UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File No. 001-40387

THE LION ELECTRIC COMPANY

(Translation of registrant’s name into English)

921 chemin de la Rivière-du-Nord

Saint-Jérôme (Québec) J7Y 5G2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

| | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| THE LION ELECTRIC COMPANY |

| Date: November 18, 2024 | By: | /s/ Dominique Perron |

| Name: | Dominique Perron |

| Title: | Chief Legal Officer and Corporate Secretary |

LION ELECTRIC ANNOUNCES FURTHER AMENDMENTS

TO CERTAIN SENIOR CREDIT INSTRUMENTS

MONTREAL, QUEBEC - November 18, 2024 – The Lion Electric Company (NYSE: LEV) (TSX: LEV) (“Lion” or the “Company”), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, announced today that it has entered into further amendments to certain of its senior credit instruments, namely (i) its senior revolving credit agreement entered into with a syndicate of lenders represented by National Bank of Canada, as administrative agent and collateral agent, and including Bank of Montreal and Federation des Caisses Desjardins du Québec (the "Revolving Credit Agreement"), and (ii) its loan agreement entered into with Finalta Capital Fund, L.P., as lender and administrative agent, and Caisse de dépôt et placement du Quebec (through one of its subsidiaries), as lender (the "Finalta CDPQ Loan Agreement").

The amendments to the Revolving Credit Agreement provide for, among other things, the extension of the period applicable to the previously announced suspension of the financial covenants thereunder from November 15, 2024, to November 30, 2024 (the "covenant relief period") and the removal of the minimum liquidity covenant under the Credit Agreement during the covenant relief period. The amendments to the Finalta CDPQ Loan Agreement provide for, among other things, the removal of the minimum liquidity covenant thereunder and the addition of restrictions on the Company's use of receivables to be received by the Company during the period. The Company will also be required under each of the Revolving Credit Agreement and the Finalta CDPQ Loan Agreement during the covenant relief period to comply in all respects with cash flow projections and a contingency plan agreed to with the lenders.

In the event the Company cannot raise additional funds or negotiate amendments, concessions or waivers with its lenders, the Company expects that it will not be able to remain in compliance under the terms of the Revolving Credit Agreement and Finalta CDPQ Loan following expiry of the covenant relief period or repay the amounts owed under the Finalta CDPQ Loan upon maturity on November 30, 2024. Any breach under the Company’s debt instruments could result, either directly or as a result of the application of cross default or cross acceleration provisions, in the Company’s lenders exercising their rights thereunder, including to request immediate repayment of amounts borrowed by the Company. As a result, the Company has been actively engaged in discussions with certain of its lenders regarding potential alternatives relating to a restructuring of its obligations. The Company also continues to fully consider all potential sources of financing and/or other alternatives, which alternatives may include a sale of the business or certain of its assets, strategic investments and/or any other similar opportunities or alternatives.

ABOUT LION ELECTRIC

Lion Electric is an innovative manufacturer of zero-emission vehicles. The Company creates, designs and manufactures all-electric class 5 to class 8 commercial urban trucks and all-electric school buses. Lion is a North American leader in electric transportation and designs, builds and assembles many of its vehicles' components, including chassis, battery packs, truck cabins and bus bodies.

Always actively seeking new and reliable technologies, Lion vehicles have unique features that are specifically adapted to its users and their everyday needs. Lion believes that transitioning to all-electric vehicles will lead to major improvements in our society, environment and overall quality of life. Lion shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol LEV.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws and within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, "forward-looking statements"), including statements regarding the amendments entered into by the Company, the Company's ability to remain in compliance under its debt instruments, discussions regarding potential alternatives relating to a restructuring of the Company's obligations, the Company's evaluation of other opportunities or alternatives, statements about Lion's beliefs and expectations and other statements that are not statements of historical facts. Forward-looking statements may be identified by the use of words such as "believe," "may," "will," "continue," "anticipate," "intend," "expect," "should," "would," "could," "plan," "project," "potential," "seem," "seek," "future," "target" or other similar expressions and any other statements that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements may contain such identifying words. The forward-looking statements contained in this press release are based on a number of estimates and assumptions that Lion believes are reasonable when made. Such estimates and assumptions are made by Lion in light of the experience of management and their perception of historical trends, current conditions and expected future developments, as well as other factors believed to be appropriate and reasonable in the circumstances. However, there can be no assurance that such estimates and assumptions will prove to be correct. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. For additional information on estimates, assumptions, risks and uncertainties underlying certain of the forward-looking statements made in this press release, please consult section 23.0 entitled "Risk Factors" of the Company's annual management's discussion and analysis of financial condition and results of operations (MD&A) for the fiscal year 2023 and in other documents filed with the applicable Canadian regulatory securities authorities and the Securities and Exchange Commission, including the Company's interim MD&As. Many of these risks are beyond Lion's management's ability to control or predict. All forward-looking statements attributable to Lion or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained and risk factors identified in the Company's annual MD&A for the fiscal year 2023 and in other documents filed with the applicable Canadian regulatory securities authorities and the Securities and Exchange Commission. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the date they are made. Except as required under applicable securities laws, Lion undertakes no obligation, and expressly disclaims any duty, to update, revise or review any forward-looking information, whether as a result of new information, future events or otherwise.

See section 2.0 of the Company's interim MD&A for the three and nine months ended September 30, 2024 (the "Interim MD&A"), entitled "Basis of Presentation," section 15.0 of the Company's Interim MD&A entitled "Liquidity and Capital Resources," and note 2 of the Company's unaudited condensed interim consolidated financial statements for the three and nine months ended September 30, 2024 which indicate the existence of material uncertainty that may cast significant doubt on the Company's ability to continue as a going concern.

For further information:

MEDIA / INVESTORS

Patrick Gervais

Vice President, Trucks & Public Affairs

patrick.gervais@thelionelectric.com

514-992-1060

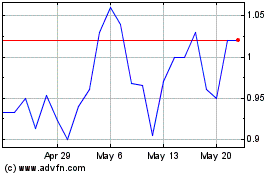

Lion Electric (NYSE:LEV)

Historical Stock Chart

From Nov 2024 to Dec 2024

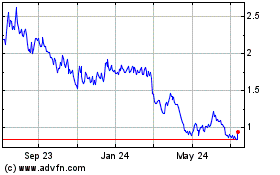

Lion Electric (NYSE:LEV)

Historical Stock Chart

From Dec 2023 to Dec 2024