0000060086FALSE00000600862024-07-292024-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| | | | | | | | |

| Date of Report (Date of earliest event reported) | | July 26, 2024 |

LOEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-6541 | | 13-2646102 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | |

9 West 57th Street, New York, NY | 10019-2714 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| Registrant’s telephone number, including area code: | (212) 521-2000 |

| | |

| NOT APPLICABLE |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | L | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On July 29, 2024, Loews Corporation issued a press release and posted on its website (www.loews.com) earnings remarks providing information on its results of operations for the second quarter of 2024. The press release is furnished as Exhibit 99.1 and the earnings remarks are furnished as Exhibit 99.2 to this Form 8-K.

The information under Item 2.02 and in Exhibits 99.1 and 99.2 in this Current Report is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information under Item 2.02 and in Exhibits 99.1 and 99.2 in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

(b) On July 26, 2024, James S. Tisch informed Loews Corporation (the “Corporation”) that he will retire from his positions as President and Chief Executive Officer and as a member of the Office of the President of the Corporation, effective December 31, 2024. He will continue to serve as a director of the Corporation and has been elected by the Board of Directors as Chairman of the Board, effective January 1, 2025.

On July 26, 2024, each of Andrew H. Tisch and Jonathan M. Tisch informed the Corporation that they will retire from their positions as directors, including as Co-Chairmen of the Board of Directors, of the Corporation, effective December 31, 2024. In connection with their retirements, the Board of Directors appointed each of them as a director emeritus, effective January 1, 2025.

On July 26, 2024, Jonathan M. Tisch also informed the Corporation that he will retire from his position as a member of the Office of the President of the Corporation, effective December 31, 2024. He will continue to serve in his position as Executive Chairman of the Corporation’s subsidiary, Loews Hotels Holding Corporation (“Loews Hotels & Co”).

(c) On July 26, 2024, the Board of Directors elected Benjamin J. Tisch as President and Chief Executive Officer of the Corporation, effective January 1, 2025.

Benjamin J. Tisch, age 42, has been Senior Vice President, Corporate Development and Strategy of the Corporation since May 2022, and prior to assuming that role was a Vice President of the Corporation since 2014.

As of the date of this Report, Benjamin J. Tisch’s compensation for his new role as President and Chief Executive Officer has not been determined. The Corporation will file an amendment to this Report when it is determined.

(d) On July 26, 2024, the Board of Directors elected Alexander H. Tisch and Benjamin J. Tisch as directors of the Corporation and appointed them as members of the Executive Committee of the Board of Directors, in each case effective January 1, 2025.

Alexander H. Tisch, age 45, has been a Vice President of the Corporation since 2014 and also currently serves as President and Chief Executive Officer of Loews Hotels & Co.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits:

See Exhibit Index.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Loews Corporation press release, issued July 29, 2024, providing information on its results of operations for the second quarter of 2024. |

| | Loews Corporation earnings remarks, posted on its website July 29, 2024, providing information on its results of operations for the second quarter of 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | LOEWS CORPORATION |

| | (Registrant) |

| | |

| | | |

| | | |

Dated: July 29, 2024 | By: | /s/ Marc A. Alpert |

| | | Marc A. Alpert |

| | | Senior Vice President, |

| | General Counsel |

| | and Secretary |

Exhibit 99.1

NEWS RELEASE

LOEWS CORPORATION REPORTS NET INCOME OF $369 MILLION

FOR THE SECOND QUARTER OF 2024

New York, NY, July 29, 2024: Loews Corporation (NYSE: L) today released its second quarter 2024 financial results.

Second Quarter 2024 highlights:

Loews Corporation reported net income of $369 million, or $1.67 per share, in the second quarter of 2024, compared to $360 million, or $1.58 per share, in the second quarter of 2023. Excluding the prior period’s $36 million gain at Loews Hotels, net income increased 14% year-over-year, driven by CNA and Boardwalk. The following are the highlights:

•CNA Financial Corporation’s (NYSE: CNA) net income attributable to Loews improved year-over-year due to higher net investment income partially offset by higher catastrophe losses.

•Boardwalk Pipelines’ results improved year-over-year mainly due to increased revenues from re-contracting at higher rates and recently completed growth projects.

•Book value per share, excluding AOCI, increased to $85.42 as of June 30, 2024, from $81.92 as of December 31, 2023 due to strong operating results and repurchases of common shares during the year.

•As of June 30, 2024, the parent company had $3.1 billion of cash and investments and $1.8 billion of debt.

•Loews Corporation repurchased 2.4 million shares of its common stock during the second quarter of 2024 for a total cost of $180 million, and bought an additional 0.2 million shares for $14 million so far in the third quarter.

CEO commentary:

“Loews had another good quarter driven by strong results at CNA and Boardwalk. CNA continued to experience profitable growth while Boardwalk capitalized on strong fundamentals in the natural gas pipeline business.”

–James S. Tisch, President and CEO, Loews Corporation

Consolidated highlights:

| | | | | | | | | | | | | | |

| June 30, |

| Three Months | Six Months |

| (In millions) | 2024 | 2023 | 2024 | 2023 |

| Net Income (Loss) Attributable to Loews Corporation: | | | | |

| CNA Financial | $ | 291 | | $ | 255 | | $ | 601 | | $ | 523 | |

| Boardwalk Pipelines | 70 | | 57 | | 191 | | 143 | |

| Loews Hotels & Co | 35 | | 74 | | 51 | | 98 | |

| Corporate | (27) | | (26) | | (17) | | (29) | |

| Net income attributable to Loews Corporation | $ | 369 | | $ | 360 | | $ | 826 | | $ | 735 | |

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

|

| |

|

| Book value per share | $ | 74.57 | | | $ | 70.69 | |

| Book value per share excluding AOCI | 85.42 | | | 81.92 | |

Three months ended June 30, 2024 compared to 2023

CNA:

•Net income attributable to Loews Corporation improved 14% to $291 million from $255 million.

•Core income increased 6% to $326 million from $308 million.

•Net investment income increased due to higher income from fixed income securities as a result of favorable reinvestment rates and a larger invested asset base and favorable returns from limited partnerships.

•Net written premiums grew by 6% driven by strong retention and new business. Net earned premiums grew by 7%.

•Property and Casualty’s underwriting income decreased due to higher catastrophe losses.

•Property and Casualty’s combined ratio was 94.8% compared to 93.8% in the second quarter of 2023 partially due to a 0.4 point increase in catastrophe losses. Property and Casualty’s underlying combined ratio was 91.6% compared to 91.1% in the second quarter of 2023.

•Net income was also positively impacted by lower investment losses driven by lower impairments.

Boardwalk:

•Net income increased 23% to $70 million compared to $57 million.

•EBITDA increased 13% to $240 million compared to $213 million.

•Net income and EBITDA improved due to increased transportation revenues from higher re-contracting rates and recently completed growth projects, increased storage and parking and lending revenues, and contribution from the Bayou Ethane acquisition.

Loews Hotels:

•Net income of $35 million compared to $74 million.

•Adjusted EBITDA of $98 million compared to $100 million.

•Net income for 2023 included a gain of $36 million related to the acquisition of an additional equity interest in, and the consolidation of, a previously unconsolidated joint venture property.

•Excluding this gain, net income decreased due to lower equity income from joint ventures as occupancy and average daily rates decreased in Orlando, partially offset by improved performance at city center hotels.

•Net income was also impacted by higher depreciation and interest expense due to the opening of the Loews Arlington Hotel and Convention Center in the first quarter of 2024.

Corporate & Other:

•Net loss of $27 million compared to $26 million.

•The decrease in results is primarily due to lower investment income from parent company equity securities partially offset by higher income from short-term investments and fixed income securities.

Six months ended June 30, 2024 compared to 2023

Loews Corporation reported net income of $826 million, or $3.72 per share, compared to $735 million, or $3.19 per share, in 2023. The following are key highlights:

•CNA’s net investment income increased due to higher income from fixed income securities as a result of favorable reinvestment rates and a larger invested asset base and favorable returns from limited partnerships and common stock.

•Property and Casualty’s underwriting results were lower due to higher net catastrophe losses partially offset by favorable net prior year loss reserve development.

•Property and Casualty’s combined ratio was 94.7% compared to 93.9%. Property and Casualty’s underlying combined ratio was 91.4% compared to 91.0%.

•CNA’s net written premiums increased 6%.

•Corporate & Other results improved year-over-year driven by higher returns from parent company equity securities and short-term investments.

•All other segment drivers of results for the six months ended June 30, 2024 as compared to the comparable prior year period are consistent with the three-month period drivers discussed above.

Share Purchases:

•On June 30, 2024, there were 219.7 million shares of Loews common stock outstanding.

•During the three months ended June 30, 2024, Loews Corporation repurchased 2.4 million shares of its common stock for a total cost of $180 million.

•Loews has repurchased an additional 0.2 million shares for $14 million so far in the third quarter.

•Depending on market conditions, Loews may from time to time purchase shares of its and its subsidiaries’ outstanding common stock in the open market, in privately negotiated transactions or otherwise.

Reconciliation of GAAP Measures to Non-GAAP Measures

This news release contains financial measures that are not in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management believes some investors may find these measures useful to evaluate our and our subsidiaries’ financial performance. CNA utilizes core income, Boardwalk utilizes earnings before interest, income tax expense, depreciation and amortization (“EBITDA”), and Loews Hotels utilizes Adjusted EBITDA. These measures are defined and reconciled to the most comparable GAAP measures on pages 6 and 7 of this release.

Earnings Remarks

For Loews Corporation

–Today, July 29, 2024, earnings remarks will be available on our website.

–Remarks will include commentary from Loews’s president and chief executive officer and chief financial officer.

For CNA

–Today, July 29, 2024, earnings remarks will be available on the Investor Relations section of CNA’s website at www.cna.com.

–Remarks will include commentary from CNA’s chairman and chief executive officer and chief financial officer.

About Loews Corporation

Loews Corporation is a diversified company with businesses in the insurance, energy, hospitality and packaging industries. For more information, please visit www.loews.com.

Forward-Looking Statements

Statements contained in this news release which are not historical facts are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters, as well as the Company’s overall business and financial performance, can be found in the Company’s reports filed with the Securities and Exchange Commission and readers of this release are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company’s website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of this news release. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Investor relations and media relations contact:

Chris Nugent

1-212-521-2403

Loews Corporation and Subsidiaries

Selected Financial Information

| | | | | | | | | | | | | | |

| June 30, |

| Three Months | Six Months |

| (In millions) | 2024 | 2023 | 2024 | 2023 |

| Revenues: | | | | |

| CNA Financial (a) | $ | 3,519 | | $ | 3,304 | | $ | 6,963 | | $ | 6,456 | |

| Boardwalk Pipelines | 488 | | 365 | | 1,005 | | 762 | |

| Loews Hotels & Co (b) | 251 | | 254 | | 467 | | 446 | |

| Corporate investment income, net | 9 | | 11 | | 63 | | 53 | |

| Total | $ | 4,267 | | $ | 3,934 | | $ | 8,498 | | $ | 7,717 | |

| Income (Loss) Before Income Tax: | | | | |

| CNA Financial (a) | $ | 402 | | $ | 361 | | $ | 829 | | $ | 732 | |

| Boardwalk Pipelines | 94 | | 76 | | 256 | | 192 | |

| Loews Hotels & Co (b) | 44 | | 101 | | 72 | | 135 | |

| Corporate: | | | | |

| Investment income, net | 9 | | 11 | | 63 | | 53 | |

| Other (c) | (42) | | (41) | | (84) | | (85) | |

| Total | $ | 507 | | $ | 508 | | $ | 1,136 | | $ | 1,027 | |

| Net Income (Loss) Attributable to Loews Corporation: | | | | |

| CNA Financial (a) | $ | 291 | | $ | 255 | | $ | 601 | | $ | 523 | |

| Boardwalk Pipelines | 70 | | 57 | | 191 | | 143 | |

| Loews Hotels & Co (b) | 35 | | 74 | | 51 | | 98 | |

| Corporate: | | | | |

| Investment income, net | 7 | | 9 | | 50 | | 42 | |

| Other (c) | (34) | | (35) | | (67) | | (71) | |

| Net income attributable to Loews Corporation | $ | 369 | | $ | 360 | | $ | 826 | | $ | 735 | |

(a)The three months ended June 30, 2024 and 2023 include net investment losses of $10 million and $32 million ($7 million and $23 million after tax and noncontrolling interests). The six months ended June 30, 2024 and 2023 include net investment losses of $32 million and $67 million ($23 million and $48 million after tax and noncontrolling interests).

(b)Includes a gain of $46 million ($36 million after tax) for the three and six months ended June 30, 2023 related to Loews Hotels & Co’s acquisition of an additional equity interest in, and the consolidation of, a previously unconsolidated joint venture property.

(c)Consists of parent company interest expense, corporate expenses and the equity income (loss) of Altium Packaging.

Loews Corporation and Subsidiaries

Consolidated Financial Review

| | | | | | | | | | | | | | |

| June 30, |

| Three Months | Six Months |

| (In millions, except per share data) | 2024 | 2023 | 2024 | 2023 |

| Revenues: | | | | |

| Insurance premiums | $ | 2,498 | | $ | 2,347 | | $ | 4,939 | | $ | 4,595 | |

| Net investment income | 639 | | 592 | | 1,308 | | 1,161 | |

| Investment gains (losses) (a) | (10) | | 14 | | (32) | | (21) | |

| Operating revenues and other | 1,140 | | 981 | | 2,283 | | 1,982 | |

| Total | 4,267 | | 3,934 | | 8,498 | | 7,717 | |

| | | | |

| Expenses: | | | | |

| Insurance claims and policyholders’ benefits | 1,882 | | 1,779 | | 3,689 | | 3,432 | |

| Operating expenses and other | 1,878 | | 1,647 | | 3,673 | | 3,258 | |

| Total | 3,760 | | 3,426 | | 7,362 | | 6,690 | |

| | | | |

| Income before income tax | 507 | | 508 | | 1,136 | | 1,027 | |

| Income tax expense | (112) | | (120) | | (256) | | (235) | |

| Net income | 395 | | 388 | | 880 | | 792 | |

| Amounts attributable to noncontrolling interests | (26) | | (28) | | (54) | | (57) | |

| Net income attributable to Loews Corporation | $ | 369 | | $ | 360 | | $ | 826 | | $ | 735 | |

| | | | |

| Net income per share attributable to Loews Corporation | $ | 1.67 | | $ | 1.58 | | $ | 3.72 | | $ | 3.19 | |

| | | | |

| Weighted average number of shares | 221.60 | | 227.97 | | 222.18 | | 230.78 | |

(a)Includes a gain of $46 million ($36 million after tax) for the three and six months ended June 30, 2023 related to Loews Hotels & Co’s acquisition of an additional equity interest in, and the consolidation of, a previously unconsolidated joint venture property.

Definitions of Non-GAAP Measures and Reconciliation of GAAP Measures to Non-GAAP Measures:

CNA Financial Corporation

Core income is calculated by excluding from CNA’s net income attributable to Loews Corporation the after-tax effects of investment gains (losses) and the effects of noncontrolling interests. The calculation of core income excludes investment gains (losses) because these are generally driven by economic factors that are not necessarily reflective of CNA’s primary operations. The following table presents a reconciliation of CNA net income attributable to Loews Corporation to core income:

| | | | | | | | | | | | | | |

| June 30, |

| Three Months | Six Months |

| (In millions) | 2024 | 2023 | 2024 | 2023 |

| CNA net income attributable to Loews Corporation | $ | 291 | | $ | 255 | | $ | 601 | | $ | 523 | |

| Investment losses | 9 | | 25 | | 26 | | 53 | |

| Noncontrolling interests | 26 | | 28 | | 54 | | 57 | |

| Core income | $ | 326 | | $ | 308 | | $ | 681 | | $ | 633 | |

Boardwalk Pipelines

EBITDA is defined as earnings before interest, income tax expense, depreciation and amortization. The following table presents a reconciliation of Boardwalk net income attributable to Loews Corporation to its EBITDA:

| | | | | | | | | | | | | | |

| June 30, |

| Three Months | Six Months |

| (In millions) | 2024 | 2023 | 2024 | 2023 |

| Boardwalk net income attributable to Loews Corporation | $ | 70 | | $ | 57 | | $ | 191 | | $ | 143 | |

| Interest, net | 38 | | 35 | | 77 | | 72 | |

| Income tax expense | 24 | | 19 | | 65 | | 49 | |

| Depreciation and amortization | 108 | | 102 | | 214 | | 203 | |

| EBITDA | $ | 240 | | $ | 213 | | $ | 547 | | $ | 467 | |

Loews Hotels & Co

Adjusted EBITDA is calculated by excluding from Loews Hotels & Co’s EBITDA, the noncontrolling interest share of EBITDA adjustments, state and local government development grants, gains or losses on asset acquisitions and dispositions, asset impairments, and equity method income, and including Loews Hotels & Co’s pro rata Adjusted EBITDA of equity method investments. Pro rata Adjusted EBITDA of equity method investments is calculated by applying Loews Hotels & Co’s ownership percentage to the underlying equity method investment’s components of EBITDA and excluding distributions in excess of basis.

The following table presents a reconciliation of Loews Hotels & Co net income attributable to Loews Corporation to its Adjusted EBITDA:

| | | | | | | | | | | | | | |

| June 30, |

| Three Months | Six Months |

| (In millions) | 2024 | 2023 | 2024 | 2023 |

| Loews Hotels & Co net income attributable to Loews Corporation | $ | 35 | | $ | 74 | | $ | 51 | | $ | 98 | |

| Interest, net | 12 | | (1) | | 17 | | 4 | |

| Income tax expense | 9 | | 27 | | 21 | | 37 | |

| Depreciation and amortization | 24 | | 17 | | 45 | | 33 | |

| EBITDA | 80 | | 117 | | 134 | | 172 | |

| Noncontrolling interest share of EBITDA adjustments | (2) | | | (4) | | |

| Gain on asset acquisition | | (46) | | | (46) | |

| Asset impairments | | | 9 | | | | 9 | |

| Equity investment adjustments: | | | | |

| Loews Hotels & Co’s equity method income | (32) | | (41) | | (59) | | (72) | |

| Pro rata Adjusted EBITDA of equity method investments | 50 | | 62 | | 106 | | 124 | |

| Consolidation adjustments | 2 | | (1) | | 1 | | (2) | |

| Adjusted EBITDA | $ | 98 | | $ | 100 | | $ | 178 | | $ | 185 | |

The following table presents a reconciliation of Loews Hotels & Co’s equity method income to the Pro rata Adjusted EBITDA of its equity method investments:

| | | | | | | | | | | | | | |

| June 30, |

| Three Months | Six Months |

| (In millions) | 2024 | 2023 | 2024 | 2023 |

| Loews Hotels & Co’s equity method income | $ | 32 | | $ | 41 | | $ | 59 | | $ | 72 | |

| Pro rata share of equity method investments: | | | | |

| Interest, net | 10 | | 12 | | 20 | | 23 | |

| Income tax expense | | | | |

| Depreciation and amortization | 12 | | 12 | | 24 | | 25 | |

| Distributions in excess of basis | (4) | | (3) | | 3 | | 3 | |

| Consolidation adjustments | | | | 1 | |

| Pro rata Adjusted EBITDA of equity method investments | $ | 50 | | $ | 62 | | $ | 106 | | $ | 124 | |

Exhibit 99.2

Loews Corporation Second Quarter 2024 Earnings Remarks

James Tisch, President & CEO:

Good morning.

Loews reported very strong results in the second quarter—but instead of reviewing the highlights of each business’s performance, I’m going to let our CFO Jane Wang provide those details so I can discuss the leadership transitions of which you may already be aware.

As you likely know, last month, Dino Robusto, the CEO of CNA Financial, announced his retirement effective December 31st, and the company’s current Global Head of Underwriting, Doug Worman, was selected by CNA’s Board to succeed Dino. We are delighted that Dino will continue to advise CNA as Executive Chairman of the Board, and we thank him for working tirelessly—and I mean tirelessly—over the past eight years to lead the company to record levels of profitability and top quartile underwriting performance.

Dino’s successor Doug Worman is a proven leader with a clear vision for the company, and we are confident—as is the CNA Board of Directors—that CNA will continue to excel under his leadership. Doug has worked closely with Dino over the past five years, and this recognition and promotion was both carefully considered and well-deserved. We look forward to working with Doug in his new role as President and CEO.

And speaking of retirement . . . by now you will have probably heard that, after exactly 25 years as CEO of Loews Corporation and a total of 47 years in the company’s employ, I have decided that a transition to new leadership is in order. As of December 31st of this year, I will retire as President and CEO, at which point Ben Tisch will assume the CEO role. On January 1st of 2025, I will become Chairman of the Board of Loews, and Andrew Tisch and Jon Tisch will become Directors Emeriti. At that time, Ben Tisch and Alex Tisch (the CEO of Loews Hotels) will join the Loews Board of Directors.

Similar to the process at CNA, at Loews we have been planning for this transition for some time. Ben has been intimately involved in setting the strategic direction of Loews as part of our senior management team for more than a decade, and the Board of Directors believes (as do I) that Ben has the skills and the attributes necessary to lead the company, bringing his own unique perspectives, talents, experience and judgment to the job. Ben is very well versed in the intricacies and nuances of our businesses, and will, I’m sure, do a great job managing the company.

I will continue to keep an office at Loews and certainly do not plan to suddenly disappear from the company. I am looking forward to my new perch as the Chairman of the Board, and while I won’t be managing the daily, weekly, or monthly affairs of Loews, I am looking forward to board discussions on the strategic direction of the company.

During my tenure, Loews has changed significantly. When I started at the company in 1977, Loews’s subsidiaries consisted of CNA Financial, Lorillard, Loews Hotels, and Loews Theatres. Over the past 47 years, the company has acquired six subsidiaries, disposed of six, and now consists of four companies: CNA Financial, Boardwalk Pipelines, Loews Hotels and a majority interest in Altium Packaging. While the make-up of Loews has evolved over the last half century, our focus on creating long-term shareholder value through prudent capital allocation has remained steadfast. In my view, we have created substantial value through acquiring, growing and occasionally divesting subsidiaries, as well as repurchasing our shares.

My first shot at truly building shareholder value at Loews came in the early 1980s when we learned that supertankers were trading for scrap value. With a nuclear engineer-turned-shipping-aficionado named Jack

Devanney, Loews bought seven supertankers, each capable of holding up to 2.7 million barrels of crude oil, in a newly created entity called Majestic Shipping. We were able to acquire tankers for about $5 million each over three years; ships were trading for scrap value due to the tanker market becoming overbuilt in the wake of the oil shock of 1979-80. We believed that all we had to do was hold on to the ships long enough for a significant number of ships in the market to be scrapped and for oil demand to rise. And if that scenario did not materialize, we assumed that we too would be able to sell the ships for scrap value, limiting our downside. It seemed to us like a high return/low risk investment.

By about 1986, the supply of tankers had declined substantially due to scrapping. At the same time, demand for the ships had increased as a result of more oil production in the Middle East—and all our ships were profitably transporting oil around the world. In the early 1990s, we sold a 50 percent interest in our ships for a valuation of about ten times what we had paid for them!

While this investment was a success, it was relatively small in the context of the Loews portfolio. However, our foray into the shipping business did lead to what was to become a significant win for Loews. In the late 1980s, Jack Devanney presciently said to me that the offshore drilling business at that time looked like the tanker business of six or seven years earlier. My ears perked up and, for about $50 million, Loews bought a company called Diamond M Drilling that would be renamed Diamond Offshore. Our investment in Diamond would eventually grow to over $700 million as we added rigs to the fleet.

Over the next three decades, Loews would receive from Diamond approximately $3.6 billion in dividends and proceeds of stock sales, which was approximately five times our cumulative investment. During Covid, the company—as well as nearly all its competitors—filed for bankruptcy due to the unprecedented decline in the price of oil.

In the early 2000s, we determined that natural gas transportation seemed like an attractive market for us. We saw an industry that seemingly had low risk and increasing demand. As a result of our analytical work, we bought two natural gas pipelines: Texas Gas Transmission, and Gulf South Pipelines. These pipeline systems run from Texas to Alabama, and Ohio to Louisiana. We rebranded them as Boardwalk Pipelines. Headquartered in Houston, Boardwalk has become a very profitable business, worth multiples of what we paid for it.

While Loews’s acquisition track record has been pretty good during my tenure, it hasn’t been perfect. In 2007, we purchased HighMount Exploration and Production Company, a natural gas E&P business also headquartered in Texas. Unfortunately, this company was severely impacted by the steep decline in natural gas prices resulting from a significant increase in shale gas production. In 2014, we sold the company at a loss after determining that further investment in the E&P sector was no longer an attractive way to allocate Loews’s capital.

In addition to acquiring new subsidiaries, over the past 25 years we have also grown and transformed our existing subsidiaries. One of the most significant transformations has been that of CNA Financial, which is currently our largest subsidiary and the biggest source of cash flow to Loews Corporation.

My career at Loews actually started at CNA in January of 1977, when—fresh out of business school—I joined the company as a financial analyst. A year and a half before then, Loews had acquired a majority stake in CNA for just under $2 a share. The company has grown significantly since then, and now trades at over $48 per share—but the transformation of CNA into a top quartile underwriter really occurred over the past 20 years. In fact, when I became CEO in 1999, CNA was considered to be the “problem child” in Loews’s portfolio of businesses.

When Loews bought CNA in 1975, it was a multi-line insurance company. Not only did it have a commercial property and casualty insurance segment, but it also had a life insurance company, a consumer finance

company, a personal automobile insurance business, a federal government health insurance business—and lots more. In 2000, we came to the strategic conclusion that CNA had to focus on its core competency, the commercial property and casualty insurance business. Under the leadership of then-CEO Steve Lilienthal, the company set out to offload its non-core businesses and focus on the core P&C business. That process took most of the first decade in the new century to complete, but now CNA is in a position to compete with the best in the business. During the tenure of Tom Motamed as CEO, and then Dino Robusto in the same role, CNA has had an extraordinary 15 years. The company has become a highly profitable, top quartile commercial property and casualty insurance underwriter. CNA certainly wins the prize for “most improved camper” in its transformation from being our largest headache to our largest and most profitable subsidiary.

Loews Hotels provides another example of the growth and transformation of an existing subsidiary—although I can’t take credit for Hotels’ extraordinary development, which was entirely due to the hard work and vision of Jon and then Alex Tisch. In fact, the hotel business is how Loews got its start, when Larry and Bob Tisch built the Summit Hotel at Lexington Avenue and 51st Street in 1960. Since that time, Loews Hotels has become a leading hotel business through its focus on developing properties in immersive destinations with built-in demand generators. In particular, Jon Tisch was instrumental in developing the 800-room Loews Miami Beach Hotel and establishing Loews Hotels’ longstanding partnership with Universal Studios in Orlando. The hotel company now owns a 50% interest in 11 properties there, with 11,000 rooms (including three properties with 2,000 rooms that are currently under development). Alex Tisch has built upon this foundation by forging key partnerships with the municipalities of Kansas City and Arlington, Texas, where he has overseen the development of multiple new hotel properties. Thanks to Jon and Alex, over the course of my tenure as CEO, not only did Loews Hotels profitably grow its portfolio from 14 properties in 1999 to 28 properties today, but my assessment of the value of our hotel company has also grown tremendously.

While nurturing and growing our subsidiaries is an important value-creation lever, knowing when to sell has been equally crucial. In my first decade as CEO, I recognized that it would be prudent for Loews to divest its tobacco company, Lorillard. It felt like the right thing to do. Therefore, we devised a creative solution whereby we first took the company public in 2002 through a tracking stock named Carolina Group, then sold Carolina Group shares several times in the market. Together with dividends and other distributions, Loews received $9.1 billion in cash from Carolina Group after its initial public offering. Finally, in 2008, we divested our remaining stake in Lorillard through a tax-free exchange of Lorillard shares for shares of Loews. As a result of these transactions, we were able to exit the tobacco business in a tax-free manner while simultaneously retiring 93.5 million shares of Loews, valued at $4.65 billion.

And speaking of retiring shares, Loews has what I like to call a “long and glorious history” of share repurchases. In fact, share repurchases have been one of our most important and consistent value creation levers. As many of you know, we firmly believe our stock trades at a meaningful discount to our view of the intrinsic value of its sum-of-the-parts, which makes repurchasing our shares highly accretive to shareholder value. Over my tenure as CEO, we have reduced our outstanding share count by almost two-thirds: from about 627 million shares to under 220 million shares today including the Lorillard exchange referred to above.

Going back to 1970, the company has bought in more than 1.4 billion split-adjusted shares. Yes, we are serial share repurchasers. My father Larry Tisch schooled me in—among many other things—the compelling economics of repurchasing shares. While getting an MBA at Wharton was important in my life, my real business education came from working for 27 years with my dad. He taught by setting an example and not by lecturing. Unlike so many father/son business stories that end in a big fight, this one had a very happy beginning, middle, and end. When my dad passed away in 2003, I felt that the safety net underneath me had been removed. It took me a few years, but I got used to life on the high wire.

There is one more individual deserving of mention in my career. When I arrived for my first day of work at the home office in New York in the summer of 1977, Joe Rosenberg was the head of the three-person investment department. My father asked Joe to “take an hour and teach Jim the business.” I learned from Joe for the next forty years. His style of investing, his views on markets, and his steadfast openness to being a contrarian combined to create an invaluable model for me to follow in my career. And, incidentally, the tiny investment department that I joined in 1977 today numbers about 50 investment professionals.

It has been an honor and a true gift to have served as the CEO of this enterprise for the past quarter century. Over the course of my career here, I have met extraordinary people, many of whom have become very close friends. It’s a wonderful thing to have known these individuals who have greatly enriched my life. There are truly too many of them to mention here.

The employees of Loews are a breed apart. We are a cohesive family with a focus on excellence as well as comradeship. It has been a blessing to walk into the office every day and be surrounded by people who are the best at their jobs and also a pleasure to be with. In particular, I want to thank and express my deep appreciation to Andy and Jon Tisch. Throughout my career at Loews, they have been steadfast supporters, trusted advisers, and outstanding partners, always offering honest and valuable insights and commentary that has redounded to the benefit of all Loews shareholders.

Finally, I wish for Ben, Alex and the whole Loews family the same great good luck that I have experienced over the past quarter century. A wise man once said, “Luck is when preparation meets opportunity.” I believe that Ben, and all the individuals in the Loews senior management team, are entirely prepared and are always looking for opportunities to create long-term value. I have complete confidence that the Loews of the next 25 years will continue on this path, in ways that are collegial, dynamic, and rewarding for our shareholders.

Jane Wang, CFO:

Thank you, Jim, for your incredible leadership and tremendous contributions to Loews over all these years. I’d also like to congratulate Ben and look forward to continuing to work with him and supporting him in his new role.

Loews reported a very strong second quarter, with net income of $369 million or $1.67 per share, compared with net income of $360 million or $1.58 per share in last year’s second quarter. Excluding a prior period gain of $36 million at Loews Hotels, net income increased 14% year-over-year, driven by solid results at both CNA and Boardwalk.

Book value per share increased from $70.69 at the end of 2023 to $74.57 at the end of 2024’s second quarter, and book value per share excluding AOCI increased from $81.92 at the end of 2023 to $85.42 at the end of the second quarter. These increases were driven by strong earnings during the first half of the year.

We are pleased that CNA continued to produce excellent results in the second quarter. The company contributed net income of $291 million to Loews, which represents an increase of $36 million compared to $255 million in the second quarter of 2023. The year-over-year increase was driven by higher net investment income partially offset by greater catastrophe losses.

Net investment income remains a tailwind for CNA. In the second quarter, the company’s net investment income increased by 7% year-over-year due to favorable reinvestment rates on fixed income securities, a larger invested asset base, and improved LP returns. Pre-tax income from fixed maturities increased by $30 million in the second quarter over the prior year’s second quarter due to a 20-basis-point increase in pre-tax yields to 4.8%. LP income increased by $19 million over last year’s second quarter.

Continued profitable growth drove another quarter of robust underlying underwriting income. Net earned and net written Property & Casualty premiums increased by 7% and 6%, respectively, compared with last year’s

second quarter. Written premium growth was driven by four points of rate, 7% growth in new business and strong retention at 85%.

CNA’s combined ratio increased by 1.0 point to 94.8% in the second quarter of 2024 versus 93.8% in the second quarter of last year. That increase was driven by a 0.4-point increase in catastrophe losses and a 0.7-point increase in the underlying loss ratio. The underlying combined ratio increased 0.5 points to 91.6%.

Please refer to CNA’s Investor Relations website for more details on their results.

Turning to our natural gas pipeline business, Boardwalk continues to benefit from strong industry fundamentals. Second-quarter EBITDA increased by 13% year-over-year, from $213 million to $240 million. Net income grew by 23% year-over-year from $57 million to $70 million in the second quarter of 2024. This growth was driven by re-contracting at higher rates for natural gas transportation and storage, as well as contributions from recently completed growth projects and from the acquisition of Bayou Ethane.

Loews Hotels reported Adjusted EBITDA of $98 million in the second quarter of 2024 compared to $100 million in the second quarter of 2023. A drop in occupancy and rate at Orlando hotels was offset by the contribution of the recently opened Loews Arlington Hotel and Convention Center as well as improved results at city center hotels due to the continued recovery in group travel.

The hotel company contributed $35 million of net income to Loews in the second quarter of 2024 versus $74 million in the prior year’s second quarter, which included a $36 million after-tax gain related to the acquisition of an additional equity interest in, and the consolidation of, a previously unconsolidated joint-venture property. Net income was impacted by greater interest expense as well as higher depreciation expense from the company’s new Loews Arlington Hotel and Convention Center.

Finally, at the parent company, Loews recorded after-tax investment income of $7 million in the second quarter of 2024, which represents a slight decrease compared to $9 million in last year’s second quarter. The year-over-year decline was driven by lower returns on our common stock portfolio, partially offset by higher income from short-term investments and fixed maturity securities.

From a cash flow perspective, Loews received $109 million in dividends from CNA and $50 million of distributions from Boardwalk in the second quarter of 2024. Year to date, Loews has received $815 million from its subsidiaries, consisting of $715 million in dividends from CNA and $100 million of distributions from Boardwalk. During the second quarter Loews repurchased 2.4 million shares for approximately $180 million. Since the end of 2023, we repurchased about 2.8 shares of our common stock at a cost of approximately $212 million. Loews ended 2024’s second quarter with $3.1 billion in cash and short-term investments.

Reconciliation of GAAP Measures to Non-GAAP Measures

These earnings remarks contain financial measures that are not in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management believes some investors may find these measures useful to evaluate our and our subsidiaries’ financial performance. Boardwalk Pipelines utilizes earnings before interest, income tax expense, depreciation and amortization (“EBITDA”) and Loews Hotels & Co utilizes Adjusted EBITDA. These measures are defined and reconciled to the most comparable GAAP measures on page 7 of these remarks.

About Loews Corporation

Loews Corporation is a diversified company with businesses in the insurance, energy, hospitality and packaging industries. For more information, please visit www.loews.com.

Forward-Looking Statements

Statements contained in these earnings remarks which are not historical facts are "forward-looking statements" within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters as well as the Company's overall business and financial performance can be found in the Company's reports filed with the Securities and Exchange Commission and readers of these remarks are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company's website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of these remarks. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company's expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Definitions of Non-GAAP Measures and Reconciliation of GAAP Measures to Non-GAAP Measures:

Boardwalk Pipelines

EBITDA is defined as earnings before interest, income tax expense, depreciation and amortization. The following table presents a reconciliation of Boardwalk net income attributable to Loews Corporation to its EBITDA:

| | | | | | | | | | |

| Three Months Ended June 30, |

| | |

| (In millions) | 2024 | 2023 | | |

| Boardwalk net income attributable to Loews Corporation | $ | 70 | | $ | 57 | | | |

| Interest, net | 38 | | 35 | | | |

| Income tax expense | 24 | | 19 | | | |

| Depreciation and amortization | 108 | | 102 | | | |

| EBITDA | $ | 240 | | $ | 213 | | | |

Loews Hotels & Co

Adjusted EBITDA is calculated by excluding from Loews Hotels & Co’s EBITDA, the noncontrolling interest share of EBITDA adjustments, state and local government development grants, gains or losses on asset acquisitions and dispositions, asset impairments, and equity method income, and including Loews Hotels & Co’s pro rata Adjusted EBITDA of equity method investments. Pro rata Adjusted EBITDA of equity method investments is calculated by applying Loews Hotels & Co’s ownership percentage to the underlying equity method investment’s components of EBITDA and excluding distributions in excess of basis.

The following table presents a reconciliation of Loews Hotels & Co net income attributable to Loews Corporation to its Adjusted EBITDA:

| | | | | | | | | | |

| Three Months Ended June 30, |

| | |

| (In millions) | 2024 | 2023 | | |

| Loews Hotels & Co net income attributable to Loews Corporation | $ | 35 | | $ | 74 | | | |

| Interest, net | 12 | | (1) | | | |

| Income tax expense | 9 | | 27 | | | |

| Depreciation and amortization | 24 | | 17 | | | |

| EBITDA | 80 | | 117 | | | |

| Noncontrolling interest share of EBITDA adjustments | (2) | | | | |

| Gain on asset acquisition | | (46) | | | |

| Asset impairments | | | 9 | | | |

| Equity investment adjustments: | | | | |

| Loews Hotels & Co’s equity method income | (32) | | (41) | | | |

| Pro rata Adjusted EBITDA of equity method investments | 50 | | 62 | | | |

| Consolidation adjustments | 2 | | (1) | | | |

| Adjusted EBITDA | $ | 98 | | $ | 100 | | | |

The following table presents a reconciliation of Loews Hotels & Co’s equity method income to the Pro rata Adjusted EBITDA of its equity method investments:

| | | | | | | | | | |

| Three Months Ended June 30, |

| | |

| (In millions) | 2024 | 2023 | | |

| Loews Hotels & Co’s equity method income | $ | 32 | | $ | 41 | | | |

| Pro rata share of equity method investments: | | | | |

| Interest, net | 10 | | 12 | | | |

| Income tax expense | | | | |

| Depreciation and amortization | 12 | | 12 | | | |

| Distributions in excess of basis | (4) | | (3) | | | |

| | | | |

| Pro rata Adjusted EBITDA of equity method investments | $ | 50 | | $ | 62 | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

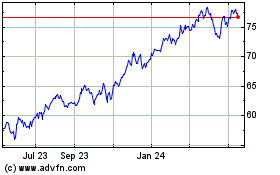

Loews (NYSE:L)

Historical Stock Chart

From Jun 2024 to Jul 2024

Loews (NYSE:L)

Historical Stock Chart

From Jul 2023 to Jul 2024