Impact Disclosure Taskforce Releases Impact Disclosure Guidance, Helping Scale Financing for the UN Sustainable Development Goals

18 April 2024 - 9:34PM

Business Wire

Taskforce calls for feedback on the draft

Impact Disclosure Guidance and the first Sustainable Development

Impact Disclosure (SDID) piloted by DP World

The Impact Disclosure Taskforce today released its draft impact

disclosure guidance, helping entities committed to addressing

development needs and reducing global inequality to access growing

pools of sustainable capital.

Established in April of 2023 and now a 60+ strong network of

financial institutions, capital markets participants, and industry

stakeholders, the Taskforce was formed to help corporate entities

and sovereigns measure and disclose their efforts to reduce major

gaps to achieving the United Nations Sustainable Development Goals

(SDGs).

The release of the draft voluntary guidance today initiates a

four-month public consultation period, from April 18, 2024 to

September 1, 2024, during which the Taskforce welcomes feedback

from industry participants and practitioners.

The voluntary guidance aims to assist corporate and sovereign

entities, particularly those in emerging markets and developing

economies (EMDE), to use the principles of impact measurement and

monitoring to attract sustainable pools of capital. The guidance

also envisions establishing mechanisms for disseminating and

analyzing disclosed impact information to promote transparency and

accountability. The creation of a Sustainable Development Impact

Disclosure (SDID) could provide sustainable financiers with more

information to assist financing decisions.

The guidance draws on existing resources and outlines a 5-step

process for entities to measure and disclose the impacts of their

business strategies or national development plans. The guidance

reflects a view amongst financiers that the full balance sheet of

entities that follow this process would be considered for their

sustainable capital allocation. The guidance is characterized by

being:

- Entity-level: assesses the entity’s overall strategy in

countries of focus, as opposed to project-level frameworks;

- Impact-oriented: focuses on outputs and outcomes, rather

than a taxonomy of sustainable activities or eligible

investments;

- Forward-looking: establishes targets that measure

intended impacts, as opposed to reporting on current sustainability

levels; and

- Context-specific: tailors document to account for

development gaps in local jurisdictions.

J.P. Morgan and Natixis Corporate & Investment Banking, the

Taskforce co-chairs, supported DP World, a leading global logistics

and supply chain solutions provider, in creating the pilot SDID

under the Impact Disclosure Guidance. This pilot SDID focuses on DP

World’s anticipated contributions to SDGs focused on health,

education, equality and economic growth through emerging markets

infrastructure. See DP World’s full SDID created in accordance with

the impact disclosure guidance here:

www.dpworld.com/sustainability.

Marc-André Blanchard, Executive Vice-President and head of

CDPQ Global, Global Head of Sustainability

“I am proud that CDPQ played an active role in developing this

important guidance. Transparent corporate disclosure is a priority

for long-term investors because it enables investment decisions

based on uniform and comparable data - critical information that

contributes to a sustainable future. I am also pleased that one of

our partners, DP World, is the first company to release a pilot

disclosure under the Impact Disclosure guidance.”

Timothée Jaulin, Head of ESG Development and Advocacy,

Amundi

“Mobilizing capital to support the UN Sustainable Development

Goals requires meaningful, impact-oriented, enhanced disclosure

standards. The Sustainable Development Impact Disclosure guidance

will be especially relevant for issuers looking to tap capital

markets for their financing needs. All capital market instruments,

including equity, general purpose debt or sustainable debt

instruments require high quality sustainability disclosure at

issuer level.”

Robert Simpson, Head of Emerging Markets Strategy &

Solutions, Pictet Asset Management

“Enhanced disclosure on development impact could be

transformative in catalysing the needed flow of funds for

investment in emerging markets to support their aim in achieving

their SDG targets.”

Arsalan Mahtafar, Co-Chair of the Impact Disclosure Taskforce

and Head of J.P. Morgan’s Development Finance Institution

“This guidance will help connect sustainable investors with

entities that are accountable to tackling the development

challenges in their countries. By connecting like-minded people and

empowering them with relevant data, we can make strides towards

achieving our global goals.”

Cédric Merle Hamon and Leisa Cardoso De Souza,

Co-Chair of the Impact Disclosure Taskforce, from the Center of

Expertise and Innovation within Natixis Corporate & Investment

Banking’s Green and Sustainable Hub

“We are thrilled about the launch of the consultation period and

crave for thoughtful feedback. Our endeavor is to harness market

signals to sustainability data, providing enhanced financial terms

to SDG contributing entities, and creating meaningful investing

opportunities.”

Adama Mariko, Deputy Executive Director for Mobilisation,

Partnerships and Communication at the French Development Agency

(AFD) and Secretary General of the Finance in Common

Initiative

“I am pleased to see the progress made by this taskforce since

COP28, submitting today its work for public peer review. This is a

commendable effort by the private sector, with the participation of

public development banks, aimed at improving access to sustainable

financing in emerging and developing countries through improved

impact measurement and disclosure.”

The Taskforce welcomes feedback on the draft guidance and

invites you to provide such feedback by visiting

www.orrick.com/IDTfeedback.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418924942/en/

Alice Gasson | Media Relations | J.P. Morgan |

alice.gasson@jpmorgan.com | jpmorgan.com

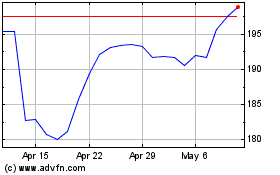

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Nov 2024 to Dec 2024

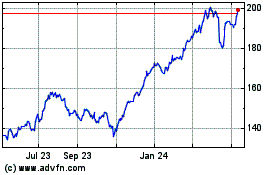

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Dec 2023 to Dec 2024