Form 8-K - Current report

13 March 2025 - 7:48AM

Edgar (US Regulatory)

0000051143falseCHX00000511432025-03-122025-03-120000051143exch:XCHIus-gaap:CommonStockMember2025-03-122025-03-120000051143exch:XNYSus-gaap:CommonStockMember2025-03-122025-03-120000051143exch:XNYSibm:Notes2.875PercentDue2025Member2025-03-122025-03-120000051143exch:XNYSibm:Notes0.950PercentDue2025Member2025-03-122025-03-120000051143exch:XNYSibm:Notes0.300PercentDue2026Member2025-03-122025-03-120000051143exch:XNYSibm:Notes1.250PercentDue2027Member2025-03-122025-03-120000051143exch:XNYSibm:Notes3.375PercentDue2027Member2025-03-122025-03-120000051143exch:XNYSibm:Notes0.300PercentDue2028Member2025-03-122025-03-120000051143exch:XNYSibm:Notes1.750PercentDue2028Member2025-03-122025-03-120000051143exch:XNYSibm:Notes1.500PercentDue2029Member2025-03-122025-03-120000051143exch:XNYSibm:Notes0.875PercentDue2030Member2025-03-122025-03-120000051143exch:XNYSibm:A2.900NotesDue2030Member2025-03-122025-03-120000051143exch:XNYSibm:Notes1.750PercentDue2031Member2025-03-122025-03-120000051143exch:XNYSibm:Notes3.625PercentDue2031Member2025-03-122025-03-120000051143exch:XNYSibm:Notes0.650PercentDue2032Member2025-03-122025-03-120000051143exch:XNYSibm:A3.150NotesDue2033Member2025-03-122025-03-120000051143exch:XNYSibm:Notes1.250PercentDue2034Member2025-03-122025-03-120000051143exch:XNYSibm:Notes3.750PercentDue2035Member2025-03-122025-03-120000051143exch:XNYSibm:A3.450NotesDue2037Member2025-03-122025-03-120000051143exch:XNYSibm:Notes4.875PercentDue2038Member2025-03-122025-03-120000051143exch:XNYSibm:Notes1.200PercentDue2040Member2025-03-122025-03-120000051143exch:XNYSibm:Notes4.000PercentDue2043Member2025-03-122025-03-120000051143exch:XNYSibm:A3.800NotesDue2045Member2025-03-122025-03-120000051143exch:XNYSibm:Debentures7.00PercentDue2025Member2025-03-122025-03-120000051143exch:XNYSibm:Debentures6.22PercentDue2027Member2025-03-122025-03-120000051143exch:XNYSibm:Debentures6.50PercentDue2028Member2025-03-122025-03-120000051143exch:XNYSibm:Debentures5.875PercentDue2032Member2025-03-122025-03-120000051143exch:XNYSibm:Debentures7.00PercentDue2045Member2025-03-122025-03-120000051143exch:XNYSibm:Debentures7.125PercentDue2096Member2025-03-122025-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: March 12, 2025

(Date of earliest event reported)

INTERNATIONAL BUSINESS MACHINES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| New York | | 1-2360 | | 13-0871985 |

| (State of Incorporation) | | (Commission File Number) | | (IRS employer Identification No.) |

| | | | | | | | | | | |

One New Orchard Road Armonk, New York | | | 10504 |

| (Address of principal executive offices) | | | (Zip Code) |

914-499-1900

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Capital stock, par value $.20 per share | | IBM | | New York Stock Exchange |

| | | | NYSE Chicago |

| 2.875% Notes due 2025 | | IBM 25A | | New York Stock Exchange |

| 0.950% Notes due 2025 | | IBM 25B | | New York Stock Exchange |

| 0.300% Notes due 2026 | | IBM 26B | | New York Stock Exchange |

| 1.250% Notes due 2027 | | IBM 27B | | New York Stock Exchange |

| 3.375% Notes due 2027 | | IBM 27F | | New York Stock Exchange |

| 0.300% Notes due 2028 | | IBM 28B | | New York Stock Exchange |

| 1.750% Notes due 2028 | | IBM 28A | | New York Stock Exchange |

| 1.500% Notes due 2029 | | IBM 29 | | New York Stock Exchange |

| 0.875% Notes due 2030 | | IBM 30A | | New York Stock Exchange |

| 2.900% Notes due 2030 | | IBM 30C | | New York Stock Exchange |

| 1.750% Notes due 2031 | | IBM 31 | | New York Stock Exchange |

| 3.625% Notes due 2031 | | IBM 31B | | New York Stock Exchange |

| 0.650% Notes due 2032 | | IBM 32A | | New York Stock Exchange |

| 3.150% Notes due 2033 | | IBM 33A | | New York Stock Exchange |

| 1.250% Notes due 2034 | | IBM 34 | | New York Stock Exchange |

| 3.750% Notes due 2035 | | IBM 35 | | New York Stock Exchange |

| 3.450% Notes due 2037 | | IBM 37 | | New York Stock Exchange |

| 4.875% Notes due 2038 | | IBM 38 | | New York Stock Exchange |

| 1.200% Notes due 2040 | | IBM 40 | | New York Stock Exchange |

| 4.000% Notes due 2043 | | IBM 43 | | New York Stock Exchange |

| 3.800% Notes due 2045 | | IBM 45A | | New York Stock Exchange |

| 7.00% Debentures due 2025 | | IBM 25 | | New York Stock Exchange |

| 6.22% Debentures due 2027 | | IBM 27 | | New York Stock Exchange |

| 6.50% Debentures due 2028 | | IBM 28 | | New York Stock Exchange |

| 5.875% Debentures due 2032 | | IBM 32D | | New York Stock Exchange |

| 7.00% Debentures due 2045 | | IBM 45 | | New York Stock Exchange |

| 7.125% Debentures due 2096 | | IBM 96 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

IBM announced that, beginning in the first quarter of 2025, it is making changes to its reported revenue categories within its Software and Consulting reportable segments to reflect the market opportunities and how it addresses them. These updates will not impact IBM’s Consolidated Financial Statements or its reportable segments. Exhibit 99.1 to this Form 8-K contains information that the company has published on its Investor Relations website (www.ibm.com/investor/) providing additional information on this update, including recast historical segment financials for 2024 and 2023. In addition, it includes reconciliations of certain non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP).

The information in this Item 7.01, including the corresponding Exhibit 99.1, is being furnished with the Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

The following exhibits are being furnished as part of this report:

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| 99.1 | | |

The following exhibit is being filed as part of this report:

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

IBM’s web site (www.ibm.com) contains a significant amount of information about IBM, including financial and other information for investors (www.ibm.com/investor/). IBM encourages investors to visit its various web sites from time to time, as information is updated and new information is posted.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

Date: March 12, 2025 | |

| | |

| By: | /s/ Nicolás A. Fehring |

| | Nicolás A. Fehring |

| | Vice President and Controller |

IBM to Update Revenue Categories within Reportable Segments March 12, 2025 We are making changes to the reported revenue categories within our Software and Consulting reportable segments to reflect the market opportunities and how we address them. These changes better align our portfolio to our core strategy and to the underlying business models. These changes also provide more relevant information to investors. These updates will not impact IBM’s Consolidated Financial Statements or our reportable segments. The Software and Consulting segments will reflect these changes beginning in the first quarter of 2025. We are providing recast historical financials today to allow investors and analysts to update their models ahead of the first quarter earnings report in April. The 2025 guidance provided at our Investor Day in February reflected these changes to our reported revenue categories. Updates to the revenue categories within the Software reportable segment IBM’s Software segment brings together hybrid cloud platform and software solutions to help clients predict, automate, secure and modernize their environments. There is no change to the overall scope of the Software segment as a result of these changes to the reported revenue categories. Beginning in first quarter 2025, IBM will report revenue and year-to-year revenue percent change for Hybrid Cloud, Automation, Data and Transaction Processing within Software. IBM will no longer report revenue for the Hybrid Platform & Solutions or Security revenue categories. • Hybrid Cloud: no change to Hybrid Cloud products. Hybrid Cloud was previously reported as Red Hat. • Automation: HashiCorp will be reported in Automation. Identity & Access Management and Threat Management businesses have moved into Automation from the prior Security revenue category. The Sustainability business has moved into Automation from Data to better align with our FinOps and Observability products. • Data: Business Automation has moved into Data from Automation to better align with the AI Assistants and Database assets. Data Security moved into Data from the prior Security revenue category to better align with our data assets. Data was previously reported as Data & AI. Exhibit 99.1

• Transaction Processing: zSecure product moved into Transaction Processing from the prior Security revenue category. Updates to the revenue categories within the Consulting reportable segment IBM Consulting helps clients design and build open, hybrid cloud architectures and optimize key workflows and business processes. There is no change to the overall scope of the Consulting segment as a result of these changes to the reported revenue categories. Beginning in the first quarter 2025, IBM will report revenue and year-to-year revenue percent change for Strategy and Technology and Intelligent Operations within Consulting. • Strategy and Technology: includes services previously reported as Technology Consulting and Business Transformation with the exception of business process operations services. • Intelligent Operations: includes services previously reported as Application Operations as well as business process operations services. Note: In an effort to provide additional and useful information regarding the company’s financial results and other financial information, as determined by generally accepted accounting principles (GAAP), these materials contain revenue growth rates adjusted for constant currency which is a non-GAAP measure. The rationale for management’s use of this non-GAAP information is included on page 6 of the company’s 2024 Annual Report, which is Exhibit 13 to the Form 10-K submitted with the SEC on February 25, 2025. The reconciliation of non-GAAP information to GAAP is included in Exhibit 3 within these materials.

Exhibit 1: 2024 Segment Revenue Snapshot Recast Using 2025 Reported Revenue Category Structure Revenue growth rates @CC, in $ billions Refer to Exhibit 3 for the reconciliation of non-GAAP financial information There is no change to IBM’s consolidated results The Software portfolio delivers end-to-end enterprise capabilities for Hybrid Cloud and AI: Hybrid Cloud: incl. RHEL, OpenShift, Ansible, Red Hat AI Automation: incl. application development & integration, infrastructure lifecycle management incl. HashiCorp, network management, security software for identity access management and threat management, observability, FinOps, IT financial management, asset lifecycle management Data: incl. AI assistants, AI tools and governance, databases, data intelligence, data integration, data security Transaction Processing: incl. Customer Information Control System and storage software, analytics and integration software running on IBM operating systems, AI assistants for Z, security software for Z Strategy and Technology: Provides strategy, process design, system implementation, cloud architecture and implementation services to help clients transform their businesses for growth and enable innovation. These services ensure clients benefit from the latest technologies to meet their objectives by leveraging AI and an ecosystem of strategic partners alongside IBM technology and Red Hat, including Adobe, AWS, Microsoft, Oracle, Palo Alto Networks, Salesforce, and SAP, among others. Intelligent Operations: Focuses on application, cloud platform, and operations services that bring efficiency to clients’ processes by operationalizing and running hybrid cloud platforms, managing core business processes, and addressing security holistically across business functions and the IT landscape. These services help clients manage, optimize, and orchestrate custom and ISV packaged applications, enhancing operations through AI-powered solutions for faster, more efficient client outcomes. 2024 Consulting Revenue 2024 Software Revenue

Exhibit 2: Segment Revenue Recast Using 2025 Reported Revenue Category Structure Note: Items in bold reflect changes from previously reported results Refer to Exhibit 3 for the reconciliation of non-GAAP financial information There is no change to IBM’s consolidated results ($ = M) B/(W) Yr/Yr at Constant Currency SOFTWARE SEGMENT 1Q23 2Q23 3Q23 4Q23 FY23 1Q24 2Q24 3Q24 4Q24 FY24 1Q24 2Q24 3Q24 4Q24 FY24 Total Revenue 5,591 6,294 5,947 7,179 25,011 5,899 6,739 6,524 7,924 27,085 6% 8% 10% 11% 9% Hybrid Cloud 1,389 1,446 1,459 1,533 5,827 1,510 1,547 1,659 1,774 6,490 9% 8% 14% 17% 12% Automation 1,263 1,502 1,459 1,785 6,008 1,391 1,620 1,563 1,984 6,558 10% 9% 7% 12% 10% Data 1,181 1,376 1,247 1,658 5,461 1,173 1,378 1,352 1,728 5,629 0% 1% 8% 5% 4% Transaction Processing 1,759 1,970 1,782 2,203 7,714 1,824 2,194 1,951 2,438 8,408 4% 13% 9% 12% 10% ($ = M) CONSULTING SEGMENT 1Q23 2Q23 3Q23 4Q23 FY23 1Q24 2Q24 3Q24 4Q24 FY24 1Q24 2Q24 3Q24 4Q24 FY24 Total Revenue 5,197 5,226 5,178 5,283 20,884 5,186 5,179 5,152 5,175 20,692 2% 2% 0% -1% 1% Strategy and Technology 2,843 2,850 2,851 2,886 11,430 2,863 2,895 2,856 2,875 11,488 3% 5% 0% 0% 2% Intelligent Operations 2,355 2,376 2,327 2,396 9,455 2,323 2,284 2,297 2,300 9,204 0% -1% -1% -3% -1% IBM Segment Revenue

Exhibit 3: Reconciliation of 2024 Revenue Performance Recast Using 2025 Reported Revenue Category Structure Note: Items in bold reflect changes from previously reported results

v3.25.0.1

Cover

|

Mar. 12, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 12, 2025

|

| Entity Registrant Name |

INTERNATIONAL BUSINESS MACHINES CORPORATION

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity File Number |

1-2360

|

| Entity Tax Identification Number |

13-0871985

|

| Entity Address, Address Line One |

One New Orchard Road

|

| Entity Address, City or Town |

Armonk

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10504

|

| City Area Code |

914

|

| Local Phone Number |

499-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000051143

|

| Amendment Flag |

false

|

| NEW YORK STOCK EXCHANGE, INC. | Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Capital stock, par value $.20 per share

|

| Trading Symbol |

IBM

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 2.875% Notes due 2025 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.875% Notes due 2025

|

| Trading Symbol |

IBM 25A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.950% Notes due 2025 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.950% Notes due 2025

|

| Trading Symbol |

IBM 25B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.300% Notes due 2026 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.300% Notes due 2026

|

| Trading Symbol |

IBM 26B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.250% Notes due 2027 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Notes due 2027

|

| Trading Symbol |

IBM 27B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.375% Notes due 2027 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.375% Notes due 2027

|

| Trading Symbol |

IBM 27F

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.300% Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.300% Notes due 2028

|

| Trading Symbol |

IBM 28B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.750% Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Notes due 2028

|

| Trading Symbol |

IBM 28A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.500% Notes due 2029 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2029

|

| Trading Symbol |

IBM 29

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.875% Notes due 2030 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2030

|

| Trading Symbol |

IBM 30A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 2.900% Notes Due 2030 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.900% Notes due 2030

|

| Trading Symbol |

IBM 30C

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.750% Notes due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Notes due 2031

|

| Trading Symbol |

IBM 31

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.625% Notes due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.625% Notes due 2031

|

| Trading Symbol |

IBM 31B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.650% Notes due 2032 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.650% Notes due 2032

|

| Trading Symbol |

IBM 32A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.150% Notes Due 2033 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.150% Notes due 2033

|

| Trading Symbol |

IBM 33A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.250% Notes due 2034 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Notes due 2034

|

| Trading Symbol |

IBM 34

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.750% Notes due 2035 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.750% Notes due 2035

|

| Trading Symbol |

IBM 35

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.450% Notes due 2037 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.450% Notes due 2037

|

| Trading Symbol |

IBM 37

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 4.875% Notes due 2038 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2038

|

| Trading Symbol |

IBM 38

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.200% Notes due 2040 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.200% Notes due 2040

|

| Trading Symbol |

IBM 40

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 4.000% Notes due 2043 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.000% Notes due 2043

|

| Trading Symbol |

IBM 43

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.800% Notes due 2045 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.800% Notes due 2045

|

| Trading Symbol |

IBM 45A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 7.00% Debentures due 2025 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Debentures due 2025

|

| Trading Symbol |

IBM 25

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 6.22% Debentures due 2027 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.22% Debentures due 2027

|

| Trading Symbol |

IBM 27

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 6.50% Debentures due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.50% Debentures due 2028

|

| Trading Symbol |

IBM 28

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 5.875% Debentures due 2032 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.875% Debentures due 2032

|

| Trading Symbol |

IBM 32D

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 7.00% Debentures due 2045 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Debentures due 2045

|

| Trading Symbol |

IBM 45

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 7.125% Debentures due 2096 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.125% Debentures due 2096

|

| Trading Symbol |

IBM 96

|

| Security Exchange Name |

NYSE

|

| NYSE CHICAGO, INC. | Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Capital stock, par value $.20 per share

|

| Trading Symbol |

IBM

|

| Security Exchange Name |

CHX

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes2.875PercentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.950PercentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.300PercentDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.250PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes3.375PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.300PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.750PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.500PercentDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.875PercentDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_A2.900NotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.750PercentDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes3.625PercentDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.650PercentDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_A3.150NotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.250PercentDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes3.750PercentDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_A3.450NotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes4.875PercentDue2038Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.200PercentDue2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes4.000PercentDue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_A3.800NotesDue2045Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures7.00PercentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures6.22PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures6.50PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures5.875PercentDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures7.00PercentDue2045Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures7.125PercentDue2096Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

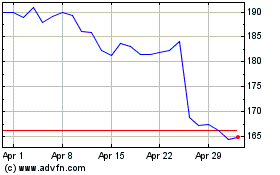

International Business M... (NYSE:IBM)

Historical Stock Chart

From Feb 2025 to Mar 2025

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Mar 2025