Informatica Announces Pricing of Secondary Public Offering of Common Stock

08 November 2024 - 6:43PM

Business Wire

Informatica (NYSE: INFA), a leader in enterprise AI-powered

cloud data management, today announced the pricing of its

previously announced underwritten registered secondary offering of

16,000,000 shares of its Class A common stock (the “Offering”) by

certain funds associated with Permira and Canada Pension Plan

Investment Board (together, the “Selling Stockholders”) at a price

to the public of $25.50. In connection with the Offering, the

Selling Stockholders have granted the underwriter a 30-day option

to purchase up to 2,400,000 additional shares. The Offering is

expected to close on November 12, 2024, subject to satisfaction of

customary closing conditions. Informatica will not receive any

proceeds from the sale of its Class A common stock by the Selling

Stockholders in the Offering.

Goldman Sachs & Co. LLC is acting as the lead book-running

manager for the Offering. J.P. Morgan is acting as the senior

active book-running manager and BofA Securities and Citigroup are

acting as junior active book-running managers for the Offering.

Deutsche Bank Securities, RBC Capital Markets, UBS Investment Bank,

BMO Capital Markets, Scotiabank, PJT Partners, LionTree, Macquarie

Capital, Wolfe | Nomura Alliance are acting as passive bookrunners

for the Offering. Centerview Partners, Academy Securities, Inc. and

Siebert Williams Shank are acting as co-managers for the

Offering.

The Offering will be made only by means of an effective

registration statement, a prospectus supplement and an accompanying

prospectus. Informatica has filed a registration statement

(including a base prospectus) on Form S-3 and a preliminary

prospectus supplement with the U.S. Securities and Exchange

Commission (the “SEC”), for the Offering to which this

communication relates. The registration statement automatically

became effective on November 7, 2024. Before you invest, you should

read the prospectus in that registration statement, the prospectus

supplement and other documents Informatica has filed with the SEC

for more complete information about Informatica and this Offering.

You may get these documents for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, a copy of the prospectus

supplement relating to the Offering may be obtained by contacting:

Goldman Sachs & Co., LLC, Attention: Prospectus Department, 200

West Street, New York, NY 10282, by telephone at 1-866-471-2526 or

email at prospectus-ny@ny.email.gs.com and J.P. Morgan Securities

LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, NY 11717 or by email

at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities law of any such state or

jurisdiction.

About Informatica

Informatica (NYSE: INFA), a leader in enterprise AI-powered

cloud data management, brings data and AI to life by empowering

businesses to realize the transformative power of their most

critical assets. We have created a new category of software, the

Informatica Intelligent Data Management Cloud™ (IDMC). IDMC is an

end-to-end data management platform, powered by CLAIRE AI, that

connects, manages and unifies data across any multi-cloud or hybrid

system, democratizing data and enabling enterprises to modernize

and advance their business strategies. Customers in approximately

100 countries, including more than 80 of the Fortune 100, rely on

Informatica to drive data-led digital transformation. Informatica.

Where data and AI come to life.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934. Forward-looking statements in

this release include statements regarding the closing of the

Offering transaction between the underwriters, the Selling

Stockholders and the Company and the filing of a prospectus

supplement. These forward-looking statements are subject to risks

and uncertainties, including the risks described in our Quarterly

Report on Form 10-Q for the quarter ended September 30, 2024, and

other filings and reports we make with the SEC from time to time.

The forward-looking statements in this press release are based on

information available to us as of the date hereof, and we disclaim

any obligation to update any forward-looking statements, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107818071/en/

Investor Relations: Victoria Hyde-Dunn

vhydedunn@informatica.com

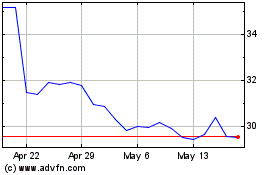

Informatica (NYSE:INFA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Informatica (NYSE:INFA)

Historical Stock Chart

From Nov 2023 to Nov 2024