January 15, 2025FALSE000169402800016940282025-01-152025-01-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 15, 2025

Liberty Energy Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-38081 | | 81-4891595 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

950 17th Street, Suite 2400

Denver, Colorado 80202

(Address and Zip Code of Principal Executive Offices)

(303) 515-2800

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | | | | | | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

| | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| | | | | | |

| Class A Common Stock, par value $0.01 | | LBRT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 22, 2025, the Board of Directors (the “Board”) of Liberty Energy Inc. (the “Company”) approved an increase to the size of the Board from nine directors to 10 directors and appointed Mr. Arjun Murti to fill the newly created vacancy. Mr. Murti was appointed as a Class I director with an initial term expiring at the 2026 annual meeting of stockholders. Additionally, the Board conditionally appointed Mr. Ron Gusek, named successor to the Chief Executive Officer of the Company, as a Class II director with an initial term expiring at the 2027 annual meeting of stockholders. Mr. Gusek’s appointment to the Board is contingent on the previously disclosed resignation of Mr. Chris Wright as Chairman of the Board, Director, and CEO of the Company subject to his ratification and confirmation (the “Confirmation Condition”) by the United States Senate to serve as the incoming Secretary of Energy of the United States. The increase in the size of the Board and the appointments of Messrs. Murti and Gusek to the Board were based upon the recommendation of the Board’s Nominating and Governance Committee.

Mr. Murti is currently a Partner at Veriten LLC, a private research, investment and strategy firm (“Veriten”), and a Senior Advisor at Warburg Pincus, a private equity firm. He previously was a Partner at Goldman Sachs (“GS”) from 2006 to 2014. Prior to becoming Partner, he served as Managing Director at GS from 2003 to 2006 and as Vice President from 1999 to 2003. During his time at GS, Mr. Murti worked as a sell-side equity research analyst covering the energy sector and was co-director of equity research for the Americas from 2012 to 2014. Previously, Mr. Murti held equity analyst positions at JP Morgan Investment Management from 1995 to 1999 and at Petrie Parkman from 1992 to 1995. Mr. Murti has been a member of the board of directors of ConocoPhillips since 2015 and serves on their audit and finance committee as chair, executive committee, and human resources and compensation committee. He also serves on the advisory boards of ClearPath and the Center on Global Energy Policy at Columbia University. Mr. Murti has a Bachelor of Science and Arts in Finance from the University of Denver.

Mr. Murti is a partner at Veriten, which the Company retained for consulting services in 2024 for approximately $250,000 and has retained again in 2025 for approximately $250,000. The Board reviewed and determined that Mr. Murti is independent under New York Stock Exchange rules and Section 10A-3 of the Securities Exchange Act of 1934, as amended. As compensation for his service on the Board, Mr. Murti will participate in the Company’s standard non-employee director compensation program. The Company expects to enter into an indemnification agreement with Mr. Murti substantially in the form that was previously filed as Exhibit 10.19 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the Securities and Exchange Commission on February 27, 2020, and is incorporated by reference herein.

On January 15, 2025, the Compensation Committee (the “Compensation Committee”) of the Board, having considered that Mr. Wright is departing the Company in order to serve the country and his significant contributions towards the success of the Company during his tenure as Chief Executive Officer, approved, effective upon and subject to the Confirmation Condition, the acceleration of vesting of all unvested time-based and performance-based restricted stock units (“RSUs”) previously awarded to Mr. Wright pursuant to the Liberty Energy Inc. Amended and Restated Long Term Incentive Plan (“LTIP”). As a result, and upon satisfaction of the Confirmation Condition, 233,025 time-based RSUs and 500,572 performance-based RSUs will become vested on behalf of Mr. Wright.

Also on January 22, 2025, effective upon and subject to the Confirmation Condition, the Compensation Committee approved compensation for Mr. Gusek in connection with his promotion to Chief Executive Officer consisting of a (a) base salary of $603,580, (b) target annual cash incentive of approximately $898,160, and (c) grant of time-based RSUs and performance-based RSUs under the Company’s LTIP with a value of approximately $3,019,000 with the time-based RSUs vesting ratably over a three year period and the performance-based RSUs with three-year cliff vesting based on the Company’s ROCE performance as compared to a group of peer companies. The number of time-based RSUs and performance-based RSUs to be issued pursuant to this grant will be determined by using a 30-day average closing price consistent with the Company’s historic practices.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included herein that address activities, events or developments that the company expects, believes or anticipates will or may occur in the future are forward-looking statements. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “outlook,” “project,” “plan,” “position,” “believe,” “intend,” “achievable,” “forecast,” “assume,” “anticipate,” “will,” “continue,” “potential,” “likely,” “should,” “could,” and similar terms and phrases. However, the absence of these words does not mean that the statements are not forward-looking. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law,

we do not undertake any obligation and expressly disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | LIBERTY ENERGY INC. |

| | | |

Dated: January 22, 2025 | | | | By: | | /s/ R. Sean Elliott |

| | | | | | R. Sean Elliott |

| | | | | | Chief Legal Officer and Corporate Secretary |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

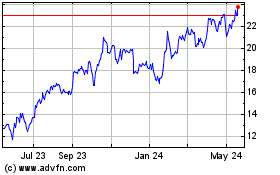

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Feb 2025 to Mar 2025

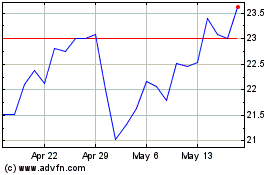

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Mar 2024 to Mar 2025