HubSpot, Inc. (NYSE: HUBS), the customer platform for scaling

companies, today announced financial results for the fourth quarter

and full year ended December 31, 2024.

Financial Highlights:

Revenue Fourth Quarter 2024:

- Total revenue was $703.2 million, up 21% on an as-reported

basis and 20% in constant currency compared to Q4'23.

- Subscription revenue was $687.3 million, up 21% on an

as-reported basis compared to Q4'23.

- Professional services and other revenue was $15.9 million, up

36% on an as-reported basis compared to Q4'23.

Full Year 2024:

- Total revenue was $2.63 billion, up 21% on an as-reported basis

and in constant currency compared to 2023.

- Subscription revenue was $2.57 billion, up 21% on an

as-reported basis compared to 2023.

- Professional services and other revenue was $58.0 million, up

24% on an as-reported basis compared to 2023.

Operating Income (Loss) Fourth Quarter 2024:

- GAAP operating margin was (1.5%), compared to (4.0%) in

Q4'23.

- Non-GAAP operating margin was 18.9%, compared to 17.1% in

Q4'23.

- GAAP operating loss was ($10.8) million, compared to ($23.2)

million in Q4'23.

- Non-GAAP operating income was $133.1 million, compared to $99.3

million in Q4'23.

Full Year 2024:

- GAAP operating margin was (2.6%), compared to (9.3%) in

2023.

- Non-GAAP operating margin was 17.5%, compared to 15.5% in

2023.

- GAAP operating loss was ($67.6) million, compared to ($200.9)

million in 2023.

- Non-GAAP operating income was $460.2 million, compared to

$337.4 million in 2023.

Net Income (Loss) Fourth Quarter 2024:

- GAAP net income was $4.9 million, or $0.10 per basic and $0.09

per diluted share, compared to net loss of ($12.4) million, or

($0.25) per basic and diluted share in Q4'23.

- Non-GAAP net income was $124.9 million, or $2.42 per basic and

$2.32 per diluted share, compared to $93.3 million, or $1.85 per

basic and $1.77 per diluted share in Q4'23.

- Weighted average basic and diluted shares outstanding for GAAP

net income (loss) per share was 51.7 million and 52.2 million

respectively, compared to 50.3 million basic and diluted shares in

Q4'23.

- Weighted average basic and diluted shares outstanding for

non-GAAP net income per share was 51.7 million and 53.9 million

respectively, compared to 50.3 million and 52.6 million,

respectively in Q4'23.

Full Year 2024:

- GAAP net income was $4.6 million, or $0.09 per basic and

diluted share, compared to net loss of ($164.5) million, or ($3.30)

per basic and diluted share in 2023.

- Non-GAAP net income was $434.1 million, or $8.48 per basic and

$8.12 per diluted share, compared to $313.1 million, or $6.28 per

basic and $6.00 per diluted share in 2023.

- Weighted average basic and diluted shares outstanding for GAAP

net income (loss) per share was 51.2 million and 51.8 million

respectively, compared to 49.9 million basic and diluted shares in

2023.

- Weighted average basic and diluted shares outstanding for

non-GAAP net income per share was 51.2 million and 53.4 million

respectively, compared to 49.9 million and 52.2 million,

respectively in 2023.

Balance Sheet and Cash Flow

- The company’s cash, cash equivalents, and short-term and

long-term investments balance was $2.2 billion as of December 31,

2024.

- During the fourth quarter, the company generated $194.1 million

of cash from operating cash flow, compared to $104.3 million during

Q4'23.

- During the fourth quarter, the company generated $198.6 million

of cash from non-GAAP operating cash flow and $163.0 million of

non-GAAP free cash flow, compared to $108.7 million of cash from

non-GAAP operating cash flow and $83.0 million of non-GAAP free

cash flow during Q4'23.

- During 2024, the company generated $598.6 million of cash from

operating cash flow, compared to $351.0 million during 2023.

- During 2024, the company generated $615.6 million of cash from

non-GAAP operating cash flow and $488.1 million of non-GAAP free

cash flow, compared to $392.5 million of cash from non-GAAP

operating cash flow and $292.5 million of non-GAAP free cash flow

during 2023.

Additional Recent Business Highlights

- Grew Customers to 247,939 at December 31, 2024, up 21% from

December 31, 2023.

- Average Subscription Revenue Per Customer was $11,312 during

the fourth quarter of 2024, down 0.5% on an as-reported basis

compared to the fourth quarter of 2023.

- Calculated billings were $767.6 million in the fourth quarter

of 2024, up 16% on an as-reported basis and 21% in constant

currency compared to Q4'23.

“We had a solid finish to 2024, highlighting our leadership as a

platform company”, said Yamini Rangan, Chief Executive Officer at

HubSpot. “2024 was a transformative year for HubSpot as we

reimagined our product, our platform, and company with AI. I’m

excited by the progress we’ve made in embedding AI across our hubs

and the value it’s driving for customers. Heading into 2025, we're

focused on cementing our position as the leading AI-first customer

platform for scaling companies. We are entering the year with more

clarity on strategy, more alignment on outcomes and more urgency in

execution than ever before.”

Business Outlook

Based on information available as of February 12, 2025, HubSpot

is issuing guidance for the full year 2025 and first quarter of

2025 as indicated below.

Full Year 2025:

- Total revenue is expected to be in the range of $2.985 billion

to $2.995 billion, up 14% year over year on an as-reported basis

and 16% in constant currency.

- Non-GAAP operating income is expected to be in the range of

$543.0 million to $547.0 million, representing an 18% operating

profit margin.

- Non-GAAP net income per common share is expected to be in the

range of $9.11 to $9.19. This assumes approximately 53.9 million

weighted average diluted shares outstanding.

First Quarter 2025:

- Total revenue is expected to be in the range of $697.0 million

to $699.0 million, up 13% year over year on an as-reported basis

and 15% in constant currency.

- Non-GAAP operating income is expected to be in the range of

$98.0 million to $99.0 million, representing a 14% operating profit

margin.

- Non-GAAP net income per common share is expected to be in the

range of $1.74 to $1.76. This assumes approximately 54.1 million

weighted average diluted shares outstanding.

Use of Non-GAAP Financial Measures

In our earnings press releases, conference calls, slide

presentations, and webcasts, we may use or discuss non-GAAP

financial measures, as defined by Regulation G. The GAAP financial

measure most directly comparable to each non-GAAP financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP financial measure and the comparable GAAP financial

measure, are included in this press release after the consolidated

financial statements. Our earnings press releases containing such

non-GAAP reconciliations can be found in the Investors section of

our website ir.hubspot.com.

Conference Call Information

HubSpot will host a conference call on Wednesday, February 12,

2025 at 4:30 p.m. Eastern Time (ET) to discuss the company’s fourth

quarter and full year 2024 financial results and its business

outlook. To register for this conference call, please use this dial

in registration link or visit HubSpot's Investor Relations website

at ir.hubspot.com. After registering, a confirmation email will be

sent, including dial-in details and a unique code for entry.

Participants who wish to register for the conference call webcast

please use this link.

An archived webcast of this conference call will also be

available on HubSpot's Investor Relations website at

ir.hubspot.com.

The company has used, and intends to continue to use, the

investor relations portion of its website as a means of disclosing

material non-public information and for complying with disclosure

obligations under Regulation FD.

About HubSpot

HubSpot is the customer platform that helps businesses connect

and grow better. HubSpot delivers seamless connection for

customer-facing teams with a unified platform that includes

AI-powered engagement hubs, a Smart CRM, and a connected ecosystem

with over 1,700 App Marketplace integrations, a community network,

and educational content. Learn more at www.hubspot.com.

Cautionary Language Concerning Forward-Looking

Statements

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements regarding management’s expectations

of future financial and operational performance and operational

expenditures, expected growth, foreign currency movement, and

business outlook, including our financial guidance for the first

fiscal quarter of and full year 2025 and our long-term financial

framework; statements regarding our positioning for future growth

and market leadership; statements regarding the economic

environment; and statements regarding expected market trends,

future priorities and related investments, and market

opportunities. These forward-looking statements include, but are

not limited to, plans, objectives, expectations and intentions and

other statements contained in this press release that are not

historical facts and statements identified by words such as

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates” or words of similar meaning. These forward-looking

statements reflect our current views about our plans, intentions,

expectations, strategies and prospects, which are based on the

information currently available to us and on assumptions we have

made. Although we believe that our plans, intentions, expectations,

strategies and prospects as reflected in or suggested by those

forward-looking statements are reasonable, we can give no assurance

that the plans, intentions, expectations or strategies will be

attained or achieved. Furthermore, actual results may differ

materially from those described in the forward-looking statements

and will be affected by a variety of risks and factors that are

beyond our control including, without limitation, risks associated

with our history of losses; our ability to retain existing

customers and add new customers; the continued growth of the market

for a customer platform; our ability to develop new products and

technologies and differentiate our platform from competing products

and technologies, including artificial intelligence and machine

learning technologies; our ability to manage our growth effectively

over the long-term to maintain our high level of service; our

ability to maintain and expand relationships with our solutions

partners; the price volatility of our common stock; the impact of

geopolitical conflicts, inflation, foreign currency movement, and

macroeconomic instability on our business, the broader economy, our

workforce and operations, the markets in which we and our partners

and customers operate, and our ability to forecast our future

financial performance; regulatory and legislative developments on

the use of artificial intelligence and machine learning; and other

risks set forth under the caption “Risk Factors” in our SEC

filings. We assume no obligation to update any forward-looking

statements contained in this document as a result of new

information, future events or otherwise.

Consolidated Balance Sheets

(in thousands)

December 31,

December 31,

2024

2023(1)

Assets

Current assets:

Cash and cash equivalents

$

512,667

$

387,987

Short-term investments

1,556,828

1,000,245

Accounts receivable

334,829

295,303

Deferred commission expense

148,693

99,326

Prepaid expenses and other current

assets

80,586

88,679

Total current assets

2,633,603

1,871,540

Long-term investments

154,212

325,703

Property and equipment, net

114,165

103,331

Capitalized software development costs,

net

154,484

106,229

Right-of-use assets

216,230

251,071

Deferred commission expense, net of

current portion

160,814

122,194

Other assets

115,254

75,247

Intangible assets, net

37,563

42,316

Goodwill

209,508

173,761

Total assets

$

3,795,833

$

3,071,392

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

3,649

$

9,106

Accrued compensation costs

67,442

53,462

Accrued commissions

102,043

78,169

Accrued expenses and other current

liabilities

125,135

94,074

Operating lease liabilities

32,693

35,047

Convertible senior notes

458,184

—

Deferred revenue

784,253

672,150

Total current liabilities

1,573,399

942,008

Operating lease liabilities, net of

current portion

254,539

296,561

Deferred revenue, net of current

portion

3,969

5,810

Other long-term liabilities

55,640

36,459

Convertible senior notes, net of current

portion

—

456,206

Total liabilities

1,887,547

1,737,044

Stockholders’ equity:

Common stock

52

50

Additional paid-in capital

2,713,697

2,136,908

Accumulated other comprehensive (loss)

income

(5,654

)

1,827

Accumulated deficit

(799,809

)

(804,437

)

Total stockholders’ equity

1,908,286

1,334,348

Total liabilities and stockholders’

equity

$

3,795,833

$

3,071,392

(1) In the three months ended March 31, 2024, we discovered an

immaterial error in our calculation of Cost of

Revenues—Subscription related to how we calculate contractual

credits in one of our third-party vendor agreements. As a result,

we have revised the Consolidated Statement of Operations by

reducing Cost of Revenues- Subscription by $1.2 million for the

three months ended December 31, 2023 and $7.1 million for the year

ended December 31, 2023 to reflect the revised impact of the

credits on that period. We have also revised the balance sheet as

of December 31, 2023 to reflect the cumulative impact of the error

on prior periods, resulting in a decrease to accrued expenses and

other current liabilities and a decrease to accumulated deficit

totaling $14.2 million. Lastly, we have updated certain line items

within the operating section of the statement of cash flows for the

three months and year ended December 31, 2023 but note no net

impact to cash flows provided by operating activities. Refer to our

Form 10-K for additional information.

Consolidated Statements of

Operations

(in thousands, except per share data)

Three Months Ended December

31,

For the Year Ended December

31,

2024

2023(1)

2024

2023(1)

Revenues:

Subscription

$

687,316

$

570,225

$

2,569,546

$

2,123,479

Professional services and other

15,856

11,689

57,997

46,751

Total revenue

703,172

581,914

2,627,543

2,170,230

Cost of revenues:

Subscription

89,505

73,664

336,878

283,675

Professional services and other

13,867

13,777

56,387

54,687

Total cost of revenues

103,372

87,441

393,265

338,362

Gross profit

599,800

494,473

2,234,278

1,831,868

Operating expenses:

Research and development

213,711

163,234

778,714

617,745

Sales and marketing

314,864

281,136

1,218,844

1,068,560

General and administrative

80,931

69,708

300,332

249,649

Restructuring

1,143

3,547

3,990

96,843

Total operating expenses

610,649

517,625

2,301,880

2,032,797

Loss from operations

(10,849

)

(23,152

)

(67,602

)

(200,929

)

Other income (expense):

Interest income

21,829

18,633

82,706

58,828

Interest expense

(949

)

(984

)

(3,721

)

(3,801

)

Other income (expense)

2,913

(2,551

)

17,294

(4,673

)

Total other income

23,793

15,098

96,279

50,354

Income (loss) before income tax

expense

12,944

(8,054

)

28,677

(150,575

)

Income tax expense

(8,009

)

(4,360

)

(24,049

)

(13,935

)

Net income (loss)

$

4,935

$

(12,414

)

$

4,628

$

(164,510

)

Net income (loss) per share, basic

$

0.10

$

(0.25

)

$

0.09

$

(3.30

)

Net income (loss) per share, diluted

$

0.09

$

(0.25

)

$

0.09

$

(3.30

)

Weighted average common shares used in

computing basic net income (loss) per share:

51,657

50,347

51,178

49,877

Weighted average common shares used in

computing diluted net income (loss) per share:

52,242

50,347

51,819

49,877

(1) In the three months ended March 31, 2024, we discovered an

immaterial error in our calculation of Cost of

Revenues—Subscription related to how we calculate contractual

credits in one of our third-party vendor agreements. As a result,

we have revised the Consolidated Statement of Operations by

reducing Cost of Revenues- Subscription by $1.2 million for the

three months ended December 31, 2023 and $7.1 million for the year

ended December 31, 2023 to reflect the revised impact of the

credits on that period. We have also revised the balance sheet as

of December 31, 2023 to reflect the cumulative impact of the error

on prior periods, resulting in a decrease to accrued expenses and

other current liabilities and a decrease to accumulated deficit

totaling $14.2 million. Lastly, we have updated certain line items

within the operating section of the statement of cash flows for the

three months and year ended December 31, 2023 but note no net

impact to cash flows provided by operating activities. Refer to our

Form 10-K for additional information.

Consolidated Statements of Cash

Flows

(in thousands)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2024

2023(1)

2024

2023(1)

Operating Activities:

Net income (loss)

$

4,935

$

(12,414

)

$

4,628

$

(164,510

)

Adjustments to reconcile net income (loss)

to net cash and cash equivalents provided by operating

activities

Depreciation and amortization

28,381

19,165

96,828

72,673

Stock-based compensation

134,388

113,726

504,770

432,271

Restructuring charges

—

2,325

—

67,263

Gain on strategic investments

(2,690

)

—

(21,245

)

—

Impairment of strategic investments

1,212

1,704

5,306

1,704

Provision for (benefit from) deferred

income taxes

3,301

265

2,690

550

Amortization of debt discount and issuance

costs

511

509

2,012

1,986

Accretion of bond discount

(14,982

)

(12,694

)

(51,676

)

(42,907

)

Unrealized currency translation

1,827

1,039

(1,550

)

(341

)

Changes in assets and liabilities

Accounts receivable

(62,241

)

(70,791

)

(48,428

)

(57,618

)

Prepaid expenses and other assets

4,191

(11,025

)

(4,415

)

(47,048

)

Deferred commission expense

(35,262

)

(26,843

)

(96,687

)

(81,178

)

Right-of-use assets

5,836

5,929

32,297

29,173

Accounts payable

(6,026

)

(8,866

)

(4,577

)

(14,031

)

Accrued expenses and other liabilities

49,807

41,013

89,129

79,947

Operating lease liabilities

(8,966

)

(7,956

)

(41,521

)

(36,889

)

Deferred revenue

89,919

69,227

131,038

109,926

Net cash and cash equivalents provided by

operating activities

194,141

104,313

598,599

350,971

Investing Activities:

Purchases of investments

(507,272

)

(443,221

)

(1,993,610

)

(1,580,504

)

Maturities of investments

503,046

347,750

1,658,601

1,502,534

Sale of investments

—

—

1,997

—

Purchases of property and equipment

(12,726

)

(8,687

)

(37,939

)

(33,718

)

Purchases of strategic investments

(3,972

)

(2,913

)

(15,538

)

(14,413

)

Purchases of intangible assets

(1,231

)

(164

)

(1,231

)

(164

)

Capitalization of software development

costs

(22,915

)

(17,084

)

(89,636

)

(66,372

)

Acquisition of a business, net of cash

acquired

(40,438

)

(142,129

)

(40,438

)

(142,129

)

Proceeds from net working capital

settlement

—

—

1,933

—

Net cash and cash equivalents used in

investing activities

(85,508

)

(266,448

)

(515,861

)

(334,766

)

Financing Activities:

Repayment of 2025 Convertible Notes

attributable to the principal

(57

)

(13

)

(57

)

(13

)

Employee taxes paid related to the net

share settlement of stock-based awards

(4,172

)

(3,143

)

(21,949

)

(10,714

)

Proceeds related to the issuance of common

stock under stock plans

14,290

9,804

75,501

47,738

Net cash and cash equivalents provided by

financing activities

10,061

6,648

53,495

37,011

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(16,087

)

8,829

(11,553

)

4,649

Net increase (decrease) in cash, cash

equivalents and restricted cash

102,607

(146,658

)

124,680

57,865

Cash, cash equivalents and restricted

cash, beginning of period

414,113

538,698

392,040

334,175

Cash, cash equivalents and restricted

cash, end of period

$

516,720

$

392,040

$

516,720

$

392,040

(1) In the three months ended March 31, 2024, we discovered an

immaterial error in our calculation of Cost of

Revenues—Subscription related to how we calculate contractual

credits in one of our third-party vendor agreements. As a result,

we have revised the Consolidated Statement of Operations by

reducing Cost of Revenues- Subscription by $1.2 million for the

three months ended December 31, 2023 and $7.1 million for the year

ended December 31, 2023 to reflect the revised impact of the

credits on that period. We have also revised the balance sheet as

of December 31, 2023 to reflect the cumulative impact of the error

on prior periods, resulting in a decrease to accrued expenses and

other current liabilities and a decrease to accumulated deficit

totaling $14.2 million. Lastly, we have updated certain line items

within the operating section of the statement of cash flows for the

three months and year ended December 31, 2023 but note no net

impact to cash flows provided by operating activities. Refer to our

Form 10-K for additional information.

Reconciliation of non-GAAP operating

income and operating margin

(in thousands, except percentages)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2024

2023

2024

2023

GAAP operating loss

$

(10,849

)

$

(23,152

)

$

(67,602

)

$

(200,929

)

Stock-based compensation

134,388

113,726

504,770

432,271

Amortization of acquired intangible

assets

2,527

1,304

9,557

5,311

Acquisition related expense

5,863

3,906

9,496

3,906

Restructuring charges

1,143

3,547

3,990

96,843

Non-GAAP operating income

$

133,072

$

99,331

$

460,211

$

337,402

GAAP operating margin

(1.5

%)

(4.0

%)

(2.6

%)

(9.3

%)

Non-GAAP operating margin

18.9

%

17.1

%

17.5

%

15.5

%

Reconciliation of non-GAAP net

income

(in thousands, except per share

amounts)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2024

2023

2024

2023

GAAP net income (loss)

$

4,935

$

(12,414

)

$

4,628

$

(164,510

)

Stock-based compensation

134,388

113,726

504,770

432,271

Acquisition related expense

5,863

3,906

9,496

3,906

Amortization of acquired intangibles

assets

2,527

1,304

9,557

5,311

Restructuring charges

1,143

3,547

3,990

96,843

Non-cash interest expense for amortization

of debt issuance costs

511

509

2,012

1,986

(Gain)/loss on strategic investments

(1,307

)

1,723

(15,854

)

1,627

Income tax effects of non-GAAP items

(23,205

)

(18,972

)

(84,481

)

(64,339

)

Non-GAAP net income

$

124,855

$

93,329

$

434,118

$

313,095

Non-GAAP net income per share:

Basic

$

2.42

$

1.85

$

8.48

$

6.28

Diluted

$

2.32

$

1.77

$

8.12

$

6.00

Shares used in non-GAAP per share

calculations

Basic

51,657

50,347

51,178

49,877

Diluted (1)

53,867

52,621

53,444

52,188

(1) The non-GAAP diluted share count includes shares related to

our 2025 notes using the if converted method. The GAAP diluted

share count excludes shares related to our 2025 notes using the if

converted method because inclusion of those shares would be

anti-dilutive.

Reconciliation of non-GAAP expense and

expense as a percentage of revenue

(in thousands, except percentages)

For the Three Months Ended

December 31,

2024

2023

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

GAAP expense

$

89,505

$

13,867

$

213,711

$

314,864

$

80,931

$

73,664

$

13,777

$

163,234

$

281,136

$

69,708

Stock -based compensation

(6,802

)

(1,011

)

(65,250

)

(38,235

)

(23,090

)

(3,542

)

(1,210

)

(37,129

)

(52,108

)

(19,737

)

Amortization of acquired intangible

assets

(1,882

)

(133

)

—

(407

)

(105

)

(911

)

—

—

(358

)

(35

)

Acquisition related expense

—

—

(3,908

)

(83

)

(1,872

)

—

—

(255

)

—

(3,651

)

Non-GAAP expense

$

80,821

$

12,723

$

144,553

$

276,139

$

55,864

$

69,211

$

12,567

$

125,850

$

228,670

$

46,285

GAAP expense as a percentage of

revenue

12.7

%

2.0

%

30.4

%

44.8

%

11.5

%

12.7

%

2.4

%

28.1

%

48.3

%

12.0

%

Non-GAAP expense as a percentage of

revenue

11.5

%

1.8

%

20.6

%

39.3

%

7.9

%

11.9

%

2.2

%

21.6

%

39.3

%

8.0

%

For the Year Ended December

31,

2024

2023

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

GAAP expense

$

336,878

$

56,387

$

778,714

$

1,218,844

$

300,332

$

283,675

$

54,687

$

617,745

$

1,068,560

$

249,649

Stock -based compensation

(23,613

)

(4,339

)

(243,164

)

(145,778

)

(87,876

)

(12,652

)

(4,958

)

(198,953

)

(140,362

)

(75,346

)

Amortization of acquired intangible

assets

(7,525

)

(133

)

—

(1,479

)

(420

)

(2,123

)

—

—

(3,153

)

(35

)

Acquisition related expense

—

—

(6,427

)

(83

)

(2,986

)

—

—

(255

)

—

(3,651

)

Non-GAAP expense

$

305,740

$

51,915

$

529,123

$

1,071,504

$

209,050

$

268,900

$

49,729

$

418,537

$

925,045

$

170,617

GAAP expense as a percentage of

revenue

12.8

%

2.1

%

29.6

%

46.4

%

11.4

%

13.1

%

2.5

%

28.5

%

49.2

%

11.5

%

Non-GAAP expense as a percentage of

revenue

11.6

%

2.0

%

20.1

%

40.8

%

8.0

%

12.4

%

2.3

%

19.3

%

42.6

%

7.9

%

Reconciliation of non-GAAP subscription

margin

(in thousands, except percentages)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2024

2023

2024

2023

GAAP subscription margin

$

597,811

$

496,561

$

2,232,668

$

1,839,804

Stock-based compensation

6,802

3,542

23,613

12,652

Amortization of acquired intangible

assets

1,882

911

7,525

2,123

Non-GAAP subscription margin

$

606,495

$

501,014

$

2,263,806

$

1,854,579

GAAP subscription margin percentage

87.0

%

87.1

%

86.9

%

86.6

%

Non-GAAP subscription margin

percentage

88.2

%

87.9

%

88.1

%

87.3

%

Reconciliation of free cash

flow

(in thousands)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2024

2023

2024

2023

GAAP net cash and cash equivalents

provided by operating activities

$

194,141

$

104,313

$

598,599

$

350,971

Purchases of property and equipment

(12,726

)

(8,687

)

(37,939

)

(33,718

)

Capitalization of software development

costs

(22,915

)

(17,084

)

(89,636

)

(66,372

)

Payment of restructuring charges

4,490

4,409

17,027

41,573

Non-GAAP free cash flow

$

162,990

$

82,951

$

488,051

$

292,454

Reconciliation of operating cash

flow

(in thousands)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2024

2023

2024

2023

GAAP net cash and cash equivalents

provided by operating activities

$

194,141

$

104,313

$

598,599

$

350,971

Payment of restructuring charges

4,490

4,409

17,027

41,573

Non-GAAP operating cash flow

$

198,631

$

108,722

$

615,626

$

392,544

Reconciliation of forecasted non-GAAP

operating income (in thousands, except percentages)

Three Months Ended March 31,

2025

Year Ended December 31,

2025

GAAP operating loss range

($34,027)-($33,027)

($38,392)-($34,392)

Stock-based compensation

121,662

544,072

Amortization of acquired intangible

assets

2,600

10,400

Acquisition related expense

6,615

22,320

Restructuring charges

1,150

4,600

Non-GAAP operating income range

$98,000-$99,000

$543,000-$547,000

Reconciliation of forecasted non-GAAP

net income and non-GAAP net income per share (in thousands,

except per share amounts)

Three Months Ended March 31,

2025

Year Ended December 31,

2025

GAAP net (loss) income range

($15,018)-($13,768)

$10,304-$15,304

Stock-based compensation

121,662

544,072

Amortization of acquired intangible

assets

2,600

10,400

Acquisition related expense

6,615

22,320

Non-cash interest expense for amortization

of debt issuance costs

491

837

Restructuring charges

1,150

4,600

Income tax effects of non-GAAP items

(23,500)-(23,750)

(101,533)-(102,533)

Non-GAAP net income range

$94,000-$95,000

$491,000-$495,000

GAAP net income per basic and diluted

share

($0.29)-($0.26)

$0.19-$0.29

Non-GAAP net income per diluted share

$1.74-$1.76

$9.11-$9.19

Weighted average common shares used in

computing GAAP basic and diluted net loss per share:

52,140

52,952

Weighted average common shares used in

computing non-GAAP diluted net loss per share:

54,084

53,873

HubSpot’s estimates of stock-based compensation, amortization of

acquired intangible assets, non-cash interest expense for

amortization of debt issuance costs, restructuring charges, and

income tax effects of non-GAAP items assume, among other things,

the occurrence of no additional acquisitions, changes in value of

strategic investments, and no further revisions to stock-based

compensation and related expenses.

Non-GAAP Financial Measures

We report our financial results in accordance with accounting

principles generally accepted in the United States of America, or

GAAP. However, management believes that, in order to properly

understand our short-term and long-term financial and operational

trends, investors may wish to consider the impact of certain

non-cash or non-recurring items when used as a supplement to

financial performance measures in accordance with GAAP. These items

result from facts and circumstances that vary in frequency and

impact on continuing operations. In this release, HubSpot’s

non-GAAP operating income, operating margin, subscription margin,

expense, expense as a percentage of revenue, net income, operating

and free cash flow are not presented in accordance with GAAP and

are not intended to be used in lieu of GAAP presentations of

results of operations.

Calculated billings is defined as total revenue recognized in a

period plus the sequential change in total deferred revenue in the

corresponding period. Non-GAAP operating cash flow is defined as

cash and cash equivalents provided by or used in operating

activities plus payment of restructuring charges. Non-GAAP free

cash flow is defined as cash and cash equivalents provided by or

used in operating activities less purchases of property and

equipment and capitalization of software development costs, plus

payment of restructuring charges. Although non-GAAP operating cash

flow and non-GAAP free cash flow are not residual cash flow

available for our discretionary expenditures, we believe

information regarding non-GAAP operating cash flow and non-GAAP

free cash flow provide useful information to investors in

understanding and evaluating the strength of our liquidity and

provides a comparable framework for assessing how our business

performed when compared to prior periods which were not impacted by

restructuring charges paid from operating cash flow.

Constant currency amounts are presented to provide a framework

for assessing our operating performance excluding the effect of

foreign exchange rate fluctuations. To exclude the effect of

foreign currency rate fluctuations, current period results for

entities reporting in currencies other than U.S. Dollars (“USD”)

are converted into USD at the average exchange rates for the

comparative period rather than the actual average exchange rates in

effect during the respective periods.

Management believes that these non-GAAP financial measures

provide additional means of evaluating period-over-period operating

performance. Specifically, these non-GAAP financial measures

provide management with additional means to understand and evaluate

the operating results and trends in our ongoing business by

eliminating certain non-cash expenses and other items that

management believes might otherwise make comparisons of our ongoing

business with prior periods more difficult, obscure trends in

ongoing operations, or reduce management’s ability to make useful

forecasts. In addition, management understands that some investors

and financial analysts find this information helpful in analyzing

our financial and operational performance and comparing this

performance to our peers and competitors. However, these non-GAAP

financial measures have limitations as an analytical tool and are

not intended to be an alternative to financial measures prepared in

accordance with GAAP. In addition, it should be noted that these

non-GAAP financial measures may be different from non-GAAP measures

used by other companies. We intend to provide these non-GAAP

financial measures as part of our future earnings discussions and,

therefore, the inclusion of these non-GAAP financial measures will

provide consistency in our financial reporting. Management may,

however, utilize other measures to illustrate performance in the

future. Investors are encouraged to review the reconciliation of

these non-GAAP measures to their most directly comparable GAAP

financial measures. A reconciliation of our non-GAAP financial

measures to their most directly comparable GAAP measures has been

provided in the financial statement tables included above in this

press release.

These non-GAAP measures exclude stock-based compensation,

amortization of acquired intangible assets, acquisition related

expenses, disposition related income, non-cash interest expense for

the amortization of debt issuance costs, gain or impairment losses

on strategic investments, restructuring charges, and account for

the income tax effects of the exclusion of these non-GAAP items. We

believe investors may want to incorporate the effects of these

items in order to compare our financial performance with that of

other companies and between time periods:

A

Stock-based compensation is a non-cash

expense accounted for in accordance with FASB ASC Topic 718. We

believe that the exclusion of stock-based compensation expense

allows for financial results that are more indicative of our

operational performance and provide for a useful comparison of our

operating results to prior periods and to our peer companies

because stock-based compensation expense varies from period to

period and company to company due to such things as differing

valuation methodologies and changes in stock price.

B

Expense for the amortization of acquired

intangible assets is excluded from non-GAAP expense and income

measures as HubSpot views amortization of these assets as arising

from pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for

impairment regularly, amortization of the cost of purchased

intangibles is a non-cash expense that is not typically affected by

operations during any particular period. Valuation and subsequent

amortization of intangible assets can also be inconsistent in

amount and frequency because they can significantly vary based on

the timing and size of acquisitions and the inherently subjective

nature of the degree to which a purchase price is allocated to

intangible assets. We believe that the exclusion of this

amortization expense provides for a useful comparison of our

operating results to prior periods, for which we have historically

excluded amortization expense, and to our peer companies, which

commonly exclude acquired intangible asset amortization. It is

important to note that although we exclude amortization of acquired

intangible assets from our non-GAAP expense and income measures,

revenue generated from such intangibles is included within our

non-GAAP income measures. The use of these intangible assets

contributed to our revenues earned during the periods presented and

will contribute to future periods as well.

C.

Acquisition related expenses, such as

transaction costs, retention payments, and holdback payments, and

disposition related income, such as proceeds from sale of assets,

are transactions that are not necessarily reflective of our

operational performance during a period. We believe that the

exclusion of these expenses and income provides for a useful

comparison of our operating results to prior periods and to our

peer companies, which commonly exclude these expenses and

income.

D.

In June 2020, we issued $460 million of

convertible notes due in 2025 with a coupon interest rate of

0.375%. The issuance cost of the debt is amortized as interest

expense over the remaining term of the debt. We believe the

exclusion of this non-cash interest expense provides for a useful

comparison of our operating results to prior periods and to our

peer companies.

E.

Strategic investments consist of

non-controlling equity investments in privately held companies. The

recognition of gains, impairment losses, or the proportionate share

of net earnings can vary significantly across periods and we do not

view them to be indicative of our fundamental operating activities

and believe the exclusion provides for a useful comparison of our

operating results to prior periods and to our peer companies.

F.

Restructuring charges are related to

severance, employee related benefits, facilities and other costs

associated with the restructuring plan implemented in January 2023.

Restructuring charges fluctuate in amount and frequency and are not

reflective of our core business operating results. In addition to

the restructuring charges related to facilities we abandoned during

the year ended 2023, through 2027, we expect to both incur

incremental restructuring charges and make cash payments related to

such facilities. The abandonment of facilities is part of the

restructuring plan we authorized on January 25, 2023 and is

intended to consolidate our lease space and create higher density

across our workspaces. The incremental charges we expect to incur

relate to continuing costs for the abandoned facilities and are

expected to be in the range of $12-13 million. We also expect to

make cash payments of approximately $43.0 million in fixed rent

payments for the abandoned facilities that will be made in monthly

installments through 2027, for which we have taken the full

restructuring charge during the year ended 2023. We plan on

excluding both the incremental charges and cash payments and the

related restructuring cash rent payments from our non-GAAP

earnings, operating cash flow, and free cash flow metrics. We

believe exclusion of these charges and cash payments provides

useful information to investors in understanding and evaluating the

strength of earnings and liquidity and provides a comparable

framework for assessing how our business performed when compared to

prior periods which were not impacted by excluded restructuring

charges paid from operating cash flow.

G.

The effects of income taxes on non-GAAP

items reflect a fixed long-term projected tax rate of 20% to

provide better consistency across reporting periods. To determine

this long-term non-GAAP tax rate, we exclude the impact of other

non-GAAP adjustments and take into account other factors such as

our current operating structure and existing tax positions in

various jurisdictions. We will periodically reevaluate this tax

rate, as necessary, for significant events such as relevant tax law

changes and material changes in our forecasted geographic earnings

mix.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212801584/en/

Investor Relations Contact: investors@hubspot.com

Media Contact: media@hubspot.com

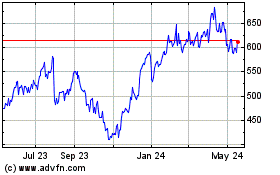

HubSpot (NYSE:HUBS)

Historical Stock Chart

From Jan 2025 to Feb 2025

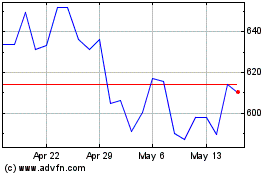

HubSpot (NYSE:HUBS)

Historical Stock Chart

From Feb 2024 to Feb 2025