicated the policy directly to suppliers as part of RCOI process.

•Step 1B - Structure internal management to support supply chain due diligence.

◦Maintained an internal cross functional team to support supply chain due diligence;

◦Appointed a member of senior staff with the necessary competence, knowledge and experience to oversee supply chain due diligence; and

◦Invested the resources necessary to support the operation and monitoring of these processes, including internal resources and external consulting support.

•Step 1C - Establish a system of transparency, information collection and control over the supply chain.

◦Implemented a process to collect required supplier and smelter RCOI and due diligence data. Details on the supply chain data-gathering are included in the RCOI and due diligence sections of this Report.

•Step 1D - Enhance company engagement with suppliers.

◦Engaged suppliers directly during RCOI process;

◦Reviewed supplier responses as part of RCOI process;

◦Added conflict minerals compliance to new supplier contracts and the Company’s supplier code of conduct; and

◦Implemented a plan to improve the quantity and quality of supplier and smelter responses year-over-year.

•Step 1E - Establish a company and/or mine level grievance mechanism.

◦Recognized the RMAP’s three audit protocols for gold, tin/tantalum, and tungsten as valid sources of smelter or mine level grievances; and

◦The Company’s ethics violations reporting system allows employees to voice, confidentially without any fear of retribution, any concerns with suspected violations of the Company’s conflict minerals policy.

Reasonable Country of Origin Inquiry (RCOI)

The Company designed its RCOI process in accordance with Step 2A and 2B of the OECD Guidelines. The Company’s RCOI process involved two stages:

•Stage 1 - Supplier RCOI (Step 2A of the OECD Guidelines); and

•Stage 2 - Smelter RCOI (Step 2B of the OECD Guidelines).

Supplier RCOI

The Company designed its supplier RCOI process in accordance with Step 2A of the OECD Guidelines. The Company’s supplier RCOI process for the Reporting Period included the following:

•Developed a list of suppliers providing conflict minerals containing components to the Company;

•Contacted each supplier and requested the industry standard Conflict Minerals Reporting Template including smelter information;

•Reviewed supplier responses for accuracy and completeness; and

•Amalgamated supplier provided smelters into a single unique list of smelters meeting the definition of a smelter under one of three industry recognized audit protocols.

For the Reporting Period, the Company’s RCOI process was executed by Claigan Environmental Inc. (“Claigan”).

The Company’s suppliers identified a total of 53 smelters in their supply chains. Despite receiving responses from certain suppliers listing smelters in their supply chain, the vast majority of our suppliers provided data at a company or divisional level, or otherwise were unable to accurately report which specific smelters were part of the supply chain for the components or parts containing the conflict minerals that were supplied to us during the Reporting Period. Therefore, we are not able to identify the specific facilities that processed conflict minerals contained in our products during the Reporting Period or to conclusively determine the country of origin of such conflict minerals.

Smelter RCOI

Due to the overlap between supplier RCOI and smelter due diligence, the smelter RCOI process is summarized in the due diligence section of this Report.

Due Diligence

The Company’s due diligence process was designed in accordance with the applicable sections of Steps 2, 3 and 4 of the OECD Guidelines.

Smelter RCOI and Due Diligence

The Company’s smelter RCOI and due diligence process were designed to:

•Identify the scope of the risk assessment of the mineral supply chain (OECD Step 2B);

•Assess whether the smelters/refiners have performed all elements of due diligence for responsible supply chains of minerals from conflict-affected and high-risk areas (OECD Step 2C); and

•Perform joint spot checks at the mineral smelter/refiner’s own facilities, as necessary, through participation in industry-driven programs (OECD Step 2D).

The Company’s smelter RCOI and due diligence process included the following for each smelter identified by suppliers as possibly being in the Company’s supply chain:

•Direct engagement of the smelter to determine whether the smelter sourced conflict minerals from the Covered Countries that were not from recycled or scrap sources;

•For smelters that declared directly (e.g., email correspondence, publicly available conflict minerals policy, or information available on their website) or through their relevant industry association that they did not source conflict minerals from the Covered Countries that were not from recycled or scrap sources, and were not audited by the RMAP, the Company reviewed publicly available information to determine if there was any contrary evidence to the smelter’s declaration. The sources reviewed included:

◦Public internet search (Google) of the facility in combination with each of the Covered Countries;

◦Review of specific Non-Governmental Organizations (“NGO”) publications. NGO publications reviewed included:

•Enough Project;

•Global Witness;

•Southern Africa Resource Watch;

•Radio Okapi; and

•The most recent UN Group of Experts report on the Covered Countries.

•For smelters that did not respond to direct engagement, the Company reviewed publicly available sources to determine if there was “any reason to believe” that the smelter may have sourced from the Covered Countries during the reporting period.

◦The Company reviewed the same sources as those used to compare against smelter sourcing declarations.

•For “high-risk smelters” (i.e., smelters that are sourcing from or there is reason to believe they may be sourcing from the Covered Countries and not conformant to the RMAP), the Company communicated the risk to a designated member of senior management (OECD Step 3A) and conducted risk mitigation on the smelter according to OECD Step 3B.

For the Reporting Period, our smelter RCOI and Due Diligence process was executed by Claigan.

Results of Assessment

Despite receiving responses from certain suppliers listing smelters in their supply chain, the vast majority of our suppliers provided data at a company or divisional level, or otherwise were unable to accurately report which specific smelters were part of the supply chain for the components or parts containing the conflict minerals that were supplied to us during the Reporting Period. Therefore, we are not able to identify the specific facilities that processed conflict minerals contained in our products during the Reporting Period or to conclusively determine the country of origin of such conflict minerals.

Improvement Plan

The Company is taking and will continue to take the following steps to improve its due diligence process so as to further mitigate any risk that the necessary conflict minerals in the Company’s products could directly or indirectly benefit or finance armed groups in the Covered Countries:

•Including a conflict minerals provision in all new and renewing supplier contracts;

•Including conflict minerals compliance in the Company’s supplier code of conduct;

•Continuing to encourage suppliers to obtain current, accurate and complete information about the smelters in their supply chain; and

•Encouraging smelters sourcing from Covered Countries to be conformant to the RMAP.

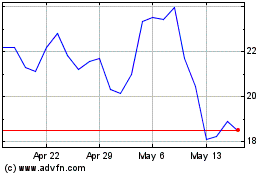

Hamilton Beach Brands (NYSE:HBB)

Historical Stock Chart

From May 2024 to Jun 2024

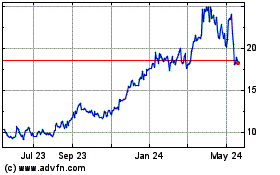

Hamilton Beach Brands (NYSE:HBB)

Historical Stock Chart

From Jun 2023 to Jun 2024